Key Insights

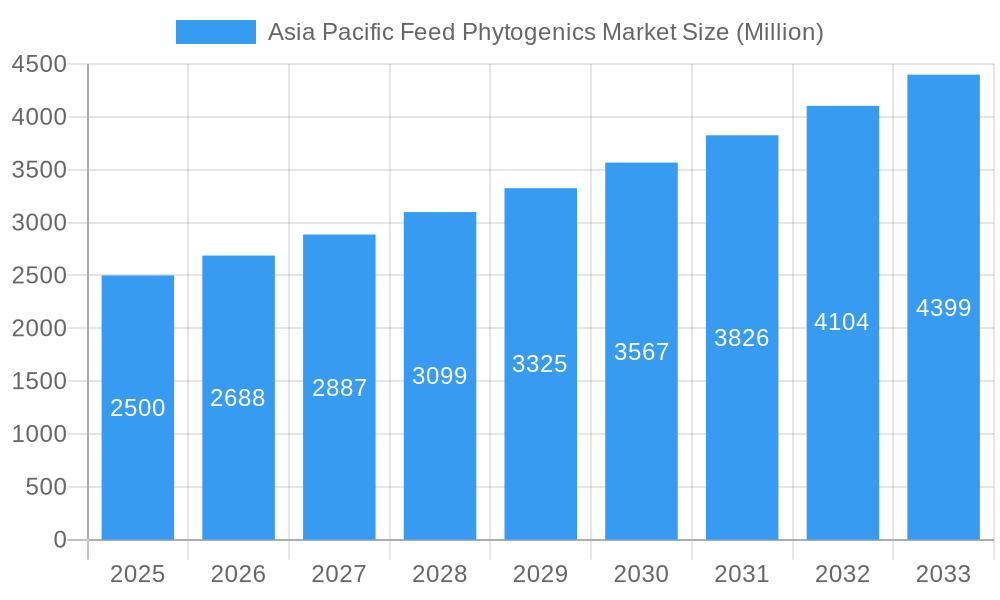

The Asia Pacific feed phytogenics market is poised for significant expansion, projected to reach approximately USD 4,500 million by 2033, with a robust Compound Annual Growth Rate (CAGR) of 7.50%. This growth is underpinned by a confluence of factors, primarily driven by the escalating demand for high-quality animal protein, increased consumer awareness regarding the health and safety of animal products, and the growing imperative to reduce antibiotic use in animal agriculture. Phytogenics, derived from plants, offer a natural and effective alternative to synthetic additives, contributing to improved animal health, enhanced feed intake and digestibility, and superior flavoring and aroma profiles. The "Others" segment within ingredients, encompassing a diverse range of plant extracts and essential oils, is expected to witness considerable traction as research and development uncover novel applications and benefits. Similarly, the "Others" category in animal types, potentially including niche livestock or exotic animals, is likely to see emerging opportunities.

Asia Pacific Feed Phytogenics Market Market Size (In Billion)

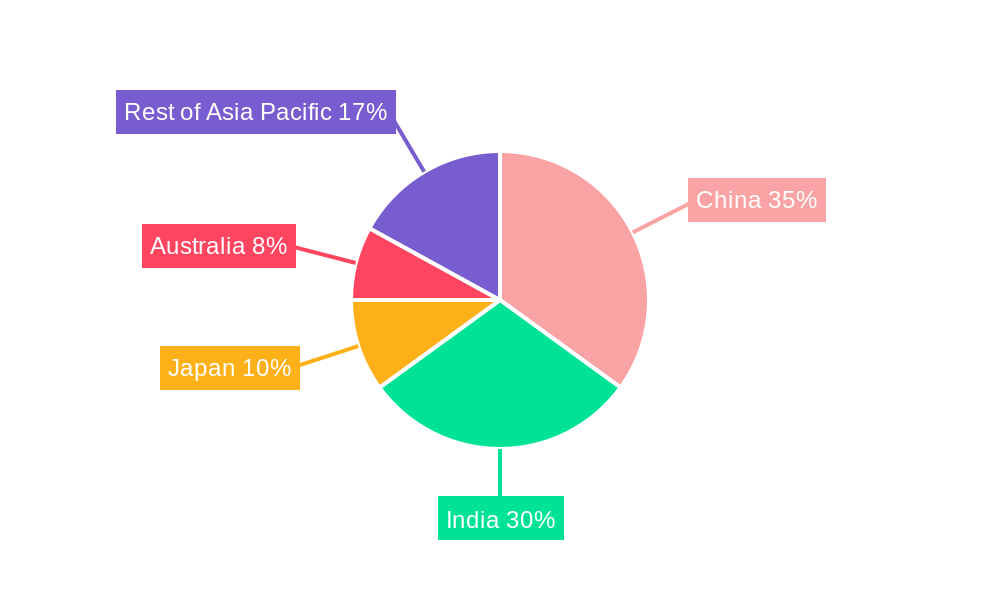

The market's trajectory is further shaped by key trends such as the increasing adoption of precision farming techniques that integrate feed additives for optimized animal performance and well-being. The growing preference for natural and sustainable animal farming practices aligns perfectly with the inherent characteristics of phytogenics. However, certain restraints, including the potential for variability in the efficacy of plant-based compounds due to geographical and seasonal factors, and the need for greater standardization and regulatory clarity, may pose challenges. Geographically, China and India are anticipated to be the leading markets, driven by their large livestock populations and rapidly growing demand for animal feed additives. While specific regional market shares were not provided, it is logical to infer substantial contributions from these key economies, followed by Japan, Australia, and the broader Rest of Asia Pacific region, all benefiting from the overarching growth drivers and increasing adoption of these innovative feed solutions.

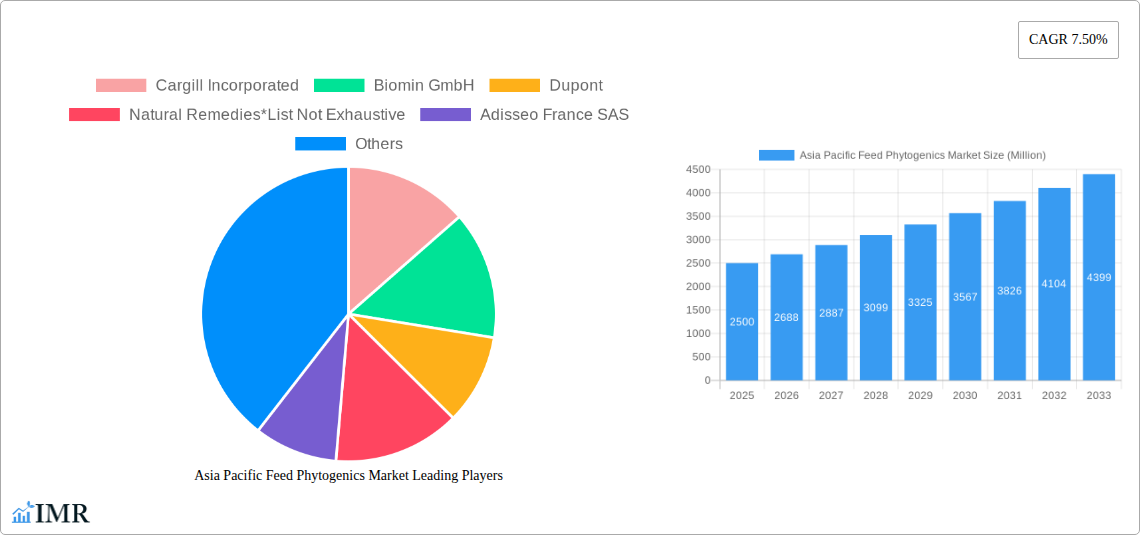

Asia Pacific Feed Phytogenics Market Company Market Share

Asia Pacific Feed Phytogenics Market: A Comprehensive Market Intelligence Report

This in-depth report provides a thorough analysis of the Asia Pacific Feed Phytogenics Market, offering critical insights into its dynamics, growth trajectory, and competitive landscape. Covering the historical period of 2019-2024, base year 2025, and forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving animal feed additives sector. We explore key market segments, including ingredients like Herbs and Spices, Essential Oils, and Others, and their applications in Feed Intake and Digestibility, Flavoring and Aroma, and Others. The report also examines growth across various animal types such as Ruminant, Poultry, Swine, Aquaculture, and Others, with a granular focus on geographies including China, India, Japan, Australia, and the Rest of Asia Pacific. With a projected market size and CAGR, this report is optimized for maximum search engine visibility and industry engagement.

Asia Pacific Feed Phytogenics Market Market Dynamics & Structure

The Asia Pacific feed phytogenics market is characterized by a moderate market concentration, with key players like Cargill Incorporated, Biomin GmbH, DuPont, Natural Remedies, Adisseo France SAS, Kemin Industries Inc., and Pancosma holding significant influence. Technological innovation serves as a primary driver, with continuous research into novel plant-derived compounds and their efficacy in improving animal health and performance. Regulatory frameworks are evolving, with increasing government support for natural and sustainable feed additives, though regional variations can present compliance challenges. Competitive product substitutes, primarily synthetic additives and other natural alternatives, are present, necessitating a focus on demonstrating the superior cost-effectiveness and safety of phytogenics. End-user demographics are shifting towards larger, more industrialized farming operations seeking to optimize feed efficiency and reduce reliance on antibiotics. Mergers and acquisitions (M&A) are a growing trend, as larger companies seek to expand their product portfolios and geographical reach, evidenced by xx M&A deal volumes in the historical period. Innovation barriers include the complexity of elucidating synergistic effects of plant compounds and ensuring consistent product quality.

- Market Concentration: Moderate, with a few dominant global players and a growing number of regional and specialized suppliers.

- Technological Innovation Drivers: Development of new extraction methods, identification of novel active compounds, and research into synergistic effects.

- Regulatory Frameworks: Increasing emphasis on natural and antibiotic-free solutions, with evolving standards for safety and efficacy across different countries.

- Competitive Product Substitutes: Synthetic antioxidants, antimicrobials, and other functional feed additives.

- End-User Demographics: Growing adoption by large-scale poultry, swine, and aquaculture operations, alongside increasing interest from the ruminant sector.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding market share and product offerings.

- Innovation Barriers: Scientific validation of efficacy, standardization of botanical extracts, and consumer perception challenges.

Asia Pacific Feed Phytogenics Market Growth Trends & Insights

The Asia Pacific feed phytogenics market is poised for robust growth, driven by an increasing demand for natural animal feed additives and a growing awareness of their health and performance benefits. The market size is projected to expand significantly from xx million units in the base year 2025 to xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Adoption rates of phytogenics are on an upward trajectory as producers seek alternatives to antibiotic growth promoters (AGPs) due to consumer concerns about antibiotic resistance and regulatory restrictions. Technological disruptions, such as advancements in encapsulation technologies to improve the stability and bioavailability of phytogenic compounds, are further fueling market penetration. Consumer behavior shifts, particularly the increasing preference for meat and animal products from animals raised without antibiotics, are compelling feed manufacturers and integrators to incorporate more natural solutions like phytogenics. This shift is further supported by growing disposable incomes in key Asia Pacific economies, leading to higher consumption of animal protein. The underlying trend is a move towards sustainable and ethical animal agriculture, where phytogenics play a crucial role in enhancing gut health, improving nutrient utilization, and boosting the immune system of livestock, thereby reducing the need for conventional veterinary interventions. The market penetration of feed phytogenics is expected to witness a substantial increase as more research validates their effectiveness and cost-efficiency compared to synthetic alternatives. The evolving landscape of animal nutrition is increasingly favoring functional ingredients that offer a holistic approach to animal well-being, making phytogenics a cornerstone of modern feed formulation in the region.

Dominant Regions, Countries, or Segments in Asia Pacific Feed Phytogenics Market

The Asia Pacific feed phytogenics market is witnessing significant growth, with China emerging as the dominant country driving market expansion. This dominance is underpinned by a confluence of factors including a colossal livestock population, a rapidly modernizing agricultural sector, and proactive government initiatives promoting sustainable farming practices and the reduction of antibiotic usage in animal feed. The poultry segment, within the animal type category, is a primary consumer of feed phytogenics, owing to its high production volumes and the well-established benefits of these additives in improving growth rates and feed conversion ratios. Within the ingredients segment, Herbs and Spices and Essential Oils are particularly sought after, offering diverse functional properties. The application of phytogenics in enhancing Feed Intake and Digestibility is also a key growth driver, directly impacting the economic viability of livestock operations.

Dominant Country: China

- Key Drivers: Large livestock population, government support for sustainable agriculture, increasing demand for antibiotic-free animal products, and significant investments in animal health and nutrition research.

- Market Share: China is estimated to hold xx% of the Asia Pacific feed phytogenics market in the base year 2025.

- Growth Potential: Continued expansion driven by technological advancements and a growing awareness of the benefits of phytogenics.

Dominant Animal Type: Poultry

- Key Drivers: High production volumes, rapid growth cycles, and a well-documented positive impact of phytogenics on feed efficiency and gut health.

- Market Share: Poultry segment is expected to account for xx% of the total market in 2025.

- Growth Potential: Sustained demand driven by global protein needs and the ongoing trend towards antibiotic reduction.

Dominant Application: Feed Intake and Digestibility

- Key Drivers: Direct impact on feed conversion ratios, improved nutrient absorption, and overall animal performance, leading to economic benefits for farmers.

- Market Share: This application area is anticipated to capture xx% of the market in 2025.

- Growth Potential: Increased focus on gut health and nutrient optimization will continue to drive demand for phytogenics in this application.

Leading Ingredients: Herbs and Spices, Essential Oils

- Key Drivers: Proven efficacy in improving gut health, antioxidant properties, antimicrobial effects, and flavoring capabilities.

- Market Share: These ingredients collectively are expected to constitute xx% of the market in 2025.

- Growth Potential: Ongoing research into new botanical sources and synergistic blends will further enhance their market position.

Asia Pacific Feed Phytogenics Market Product Landscape

The Asia Pacific feed phytogenics market is witnessing a surge in innovative product development, focusing on enhanced efficacy and targeted applications. Companies are increasingly launching proprietary blends of herbs and spices and essential oils with scientifically validated claims for improving feed intake and digestibility, promoting gut health, and acting as natural antioxidants. Advanced extraction and encapsulation technologies are being employed to ensure the stability and bioavailability of active compounds, leading to superior performance metrics. Unique selling propositions revolve around antibiotic-free solutions, improved animal welfare, and enhanced product quality. Technological advancements include the development of synergistic formulations that combine multiple plant-derived ingredients to achieve broader and more potent effects, catering to the evolving demands for sustainable and effective animal feed additives.

Key Drivers, Barriers & Challenges in Asia Pacific Feed Phytogenics Market

The Asia Pacific feed phytogenics market is propelled by several key drivers. The escalating global demand for antibiotic-free animal products, coupled with growing consumer awareness regarding food safety and animal welfare, is a primary impetus. Technological advancements in phytogenic compound extraction and formulation enhance their efficacy and ease of integration into animal feed. Favorable government regulations in certain Asia Pacific countries promoting the use of natural feed additives and restricting antibiotic use further accelerate adoption.

Conversely, significant challenges and barriers exist. The complexity of standardizing the potency and composition of natural ingredients due to variations in botanical sources and geographical conditions poses a challenge. The high cost of some phytogenic compounds compared to conventional synthetic additives can hinder widespread adoption, especially in price-sensitive markets. Insufficient scientific research and validation in specific animal species or for particular applications can create skepticism among some industry stakeholders. Supply chain disruptions and the availability of raw materials can also impact market stability. Furthermore, intense competition from established synthetic feed additives and the need for effective consumer education to overcome potential misconceptions about the efficacy of natural alternatives are critical hurdles.

Emerging Opportunities in Asia Pacific Feed Phytogenics Market

Emerging opportunities in the Asia Pacific feed phytogenics market lie in the untapped potential of novel botanical sources and the development of customized solutions for specific animal health challenges. The increasing focus on the gut microbiome and its role in overall animal health presents a significant avenue for research and product development of phytogenics that modulate the gut ecosystem. The growing demand for sustainable aquaculture practices also opens doors for phytogenic feed additives that can improve fish health and reduce mortality rates. Furthermore, the expansion of the Rest of Asia Pacific region, encompassing emerging economies with rapidly growing livestock industries, offers substantial untapped market potential. The development of value-added products, such as pre-mixed phytogenic solutions for specific life stages or disease prevention, can further cater to the evolving needs of feed manufacturers and farmers.

Growth Accelerators in the Asia Pacific Feed Phytogenics Market Industry

Several catalysts are accelerating long-term growth in the Asia Pacific feed phytogenics market industry. Breakthroughs in understanding the synergistic interactions of various plant compounds are leading to the development of more potent and effective phytogenic formulations. Strategic partnerships between ingredient suppliers, feed manufacturers, and research institutions are fostering innovation and accelerating market penetration. Market expansion strategies, including focusing on specific animal types and regions with high growth potential, are key drivers. The increasing investment in research and development by major players to scientifically validate the efficacy and safety of their phytogenic products is crucial. Furthermore, the growing body of scientific evidence supporting the benefits of phytogenics in improving animal performance, reducing environmental impact, and enhancing food safety is a powerful growth accelerator.

Key Players Shaping the Asia Pacific Feed Phytogenics Market Market

- Cargill Incorporated

- Biomin GmbH

- DuPont

- Natural Remedies

- Adisseo France SAS

- Kemin Industries Inc.

- Pancosma

Notable Milestones in Asia Pacific Feed Phytogenics Market Sector

- 2023 March: Kemin Industries Inc. launches a new generation of gut health solutions for poultry in the Southeast Asian market, featuring enhanced phytogenic blends.

- 2022 November: Biomin GmbH announces strategic expansion of its R&D capabilities in China to focus on localized phytogenic solutions for swine.

- 2021 August: DuPont invests in new manufacturing facilities to meet the growing demand for its portfolio of natural feed additives in the Asia Pacific region.

- 2020 June: Natural Remedies successfully obtains regulatory approval for a novel phytogenic compound in India for use in aquaculture feed.

- 2019 April: Adisseo France SAS acquires a stake in a local Chinese phytogenics producer, strengthening its presence in the poultry feed additive market.

In-Depth Asia Pacific Feed Phytogenics Market Market Outlook

The outlook for the Asia Pacific feed phytogenics market remains exceptionally positive, driven by a powerful combination of macro trends and specific industry developments. Growth accelerators such as the global shift towards antibiotic-free animal production, increasing consumer demand for safe and sustainable food, and continuous technological innovation in phytogenic compound extraction and formulation will sustain robust market expansion. Strategic opportunities lie in further exploring the untapped potential of emerging economies within the region, developing specialized phytogenic solutions for various animal species and production systems, and strengthening collaborations across the value chain. The increasing investment in research and development by key players, alongside favorable regulatory shifts, will continue to drive the adoption of phytogenics as essential components of modern animal nutrition. The market is poised for sustained growth, offering significant potential for stakeholders to capitalize on the evolving demands for natural, effective, and sustainable animal feed solutions.

Asia Pacific Feed Phytogenics Market Segmentation

-

1. Ingredients

- 1.1. Herbs and Spices

- 1.2. Essential Oils

- 1.3. Others

-

2. Application

- 2.1. Feed Intake and Digestibility

- 2.2. Flavoring and Aroma

- 2.3. Others (

-

3. Animal Type

- 3.1. Ruminant

- 3.2. Poultry

- 3.3. Swine

- 3.4. Aquaculture

- 3.5. Others

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Australia

- 4.5. Rest of Asia Pacific

Asia Pacific Feed Phytogenics Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Feed Phytogenics Market Regional Market Share

Geographic Coverage of Asia Pacific Feed Phytogenics Market

Asia Pacific Feed Phytogenics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Compound Feed Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Herbs and Spices

- 5.1.2. Essential Oils

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Feed Intake and Digestibility

- 5.2.2. Flavoring and Aroma

- 5.2.3. Others (

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Ruminant

- 5.3.2. Poultry

- 5.3.3. Swine

- 5.3.4. Aquaculture

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. China Asia Pacific Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Herbs and Spices

- 6.1.2. Essential Oils

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Feed Intake and Digestibility

- 6.2.2. Flavoring and Aroma

- 6.2.3. Others (

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Ruminant

- 6.3.2. Poultry

- 6.3.3. Swine

- 6.3.4. Aquaculture

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. India Asia Pacific Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Herbs and Spices

- 7.1.2. Essential Oils

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Feed Intake and Digestibility

- 7.2.2. Flavoring and Aroma

- 7.2.3. Others (

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Ruminant

- 7.3.2. Poultry

- 7.3.3. Swine

- 7.3.4. Aquaculture

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Japan Asia Pacific Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Herbs and Spices

- 8.1.2. Essential Oils

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Feed Intake and Digestibility

- 8.2.2. Flavoring and Aroma

- 8.2.3. Others (

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Ruminant

- 8.3.2. Poultry

- 8.3.3. Swine

- 8.3.4. Aquaculture

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Australia Asia Pacific Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 9.1.1. Herbs and Spices

- 9.1.2. Essential Oils

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Feed Intake and Digestibility

- 9.2.2. Flavoring and Aroma

- 9.2.3. Others (

- 9.3. Market Analysis, Insights and Forecast - by Animal Type

- 9.3.1. Ruminant

- 9.3.2. Poultry

- 9.3.3. Swine

- 9.3.4. Aquaculture

- 9.3.5. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 10. Rest of Asia Pacific Asia Pacific Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 10.1.1. Herbs and Spices

- 10.1.2. Essential Oils

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Feed Intake and Digestibility

- 10.2.2. Flavoring and Aroma

- 10.2.3. Others (

- 10.3. Market Analysis, Insights and Forecast - by Animal Type

- 10.3.1. Ruminant

- 10.3.2. Poultry

- 10.3.3. Swine

- 10.3.4. Aquaculture

- 10.3.5. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biomin GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dupont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Natural Remedies*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Adisseo France SAS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemin Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pancosma

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia Pacific Feed Phytogenics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Feed Phytogenics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 2: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 7: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 9: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 12: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 14: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 17: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 19: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 22: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 24: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 27: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 29: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Feed Phytogenics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Feed Phytogenics Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Asia Pacific Feed Phytogenics Market?

Key companies in the market include Cargill Incorporated, Biomin GmbH, Dupont, Natural Remedies*List Not Exhaustive, Adisseo France SAS, Kemin Industries Inc, Pancosma.

3. What are the main segments of the Asia Pacific Feed Phytogenics Market?

The market segments include Ingredients, Application, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Compound Feed Production.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Feed Phytogenics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Feed Phytogenics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Feed Phytogenics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Feed Phytogenics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence