Key Insights

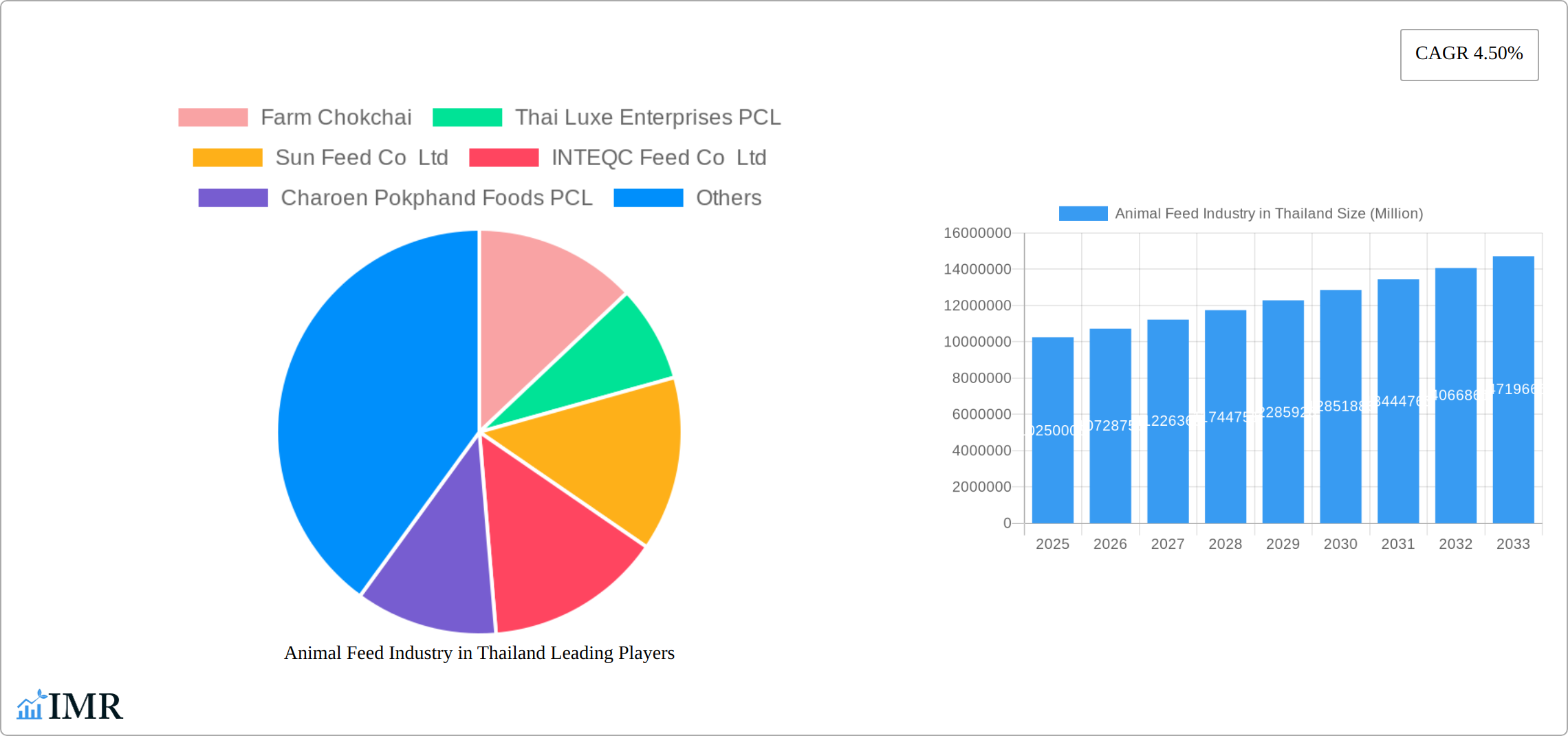

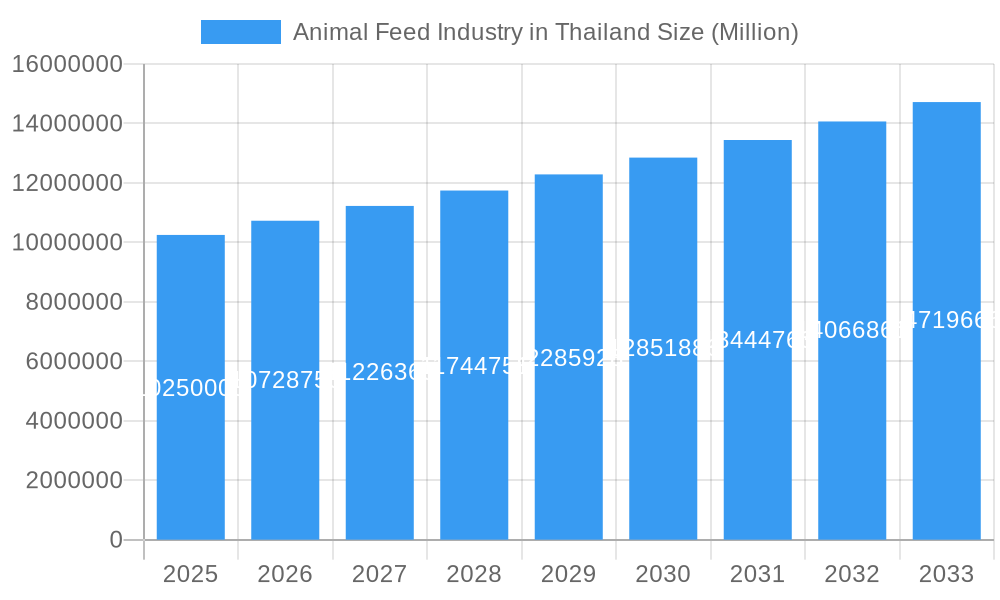

The Thai animal feed market, valued at approximately 10.25 million USD in 2025, is projected to experience steady growth, driven by a rising demand for animal protein within the country and increasing exports. The Compound Annual Growth Rate (CAGR) of 4.50% from 2025-2033 indicates a significant expansion opportunity. Key growth drivers include the rising population and increasing per capita income leading to higher meat consumption. Furthermore, advancements in feed technology focusing on improved nutrition and disease resistance are boosting efficiency and profitability for farmers. The market is segmented by animal type (ruminants, poultry, swine, aquaculture, others) and ingredient type (cereals, cakes & meals, by-products, supplements), reflecting the diverse needs of the Thai livestock industry. Major players like Charoen Pokphand Foods PCL, Betagro Public Company Limited, and Thai Union Group Public Company Limited dominate the market, leveraging their established distribution networks and brand recognition. However, challenges such as fluctuating raw material prices and government regulations related to animal health and environmental concerns could pose restraints to market growth. Despite these challenges, the long-term outlook for the Thai animal feed industry remains positive, fueled by consistent domestic demand and potential for regional expansion.

Animal Feed Industry in Thailand Market Size (In Million)

The strategic focus of major players is shifting towards sustainable and technologically advanced feed solutions. This includes incorporating alternative protein sources and improving feed efficiency to reduce environmental impact and production costs. The increasing adoption of precision feeding techniques, data analytics, and automation within farms are contributing to operational optimization. This technological advancement enhances feed utilization, promotes animal welfare, and enhances overall farm profitability. Further market segmentation analysis across different regions of Thailand could reveal localized growth patterns and opportunities for specialized feed products catering to specific animal breeds and farming practices. Understanding these nuances will be critical for companies aiming to expand their market share and capitalize on this dynamic market.

Animal Feed Industry in Thailand Company Market Share

Animal Feed Industry in Thailand: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Animal Feed Industry in Thailand, covering market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Market values are presented in Million units.

Animal Feed Industry in Thailand Market Dynamics & Structure

The Thai animal feed industry exhibits a moderately concentrated market structure, with several large multinational and domestic players dominating the landscape. Technological innovation, particularly in feed formulation and precision feeding, is a key driver, alongside evolving regulatory frameworks focused on sustainability and food safety. Competition from substitute products is moderate, with the industry facing pressure from alternative protein sources. End-user demographics, characterized by a growing population and increasing demand for animal protein, significantly impact market growth. Mergers and acquisitions (M&A) activity has been observed, particularly in the recent period and is expected to continue.

- Market Concentration: Highly concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on precision feeding, sustainable feed sources, and improved feed efficiency.

- Regulatory Framework: Emphasis on food safety, environmental sustainability, and animal welfare.

- Competitive Substitutes: Plant-based proteins and alternative animal protein sources.

- End-User Demographics: Growing population and rising per capita consumption of animal protein fuels demand.

- M&A Activity: xx deals recorded between 2019 and 2024, indicating industry consolidation. (e.g., Cargill's acquisition of a feed mill).

Animal Feed Industry in Thailand Growth Trends & Insights

The Thai animal feed market has demonstrated remarkable and consistent growth during the historical period (2019-2024). This upward trajectory is largely attributable to the sustained expansion of livestock production, a burgeoning domestic and international consumer appetite for diverse animal protein sources (including meat, eggs, and dairy), and proactive governmental initiatives aimed at bolstering the agricultural sector. Looking ahead, the market is anticipated to maintain its growth momentum through the forecast period (2025-2033), albeit at a somewhat more measured pace, reflecting market maturity and evolving dynamics. The sector is experiencing a significant acceleration in growth and a substantial enhancement of overall efficiency due to rapid technological advancements. These include the widespread adoption of precision feeding technologies that optimize nutrient delivery to individual animals, and the sophisticated application of data analytics for the development of highly tailored and efficient feed formulations. Furthermore, evolving consumer preferences, which increasingly prioritize higher-quality animal products characterized by superior taste, nutritional value, and enhanced food safety, coupled with a heightened societal focus on animal welfare and ethical farming practices, are potent forces shaping market evolution and driving demand for premium feed solutions.

- Market Size: Expected to reach XX Million units in 2024, with projections indicating a growth to XX Million units by 2033.

- CAGR: Projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033.

- Market Penetration: Estimated at xx% in 2024, with an expected increase to xx% by 2033, signifying deeper market reach and adoption.

- Technological Disruptions: Accelerated adoption of cutting-edge precision feeding technologies and advanced data analytics for feed optimization and farm management.

- Consumer Behavior Shifts: A discernible and increasing preference for animal products derived from sustainably produced feed and ethically managed livestock operations.

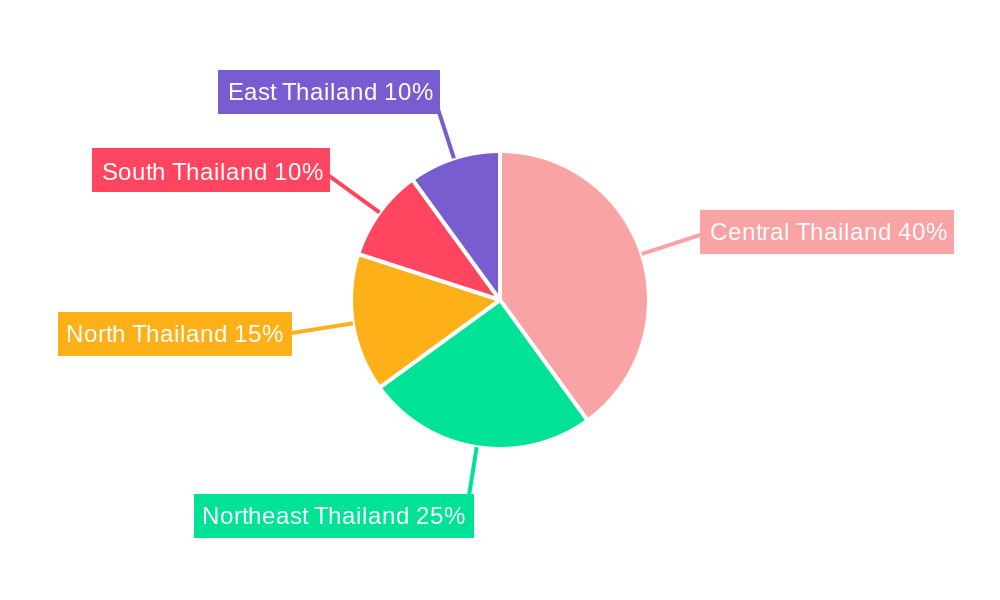

Dominant Regions, Countries, or Segments in Animal Feed Industry in Thailand

Within the dynamic Thai animal feed market, the poultry segment unequivocally holds a dominant position. This is primarily fueled by the consistently high consumer demand for poultry meat and eggs, which are staple protein sources in the Thai diet. Geographically, the central and eastern regions of Thailand exhibit the highest market concentration. This is a direct consequence of their greater livestock density, robust agricultural infrastructure, and established logistical networks that facilitate efficient feed production and distribution. When examining feed ingredients, cereals and oilseed cakes/meals currently represent the largest segment by volume due to their cost-effectiveness and foundational nutritional value. However, there is a pronounced and growing adoption of specialized feed supplements. These supplements are increasingly sought after by farmers to enhance animal health, bolster immune systems, improve feed conversion ratios, and ultimately boost overall productivity and profitability.

- Dominant Animal Type: Poultry remains the leading segment, capturing the highest market share and exhibiting strong growth potential.

- Dominant Ingredient: Cereals and oilseed cakes/meals continue to be the most consumed ingredients, forming the backbone of many feed formulations.

- Dominant Region: Central and Eastern Thailand are the primary hubs for the animal feed industry, characterized by high livestock density and well-developed agricultural infrastructure.

- Key Drivers: The persistent rise in consumer demand for animal protein, ongoing government support for the livestock sector, and the accelerating adoption of advanced feed technologies are the primary catalysts for market expansion.

Animal Feed Industry in Thailand Product Landscape

The Thai animal feed market is characterized by a diverse and continuously evolving product landscape. Manufacturers offer a wide array of feed formulations meticulously designed to cater to the specific nutritional requirements and growth stages of various animal types, including poultry, swine, aquaculture, and ruminants. A significant focus of current innovation lies in developing feed solutions that offer enhanced digestibility, improved nutrient utilization efficiency, and the strategic incorporation of functional ingredients. These functional ingredients, such as probiotics, prebiotics, enzymes, and essential oils, are vital for bolstering animal health, strengthening immune responses, and maximizing overall productivity. Furthermore, there is a palpable shift towards greater emphasis on sustainable sourcing practices and the development of products with a reduced environmental footprint. This includes the exploration of alternative protein sources, waste valorization, and formulations that minimize nutrient excretion. These advancements are collectively aimed at meeting the escalating demand for high-quality, safe, and sustainably produced animal feed, aligning with both market trends and global environmental stewardship goals.

Key Drivers, Barriers & Challenges in Animal Feed Industry in Thailand

Key Drivers: The primary engines propelling the Thai animal feed industry forward include the relentless rise in consumer demand for affordable and accessible animal protein, robust government support and policies favoring the livestock farming sector, and the accelerating adoption of sophisticated and advanced feed technologies that promise enhanced efficiency and sustainability.

Key Challenges: The industry grapples with several significant hurdles. Persistent fluctuations in the prices of key raw materials, such as corn and soybean meal, due to global market dynamics and weather patterns, create cost volatility. Stringent and evolving regulatory requirements pertaining to feed safety, quality, and environmental impact necessitate continuous adaptation and investment. Intense competition, both from established domestic players and increasingly from international feed manufacturers, exerts pressure on margins. Furthermore, supply chain disruptions, exacerbated by factors like unpredictable climate change events, geopolitical instability, and logistical bottlenecks, can significantly impact the availability and cost of raw materials, potentially leading to increased production costs and the risk of supply shortages, thereby affecting the overall profitability and stability of the industry.

Emerging Opportunities in Animal Feed Industry in Thailand

Untapped markets in specialized animal feeds (e.g., organic, functional feeds) and the growing adoption of precision feeding technology offer significant opportunities for growth. The increasing focus on sustainability and the demand for products with reduced environmental footprints provide further avenues for innovation. Exploring alternative protein sources and addressing consumer concerns about animal welfare can open up new market segments.

Growth Accelerators in the Animal Feed Industry in Thailand Industry

Technological breakthroughs in feed formulation, precision feeding technologies, and data analytics play a pivotal role in accelerating growth. Strategic partnerships between feed manufacturers, technology providers, and livestock farmers facilitate the adoption of innovative solutions and optimize overall supply chains. Expanding into new market segments, exploring export opportunities, and enhancing product differentiation strategies further contribute to growth.

Key Players Shaping the Animal Feed Industry in Thailand Market

- Farm Chokchai

- Thai Luxe Enterprises PCL

- Sun Feed Co Ltd

- INTEQC Feed Co Ltd

- Charoen Pokphand Foods PCL

- Laemthong Corporation Group

- S P M FEED MILL COMPANY LIMITED

- Alltech Inc

- Cargill Inc

- Betagro Public Company Limited

- Thai Union Group Public Company Limited

Notable Milestones in Animal Feed Industry in Thailand Sector

- September 2022: Cargill acquired a feed mill in Prachinburi, expanding its poultry and swine feed production capacity by 72,000 metric tons annually.

- September 2022: Charoen Pokphand Foods' Pakthongchai feed mill achieved carbon-neutral certification, setting a benchmark for sustainable practices.

- January 2022: Royal DSM and CPF partnered to measure and improve the environmental footprint of animal protein production using DSM's Sustell service.

In-Depth Animal Feed Industry in Thailand Market Outlook

The Thai animal feed industry is strategically positioned for sustained and robust growth in the coming years. This optimistic outlook is underpinned by a confluence of powerful factors, including the ever-increasing demand for animal protein to feed a growing population, the transformative impact of technological advancements that are revolutionizing feed production and farm management, and a growing imperative to embrace sustainability across the entire value chain. To secure long-term success and maintain a competitive edge, strategic investments in research and development for innovative feed solutions, the implementation of sustainable sourcing and production practices, and the continuous optimization of efficient and resilient supply chains will be paramount. Companies that demonstrate agility in adapting to evolving consumer preferences, which increasingly favor ethically sourced and environmentally friendly products, and those that proactively navigate and comply with stringent regulatory requirements, will be best positioned to capitalize on the immense potential and capitalize on the burgeoning opportunities within the Thai animal feed market.

Animal Feed Industry in Thailand Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes and Meals

- 2.3. By-products

- 2.4. Supplements

Animal Feed Industry in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Animal Feed Industry in Thailand Regional Market Share

Geographic Coverage of Animal Feed Industry in Thailand

Animal Feed Industry in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Preferences for the Animal Sourced Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes and Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes and Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. South America Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes and Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Europe Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes and Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East & Africa Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes and Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Asia Pacific Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes and Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Farm Chokchai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thai Luxe Enterprises PCL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sun Feed Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 INTEQC Feed Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Charoen Pokphand Foods PCL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Laemthong Corporation Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 S P M FEED MILL COMPANY LIMITED

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alltech Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cargill Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Betagro Public Company Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thai Union Group Public Company Limite

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Farm Chokchai

List of Figures

- Figure 1: Global Animal Feed Industry in Thailand Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: North America Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: North America Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: North America Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 9: South America Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: South America Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 11: South America Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: South America Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Europe Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 17: Europe Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Europe Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 21: Middle East & Africa Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Middle East & Africa Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 23: Middle East & Africa Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: Middle East & Africa Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Asia Pacific Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Asia Pacific Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Asia Pacific Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Asia Pacific Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 6: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 12: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 17: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 18: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 29: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 30: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 38: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 39: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Feed Industry in Thailand?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Animal Feed Industry in Thailand?

Key companies in the market include Farm Chokchai, Thai Luxe Enterprises PCL, Sun Feed Co Ltd, INTEQC Feed Co Ltd, Charoen Pokphand Foods PCL, Laemthong Corporation Group, S P M FEED MILL COMPANY LIMITED, Alltech Inc, Cargill Inc, Betagro Public Company Limited, Thai Union Group Public Company Limite.

3. What are the main segments of the Animal Feed Industry in Thailand?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Preferences for the Animal Sourced Food.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Cargill acquired a feed mill in Prachinburi province in Thailand to expand its capabilities for its animal feed and nutrition business. Through the acquisition, the plant will now produce poultry and swine feed for Cargill's customers based in Thailand. The company planned production in a year at its new plant which produces 72,000 Metric Ton per year for swine and poultry customers in the Eastern and Northeastern areas of Thailand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Feed Industry in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Feed Industry in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Feed Industry in Thailand?

To stay informed about further developments, trends, and reports in the Animal Feed Industry in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence