Key Insights

The global pet food market is projected to achieve a market size of $156.1 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.7%. This expansion is driven by the increasing trend of pet humanization, leading owners to invest in premium and specialized nutrition. Growing awareness of pet health fuels demand for nutraceuticals like probiotics and omega-3s. The convenience of e-commerce and the availability of veterinary-specific diets also contribute to market growth. Key segments include dry and wet food, treats, nutraceuticals, and veterinary diets, with dogs and cats being the primary pet categories.

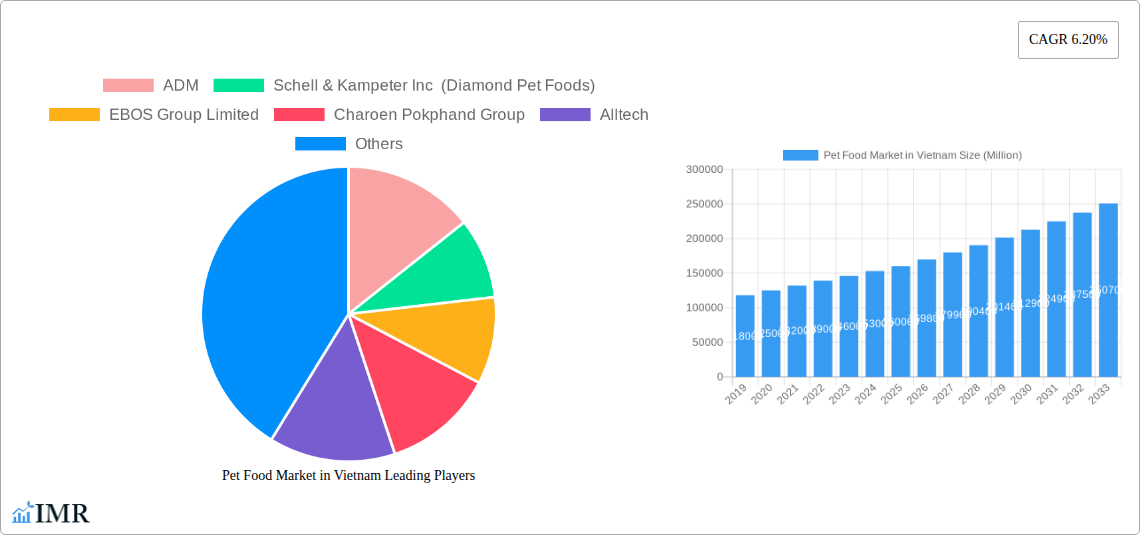

Pet Food Market in Vietnam Market Size (In Million)

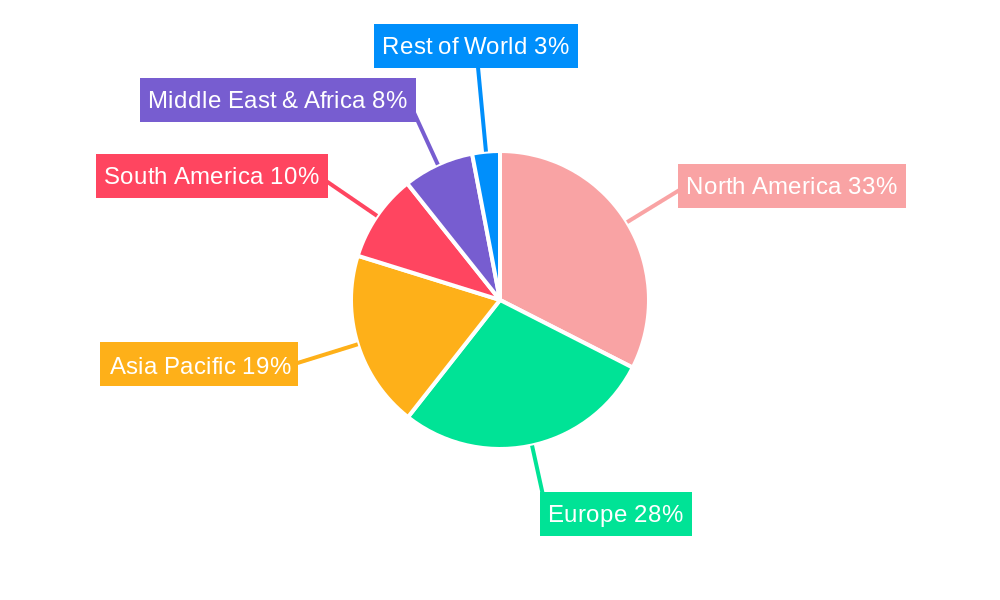

Evolving consumer preferences for natural, organic, and sustainable ingredients, alongside the popularity of freeze-dried and jerky treats, are shaping market trends. While opportunities are abundant, rising raw material costs and supply chain disruptions may present challenges. North America and Europe currently lead the market due to high pet ownership and advanced veterinary care. However, the Asia Pacific region, particularly China and India, is expected to experience the most rapid growth, driven by rising disposable incomes and increasing pet ownership. Major players like Mars Incorporated, Nestle (Purina), and ADM are investing in product innovation and global expansion to leverage these opportunities.

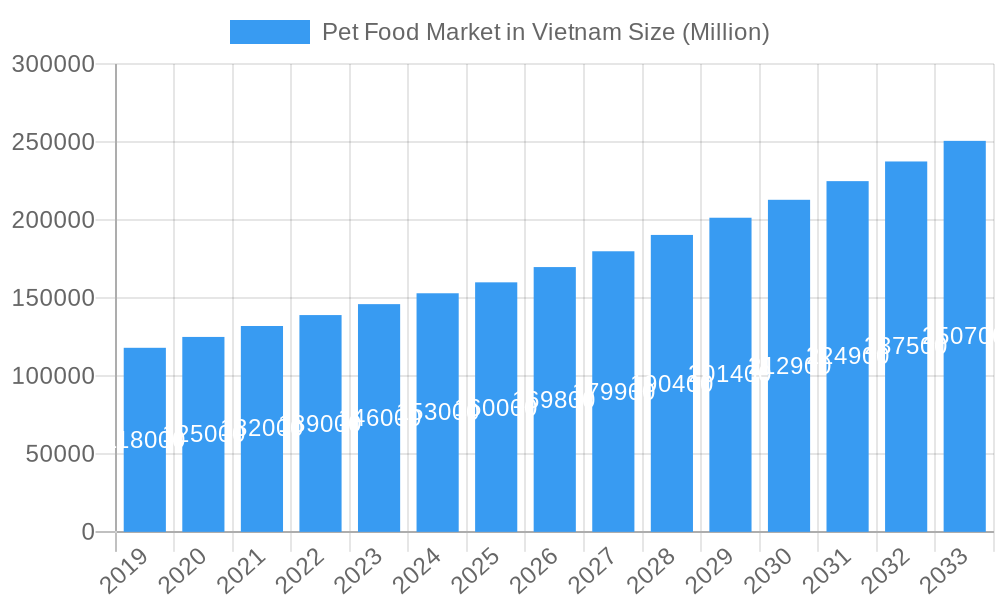

Pet Food Market in Vietnam Company Market Share

Comprehensive Report: Vietnam Pet Food Market Analysis 2025-2033

Unlock the lucrative potential of Vietnam's rapidly expanding pet food market with this definitive industry report. Analyze parent and child market segments, from staple dry kibbles to premium wet foods, specialized veterinary diets, functional treats, and vital pet nutraceuticals. Understand the evolving demands driven by cat and dog owners, and explore the crucial role of online channels, specialty stores, and supermarkets in shaping consumer purchasing behavior. This in-depth analysis, covering the historical period of 2019-2024 and a forecast to 2033, provides actionable insights into market dynamics, growth trends, dominant segments, product innovation, key drivers, barriers, and emerging opportunities. Essential for manufacturers, distributors, investors, and policymakers seeking to capitalize on this burgeoning market.

Pet Food Market in Vietnam Market Dynamics & Structure

The Vietnam pet food market is characterized by a dynamic and evolving landscape, driven by increasing pet humanization and a growing middle class with disposable income. Market concentration is moderately high, with major global and regional players like Mars Incorporated, Nestle (Purina), and Charoen Pokphand Group holding significant shares. Technological innovation is a key driver, focusing on improved palatability, nutritional completeness, and specialized functional benefits in products like pet nutraceuticals and pet veterinary diets. Regulatory frameworks are becoming more robust, ensuring product safety and quality standards. Competitive product substitutes, such as homemade pet food, are present but are increasingly outweighed by the convenience and nutritional assurance of commercial options. End-user demographics are shifting towards younger, urban populations who view pets as family members, demanding premium and health-conscious food choices. Mergers and acquisitions (M&A) are anticipated to increase as larger companies seek to expand their footprint and acquire innovative smaller brands.

- Market Concentration: Moderate to high, with established global brands dominating.

- Technological Innovation: Focus on functional ingredients, advanced processing, and tailored nutrition.

- Regulatory Frameworks: Developing to ensure food safety and quality standards for pet food products.

- Competitive Substitutes: Limited impact from homemade options due to convenience and nutritional science.

- End-User Demographics: Young, urban pet owners driving demand for premium and specialized pet food.

- M&A Trends: Potential for consolidation as market matures.

Pet Food Market in Vietnam Growth Trends & Insights

The pet food market in Vietnam is poised for substantial growth, with the market size projected to increase significantly from its base year of 2025. This expansion is fueled by a rising adoption rate of companion animals, particularly dogs and cats, as Vietnamese households increasingly embrace the concept of pets as integral family members. The online channel has emerged as a major growth engine, offering unparalleled convenience and access to a wider array of premium and specialized pet food products, including pet treats and pet nutraceuticals/supplements. Technological disruptions are playing a crucial role, with advancements in food processing and ingredient research leading to the development of more nutritionally advanced and health-benefiting options. Consumer behavior shifts are evident, with owners willing to invest more in their pets' well-being, leading to a higher demand for specialized diets such as pet veterinary diets and functional pet treats. The projected Compound Annual Growth Rate (CAGR) for the Vietnam pet food market indicates a robust upward trajectory throughout the forecast period of 2025–2033.

- Market Size Evolution: Significant projected growth driven by increasing pet ownership.

- Adoption Rates: Steadily rising, especially for dogs and cats.

- Technological Disruptions: Innovations in nutrition, processing, and specialized product development.

- Consumer Behavior Shifts: Increased spending on pet health and premiumization of diets.

- Market Penetration: Growing significantly as awareness and accessibility increase.

Dominant Regions, Countries, or Segments in Pet Food Market in Vietnam

The pet food market in Vietnam is experiencing rapid growth across several key segments, with Dogs currently representing the most dominant pet category, driving substantial demand for various pet food products. Within the Pet Food Product segment, Dry Pet Food, particularly Kibbles, holds the largest market share due to its convenience, affordability, and long shelf life. However, Wet Pet Food is witnessing rapid growth as consumers seek more palatable and varied options. The Pet Treats segment is also a significant contributor, with Crunchy Treats and Soft & Chewy Treats being highly popular, while Dental Treats are gaining traction due to a growing awareness of oral hygiene in pets.

The Online Channel has emerged as the leading distribution channel, surpassing traditional retail formats like Supermarkets/Hypermarkets and Convenience Stores. This is attributed to the ease of access, wider product selection, and competitive pricing offered by e-commerce platforms. Specialty Stores also play a crucial role in catering to niche demands for premium and specialized products.

- Dominant Pet Segment: Dogs represent the largest consumer base, followed closely by Cats.

- Leading Pet Food Product: Dry Pet Food (Kibbles) commands the highest market share.

- Fastest Growing Product Segment: Wet Pet Food and Pet Treats are exhibiting accelerated growth.

- Key Nutraceutical Segment: Probiotics and Vitamins and Minerals are gaining popularity for their health benefits.

- Dominant Distribution Channel: Online Channel is leading, followed by Specialty Stores.

- Emerging Distribution Channel: Supermarkets/Hypermarkets are increasing their pet food offerings.

- Growth Drivers: Increasing pet ownership, rising disposable incomes, and a growing emphasis on pet health and wellness.

- Market Share (Dogs): Estimated at xx% of the total pet food market.

- Market Share (Online Channel): Estimated at xx% of total pet food sales.

- Growth Potential (Pet Nutraceuticals): Significant expansion driven by health-conscious pet owners.

Pet Food Market in Vietnam Product Landscape

The pet food product landscape in Vietnam is characterized by increasing sophistication and a focus on health-oriented innovations. Manufacturers are introducing premium dry pet food formulations with enhanced protein content and grain-free options. The wet pet food segment is expanding with a wider variety of protein sources and textures. Pet nutraceuticals/supplements, including probiotics and Omega-3 Fatty Acids, are gaining significant traction as owners seek to proactively manage their pets' health. Pet treats, ranging from dental treats to freeze-dried and jerky treats, are evolving beyond mere rewards to functional products promoting oral health and providing concentrated nutrition. Pet veterinary diets, addressing specific health concerns like digestive sensitivity and urinary tract disease, are also becoming more accessible. Companies like Mars Incorporated and Nestle (Purina) are at the forefront of these product advancements.

Key Drivers, Barriers & Challenges in Pet Food Market in Vietnam

The pet food market in Vietnam is propelled by a combination of powerful drivers, including increasing pet ownership driven by a growing middle class, rising disposable incomes enabling premium product purchases, and a pervasive trend of pet humanization where pets are considered family members. Technological advancements in pet nutrition and product formulation, coupled with the expanding reach of the online channel, further accelerate market growth.

However, the market also faces significant barriers and challenges. The primary challenge includes supply chain issues, particularly in sourcing high-quality raw materials and ensuring efficient distribution networks across the country. Regulatory hurdles related to food safety standards and import/export regulations can also impede market entry and expansion. Intense competitive pressures from both established international brands and emerging local players, alongside the potential for counterfeit products, present ongoing challenges. Furthermore, price sensitivity among a segment of consumers can limit the adoption of premium pet food products.

Emerging Opportunities in Pet Food Market in Vietnam

Emerging opportunities in the pet food market in Vietnam are abundant, driven by evolving consumer preferences and untapped market segments. The rising demand for organic and natural pet food presents a significant avenue for growth, aligning with global health trends. The pet nutraceuticals/supplements market, particularly for probiotics and specialized functional ingredients, is ripe for expansion as pet owners become more proactive about their pets' long-term health. Furthermore, the development of tailored pet veterinary diets for specific breeds and age groups offers a niche but growing opportunity. The increasing adoption of cats presents a substantial opportunity to diversify product offerings beyond the dominant dog food market.

Growth Accelerators in the Pet Food Market in Vietnam Industry

Long-term growth in the pet food market in Vietnam will be significantly accelerated by several catalysts. Technological breakthroughs in developing sustainable and novel protein sources will address supply chain concerns and cater to eco-conscious consumers. Strategic partnerships between international manufacturers and local distributors will enhance market penetration and brand visibility. Furthermore, market expansion strategies focusing on smaller cities and provinces, alongside robust digital marketing campaigns to educate consumers about pet nutrition, will unlock new customer bases. The continued premiumization of pet food products and the introduction of innovative pet treats and functional foods will also drive sustained growth.

Key Players Shaping the Pet Food Market in Vietnam Market

- ADM

- Schell & Kampeter Inc (Diamond Pet Foods)

- EBOS Group Limited

- Charoen Pokphand Group

- Alltech

- Mars Incorporated

- Nestle (Purina)

- Vafo Praha s r o

- DoggyMan H A Co Ltd

- Virbac

Notable Milestones in Pet Food Market in Vietnam Sector

- May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats, expanding their cat treat portfolio.

- May 2023: Vafo Praha, s.r.o. launched its new range of Brit RAW Freeze-dried treats and toppers for dogs. These products are made up of high-quality proteins and minimally processed ingredients for potential health benefits, addressing the growing demand for natural pet food and pet nutraceuticals.

- May 2023: Vafo Praha, s.r.o. launched its new line of functional snacks for dogs called Brit Dental Stick. The products are available in four different varieties with seven sticks in a package, catering to the increasing importance of dental treats in the dog food market.

In-Depth Pet Food Market in Vietnam Market Outlook

The in-depth pet food market in Vietnam outlook is exceptionally promising, driven by sustained growth accelerators. The continued upward trend in pet ownership, coupled with an increasing willingness among Vietnamese consumers to invest in premium and specialized pet nutrition, forms the bedrock of this optimistic forecast. Strategic initiatives focusing on product innovation within pet nutraceuticals and pet veterinary diets, alongside expanded distribution through the online channel and strategic partnerships, are poised to further ignite market expansion. Emerging opportunities in niche segments like organic pet food and specialized treats will provide additional avenues for revenue generation and market penetration, solidifying Vietnam's position as a key growth market in the global pet food industry.

Pet Food Market in Vietnam Segmentation

-

1. Pet Food Product

-

1.1. By Sub Product

-

1.1.1. Dry Pet Food

-

1.1.1.1. By Sub Dry Pet Food

- 1.1.1.1.1. Kibbles

- 1.1.1.1.2. Other Dry Pet Food

-

1.1.1.1. By Sub Dry Pet Food

- 1.1.2. Wet Pet Food

-

1.1.1. Dry Pet Food

-

1.2. Pet Nutraceuticals/Supplements

- 1.2.1. Milk Bioactives

- 1.2.2. Omega-3 Fatty Acids

- 1.2.3. Probiotics

- 1.2.4. Proteins and Peptides

- 1.2.5. Vitamins and Minerals

- 1.2.6. Other Nutraceuticals

-

1.3. Pet Treats

- 1.3.1. Crunchy Treats

- 1.3.2. Dental Treats

- 1.3.3. Freeze-dried and Jerky Treats

- 1.3.4. Soft & Chewy Treats

- 1.3.5. Other Treats

-

1.4. Pet Veterinary Diets

- 1.4.1. Diabetes

- 1.4.2. Digestive Sensitivity

- 1.4.3. Oral Care Diets

- 1.4.4. Renal

- 1.4.5. Urinary tract disease

- 1.4.6. Other Veterinary Diets

-

1.1. By Sub Product

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Pet Food Market in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pet Food Market in Vietnam Regional Market Share

Geographic Coverage of Pet Food Market in Vietnam

Pet Food Market in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Food Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 5.1.1. By Sub Product

- 5.1.1.1. Dry Pet Food

- 5.1.1.1.1. By Sub Dry Pet Food

- 5.1.1.1.1.1. Kibbles

- 5.1.1.1.1.2. Other Dry Pet Food

- 5.1.1.1.1. By Sub Dry Pet Food

- 5.1.1.2. Wet Pet Food

- 5.1.1.1. Dry Pet Food

- 5.1.2. Pet Nutraceuticals/Supplements

- 5.1.2.1. Milk Bioactives

- 5.1.2.2. Omega-3 Fatty Acids

- 5.1.2.3. Probiotics

- 5.1.2.4. Proteins and Peptides

- 5.1.2.5. Vitamins and Minerals

- 5.1.2.6. Other Nutraceuticals

- 5.1.3. Pet Treats

- 5.1.3.1. Crunchy Treats

- 5.1.3.2. Dental Treats

- 5.1.3.3. Freeze-dried and Jerky Treats

- 5.1.3.4. Soft & Chewy Treats

- 5.1.3.5. Other Treats

- 5.1.4. Pet Veterinary Diets

- 5.1.4.1. Diabetes

- 5.1.4.2. Digestive Sensitivity

- 5.1.4.3. Oral Care Diets

- 5.1.4.4. Renal

- 5.1.4.5. Urinary tract disease

- 5.1.4.6. Other Veterinary Diets

- 5.1.1. By Sub Product

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 6. North America Pet Food Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 6.1.1. By Sub Product

- 6.1.1.1. Dry Pet Food

- 6.1.1.1.1. By Sub Dry Pet Food

- 6.1.1.1.1.1. Kibbles

- 6.1.1.1.1.2. Other Dry Pet Food

- 6.1.1.1.1. By Sub Dry Pet Food

- 6.1.1.2. Wet Pet Food

- 6.1.1.1. Dry Pet Food

- 6.1.2. Pet Nutraceuticals/Supplements

- 6.1.2.1. Milk Bioactives

- 6.1.2.2. Omega-3 Fatty Acids

- 6.1.2.3. Probiotics

- 6.1.2.4. Proteins and Peptides

- 6.1.2.5. Vitamins and Minerals

- 6.1.2.6. Other Nutraceuticals

- 6.1.3. Pet Treats

- 6.1.3.1. Crunchy Treats

- 6.1.3.2. Dental Treats

- 6.1.3.3. Freeze-dried and Jerky Treats

- 6.1.3.4. Soft & Chewy Treats

- 6.1.3.5. Other Treats

- 6.1.4. Pet Veterinary Diets

- 6.1.4.1. Diabetes

- 6.1.4.2. Digestive Sensitivity

- 6.1.4.3. Oral Care Diets

- 6.1.4.4. Renal

- 6.1.4.5. Urinary tract disease

- 6.1.4.6. Other Veterinary Diets

- 6.1.1. By Sub Product

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 7. South America Pet Food Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 7.1.1. By Sub Product

- 7.1.1.1. Dry Pet Food

- 7.1.1.1.1. By Sub Dry Pet Food

- 7.1.1.1.1.1. Kibbles

- 7.1.1.1.1.2. Other Dry Pet Food

- 7.1.1.1.1. By Sub Dry Pet Food

- 7.1.1.2. Wet Pet Food

- 7.1.1.1. Dry Pet Food

- 7.1.2. Pet Nutraceuticals/Supplements

- 7.1.2.1. Milk Bioactives

- 7.1.2.2. Omega-3 Fatty Acids

- 7.1.2.3. Probiotics

- 7.1.2.4. Proteins and Peptides

- 7.1.2.5. Vitamins and Minerals

- 7.1.2.6. Other Nutraceuticals

- 7.1.3. Pet Treats

- 7.1.3.1. Crunchy Treats

- 7.1.3.2. Dental Treats

- 7.1.3.3. Freeze-dried and Jerky Treats

- 7.1.3.4. Soft & Chewy Treats

- 7.1.3.5. Other Treats

- 7.1.4. Pet Veterinary Diets

- 7.1.4.1. Diabetes

- 7.1.4.2. Digestive Sensitivity

- 7.1.4.3. Oral Care Diets

- 7.1.4.4. Renal

- 7.1.4.5. Urinary tract disease

- 7.1.4.6. Other Veterinary Diets

- 7.1.1. By Sub Product

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 8. Europe Pet Food Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 8.1.1. By Sub Product

- 8.1.1.1. Dry Pet Food

- 8.1.1.1.1. By Sub Dry Pet Food

- 8.1.1.1.1.1. Kibbles

- 8.1.1.1.1.2. Other Dry Pet Food

- 8.1.1.1.1. By Sub Dry Pet Food

- 8.1.1.2. Wet Pet Food

- 8.1.1.1. Dry Pet Food

- 8.1.2. Pet Nutraceuticals/Supplements

- 8.1.2.1. Milk Bioactives

- 8.1.2.2. Omega-3 Fatty Acids

- 8.1.2.3. Probiotics

- 8.1.2.4. Proteins and Peptides

- 8.1.2.5. Vitamins and Minerals

- 8.1.2.6. Other Nutraceuticals

- 8.1.3. Pet Treats

- 8.1.3.1. Crunchy Treats

- 8.1.3.2. Dental Treats

- 8.1.3.3. Freeze-dried and Jerky Treats

- 8.1.3.4. Soft & Chewy Treats

- 8.1.3.5. Other Treats

- 8.1.4. Pet Veterinary Diets

- 8.1.4.1. Diabetes

- 8.1.4.2. Digestive Sensitivity

- 8.1.4.3. Oral Care Diets

- 8.1.4.4. Renal

- 8.1.4.5. Urinary tract disease

- 8.1.4.6. Other Veterinary Diets

- 8.1.1. By Sub Product

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 9. Middle East & Africa Pet Food Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 9.1.1. By Sub Product

- 9.1.1.1. Dry Pet Food

- 9.1.1.1.1. By Sub Dry Pet Food

- 9.1.1.1.1.1. Kibbles

- 9.1.1.1.1.2. Other Dry Pet Food

- 9.1.1.1.1. By Sub Dry Pet Food

- 9.1.1.2. Wet Pet Food

- 9.1.1.1. Dry Pet Food

- 9.1.2. Pet Nutraceuticals/Supplements

- 9.1.2.1. Milk Bioactives

- 9.1.2.2. Omega-3 Fatty Acids

- 9.1.2.3. Probiotics

- 9.1.2.4. Proteins and Peptides

- 9.1.2.5. Vitamins and Minerals

- 9.1.2.6. Other Nutraceuticals

- 9.1.3. Pet Treats

- 9.1.3.1. Crunchy Treats

- 9.1.3.2. Dental Treats

- 9.1.3.3. Freeze-dried and Jerky Treats

- 9.1.3.4. Soft & Chewy Treats

- 9.1.3.5. Other Treats

- 9.1.4. Pet Veterinary Diets

- 9.1.4.1. Diabetes

- 9.1.4.2. Digestive Sensitivity

- 9.1.4.3. Oral Care Diets

- 9.1.4.4. Renal

- 9.1.4.5. Urinary tract disease

- 9.1.4.6. Other Veterinary Diets

- 9.1.1. By Sub Product

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 10. Asia Pacific Pet Food Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 10.1.1. By Sub Product

- 10.1.1.1. Dry Pet Food

- 10.1.1.1.1. By Sub Dry Pet Food

- 10.1.1.1.1.1. Kibbles

- 10.1.1.1.1.2. Other Dry Pet Food

- 10.1.1.1.1. By Sub Dry Pet Food

- 10.1.1.2. Wet Pet Food

- 10.1.1.1. Dry Pet Food

- 10.1.2. Pet Nutraceuticals/Supplements

- 10.1.2.1. Milk Bioactives

- 10.1.2.2. Omega-3 Fatty Acids

- 10.1.2.3. Probiotics

- 10.1.2.4. Proteins and Peptides

- 10.1.2.5. Vitamins and Minerals

- 10.1.2.6. Other Nutraceuticals

- 10.1.3. Pet Treats

- 10.1.3.1. Crunchy Treats

- 10.1.3.2. Dental Treats

- 10.1.3.3. Freeze-dried and Jerky Treats

- 10.1.3.4. Soft & Chewy Treats

- 10.1.3.5. Other Treats

- 10.1.4. Pet Veterinary Diets

- 10.1.4.1. Diabetes

- 10.1.4.2. Digestive Sensitivity

- 10.1.4.3. Oral Care Diets

- 10.1.4.4. Renal

- 10.1.4.5. Urinary tract disease

- 10.1.4.6. Other Veterinary Diets

- 10.1.1. By Sub Product

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Pet Food Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schell & Kampeter Inc (Diamond Pet Foods)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EBOS Group Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Charoen Pokphand Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alltech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nestle (Purina)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vafo Praha s r o

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DoggyMan H A Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virba

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Pet Food Market in Vietnam Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Pet Food Market in Vietnam Revenue (million), by Pet Food Product 2025 & 2033

- Figure 3: North America Pet Food Market in Vietnam Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 4: North America Pet Food Market in Vietnam Revenue (million), by Pets 2025 & 2033

- Figure 5: North America Pet Food Market in Vietnam Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America Pet Food Market in Vietnam Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America Pet Food Market in Vietnam Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Pet Food Market in Vietnam Revenue (million), by Country 2025 & 2033

- Figure 9: North America Pet Food Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Pet Food Market in Vietnam Revenue (million), by Pet Food Product 2025 & 2033

- Figure 11: South America Pet Food Market in Vietnam Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 12: South America Pet Food Market in Vietnam Revenue (million), by Pets 2025 & 2033

- Figure 13: South America Pet Food Market in Vietnam Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America Pet Food Market in Vietnam Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: South America Pet Food Market in Vietnam Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Pet Food Market in Vietnam Revenue (million), by Country 2025 & 2033

- Figure 17: South America Pet Food Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Pet Food Market in Vietnam Revenue (million), by Pet Food Product 2025 & 2033

- Figure 19: Europe Pet Food Market in Vietnam Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 20: Europe Pet Food Market in Vietnam Revenue (million), by Pets 2025 & 2033

- Figure 21: Europe Pet Food Market in Vietnam Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe Pet Food Market in Vietnam Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Pet Food Market in Vietnam Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Pet Food Market in Vietnam Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Pet Food Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Pet Food Market in Vietnam Revenue (million), by Pet Food Product 2025 & 2033

- Figure 27: Middle East & Africa Pet Food Market in Vietnam Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 28: Middle East & Africa Pet Food Market in Vietnam Revenue (million), by Pets 2025 & 2033

- Figure 29: Middle East & Africa Pet Food Market in Vietnam Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa Pet Food Market in Vietnam Revenue (million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Pet Food Market in Vietnam Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Pet Food Market in Vietnam Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Pet Food Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Pet Food Market in Vietnam Revenue (million), by Pet Food Product 2025 & 2033

- Figure 35: Asia Pacific Pet Food Market in Vietnam Revenue Share (%), by Pet Food Product 2025 & 2033

- Figure 36: Asia Pacific Pet Food Market in Vietnam Revenue (million), by Pets 2025 & 2033

- Figure 37: Asia Pacific Pet Food Market in Vietnam Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific Pet Food Market in Vietnam Revenue (million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Pet Food Market in Vietnam Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Pet Food Market in Vietnam Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Pet Food Market in Vietnam Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pet Food Market in Vietnam Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 2: Global Pet Food Market in Vietnam Revenue million Forecast, by Pets 2020 & 2033

- Table 3: Global Pet Food Market in Vietnam Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Pet Food Market in Vietnam Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Pet Food Market in Vietnam Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 6: Global Pet Food Market in Vietnam Revenue million Forecast, by Pets 2020 & 2033

- Table 7: Global Pet Food Market in Vietnam Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Pet Food Market in Vietnam Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Pet Food Market in Vietnam Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 13: Global Pet Food Market in Vietnam Revenue million Forecast, by Pets 2020 & 2033

- Table 14: Global Pet Food Market in Vietnam Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Pet Food Market in Vietnam Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Pet Food Market in Vietnam Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 20: Global Pet Food Market in Vietnam Revenue million Forecast, by Pets 2020 & 2033

- Table 21: Global Pet Food Market in Vietnam Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Pet Food Market in Vietnam Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Pet Food Market in Vietnam Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 33: Global Pet Food Market in Vietnam Revenue million Forecast, by Pets 2020 & 2033

- Table 34: Global Pet Food Market in Vietnam Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Pet Food Market in Vietnam Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Pet Food Market in Vietnam Revenue million Forecast, by Pet Food Product 2020 & 2033

- Table 43: Global Pet Food Market in Vietnam Revenue million Forecast, by Pets 2020 & 2033

- Table 44: Global Pet Food Market in Vietnam Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Pet Food Market in Vietnam Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Pet Food Market in Vietnam Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Food Market in Vietnam?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Pet Food Market in Vietnam?

Key companies in the market include ADM, Schell & Kampeter Inc (Diamond Pet Foods), EBOS Group Limited, Charoen Pokphand Group, Alltech, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, DoggyMan H A Co Ltd, Virba.

3. What are the main segments of the Pet Food Market in Vietnam?

The market segments include Pet Food Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 156.1 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.May 2023: Vafo Praha, s.r.o. launched its new range of Brit RAW Freeze-dried treats and toppers for dogs. These products are made up of high-quality proteins and minimally processed ingredients for potential health benefits.May 2023: Vafo Praha, s.r.o. launched its new line of functional snacks for dogs called Brit Dental Stick. The products are available in four different varieties with seven sticks in a package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Food Market in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Food Market in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Food Market in Vietnam?

To stay informed about further developments, trends, and reports in the Pet Food Market in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence