Key Insights

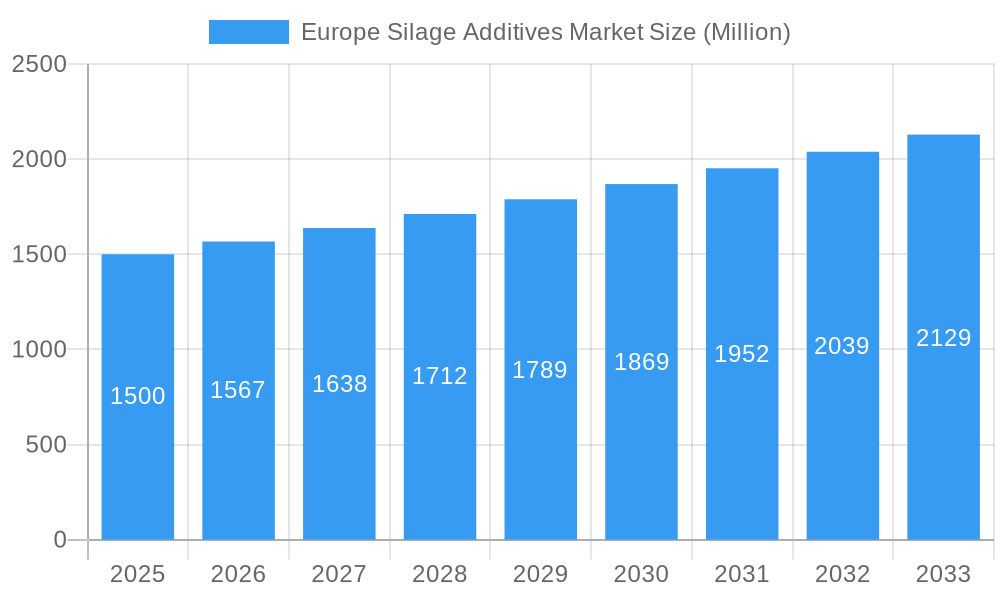

The European silage additives market is projected for substantial growth, estimated to reach $2.27 billion by 2024, with a compound annual growth rate (CAGR) of 4.67% anticipated through 2033. This expansion is driven by increasing demand for superior animal nutrition, enhanced feed efficiency, and minimized spoilage in European livestock operations. As dairy and beef farming intensifies to meet global protein needs, effective silage preservation is crucial. Key growth factors include farmer awareness of the economic benefits of high-quality silage, such as increased milk production, improved animal health, and reduced feed waste. Technological advancements in silage additive formulations also contribute to market penetration. Furthermore, a focus on sustainable agriculture and reducing livestock-related greenhouse gas emissions indirectly supports demand for additives that optimize nutrient utilization and reduce spoilage.

Europe Silage Additives Market Market Size (In Billion)

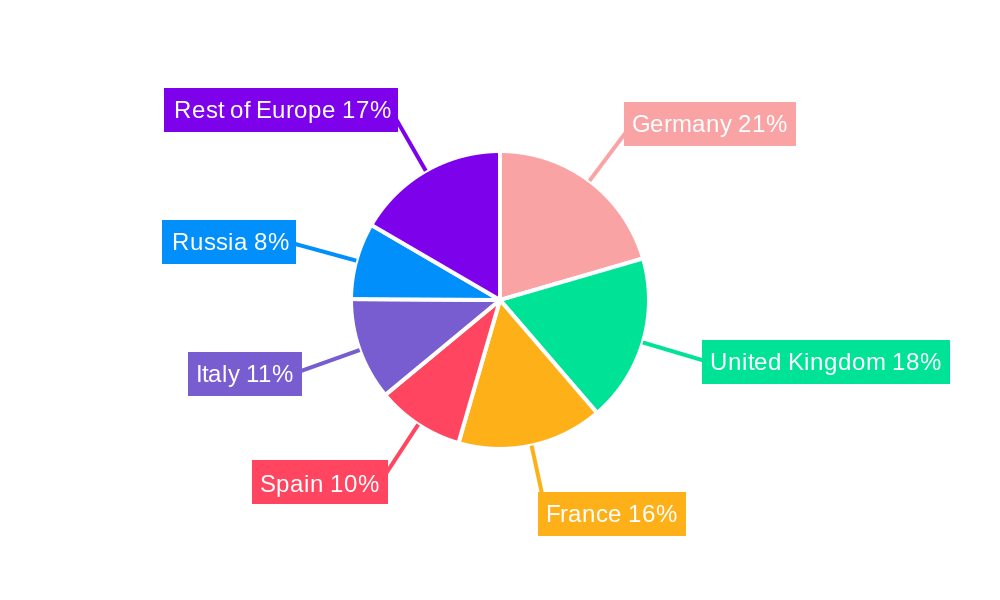

The market features diverse product segments, with inoculants and organic acids & salts leading due to their proven efficacy in rapid fermentation and microbial inhibition. Enzymes show promise for enhanced digestibility and nutrient availability. Cereals and legumes are the primary silage types treated, demonstrating the widespread application of these additives. Europe, with its established livestock sector, is the primary market. Germany, the United Kingdom, and France are expected to be leading consumers, driven by advanced farming practices and supportive regulations. Potential restraints include fluctuating raw material costs and initial investment perceptions for some farmers. However, long-term economic advantages and the necessity for efficient feed management are expected to ensure sustained market growth.

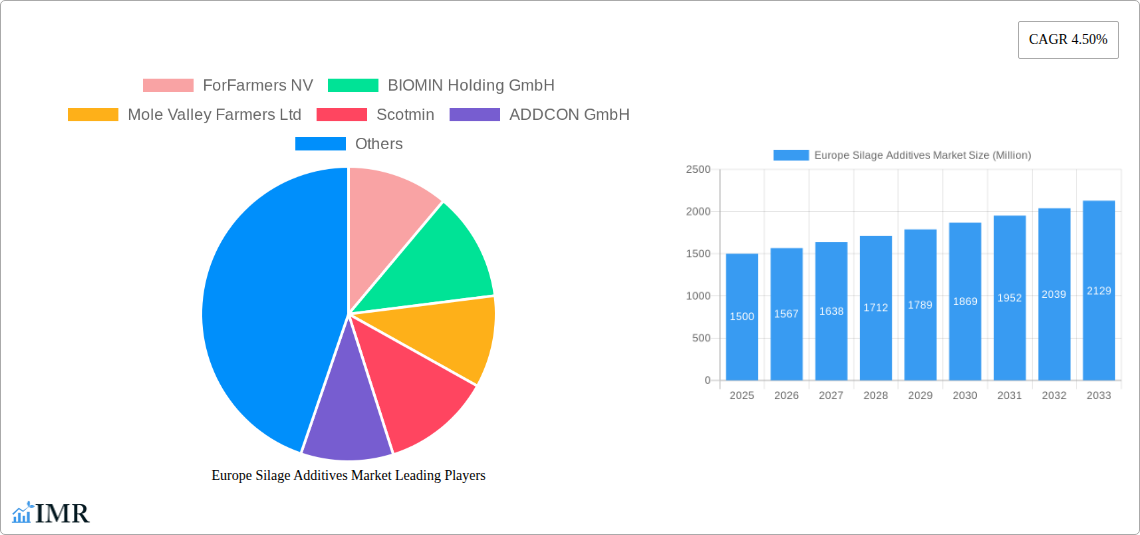

Europe Silage Additives Market Company Market Share

Europe Silage Additives Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Europe Silage Additives Market, offering critical insights into market dynamics, growth trends, regional dominance, product innovation, key drivers, barriers, emerging opportunities, and the competitive landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving silage additives industry in Europe.

Europe Silage Additives Market Market Dynamics & Structure

The Europe Silage Additives Market is characterized by a moderate to high concentration, with a few key players holding significant market share, while a larger number of smaller regional and specialized companies contribute to market diversity. Technological innovation is a primary driver, with continuous research and development focused on enhancing the efficacy of silage additives in preserving nutritional value, reducing spoilage, and improving animal feed digestibility. Regulatory frameworks, particularly those related to food safety and animal welfare, play a crucial role in shaping product development and market access. Stringent regulations from bodies like the European Food Safety Authority (EFSA) necessitate rigorous testing and approval processes, influencing product formulations and market entry strategies. Competitive product substitutes are present, including alternative feed preservation methods and the development of more naturally resilient forage crops, which create a dynamic competitive environment. End-user demographics are increasingly driven by dairy and beef producers seeking to optimize feed efficiency, reduce economic losses due to spoilage, and improve livestock health and productivity. Mergers and acquisitions (M&A) are a notable trend, with larger companies acquiring innovative startups or smaller competitors to expand their product portfolios, geographical reach, and technological capabilities. For instance, in the historical period (2019-2024), there were an estimated XX M&A deal volumes in the European silage additives sector, indicating strategic consolidation. Barriers to innovation include the high cost of research and development, the lengthy regulatory approval process, and the need for extensive field trials to validate product efficacy across diverse agricultural conditions.

- Market Concentration: Dominated by a mix of global corporations and specialized regional players.

- Technological Innovation: Focus on microbial inoculants, enzyme-based solutions, and advanced preservation techniques.

- Regulatory Landscape: Influence of EFSA and national regulations on product approval and market access.

- Competitive Landscape: Competition from alternative feed preservation methods and advancements in forage genetics.

- End-User Focus: Increasing demand from livestock producers for improved feed quality and animal performance.

- M&A Activity: Strategic acquisitions to gain market share and technological advantage.

Europe Silage Additives Market Growth Trends & Insights

The Europe Silage Additives Market is poised for substantial growth, driven by an increasing awareness of the economic and nutritional benefits associated with effective silage preservation. The market size evolution is projected to witness a robust expansion, with an estimated market value of $XXX million in 2025, and anticipated to reach $XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is underpinned by the rising adoption rates of advanced silage additives among European farmers. The adoption rates are being propelled by the need to maximize the nutritional value of forage, reduce nutrient losses during ensiling, and mitigate the risk of spoilage-related economic losses. Technological disruptions, such as the development of highly specific microbial strains for inoculants and the refinement of enzyme formulations for improved protein and fiber digestibility, are significantly influencing market dynamics. Consumer behavior shifts, particularly a growing demand for high-quality animal products and a greater emphasis on sustainable farming practices, are indirectly bolstering the silage additives market. Farmers are recognizing that investing in superior silage quality translates to healthier livestock, reduced reliance on imported feed, and a more sustainable agricultural footprint. The market penetration of silage additives is expected to deepen across various European countries, moving beyond traditional large-scale operations to encompass smaller and medium-sized farms. This expansion is facilitated by educational initiatives, government subsidies for modern farming practices, and the availability of cost-effective additive solutions. The inherent challenges of variable weather patterns and the continuous need to improve feed conversion ratios in livestock farming also serve as persistent catalysts for increased adoption. Furthermore, the development of tailor-made silage additives for specific crop types and intended animal diets is enhancing their appeal and effectiveness, driving further market growth.

Dominant Regions, Countries, or Segments in Europe Silage Additives Market

The Germany region is projected to be a dominant force in the Europe Silage Additives Market, exhibiting significant market share and robust growth potential. This dominance is attributed to several key factors, including Germany's large and highly productive dairy and beef cattle sectors, a strong emphasis on agricultural innovation and efficiency, and supportive government policies encouraging advanced farming practices. The country's extensive agricultural infrastructure and a farmer base that is generally receptive to adopting new technologies contribute significantly to the widespread use of silage additives.

Within the Type segment, Inoculants are expected to lead the market growth. This is driven by their proven efficacy in initiating and controlling the fermentation process, leading to stable, nutrient-rich silage. The development of diverse and highly effective microbial strains tailored for specific forage types and ensiling conditions has further cemented their position.

In terms of Silage Type, Cereals are anticipated to command a substantial market share. This is due to the widespread cultivation of cereal crops like maize and corn across Europe, which are primary feed sources for livestock. The ensiling of cereals presents unique fermentation challenges that silage additives are specifically designed to address, ensuring optimal preservation and digestibility.

- Leading Region: Germany, owing to its extensive livestock industry and pro-innovation agricultural policies.

- Dominant Type Segment: Inoculants, due to their fundamental role in initiating beneficial fermentation.

- Key Drivers for Inoculants: Enhanced fermentation control, improved aerobic stability, and reduced nutrient losses.

- Market Share: Expected to hold a significant portion of the overall silage additives market by 2025.

- Dominant Silage Type: Cereals, particularly maize and corn, as primary feed crops.

- Key Drivers for Cereals: Widespread cultivation and the critical need for effective preservation to maintain nutritional value.

- Growth Potential: High demand driven by the extensive use of cereal silage in livestock diets.

- Economic Policies: Favorable agricultural subsidies and investment in research and development in key European nations.

- Infrastructure: Well-developed agricultural extension services and distribution networks facilitating additive adoption.

- Technological Advancement: Continuous innovation in microbial strains and formulation for inoculants.

Europe Silage Additives Market Product Landscape

The Europe Silage Additives Market is witnessing a surge in innovative product developments aimed at enhancing silage quality and farmer profitability. Key product innovations include advanced inoculants featuring multi-strain bacterial blends optimized for specific forage types, such as lactic acid bacteria strains that accelerate lactic acid production for faster pH drop and improved preservation. Furthermore, novel enzyme formulations are gaining traction, designed to break down complex carbohydrates and proteins, thereby increasing the digestibility of silage and improving nutrient absorption in livestock. Organic acids and their salts continue to evolve, with enhanced formulations offering broader-spectrum antimicrobial activity and improved stability. The application spectrum of these additives is broadening, moving beyond simple spoilage prevention to address complex challenges like mycotoxin reduction and improved rumen function. Performance metrics being emphasized include improved aerobic stability, reduced dry matter loss, enhanced crude protein content, and increased energy density of the silage, directly translating to better animal performance and economic returns for farmers.

Key Drivers, Barriers & Challenges in Europe Silage Additives Market

Key Drivers:

- Increasing Demand for High-Quality Animal Feed: Driven by the need for improved livestock health, productivity, and efficiency.

- Economic Losses due to Silage Spoilage: Farmers are actively seeking solutions to minimize significant financial losses incurred from feed spoilage.

- Technological Advancements: Continuous innovation in microbial and enzymatic additives enhances efficacy and expands application.

- Government Support and Subsidies: Policies promoting modern agricultural practices and sustainable feed production.

- Growing Awareness of Nutritional Benefits: Farmers understanding the direct link between silage quality and animal performance.

Key Barriers & Challenges:

- High Initial Investment Cost: Some advanced silage additives can represent a significant upfront cost for farmers, especially smaller operations.

- Regulatory Hurdles and Approval Processes: Lengthy and complex regulatory procedures for new additive formulations can delay market entry.

- Variability in Forage Quality and Environmental Conditions: The effectiveness of additives can be influenced by differences in crop type, maturity, and local weather patterns.

- Limited Farmer Awareness and Education: In some regions, a lack of comprehensive understanding of the benefits and proper application of silage additives persists.

- Competition from Alternative Feed Management Strategies: The availability of other feed preservation methods and the development of genetically improved forage varieties can pose competition.

- Supply Chain Disruptions: Global and regional supply chain complexities can impact the availability and cost of raw materials and finished products.

Emerging Opportunities in Europe Silage Additives Market

Emerging opportunities in the Europe Silage Additives Market lie in the development of sustainable and bio-based additives, aligning with the EU's Green Deal objectives. There is a growing demand for additives that not only preserve silage but also contribute to reducing greenhouse gas emissions from livestock. Untapped markets within Eastern European countries, with their expanding agricultural sectors, present significant growth potential. Furthermore, the innovation in functional additives that provide specific benefits beyond basic preservation, such as improved animal gut health or reduced methane emissions, is a promising avenue. The increasing adoption of precision agriculture techniques also opens doors for tailor-made silage additive solutions delivered based on real-time farm data.

Growth Accelerators in the Europe Silage Additives Market Industry

Long-term growth in the Europe Silage Additives Market will be significantly accelerated by continued technological breakthroughs in the discovery and application of novel microbial strains and enzyme complexes. Strategic partnerships between additive manufacturers, feed producers, and agricultural research institutions are crucial for fostering innovation and facilitating the rapid dissemination of knowledge and new products. Market expansion strategies, particularly focusing on educating smaller farms and exploring new geographical markets within Europe, will also be key accelerators. The increasing consumer demand for ethically produced and sustainably sourced animal products will further drive the need for efficient and high-quality feed, directly benefiting the silage additives sector.

Key Players Shaping the Europe Silage Additives Market Market

- ForFarmers NV

- BIOMIN Holding GmbH

- Mole Valley Farmers Ltd

- Scotmin

- ADDCON GmbH

- KW Forage system

- Archer Daniels Midland Company

- Brett Brothers Ltd

- BASF SE

- Carrs Billington

- Lallemand Animal Nutrition

- Volac International Limited

- Wynnstay grou

- Nutreco N V

- Chr Hansen

- Envirosystems

- Pearce Group of Companies

Notable Milestones in Europe Silage Additives Market Sector

- 2022: Launch of a new generation of multi-strain inoculants by Lallemand Animal Nutrition, offering enhanced aerobic stability and improved fermentation profiles for diverse forage types.

- 2021: BASF SE announces significant investment in research for novel enzyme-based silage additives aimed at increasing protein digestibility.

- 2020: BIOMIN Holding GmbH acquires a specialized mycotoxin reduction additive company, expanding its portfolio to address emerging feed safety concerns.

- 2019: Chr Hansen introduces an innovative probiotic-based silage additive designed to improve rumen function and overall animal health.

- 2023: Volac International Limited expands its silage additive range with a focus on organic acids and their salts, targeting enhanced spoilage prevention in challenging conditions.

- 2024: ADDCON GmbH develops a new preservative formulation for high-moisture silages, addressing specific challenges in grass and maize ensiling.

In-Depth Europe Silage Additives Market Market Outlook

The future of the Europe Silage Additives Market is exceptionally promising, driven by an intensified focus on feed efficiency, sustainability, and animal welfare. Growth accelerators such as the development of precision fermentation techniques for microbial additives and the integration of AI in predicting optimal additive application will shape the landscape. Strategic collaborations between established players and innovative startups will continue to fuel product diversification and market penetration. The increasing demand for climate-resilient agriculture and reduced environmental impact in livestock farming will further solidify the essential role of high-performance silage additives in achieving these objectives, offering substantial long-term market potential and diverse strategic opportunities for stakeholders.

Europe Silage Additives Market Segmentation

-

1. Type

- 1.1. Inoculants

- 1.2. Organic Acids & Salts

- 1.3. Enzymes

- 1.4. Adsorbents

- 1.5. Preservatives

- 1.6. Other Types

-

2. Silage Type

- 2.1. Cereals

- 2.2. Legumes

- 2.3. Other Silage Types

Europe Silage Additives Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Silage Additives Market Regional Market Share

Geographic Coverage of Europe Silage Additives Market

Europe Silage Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Standard Animal Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inoculants

- 5.1.2. Organic Acids & Salts

- 5.1.3. Enzymes

- 5.1.4. Adsorbents

- 5.1.5. Preservatives

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Silage Type

- 5.2.1. Cereals

- 5.2.2. Legumes

- 5.2.3. Other Silage Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inoculants

- 6.1.2. Organic Acids & Salts

- 6.1.3. Enzymes

- 6.1.4. Adsorbents

- 6.1.5. Preservatives

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Silage Type

- 6.2.1. Cereals

- 6.2.2. Legumes

- 6.2.3. Other Silage Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inoculants

- 7.1.2. Organic Acids & Salts

- 7.1.3. Enzymes

- 7.1.4. Adsorbents

- 7.1.5. Preservatives

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Silage Type

- 7.2.1. Cereals

- 7.2.2. Legumes

- 7.2.3. Other Silage Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inoculants

- 8.1.2. Organic Acids & Salts

- 8.1.3. Enzymes

- 8.1.4. Adsorbents

- 8.1.5. Preservatives

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Silage Type

- 8.2.1. Cereals

- 8.2.2. Legumes

- 8.2.3. Other Silage Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Spain Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inoculants

- 9.1.2. Organic Acids & Salts

- 9.1.3. Enzymes

- 9.1.4. Adsorbents

- 9.1.5. Preservatives

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Silage Type

- 9.2.1. Cereals

- 9.2.2. Legumes

- 9.2.3. Other Silage Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Russia Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inoculants

- 10.1.2. Organic Acids & Salts

- 10.1.3. Enzymes

- 10.1.4. Adsorbents

- 10.1.5. Preservatives

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Silage Type

- 10.2.1. Cereals

- 10.2.2. Legumes

- 10.2.3. Other Silage Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Inoculants

- 11.1.2. Organic Acids & Salts

- 11.1.3. Enzymes

- 11.1.4. Adsorbents

- 11.1.5. Preservatives

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Silage Type

- 11.2.1. Cereals

- 11.2.2. Legumes

- 11.2.3. Other Silage Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Silage Additives Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Inoculants

- 12.1.2. Organic Acids & Salts

- 12.1.3. Enzymes

- 12.1.4. Adsorbents

- 12.1.5. Preservatives

- 12.1.6. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Silage Type

- 12.2.1. Cereals

- 12.2.2. Legumes

- 12.2.3. Other Silage Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 ForFarmers NV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 BIOMIN Holding GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mole Valley Farmers Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Scotmin

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ADDCON GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KW Forage system

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Archer Daniels Midland Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Brett Brothers Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BASF SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Carrs Billington

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Lallemand Animal Nutrition

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Volac International Limited

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Wynnstay grou

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Nutreco N V

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Chr Hansen

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Envirosystems

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Pearce Group of Companies

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 ForFarmers NV

List of Figures

- Figure 1: Europe Silage Additives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Silage Additives Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 3: Europe Silage Additives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 6: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 9: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 12: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 15: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 18: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 21: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Silage Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Silage Additives Market Revenue billion Forecast, by Silage Type 2020 & 2033

- Table 24: Europe Silage Additives Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Silage Additives Market?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the Europe Silage Additives Market?

Key companies in the market include ForFarmers NV, BIOMIN Holding GmbH, Mole Valley Farmers Ltd, Scotmin, ADDCON GmbH, KW Forage system, Archer Daniels Midland Company, Brett Brothers Ltd, BASF SE, Carrs Billington, Lallemand Animal Nutrition, Volac International Limited, Wynnstay grou, Nutreco N V, Chr Hansen, Envirosystems, Pearce Group of Companies.

3. What are the main segments of the Europe Silage Additives Market?

The market segments include Type, Silage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for Standard Animal Meat.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Silage Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Silage Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Silage Additives Market?

To stay informed about further developments, trends, and reports in the Europe Silage Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence