Key Insights

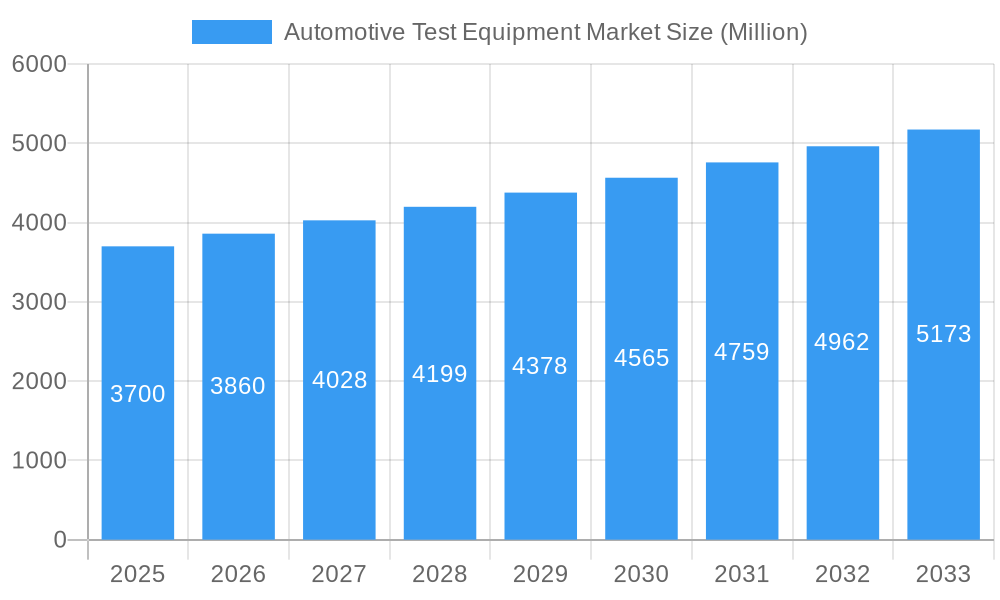

The global Automotive Test Equipment market is poised for substantial expansion, projecting a market size of USD 3.7 billion in 2025, driven by a robust compound annual growth rate (CAGR) of 4.3% throughout the forecast period of 2025-2033. This growth is underpinned by the increasing complexity and technological sophistication of vehicles, particularly the surge in electric and autonomous driving technologies. Stringent automotive safety regulations worldwide are a significant catalyst, compelling manufacturers to invest heavily in advanced testing solutions to ensure compliance and enhance vehicle performance and reliability. The relentless pursuit of improved fuel efficiency and reduced emissions also fuels demand for specialized testing equipment that can accurately measure and optimize various vehicle systems. Furthermore, the ever-evolving landscape of automotive electronics, from advanced driver-assistance systems (ADAS) to in-car infotainment, necessitates continuous validation and testing, creating a sustained demand for innovative test solutions.

Automotive Test Equipment Market Market Size (In Billion)

Key drivers fueling this market include the widespread adoption of electric vehicles (EVs), which require specialized battery testing, charging system validation, and motor performance analysis. The ongoing development and integration of autonomous driving technologies, with their complex sensor suites and processing units, also demand highly sophisticated diagnostic and verification equipment. Emerging trends such as the increasing focus on vehicle cybersecurity, the integration of AI and machine learning in automotive design, and the growing demand for connected car services are further shaping the market. While the market is experiencing healthy growth, challenges such as the high initial investment cost for advanced testing equipment and the need for skilled personnel to operate and interpret results can present restraints. However, the overarching trend towards safer, more efficient, and technologically advanced vehicles, coupled with supportive regulatory frameworks, ensures a positive outlook for the Automotive Test Equipment market.

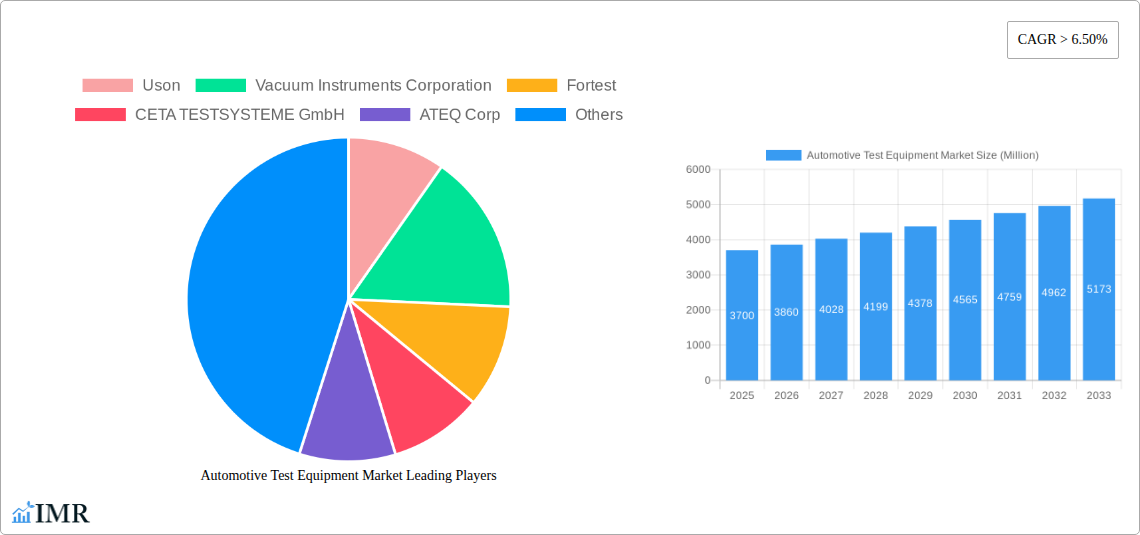

Automotive Test Equipment Market Company Market Share

Automotive Test Equipment Market: Comprehensive Growth Analysis, Forecast to 2033

Report Description:

Gain unparalleled insights into the dynamic Automotive Test Equipment Market with this in-depth analysis. This report meticulously examines the automotive testing solutions, automotive diagnostic equipment, and automotive inspection tools market from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. Delve into the parent market of automotive testing solutions and its crucial child markets, understanding their interconnected growth trajectories. We provide precise quantitative data, including market share percentages and projected values in billion units, to inform your strategic decisions. This report is essential for manufacturers, suppliers, technology developers, and automotive industry stakeholders seeking to navigate the evolving landscape of vehicle testing equipment and automotive electronics testing.

Automotive Test Equipment Market Market Dynamics & Structure

The automotive test equipment market is characterized by a moderate concentration, with key players investing heavily in technological innovation to meet stringent emission standards and the increasing complexity of vehicle electronics. Regulatory frameworks, such as Euro 7 and stricter EPA mandates, are significant drivers for advanced emission testing equipment and engine diagnostic tools. Competitive product substitutes are emerging, particularly in software-based diagnostics, but specialized hardware remains critical for comprehensive testing. End-user demographics are shifting towards electric vehicles (EVs) and autonomous driving systems, demanding sophisticated EV battery testing equipment and ADAS calibration tools. Mergers and acquisitions (M&A) are a prominent trend, with companies consolidating to expand their product portfolios and geographic reach, especially in areas like automotive sensor testing.

- Market Concentration: Moderate, with significant investment in R&D by leading firms.

- Technological Innovation Drivers: Stringent emission regulations, electrification of vehicles, advancements in autonomous driving technology, and increased vehicle connectivity.

- Regulatory Frameworks: Growing stringency of global emission standards and safety regulations for vehicles.

- Competitive Product Substitutes: Rise of advanced software diagnostics, though hardware remains vital for physical testing.

- End-User Demographics: Increasing demand for EV-specific testing solutions, ADAS calibration, and advanced powertrain diagnostics.

- M&A Trends: Consolidation to gain market share and broaden technological capabilities, particularly in specialized testing segments.

Automotive Test Equipment Market Growth Trends & Insights

The automotive test equipment market is poised for robust growth, driven by the accelerating transition to electric vehicles and the increasing sophistication of automotive technologies. The global market size is projected to witness a significant expansion, fueled by rising adoption rates of advanced diagnostic and testing solutions across the automotive value chain. Technological disruptions, such as the integration of AI and machine learning in testing equipment for predictive maintenance and faster diagnostics, are reshaping market dynamics. Consumer behavior shifts, emphasizing vehicle safety, performance, and reliability, further underscore the importance of comprehensive testing. The market is experiencing a substantial CAGR, with penetration rates for specialized automotive testing equipment increasing across both original equipment manufacturers (OEMs) and aftermarket service providers. The growing complexity of vehicle architectures, including advanced driver-assistance systems (ADAS) and intricate electronic control units (ECUs), necessitates continuous upgrades to testing capabilities, from automotive electrical testing to automotive software testing. The demand for efficient and accurate automotive emissions testing continues to evolve with new regulatory mandates.

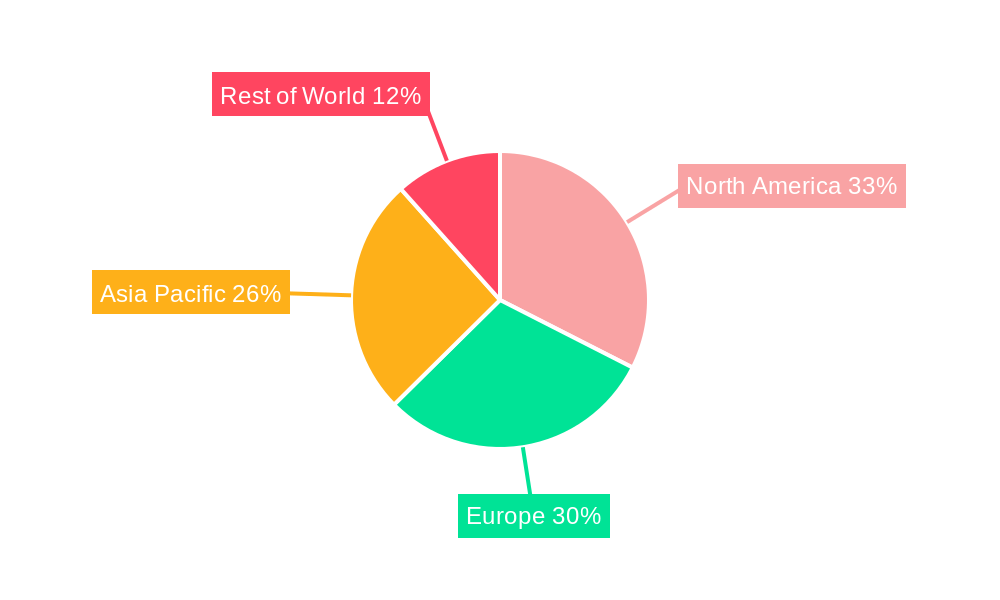

Dominant Regions, Countries, or Segments in Automotive Test Equipment Market

The Automotive & Transportation segment, within the broader Automotive Test Equipment Market, stands as the dominant force driving market growth. This supremacy is attributed to the sheer volume of vehicles produced globally and the continuous demand for their testing throughout their lifecycle. Within this segment, regions with robust automotive manufacturing bases, such as Asia Pacific, North America, and Europe, are leading the charge.

- Asia Pacific: This region is a powerhouse, driven by countries like China, Japan, and South Korea, which are major automotive manufacturing hubs and early adopters of new technologies. The burgeoning EV market in China, coupled with government incentives for electric mobility, significantly boosts demand for specialized EV battery testing equipment and automotive charging system testers. The presence of numerous global and local automotive manufacturers ensures a consistent need for automotive diagnostic tools and vehicle inspection systems.

- North America: The United States, in particular, is a significant market due to its large vehicle parc and stringent safety and emission standards. The increasing focus on autonomous vehicle development and the rapid adoption of electric vehicles are creating substantial demand for advanced ADAS calibration tools and automotive sensor testing equipment. The aftermarket service sector also plays a crucial role, with repair shops requiring sophisticated automotive repair tools and OBD-II scanners.

- Europe: European nations are at the forefront of emission regulations, such as Euro 7, which drives the demand for advanced automotive emission testing equipment. The strong presence of premium automotive brands and their commitment to innovation in areas like electrification and connectivity further bolster the market for high-end automotive testing solutions. The widespread adoption of connected car technologies also necessitates advanced automotive communication testing.

The Automotive & Transportation segment's dominance is further reinforced by its intrinsic link to the core function of the automotive industry – manufacturing and maintaining vehicles. Economic policies promoting automotive production, infrastructure development supporting manufacturing facilities, and the constant need for quality control and compliance with evolving standards all contribute to the segment's sustained growth and market share.

Automotive Test Equipment Market Product Landscape

The product landscape of the automotive test equipment market is defined by continuous innovation and diversification. Key product categories include sophisticated diagnostic tools, advanced emission analyzers, specialized EV battery testers, ADAS calibration systems, and comprehensive vehicle inspection equipment. Innovations focus on enhanced accuracy, faster testing cycles, wireless connectivity, and integration with cloud-based data management platforms. Unique selling propositions lie in the equipment's ability to diagnose complex issues in modern vehicles, from intricate powertrain electronics to advanced safety systems. Technological advancements are enabling real-time data acquisition and analysis, providing technicians with actionable insights for efficient repairs and quality assurance. The demand for integrated solutions that can perform multiple tests with a single setup is also rising.

Key Drivers, Barriers & Challenges in Automotive Test Equipment Market

Key Drivers: The automotive test equipment market is primarily propelled by the rapid evolution of automotive technology, especially the surge in electric vehicles (EVs) and autonomous driving systems. Stringent global emission and safety regulations are mandating the use of advanced automotive testing equipment for compliance. The increasing complexity of vehicle electronics and the need for precise automotive sensor testing and ECU diagnostics also contribute significantly. Furthermore, the growing aftermarket demand for reliable vehicle maintenance and repair services fuels the need for sophisticated automotive diagnostic tools.

Barriers & Challenges: High development costs associated with cutting-edge automotive testing solutions present a significant barrier. The rapid pace of technological change requires continuous investment in R&D and product updates, which can be challenging for smaller manufacturers. Supply chain disruptions, particularly for specialized electronic components, can impact production timelines and costs for vehicle testing equipment. Intense competition from both established players and emerging technologies creates price pressures. Moreover, the need for skilled technicians to operate and interpret data from complex automotive diagnostic equipment can be a constraint in some regions.

Emerging Opportunities in Automotive Test Equipment Market

Emerging opportunities in the automotive test equipment market are centered around the burgeoning electric vehicle ecosystem and the advancement of autonomous driving. There is a significant untapped market for specialized EV battery testing equipment, including state-of-health assessment, charge/discharge cycle testing, and thermal management validation. The growing adoption of software-defined vehicles presents opportunities for advanced automotive software testing and validation tools. Furthermore, the need for robust cybersecurity testing for connected vehicles is an expanding frontier. Emerging markets in developing economies, with increasing vehicle ownership and evolving regulatory landscapes, also offer substantial growth potential for a wide range of automotive testing solutions.

Growth Accelerators in the Automotive Test Equipment Market Industry

Several key catalysts are accelerating growth in the automotive test equipment market. The relentless pursuit of automotive innovation, particularly in electrification and autonomous driving, necessitates continuous development and adoption of more sophisticated testing methodologies. Strategic partnerships between technology providers and automotive manufacturers are crucial for co-developing tailored testing solutions. Market expansion strategies, focusing on emerging economies and specific vehicle segments like commercial vehicles, are opening new avenues for growth. Furthermore, advancements in artificial intelligence and machine learning are being integrated into testing equipment, enabling predictive diagnostics and more efficient quality control, acting as significant growth accelerators for the automotive diagnostic equipment sector.

Key Players Shaping the Automotive Test Equipment Market Market

- Uson

- Vacuum Instruments Corporation

- Fortest

- CETA TESTSYSTEME GmbH

- ATEQ Corp

- CTS Cincinnati

- InterTech Development Company

- LACO Technologies

- INFICON

- TASI Group

- Pfeiffer Vacuum GmbH

- Cosmo Instruments Co ltd

- TQC Automation & Test Solutions

- GMJ Systems & Automations Pvt Ltd

Notable Milestones in Automotive Test Equipment Market Sector

- Oct 2020: Vacuum Instruments Corporation and ATEQ Corp. North America entered into a strategic partnership, offering an extensive leak-testing product range and deep expertise. This collaboration aims to provide comprehensive solutions for key applications such as electric vehicle batteries and fuel cells.

- Feb 2022: ATEQ Corp., a manufacturer of leak and flow testers, partnered with North Central Manufacturing Solutions, a manufacturing solution provider. This partnership enhances ATEQ's local customer service capabilities in the Upper Midwest region.

In-Depth Automotive Test Equipment Market Market Outlook

The future outlook for the automotive test equipment market is exceptionally promising, driven by a confluence of technological advancements and evolving industry demands. Growth accelerators such as the ongoing electrification of the global vehicle fleet and the maturation of autonomous driving technologies will continue to fuel the need for highly specialized and accurate testing equipment. Strategic partnerships and collaborations will remain pivotal in driving innovation and market penetration. Opportunities abound in the development of integrated testing platforms for EVs, including battery management systems, charging infrastructure validation, and thermal performance analysis. The increasing focus on vehicle cybersecurity will also create a new segment for advanced diagnostic and testing tools. Companies that can adapt to these evolving trends and offer comprehensive, data-driven solutions will be well-positioned to capitalize on the significant growth potential within the global automotive testing solutions landscape.

Automotive Test Equipment Market Segmentation

-

1. End-user

- 1.1. HVAC/R

- 1.2. Automotive & Transportation

- 1.3. Medical & Pharmaceutical

- 1.4. Packaging

- 1.5. Industrial

- 1.6. Others

Automotive Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Automotive Test Equipment Market Regional Market Share

Geographic Coverage of Automotive Test Equipment Market

Automotive Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from Oil and Gas Industry Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. HVAC/R

- 5.1.2. Automotive & Transportation

- 5.1.3. Medical & Pharmaceutical

- 5.1.4. Packaging

- 5.1.5. Industrial

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. North America Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. HVAC/R

- 6.1.2. Automotive & Transportation

- 6.1.3. Medical & Pharmaceutical

- 6.1.4. Packaging

- 6.1.5. Industrial

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. HVAC/R

- 7.1.2. Automotive & Transportation

- 7.1.3. Medical & Pharmaceutical

- 7.1.4. Packaging

- 7.1.5. Industrial

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Pacific Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. HVAC/R

- 8.1.2. Automotive & Transportation

- 8.1.3. Medical & Pharmaceutical

- 8.1.4. Packaging

- 8.1.5. Industrial

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. South America Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. HVAC/R

- 9.1.2. Automotive & Transportation

- 9.1.3. Medical & Pharmaceutical

- 9.1.4. Packaging

- 9.1.5. Industrial

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Middle East Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. HVAC/R

- 10.1.2. Automotive & Transportation

- 10.1.3. Medical & Pharmaceutical

- 10.1.4. Packaging

- 10.1.5. Industrial

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Uson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vacuum Instruments Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fortest

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CETA TESTSYSTEME GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ATEQ Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CTS Cincinnati

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 InterTech Development Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LACO Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 INFICON

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TASI Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfeiffer Vacuum GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cosmo Instruments Co ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TQC Automation & Test Solutions

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GMJ Systems & Automations Pvt Ltd**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Uson

List of Figures

- Figure 1: Global Automotive Test Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 3: North America Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: North America Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 7: Europe Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: Europe Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 11: Asia Pacific Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Pacific Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 15: South America Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: South America Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 19: Middle East Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 20: Middle East Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 2: Global Automotive Test Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: US Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 10: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: UK Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: France Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Russia Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Spain Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 18: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: India Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: China Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 24: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Brazil Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Argentina Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 28: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: UAE Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Test Equipment Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Automotive Test Equipment Market?

Key companies in the market include Uson, Vacuum Instruments Corporation, Fortest, CETA TESTSYSTEME GmbH, ATEQ Corp, CTS Cincinnati, InterTech Development Company, LACO Technologies, INFICON, TASI Group, Pfeiffer Vacuum GmbH, Cosmo Instruments Co ltd, TQC Automation & Test Solutions, GMJ Systems & Automations Pvt Ltd**List Not Exhaustive.

3. What are the main segments of the Automotive Test Equipment Market?

The market segments include End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from Oil and Gas Industry Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Oct 2020 - Vacuum Instruments Corporation and ATEQ Corp. North America entered into a strategic partnership. The partnership offers the world's largest leak-testing product range and the best experts in leak-testing technologies. ATEQ and VIC combine experiences with key applications, like electric vehicle batteries and fuel cells, in order to provide comprehensive and reliable solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Test Equipment Market?

To stay informed about further developments, trends, and reports in the Automotive Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence