Key Insights

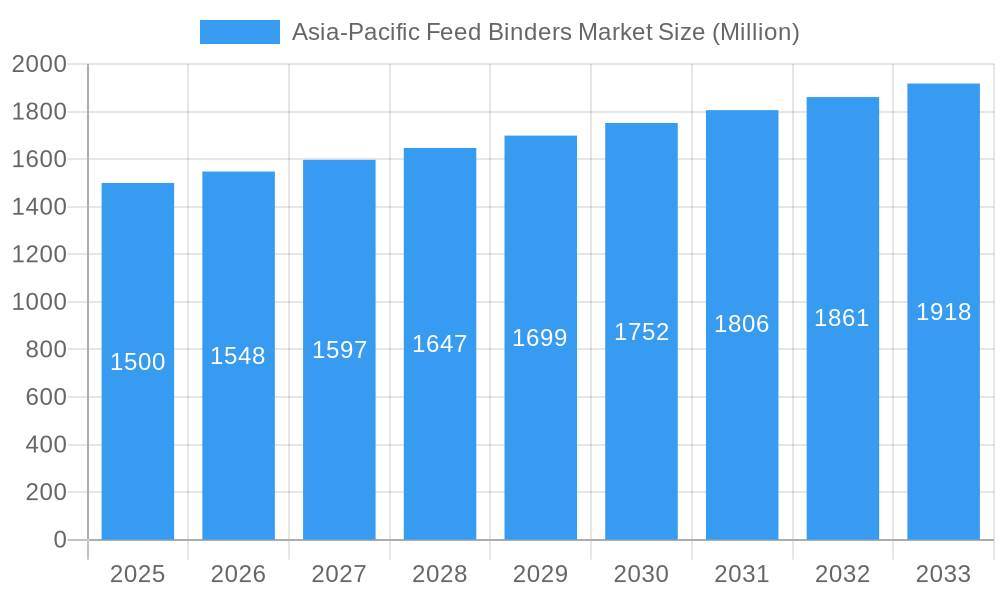

The Asia-Pacific feed binders market is poised for significant growth, estimated to reach a market size of approximately USD 1500 million by 2025 and projected to expand to over USD 1900 million by 2033, driven by a Compound Annual Growth Rate (CAGR) of 3.20%. This expansion is primarily fueled by the escalating demand for animal protein across the region, necessitating improved feed efficiency and reduced wastage. Key drivers include the burgeoning poultry and aquaculture sectors, which are increasingly adopting advanced feed formulations to enhance animal health and productivity. Furthermore, supportive government initiatives promoting sustainable agriculture and animal husbandry practices, coupled with a growing awareness among feed manufacturers about the benefits of binders in optimizing nutrient absorption and pellet quality, are significant growth catalysts. The natural segment, favored for its perceived health benefits and consumer preference for organic products, is expected to witness robust expansion, though synthetic binders will continue to hold a substantial market share due to their cost-effectiveness and superior binding capabilities.

Asia-Pacific Feed Binders Market Market Size (In Billion)

The market is characterized by evolving trends such as the development of innovative binder technologies offering enhanced digestibility and reduced environmental impact. The increasing adoption of specialized binders tailored for specific animal types, including ruminants, swine, and aquaculture species, is also a prominent trend. However, the market faces certain restraints, including the volatile prices of raw materials used in binder production and stringent regulatory frameworks governing feed additives in some countries. Despite these challenges, the Asia-Pacific region, with its vast agricultural base and rapidly developing economies, presents considerable opportunities. China and India, being major producers and consumers of animal feed, are expected to lead the market in terms of both production and consumption. Emerging economies within the Rest of Asia Pacific also offer substantial untapped potential as animal agriculture continues to modernize. Companies like Natural Remedies, Alltech, and Cargill Inc. are actively investing in research and development to introduce novel and sustainable feed binder solutions, anticipating the growing demand and competitive landscape.

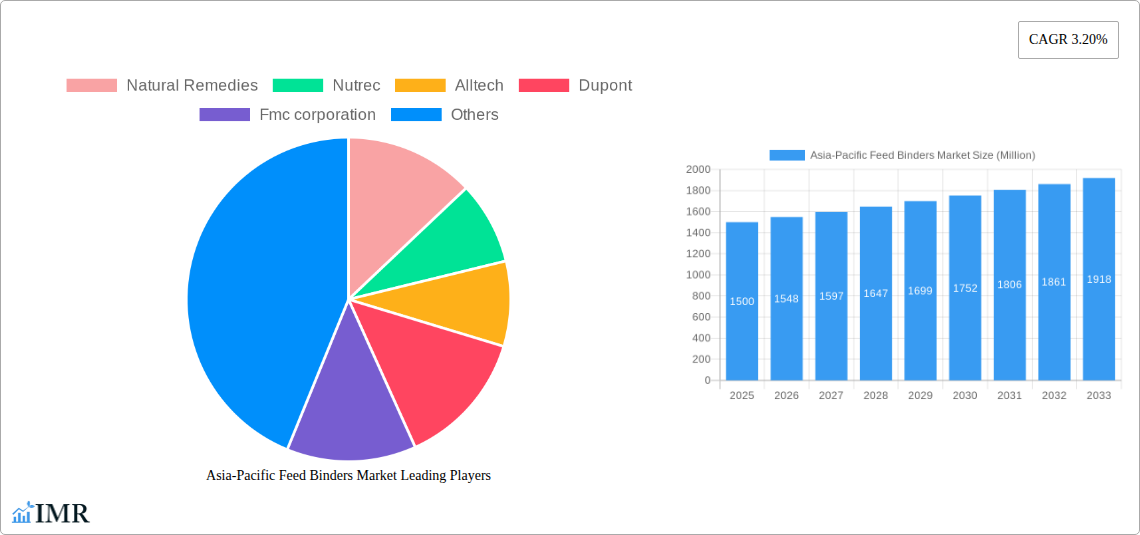

Asia-Pacific Feed Binders Market Company Market Share

Here's a comprehensive, SEO-optimized report description for the Asia-Pacific Feed Binders Market, designed for immediate use without modification:

This in-depth report provides a granular analysis of the Asia-Pacific Feed Binders Market, encompassing its dynamics, growth trends, regional dominance, product landscape, and key players. The study covers the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019–2024. We delve into critical market segments, including natural and synthetic binders, and analyze their application across Ruminant, Poultry, Swine, Aquaculture, and Other animal types. Geographic segmentation focuses on China, Australia, India, Japan, and the Rest of Asia Pacific. This report is essential for stakeholders seeking to understand and capitalize on the rapidly evolving animal feed additives, poultry feed binders, aquaculture feed binders, and swine feed binders market in the region.

Asia-Pacific Feed Binders Market Market Dynamics & Structure

The Asia-Pacific Feed Binders Market exhibits a moderately concentrated structure, with key players like Alltech, Dupont, and Cargill Inc. strategically investing in technological innovation to enhance feed pellet quality and nutrient absorption. Regulatory frameworks, particularly concerning animal health and food safety, are increasingly stringent, driving demand for compliant and effective feed binder solutions. Competitive product substitutes, such as alternative pelleting aids and improved feed processing techniques, pose a continuous challenge, necessitating ongoing R&D efforts. End-user demographics, primarily driven by the growth of the livestock and aquaculture industries, are shifting towards more sustainable and efficient feed production methods. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with companies acquiring specialized technologies and expanding their market reach. For instance, a hypothetical M&A deal volume of 5 deals in the historical period highlights this trend. Innovation barriers include the high cost of research and development and the complex approval processes for novel feed additives.

- Market Concentration: Moderately concentrated with key players dominating market share.

- Technological Innovation Drivers: Focus on improved pellet durability, nutrient bioavailability, and cost-effectiveness.

- Regulatory Frameworks: Increasing emphasis on animal welfare, food safety, and environmental sustainability.

- Competitive Product Substitutes: Rising adoption of alternative pelleting aids and advanced feed processing technologies.

- End-User Demographics: Growing demand from expanding livestock and aquaculture sectors, particularly in emerging economies.

- M&A Trends: Strategic acquisitions to gain market share and acquire technological expertise.

- Innovation Barriers: High R&D costs, lengthy regulatory approval cycles, and the need for extensive efficacy trials.

Asia-Pacific Feed Binders Market Growth Trends & Insights

The Asia-Pacific Feed Binders Market is projected to experience robust growth, fueled by the escalating demand for high-quality animal protein and the increasing adoption of intensive farming practices. The market size is anticipated to grow from an estimated USD 750 Million units in 2025 to USD 1,200 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.0% during the forecast period. This expansion is driven by a significant increase in the adoption rates of specialized feed pellet binders across various animal categories. Technological disruptions, such as advancements in enzyme technology and the development of biodegradable binders, are reshaping the market by offering more sustainable and efficient solutions. Consumer behavior shifts towards health-conscious and sustainably produced animal products are indirectly influencing the demand for premium feed ingredients, including effective feed binders that contribute to better animal health and reduced environmental impact. The market penetration of advanced feed binder technologies is expected to rise considerably as farmers and feed manufacturers recognize their economic and operational benefits.

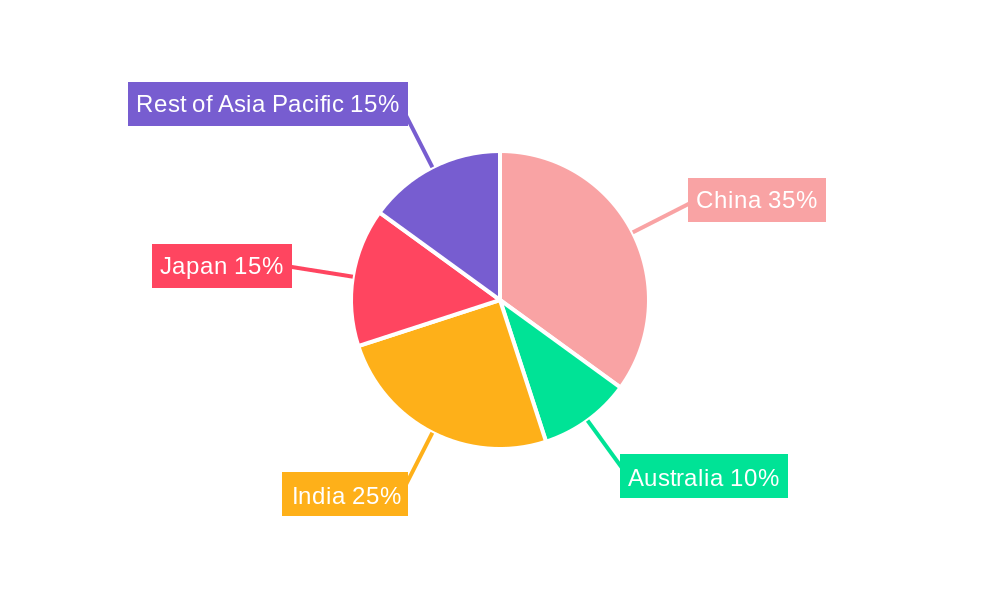

Dominant Regions, Countries, or Segments in Asia-Pacific Feed Binders Market

China emerges as the dominant region in the Asia-Pacific Feed Binders Market, driven by its massive livestock and aquaculture production capacities and significant government support for agricultural modernization. In 2025, China is estimated to hold a market share of approximately 40% of the total Asia-Pacific market. The country's burgeoning middle class and increasing per capita income contribute to a higher demand for meat and seafood, directly translating to a larger market for animal feed and its constituent additives, including feed binders for aquaculture and feed binders for poultry.

Dominant Country: China, owing to its large-scale livestock and aquaculture operations.

- Key Drivers: Massive domestic demand for animal protein, government initiatives to boost agricultural productivity, and rapid industrialization of feed production.

- Market Share (Estimated 2025): ~40%

- Growth Potential: High, driven by continuous expansion of the animal husbandry sector.

Dominant Segment by Animal Type: Poultry is anticipated to represent the largest segment within the animal type category, accounting for an estimated 35% of the market in 2025.

- Key Drivers: The efficiency and rapid growth cycle of poultry farming make it highly responsive to improved feed formulations.

- Market Share (Estimated 2025): ~35% (Poultry)

Dominant Segment by Type: Natural feed binders are experiencing a surge in demand, driven by consumer preference for natural and sustainable ingredients. This segment is expected to capture an estimated 55% of the market by 2025.

- Key Drivers: Growing consumer awareness about animal welfare and food safety, alongside regulatory encouragement for sustainable sourcing.

- Market Share (Estimated 2025): ~55% (Natural)

India and the Rest of Asia Pacific are also demonstrating significant growth, supported by expanding economies and increasing investments in animal agriculture. Japan, while a mature market, continues to contribute through its focus on high-quality feed and specialized animal nutrition.

Asia-Pacific Feed Binders Market Product Landscape

The Asia-Pacific Feed Binders Market product landscape is characterized by continuous innovation in both natural and synthetic formulations. Key advancements include the development of highly effective lignosulfonate-based binders and the increasing integration of functional ingredients like yeasts and probiotics into binder formulations. These innovations enhance pellet durability, reduce fines, and contribute to improved gut health in animals, leading to better feed conversion ratios. Performance metrics such as increased pellet durability by over 95% and reduced fines to under 2% are becoming standard benchmarks. Unique selling propositions focus on cost-effectiveness, improved digestibility, and minimal environmental impact.

Key Drivers, Barriers & Challenges in Asia-Pacific Feed Binders Market

Key Drivers:

- Growing Demand for Animal Protein: A burgeoning population and rising disposable incomes in the Asia-Pacific region are significantly increasing the consumption of meat, poultry, and seafood.

- Intensification of Livestock and Aquaculture Farming: The need for efficient feed production to support large-scale animal husbandry drives the demand for effective feed binders.

- Technological Advancements: Innovations in binder formulations, including the development of more efficient and sustainable options, are pushing market growth.

- Government Support and Policies: Favorable government initiatives aimed at boosting agricultural productivity and food security indirectly support the feed additives market.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the cost of key raw materials for binder production can impact profitability and pricing strategies.

- Stringent Regulatory Approvals: Obtaining necessary approvals for new feed additives can be a time-consuming and costly process, especially in diverse regional markets.

- Awareness and Adoption Gap: In some developing economies within the region, there may be a gap in awareness regarding the benefits of advanced feed binders among smaller farm operations.

- Competition from Substitute Products: While feed binders are crucial, competition from other feed processing aids and improved nutrition strategies can pose a challenge.

Emerging Opportunities in Asia-Pacific Feed Binders Market

Emerging opportunities in the Asia-Pacific Feed Binders Market lie in the growing demand for specialized binders catering to the unique nutritional needs of specific animal breeds and life stages. The increasing focus on sustainable aquaculture practices presents a significant opportunity for the development of eco-friendly and highly effective aquaculture feed binders. Furthermore, the untapped potential within smaller economies and the increasing adoption of advanced feed milling technologies in these regions offer avenues for market expansion. The growing trend of precision nutrition in animal feed also creates opportunities for customized binder solutions that optimize nutrient delivery and animal health.

Growth Accelerators in the Asia-Pacific Feed Binders Market Industry

Long-term growth in the Asia-Pacific Feed Binders Market is being accelerated by continuous technological breakthroughs in the development of novel binding agents, including those derived from renewable resources. Strategic partnerships between feed manufacturers and feed binder suppliers are crucial for driving innovation and market penetration. Furthermore, market expansion strategies, particularly in emerging economies within Southeast Asia and South Asia, are set to fuel sustained growth. The increasing global emphasis on animal welfare and the reduction of environmental impact from livestock farming are also significant catalysts, promoting the adoption of advanced feed binder technologies that contribute to efficient resource utilization and reduced waste.

Key Players Shaping the Asia-Pacific Feed Binders Market Market

- Natural Remedies

- Nutreco

- Alltech

- DuPont

- FMC Corporation

- Archer Daniels Midland Company

- Kemin Inc.

- Cargill Inc.

Notable Milestones in Asia-Pacific Feed Binders Market Sector

- 2023: Introduction of advanced lignosulfonate-based binders with enhanced pellet durability by leading global manufacturers, improving feed pellet integrity by an estimated 98%.

- 2022: Increased investment in R&D for natural and sustainable feed binder alternatives in response to growing consumer and regulatory demand for eco-friendly animal agriculture.

- 2021: Several key players expanded their production capacities in Southeast Asian countries to cater to the rapidly growing demand for poultry and aquaculture feed binders.

- 2020: Launch of innovative binder formulations that also offer gut health benefits, integrating functional ingredients alongside binding properties.

- 2019: Growing adoption of digital technologies in feed milling operations, leading to greater demand for precisely formulated feed binders that optimize pellet quality and production efficiency.

In-Depth Asia-Pacific Feed Binders Market Market Outlook

The future outlook for the Asia-Pacific Feed Binders Market remains exceptionally promising, driven by the persistent need for efficient and sustainable animal nutrition. Growth accelerators such as technological advancements in bio-based binders and the increasing demand for functional feed additives will continue to shape the market. Strategic partnerships and market expansion initiatives, particularly in developing economies, will unlock significant potential. The overarching trend towards enhanced animal welfare and reduced environmental footprints in agriculture will further solidify the importance of high-performance feed binders, ensuring robust market growth and creating substantial opportunities for innovation and investment.

Asia-Pacific Feed Binders Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. China

- 3.2. Australia

- 3.3. India

- 3.4. Japan

- 3.5. Rest of Asia Pacific

Asia-Pacific Feed Binders Market Segmentation By Geography

- 1. China

- 2. Australia

- 3. India

- 4. Japan

- 5. Rest of Asia Pacific

Asia-Pacific Feed Binders Market Regional Market Share

Geographic Coverage of Asia-Pacific Feed Binders Market

Asia-Pacific Feed Binders Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Industrialization of Livestock

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Feed Binders Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Australia

- 5.3.3. India

- 5.3.4. Japan

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Australia

- 5.4.3. India

- 5.4.4. Japan

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Feed Binders Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Australia

- 6.3.3. India

- 6.3.4. Japan

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Australia Asia-Pacific Feed Binders Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Australia

- 7.3.3. India

- 7.3.4. Japan

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Feed Binders Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Australia

- 8.3.3. India

- 8.3.4. Japan

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan Asia-Pacific Feed Binders Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Australia

- 9.3.3. India

- 9.3.4. Japan

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Feed Binders Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural

- 10.1.2. Synthetic

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Australia

- 10.3.3. India

- 10.3.4. Japan

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Natural Remedies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nutrec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alltech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dupont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fmc corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Archer Daniels Midland Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemin Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cargill Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Natural Remedies

List of Figures

- Figure 1: Asia-Pacific Feed Binders Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Feed Binders Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 7: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 15: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 19: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 23: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Feed Binders Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Feed Binders Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Asia-Pacific Feed Binders Market?

Key companies in the market include Natural Remedies, Nutrec, Alltech, Dupont, Fmc corporation, Archer Daniels Midland Company, Kemin Inc, Cargill Inc.

3. What are the main segments of the Asia-Pacific Feed Binders Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Industrialization of Livestock.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Feed Binders Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Feed Binders Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Feed Binders Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Feed Binders Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence