Key Insights

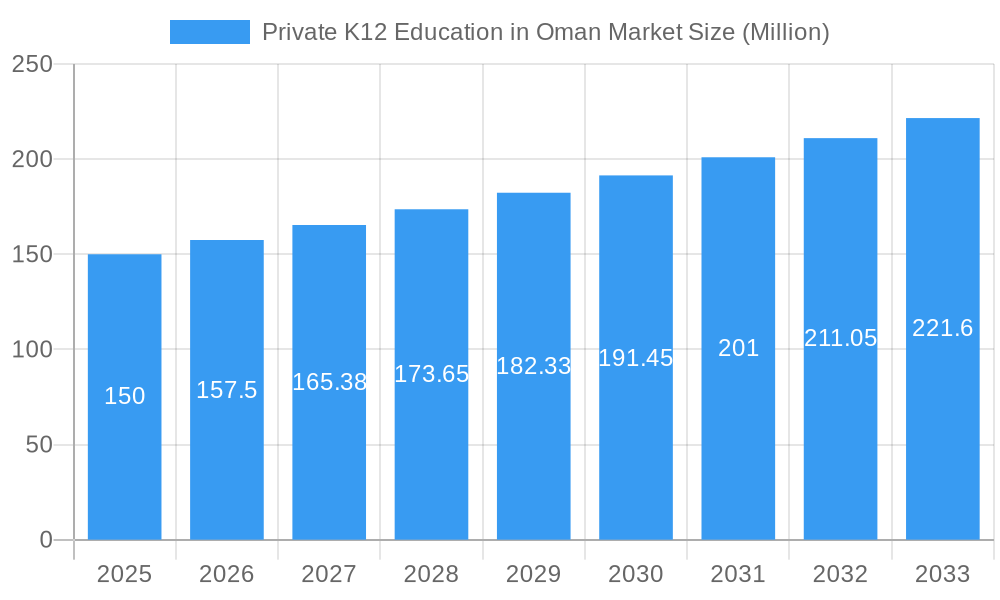

The Private K12 Education market in Oman is experiencing steady growth, driven by increasing disposable incomes, a rising preference for English-medium instruction, and a growing emphasis on quality education. The market's Compound Annual Growth Rate (CAGR) of 5% from 2019 to 2024 suggests a consistent expansion. While precise market sizing data is unavailable, considering the presence of established international schools like The American International School of Muscat and The British School Muscat, alongside several other private institutions, it's reasonable to estimate the 2025 market value to be around $150 million (USD). This figure reflects a robust market driven by parental investment in their children's future, coupled with the government's support for private education initiatives to enhance the national education system. Key market segments include British curriculum, American curriculum, and other international curricula, each catering to distinct parental preferences and reflecting the diversity of the expatriate and Omani population. The continued growth is projected to be fueled by increasing school enrollments, the introduction of innovative teaching methodologies, and advancements in educational technology.

Private K12 Education in Oman Market Market Size (In Million)

Looking ahead to 2033, the market is expected to maintain a similar growth trajectory, with the CAGR of 5% indicating a substantial expansion. However, potential restraints such as regulatory changes, economic fluctuations, and competition among existing and new entrants could influence the market's overall performance. The competitive landscape is characterized by a mix of established international schools with strong brand recognition and newer private schools catering to niche segments. Successful players will need to adapt to changing market dynamics by offering high-quality educational programs, employing qualified teachers, and incorporating modern technologies to enhance the learning experience. Continued government investment in education infrastructure and supportive policies will also play a crucial role in shaping the future of the private K12 education market in Oman.

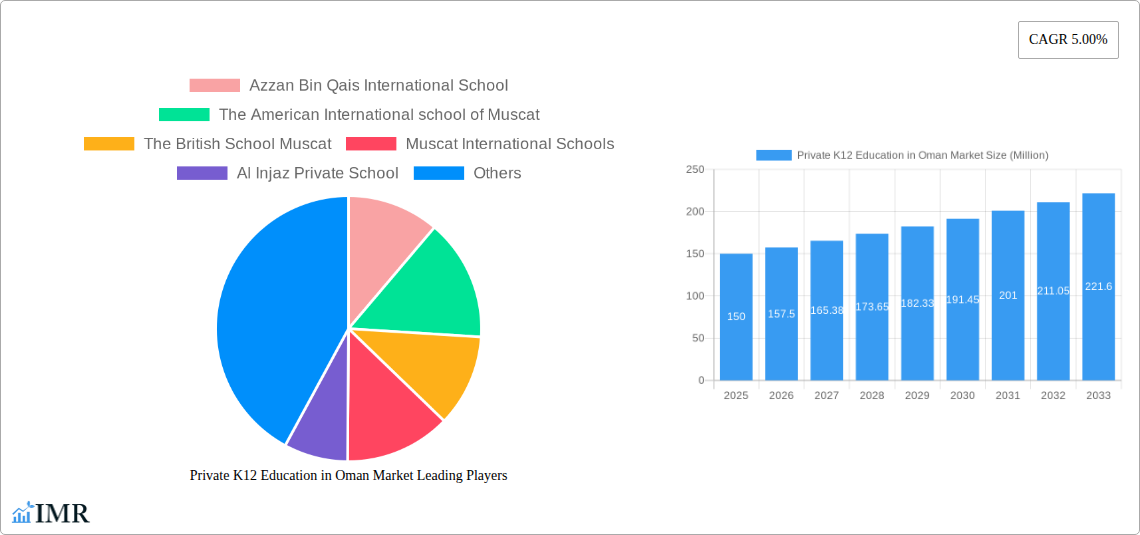

Private K12 Education in Oman Market Company Market Share

Private K12 Education in Oman Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Private K12 Education market in Oman, offering invaluable insights for investors, educators, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth trends, and future opportunities within this dynamic sector. The report also analyzes the parent market of the Omani education sector and the child market of private K12 education.

Private K12 Education in Oman Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within Oman's private K12 education sector. The market is moderately concentrated, with several key players holding significant market share. However, the presence of numerous smaller, specialized schools contributes to a dynamic and competitive environment.

- Market Concentration: The top five private schools account for approximately xx% of the market share in 2025 (estimated).

- Technological Innovation: Adoption of EdTech solutions, including online learning platforms and digital assessment tools, is increasing, but faces challenges related to infrastructure and teacher training.

- Regulatory Framework: The Ministry of Education's regulations significantly influence curriculum standards, licensing, and operational aspects.

- Competitive Substitutes: Public schools represent the main substitute, but the demand for private education driven by perceived quality differences and specialized programs sustains the sector’s growth.

- End-User Demographics: The target demographic comprises expatriates and affluent Omani families seeking enhanced educational opportunities for their children. A rising middle class further fuels demand.

- M&A Trends: The number of M&A deals in the private K12 education sector in Oman between 2019 and 2024 averaged xx deals annually, with a total market value of xx Million. Consolidation is expected to continue.

Private K12 Education in Oman Market Growth Trends & Insights

The Omani private K12 education market exhibits strong growth potential, driven by factors such as rising disposable incomes, increasing awareness of the importance of quality education, and a growing expatriate population. The market size experienced significant growth in the historical period (2019-2024), reaching an estimated value of xx Million in 2025. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Market penetration remains relatively low, indicating significant untapped potential. Technological disruptions, particularly the increased integration of technology in education, are driving adoption rates and influencing consumer behavior. Consumers are increasingly seeking personalized learning experiences and international curriculum options.

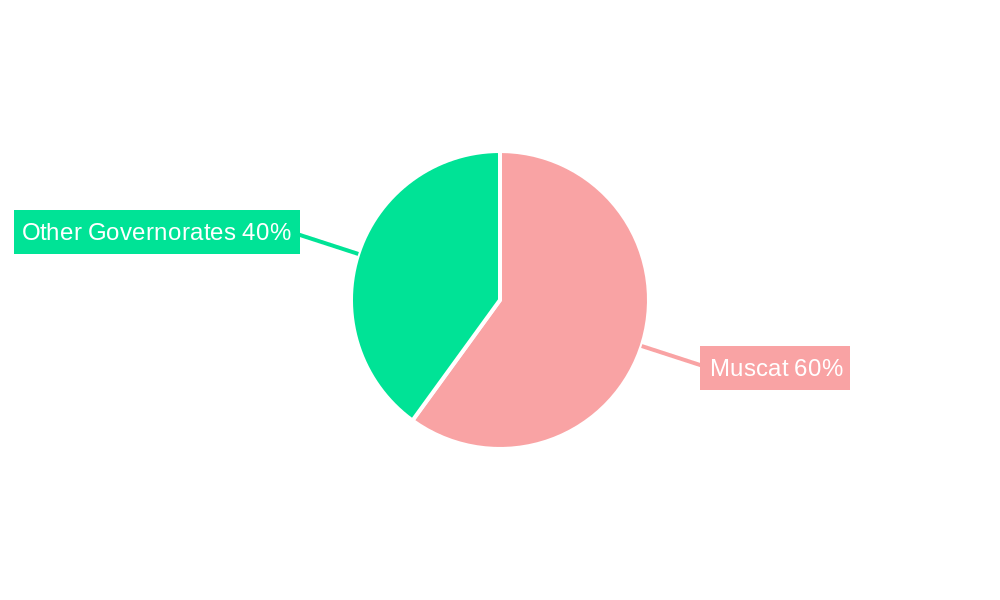

Dominant Regions, Countries, or Segments in Private K12 Education in Oman Market

Muscat Governorate dominates the private K12 education market in Oman, accounting for approximately xx% of the total market value in 2025. This dominance stems from higher population density, a larger expatriate community, and a concentration of high-income households.

- Key Drivers:

- Concentrated population in Muscat.

- Higher disposable incomes in Muscat.

- Strong presence of international schools catering to expatriates.

- Well-developed infrastructure in Muscat.

The significant presence of international schools (e.g., British, American curricula) offering higher education quality standards further contributes to the market’s growth in Muscat.

Private K12 Education in Oman Market Product Landscape

The private K12 education market in Oman offers diverse product offerings, including curricula aligned with international standards (e.g., British, American, International Baccalaureate), specialized programs (e.g., STEM, arts), and extracurricular activities. Product innovation centers on enhanced learning experiences using technology and personalized learning approaches. Key differentiators include international accreditation, specialized curriculum offerings, and state-of-the-art facilities.

Key Drivers, Barriers & Challenges in Private K12 Education in Oman Market

Key Drivers:

- Increasing disposable incomes among Omani families and a growing expatriate population.

- Government initiatives promoting private sector investment in education.

- Rising demand for international curricula and specialized programs.

Key Challenges:

- Intense competition among private schools. Competition for qualified teachers and students is fierce.

- Regulatory hurdles and licensing requirements can impede market entry and expansion.

- Relatively high operational costs, including teacher salaries and infrastructure maintenance, can affect profitability. These costs result in high tuition fees, potentially limiting accessibility.

Emerging Opportunities in Private K12 Education in Oman Market

Untapped opportunities exist in expanding access to specialized programs such as STEM and vocational education. There is also potential in developing more personalized learning solutions and leveraging technology to enhance the learning experience. Further expansion into less populated areas of Oman could tap into growing demand.

Growth Accelerators in the Private K12 Education in Oman Market Industry

Strategic partnerships between private schools and international educational institutions, coupled with investments in advanced educational technologies, can accelerate market growth. Expanding into niche markets, such as early childhood education or specialized vocational training, holds further growth potential. Government initiatives to support the private sector will further facilitate growth.

Key Players Shaping the Private K12 Education in Oman Market Market

- Azzan Bin Qais International School

- The American International School of Muscat

- The British School Muscat

- Muscat International Schools

- Al Injaz Private School

- The International School of Choueifat - Muscat

- (List Not Exhaustive)

Notable Milestones in Private K12 Education in Oman Market Sector

- 2020: Introduction of new national curriculum standards impacting private schools.

- 2022: Launch of several new private schools in Muscat Governorate.

- 2023: Increased investment in EdTech solutions by several leading private schools.

- (Further milestones to be added based on available data)

In-Depth Private K12 Education in Oman Market Market Outlook

The future outlook for the private K12 education market in Oman remains positive, with continuous growth anticipated driven by increasing demand for quality education, technological advancements, and government support. Strategic partnerships, investments in infrastructure and technology, and expansion into niche markets will be crucial for success. The market's growth will likely continue to be driven by the affluent class and expatriate community.

Private K12 Education in Oman Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic

- 2.4. CBSE

- 2.5. Others

Private K12 Education in Oman Market Segmentation By Geography

- 1. North Region

- 2. West region

- 3. South Region

- 4. East Region

Private K12 Education in Oman Market Regional Market Share

Geographic Coverage of Private K12 Education in Oman Market

Private K12 Education in Oman Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Government initiatives - National Education Strategy 2040

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic

- 5.2.4. CBSE

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic

- 6.2.4. CBSE

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic

- 7.2.4. CBSE

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic

- 8.2.4. CBSE

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic

- 9.2.4. CBSE

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Azzan Bin Qais International School

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The American International school of Muscat

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The British School Muscat

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Muscat International Schools

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Injaz Private School

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The International School of Choueifat - Muscat**List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Azzan Bin Qais International School

List of Figures

- Figure 1: Global Private K12 Education in Oman Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 3: North Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 4: North Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 5: North Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 6: North Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: West region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 9: West region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 10: West region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 11: West region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 12: West region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 13: West region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 15: South Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 16: South Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 17: South Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 18: South Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 19: South Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: East Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 21: East Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 22: East Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 23: East Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 24: East Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 25: East Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 3: Global Private K12 Education in Oman Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 5: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 6: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 9: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 11: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 12: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 15: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Private K12 Education in Oman Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Private K12 Education in Oman Market?

Key companies in the market include Azzan Bin Qais International School, The American International school of Muscat, The British School Muscat, Muscat International Schools, Al Injaz Private School, The International School of Choueifat - Muscat**List Not Exhaustive.

3. What are the main segments of the Private K12 Education in Oman Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Government initiatives - National Education Strategy 2040.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Private K12 Education in Oman Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Private K12 Education in Oman Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Private K12 Education in Oman Market?

To stay informed about further developments, trends, and reports in the Private K12 Education in Oman Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence