Key Insights

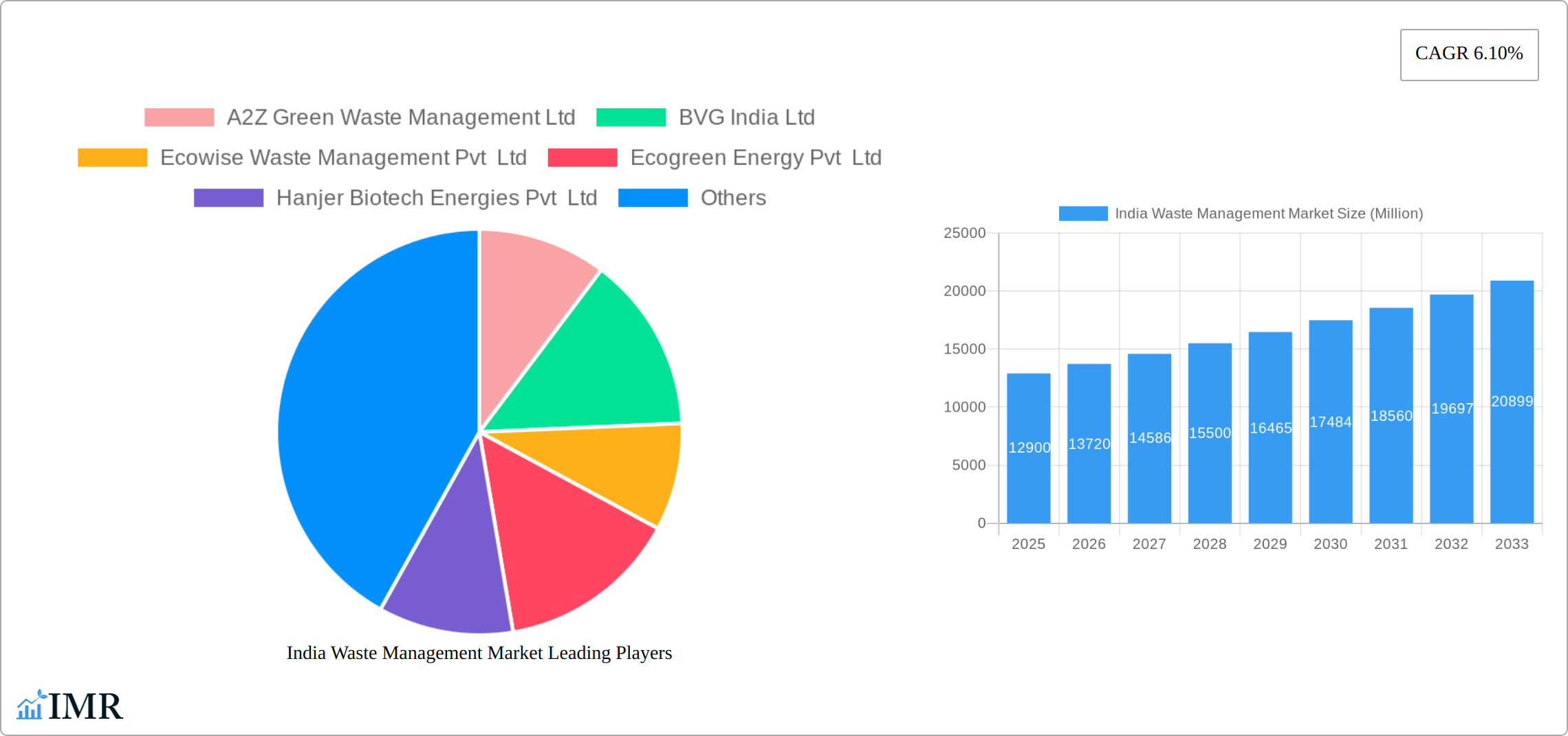

The India Waste Management Market, valued at $12.90 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations aimed at improving waste management infrastructure. The compound annual growth rate (CAGR) of 6.10% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Key drivers include the government's "Swachh Bharat Abhiyan" initiative, promoting sanitation and waste management across the country, along with growing industrialization and a consequent increase in industrial waste generation. Furthermore, the rising adoption of innovative waste-to-energy technologies and private sector investment in waste management solutions are fueling market growth. Challenges persist, however, including inefficient waste collection systems in many areas, lack of awareness among citizens regarding proper waste segregation, and the need for further technological advancements to efficiently handle diverse waste streams. The market's segmentation, though unspecified, likely encompasses various waste types (municipal solid waste, industrial waste, hazardous waste, etc.), services (collection, processing, disposal, recycling), and technologies employed.

India Waste Management Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established players and emerging companies. Prominent players like Ramky Enviro Engineers Ltd, IL&FS Environmental Infrastructure and Services Ltd, and others are actively contributing to the market's expansion through strategic acquisitions, technological upgrades, and expansion of their service portfolios. Future growth will likely be shaped by increasing public-private partnerships, technological innovation in waste-to-energy and recycling technologies, and a greater focus on sustainable waste management practices to address the growing environmental concerns and meet the nation's burgeoning waste management needs. The market's growth trajectory is promising, with opportunities for significant expansion in both urban and rural areas.

India Waste Management Market Company Market Share

India Waste Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Waste Management Market, encompassing market dynamics, growth trends, regional segmentation, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand this rapidly evolving sector. The report examines both the parent market (Waste Management) and child markets (e.g., solid waste management, e-waste management, recycling). Market values are presented in million units.

India Waste Management Market Dynamics & Structure

The Indian waste management market is characterized by a fragmented structure, with numerous players of varying sizes. Market concentration is low, with no single dominant player controlling a significant share. However, larger companies are increasingly consolidating their market position through mergers and acquisitions (M&A). Technological innovation is a key driver, with advancements in waste-to-energy technologies, recycling techniques, and smart waste management solutions transforming the landscape. Stringent government regulations, aimed at improving environmental sustainability and public health, are also significantly influencing market growth. The market faces competition from informal waste management practices, which pose a significant challenge. End-user demographics show a growing urban population and increasing environmental awareness driving demand for efficient waste management solutions.

- Market Concentration: Low, with numerous small and medium-sized enterprises (SMEs).

- Technological Innovation: Significant advancements in waste-to-energy, recycling, and smart waste management solutions.

- Regulatory Framework: Stringent environmental regulations driving adoption of sustainable practices.

- Competitive Product Substitutes: Informal waste management practices represent a significant challenge.

- M&A Activity: Increasing consolidation amongst larger players, xx deals in the past five years.

- End-User Demographics: Rapid urbanization and rising environmental awareness are key demand drivers.

India Waste Management Market Growth Trends & Insights

The India Waste Management Market is experiencing robust growth, driven by factors such as increasing urbanization, rising environmental concerns, and government initiatives promoting sustainable waste management practices. The market size is estimated at xx million in 2025 and is projected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as AI-powered waste sorting and automated collection systems, are accelerating market adoption. Consumer behavior is shifting towards greater environmental consciousness, increasing demand for eco-friendly waste management solutions. Market penetration for advanced waste management technologies remains relatively low but is expected to increase significantly in the coming years.

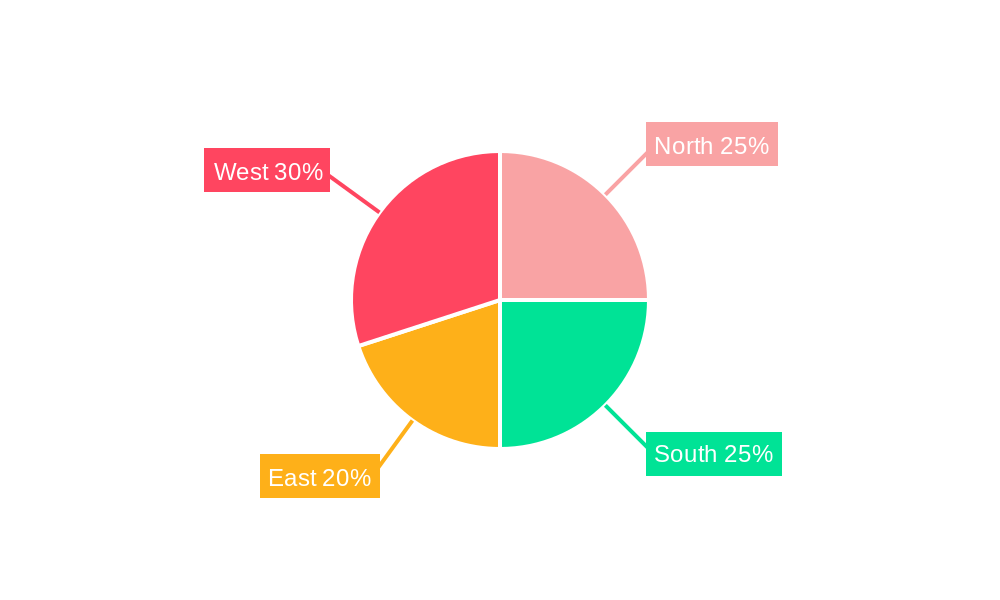

Dominant Regions, Countries, or Segments in India Waste Management Market

The metropolitan cities of India, such as Mumbai, Delhi, Bengaluru, and Chennai, represent the dominant regions in the waste management market due to high population density, substantial waste generation, and greater investment in infrastructure. These regions demonstrate higher adoption rates for advanced waste management technologies and services compared to rural areas. The rapid urbanization and industrialization within these cities contribute to significant waste generation, fueling the need for comprehensive waste management solutions. Favorable government policies and incentives further stimulate growth.

- Key Drivers: High population density, industrialization, stringent environmental regulations, and government support.

- Dominance Factors: Higher waste generation, increased awareness, and better infrastructure development.

- Growth Potential: Significant untapped potential in tier-2 and tier-3 cities and rural areas.

- Market Share: Metropolitan cities account for approximately xx% of the total market share.

India Waste Management Market Product Landscape

The Indian waste management market is characterized by a comprehensive ecosystem of products and services designed to address the nation's growing waste challenges. This includes advanced waste collection vehicles equipped with GPS tracking and route optimization, sophisticated waste processing equipment such as shredders, balers, and compactors, and state-of-the-art recycling facilities leveraging automated sorting technologies. Comprehensive landfill solutions are also integral, focusing on engineered landfills with leachate collection and gas capture systems to minimize environmental impact.

Recent product innovations are significantly enhancing operational efficiency and sustainability. AI-powered waste sorting systems are revolutionizing material recovery, enabling higher purity of recyclables. Smart bins, equipped with sensors, are optimizing collection routes in real-time, reducing fuel consumption and operational costs. Furthermore, the market is experiencing a robust surge in demand for sustainable and environmentally friendly solutions. Technologies like anaerobic digestion are gaining traction for their ability to convert organic waste into biogas for energy generation, while waste-to-energy (WtE) technologies are becoming increasingly prominent in reducing landfill burden and creating a valuable energy source. These advancements collectively contribute to a more circular economy and a cleaner environment.

Key Drivers, Barriers & Challenges in India Waste Management Market

Key Drivers:

- Rising urbanization and industrialization leading to increased waste generation.

- Stringent government regulations and policies promoting sustainable waste management.

- Growing environmental awareness among consumers.

- Technological advancements leading to more efficient waste management solutions.

Challenges:

- Lack of adequate infrastructure, particularly in smaller cities and rural areas.

- Informal waste management practices, which contribute to environmental pollution.

- Limited public awareness regarding the importance of proper waste disposal.

- High initial investment costs associated with implementing advanced waste management systems. This results in a xx million shortfall in funding annually.

Emerging Opportunities in India Waste Management Market

- Geographical Expansion: Tapping into the vast, yet often underserved, markets in tier-2 and tier-3 cities, as well as rural hinterlands, presents a significant opportunity for scalable waste management solutions.

- Technological Integration: The strategic adoption and development of cutting-edge technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain for waste tracking and management systems offer immense potential for enhanced efficiency and transparency.

- Circular Economy Catalysis: Driving the adoption of circular economy principles, promoting product design for recyclability, and fostering robust take-back schemes will significantly boost recycling rates and resource recovery.

- Public-Private Collaboration: Strengthening public-private partnerships (PPPs) through innovative financing models and policy frameworks is crucial for attracting investment, driving large-scale project implementation, and fostering a conducive ecosystem for growth.

- Specialized Waste Streams: Focusing on the management of specific waste streams like e-waste, hazardous waste, and construction & demolition waste, which are rapidly growing, presents niche market opportunities.

Growth Accelerators in the India Waste Management Market Industry

The India waste management market is experiencing accelerated growth driven by a confluence of factors. Technological breakthroughs are at the forefront, with AI-powered waste sorting systems and smart bins significantly improving efficiency, precision, and cost-effectiveness. Advanced recycling technologies are enabling higher recovery rates for valuable materials. Strategic partnerships between private sector players and municipal corporations are instrumental in enabling the planning and execution of ambitious waste management projects, leveraging private sector expertise and capital. The expansion into untapped geographical markets, particularly in emerging urban centers and rural regions, is unlocking substantial growth potential. Moreover, a heightened national focus on sustainability and the principles of a circular economy is strongly influencing consumer and industry behavior, driving the demand for innovative and eco-friendly waste management solutions that prioritize resource recovery and waste minimization.

Key Players Shaping the India Waste Management Market Market

- A2Z Green Waste Management Ltd

- BVG India Ltd

- Ecowise Waste Management Pvt Ltd

- Ecogreen Energy Pvt Ltd

- Hanjer Biotech Energies Pvt Ltd

- Tatva Global Environment Ltd

- Waste Ventures India Pvt Ltd

- Hydroair Tectonics (PCD) Ltd

- IL&FS Environmental Infrastructure and Services Ltd

- Jindal ITF Urban Infrastructure Ltd

- Ramky Enviro Engineers Ltd

- SPML Infra Ltd

- MSW (Municipal Solid Waste) Management companies

- Waste-to-Energy plant operators

- E-waste recyclers

- Composting and Biogas plant developers List Not Exhaustive

Notable Milestones in India Waste Management Market Sector

- August 2023: The Brihanmumbai Municipal Corporation (BMC) strategically adopted and integrated key components of the highly successful 'Indore model' for solid waste management (SWM) to enhance waste collection, segregation, and processing efficiency in Mumbai, signaling a national trend towards replicable best practices.

- March 2023: Bharat Petroleum Corporation Limited (BPCL) took a significant stride in corporate environmental responsibility by launching its comprehensive "Sound Management of Waste Disposal (SMWD)" initiative. This program places a strong emphasis on the reduction and recycling of electronic waste (e-waste), with an ambitious target of achieving zero-waste-to-landfill certification by 2025, setting a benchmark for industrial waste management.

- Ongoing: Several states and urban local bodies are actively implementing policies to promote source segregation of waste, encouraging citizen participation and laying the groundwork for efficient downstream processing and recycling.

- Recent: Increased government impetus and funding are being directed towards the development of decentralized waste management facilities and the promotion of waste-to-energy projects across various urban agglomerations.

In-Depth India Waste Management Market Market Outlook

The future of the India Waste Management Market is exceptionally promising, driven by sustained urbanization, stringent environmental regulations, and technological advancements. Strategic partnerships, increased private sector investment, and a greater emphasis on the circular economy will further propel market growth. The focus on sustainable and technologically advanced waste management solutions presents lucrative opportunities for both established players and new entrants. The market's potential for innovation and expansion, particularly in underserved areas, ensures robust growth in the coming years.

India Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic Waste

- 1.6. Bio-medical Waste

-

2. Disposal Methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of Ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public-private Partnership

India Waste Management Market Segmentation By Geography

- 1. India

India Waste Management Market Regional Market Share

Geographic Coverage of India Waste Management Market

India Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization

- 3.3. Market Restrains

- 3.3.1. Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization

- 3.4. Market Trends

- 3.4.1. Increase in amount of waste generated

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic Waste

- 5.1.6. Bio-medical Waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of Ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public-private Partnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A2Z Green Waste Management Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BVG India Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ecowise Waste Management Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecogreen Energy Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanjer Biotech Energies Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tatva Global Environment Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Ventures India Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hydroair Tectonics (PCD) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IL&FS Environmental Infrastructure and Services Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jindal ITF Urban Infrastructure Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ramky Enviro Engineers Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SPML Infra Ltd**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 A2Z Green Waste Management Ltd

List of Figures

- Figure 1: India Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: India Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: India Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: India Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 4: India Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 5: India Waste Management Market Revenue Million Forecast, by Type of Ownership 2020 & 2033

- Table 6: India Waste Management Market Volume Billion Forecast, by Type of Ownership 2020 & 2033

- Table 7: India Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 10: India Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 11: India Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 12: India Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 13: India Waste Management Market Revenue Million Forecast, by Type of Ownership 2020 & 2033

- Table 14: India Waste Management Market Volume Billion Forecast, by Type of Ownership 2020 & 2033

- Table 15: India Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waste Management Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the India Waste Management Market?

Key companies in the market include A2Z Green Waste Management Ltd, BVG India Ltd, Ecowise Waste Management Pvt Ltd, Ecogreen Energy Pvt Ltd, Hanjer Biotech Energies Pvt Ltd, Tatva Global Environment Ltd, Waste Ventures India Pvt Ltd, Hydroair Tectonics (PCD) Ltd, IL&FS Environmental Infrastructure and Services Ltd, Jindal ITF Urban Infrastructure Ltd, Ramky Enviro Engineers Ltd, SPML Infra Ltd**List Not Exhaustive.

3. What are the main segments of the India Waste Management Market?

The market segments include Waste Type, Disposal Methods, Type of Ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization.

6. What are the notable trends driving market growth?

Increase in amount of waste generated.

7. Are there any restraints impacting market growth?

Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization.

8. Can you provide examples of recent developments in the market?

August 2023: The Brihanmumbai Municipal Corporation (BMC) analyzed the highly successful 'Indore model' of waste management to enhance solid waste management (SWM) in Mumbai. This approach has contributed to Indore, known as the 'Mini Mumbai' of Madhya Pradesh, maintaining its position as the cleanest city in India for six consecutive years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waste Management Market?

To stay informed about further developments, trends, and reports in the India Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence