Key Insights

The global X-ray film market is projected to reach $908 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.7%. This expansion is fueled by rising demand for diagnostic imaging in healthcare due to aging demographics, increasing chronic disease prevalence, and medical technology advancements. Diagnostic centers and hospitals are primary consumers, utilizing X-ray films for diverse medical examinations. The industrial sector's increasing use of non-destructive testing for quality assurance also contributes to market growth. Despite the rise of digital radiography, traditional X-ray film maintains its relevance in specific regions and applications due to existing infrastructure and cost-effectiveness.

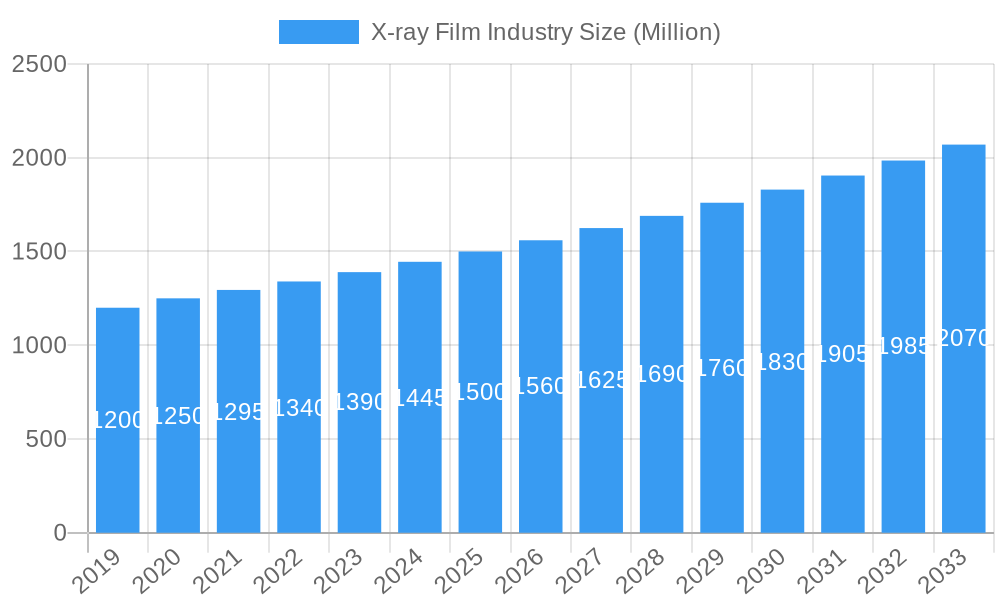

X-ray Film Industry Market Size (In Million)

Market dynamics are shaped by key drivers such as the emphasis on early disease detection and the ongoing requirement for dependable diagnostic tools. Emerging economies offer substantial growth prospects with expanding healthcare access and infrastructure. However, the market faces challenges from the rapid adoption of digital X-ray systems, which provide superior image manipulation, storage, and retrieval. Regulatory frameworks and environmental considerations related to film processing also pose obstacles. Nevertheless, ongoing innovations in film technology, focusing on enhanced image quality and reduced processing times, coupled with strategic partnerships and market expansion by leading companies like Fujifilm Corporation, Agfa-Gevaert N.V., and Konica Minolta Inc., are expected to maintain positive market trends. The Asia Pacific region is poised to lead this market, driven by swift healthcare infrastructure development and a vast patient population.

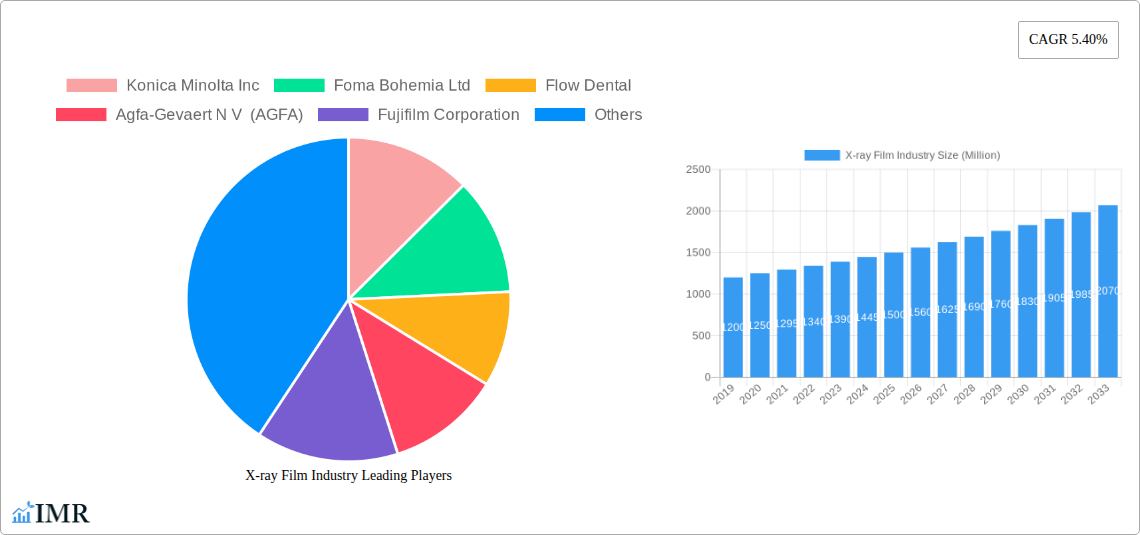

X-ray Film Industry Company Market Share

X-ray Film Industry Report: Market Analysis, Trends, and Forecast (2019–2033)

This comprehensive report delves into the intricate dynamics of the X-ray Film Industry, providing an in-depth analysis of market size, growth trajectories, and future outlook. Spanning the study period of 2019–2033, with a base year of 2025, this report leverages extensive research to equip industry stakeholders with actionable insights for strategic decision-making. We explore the parent and child market segments, offering a granular view of the landscape. All quantitative values are presented in Million units for clarity and consistency.

X-ray Film Industry Market Dynamics & Structure

The X-ray Film Industry exhibits a dynamic market concentration, influenced by ongoing technological advancements and evolving regulatory landscapes. Key innovation drivers include the quest for higher resolution imaging, enhanced radiation dose reduction, and the integration of digital technologies. Regulatory frameworks, particularly concerning medical device safety and data privacy, significantly shape market entry and product development. Competitive product substitutes, predominantly digital radiography (DR) and computed radiography (CR) systems, are increasingly displacing traditional film-based X-ray imaging, posing a significant challenge to legacy film manufacturers. End-user demographics, driven by an aging global population and rising prevalence of chronic diseases, are fueling demand for advanced diagnostic imaging solutions. Mergers and acquisitions (M&A) trends, though less pronounced in the traditional film segment, continue to consolidate players in the broader medical imaging sector.

- Market Concentration: The market, while historically dominated by a few key players, is experiencing a shift with the rise of digital alternatives.

- Technological Innovation Drivers: Focus on miniaturization of equipment, improved image processing algorithms, and AI-driven analysis.

- Regulatory Frameworks: Stringent approvals for medical imaging devices, impacting R&D and market access.

- Competitive Product Substitutes: Digital X-ray systems (DR/CR) offer immediate results and lower long-term costs.

- End-User Demographics: Increasing demand from healthcare facilities in developing economies and specialized medical fields.

- M&A Trends: Consolidation primarily in the digital imaging and related software sectors.

X-ray Film Industry Growth Trends & Insights

The X-ray Film Industry, while facing significant disruption from digital technologies, continues to demonstrate resilience in specific niches and geographic regions. The market size has seen a gradual decline in traditional film consumption, projected to reach approximately $XX million by 2025, a decrease from historical highs. However, the demand for specialized X-ray films in industrial applications and certain medical imaging modalities persists. Adoption rates of digital radiography are soaring, surpassing 70% in developed healthcare systems by 2024. This technological disruption is fundamentally altering the market's trajectory, pushing traditional film manufacturers to pivot towards digital solutions or focus on niche markets. Consumer behavior shifts are characterized by a preference for faster diagnostic turnaround times, greater image accessibility, and reduced radiation exposure, all of which favor digital imaging. The CAGR for the traditional X-ray film segment is projected to be negative, estimated at -X.X% during the forecast period, while the broader medical imaging market, encompassing digital solutions, is expected to grow at a robust CAGR of Y.Y%. Market penetration of digital X-ray systems in hospitals is estimated at over 85% globally by 2033. The transition signifies not just a change in technology but a transformation in healthcare delivery, emphasizing efficiency and improved patient outcomes. The evolving needs of research institutions and industrial inspection sectors also contribute to a smaller but stable demand for film, particularly in applications where archival quality and specific spectral sensitivities are paramount. The economic impact of this transition is substantial, with significant investment shifting from film manufacturing and processing to digital hardware, software, and IT infrastructure. Understanding these complex interdependencies is crucial for forecasting future market performance.

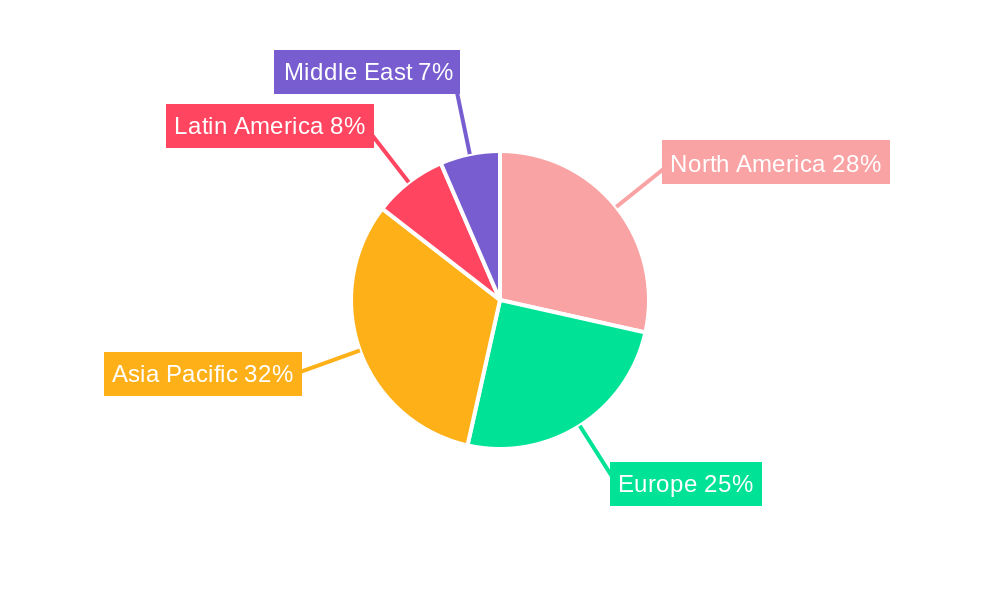

Dominant Regions, Countries, or Segments in X-ray Film Industry

The Medical segment, encompassing Diagnostic Centers, Hospitals, and Research and Educational Institutions, remains the dominant end-user segment for the X-ray Film Industry, accounting for approximately 80% of the global market share in 2025. This dominance is driven by the continuous need for diagnostic imaging in healthcare. North America and Europe are the leading regions, driven by robust healthcare infrastructure, high disposable incomes, and early adoption of advanced medical technologies. The United States, in particular, represents a significant market due to its large hospital network and extensive research facilities. However, the Asia-Pacific region is emerging as a high-growth market, propelled by increasing healthcare expenditure, expanding medical tourism, and a growing patient base. Countries like China and India are witnessing substantial investments in healthcare infrastructure, leading to a surge in demand for diagnostic imaging solutions, including X-ray films, albeit with a rapid shift towards digital alternatives.

- Dominant Segment: Medical End Users (Diagnostic Centers, Hospitals, Research and Educational Institutions).

- Key Drivers in Medical Segment: Aging population, increasing chronic disease prevalence, growing demand for early disease detection, and advancements in medical imaging techniques.

- Leading Regions: North America and Europe, characterized by advanced healthcare systems and high adoption of imaging technologies.

- High-Growth Region: Asia-Pacific, fueled by rising healthcare investments and improving accessibility.

- Key Countries: United States, Germany, Japan, China, and India exhibit significant market presence.

- Market Share & Growth Potential: While traditional film is declining in these regions, the overall medical imaging market is expanding, influencing the demand for related services and digital solutions.

- Industrial Segment: This segment, including applications in non-destructive testing, security screening, and manufacturing quality control, constitutes approximately 15% of the market. Growth here is steadier, driven by industrialization and stringent quality standards.

- Other End Users: This niche segment, encompassing specialized applications, accounts for the remaining 5%.

X-ray Film Industry Product Landscape

The product landscape within the X-ray Film Industry is characterized by continuous innovation aimed at enhancing image quality, reducing radiation exposure, and improving efficiency. Traditional X-ray films are evolving with finer grain emulsions and improved contrast characteristics for sharper image detail. Innovations in film-screen technology, such as rare-earth intensifying screens, significantly boost image brightness and reduce patient exposure times. While the market share of analog film is shrinking due to the digital revolution, specialized films designed for specific applications, like mammography or industrial radiography, continue to see targeted development. These films offer unique spectral sensitivities and resolution capabilities that are, in some niche areas, still preferred over digital counterparts for their archival properties and cost-effectiveness in specific low-volume scenarios.

Key Drivers, Barriers & Challenges in X-ray Film Industry

Key Drivers:

- Persistent Demand in Niche Applications: Industrial radiography, security screening, and specific medical imaging modalities where digital alternatives are less cost-effective or technologically mature.

- Economic Development in Emerging Markets: Gradual adoption of medical imaging technologies, including film-based systems, in regions with developing healthcare infrastructure.

- Cost-Effectiveness: In certain budget-constrained environments, traditional film-based systems can offer a lower upfront investment compared to digital systems.

- Archival Quality: The longevity and inherent archival nature of film can be advantageous for certain long-term record-keeping requirements.

Key Barriers & Challenges:

- Digitalization of Healthcare: The rapid and widespread adoption of Digital Radiography (DR) and Computed Radiography (CR) systems is the primary challenge, leading to a decline in demand for conventional X-ray films.

- Higher Operational Costs of Film: Film processing involves chemical costs, specialized darkroom facilities, and longer turnaround times compared to digital imaging.

- Image Interpretation and Storage: Digital images offer easier manipulation, enhancement, and digital storage, while film requires physical storage space and manual interpretation.

- Environmental Concerns: The disposal of chemicals used in film processing raises environmental concerns and regulatory scrutiny.

- Supply Chain Volatility: The declining market size for traditional films can lead to supply chain disruptions and increased production costs for remaining manufacturers.

Emerging Opportunities in X-ray Film Industry

Emerging opportunities for the X-ray Film Industry lie in catering to the ongoing demand for specialized industrial radiography applications, where non-destructive testing and quality control remain critical. Furthermore, there's a nascent opportunity in developing hybrid imaging solutions that bridge the gap between traditional film and digital technologies, offering enhanced functionalities for niche medical applications. The demand for high-quality film in specific research applications requiring precise spectral sensitivity also presents a niche but viable market. Expanding into emerging economies with developing healthcare infrastructure, where digital solutions might be prohibitively expensive initially, could also offer a temporary growth avenue before their eventual transition to digital.

Growth Accelerators in the X-ray Film Industry Industry

Growth in the X-ray Film Industry is primarily driven by the continued demand from industrial sectors for non-destructive testing and quality assurance. Advancements in film emulsion technology, leading to improved resolution and sensitivity, are also crucial for maintaining competitiveness in these specialized areas. Furthermore, strategic partnerships between film manufacturers and industrial equipment providers can accelerate the adoption of film-based solutions in new applications. Market expansion into developing regions where the initial investment in digital infrastructure is a barrier can also act as a temporary growth accelerator.

Key Players Shaping the X-ray Film Industry Market

- Konica Minolta Inc

- Foma Bohemia Ltd

- Flow Dental

- Agfa-Gevaert N V (AGFA)

- Fujifilm Corporation

- Codonics Inc

- Carestream Health Inc

- Sony Corporation

Notable Milestones in X-ray Film Industry Sector

- 2019: Increased investment in digital radiography (DR) systems by major healthcare providers globally, signaling a continued shift away from film.

- 2020: Introduction of advanced spectral imaging films for industrial applications by several leading manufacturers, enhancing non-destructive testing capabilities.

- 2021: Agfa-Gevaert announces strategic focus on its digital imaging solutions, reducing its traditional film portfolio.

- 2022: Fujifilm continues to leverage its expertise in film technology to develop specialized medical and industrial imaging products.

- 2023: Foma Bohemia Ltd continues to serve its established customer base with high-quality medical and industrial X-ray films.

- 2024: Growing interest in the environmental impact of film processing, leading to research into greener chemical alternatives and recycling programs.

In-Depth X-ray Film Industry Market Outlook

The X-ray Film Industry is poised for a transformative future, characterized by a strategic pivot towards niche markets and specialized applications. While the overall market for conventional medical X-ray films is expected to contract due to the widespread adoption of digital imaging technologies, significant opportunities persist within the industrial radiography and specialized medical diagnostic sectors. Growth accelerators such as technological breakthroughs in film resolution and sensitivity, coupled with strategic partnerships aimed at expanding into underserved emerging markets, will be critical. The future outlook emphasizes innovation in higher-value, specialized film products and a potential focus on digital imaging solutions by existing players, ensuring continued relevance in the evolving healthcare and industrial landscapes.

X-ray Film Industry Segmentation

-

1. End User

-

1.1. Medical

- 1.1.1. Diagnostic Centers

- 1.1.2. Hospitals

- 1.1.3. Research and Educational Institutions

- 1.2. Industrial

- 1.3. Other End Users

-

1.1. Medical

X-ray Film Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

X-ray Film Industry Regional Market Share

Geographic Coverage of X-ray Film Industry

X-ray Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Continued Adoption of Traditional X-ray Equipment in Developing Economies

- 3.3. Market Restrains

- 3.3.1. ; Emergence of Digital Radiography and Flat Panel Detector Technology

- 3.4. Market Trends

- 3.4.1. Diagnostic Centers Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Medical

- 5.1.1.1. Diagnostic Centers

- 5.1.1.2. Hospitals

- 5.1.1.3. Research and Educational Institutions

- 5.1.2. Industrial

- 5.1.3. Other End Users

- 5.1.1. Medical

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Medical

- 6.1.1.1. Diagnostic Centers

- 6.1.1.2. Hospitals

- 6.1.1.3. Research and Educational Institutions

- 6.1.2. Industrial

- 6.1.3. Other End Users

- 6.1.1. Medical

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Medical

- 7.1.1.1. Diagnostic Centers

- 7.1.1.2. Hospitals

- 7.1.1.3. Research and Educational Institutions

- 7.1.2. Industrial

- 7.1.3. Other End Users

- 7.1.1. Medical

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Medical

- 8.1.1.1. Diagnostic Centers

- 8.1.1.2. Hospitals

- 8.1.1.3. Research and Educational Institutions

- 8.1.2. Industrial

- 8.1.3. Other End Users

- 8.1.1. Medical

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Medical

- 9.1.1.1. Diagnostic Centers

- 9.1.1.2. Hospitals

- 9.1.1.3. Research and Educational Institutions

- 9.1.2. Industrial

- 9.1.3. Other End Users

- 9.1.1. Medical

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Medical

- 10.1.1.1. Diagnostic Centers

- 10.1.1.2. Hospitals

- 10.1.1.3. Research and Educational Institutions

- 10.1.2. Industrial

- 10.1.3. Other End Users

- 10.1.1. Medical

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Konica Minolta Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Foma Bohemia Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flow Dental

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Agfa-Gevaert N V (AGFA)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujifilm Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Codonics Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carestream Health Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sony Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global X-ray Film Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global X-ray Film Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 4: North America X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 5: North America X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 7: North America X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 8: North America X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 12: Europe X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: Europe X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 16: Europe X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 20: Asia Pacific X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: Asia Pacific X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Asia Pacific X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 28: Latin America X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Latin America X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Latin America X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 32: Latin America X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 36: Middle East X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 37: Middle East X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 39: Middle East X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Middle East X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East X-ray Film Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 2: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 3: Global X-ray Film Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global X-ray Film Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 10: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 14: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 19: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 22: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the X-ray Film Industry?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the X-ray Film Industry?

Key companies in the market include Konica Minolta Inc, Foma Bohemia Ltd, Flow Dental, Agfa-Gevaert N V (AGFA), Fujifilm Corporation, Codonics Inc, Carestream Health Inc, Sony Corporation.

3. What are the main segments of the X-ray Film Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 908 million as of 2022.

5. What are some drivers contributing to market growth?

; Continued Adoption of Traditional X-ray Equipment in Developing Economies.

6. What are the notable trends driving market growth?

Diagnostic Centers Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; Emergence of Digital Radiography and Flat Panel Detector Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "X-ray Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the X-ray Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the X-ray Film Industry?

To stay informed about further developments, trends, and reports in the X-ray Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence