Key Insights

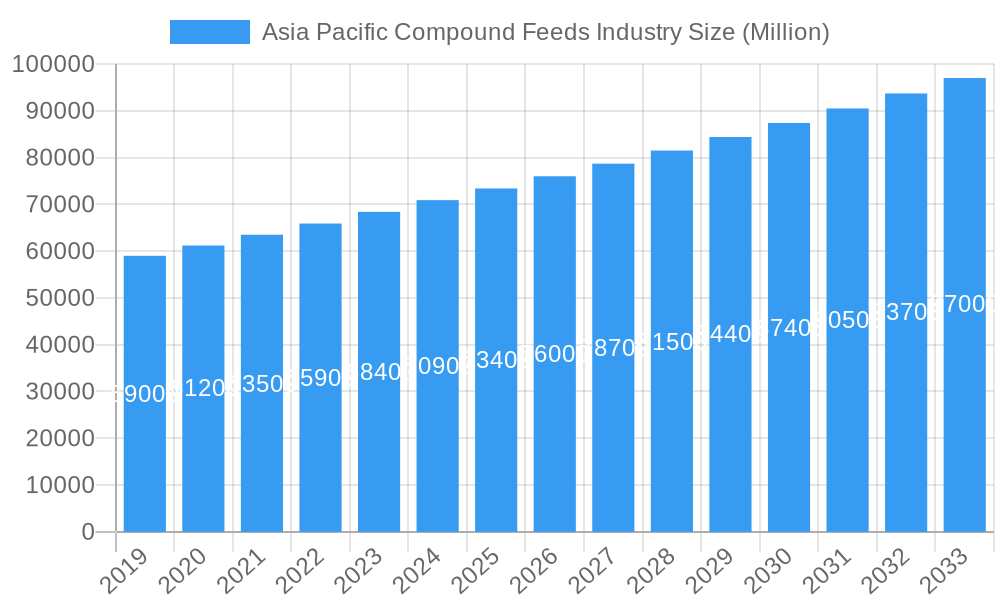

The Asia Pacific Compound Feeds Industry is poised for robust growth, driven by increasing demand for animal protein and a burgeoning livestock sector. With a projected market size of approximately USD 70,000 million in 2025, the industry is set to expand at a Compound Annual Growth Rate (CAGR) of 4.20% through 2033. This expansion is significantly fueled by the rising disposable incomes across the region, leading to higher consumption of meat, poultry, and fish. Consequently, the need for high-quality, scientifically formulated animal feed to enhance animal health, productivity, and meat quality is paramount. The increasing adoption of advanced farming techniques and greater awareness among farmers regarding the benefits of compound feeds over traditional feed methods are also key drivers. Furthermore, government initiatives aimed at promoting animal husbandry and ensuring food security are indirectly boosting the compound feed market. The market is segmented into various ingredients such as cereals, oilseeds, and molasses, along with a growing emphasis on supplements like vitamins, amino acids, enzymes, and probiotics, which are crucial for optimizing animal nutrition and preventing diseases, thereby contributing to improved feed conversion ratios.

Asia Pacific Compound Feeds Industry Market Size (In Billion)

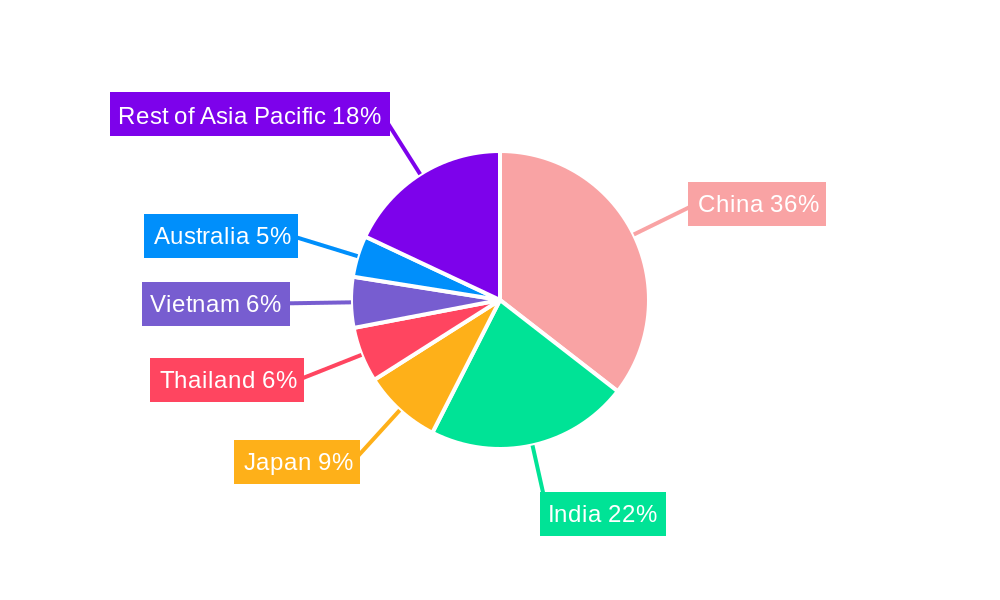

The industry's growth trajectory is further shaped by emerging trends in sustainable feed production and the development of specialized feeds catering to specific animal types and life stages. The Poultry Feed segment, in particular, is anticipated to dominate due to the widespread consumption of poultry products in Asia. Ruminant and Swine feeds also represent significant segments, driven by the growing demand for red meat. Geographically, China and India are expected to be the largest markets, accounting for a substantial share due to their massive livestock populations and expanding agricultural sectors. While the market benefits from these drivers, certain restraints such as the fluctuating prices of raw materials, stringent environmental regulations, and the prevalence of unorganized feed manufacturers in some sub-regions could pose challenges. However, the overall outlook remains optimistic, with continuous innovation in feed formulations and increasing investments in research and development expected to propel the Asia Pacific Compound Feeds Industry to new heights.

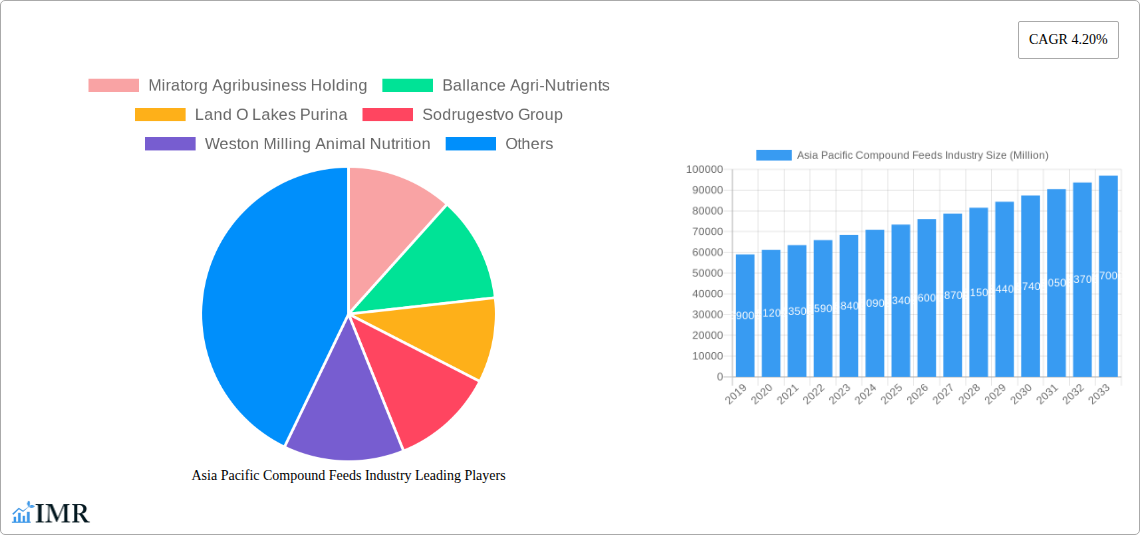

Asia Pacific Compound Feeds Industry Company Market Share

Here is a compelling, SEO-optimized report description for the Asia Pacific Compound Feeds Industry, designed to maximize search engine visibility and engage industry professionals:

Report Title: Asia Pacific Compound Feeds Industry Market Analysis and Growth Forecast 2025-2033: Trends, Opportunities, and Key Players

Report Description:

Dive deep into the dynamic Asia Pacific compound feeds industry with this comprehensive market analysis and forecast. Explore critical trends shaping the animal nutrition market across the region, from poultry feed and swine feed to aquatic feed and ruminant feed. This report offers in-depth insights into market dynamics, growth drivers, emerging opportunities, and the competitive landscape, providing essential intelligence for stakeholders aiming to capitalize on the booming animal feed production in China, India, and other key Asia Pacific economies. Understand the intricate market structure, analyze parent and child markets, and uncover the strategic moves of leading companies. This report is your definitive guide to navigating the Asia Pacific animal feed market.

Asia Pacific Compound Feeds Industry Market Dynamics & Structure

The Asia Pacific compound feeds industry is characterized by a moderately concentrated market, driven by increasing demand for protein-rich diets and a growing awareness of animal health and productivity. Technological innovation is a significant driver, with advancements in feed formulations, processing technologies, and the integration of novel ingredients like prebiotics and probiotics. Regulatory frameworks, while evolving, are increasingly focused on food safety, animal welfare, and sustainability, influencing production practices and market entry. Competitive product substitutes are primarily influenced by ingredient availability and cost, with cereals and oilseeds dominating the ingredient landscape. End-user demographics are shifting towards more industrialized farming operations, demanding consistent, high-quality feed solutions. Mergers and acquisitions (M&A) are a prevalent trend, as larger players consolidate their market presence and expand their product portfolios. For instance, the acquisition of a feed mill by ADM Animal Nutrition in May 2022 underscores this consolidation. Overall market concentration for compound feeds in Asia Pacific is estimated at XX%, with significant M&A deal volumes recorded in recent years, reflecting a strategic drive for scale and market penetration.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation: Focus on feed efficiency, animal health, and sustainability.

- Regulatory Frameworks: Increasing emphasis on safety, welfare, and environmental standards.

- Competitive Substitutes: Driven by ingredient cost and availability, particularly cereals and oilseeds.

- End-User Demographics: Shift towards large-scale, professional farming operations.

- M&A Trends: Active consolidation and expansion through strategic acquisitions.

Asia Pacific Compound Feeds Industry Growth Trends & Insights

The Asia Pacific compound feeds industry is poised for significant growth, driven by a confluence of demographic, economic, and technological factors. The escalating global population, particularly in Asia, is fueling a robust demand for animal protein, consequently boosting the need for efficient and cost-effective animal feed solutions. This demand translates into substantial market size evolution, with projections indicating a consistent upward trajectory. Adoption rates for advanced feed technologies and specialized formulations are accelerating, as farmers recognize the direct correlation between feed quality and animal health, productivity, and profitability. Technological disruptions, such as the development of precision nutrition and AI-driven feed management systems, are further optimizing feed utilization and reducing waste. Consumer behavior shifts, including a growing preference for sustainably sourced animal products and enhanced traceability, are influencing feed composition and production practices. The CAGR for the Asia Pacific compound feeds industry is estimated at XX% during the forecast period. Market penetration of high-quality compound feeds is projected to reach XX% by 2033, driven by increasing disposable incomes and a greater focus on food security. For example, ADM's expansion in China with its state-of-the-art flavor production facility in October 2021 highlights the industry's commitment to leveraging cutting-edge technology to meet evolving market needs and advance growth strategies. This strategic investment is set to enhance ADM's capabilities in providing tailored solutions, further contributing to the market's overall expansion and innovation.

Dominant Regions, Countries, or Segments in Asia Pacific Compound Feeds Industry

The Asia Pacific compound feeds industry is experiencing robust growth across multiple fronts, with distinct regions and segments leading the charge. China stands out as the most dominant country, fueled by its vast population, large-scale agricultural sector, and increasing per capita consumption of animal protein. The poultry feed segment is a significant growth driver within China and across the entire region, owing to its efficiency in meat production and relatively lower cost compared to other animal proteins. India is another powerhouse, with its expanding middle class and a strong traditional reliance on animal protein, particularly for dairy and poultry. The swine feed market, while experiencing fluctuations due to disease outbreaks, remains a crucial segment, especially in countries like Vietnam and China.

Geographically, the Rest of Asia Pacific category, encompassing countries like Indonesia, the Philippines, and Malaysia, presents substantial untapped potential and is witnessing rapid development. The aquatic feed segment is also gaining prominence, particularly in Southeast Asian nations like Thailand and Vietnam, driven by the thriving aquaculture industry and increasing demand for fish and seafood.

Key drivers for dominance in these regions and segments include:

- Economic Policies: Government support for agriculture and livestock development, including subsidies and infrastructure investments.

- Infrastructure Development: Improved logistics and supply chain networks facilitating feed distribution.

- Consumer Demand: Rising incomes and evolving dietary preferences for protein-rich foods.

- Technological Adoption: Increasing adoption of modern farming practices and advanced feed technologies.

- Market Size and Population: Large domestic markets with substantial animal populations.

In terms of ingredients, cereals (such as corn and wheat) and oilseeds (like soybean meal) form the foundational components of compound feeds, their dominance directly linked to their availability and cost-effectiveness, estimated to constitute over XX% and XX% respectively of the total ingredient market. Supplements, particularly amino acids and vitamins, are critical for optimizing animal performance and health, driving their significant market share. The poultry feed segment, estimated at XX million units in consumption, is the largest animal type segment, followed by swine feed at XX million units and ruminant feed at XX million units.

Asia Pacific Compound Feeds Industry Product Landscape

The Asia Pacific compound feeds industry is witnessing a surge in product innovation focused on enhanced animal health, improved feed efficiency, and sustainability. Manufacturers are developing specialized feed formulations catering to specific animal life stages, breeds, and production goals. The integration of functional ingredients such as prebiotics, probiotics, enzymes, and antioxidants is a notable trend, aimed at boosting gut health, nutrient absorption, and immune responses, thereby reducing the reliance on antibiotics. Performance metrics such as feed conversion ratio (FCR), growth rate, and meat/milk/egg production are key indicators of product efficacy. Unique selling propositions often revolve around customized solutions, improved palatability, and the utilization of locally sourced ingredients. Technological advancements in extrusion, pelleting, and microencapsulation are further refining product quality and shelf-life.

Key Drivers, Barriers & Challenges in Asia Pacific Compound Feeds Industry

The Asia Pacific compound feeds industry is propelled by several key drivers. The escalating demand for animal protein due to population growth and rising disposable incomes is a primary catalyst. Government initiatives promoting livestock sector development and food security further bolster the market. Technological advancements in feed formulation and animal husbandry enhance productivity, while increasing awareness of animal health and welfare among consumers and producers drives demand for high-quality feeds.

However, the industry faces significant barriers and challenges. Volatility in raw material prices, particularly for key ingredients like corn and soybean meal, poses a considerable economic risk. Stringent and evolving regulatory landscapes regarding feed safety and environmental impact can create compliance hurdles. Supply chain disruptions, exacerbated by geopolitical events and logistics challenges, can impact availability and cost. Furthermore, competitive pressures from both domestic and international players, alongside the need for continuous innovation to meet diverse market needs, present ongoing challenges.

Emerging Opportunities in Asia Pacific Compound Feeds Industry

Emerging opportunities in the Asia Pacific compound feeds industry are abundant and diverse. The growing demand for sustainable and ethically produced animal protein presents a significant avenue for growth, encouraging the development of feed solutions that minimize environmental impact. The aquaculture sector's rapid expansion across Southeast Asia offers a fertile ground for specialized aquatic feed formulations. Furthermore, the increasing adoption of precision nutrition technologies, leveraging data analytics and AI, allows for highly customized feed strategies that optimize animal performance and reduce waste. Untapped markets in less developed countries within the region, coupled with evolving consumer preferences for healthier, antibiotic-free animal products, create substantial potential for innovative feed solutions and niche market penetration.

Growth Accelerators in the Asia Pacific Compound Feeds Industry Industry

Several growth accelerators are poised to propel the Asia Pacific compound feeds industry forward. Technological breakthroughs in feed additive development, such as novel enzymes and microbial solutions, are enhancing nutrient utilization and animal health. Strategic partnerships between feed manufacturers, ingredient suppliers, and research institutions are fostering innovation and the development of more effective and sustainable feed products. Market expansion strategies, including mergers, acquisitions, and joint ventures, are enabling companies to broaden their geographic reach and product portfolios. The increasing investment in research and development to address specific regional challenges, such as disease prevention and climate resilience, will further accelerate market growth.

Key Players Shaping the Asia Pacific Compound Feeds Industry Market

- Miratorg Agribusiness Holding

- Ballance Agri-Nutrients

- Land O Lakes Purina

- Sodrugestvo Group

- Weston Milling Animal Nutrition

- ForFarmers

- De Heus

- DeKalb Feeds

- Alltech Inc

- Archer Daniels Midland

- Charoen Pokphand

- Heiskell & CO

- Cargill Inc

- Kent Feeds

- Kyodo Shiryo Company

- Zheng DA International Grou

- New Hope Group

Notable Milestones in Asia Pacific Compound Feeds Industry Sector

- May 2022: ADM Animal Nutrition, a global leader in animal nutrition, acquired a feed mill in Polomolok, South Cotabato, from South Sunrays Milling Corporation. The addition is a step forward in providing a wide range of leading-edge products to meet Asia's demand for innovative and high-quality products in the animal nutrition market.

- October 2021: ADM expanded its global nutrition capabilities with the establishment of ADM Food Technology (Pinghu), a state-of-the-art, fully automated flavor production facility in Pinghu, Zhejiang Province, China. The new, leading-edge flavor facility in Pinghu will serve as ADM's flavor supply hub in Asia-Pacific, allowing ADM to leverage expertise and leading-edge technologies and build out the ADM pantry to meet customer needs further and advance our growth strategy.

In-Depth Asia Pacific Compound Feeds Industry Market Outlook

The in-depth market outlook for the Asia Pacific compound feeds industry is exceptionally promising, driven by a sustained surge in demand for animal protein and continuous technological advancements. The strategic investments in R&D and capacity expansion by key players, exemplified by ADM's recent milestones, underscore a strong commitment to catering to the region's evolving needs. Growth accelerators, including the development of innovative feed additives and a focus on sustainable practices, will further solidify the market's expansion. Strategic partnerships and a proactive approach to navigating regulatory landscapes will be crucial for sustained growth. The industry is well-positioned to capitalize on emerging opportunities in niche segments like aquaculture and specialized feeds for antibiotic-free production, ensuring robust future market potential.

Asia Pacific Compound Feeds Industry Segmentation

-

1. Ingredients

- 1.1. Cereals

- 1.2. Oilseeds

- 1.3. Molases

- 1.4. Supplemets

- 1.5. Other Ingredients

-

2. Supplements

- 2.1. Vitamins

- 2.2. Amino Acids

- 2.3. Antibiotics

- 2.4. Enzymes

- 2.5. Antioxidants

- 2.6. Acidifiers

- 2.7. Prebiotics and Probiotics

- 2.8. Other Supplements

-

3. Animal Types

- 3.1. Ruminant Feed

- 3.2. Swine Feed

- 3.3. Poultry Feed

- 3.4. Aquatic Feed

- 3.5. Other Animal Types

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Thailand

- 4.5. Vietnam

- 4.6. Australia

- 4.7. Rest of Asia Pacific

Asia Pacific Compound Feeds Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Thailand

- 5. Vietnam

- 6. Australia

- 7. Rest of Asia Pacific

Asia Pacific Compound Feeds Industry Regional Market Share

Geographic Coverage of Asia Pacific Compound Feeds Industry

Asia Pacific Compound Feeds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Surge in Meat Production and Huge Demand for Meat Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Cereals

- 5.1.2. Oilseeds

- 5.1.3. Molases

- 5.1.4. Supplemets

- 5.1.5. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Supplements

- 5.2.1. Vitamins

- 5.2.2. Amino Acids

- 5.2.3. Antibiotics

- 5.2.4. Enzymes

- 5.2.5. Antioxidants

- 5.2.6. Acidifiers

- 5.2.7. Prebiotics and Probiotics

- 5.2.8. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Animal Types

- 5.3.1. Ruminant Feed

- 5.3.2. Swine Feed

- 5.3.3. Poultry Feed

- 5.3.4. Aquatic Feed

- 5.3.5. Other Animal Types

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Thailand

- 5.4.5. Vietnam

- 5.4.6. Australia

- 5.4.7. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Thailand

- 5.5.5. Vietnam

- 5.5.6. Australia

- 5.5.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. China Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Cereals

- 6.1.2. Oilseeds

- 6.1.3. Molases

- 6.1.4. Supplemets

- 6.1.5. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Supplements

- 6.2.1. Vitamins

- 6.2.2. Amino Acids

- 6.2.3. Antibiotics

- 6.2.4. Enzymes

- 6.2.5. Antioxidants

- 6.2.6. Acidifiers

- 6.2.7. Prebiotics and Probiotics

- 6.2.8. Other Supplements

- 6.3. Market Analysis, Insights and Forecast - by Animal Types

- 6.3.1. Ruminant Feed

- 6.3.2. Swine Feed

- 6.3.3. Poultry Feed

- 6.3.4. Aquatic Feed

- 6.3.5. Other Animal Types

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Thailand

- 6.4.5. Vietnam

- 6.4.6. Australia

- 6.4.7. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. India Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Cereals

- 7.1.2. Oilseeds

- 7.1.3. Molases

- 7.1.4. Supplemets

- 7.1.5. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Supplements

- 7.2.1. Vitamins

- 7.2.2. Amino Acids

- 7.2.3. Antibiotics

- 7.2.4. Enzymes

- 7.2.5. Antioxidants

- 7.2.6. Acidifiers

- 7.2.7. Prebiotics and Probiotics

- 7.2.8. Other Supplements

- 7.3. Market Analysis, Insights and Forecast - by Animal Types

- 7.3.1. Ruminant Feed

- 7.3.2. Swine Feed

- 7.3.3. Poultry Feed

- 7.3.4. Aquatic Feed

- 7.3.5. Other Animal Types

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Thailand

- 7.4.5. Vietnam

- 7.4.6. Australia

- 7.4.7. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Japan Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Cereals

- 8.1.2. Oilseeds

- 8.1.3. Molases

- 8.1.4. Supplemets

- 8.1.5. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Supplements

- 8.2.1. Vitamins

- 8.2.2. Amino Acids

- 8.2.3. Antibiotics

- 8.2.4. Enzymes

- 8.2.5. Antioxidants

- 8.2.6. Acidifiers

- 8.2.7. Prebiotics and Probiotics

- 8.2.8. Other Supplements

- 8.3. Market Analysis, Insights and Forecast - by Animal Types

- 8.3.1. Ruminant Feed

- 8.3.2. Swine Feed

- 8.3.3. Poultry Feed

- 8.3.4. Aquatic Feed

- 8.3.5. Other Animal Types

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Thailand

- 8.4.5. Vietnam

- 8.4.6. Australia

- 8.4.7. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Thailand Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 9.1.1. Cereals

- 9.1.2. Oilseeds

- 9.1.3. Molases

- 9.1.4. Supplemets

- 9.1.5. Other Ingredients

- 9.2. Market Analysis, Insights and Forecast - by Supplements

- 9.2.1. Vitamins

- 9.2.2. Amino Acids

- 9.2.3. Antibiotics

- 9.2.4. Enzymes

- 9.2.5. Antioxidants

- 9.2.6. Acidifiers

- 9.2.7. Prebiotics and Probiotics

- 9.2.8. Other Supplements

- 9.3. Market Analysis, Insights and Forecast - by Animal Types

- 9.3.1. Ruminant Feed

- 9.3.2. Swine Feed

- 9.3.3. Poultry Feed

- 9.3.4. Aquatic Feed

- 9.3.5. Other Animal Types

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Thailand

- 9.4.5. Vietnam

- 9.4.6. Australia

- 9.4.7. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 10. Vietnam Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 10.1.1. Cereals

- 10.1.2. Oilseeds

- 10.1.3. Molases

- 10.1.4. Supplemets

- 10.1.5. Other Ingredients

- 10.2. Market Analysis, Insights and Forecast - by Supplements

- 10.2.1. Vitamins

- 10.2.2. Amino Acids

- 10.2.3. Antibiotics

- 10.2.4. Enzymes

- 10.2.5. Antioxidants

- 10.2.6. Acidifiers

- 10.2.7. Prebiotics and Probiotics

- 10.2.8. Other Supplements

- 10.3. Market Analysis, Insights and Forecast - by Animal Types

- 10.3.1. Ruminant Feed

- 10.3.2. Swine Feed

- 10.3.3. Poultry Feed

- 10.3.4. Aquatic Feed

- 10.3.5. Other Animal Types

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Thailand

- 10.4.5. Vietnam

- 10.4.6. Australia

- 10.4.7. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 11. Australia Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredients

- 11.1.1. Cereals

- 11.1.2. Oilseeds

- 11.1.3. Molases

- 11.1.4. Supplemets

- 11.1.5. Other Ingredients

- 11.2. Market Analysis, Insights and Forecast - by Supplements

- 11.2.1. Vitamins

- 11.2.2. Amino Acids

- 11.2.3. Antibiotics

- 11.2.4. Enzymes

- 11.2.5. Antioxidants

- 11.2.6. Acidifiers

- 11.2.7. Prebiotics and Probiotics

- 11.2.8. Other Supplements

- 11.3. Market Analysis, Insights and Forecast - by Animal Types

- 11.3.1. Ruminant Feed

- 11.3.2. Swine Feed

- 11.3.3. Poultry Feed

- 11.3.4. Aquatic Feed

- 11.3.5. Other Animal Types

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Japan

- 11.4.4. Thailand

- 11.4.5. Vietnam

- 11.4.6. Australia

- 11.4.7. Rest of Asia Pacific

- 11.1. Market Analysis, Insights and Forecast - by Ingredients

- 12. Rest of Asia Pacific Asia Pacific Compound Feeds Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Ingredients

- 12.1.1. Cereals

- 12.1.2. Oilseeds

- 12.1.3. Molases

- 12.1.4. Supplemets

- 12.1.5. Other Ingredients

- 12.2. Market Analysis, Insights and Forecast - by Supplements

- 12.2.1. Vitamins

- 12.2.2. Amino Acids

- 12.2.3. Antibiotics

- 12.2.4. Enzymes

- 12.2.5. Antioxidants

- 12.2.6. Acidifiers

- 12.2.7. Prebiotics and Probiotics

- 12.2.8. Other Supplements

- 12.3. Market Analysis, Insights and Forecast - by Animal Types

- 12.3.1. Ruminant Feed

- 12.3.2. Swine Feed

- 12.3.3. Poultry Feed

- 12.3.4. Aquatic Feed

- 12.3.5. Other Animal Types

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. China

- 12.4.2. India

- 12.4.3. Japan

- 12.4.4. Thailand

- 12.4.5. Vietnam

- 12.4.6. Australia

- 12.4.7. Rest of Asia Pacific

- 12.1. Market Analysis, Insights and Forecast - by Ingredients

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Miratorg Agribusiness Holding

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ballance Agri-Nutrients

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Land O Lakes Purina

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sodrugestvo Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Weston Milling Animal Nutrition

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ForFarmers

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 De Heus

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 DeKalb Feeds

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Alltech Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Archer Daniels Midland

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Charoen Pokphand

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Heiskell & CO

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Cargill Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Kent Feeds

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kyodo Shiryo Company

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Zheng DA International Grou

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 New Hope Group

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 Miratorg Agribusiness Holding

List of Figures

- Figure 1: Asia Pacific Compound Feeds Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Compound Feeds Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 2: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 3: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 4: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 7: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 8: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 9: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 12: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 13: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 14: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 17: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 18: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 19: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 22: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 23: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 24: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 27: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 28: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 29: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 32: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 33: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 34: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 35: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 37: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Supplements 2020 & 2033

- Table 38: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Animal Types 2020 & 2033

- Table 39: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 40: Asia Pacific Compound Feeds Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Compound Feeds Industry?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Asia Pacific Compound Feeds Industry?

Key companies in the market include Miratorg Agribusiness Holding, Ballance Agri-Nutrients, Land O Lakes Purina, Sodrugestvo Group, Weston Milling Animal Nutrition, ForFarmers, De Heus, DeKalb Feeds, Alltech Inc, Archer Daniels Midland, Charoen Pokphand, Heiskell & CO, Cargill Inc, Kent Feeds, Kyodo Shiryo Company, Zheng DA International Grou, New Hope Group.

3. What are the main segments of the Asia Pacific Compound Feeds Industry?

The market segments include Ingredients, Supplements, Animal Types, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Surge in Meat Production and Huge Demand for Meat Protein.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2022: ADM Animal Nutrition, a global leader in animal nutrition, acquired a feed mill in Polomolok, South Cotabato, from South Sunrays Milling Corporation. The addition is a step forward in providing a wide range of leading-edge products to meet Asia's demand for innovative and high-quality products in the animal nutrition market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Compound Feeds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Compound Feeds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Compound Feeds Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Compound Feeds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence