Key Insights

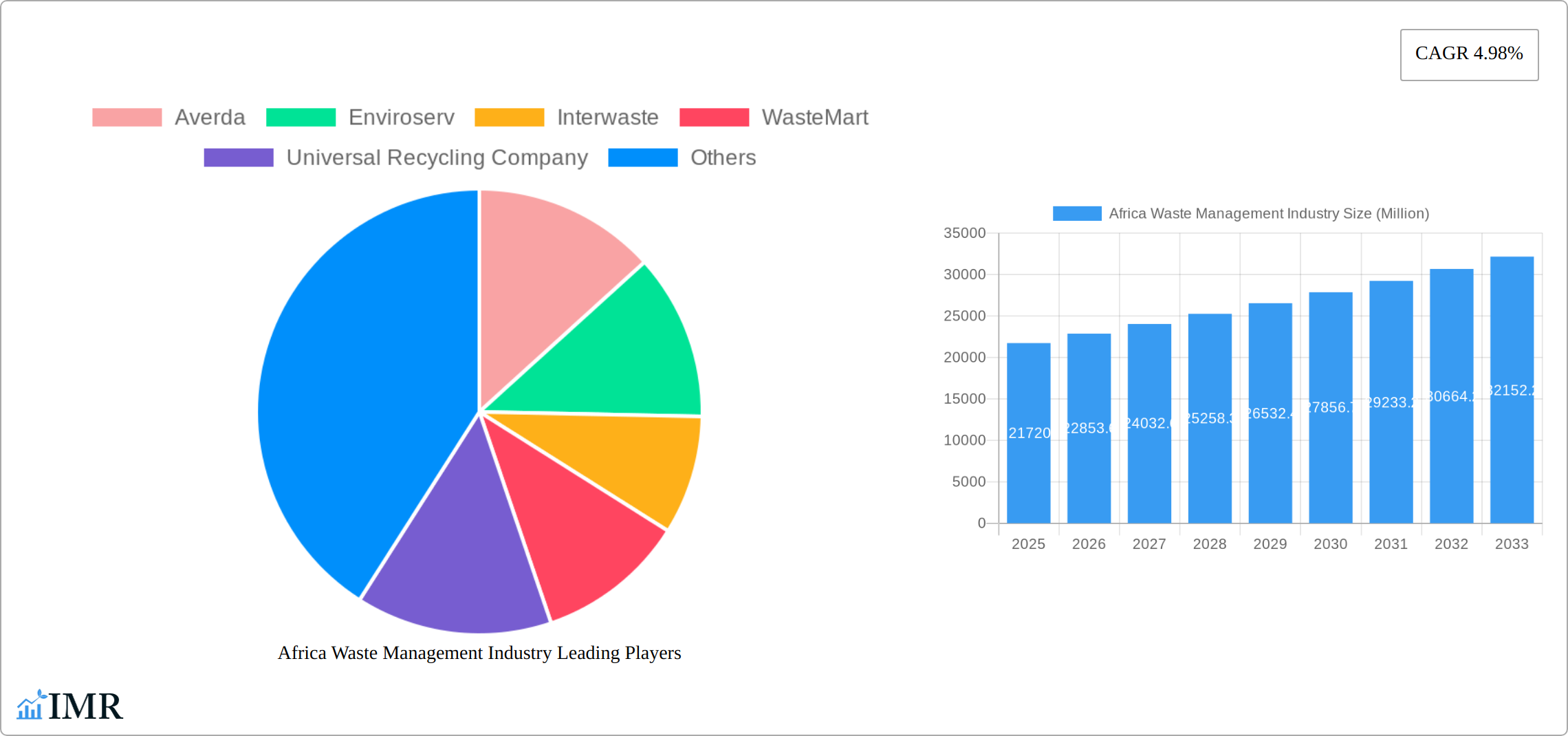

The African waste management market, valued at $21.72 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.98% from 2025 to 2033. This expansion is fueled by several key drivers. Rapid urbanization across the continent is leading to a significant increase in waste generation, creating a pressing need for efficient waste management solutions. Rising environmental awareness among governments and citizens is driving demand for sustainable waste disposal practices, including recycling and waste-to-energy initiatives. Furthermore, increasing investments in infrastructure development, coupled with supportive government regulations and policies promoting private sector participation, are contributing to market growth. However, challenges remain. Limited funding and infrastructure in many regions hinder the implementation of comprehensive waste management systems. Lack of awareness and inconsistent waste segregation practices among the population pose significant obstacles. Additionally, the informal waste sector, while providing employment, often lacks the necessary resources and expertise for environmentally sound waste handling.

Africa Waste Management Industry Market Size (In Billion)

Despite these challenges, the market presents significant opportunities. The increasing adoption of advanced waste management technologies, such as waste-to-energy plants and smart waste management systems, is creating new avenues for growth. The development of public-private partnerships (PPPs) is facilitating the implementation of large-scale waste management projects. Furthermore, the growing focus on circular economy principles, promoting resource recovery and recycling, is driving innovation and investment in the sector. Key players like Averda, Enviroserv, and Interwaste are actively shaping the market landscape, while smaller, localized companies are also playing a crucial role in addressing specific regional needs. The future of the African waste management market hinges on addressing existing challenges through strategic investments, technological advancements, and collaborative efforts between governments, private sector players, and local communities.

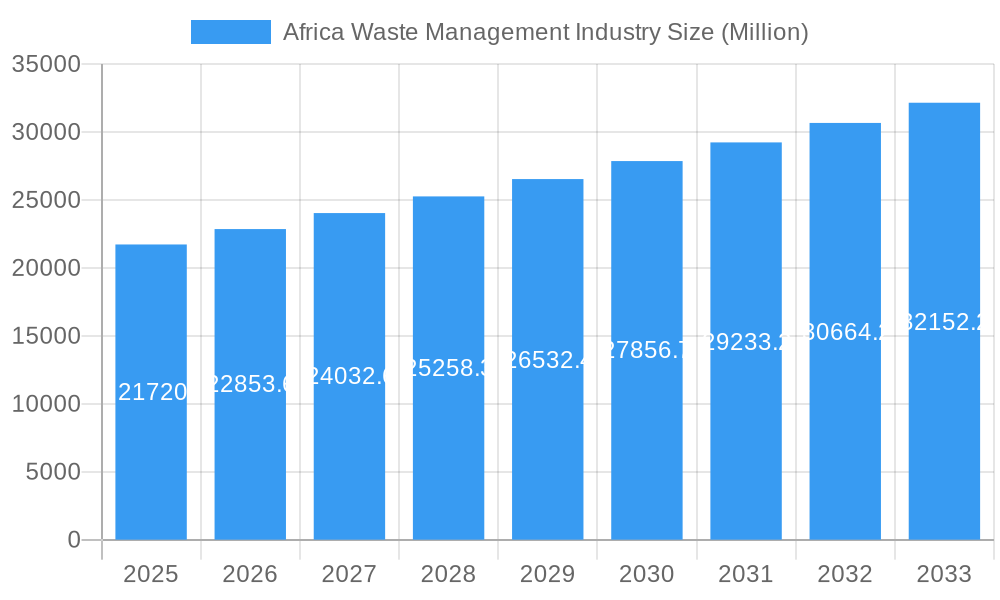

Africa Waste Management Industry Company Market Share

Africa Waste Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa waste management industry, covering market dynamics, growth trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and policymakers seeking to understand and capitalize on this rapidly evolving sector. The report analyzes parent markets (waste management) and child markets (recycling, waste collection, treatment, disposal) to provide a granular understanding of this complex landscape. The market size is expected to reach xx Million by 2033.

Africa Waste Management Industry Market Dynamics & Structure

The African waste management industry is a dynamic sector experiencing substantial transformation, shaped by a confluence of evolving regulatory landscapes, rapid technological advancements, and a growing recognition of environmental imperatives. The market landscape is characterized by a diverse ecosystem, featuring a mix of established multinational corporations with expansive operational footprints and agile, localized enterprises catering to specific regional needs. Market concentration exhibits a moderate level, with key players strategically positioning themselves to capture significant market shares within distinct service segments and geographical areas.

- Market Concentration: The top 5 players are estimated to hold approximately 35-45% of the market share in 2025, indicating a trend towards consolidation and the increasing influence of larger entities.

- Technological Innovation: A significant catalyst for market evolution is the accelerating adoption of smart waste management systems, including IoT-enabled sensors for real-time monitoring and route optimization. Advancements in recycling technologies, such as enhanced material recovery facilities (MRFs) and sophisticated sorting mechanisms, are also pivotal. Furthermore, the integration of Artificial Intelligence (AI) and data analytics is revolutionizing waste stream characterization, predictive analytics for collection efficiency, and the optimization of resource recovery. Challenges persist, including limited access to cutting-edge technology and a need for increased investment in specific regions.

- Regulatory Frameworks: Regulatory environments across African nations exhibit considerable diversity, directly influencing investment decisions and operational strategies. While some countries have robust policy frameworks, others are still developing their regulatory structures. Harmonization efforts are ongoing, aiming to create a more standardized and conducive environment for the industry, though significant hurdles remain in achieving continent-wide consistency.

- Competitive Product Substitutes: While traditional waste management services remain foundational, the emergence of innovative solutions is reshaping the competitive landscape. Advanced recycling technologies and the burgeoning waste-to-energy (WtE) sector are increasingly offering viable alternatives to conventional landfill disposal, presenting a strong substitute in terms of resource recovery and energy generation.

- End-User Demographics: The relentless pace of urbanization and sustained population growth across Africa are primary drivers of escalating waste generation. This demographic shift inherently amplifies the demand for efficient, scalable, and environmentally responsible waste management solutions.

- M&A Trends: The recent past has witnessed a notable surge in Mergers & Acquisitions (M&A) activity within the African waste management sector. This trend underscores strategic consolidation, market expansion initiatives, and the drive for enhanced operational efficiencies by leading players. The estimated value of M&A deals in the sector reached approximately 750-900 Million USD in 2024, reflecting growing investor confidence.

Africa Waste Management Industry Growth Trends & Insights

The African waste management market is currently experiencing robust and sustained growth, propelled by a confluence of powerful drivers including accelerated urbanization, a heightened global and local awareness of environmental sustainability, and increasingly supportive government policies and initiatives. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 7-9% during the forecast period spanning 2025-2033. Technological disruptions, particularly in the fields of waste-to-energy (WtE) conversion and the implementation of smart waste management solutions, are significantly accelerating this growth trajectory. Concurrently, evolving consumer behavior, characterized by a growing inclination towards recycling and waste reduction practices, is further fueling market expansion. Despite this growth, the penetration of modern, integrated waste management services across much of the continent remains relatively nascent, presenting substantial and largely untapped opportunities for further development and investment.

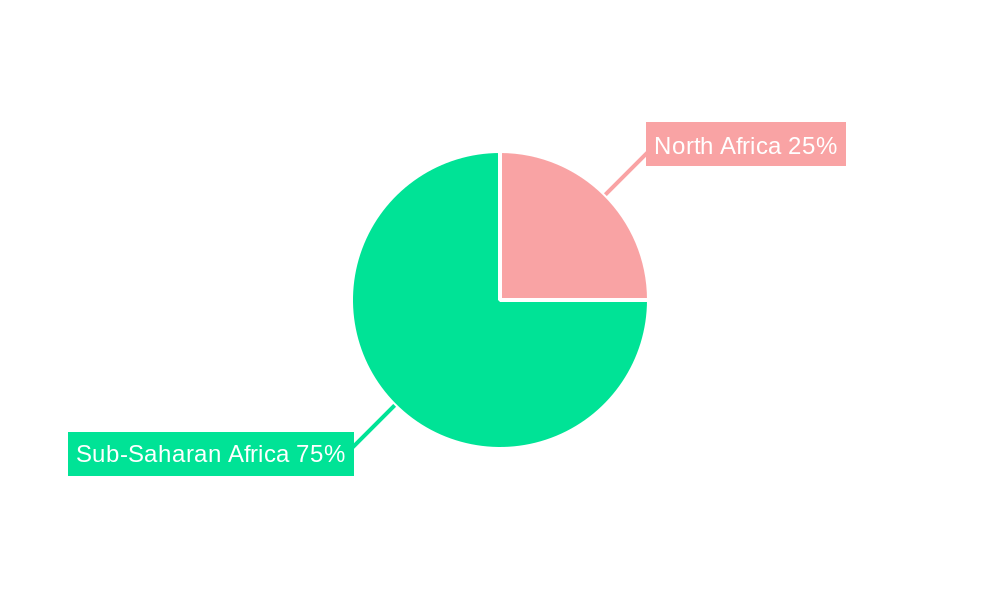

Dominant Regions, Countries, or Segments in Africa Waste Management Industry

Currently, South Africa, Egypt, and Nigeria stand out as the leading national markets within the African waste management industry. Their dominance is attributed to a combination of factors, including higher population densities, more robust economic activity, and comparatively more developed infrastructure and regulatory frameworks. However, a significant and largely untapped growth potential exists across the entire African continent, with numerous emerging markets poised for rapid expansion.

- Key Drivers:

- Economic Growth: The rapid and sustained economic expansion observed in various African regions directly fuels the demand for enhanced and more sophisticated waste management services, driven by increased consumption and industrial activity.

- Government Initiatives: A growing commitment from governments to invest in critical infrastructure development, coupled with the introduction of supportive policies and regulations, is a pivotal force driving the overall market development and creating a more conducive investment climate.

- Private Sector Involvement: The increasing influx of substantial private sector investment is a crucial enabler of innovation, technological adoption, and the overall expansion of the waste management market across the continent.

- Dominance Factors:

- Market Size: South Africa's leading position in market size is a direct consequence of its more advanced infrastructure, established regulatory systems, and a higher level of industrialization.

- Growth Potential: Sub-Saharan Africa, in particular, represents a vast reservoir of untapped potential due to its rapidly growing urban populations and increasingly prominent environmental concerns, creating a fertile ground for new market entrants and service expansion.

- Government Support: Favorable government policies, clear regulatory guidelines, and active support mechanisms play an indispensable role in determining the success and sustainability of market players operating within this diverse landscape.

Africa Waste Management Industry Product Landscape

The product and service landscape within the African waste management industry is comprehensive, encompassing a wide spectrum of essential activities. These include sophisticated waste collection and transportation logistics, advanced processing and treatment methodologies, efficient recycling operations, specialized hazardous waste management, environmentally sound disposal techniques, and increasingly, innovative waste-to-energy (WtE) solutions. Current innovations are primarily focused on enhancing operational efficiency, minimizing the environmental footprint of waste management practices, and maximizing the recovery rates of valuable recyclable materials. Key technological advancements driving this evolution include the deployment of smart bins with integrated sensors for optimized collection routes, the implementation of advanced sorting technologies utilizing AI and robotics, and the adoption of anaerobic digestion processes for organic waste conversion into biogas and fertilizer.

Key Drivers, Barriers & Challenges in Africa Waste Management Industry

Key Drivers: Rapid urbanization, rising environmental awareness, increased government regulations, and growing private sector investment are major driving forces. For example, the increasing adoption of waste-to-energy technologies promises to contribute significantly to both energy generation and waste reduction.

Key Challenges and Restraints: Inadequate infrastructure, limited funding, lack of awareness, inconsistent regulatory frameworks, and the informal nature of the sector remain major obstacles to widespread adoption of modern waste management practices. This results in significant financial losses for companies and affects overall sustainability efforts. The estimated annual economic loss due to inadequate waste management is approximately xx Million.

Emerging Opportunities in Africa Waste Management Industry

Untapped markets in rural areas and smaller cities present significant growth opportunities. Innovative applications of waste-to-energy and circular economy models are gaining traction. The increasing demand for sustainable and environmentally friendly solutions presents a significant opportunity for businesses to innovate and capture market share.

Growth Accelerators in the Africa Waste Management Industry

Technological advancements, particularly in AI-powered waste management solutions, are driving efficiency and reducing costs. Strategic partnerships between public and private sector entities are fostering collaboration and investment. Expanding market access through improved infrastructure and increased awareness will accelerate growth across the continent.

Key Players Shaping the Africa Waste Management Industry Market

- Averda

- Enviroserv

- Interwaste

- WasteMart

- Universal Recycling Company

- Desco

- PETCO

- The Glass Recycling Company

- Oricol Environmental Services SA (PTY) LTD

- WeCyclers

- The Waste Group (Pty) Ltd

- SA Waste (PTY) Ltd

- List Not Exhaustive

Notable Milestones in Africa Waste Management Industry Sector

- October 2022: SUEZ, RBH, and AIIM finalized the acquisition of EnviroServ, strengthening SUEZ's African presence.

- May 2022: IFC provided a USD 30 million loan to Averda, supporting its expansion in Africa and the Middle East.

In-Depth Africa Waste Management Industry Market Outlook

The African waste management market presents a landscape brimming with immense potential for substantial future growth and transformation. The relentless trend of urbanization, coupled with a steadily rising global and local consciousness regarding environmental sustainability and the implementation of supportive government policies, will collectively drive an escalating demand for modern and integrated waste management solutions. To fully unlock this significant potential, strategic and substantial investments in infrastructure development, the adoption of advanced technologies, and the cultivation of skilled human capital will be absolutely critical. The market is unequivocally poised for significant expansion, driven by the relentless pace of technological innovation, the robust engagement of the private sector, and an ever-growing continental and global emphasis on achieving greater sustainability in all aspects of economic activity.

Africa Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

Africa Waste Management Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Waste Management Industry Regional Market Share

Geographic Coverage of Africa Waste Management Industry

Africa Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Awareness towards the Waste Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Averda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enviroserv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interwaste

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WasteMart

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Recycling Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PETCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Glass Recycling Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oricol Environmental Services SA (PTY) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WeCyclers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Waste Group (Pty) Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SA Waste (PTY) Ltd **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Averda

List of Figures

- Figure 1: Africa Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Africa Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Africa Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Africa Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Africa Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Nigeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: South Africa Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Africa Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Egypt Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Egypt Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Kenya Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Kenya Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Ethiopia Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ethiopia Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Morocco Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Morocco Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ghana Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ghana Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Algeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Algeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Tanzania Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Tanzania Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Ivory Coast Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Waste Management Industry?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Africa Waste Management Industry?

Key companies in the market include Averda, Enviroserv, Interwaste, WasteMart, Universal Recycling Company, Desco, PETCO, The Glass Recycling Company, Oricol Environmental Services SA (PTY) LTD, WeCyclers, The Waste Group (Pty) Ltd, SA Waste (PTY) Ltd **List Not Exhaustive.

3. What are the main segments of the Africa Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Awareness towards the Waste Management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022- In line with the conditions stated on June 9, 2022, SUEZ, Royal Bafokeng Holdings (RBH), and African Infrastructure Investment Managers (AIIM) finalized the acquisition of EnviroServ Proprietary Holdings Ltd and its subsidiaries (collectively, "EnviroServ") after receiving permission from the regional antitrust authorities. By this purchase, SUEZ will be able to solidify both its presence in Africa and its position as a global leader in the treatment of municipal and industrial waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Waste Management Industry?

To stay informed about further developments, trends, and reports in the Africa Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence