Key Insights

The European Financial Advisory Services market is projected to reach $184.8 billion by 2025, driven by a CAGR of 4.5% through 2033. Growth is propelled by increasing demand for specialized financial expertise amidst complex regulations, digital transformation imperatives, and the need for strategic financial planning and risk mitigation. Key service segments include Corporate Finance, Accounting Advisory, and Tax Advisory. Surging M&A activity and a focus on robust risk management frameworks are significant growth contributors.

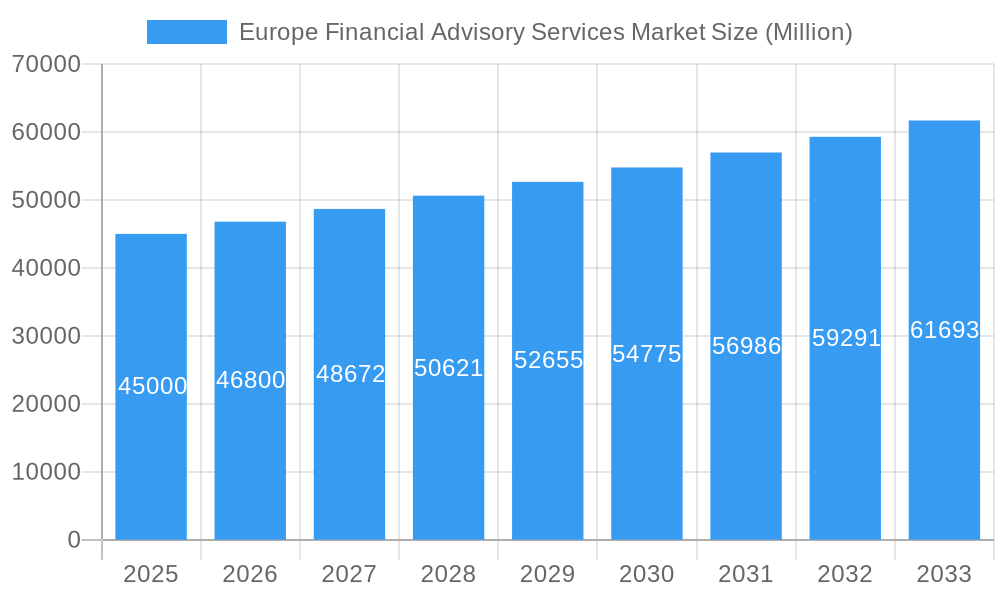

Europe Financial Advisory Services Market Market Size (In Billion)

Key market trends include the adoption of advanced analytics and AI for enhanced decision-making, a growing emphasis on ESG advisory, and evolving needs of enterprises of all sizes. While large enterprises dominate, SMEs are increasingly seeking external financial guidance. BFSI, IT & Telecom, and Manufacturing are primary demand drivers, with Retail & E-commerce and Healthcare showing strong potential. Geographically, the United Kingdom, Germany, and France are key European markets. Evolving regulatory landscapes and economic uncertainties may present moderate restraints, requiring agile advisory strategies.

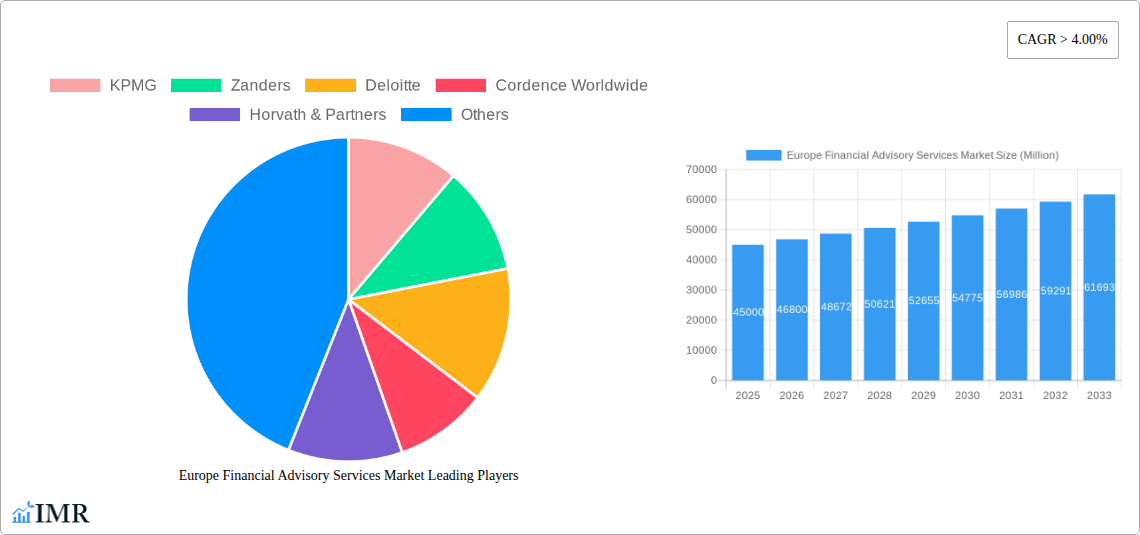

Europe Financial Advisory Services Market Company Market Share

Europe Financial Advisory Services Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a granular analysis of the Europe Financial Advisory Services Market, a dynamic sector experiencing significant evolution. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, and projecting future trends through 2033, this study is essential for understanding market dynamics, growth drivers, and competitive strategies. We explore parent and child market segments, integrating high-traffic keywords such as "financial consulting Europe," "corporate finance advisory," "transaction services," "risk management consulting," and "accounting advisory services" to maximize visibility. All quantitative data is presented in millions of units.

Europe Financial Advisory Services Market Market Dynamics & Structure

The Europe Financial Advisory Services Market exhibits a moderately concentrated structure, with a mix of large global players and specialized regional firms vying for market share. Technological innovation is a key driver, with advancements in AI, big data analytics, and cloud computing transforming how advisory services are delivered and the insights provided. Regulatory frameworks, particularly around financial compliance and data privacy (e.g., GDPR), continue to shape service offerings and necessitate expert guidance. Competitive product substitutes are emerging, with in-house solutions and advanced software platforms offering some alternatives to external advisory. End-user demographics are diversifying, with SMEs increasingly seeking sophisticated financial advice, not just large enterprises. M&A trends are active, reflecting a strategic push for expanded capabilities and market reach.

- Market Concentration: Dominated by a few large global consultancies, with a growing number of niche players and regional specialists.

- Technological Innovation Drivers: AI-powered analytics for risk assessment, blockchain for transaction transparency, and cloud-based platforms for enhanced collaboration and data management.

- Regulatory Frameworks: Stringent compliance requirements in areas like ESG reporting, anti-money laundering (AML), and financial crime prevention.

- Competitive Product Substitutes: Sophisticated financial planning software, automated reporting tools, and in-house expertise.

- End-User Demographics: Growing demand from SMEs for accessible, tailored financial advice; increased focus on digital transformation across all enterprise sizes.

- M&A Trends: Acquisitions aimed at bolstering expertise in specific verticals (e.g., FinTech, ESG) and expanding geographic footprints.

Europe Financial Advisory Services Market Growth Trends & Insights

The Europe Financial Advisory Services Market is poised for robust growth, driven by a confluence of economic, regulatory, and technological factors. The market size is projected to expand significantly from an estimated €XX million in 2025 to €XX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.X%. Adoption rates for specialized advisory services, particularly in areas like digital transformation, cybersecurity, and Environmental, Social, and Governance (ESG) compliance, are accelerating. Technological disruptions, including the widespread integration of AI and machine learning in financial modeling and risk assessment, are reshaping service delivery. Consumer behavior is shifting towards a preference for proactive, data-driven, and outcome-oriented advisory partnerships. The increasing complexity of the financial landscape, coupled with evolving business models, necessitates continuous engagement with financial advisors to navigate challenges and capitalize on opportunities. This sustained demand, from both established corporations and burgeoning startups, underscores the market's resilience and future potential.

The market penetration of specialized financial advisory services is on an upward trajectory. While large enterprises have long been key consumers, Small & Medium-Sized Enterprises (SMEs) are increasingly recognizing the value of expert financial guidance to foster sustainable growth and competitive advantage. This expansion into the SME segment represents a significant growth opportunity. Furthermore, the rise of disruptive technologies is not only a challenge but also a powerful catalyst for growth, as businesses require expert advice to integrate and leverage these innovations effectively. Shifting consumer preferences, marked by a demand for more integrated and holistic financial strategies, are also contributing to market expansion. Clients are seeking advisors who can offer a comprehensive suite of services, from strategic financial planning to operational efficiency improvements. The market's ability to adapt to these evolving needs will be critical for sustained growth and market leadership.

Dominant Regions, Countries, or Segments in Europe Financial Advisory Services Market

Within the Europe Financial Advisory Services Market, the Financial, Insurance, and Real Estate (BFSI) industry vertical consistently emerges as the dominant segment driving growth. This dominance is rooted in the inherent complexity of financial regulations, the constant need for risk management, and the perpetual pursuit of strategic financial planning and transaction optimization within this sector. Leading countries within this vertical include the United Kingdom, Germany, and France, owing to their robust financial hubs and extensive presence of major financial institutions.

Key Drivers for BFSI Dominance:

- Intense Regulatory Landscape: The BFSI sector is subject to stringent and ever-evolving regulations (e.g., Basel III, Solvency II, PSD2), requiring specialized advisory for compliance, risk mitigation, and strategic adaptation.

- High Transaction Volumes: M&A activity, capital raising, and complex financial instrument trading within BFSI generate a substantial demand for transaction services, corporate finance, and valuation advisory.

- Sophisticated Risk Management Needs: The inherent volatility and interconnectedness of the financial system necessitate expert guidance in areas like credit risk, market risk, operational risk, and cybersecurity.

- Digital Transformation Imperative: Financial institutions are at the forefront of digital innovation, requiring advisory services to navigate FinTech integration, AI implementation, and data analytics for improved customer experience and operational efficiency.

- Economic Sensitivity: The BFSI sector's direct link to economic cycles makes strategic financial planning and advisory crucial for navigating downturns and capitalizing on growth opportunities.

Market Share & Growth Potential: The BFSI vertical commands a significant market share, estimated at XX% of the total Europe Financial Advisory Services Market in 2025, and is projected to maintain its leading position with a CAGR of X.XX% during the forecast period. The continuous need for compliance, coupled with ongoing digital transformation initiatives and the inherent complexities of financial markets, ensures sustained demand for advisory services within this sector.

Europe Financial Advisory Services Market Product Landscape

The product landscape within the Europe Financial Advisory Services Market is characterized by increasingly sophisticated and specialized offerings. Innovations are focused on leveraging advanced technologies to deliver data-driven insights and actionable strategies. Key product developments include AI-powered risk assessment tools that offer real-time monitoring and predictive analytics, integrated platforms for seamless transaction advisory and due diligence, and bespoke solutions for ESG compliance and reporting. The performance metrics of these services are measured by their ability to deliver tangible outcomes such as cost savings, revenue growth, risk reduction, and improved operational efficiency. Unique selling propositions often revolve around deep industry expertise, proprietary analytical frameworks, and a commitment to client-centric problem-solving. Technological advancements are enabling a shift from traditional advisory models to more proactive, predictive, and value-added partnership approaches.

Key Drivers, Barriers & Challenges in Europe Financial Advisory Services Market

Key Drivers:

- Increasing Regulatory Complexity: Evolving compliance mandates across industries, particularly in finance, healthcare, and public sectors, drive demand for specialized advisory.

- Digital Transformation Imperative: Businesses across all verticals are investing in technology, requiring expert guidance on strategy, implementation, and optimization.

- Globalization and Cross-Border Transactions: The need for expert advice on international market entry, mergers, acquisitions, and tax implications fuels growth.

- Data Analytics and AI Adoption: Businesses are seeking to leverage data for strategic decision-making, creating demand for advisory in data management, analysis, and AI integration.

Key Barriers & Challenges:

- Intense Competition: The market is characterized by numerous established players and emerging niche consultancies, leading to price pressures.

- Talent Acquisition and Retention: A shortage of skilled professionals with specialized expertise in areas like cybersecurity and AI can hinder service delivery.

- Economic Uncertainty and Budget Constraints: Downturns or uncertainty can lead to reduced client spending on advisory services.

- Client Resistance to Change: Implementing recommended strategies can face internal resistance within client organizations, impacting successful outcomes.

- Cybersecurity Risks: Advisory firms themselves are targets for cyberattacks, necessitating robust security measures to protect client data.

Emerging Opportunities in Europe Financial Advisory Services Market

Emerging opportunities in the Europe Financial Advisory Services Market are largely driven by the increasing focus on sustainability, the digital revolution, and the evolving needs of specific industry verticals. The growing emphasis on Environmental, Social, and Governance (ESG) factors presents a significant avenue for growth, with companies seeking advisory services to develop and implement ESG strategies, conduct impact assessments, and ensure compliance with reporting standards. The continued digitalization of businesses, particularly in the Retail & E-commerce and IT & Telecom sectors, creates demand for advisory in areas such as cloud migration, cybersecurity resilience, and data analytics implementation. Furthermore, the burgeoning FinTech sector and the need for specialized advisory in areas like blockchain adoption, digital asset management, and regulatory technology (RegTech) offer substantial untapped potential.

Growth Accelerators in the Europe Financial Advisory Services Market Industry

Several catalysts are accelerating the growth of the Europe Financial Advisory Services Market. Technological breakthroughs, particularly in artificial intelligence, machine learning, and big data analytics, are enabling consultancies to offer more sophisticated, data-driven, and predictive advisory services, enhancing client value. Strategic partnerships between advisory firms and technology providers are also a significant growth accelerator, allowing for the co-creation of innovative solutions and expanded service portfolios. Market expansion strategies, including geographic penetration into emerging European economies and deepening specialization within high-demand verticals like healthcare and the public sector, are further fueling growth. The increasing demand for integrated services, combining strategy, technology, and operational expertise, positions firms that can offer end-to-end solutions for significant growth.

Key Players Shaping the Europe Financial Advisory Services Market Market

- KPMG

- Zanders

- Deloitte

- Cordence Worldwide

- Horvath & Partners

- Alvarez & Marsal

- Coeus Consulting

- McKinsey & Company

- Mercer

- Delta Capita

Notable Milestones in Europe Financial Advisory Services Market Sector

- February 2023: Deloitte boosted its start-up and scale-up capabilities with the acquisition of 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 Pilots as part of its portfolio, Deloitte will be able to better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth through to technology, infrastructure, and venture capital solutions. This strategic move enhances Deloitte's offerings for emerging businesses and strengthens its position in the innovation ecosystem.

- January 2023: Global management and technology consultancy BearingPoint strengthened its team in France with the acquisition of Levo Consultants, a Paris-based financial services consultancy. This acquisition bolsters BearingPoint's expertise in the financial services sector in France, expanding its client base and service capabilities.

In-Depth Europe Financial Advisory Services Market Market Outlook

The Europe Financial Advisory Services Market is set for continued expansion, propelled by the ongoing digital transformation wave and the increasing imperative for robust risk management and compliance solutions across diverse industry verticals. The market's future trajectory is significantly influenced by the demand for specialized advisory in areas such as ESG integration, cybersecurity resilience, and the strategic adoption of emerging technologies like AI and blockchain. Strategic partnerships and a focus on delivering measurable business outcomes will be critical for firms aiming to capture market share. The ability of advisory firms to adapt to evolving client needs, such as the demand for more agile and integrated service delivery models, will also play a crucial role in shaping the future landscape of financial advisory services in Europe.

Europe Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Other Types

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Other Industry Verticals

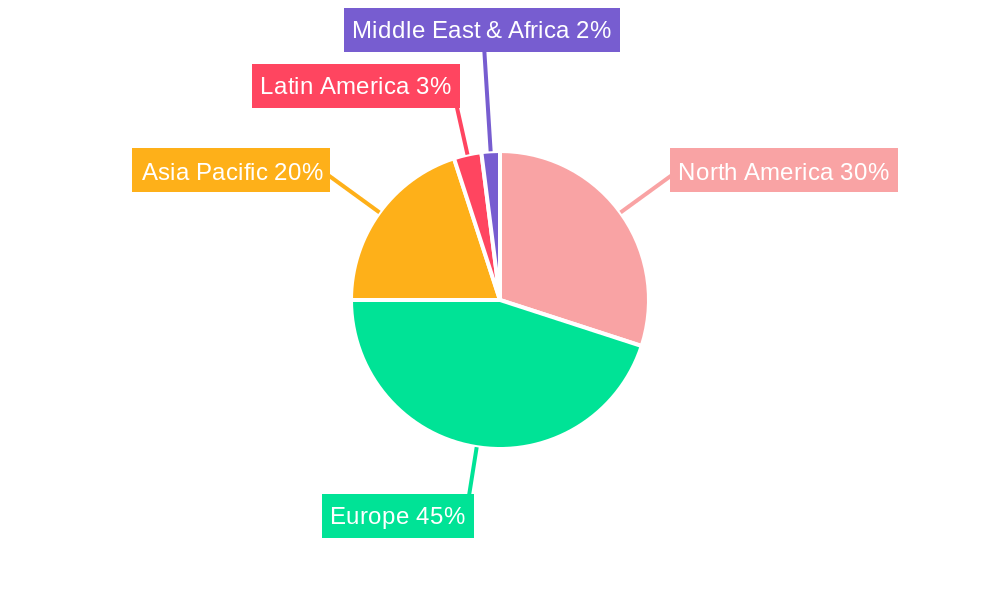

Europe Financial Advisory Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Financial Advisory Services Market Regional Market Share

Geographic Coverage of Europe Financial Advisory Services Market

Europe Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Tax Advisory by Financial Advisory Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KPMG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zanders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cordence Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Horvath & Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alvarez & Marsal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coeus Consulting

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 McKinsey & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delta Capita**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KPMG

List of Figures

- Figure 1: Europe Financial Advisory Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Europe Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Europe Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Financial Advisory Services Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Financial Advisory Services Market?

Key companies in the market include KPMG, Zanders, Deloitte, Cordence Worldwide, Horvath & Partners, Alvarez & Marsal, Coeus Consulting, McKinsey & Company, Mercer, Delta Capita**List Not Exhaustive.

3. What are the main segments of the Europe Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Tax Advisory by Financial Advisory Services.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities with the acquisition of 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 Pilots as part of its portfolio, Deloitte will be able to better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth through to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Europe Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence