Key Insights

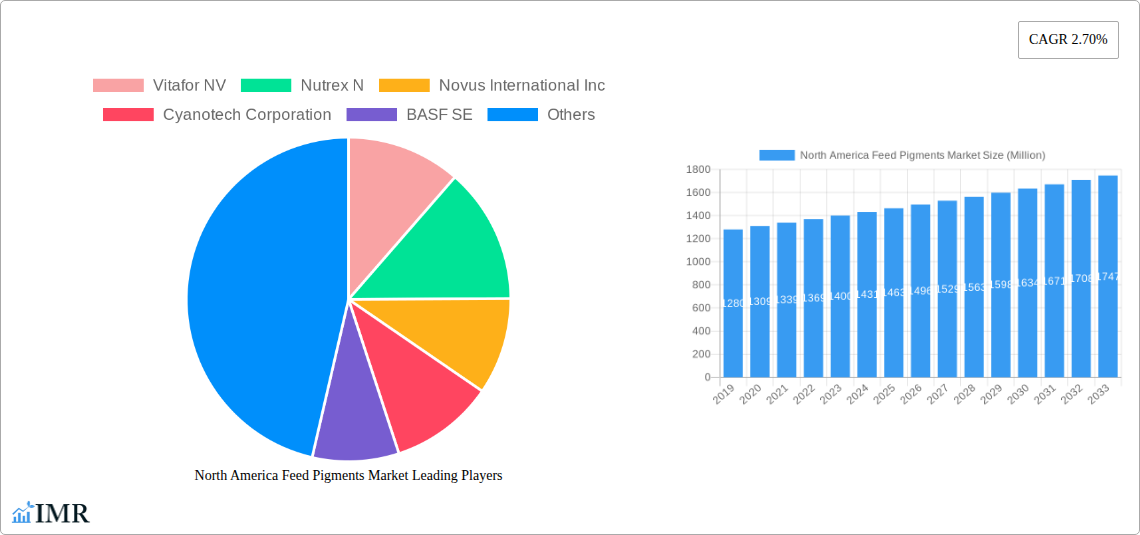

The North America Feed Pigments Market is projected to experience steady growth, reaching an estimated market size of approximately $1,500 million by the end of 2025. This growth is driven by a confluence of factors, including the increasing demand for high-quality animal protein, the rising awareness among livestock producers regarding the health and welfare benefits of specific feed additives, and advancements in pigment technology. The market's Compound Annual Growth Rate (CAGR) of 2.70% from 2025 to 2033 signifies a robust but balanced expansion. Key drivers include the demand for carotenoids, particularly lutein and zeaxanthin, for their roles in animal vision and immune function, and astaxanthin for its potent antioxidant properties. The expanding aquaculture sector, coupled with the continuous need for efficient poultry and swine production, further fuels the demand for these essential feed pigments, contributing to an overall market value of $1,500 million in 2025 and a projected value of $1,764 million by 2033.

North America Feed Pigments Market Market Size (In Billion)

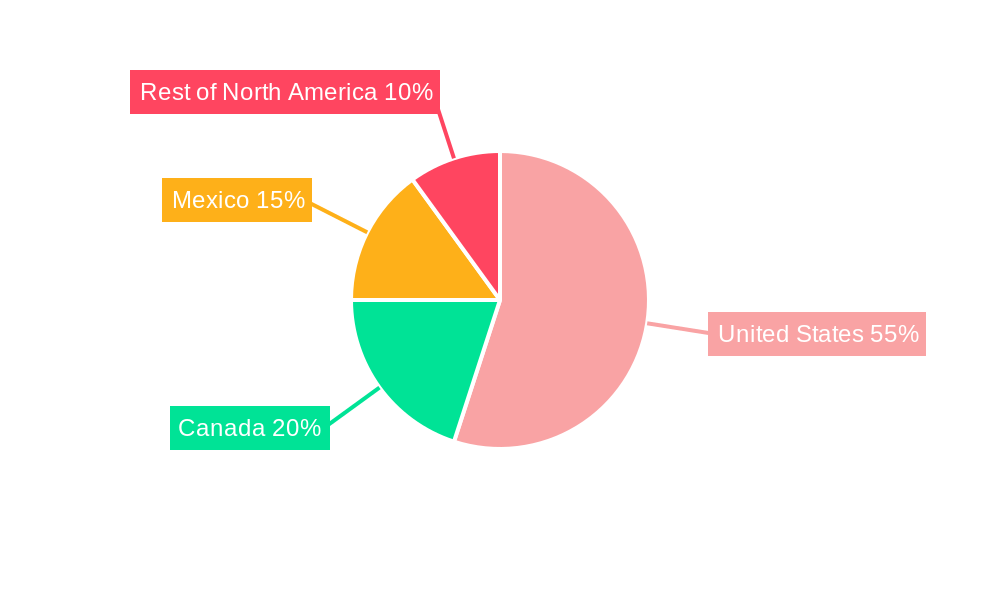

The market is segmented by pigment type, with carotenoids like lutein, zeaxanthin, and astaxanthin holding significant share due to their well-documented benefits in improving animal appearance and health. The application of these pigments spans across ruminants, poultry, swine, and aquaculture, with poultry and aquaculture being particularly strong consumers. Geographically, the United States commands the largest market share within North America, followed by Canada and Mexico, due to their large-scale animal agriculture operations. However, challenges such as the volatility in raw material prices and the stringent regulatory landscape surrounding feed additives could potentially restrain market growth. Despite these restraints, ongoing research and development into novel pigment formulations and sustainable sourcing methods are expected to foster innovation and ensure continued market vitality. The market is estimated to grow to $1,764 million by 2033, reflecting a consistent upward trajectory.

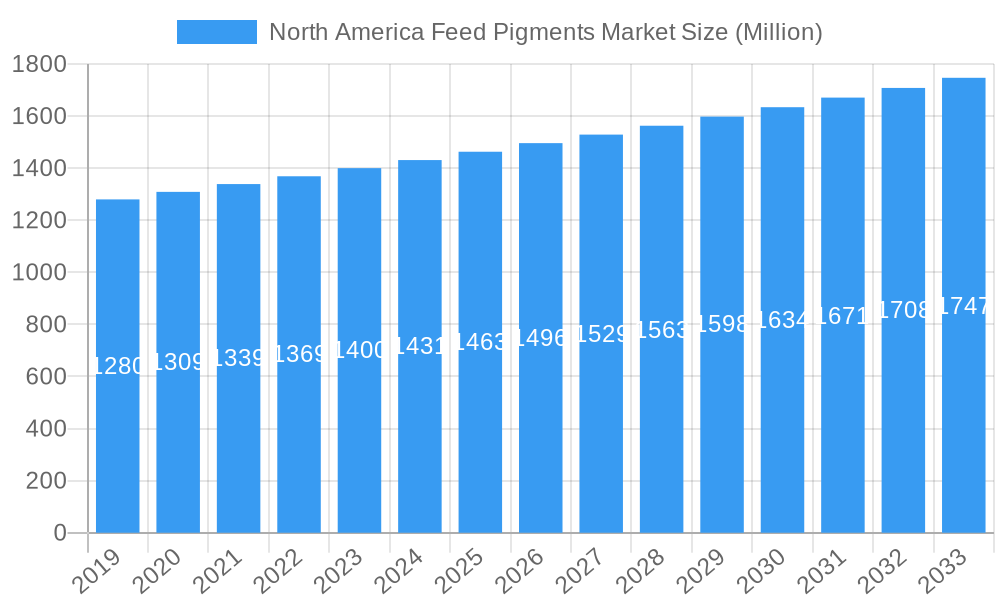

North America Feed Pigments Market Company Market Share

This comprehensive report delves into the dynamic North America Feed Pigments Market, offering in-depth analysis and actionable insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this study provides a robust understanding of market evolution, key drivers, emerging opportunities, and the competitive landscape. We explore the intricate interplay between parent and child markets, offering a holistic view of the industry's trajectory.

North America Feed Pigments Market Market Dynamics & Structure

The North America Feed Pigments Market is characterized by a moderately consolidated structure, with leading companies vying for market share through innovation and strategic alliances. Technological advancements in pigment synthesis and application are key drivers, enabling the development of more effective and sustainable feed solutions. Regulatory frameworks, particularly concerning animal welfare and food safety, significantly influence product development and market access. The presence of competitive product substitutes, such as natural colorants and alternative feed additives, necessitates continuous innovation and differentiation. End-user demographics, primarily driven by the expansion of the livestock and aquaculture sectors, dictate demand patterns. Mergers and acquisitions (M&A) are playing a crucial role in consolidating market presence and expanding product portfolios. For instance, the past five years have seen an estimated XX M&A deals within the broader feed additives sector, reflecting a trend towards vertical integration and enhanced operational efficiency. Innovation barriers include the high cost of R&D for novel pigment formulations and the stringent approval processes for new feed ingredients.

North America Feed Pigments Market Growth Trends & Insights

The North America Feed Pigments Market is projected to experience significant growth, driven by escalating demand for visually appealing and nutritionally enhanced animal products. Industry experts forecast a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth trajectory is underpinned by increasing consumer awareness regarding the quality and origin of animal protein, thereby influencing feed formulations. Technological disruptions, including advancements in biotechnological pigment production and precision farming techniques, are revolutionizing the market. These innovations are leading to the development of feed pigments that not only impart desired coloration but also offer enhanced bioavailability and health benefits for animals. Consumer behavior shifts, particularly the growing preference for naturally sourced and sustainable ingredients, are compelling feed manufacturers to invest in eco-friendly pigment alternatives. Market penetration of specialized feed pigments is anticipated to rise, with increased adoption in poultry and aquaculture segments. The estimated market size for feed pigments in North America is expected to reach $XXX Million by 2033, a substantial increase from the $XXX Million recorded in 2025. This expansion is a direct result of the growing understanding of how feed pigments contribute to animal health, productivity, and end-product quality.

Dominant Regions, Countries, or Segments in North America Feed Pigments Market

The United States is poised to remain the dominant region in the North America Feed Pigments Market, driven by its expansive livestock industry and strong emphasis on animal health and product quality. The poultry segment, particularly for broiler chickens and laying hens, is a major consumer of feed pigments, demanding consistent yolk coloration and broiler skin appearance. The United States accounts for approximately XX% of the total North American market share for feed pigments.

- Poultry Segment: This segment is the leading driver of demand, fueled by the consistent need for visually appealing egg yolks and broiler meat. The market size for feed pigments in the poultry segment is estimated to reach $XXX Million by 2033.

- Swine Segment: Growing demand for pork products and the increasing focus on optimizing piglet health and performance contribute to the robust growth of feed pigments in this segment, estimated at $XXX Million by 2033.

- Aquaculture Segment: The rapid expansion of fish and shrimp farming, coupled with the need to enhance the flesh color of farmed aquatic species, makes this a rapidly growing segment, projected to reach $XXX Million by 2033.

- Carotenoids Dominate: Within the pigment types, Carotenoids, particularly Lutein and Zeaxanthin, are the most sought-after due to their strong coloring properties and antioxidant benefits. These represent approximately XX% of the total pigment market value. Alpha-Carotene and Beta-Carotene are also significant contributors.

- Technological Advancements: The adoption of advanced manufacturing processes and a focus on research and development in the United States are enabling the production of high-purity and bioavailable feed pigments.

- Economic Policies and Subsidies: Favorable agricultural policies and subsidies within the United States support the growth of the animal feed industry, indirectly boosting demand for feed pigments.

- Infrastructure: Well-developed logistics and supply chain infrastructure in the United States ensure efficient distribution of feed pigments across the country.

- Rest of North America: Canada and Mexico are also significant contributors, with their respective agricultural sectors showing steady growth and increasing adoption of advanced feed technologies. The Rest of North America segment is projected to grow at a CAGR of XX%, reaching $XXX Million by 2033.

North America Feed Pigments Market Product Landscape

The North America Feed Pigments Market is characterized by a diverse product landscape driven by continuous innovation and the pursuit of enhanced efficacy. Leading companies are focusing on developing natural and synthetic carotenoids, such as Astaxanthin and Canthaxanthin, which offer superior coloring capabilities and antioxidant properties for various animal types. Innovations also include microencapsulation technologies to improve pigment stability and bioavailability in feed. Furthermore, the development of multi-functional pigments that provide both coloration and health benefits, such as immune support, is a key trend. The application of these pigments extends across poultry, swine, ruminants, and aquaculture, with specific formulations tailored to meet the distinct physiological needs and market demands of each animal type.

Key Drivers, Barriers & Challenges in North America Feed Pigments Market

Key Drivers:

- Growing demand for aesthetically pleasing animal protein products: Consumers increasingly prefer food products with consistent and appealing visual characteristics, driving the demand for feed pigments that enhance the color of eggs, meat, and fish.

- Focus on animal health and welfare: Feed pigments, particularly carotenoids, offer antioxidant benefits and can contribute to improved immune function and overall animal health, aligning with the industry's focus on animal welfare.

- Technological advancements in pigment production: Innovations in synthesis and extraction methods are leading to more cost-effective and sustainable production of high-quality feed pigments.

- Expansion of aquaculture and poultry sectors: The rapid growth in these animal farming segments directly translates to increased demand for feed additives, including pigments.

Barriers & Challenges:

- Price volatility of raw materials: Fluctuations in the prices of natural and synthetic raw materials can impact the cost-effectiveness of pigment production.

- Stringent regulatory approvals: Obtaining regulatory approval for new feed additives can be a lengthy and complex process, posing a challenge for market entry.

- Competition from natural colorants: The growing consumer preference for natural ingredients is fueling competition from naturally derived colorants, which may sometimes be perceived as a substitute for synthetic pigments.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability and timely delivery of feed pigments, affecting production schedules for feed manufacturers.

Emerging Opportunities in North America Feed Pigments Market

Emerging opportunities in the North America Feed Pigments Market lie in the development of novel, bio-available carotenoid formulations that offer dual benefits of coloration and enhanced animal immunity. The increasing consumer demand for "clean label" products also presents a significant opportunity for natural feed pigments derived from sustainable sources like algae and plant extracts. Furthermore, the expansion of the aquaculture sector, particularly for species where flesh coloration is a key market attribute, offers a substantial untapped market. The development of customized pigment solutions for specific regional market preferences and niche animal types will also create new avenues for growth.

Growth Accelerators in the North America Feed Pigments Market Industry

Growth accelerators in the North America Feed Pigments Market are being fueled by significant advancements in biotechnology and enzyme-assisted synthesis, leading to more efficient and eco-friendly production of high-purity pigments. Strategic partnerships between feed additive manufacturers and animal nutrition companies are fostering innovation and market penetration. Furthermore, the increasing adoption of precision farming technologies allows for tailored feed formulations, including optimized pigment inclusion rates, thereby enhancing their effectiveness. The growing global trade in animal protein products also drives the demand for feed pigments that meet international quality standards.

Key Players Shaping the North America Feed Pigments Market Market

- Vitafor NV

- Nutrex N

- Novus International Inc

- Cyanotech Corporation

- BASF SE

- Synthite Industries Ltd

- DSM

- Kemin Industries Inc

Notable Milestones in North America Feed Pigments Market Sector

- 2023: Launch of a novel, highly bioavailable Lutein ester formulation for poultry by DSM, enhancing egg yolk pigmentation and bird health.

- 2022: BASF SE introduces a new synthetic Canthaxanthin product line with improved stability for swine feed applications.

- 2021: Kemin Industries Inc. acquires a leading producer of natural astaxanthin, expanding its portfolio of sustainable feed colorants.

- 2020: Novus International Inc. announces significant investment in R&D for next-generation carotenoids with enhanced antioxidant properties.

- 2019: Vitafor NV expands its production capacity for natural beta-carotene, catering to the growing demand for plant-based feed ingredients.

In-Depth North America Feed Pigments Market Market Outlook

The North America Feed Pigments Market outlook is highly positive, driven by robust growth accelerators such as sustainable sourcing initiatives, advanced biotechnological production methods, and strategic collaborations within the animal nutrition industry. The increasing focus on animal health, coupled with evolving consumer preferences for visually appealing and high-quality animal protein, will continue to propel market expansion. Continued investment in research and development for innovative, multi-functional pigments, alongside the expansion into niche aquaculture applications, will create significant strategic opportunities for market participants. The market is well-positioned for sustained growth, with an anticipated value of $XXX Million by 2033.

North America Feed Pigments Market Segmentation

-

1. Type

-

1.1. Carotenoids

- 1.1.1. Alpha-Carotene

- 1.1.2. Beta-Carotene

- 1.1.3. Lycopene

- 1.1.4. Lutein

- 1.1.5. Zeaxanthin

- 1.1.6. Astaxanthin

- 1.1.7. Canthaxanthin

- 1.1.8. Others

- 1.2. Other Types

-

1.1. Carotenoids

-

2. Aninal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Application

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Feed Pigments Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Feed Pigments Market Regional Market Share

Geographic Coverage of North America Feed Pigments Market

North America Feed Pigments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Animal Sourced Proteins

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Pigments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carotenoids

- 5.1.1.1. Alpha-Carotene

- 5.1.1.2. Beta-Carotene

- 5.1.1.3. Lycopene

- 5.1.1.4. Lutein

- 5.1.1.5. Zeaxanthin

- 5.1.1.6. Astaxanthin

- 5.1.1.7. Canthaxanthin

- 5.1.1.8. Others

- 5.1.2. Other Types

- 5.1.1. Carotenoids

- 5.2. Market Analysis, Insights and Forecast - by Aninal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Application

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Feed Pigments Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carotenoids

- 6.1.1.1. Alpha-Carotene

- 6.1.1.2. Beta-Carotene

- 6.1.1.3. Lycopene

- 6.1.1.4. Lutein

- 6.1.1.5. Zeaxanthin

- 6.1.1.6. Astaxanthin

- 6.1.1.7. Canthaxanthin

- 6.1.1.8. Others

- 6.1.2. Other Types

- 6.1.1. Carotenoids

- 6.2. Market Analysis, Insights and Forecast - by Aninal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Application

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Feed Pigments Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carotenoids

- 7.1.1.1. Alpha-Carotene

- 7.1.1.2. Beta-Carotene

- 7.1.1.3. Lycopene

- 7.1.1.4. Lutein

- 7.1.1.5. Zeaxanthin

- 7.1.1.6. Astaxanthin

- 7.1.1.7. Canthaxanthin

- 7.1.1.8. Others

- 7.1.2. Other Types

- 7.1.1. Carotenoids

- 7.2. Market Analysis, Insights and Forecast - by Aninal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Application

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Feed Pigments Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carotenoids

- 8.1.1.1. Alpha-Carotene

- 8.1.1.2. Beta-Carotene

- 8.1.1.3. Lycopene

- 8.1.1.4. Lutein

- 8.1.1.5. Zeaxanthin

- 8.1.1.6. Astaxanthin

- 8.1.1.7. Canthaxanthin

- 8.1.1.8. Others

- 8.1.2. Other Types

- 8.1.1. Carotenoids

- 8.2. Market Analysis, Insights and Forecast - by Aninal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Application

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Feed Pigments Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carotenoids

- 9.1.1.1. Alpha-Carotene

- 9.1.1.2. Beta-Carotene

- 9.1.1.3. Lycopene

- 9.1.1.4. Lutein

- 9.1.1.5. Zeaxanthin

- 9.1.1.6. Astaxanthin

- 9.1.1.7. Canthaxanthin

- 9.1.1.8. Others

- 9.1.2. Other Types

- 9.1.1. Carotenoids

- 9.2. Market Analysis, Insights and Forecast - by Aninal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Other Application

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vitafor NV

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nutrex N

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Novus International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cyanotech Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BASF SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Synthite Industries Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 DSM

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kemin Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Vitafor NV

List of Figures

- Figure 1: North America Feed Pigments Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Feed Pigments Market Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Pigments Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Feed Pigments Market Revenue undefined Forecast, by Aninal Type 2020 & 2033

- Table 3: North America Feed Pigments Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Feed Pigments Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Feed Pigments Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: North America Feed Pigments Market Revenue undefined Forecast, by Aninal Type 2020 & 2033

- Table 7: North America Feed Pigments Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Feed Pigments Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Feed Pigments Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: North America Feed Pigments Market Revenue undefined Forecast, by Aninal Type 2020 & 2033

- Table 11: North America Feed Pigments Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Feed Pigments Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Feed Pigments Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: North America Feed Pigments Market Revenue undefined Forecast, by Aninal Type 2020 & 2033

- Table 15: North America Feed Pigments Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Feed Pigments Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: North America Feed Pigments Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: North America Feed Pigments Market Revenue undefined Forecast, by Aninal Type 2020 & 2033

- Table 19: North America Feed Pigments Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Feed Pigments Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Pigments Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the North America Feed Pigments Market?

Key companies in the market include Vitafor NV, Nutrex N, Novus International Inc, Cyanotech Corporation, BASF SE, Synthite Industries Ltd, DSM, Kemin Industries Inc.

3. What are the main segments of the North America Feed Pigments Market?

The market segments include Type, Aninal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Animal Sourced Proteins.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Pigments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Pigments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Pigments Market?

To stay informed about further developments, trends, and reports in the North America Feed Pigments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence