Key Insights

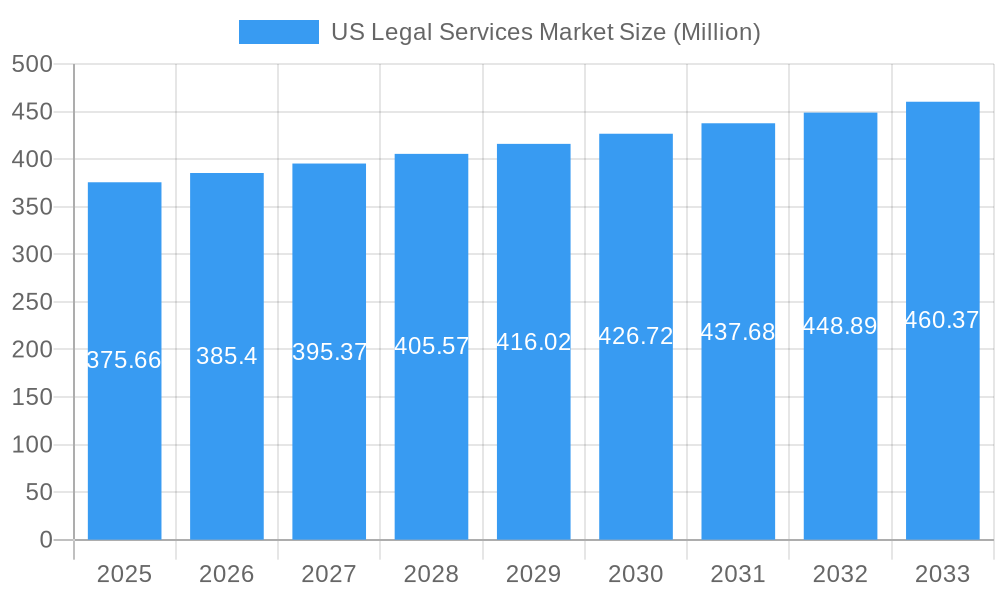

The US Legal Services Market is poised for steady expansion, with a current market size of USD 375.66 million. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 2.64% through 2033. This sustained trajectory is fueled by increasing demand across diverse end-user segments, including private consumers, SMEs, and large businesses, who increasingly require specialized legal counsel for complex matters. The evolving regulatory landscape and the growing emphasis on compliance and risk management within corporate and financial sectors are significant drivers of this market. Furthermore, the continuous emergence of new legal challenges in areas like personal injury, data privacy, and intellectual property necessitate expert legal representation, thereby underpinning market growth.

US Legal Services Market Market Size (In Million)

The market's expansion is also shaped by evolving trends in service delivery. While traditional representation and advice remain core offerings, there's a noticeable shift towards greater adoption of technology for legal research, document automation, and client communication. This enhances efficiency and accessibility, particularly for segments like Legal Aid Consumers and SMEs. Emerging applications in niche areas and the increasing complexity of international commercial transactions are also contributing to market diversification. However, the market also faces restraints, including the high cost of legal services for some segments and the growing adoption of alternative dispute resolution methods. Nonetheless, the fundamental need for robust legal frameworks and expert navigation within them ensures a resilient and growing US Legal Services Market.

US Legal Services Market Company Market Share

US Legal Services Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the US Legal Services Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, and emerging opportunities. With a forecast period from 2025 to 2033, this study leverages critical data from 2019-2024 to offer unparalleled insights for legal professionals, law firms, and stakeholders. Explore market concentration, technological advancements, regulatory frameworks, and M&A trends. Understand evolving end-user demographics, shifting consumer behavior, and the impact of legal aid consumers, private consumers, SMEs, charities, large businesses, and government entities.

The report dissects the market by application, including corporate, financial, and commercial law, personal injury, commercial and residential property, wills, trusts, and probate, family law, employment law, criminal law, and other applications. Furthermore, it examines the service landscape, detailing representation, advice, notarial activities, and research. Gain strategic advantages by understanding key players such as Latham & Watkins LLP, Kirkland & Ellis LLP, Skadden Arps Slate Meagher & Flom LLP, Cravath Swaine & Moore LLP, Wachtell Lipton Rosen & Katz, Davis Polk & Wardwell LLP, Sullivan & Cromwell LLP, Simpson Thacher & Bartlett LLP, Paul Weiss Rifkind Wharton & Garrison LLP, Gibson Dunn, and Ropes & Gray. All values are presented in millions of units for precise financial understanding.

US Legal Services Market Market Dynamics & Structure

The US Legal Services Market is characterized by a moderately concentrated structure, with a significant presence of large, established law firms alongside a vibrant ecosystem of boutique practices and specialized service providers. Technological innovation is a key driver, with the adoption of AI-powered legal research tools, e-discovery platforms, and practice management software increasingly shaping efficiency and service delivery. Regulatory frameworks, though complex and continuously evolving, provide a stable albeit challenging environment for market participants. Competitive product substitutes are emerging, particularly in the form of Alternative Legal Service Providers (ALSPs) offering specialized services like contract review and document management, putting pressure on traditional models.

End-user demographics play a crucial role, with large businesses and government entities representing substantial market segments due to complex transactional and regulatory needs. Private consumers and SMEs also contribute significantly, particularly in areas like family law, property, and employment law. Mergers and Acquisitions (M&A) activity, while not as frenetic as in some other industries, remains a strategic tool for firms seeking to expand geographic reach, acquire specialized expertise, or consolidate market share. For instance, the base year of 2025 is projected to witness a total market value of approximately $385,000 million, with M&A deals contributing an estimated $5,000 million in transaction value. Barriers to innovation include the inherent conservatism within the legal profession, significant upfront investment required for new technologies, and the need for continuous professional development to adapt to evolving digital landscapes.

- Market Concentration: Dominated by a tier of elite law firms, with increasing fragmentation at the mid and smaller firm levels.

- Technological Innovation: Driven by AI, cloud computing, and data analytics for enhanced research, case management, and client communication.

- Regulatory Frameworks: Influence practice areas, ethical standards, and market entry barriers, particularly at the state level.

- Competitive Substitutes: Rise of ALSPs in routine legal tasks, impacting traditional service offerings and pricing models.

- End-User Demographics: Large businesses and government are key consumers, followed by SMEs and individuals for personal matters.

- M&A Trends: Strategic consolidation for talent acquisition, market expansion, and service diversification.

US Legal Services Market Growth Trends & Insights

The US Legal Services Market is poised for robust growth, projected to expand from an estimated $385,000 million in the base year of 2025 to an impressive $470,000 million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.8%. This upward trajectory is fueled by several interconnected trends. The increasing complexity of corporate transactions, cross-border disputes, and evolving regulatory landscapes in areas like data privacy and environmental law are driving demand for specialized legal expertise. Furthermore, a growing awareness among individuals and SMEs of their legal rights and the importance of proactive legal counsel is contributing to market penetration for services such as estate planning, family law, and employment advice.

Technological disruptions, while posing challenges, are also significant growth accelerators. The integration of Artificial Intelligence (AI) in legal research, contract analysis, and predictive litigation outcomes is enhancing efficiency and reducing costs for both law firms and their clients. This efficiency gain allows firms to handle a higher volume of cases and offer more competitive pricing, thereby expanding their client base. Consumer behavior is shifting towards a preference for technology-enabled legal services, including online consultations, secure client portals, and virtual legal assistance. This demand for convenience and accessibility is pushing firms to adopt digital strategies, creating new service delivery models and revenue streams. The market penetration for digital legal services is expected to grow from 20% in 2025 to 35% by 2033.

The historical period (2019-2024) saw steady growth, with the market size increasing from approximately $320,000 million in 2019 to an estimated $360,000 million in 2024, indicating a CAGR of roughly 3.5% during this phase. This foundational growth set the stage for accelerated expansion in the forecast period. The increasing globalization of businesses necessitates sophisticated international legal counsel, further boosting the demand for complex corporate and commercial law services, which are anticipated to grow at a CAGR of 5.2% during the forecast period. The rise of the gig economy and evolving employment models are also creating new legal challenges and opportunities in employment law, projected to see a CAGR of 4.5%.

Dominant Regions, Countries, or Segments in US Legal Services Market

Within the expansive US Legal Services Market, Corporate, Financial, and Commercial Law emerges as the dominant segment, consistently driving market growth and influencing regional specialization. This segment's supremacy is rooted in the sheer volume and complexity of business transactions, regulatory compliance mandates, and the high stakes involved in corporate litigation and advisory services. Large businesses, a key end-user within this application, require sophisticated legal support for mergers and acquisitions, intellectual property protection, international trade, antitrust regulations, and capital markets activities. The estimated market share for Corporate, Financial, and Commercial Law in 2025 is approximately 35% of the total market value, translating to an estimated $134,750 million.

The dominance of this segment is further amplified by its geographical concentration. Major financial hubs like New York City, which hosts numerous large businesses and financial institutions, naturally become epicenters for corporate legal services. Similarly, regions with strong technology sectors, such as Silicon Valley in California, exhibit a high demand for intellectual property law and venture capital advisory services, which fall under this broad application. Economic policies that encourage business investment, innovation, and international trade directly correlate with the growth of this segment. For instance, favorable tax laws or streamlined regulatory processes for starting and operating businesses can lead to increased demand for corporate legal counsel.

- Dominant Application: Corporate, Financial, and Commercial Law.

- Key Drivers: High value of transactions, complex regulatory environments, global business operations, intellectual property protection needs.

- Market Share (2025 Est.): Approximately 35% ($134,750 million).

- Growth Potential: Driven by M&A activity, cross-border investments, and evolving financial regulations.

- Dominant End User: Large Businesses.

- Influence: Their sophisticated legal needs set standards and drive innovation across various legal service areas.

- Contribution: Significant revenue generators for firms specializing in corporate law.

- Dominant Service: Advice and Representation.

- Role: Crucial for navigating complex legal frameworks and mitigating risks for corporate clients.

- Regional Influence: Metropolitan areas with strong financial and corporate sectors, such as New York and California, are centers of this dominance.

US Legal Services Market Product Landscape

The product landscape of the US Legal Services Market is characterized by an evolution from traditional paper-based processes to sophisticated digital solutions. Core offerings include legal advice, representation in various legal forums, and specialized services like notarial activities and in-depth legal research. Innovations are rapidly transforming these offerings. AI-powered legal research platforms, such as those developed by LexisNexis and Westlaw, are significantly enhancing the speed and accuracy of identifying relevant precedents and statutes, optimizing the research process for legal professionals. E-discovery tools are streamlining the collection, review, and production of electronic information in litigation, a critical component of litigation support.

Practice management software, integrated with client portals and billing systems, offers a comprehensive solution for law firms to manage client relationships, case workflows, and financial operations efficiently. Furthermore, specialized software for contract analysis and review is helping corporate legal departments and law firms manage their contractual obligations more effectively. The unique selling proposition for many firms now lies in their ability to leverage these technological advancements to provide faster, more cost-effective, and more transparent legal services to their clients, particularly in high-volume areas. Technological advancements are enabling the development of niche legal tech solutions, such as AI-driven contract automation and blockchain-based secure document management, further diversifying the product landscape.

Key Drivers, Barriers & Challenges in US Legal Services Market

Key Drivers: The US Legal Services Market is propelled by several potent forces. The increasing complexity of global business operations and international trade necessitates specialized legal expertise in areas like cross-border litigation and compliance, driving demand. Evolving regulatory landscapes, particularly in data privacy (e.g., GDPR, CCPA) and environmental law, compel businesses to seek expert legal counsel to ensure compliance. Technological advancements, including AI and automation in legal research and contract review, are enhancing efficiency and offering new service delivery models. Shifts in consumer behavior, with a growing expectation for accessible and cost-effective legal solutions, are also a significant driver, encouraging innovation in service delivery.

Barriers & Challenges: Despite its growth, the market faces significant challenges. Regulatory hurdles, while creating demand, also impose stringent ethical standards and licensing requirements that can be barriers to entry for new providers, especially in specialized areas. The inherent conservatism within the legal profession can slow down the adoption of new technologies and business models, acting as a restraint on innovation. High operational costs, including substantial overheads and the need for continuous professional development, can impact profitability. Competitive pressures from Alternative Legal Service Providers (ALSPs) offering more streamlined and cost-effective solutions for routine tasks pose a challenge to traditional law firms. Supply chain issues, particularly concerning the availability of specialized legal talent in niche areas, can also impact service delivery timelines and costs.

Emerging Opportunities in US Legal Services Market

Emerging opportunities in the US Legal Services Market are largely driven by technological advancements and evolving societal needs. The burgeoning field of cybersecurity law presents a significant opportunity, with increasing cyber threats and data breaches necessitating expert legal guidance on prevention, response, and litigation. The growing emphasis on Environmental, Social, and Governance (ESG) factors by corporations is creating a demand for legal services related to sustainability reporting, corporate social responsibility, and climate change compliance. Furthermore, the rise of the gig economy and flexible work arrangements is spurring the need for specialized employment law advice for both employers and independent contractors.

The integration of legal technology (LegalTech) offers fertile ground for innovation. Opportunities exist in developing AI-powered tools for predictive analytics in litigation, advanced contract lifecycle management systems, and secure, blockchain-based platforms for legal document management. The increasing demand for affordable and accessible legal services among underserved populations also presents an opportunity for innovative service delivery models, such as tech-enabled legal aid services and subscription-based legal support for SMEs.

Growth Accelerators in the US Legal Services Market Industry

Several catalysts are accelerating the growth of the US Legal Services Market. Technological breakthroughs, particularly in Artificial Intelligence (AI) and data analytics, are revolutionizing legal research, document review, and predictive modeling, enhancing efficiency and enabling firms to take on more complex cases. Strategic partnerships between law firms and LegalTech companies are fostering innovation and the development of integrated service solutions, creating competitive advantages. The increasing globalization of businesses continues to fuel demand for sophisticated international legal counsel, driving expansion into new markets and practice areas.

Market expansion strategies, including the opening of new offices in burgeoning economic centers and the acquisition of specialized expertise through M&A, are also contributing to sustained growth. Furthermore, the growing emphasis on proactive legal counsel and risk management by businesses of all sizes is shifting the paradigm from reactive problem-solving to strategic advisory services, a key growth accelerator.

Key Players Shaping the US Legal Services Market Market

- Latham & Watkins LLP

- Kirkland & Ellis LLP

- Skadden Arps Slate Meagher & Flom LLP

- Cravath Swaine & Moore LLP

- Wachtell Lipton Rosen & Katz

- Davis Polk & Wardwell LLP

- Sullivan & Cromwell LLP

- Simpson Thacher & Bartlett LLP

- Paul Weiss Rifkind Wharton & Garrison LLP

- Gibson Dunn

- Ropes & Gray

Notable Milestones in US Legal Services Market Sector

- April 2021: Kirkland & Ellis LLP expanded its third outpost in Texas, increasing its total number of locations to 17. This expansion included 10 offices in the United States, three in Asia, and four in Europe, demonstrating a strategic global reach.

- January 2021: Latham & Watkins LLP added a new partner in Tokyo, Hiroaki Takagi, focusing on Japanese law matters. Takagi's addition, from Nishimura & Asahi where he specialized in securities and corporate transactions, bolstered the firm's expertise in the Asian market.

In-Depth US Legal Services Market Market Outlook

The future outlook for the US Legal Services Market is exceptionally promising, with sustained growth projected through 2033. Growth accelerators, including pervasive technological integration and the expanding scope of regulatory compliance, will continue to drive demand for specialized legal expertise. The increasing sophistication of businesses and individuals in seeking proactive legal counsel, coupled with the development of more accessible and efficient service delivery models through LegalTech, will further bolster market expansion. Strategic initiatives by leading firms to enhance global reach and acquire niche expertise will shape the competitive landscape, creating a dynamic environment for innovation and service evolution. This outlook signifies substantial opportunities for investment, strategic planning, and adaptation within the legal sector.

US Legal Services Market Segmentation

-

1. End User

- 1.1. Legal Aid Consumers

- 1.2. Private Consumers

- 1.3. SMEs

- 1.4. Charities

- 1.5. Large Businesses

- 1.6. Government

-

2. Application

- 2.1. Corporate, Financial, and Commercial Law

- 2.2. Personal Injury

- 2.3. Commercial and Residential Property

- 2.4. Wills, Trusts, and Probate

- 2.5. Family Law

- 2.6. Employment Law

- 2.7. Criminal Law

- 2.8. Other Applications

-

3. Service

- 3.1. Representation

- 3.2. Advice

- 3.3. Notarial Activities

- 3.4. Research

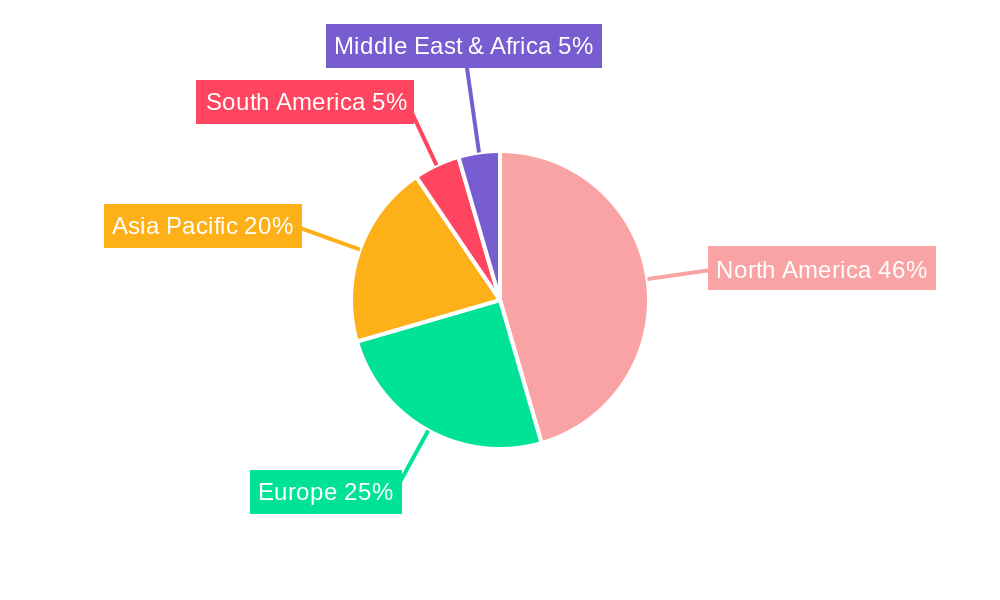

US Legal Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Legal Services Market Regional Market Share

Geographic Coverage of US Legal Services Market

US Legal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Security Breaches in the Law Firms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Legal Aid Consumers

- 5.1.2. Private Consumers

- 5.1.3. SMEs

- 5.1.4. Charities

- 5.1.5. Large Businesses

- 5.1.6. Government

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Corporate, Financial, and Commercial Law

- 5.2.2. Personal Injury

- 5.2.3. Commercial and Residential Property

- 5.2.4. Wills, Trusts, and Probate

- 5.2.5. Family Law

- 5.2.6. Employment Law

- 5.2.7. Criminal Law

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Representation

- 5.3.2. Advice

- 5.3.3. Notarial Activities

- 5.3.4. Research

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America US Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Legal Aid Consumers

- 6.1.2. Private Consumers

- 6.1.3. SMEs

- 6.1.4. Charities

- 6.1.5. Large Businesses

- 6.1.6. Government

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Corporate, Financial, and Commercial Law

- 6.2.2. Personal Injury

- 6.2.3. Commercial and Residential Property

- 6.2.4. Wills, Trusts, and Probate

- 6.2.5. Family Law

- 6.2.6. Employment Law

- 6.2.7. Criminal Law

- 6.2.8. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Service

- 6.3.1. Representation

- 6.3.2. Advice

- 6.3.3. Notarial Activities

- 6.3.4. Research

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. South America US Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Legal Aid Consumers

- 7.1.2. Private Consumers

- 7.1.3. SMEs

- 7.1.4. Charities

- 7.1.5. Large Businesses

- 7.1.6. Government

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Corporate, Financial, and Commercial Law

- 7.2.2. Personal Injury

- 7.2.3. Commercial and Residential Property

- 7.2.4. Wills, Trusts, and Probate

- 7.2.5. Family Law

- 7.2.6. Employment Law

- 7.2.7. Criminal Law

- 7.2.8. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Service

- 7.3.1. Representation

- 7.3.2. Advice

- 7.3.3. Notarial Activities

- 7.3.4. Research

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Europe US Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Legal Aid Consumers

- 8.1.2. Private Consumers

- 8.1.3. SMEs

- 8.1.4. Charities

- 8.1.5. Large Businesses

- 8.1.6. Government

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Corporate, Financial, and Commercial Law

- 8.2.2. Personal Injury

- 8.2.3. Commercial and Residential Property

- 8.2.4. Wills, Trusts, and Probate

- 8.2.5. Family Law

- 8.2.6. Employment Law

- 8.2.7. Criminal Law

- 8.2.8. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Service

- 8.3.1. Representation

- 8.3.2. Advice

- 8.3.3. Notarial Activities

- 8.3.4. Research

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Middle East & Africa US Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Legal Aid Consumers

- 9.1.2. Private Consumers

- 9.1.3. SMEs

- 9.1.4. Charities

- 9.1.5. Large Businesses

- 9.1.6. Government

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Corporate, Financial, and Commercial Law

- 9.2.2. Personal Injury

- 9.2.3. Commercial and Residential Property

- 9.2.4. Wills, Trusts, and Probate

- 9.2.5. Family Law

- 9.2.6. Employment Law

- 9.2.7. Criminal Law

- 9.2.8. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Service

- 9.3.1. Representation

- 9.3.2. Advice

- 9.3.3. Notarial Activities

- 9.3.4. Research

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Asia Pacific US Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Legal Aid Consumers

- 10.1.2. Private Consumers

- 10.1.3. SMEs

- 10.1.4. Charities

- 10.1.5. Large Businesses

- 10.1.6. Government

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Corporate, Financial, and Commercial Law

- 10.2.2. Personal Injury

- 10.2.3. Commercial and Residential Property

- 10.2.4. Wills, Trusts, and Probate

- 10.2.5. Family Law

- 10.2.6. Employment Law

- 10.2.7. Criminal Law

- 10.2.8. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Service

- 10.3.1. Representation

- 10.3.2. Advice

- 10.3.3. Notarial Activities

- 10.3.4. Research

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Latham & Watkins LLP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kirkland & Ellis LLP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Skadden Arps Slate Meagher & Flom LLP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cravath Swaine & Moore LLP

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wachtell Lipton Rosen & Katz

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Davis Polk & Wardwell LLP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sullivan & Cromwell LLP

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Simpson Thacher & Bartlett LLP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Paul Weiss Rifkind Wharton & Garrison LLP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gibson Dunn

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ropes & Gray**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Latham & Watkins LLP

List of Figures

- Figure 1: Global US Legal Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Legal Services Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America US Legal Services Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America US Legal Services Market Volume (Billion), by End User 2025 & 2033

- Figure 5: North America US Legal Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America US Legal Services Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America US Legal Services Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America US Legal Services Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America US Legal Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America US Legal Services Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America US Legal Services Market Revenue (Million), by Service 2025 & 2033

- Figure 12: North America US Legal Services Market Volume (Billion), by Service 2025 & 2033

- Figure 13: North America US Legal Services Market Revenue Share (%), by Service 2025 & 2033

- Figure 14: North America US Legal Services Market Volume Share (%), by Service 2025 & 2033

- Figure 15: North America US Legal Services Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America US Legal Services Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America US Legal Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America US Legal Services Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America US Legal Services Market Revenue (Million), by End User 2025 & 2033

- Figure 20: South America US Legal Services Market Volume (Billion), by End User 2025 & 2033

- Figure 21: South America US Legal Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: South America US Legal Services Market Volume Share (%), by End User 2025 & 2033

- Figure 23: South America US Legal Services Market Revenue (Million), by Application 2025 & 2033

- Figure 24: South America US Legal Services Market Volume (Billion), by Application 2025 & 2033

- Figure 25: South America US Legal Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: South America US Legal Services Market Volume Share (%), by Application 2025 & 2033

- Figure 27: South America US Legal Services Market Revenue (Million), by Service 2025 & 2033

- Figure 28: South America US Legal Services Market Volume (Billion), by Service 2025 & 2033

- Figure 29: South America US Legal Services Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: South America US Legal Services Market Volume Share (%), by Service 2025 & 2033

- Figure 31: South America US Legal Services Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America US Legal Services Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America US Legal Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America US Legal Services Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe US Legal Services Market Revenue (Million), by End User 2025 & 2033

- Figure 36: Europe US Legal Services Market Volume (Billion), by End User 2025 & 2033

- Figure 37: Europe US Legal Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Europe US Legal Services Market Volume Share (%), by End User 2025 & 2033

- Figure 39: Europe US Legal Services Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Europe US Legal Services Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Europe US Legal Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Europe US Legal Services Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Europe US Legal Services Market Revenue (Million), by Service 2025 & 2033

- Figure 44: Europe US Legal Services Market Volume (Billion), by Service 2025 & 2033

- Figure 45: Europe US Legal Services Market Revenue Share (%), by Service 2025 & 2033

- Figure 46: Europe US Legal Services Market Volume Share (%), by Service 2025 & 2033

- Figure 47: Europe US Legal Services Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe US Legal Services Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe US Legal Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe US Legal Services Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa US Legal Services Market Revenue (Million), by End User 2025 & 2033

- Figure 52: Middle East & Africa US Legal Services Market Volume (Billion), by End User 2025 & 2033

- Figure 53: Middle East & Africa US Legal Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Middle East & Africa US Legal Services Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Middle East & Africa US Legal Services Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East & Africa US Legal Services Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East & Africa US Legal Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East & Africa US Legal Services Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East & Africa US Legal Services Market Revenue (Million), by Service 2025 & 2033

- Figure 60: Middle East & Africa US Legal Services Market Volume (Billion), by Service 2025 & 2033

- Figure 61: Middle East & Africa US Legal Services Market Revenue Share (%), by Service 2025 & 2033

- Figure 62: Middle East & Africa US Legal Services Market Volume Share (%), by Service 2025 & 2033

- Figure 63: Middle East & Africa US Legal Services Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa US Legal Services Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa US Legal Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa US Legal Services Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific US Legal Services Market Revenue (Million), by End User 2025 & 2033

- Figure 68: Asia Pacific US Legal Services Market Volume (Billion), by End User 2025 & 2033

- Figure 69: Asia Pacific US Legal Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 70: Asia Pacific US Legal Services Market Volume Share (%), by End User 2025 & 2033

- Figure 71: Asia Pacific US Legal Services Market Revenue (Million), by Application 2025 & 2033

- Figure 72: Asia Pacific US Legal Services Market Volume (Billion), by Application 2025 & 2033

- Figure 73: Asia Pacific US Legal Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: Asia Pacific US Legal Services Market Volume Share (%), by Application 2025 & 2033

- Figure 75: Asia Pacific US Legal Services Market Revenue (Million), by Service 2025 & 2033

- Figure 76: Asia Pacific US Legal Services Market Volume (Billion), by Service 2025 & 2033

- Figure 77: Asia Pacific US Legal Services Market Revenue Share (%), by Service 2025 & 2033

- Figure 78: Asia Pacific US Legal Services Market Volume Share (%), by Service 2025 & 2033

- Figure 79: Asia Pacific US Legal Services Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific US Legal Services Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Asia Pacific US Legal Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific US Legal Services Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global US Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Global US Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global US Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global US Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Global US Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 7: Global US Legal Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global US Legal Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global US Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global US Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Global US Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global US Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Global US Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global US Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 15: Global US Legal Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global US Legal Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global US Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global US Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 25: Global US Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global US Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global US Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Global US Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Global US Legal Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global US Legal Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Brazil US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 38: Global US Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 39: Global US Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global US Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 41: Global US Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 42: Global US Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 43: Global US Legal Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global US Legal Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: France US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Italy US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Spain US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Benelux US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Nordics US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global US Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 64: Global US Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 65: Global US Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global US Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 67: Global US Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 68: Global US Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 69: Global US Legal Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global US Legal Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Turkey US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Israel US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: GCC US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: North Africa US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: South Africa US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Global US Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 84: Global US Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 85: Global US Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 86: Global US Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 87: Global US Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 88: Global US Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 89: Global US Legal Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global US Legal Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 91: China US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: India US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Japan US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Korea US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Oceania US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific US Legal Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific US Legal Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Legal Services Market?

The projected CAGR is approximately 2.64%.

2. Which companies are prominent players in the US Legal Services Market?

Key companies in the market include Latham & Watkins LLP, Kirkland & Ellis LLP, Skadden Arps Slate Meagher & Flom LLP, Cravath Swaine & Moore LLP, Wachtell Lipton Rosen & Katz, Davis Polk & Wardwell LLP, Sullivan & Cromwell LLP, Simpson Thacher & Bartlett LLP, Paul Weiss Rifkind Wharton & Garrison LLP, Gibson Dunn, Ropes & Gray**List Not Exhaustive.

3. What are the main segments of the US Legal Services Market?

The market segments include End User, Application, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 375.66 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Security Breaches in the Law Firms.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2021, Kirkland and Ellis expanded its third outpost in Texas. With this expansion, the total number of locations increased to 17. The 10 offices are in the United States, whereas three are in Asia and four are in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Legal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Legal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Legal Services Market?

To stay informed about further developments, trends, and reports in the US Legal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence