Key Insights

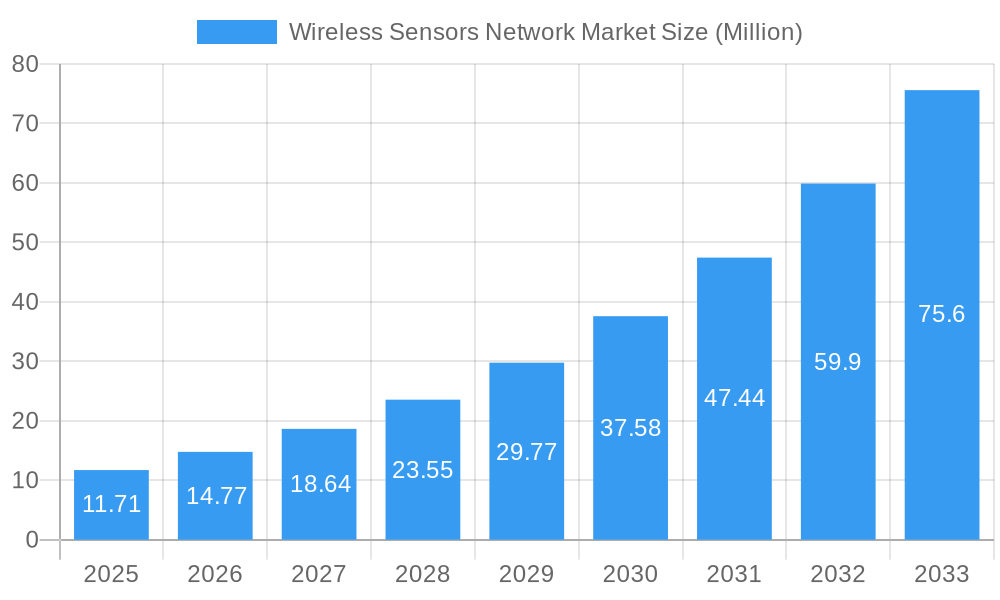

The global Wireless Sensor Network (WSN) market is poised for explosive growth, projected to reach a substantial USD 11.71 billion by 2025. This rapid expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 26.59% from 2019 to 2033, indicating a highly dynamic and evolving industry. The inherent benefits of WSNs, including enhanced operational efficiency, real-time data acquisition, reduced cabling costs, and increased flexibility, are driving their adoption across a multitude of sectors. Key growth drivers include the burgeoning demand for industrial automation and the "Industry 4.0" revolution, the increasing sophistication of IoT devices, and the critical need for advanced monitoring and control systems in sectors like military and security, medical, and transportation. The burgeoning adoption of smart cities and the growing emphasis on data-driven decision-making further bolster this upward trajectory.

Wireless Sensors Network Market Market Size (In Million)

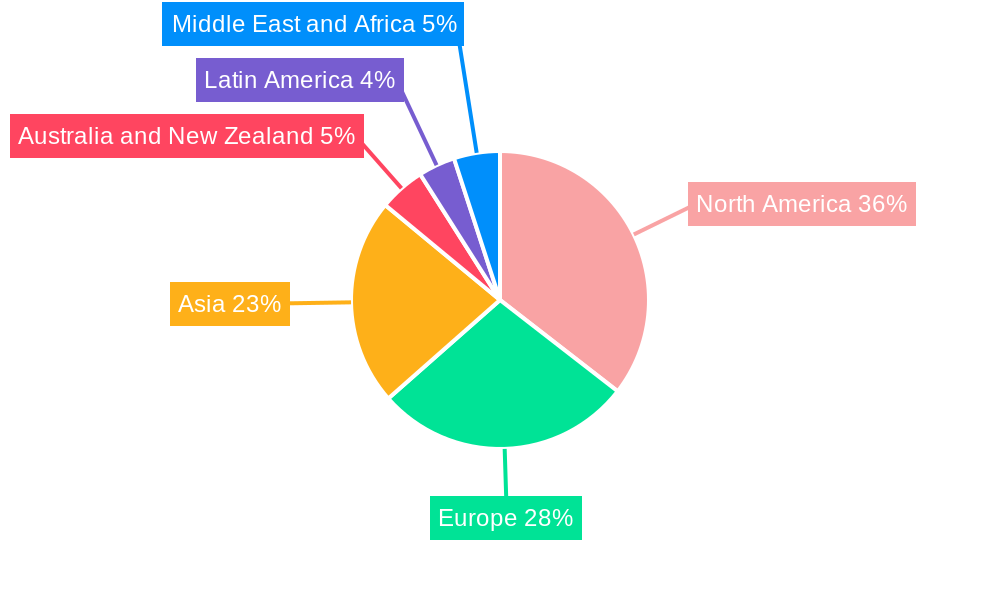

The WSN market’s segmentation reveals a diverse application landscape. The Military and Security sector, along with Medical applications, are expected to be significant revenue generators due to their stringent requirements for reliable and secure data transmission. Transportation and Logistics, Oil and Gas, and Water and Wastewater industries are also experiencing robust growth as they leverage WSNs for asset tracking, predictive maintenance, and environmental monitoring. Consumer Packaged Goods, particularly within Food and Beverage, are increasingly adopting WSNs for supply chain visibility and quality control. Geographically, North America, led by the United States and Canada, is expected to maintain a dominant market share, driven by early adoption and technological advancements. However, Asia, particularly China and India, is anticipated to witness the fastest growth, fueled by rapid industrialization and a burgeoning IoT ecosystem. Restraints such as data security concerns and interoperability challenges are being actively addressed through evolving standards and technological innovation, paving the way for sustained market penetration.

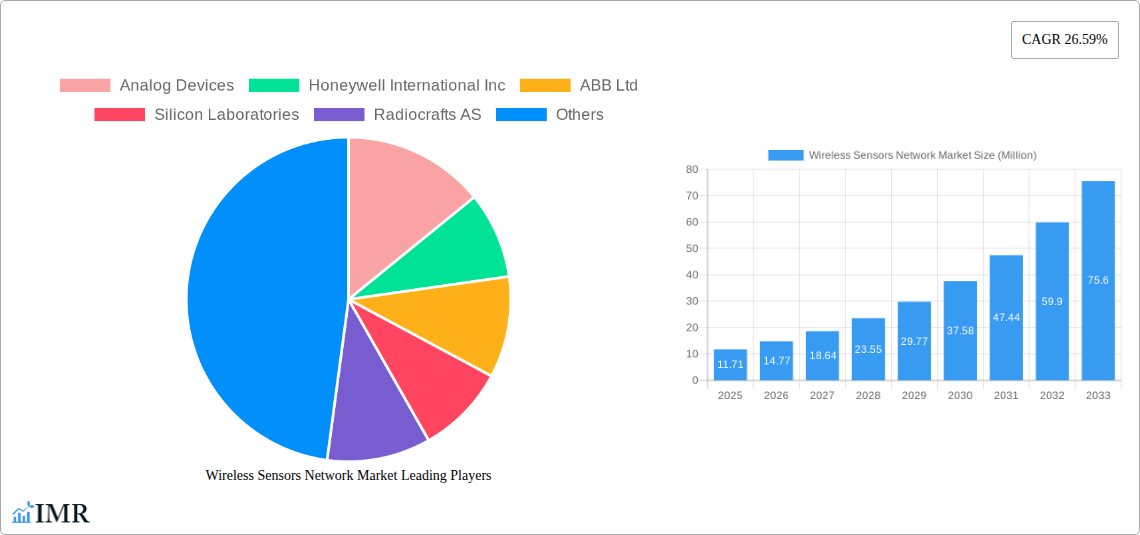

Wireless Sensors Network Market Company Market Share

Comprehensive Report: Wireless Sensors Network Market Analysis 2019–2033

This in-depth report offers a strategic outlook on the global Wireless Sensors Network (WSN) Market, providing critical insights for stakeholders navigating this dynamic sector. Spanning the historical period from 2019 to 2024 and projecting forward to 2033, with a base year of 2025, this analysis delves into market dynamics, growth trends, regional dominance, product innovation, key drivers and challenges, emerging opportunities, and the competitive landscape.

Report Scope:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Key Market Segments Covered:

- End-user Segments: Military and Security, Medical, Transportation and Logistics, Oil and Gas, Water and Wastewater, Consumer Packaged Goods (Food and Beverage), Other End-users.

- Parent Market: Internet of Things (IoT) Market

- Child Markets: Industrial IoT (IIoT) Sensors, Wearable Health Sensors, Smart Grid Sensors, Environmental Monitoring Sensors.

Quantitative Insights (All values in Million units):

- Global Wireless Sensors Network Market Size (2025 Estimate): $XX Million

- CAGR (2025–2033): XX%

Wireless Sensors Network Market Dynamics & Structure

The Wireless Sensors Network (WSN) Market is characterized by a moderately concentrated structure, with several key players like Analog Devices, Honeywell International Inc., and Siemens AG holding significant market share. Technological innovation is a primary driver, fueled by advancements in low-power communication protocols (e.g., LoRaWAN, Zigbee), miniaturization of sensor components, and the increasing integration of AI for data analytics. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, HIPAA), play a crucial role in shaping market adoption and development, especially in sectors like healthcare and industrial automation. Competitive product substitutes, such as wired sensor systems and alternative wireless technologies, present ongoing challenges, though the inherent flexibility and cost-effectiveness of WSNs often provide a competitive edge. End-user demographics are rapidly evolving, with a growing demand for real-time data and automation across diverse industries. Mergers and acquisitions (M&A) activity is a notable trend, as larger companies acquire specialized WSN providers to enhance their product portfolios and expand market reach. For instance, M&A deal volumes are projected to increase by XX% over the forecast period, driven by the strategic importance of WSNs in the broader digital transformation landscape. Innovation barriers include the complexity of network management in large-scale deployments and the need for robust cybersecurity solutions to protect against sophisticated threats.

- Market Concentration: Moderately concentrated with key players.

- Technological Innovation Drivers: Low-power protocols, miniaturization, AI integration.

- Regulatory Frameworks: Data privacy, security standards impact adoption.

- Competitive Product Substitutes: Wired systems, alternative wireless tech.

- End-user Demographics: Increasing demand for real-time data and automation.

- M&A Trends: Increasing activity for portfolio expansion and market consolidation.

- Innovation Barriers: Network management complexity, cybersecurity.

Wireless Sensors Network Market Growth Trends & Insights

The global Wireless Sensors Network (WSN) Market is poised for substantial expansion, driven by the pervasive adoption of the Internet of Things (IoT) and the increasing need for intelligent data collection and analysis across industries. The market size is projected to grow from an estimated $XX Million in 2025 to over $XXX Million by 2033, exhibiting a compound annual growth rate (CAGR) of XX%. This robust growth is underpinned by accelerating adoption rates, particularly in industrial automation, smart cities, and healthcare. Technological disruptions, such as the development of energy-harvesting sensors and advanced edge computing capabilities, are further enhancing the functionality and efficiency of WSNs, enabling more sophisticated applications. Consumer behavior shifts towards convenience and efficiency are also fueling demand for smart home devices and connected appliances that rely heavily on WSN technology. The market penetration of WSN solutions is expected to deepen significantly, moving beyond niche applications to become an integral part of mainstream infrastructure. Specific metrics indicate that the adoption of WSNs in the manufacturing sector alone is projected to grow by XX% annually, driven by predictive maintenance and operational efficiency gains. Furthermore, the increasing deployment of WSNs in environmental monitoring for smart agriculture and pollution control is a key growth driver. The transition from discrete sensor deployments to integrated network solutions signifies a maturation of the market, with a greater emphasis on interoperability and standardized communication protocols. This evolution is creating new avenues for innovation and market differentiation, ensuring sustained growth for WSN providers. The ongoing advancements in wireless communication technologies, including 5G and future iterations, will further reduce latency and increase bandwidth, unlocking new use cases and accelerating the adoption of complex WSN applications. The economic benefits derived from improved operational efficiency, reduced waste, and enhanced decision-making are powerful motivators for widespread WSN implementation.

Dominant Regions, Countries, or Segments in Wireless Sensors Network Market

The Industrial IoT (IIoT) Sensors segment within the broader Wireless Sensors Network market is emerging as a dominant force, driven by significant investments in automation and operational efficiency across various industries. North America, particularly the United States, currently leads the market, owing to its advanced technological infrastructure, strong research and development capabilities, and the early adoption of smart manufacturing and predictive maintenance technologies in sectors like Oil and Gas and Transportation and Logistics. Economic policies promoting industrial digitization and the presence of key technology providers further bolster its dominance. For instance, the U.S. market share in industrial WSN applications is estimated to be XX% in 2025.

In Europe, Germany and the UK are significant contributors, with a strong focus on smart grid initiatives and advanced manufacturing. The stringent environmental regulations in these countries are also driving the adoption of WSNs for water and wastewater management and emissions monitoring. Asia-Pacific, led by China and Japan, is rapidly gaining ground, fueled by massive investments in smart city projects, a burgeoning manufacturing base, and government initiatives to promote technological innovation. The region's significant population and rapid industrialization present immense growth potential for WSNs across all end-user segments.

The Oil and Gas sector stands out as a crucial end-user segment, demanding robust and reliable WSN solutions for remote monitoring of pipelines, drilling operations, and production facilities. The inherent risks and vast geographical spread of operations in this industry make wireless sensor networks indispensable for enhancing safety, optimizing resource management, and minimizing environmental impact. The market share of WSNs in the Oil and Gas sector is expected to reach XX% by 2033. Similarly, the Transportation and Logistics sector is experiencing substantial growth due to the need for real-time tracking of goods, fleet management optimization, and the development of autonomous vehicles, all of which rely heavily on sophisticated WSNs. The Medical sector, particularly with the rise of remote patient monitoring and wearable health devices, is another key growth area, driven by the demand for continuous health data and improved patient care. The Military and Security segment also represents a significant, albeit more specialized, market for WSNs, emphasizing surveillance, reconnaissance, and secure communication.

- Dominant Segment: Industrial IoT (IIoT) Sensors.

- Leading Region: North America (U.S.) driven by industrial automation.

- Key European Markets: Germany, UK (smart grids, advanced manufacturing).

- Emerging APAC Markets: China, Japan (smart cities, manufacturing).

- Key End-user Segments: Oil and Gas (safety, efficiency), Transportation and Logistics (tracking, fleet management), Medical (remote monitoring).

- Growth Potential Factors: Technological infrastructure, government initiatives, regulatory landscape.

Wireless Sensors Network Market Product Landscape

The Wireless Sensors Network (WSN) product landscape is characterized by rapid innovation and a diverse range of solutions tailored to specific end-user needs. Key product developments focus on enhancing sensor accuracy, power efficiency, communication range, and data security. Miniaturized, low-power sensors are becoming increasingly prevalent, enabling their integration into virtually any device, from industrial machinery to wearable health trackers. Advanced materials and energy-harvesting technologies are further extending battery life and reducing maintenance requirements. Applications are expanding beyond traditional environmental monitoring to encompass intelligent automation, predictive maintenance, asset tracking, and personalized healthcare. Unique selling propositions often lie in the seamless integration of hardware and software, robust network management platforms, and the ability to provide real-time, actionable insights. Technological advancements in edge computing are enabling localized data processing, reducing latency and dependence on cloud infrastructure for critical operations.

Key Drivers, Barriers & Challenges in Wireless Sensors Network Market

The Wireless Sensors Network (WSN) Market is propelled by several key drivers. The escalating demand for real-time data and automation across industries, from manufacturing to healthcare, is a primary growth factor. Technological advancements in low-power communication, miniaturization, and battery life are enabling more efficient and cost-effective deployments. The growing adoption of IoT and smart technologies across various sectors, including smart cities and industrial automation, further fuels WSN market expansion.

However, the market faces significant barriers and challenges. The initial cost of deployment for large-scale WSNs can be substantial, posing a hurdle for some organizations. Cybersecurity concerns and the risk of data breaches remain a critical challenge, requiring robust security protocols and continuous vigilance. Interoperability issues between different WSN standards and platforms can complicate integration and scalability. Furthermore, regulatory hurdles related to data privacy and spectrum allocation can impact market growth and deployment strategies. Supply chain disruptions, as seen in recent global events, can affect the availability of critical components, leading to price volatility and project delays.

Emerging Opportunities in Wireless Sensors Network Market

Emerging opportunities in the Wireless Sensors Network market lie in the development of highly specialized, ultra-low-power sensors for niche applications, such as implantable medical devices and advanced environmental monitoring systems. The growing trend towards sustainable practices is creating demand for WSNs in smart agriculture for precision farming and in smart grid applications for efficient energy management. The expansion of the edge computing ecosystem offers opportunities for WSNs to become more intelligent and autonomous, processing data closer to the source. Furthermore, the increasing demand for personalized health monitoring and the proliferation of wearable technology present a significant untapped market for sophisticated WSN solutions.

Growth Accelerators in the Wireless Sensors Network Market Industry

Several growth accelerators are poised to significantly impact the Wireless Sensors Network industry. Technological breakthroughs in areas like artificial intelligence (AI) and machine learning (ML) are enabling more sophisticated data analysis and predictive capabilities within WSNs, driving efficiency and creating new revenue streams. Strategic partnerships between WSN providers, cloud service providers, and application developers are fostering an ecosystem that accelerates innovation and market penetration. Market expansion strategies, particularly in emerging economies with rapidly industrializing sectors and growing urbanization, represent a substantial opportunity for growth. The increasing focus on Industry 4.0 and digital transformation initiatives globally further solidifies the role of WSNs as a foundational technology for smart systems.

Key Players Shaping the Wireless Sensors Network Market Market

- Analog Devices

- Honeywell International Inc.

- ABB Ltd

- Silicon Laboratories

- Radiocrafts AS

- Emerson Electric Co

- NXP Semiconductors

- Siemens AG

- Yokogawa Electric Corporation

- Atmel Corporation

- ST Microelectronics

- General Electric Company

Notable Milestones in Wireless Sensors Network Market Sector

- March 2024: Brown researchers developed a brain-inspired wireless system to gather data from salt-sized sensors. These sensor networks are designed so the chips can be implanted into the body or integrated into wearable devices. Each submillimeter-sized silicon sensor mimics how neurons in the brain communicate through spikes of electrical activity. The sensors detect specific events as spikes and then transmit that data wirelessly in real time using radio waves, saving both energy and bandwidth.

- March 2024: IIT-Mandi introduced a groundbreaking power management unit designed explicitly for directly cloud-enabled indoor wireless sensor network (WSN) nodes. These nodes, offering distinct advantages over low-power wireless communication technologies, often face challenges related to the consumption of higher peak current during data transmission, leading to battery capacity degradation and reduced lifespan.

In-Depth Wireless Sensors Network Market Market Outlook

The future outlook for the Wireless Sensors Network market is exceptionally promising, driven by the relentless pursuit of efficiency, automation, and data-driven decision-making across all industries. Growth accelerators, including advancements in AI/ML, strategic ecosystem partnerships, and expansion into developing markets, will continue to fuel this trajectory. The increasing integration of WSNs into critical infrastructure, such as smart cities and advanced manufacturing facilities, will solidify their position as indispensable components of the digital economy. Strategic opportunities lie in the development of more secure, interoperable, and energy-efficient WSN solutions, catering to the evolving demands of end-users and the ever-expanding landscape of connected devices. The market is set to witness continued innovation, with a focus on creating intelligent, self-optimizing sensor networks that deliver actionable insights and drive transformative change.

Wireless Sensors Network Market Segmentation

-

1. End-user

- 1.1. Military and Security

- 1.2. Medical

- 1.3. Transportation and Logistics

- 1.4. Oil and Gas

- 1.5. Water and Wastewater

- 1.6. Consumer Packaged Goods (Food and Beverage)

- 1.7. Other End-users

Wireless Sensors Network Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Argentina

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

Wireless Sensors Network Market Regional Market Share

Geographic Coverage of Wireless Sensors Network Market

Wireless Sensors Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies; Reducing Cost of Wireless Sensors

- 3.3. Market Restrains

- 3.3.1. Associated Complexities Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Medical Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Military and Security

- 5.1.2. Medical

- 5.1.3. Transportation and Logistics

- 5.1.4. Oil and Gas

- 5.1.5. Water and Wastewater

- 5.1.6. Consumer Packaged Goods (Food and Beverage)

- 5.1.7. Other End-users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. North America Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. Military and Security

- 6.1.2. Medical

- 6.1.3. Transportation and Logistics

- 6.1.4. Oil and Gas

- 6.1.5. Water and Wastewater

- 6.1.6. Consumer Packaged Goods (Food and Beverage)

- 6.1.7. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. Military and Security

- 7.1.2. Medical

- 7.1.3. Transportation and Logistics

- 7.1.4. Oil and Gas

- 7.1.5. Water and Wastewater

- 7.1.6. Consumer Packaged Goods (Food and Beverage)

- 7.1.7. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. Military and Security

- 8.1.2. Medical

- 8.1.3. Transportation and Logistics

- 8.1.4. Oil and Gas

- 8.1.5. Water and Wastewater

- 8.1.6. Consumer Packaged Goods (Food and Beverage)

- 8.1.7. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. Australia and New Zealand Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. Military and Security

- 9.1.2. Medical

- 9.1.3. Transportation and Logistics

- 9.1.4. Oil and Gas

- 9.1.5. Water and Wastewater

- 9.1.6. Consumer Packaged Goods (Food and Beverage)

- 9.1.7. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Latin America Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. Military and Security

- 10.1.2. Medical

- 10.1.3. Transportation and Logistics

- 10.1.4. Oil and Gas

- 10.1.5. Water and Wastewater

- 10.1.6. Consumer Packaged Goods (Food and Beverage)

- 10.1.7. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Middle East and Africa Wireless Sensors Network Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 11.1.1. Military and Security

- 11.1.2. Medical

- 11.1.3. Transportation and Logistics

- 11.1.4. Oil and Gas

- 11.1.5. Water and Wastewater

- 11.1.6. Consumer Packaged Goods (Food and Beverage)

- 11.1.7. Other End-users

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Analog Devices

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ABB Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Silicon Laboratories

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Radiocrafts AS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Emerson Electric Co

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NXP Semiconductors

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Siemens AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Yokogawa Electric Corporatio

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Atmel Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 ST Microelectronics

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 General Electric Company

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Analog Devices

List of Figures

- Figure 1: Global Wireless Sensors Network Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wireless Sensors Network Market Revenue (Million), by End-user 2025 & 2033

- Figure 3: North America Wireless Sensors Network Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: North America Wireless Sensors Network Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Wireless Sensors Network Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Wireless Sensors Network Market Revenue (Million), by End-user 2025 & 2033

- Figure 7: Europe Wireless Sensors Network Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: Europe Wireless Sensors Network Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Wireless Sensors Network Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Wireless Sensors Network Market Revenue (Million), by End-user 2025 & 2033

- Figure 11: Asia Wireless Sensors Network Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Wireless Sensors Network Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Wireless Sensors Network Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Wireless Sensors Network Market Revenue (Million), by End-user 2025 & 2033

- Figure 15: Australia and New Zealand Wireless Sensors Network Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Australia and New Zealand Wireless Sensors Network Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Wireless Sensors Network Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Wireless Sensors Network Market Revenue (Million), by End-user 2025 & 2033

- Figure 19: Latin America Wireless Sensors Network Market Revenue Share (%), by End-user 2025 & 2033

- Figure 20: Latin America Wireless Sensors Network Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Wireless Sensors Network Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Wireless Sensors Network Market Revenue (Million), by End-user 2025 & 2033

- Figure 23: Middle East and Africa Wireless Sensors Network Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East and Africa Wireless Sensors Network Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Wireless Sensors Network Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: Global Wireless Sensors Network Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Wireless Sensors Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: Global Wireless Sensors Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 13: Global Wireless Sensors Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: China Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Japan Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 18: Global Wireless Sensors Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Wireless Sensors Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Brazil Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Wireless Sensors Network Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 25: Global Wireless Sensors Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: United Arab Emirates Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Africa Wireless Sensors Network Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Sensors Network Market?

The projected CAGR is approximately 26.59%.

2. Which companies are prominent players in the Wireless Sensors Network Market?

Key companies in the market include Analog Devices, Honeywell International Inc, ABB Ltd, Silicon Laboratories, Radiocrafts AS, Emerson Electric Co, NXP Semiconductors, Siemens AG, Yokogawa Electric Corporatio, Atmel Corporation, ST Microelectronics, General Electric Company.

3. What are the main segments of the Wireless Sensors Network Market?

The market segments include End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies; Reducing Cost of Wireless Sensors.

6. What are the notable trends driving market growth?

Medical Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Associated Complexities Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2024: Brown researchers developed a brain-inspired wireless system to gather data from salt-sized sensors. These sensor networks are designed so the chips can be implanted into the body or integrated into wearable devices. Each submillimeter-sized silicon sensor mimics how neurons in the brain communicate through spikes of electrical activity. The sensors detect specific events as spikes and then transmit that data wirelessly in real time using radio waves, saving both energy and bandwidth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Sensors Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Sensors Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Sensors Network Market?

To stay informed about further developments, trends, and reports in the Wireless Sensors Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence