Key Insights

The European Feed Mycotoxin Detoxifier Market is projected for significant expansion, anticipated to reach USD 2.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This growth is fueled by heightened producer awareness of mycotoxins' adverse impacts on animal health, productivity, and the safety of animal-derived food products. Increased demand for high-quality animal protein and stringent European food safety regulations further propel the adoption of feed mycotoxin detoxifiers. Key sectors such as poultry and ruminants are major demand drivers due to operational scale and the economic impact of mycotoxin contamination.

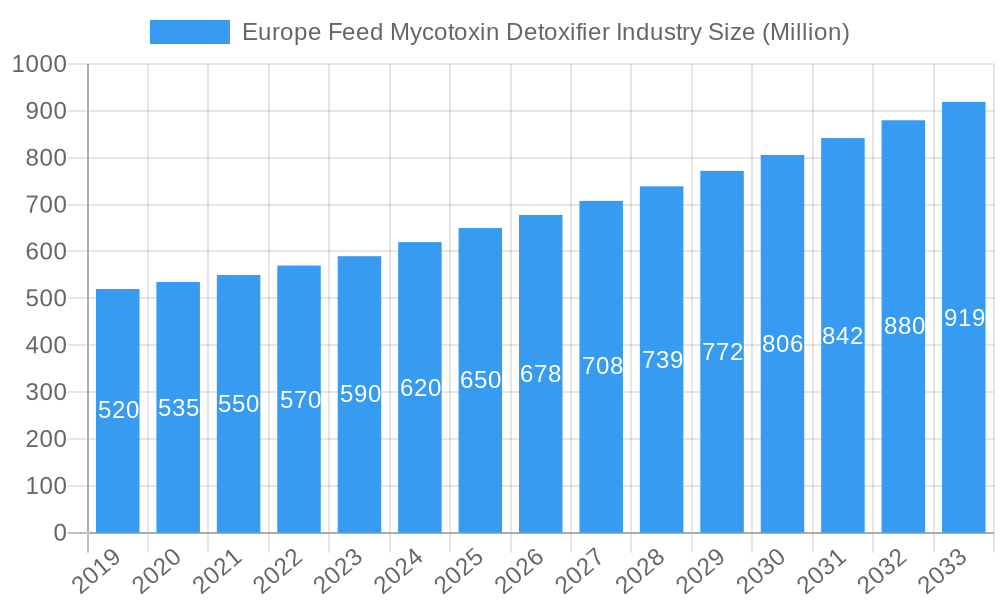

Europe Feed Mycotoxin Detoxifier Industry Market Size (In Billion)

Emerging trends include the development of novel, highly effective detoxifiers with improved specificity and broader efficacy. Innovations in bio-detoxifiers, utilizing microbial fermentation and enzyme technologies, offer sustainable solutions. However, the cost of advanced formulations and the need for enhanced producer education on early detection and management pose challenges. Europe's developed agricultural sector, with its focus on animal welfare and food safety, positions it as a pivotal market. The United Kingdom, Germany, France, and the Netherlands are expected to lead market growth, supported by proactive regulations and robust feed industry infrastructure.

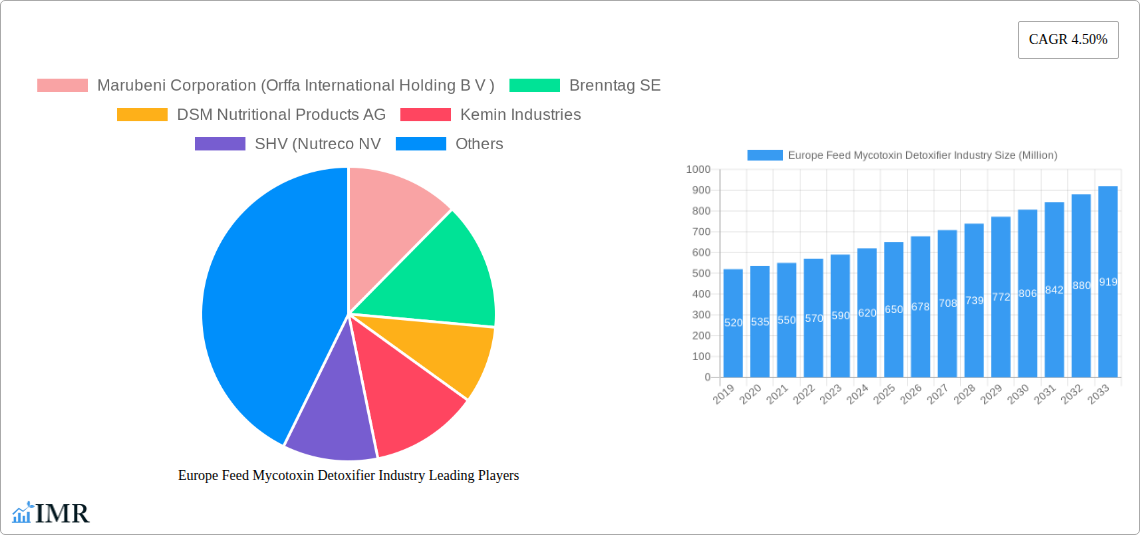

Europe Feed Mycotoxin Detoxifier Industry Company Market Share

This report provides a comprehensive analysis of the Europe feed mycotoxin detoxifier market, examining key growth drivers, emerging trends, and competitive landscapes. Covering the period 2019–2033, it offers critical insights for stakeholders in animal nutrition and feed additives. The analysis includes market structure, growth trajectories, dominant segments and regions, product offerings, challenges, opportunities, and profiles of key industry players influencing mycotoxin control in animal feed. This report offers strategic guidance for navigating the evolving European animal feed industry and optimizing investments in feed additive solutions.

Europe Feed Mycotoxin Detoxifier Industry Market Dynamics & Structure

The Europe feed mycotoxin detoxifier market is characterized by a moderately concentrated landscape, with key players like Marubeni Corporation (Orffa International Holding B V), Brenntag SE, DSM Nutritional Products AG, Kemin Industries, and SHV (Nutreco NV) holding significant market share. Technological innovation is a primary driver, with continuous research and development focused on more effective and environmentally friendly detoxifying agents. Regulatory frameworks, particularly from the European Food Safety Authority (EFSA), play a crucial role in defining product standards and market access, fostering a demand for certified and scientifically validated solutions. Competitive product substitutes, such as alternative feed ingredients with natural mycotoxin binding properties, also influence market dynamics. End-user demographics, driven by increasing awareness of animal health, food safety, and the economic impact of mycotoxin contamination, are increasingly demanding advanced detoxifier solutions. Mergers and acquisitions (M&A) are notable, with companies seeking to expand their product portfolios and geographical reach. For instance, in 2023, the market witnessed an estimated 5-7 M&A deals valued at an aggregate of approximately €150-€200 Million, signaling consolidation and strategic expansion. Innovation barriers include the high cost of R&D for novel compounds and the lengthy regulatory approval processes.

- Market Concentration: Moderate, with a few dominant global players and several regional manufacturers.

- Technological Innovation: Driven by R&D in novel binding agents, biotransformation enzymes, and immune-modulating compounds.

- Regulatory Frameworks: Strict EU regulations on feed safety and mycotoxin limits necessitate compliance and drive demand for efficacy-proven products.

- Competitive Substitutes: Natural feed ingredients with potential mycotoxin binding properties, though often less potent than specialized detoxifiers.

- End-User Demographics: Growing demand from livestock producers for improved animal performance, reduced health issues, and enhanced food safety.

- M&A Trends: Strategic acquisitions to gain market share, expand product offerings, and enter new geographical regions. Estimated 5-7 M&A deals in 2023 with a total value of €150-€200 Million.

- Innovation Barriers: High R&D costs, lengthy approval timelines, and the need for extensive field trials.

Europe Feed Mycotoxin Detoxifier Industry Growth Trends & Insights

The Europe feed mycotoxin detoxifier market is poised for robust growth, driven by an escalating awareness of the detrimental effects of mycotoxins on animal health, productivity, and ultimately, human food safety. The market size for feed mycotoxin detoxifiers in Europe is projected to witness a significant expansion from an estimated €750 Million in 2024 to over €1.2 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033. This growth is underpinned by increasing adoption rates of advanced detoxifier technologies across all animal segments, spurred by higher feed safety standards and the economic imperative to mitigate losses associated with mycotoxin exposure. Technological disruptions are continuously emerging, with a greater emphasis on multi-component solutions that address a wider spectrum of mycotoxins and enhance animal immune responses. Consumer behavior shifts, driven by a demand for antibiotic-free and healthier animal products, indirectly fuel the need for effective mycotoxin management to maintain optimal animal health without relying on antimicrobials. Market penetration of advanced detoxifiers is estimated to have reached 55% in 2024 and is expected to climb to over 70% by 2033. The economic impact of mycotoxins on the European livestock sector is substantial, with estimated annual losses ranging from €500 Million to €700 Million due to reduced performance, increased susceptibility to diseases, and feed spoilage. This economic reality serves as a powerful catalyst for the adoption of feed mycotoxin detoxifiers. The increasing complexity of mycotoxin contamination, often involving multiple toxins simultaneously, necessitates sophisticated solutions that go beyond simple binding, incorporating biotransformation capabilities to neutralize toxins more effectively. The ongoing evolution of feed formulation practices, including the increased use of alternative protein sources, can also introduce new mycotoxin risks, further solidifying the need for comprehensive detoxifier strategies. The market is also witnessing a growing demand for functional additives that not only detoxify but also contribute to improved gut health, immune function, and overall animal well-being, creating a value-added proposition for feed detoxifier manufacturers.

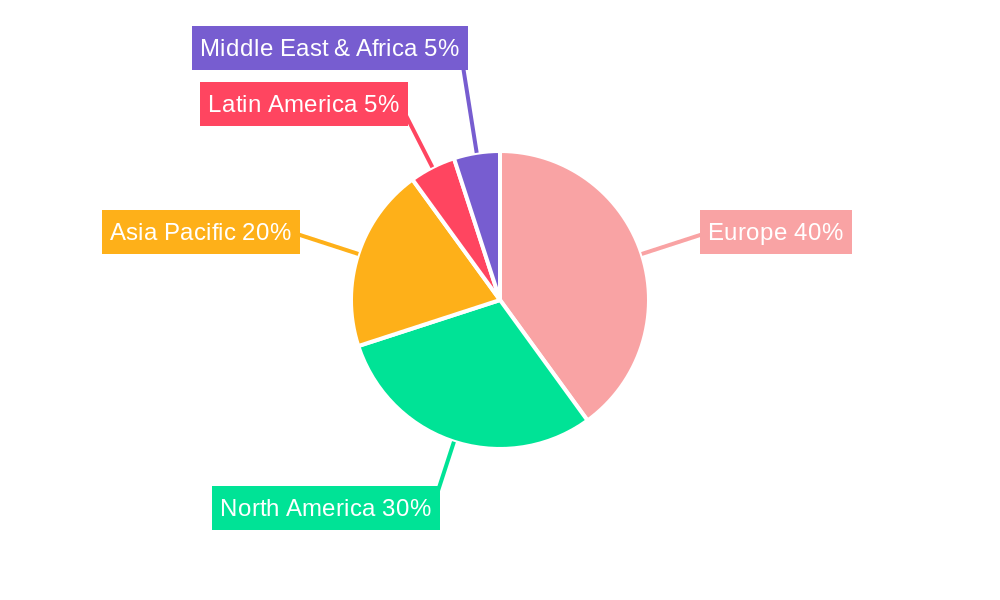

Dominant Regions, Countries, or Segments in Europe Feed Mycotoxin Detoxifier Industry

Within the European landscape, the Poultry segment, encompassing broilers, layers, and other poultry birds, currently dominates the feed mycotoxin detoxifier market. This dominance is attributed to several key drivers. Poultry production in Europe is characterized by high-density farming and rapid growth cycles, making them particularly susceptible to the adverse effects of mycotoxins, which can lead to significant economic losses through reduced feed conversion, immunosuppression, and condemnations. The Poultry segment is estimated to account for approximately 40% of the total Europe feed mycotoxin detoxifier market share in 2024. Economic policies supporting efficient livestock production and increasing consumer demand for poultry products contribute to the sector's significant scale.

The Sub Additive: Binders segment also holds a substantial market position, often integrated into comprehensive mycotoxin management strategies. Binders, particularly those based on clays and yeast cell wall derivatives, are widely adopted due to their proven efficacy in adsorbing a range of mycotoxins, thereby preventing their absorption in the animal's gastrointestinal tract. This segment is estimated to capture around 35% of the market share for detoxifiers in 2024.

Geographically, Germany stands out as a leading country within the Europe feed mycotoxin detoxifier market. Its robust agricultural sector, stringent feed quality regulations, and high awareness among feed producers and livestock farmers regarding mycotoxin risks contribute to its significant market share. Germany's advanced feed industry infrastructure and strong focus on animal welfare and food safety create a conducive environment for the adoption of premium detoxifier solutions. The country is estimated to contribute approximately 15-18% to the overall European market revenue.

France and the United Kingdom are also key contributors, driven by similar factors of large-scale animal production, evolving regulatory landscapes, and a proactive approach to animal health and nutrition. The increasing adoption of Biotransformers, which utilize enzymatic activity to neutralize mycotoxins, is a notable growth driver in these regions, reflecting a move towards more sophisticated and targeted detoxification methods.

- Dominant Animal Segment: Poultry (Broiler, Layer, Other Poultry Birds) – estimated 40% market share in 2024.

- Drivers: High-density farming, rapid growth cycles, susceptibility to economic losses from mycotoxin contamination.

- Dominant Sub-Additive Segment: Binders – estimated 35% market share in 2024.

- Drivers: Proven efficacy in mycotoxin adsorption, wide availability, and cost-effectiveness.

- Leading Country: Germany – estimated 15-18% market share.

- Drivers: Strong agricultural sector, strict regulations, high awareness, advanced feed industry.

- Key Growth Drivers: Economic policies supporting livestock production, increasing consumer demand for animal products, evolving regulatory standards, and the adoption of advanced detoxification technologies like biotransformers.

- Market Share and Growth Potential: The poultry segment is expected to maintain its leading position, with significant growth also anticipated in aquaculture due to expanding production and increased focus on feed safety.

Europe Feed Mycotoxin Detoxifier Industry Product Landscape

The Europe feed mycotoxin detoxifier market is characterized by a dynamic product landscape featuring innovative solutions designed to combat the pervasive threat of mycotoxin contamination. Key product categories include binders, primarily composed of clays, zeolites, and yeast cell wall derivatives, which physically adsorb mycotoxins. Complementing these are biotransformers, often incorporating enzymes and specific microorganisms that metabolize and neutralize a broader spectrum of mycotoxins into less harmful compounds. Advanced formulations are increasingly integrating both binding and biotransformation properties, offering synergistic effects for enhanced efficacy. Product performance is measured by factors such as binding capacity across various mycotoxins (e.g., aflatoxins, fumonisins, ochratoxins), the degree of biotransformation achieved, and their impact on animal health parameters like growth performance, immune response, and organ protection. Unique selling propositions often lie in the broad-spectrum efficacy, stability under various feed processing conditions, and specific targeting of emerging or particularly virulent mycotoxin strains. Technological advancements are leading to the development of encapsulated enzymes for improved stability and targeted release, as well as novel natural compounds with detoxifying properties. The market is witnessing a trend towards highly specialized solutions tailored to specific animal species and their unique mycotoxin challenges.

Key Drivers, Barriers & Challenges in Europe Feed Mycotoxin Detoxifier Industry

Key Drivers: The Europe feed mycotoxin detoxifier industry is propelled by several powerful forces. Increasing awareness among feed producers and livestock farmers regarding the significant economic losses incurred due to mycotoxin contamination—estimated at over €500 Million annually—is a primary driver. Stringent European Union regulations on feed safety and mycotoxin limits necessitate compliance and drive the demand for effective detoxifier solutions. Technological advancements in developing broad-spectrum binders and effective biotransformers are enhancing product efficacy and driving adoption. The growing consumer demand for safe, high-quality animal protein and the increasing emphasis on animal welfare also contribute to the market's expansion.

Barriers & Challenges: Despite the positive growth trajectory, the industry faces significant challenges. The high cost of research and development for novel and highly effective detoxifier compounds, coupled with lengthy regulatory approval processes, can hinder innovation. Fluctuations in raw material prices for key ingredients used in detoxifier production can impact profitability and pricing strategies. The presence of competitive product substitutes, including alternative feed ingredients with potential natural mycotoxin binding properties, can also pose a challenge. Furthermore, ensuring consistent product efficacy across diverse feed matrices and varying levels of mycotoxin contamination in different geographical regions requires continuous innovation and rigorous quality control. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of essential raw materials, posing a threat to consistent market supply.

Emerging Opportunities in Europe Feed Mycotoxin Detoxifier Industry

Emerging opportunities in the Europe feed mycotoxin detoxifier industry lie in the development and application of next-generation solutions. There is a growing demand for multifunctional additives that not only detoxify but also offer synergistic benefits such as improved gut health, immune modulation, and enhanced nutrient digestibility. The aquaculture sector presents a significant untapped market, with increasing production volumes and a greater focus on feed safety and animal health creating a strong need for specialized detoxifiers. Innovations in precision nutrition, where detoxifiers are tailored to specific feed compositions and animal life stages, represent another avenue for growth. Furthermore, the exploration of novel natural compounds and biotechnological approaches, including the use of specific probiotics or prebiotics with mycotoxin-neutralizing capabilities, offers promising new product development avenues. The increasing emphasis on sustainability within the agricultural sector also opens opportunities for eco-friendly and sustainably sourced detoxifier ingredients.

Growth Accelerators in the Europe Feed Mycotoxin Detoxifier Industry Industry

Several key catalysts are accelerating growth in the Europe feed mycotoxin detoxifier industry. Technological breakthroughs in enzymatic detoxification and the development of advanced adsorbent materials are significantly enhancing product performance and broadening their application scope. Strategic partnerships between feed additive manufacturers and research institutions are fostering innovation and accelerating the development of novel, science-backed solutions. Market expansion strategies, including increased penetration into emerging markets within Europe and the development of region-specific product formulations, are further driving growth. The growing trend towards integrated animal health management programs, where mycotoxin control is a cornerstone, also acts as a significant growth accelerator. Investments in production capacity by leading players to meet rising demand and the continuous introduction of new and improved product lines are also fueling the market's upward trajectory.

Key Players Shaping the Europe Feed Mycotoxin Detoxifier Industry Market

- Marubeni Corporation (Orffa International Holding B V)

- Brenntag SE

- DSM Nutritional Products AG

- Kemin Industries

- SHV (Nutreco NV)

- Centafarm SRL

- BASF SE

- Impextraco NV

- Cargill Inc

- Adisseo

Notable Milestones in Europe Feed Mycotoxin Detoxifier Industry Sector

- November 2022: Kemin Industries introduced Toxfin Care, a solution designed to protect feed from mycotoxins, strengthen the immune system, protect organs, and prevent performance and productivity loss.

- July 2022: Cargill extended its partnership with Innovafeed to provide aquafarmers with innovative and nutritious ingredients, including additives, highlighting a commitment to advanced feed solutions.

- January 2022: Orffa expanded its presence in South Korea and Turkey to provide new and science-based specialty feed solutions to the animal feed industry, indicating strategic global growth and product offering enhancement.

In-Depth Europe Feed Mycotoxin Detoxifier Industry Market Outlook

The outlook for the Europe feed mycotoxin detoxifier industry remains exceptionally strong, driven by an unyielding commitment to animal health, food safety, and economic efficiency. Growth accelerators, including continuous technological innovation in biotransformation and adsorption technologies, alongside strategic collaborations, are paving the way for more potent and targeted mycotoxin management solutions. The increasing adoption of integrated animal health and nutrition strategies positions mycotoxin detoxifiers as indispensable components of modern feed formulation. Future market potential is further amplified by the expanding aquaculture sector and the growing consumer preference for sustainably produced animal protein, which necessitates stringent control over feed quality. Strategic opportunities lie in developing value-added products that offer multiple benefits beyond detoxification, such as immune support and gut health enhancement, and in catering to the unique needs of diverse animal segments and geographical regions. The industry is poised for sustained growth as it addresses the persistent challenge of mycotoxin contamination.

Europe Feed Mycotoxin Detoxifier Industry Segmentation

-

1. Sub Additive

- 1.1. Binders

- 1.2. Biotransformers

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

Europe Feed Mycotoxin Detoxifier Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Feed Mycotoxin Detoxifier Industry Regional Market Share

Geographic Coverage of Europe Feed Mycotoxin Detoxifier Industry

Europe Feed Mycotoxin Detoxifier Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Mycotoxin Detoxifier Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Binders

- 5.1.2. Biotransformers

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marubeni Corporation (Orffa International Holding B V )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brenntag SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSM Nutritional Products AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kemin Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SHV (Nutreco NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Centafarm SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Impextraco NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cargill Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Marubeni Corporation (Orffa International Holding B V )

List of Figures

- Figure 1: Europe Feed Mycotoxin Detoxifier Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Feed Mycotoxin Detoxifier Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Mycotoxin Detoxifier Industry Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 2: Europe Feed Mycotoxin Detoxifier Industry Revenue billion Forecast, by Animal 2020 & 2033

- Table 3: Europe Feed Mycotoxin Detoxifier Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Feed Mycotoxin Detoxifier Industry Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 5: Europe Feed Mycotoxin Detoxifier Industry Revenue billion Forecast, by Animal 2020 & 2033

- Table 6: Europe Feed Mycotoxin Detoxifier Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Feed Mycotoxin Detoxifier Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Mycotoxin Detoxifier Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Europe Feed Mycotoxin Detoxifier Industry?

Key companies in the market include Marubeni Corporation (Orffa International Holding B V ), Brenntag SE, DSM Nutritional Products AG, Kemin Industries, SHV (Nutreco NV, Centafarm SRL, BASF SE, Impextraco NV, Cargill Inc, Adisseo.

3. What are the main segments of the Europe Feed Mycotoxin Detoxifier Industry?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

November 2022: Kemin Industries introduced Toxfin Care, a solution that protects feed from mycotoxins. It strengthens the immune system, protects organs, and prevents loss of performance and productivity.July 2022: Cargill has extended its partnership with Innovafeed to provide aquafarmers with innovative and nutritious ingredients, including additives.January 2022: Orffa has expanded its presence in South Korea and Turkey to provide new and science-based specialty feed solutions to the animal feed industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Mycotoxin Detoxifier Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Mycotoxin Detoxifier Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Mycotoxin Detoxifier Industry?

To stay informed about further developments, trends, and reports in the Europe Feed Mycotoxin Detoxifier Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence