Key Insights

Australia's feed additive market is projected for substantial growth, with an estimated market size of $14.6 billion by 2025. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 8.3% over the forecast period. This expansion is primarily driven by the escalating global demand for high-quality animal protein, spurred by a growing population and shifting dietary habits. Within Australia, the aquaculture and poultry industries are leading this growth, supported by advancements in farming technologies and an increased emphasis on animal health and welfare. The critical role of feed additives in optimizing nutrient absorption, improving feed efficiency, and preventing disease outbreaks is paramount for the economic sustainability of these livestock sectors. Moreover, increasingly stringent regulations on antibiotic usage are creating significant demand for natural alternatives like phytogenics, probiotics, and prebiotics to enhance gut health and immunity.

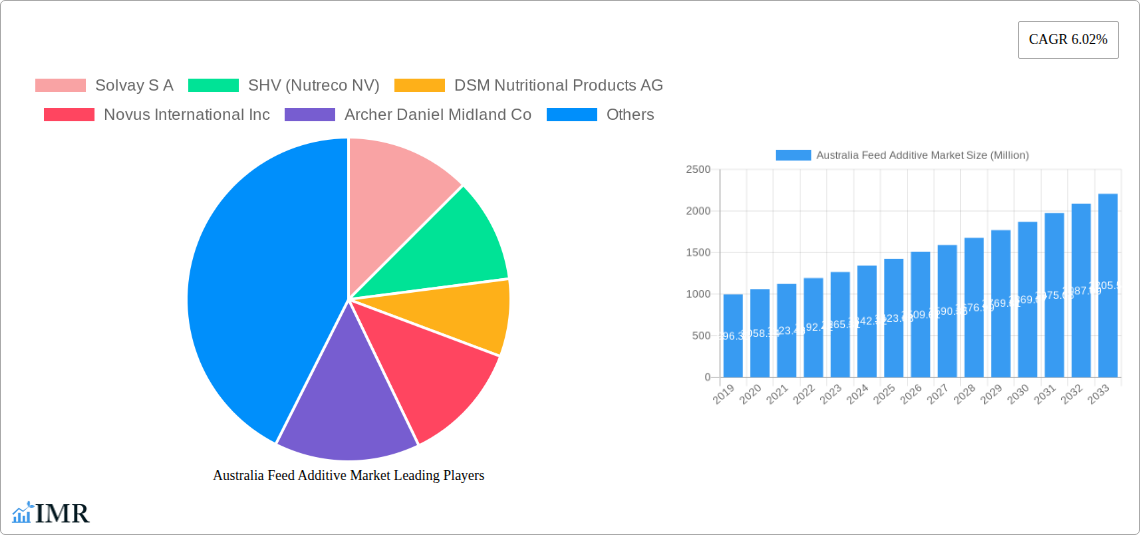

Australia Feed Additive Market Market Size (In Billion)

Key drivers in the Australian feed additive market include the widespread adoption of enzyme technologies for enhanced nutrient digestibility and reduced environmental impact, particularly concerning phosphorus and nitrogen excretion. The market is also seeing a rising demand for mycotoxin detoxifiers and antioxidants to protect animal health from feed contaminants and oxidative stress. Innovation in product formulation, focusing on improved bioavailability and targeted delivery of active ingredients, is a crucial trend. While challenges such as fluctuating raw material costs and rigorous regulatory approval processes exist, leading companies are actively addressing these through significant investments in research and development, developing sustainable and cost-effective solutions to capitalize on market opportunities.

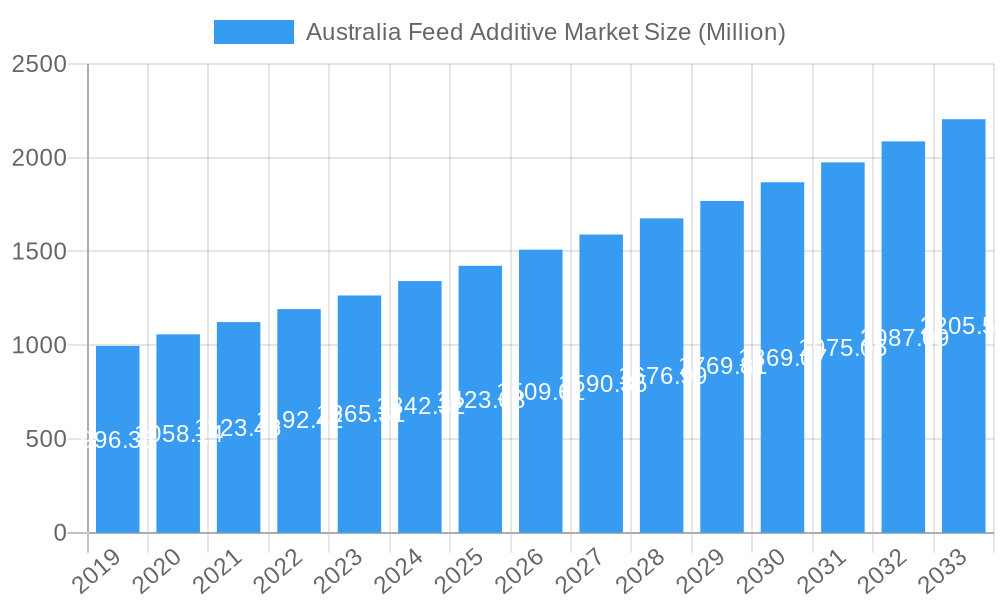

Australia Feed Additive Market Company Market Share

Australia Feed Additive Market: Comprehensive Report 2025-2033

This in-depth report offers a strategic analysis of the Australian Feed Additive Market, projecting significant growth from a base year of 2025 through 2033. Delve into the intricate dynamics, growth trends, and dominant segments of this vital industry. We provide granular insights into product landscapes, key drivers, emerging opportunities, and the competitive strategies of major players, all crucial for stakeholders seeking to navigate and capitalize on the evolving Australian animal nutrition sector. Values are presented in Million units for clarity and comparability.

Australia Feed Additive Market Market Dynamics & Structure

The Australia Feed Additive Market is characterized by a moderately consolidated structure, driven by increasing demand for enhanced animal productivity and welfare. Technological innovation is a key driver, with a growing focus on bio-based and sustainable feed additive solutions. Regulatory frameworks, particularly those pertaining to animal health, food safety, and environmental impact, significantly influence market entry and product development. Competitive product substitutes are emerging, especially in the form of natural alternatives to synthetic additives. End-user demographics, primarily feed manufacturers, livestock producers (poultry, swine, ruminants, and aquaculture), are increasingly prioritizing efficacy, cost-effectiveness, and traceability. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to expand product portfolios and market reach. For instance, recent M&A activity highlights a trend towards acquiring specialized biotech firms to bolster innovation in novel feed additives. The market’s concentration is influenced by a handful of global players and several regional specialists, contributing to a dynamic competitive landscape. Barriers to innovation include rigorous research and development costs and the lengthy approval processes for new additive formulations.

- Market Concentration: Moderately consolidated with key global players and regional specialists.

- Technological Innovation: Driven by demand for bio-based, sustainable, and high-efficacy additives.

- Regulatory Frameworks: Crucial in shaping product approvals, safety standards, and market access.

- Competitive Substitutes: Growing availability of natural and botanical alternatives.

- End-User Demographics: Focus on efficiency, cost, and sustainability from feed manufacturers and livestock producers.

- M&A Trends: Strategic acquisitions to enhance product portfolios and expand global presence.

Australia Feed Additive Market Growth Trends & Insights

The Australia Feed Additive Market is poised for robust expansion, driven by a confluence of factors including rising meat and dairy consumption, increasing awareness of animal health and welfare, and the imperative for sustainable livestock production. The market size evolution is projected to witness a steady upward trajectory, fueled by the adoption of advanced feed formulations and innovative additive solutions. Technological disruptions, such as the integration of artificial intelligence in feed optimization and the development of precision nutrition technologies, are poised to transform the industry. Consumer behavior shifts, including a growing preference for ethically sourced and high-quality animal protein, indirectly boost the demand for feed additives that enhance animal health and reduce antibiotic reliance. The adoption rates of specialized additives, like probiotics and prebiotics for gut health, are particularly high. Market penetration is expected to deepen across all animal segments as producers recognize the economic and health benefits. The CAGR for the forecast period is estimated at xx% (e.g., 6.5%), reflecting a significant growth opportunity. This growth is underpinned by an increasing investment in research and development by key companies and a growing recognition of feed additives as essential tools for optimizing animal performance and reducing the environmental footprint of livestock farming. The shift towards antibiotic-free production further accelerates the demand for alternative feed additives that can maintain animal health and growth performance.

Dominant Regions, Countries, or Segments in Australia Feed Additive Market

The Australian Feed Additive Market is significantly influenced by the dominance of specific segments and animal categories. Within the Additive segment, Amino Acids (Lysine, Methionine, Threonine) consistently lead due to their fundamental role in optimizing animal growth and feed conversion ratios, particularly in poultry and swine production. Vitamins (Vitamin A, Vitamin E, other B vitamins) also hold a substantial market share, addressing essential nutrient requirements and supporting overall animal health. Enzymes, especially phytases and carbohydrases, are experiencing rapid growth due to their ability to improve nutrient digestibility, reduce feed costs, and mitigate environmental impact by lowering phosphorus excretion.

In terms of Animal segments, Poultry (Broiler, Layer) remains the largest consumer of feed additives, driven by the high volume of production and the critical need for efficient feed utilization and disease prevention. The Swine segment follows closely, with a strong demand for amino acids and gut health promoters. Ruminants (Dairy Cattle, Beef Cattle) represent a growing segment, with increasing adoption of feed additives aimed at improving ruminal fermentation, milk production, and overall health. Aquaculture is an emerging and rapidly expanding segment, showcasing significant potential for growth in specialized feed additives to enhance disease resistance and growth rates in fish and shrimp.

Geographically, while the report focuses on Australia, the dominant regions within the country for feed additive consumption are typically areas with high concentrations of intensive livestock farming, such as Queensland, New South Wales, and Victoria. These regions benefit from favorable agricultural policies, access to feed formulation facilities, and a well-established livestock industry. The growth potential in aquaculture regions along the coastlines is also noteworthy.

- Dominant Additive Segments: Amino Acids, Vitamins, Enzymes (Phytases, Carbohydrases).

- Key Animal Segments: Poultry (Broiler, Layer), Swine, Ruminants (Dairy, Beef Cattle).

- Emerging Segment: Aquaculture (Fish, Shrimp).

- Dominant Geographic Influence (within Australia): Regions with intensive livestock operations.

- Growth Drivers: Economic viability of livestock production, focus on animal health and efficiency, and sustainability initiatives.

Australia Feed Additive Market Product Landscape

The Australia Feed Additive Market is characterized by a dynamic product landscape, with continuous innovation focused on enhancing animal performance, health, and sustainability. Key product innovations include the development of highly bioavailable forms of essential nutrients, novel enzyme formulations for improved digestibility, and sophisticated blends of probiotics and prebiotics for targeted gut health management. Applications span across all major animal categories, from enhancing growth rates and feed conversion in poultry and swine to improving milk yield and quality in dairy cattle, and boosting disease resistance in aquaculture. Performance metrics are increasingly sophisticated, focusing on measurable improvements in animal growth, feed efficiency, reduced mortality rates, and enhanced product quality (e.g., meat tenderness, egg quality). Unique selling propositions often revolve around scientifically validated efficacy, safety, ease of use, and the potential for reduced antibiotic dependence. Technological advancements are leading to more precise delivery systems and synergistic combinations of active ingredients, offering tailored solutions for specific animal health challenges and production goals.

Key Drivers, Barriers & Challenges in Australia Feed Additive Market

Key Drivers:

The Australia Feed Additive Market is propelled by several key forces. The escalating demand for high-quality animal protein, driven by population growth and changing dietary preferences, necessitates improved livestock productivity. Growing awareness and concern for animal welfare and health are driving the adoption of feed additives that promote well-being and reduce disease incidence. The global push towards sustainable agriculture and reducing the environmental impact of livestock farming is a significant driver, encouraging the use of additives that improve nutrient utilization and reduce waste. Furthermore, the ongoing efforts to reduce antibiotic usage in animal production are creating a substantial demand for effective, non-antibiotic growth promoters and disease prevention solutions. Technological advancements in feed formulation and additive science are also crucial, enabling the development of more efficacious and targeted products.

Barriers & Challenges:

Despite the strong growth prospects, the market faces significant challenges. The high cost of research and development for novel feed additives can be a barrier to entry for smaller companies. Stringent regulatory approval processes for new products can lead to lengthy timelines and increased investment. Volatility in raw material prices, particularly for vitamins and amino acids, can impact the profitability and competitiveness of feed additive manufacturers. Supply chain disruptions, as witnessed globally, can affect the availability and cost of essential ingredients. Intense competition from both established global players and emerging regional suppliers can exert pricing pressure. Educating end-users about the benefits and optimal application of newer, more complex additive solutions also presents an ongoing challenge.

Emerging Opportunities in Australia Feed Additive Market

The Australia Feed Additive Market presents several exciting emerging opportunities. The rapidly growing aquaculture sector in Australia offers a significant untapped market for specialized feed additives designed to enhance disease resistance, growth rates, and feed conversion efficiency in fish and shrimp. The increasing consumer demand for "antibiotic-free" and "natural" animal products is creating a substantial market for phytogenics, probiotics, prebiotics, and organic acids as alternatives to traditional growth promoters and antibiotics. There is also a growing opportunity in developing feed additives that support animal gut health and immunity, which are crucial for reducing reliance on therapeutic interventions and improving overall animal resilience. Furthermore, the development of customized feed additive solutions tailored to specific regional breeds, farming practices, and feed types offers a niche for innovative companies. The focus on reducing the environmental footprint of livestock farming is also opening doors for additives that improve nutrient digestibility, reduce methane emissions, and minimize waste.

Growth Accelerators in the Australia Feed Additive Market Industry

Several catalysts are accelerating long-term growth in the Australia Feed Additive Market. Technological breakthroughs in biotechnology and animal nutrition are leading to the development of more potent and targeted feed additives, such as novel enzymes and precision fermentation-derived ingredients. Strategic partnerships between feed additive manufacturers, research institutions, and livestock producers are fostering innovation and accelerating the adoption of new solutions. Market expansion strategies, including the development of new product lines and entry into underserved animal segments or geographic regions within Australia, are also key growth drivers. For instance, increased investment in R&D for sustainable and naturally derived additives is a significant accelerator, aligning with both industry trends and consumer preferences. Collaborations aimed at optimizing feed formulation and delivery systems are also enhancing the effectiveness and market penetration of feed additives.

Key Players Shaping the Australia Feed Additive Market Market

- Solvay S A

- SHV (Nutreco NV)

- DSM Nutritional Products AG

- Novus International Inc

- Archer Daniel Midland Co

- BASF SE

- Lonza Group Ltd

- Cargill Inc

- IFF (Danisco Animal Nutrition)

- Phibro Animal Health Corporation

Notable Milestones in Australia Feed Additive Market Sector

- January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives, strengthening its innovation pipeline in novel animal nutrition solutions.

- June 2022: Delacon and Cargill collaborated to establish a global plant-based phytogenic feed additives business, combining extensive expertise and expanding global presence for enhanced animal nutrition.

- January 2022: The DSM-Novozymes alliance introduced Hiphorius, a new generation of phytase. This comprehensive solution assists poultry producers in achieving lucrative and sustainable protein output.

In-Depth Australia Feed Additive Market Market Outlook

The future outlook for the Australia Feed Additive Market is exceptionally promising, driven by a sustained demand for enhanced animal productivity, health, and sustainable farming practices. Growth accelerators, including cutting-edge advancements in biotechnology and precision nutrition, are paving the way for highly effective and targeted additive solutions. Strategic partnerships and collaborations are crucial for unlocking new market potential and accelerating the adoption of innovative products. The increasing consumer preference for ethically sourced and antibiotic-free animal products will continue to fuel the demand for natural and beneficial feed additives. Emerging opportunities in aquaculture and specialized gut health solutions present significant avenues for market expansion. By focusing on research and development, strategic market penetration, and aligning with sustainability goals, stakeholders can effectively capitalize on the robust growth trajectory projected for the Australian feed additive industry.

Australia Feed Additive Market Segmentation

-

1. Additive

-

1.1. Acidifiers

-

1.1.1. By Sub Additive

- 1.1.1.1. Fumaric Acid

- 1.1.1.2. Lactic Acid

- 1.1.1.3. Propionic Acid

- 1.1.1.4. Other Acidifiers

-

1.1.1. By Sub Additive

-

1.2. Amino Acids

- 1.2.1. Lysine

- 1.2.2. Methionine

- 1.2.3. Threonine

- 1.2.4. Tryptophan

- 1.2.5. Other Amino Acids

-

1.3. Antibiotics

- 1.3.1. Bacitracin

- 1.3.2. Penicillins

- 1.3.3. Tetracyclines

- 1.3.4. Tylosin

- 1.3.5. Other Antibiotics

-

1.4. Antioxidants

- 1.4.1. Butylated Hydroxyanisole (BHA)

- 1.4.2. Butylated Hydroxytoluene (BHT)

- 1.4.3. Citric Acid

- 1.4.4. Ethoxyquin

- 1.4.5. Propyl Gallate

- 1.4.6. Tocopherols

- 1.4.7. Other Antioxidants

-

1.5. Binders

- 1.5.1. Natural Binders

- 1.5.2. Synthetic Binders

-

1.6. Enzymes

- 1.6.1. Carbohydrases

- 1.6.2. Phytases

- 1.6.3. Other Enzymes

- 1.7. Flavors & Sweeteners

-

1.8. Minerals

- 1.8.1. Macrominerals

- 1.8.2. Microminerals

-

1.9. Mycotoxin Detoxifiers

- 1.9.1. Biotransformers

-

1.10. Phytogenics

- 1.10.1. Essential Oil

- 1.10.2. Herbs & Spices

- 1.10.3. Other Phytogenics

-

1.11. Pigments

- 1.11.1. Carotenoids

- 1.11.2. Curcumin & Spirulina

-

1.12. Prebiotics

- 1.12.1. Fructo Oligosaccharides

- 1.12.2. Galacto Oligosaccharides

- 1.12.3. Inulin

- 1.12.4. Lactulose

- 1.12.5. Mannan Oligosaccharides

- 1.12.6. Xylo Oligosaccharides

- 1.12.7. Other Prebiotics

-

1.13. Probiotics

- 1.13.1. Bifidobacteria

- 1.13.2. Enterococcus

- 1.13.3. Lactobacilli

- 1.13.4. Pediococcus

- 1.13.5. Streptococcus

- 1.13.6. Other Probiotics

-

1.14. Vitamins

- 1.14.1. Vitamin A

- 1.14.2. Vitamin B

- 1.14.3. Vitamin C

- 1.14.4. Vitamin E

- 1.14.5. Other Vitamins

-

1.15. Yeast

- 1.15.1. Live Yeast

- 1.15.2. Selenium Yeast

- 1.15.3. Spent Yeast

- 1.15.4. Torula Dried Yeast

- 1.15.5. Whey Yeast

- 1.15.6. Yeast Derivatives

-

1.1. Acidifiers

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

Australia Feed Additive Market Segmentation By Geography

- 1. Australia

Australia Feed Additive Market Regional Market Share

Geographic Coverage of Australia Feed Additive Market

Australia Feed Additive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Feed Additive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Additive

- 5.1.1. Acidifiers

- 5.1.1.1. By Sub Additive

- 5.1.1.1.1. Fumaric Acid

- 5.1.1.1.2. Lactic Acid

- 5.1.1.1.3. Propionic Acid

- 5.1.1.1.4. Other Acidifiers

- 5.1.1.1. By Sub Additive

- 5.1.2. Amino Acids

- 5.1.2.1. Lysine

- 5.1.2.2. Methionine

- 5.1.2.3. Threonine

- 5.1.2.4. Tryptophan

- 5.1.2.5. Other Amino Acids

- 5.1.3. Antibiotics

- 5.1.3.1. Bacitracin

- 5.1.3.2. Penicillins

- 5.1.3.3. Tetracyclines

- 5.1.3.4. Tylosin

- 5.1.3.5. Other Antibiotics

- 5.1.4. Antioxidants

- 5.1.4.1. Butylated Hydroxyanisole (BHA)

- 5.1.4.2. Butylated Hydroxytoluene (BHT)

- 5.1.4.3. Citric Acid

- 5.1.4.4. Ethoxyquin

- 5.1.4.5. Propyl Gallate

- 5.1.4.6. Tocopherols

- 5.1.4.7. Other Antioxidants

- 5.1.5. Binders

- 5.1.5.1. Natural Binders

- 5.1.5.2. Synthetic Binders

- 5.1.6. Enzymes

- 5.1.6.1. Carbohydrases

- 5.1.6.2. Phytases

- 5.1.6.3. Other Enzymes

- 5.1.7. Flavors & Sweeteners

- 5.1.8. Minerals

- 5.1.8.1. Macrominerals

- 5.1.8.2. Microminerals

- 5.1.9. Mycotoxin Detoxifiers

- 5.1.9.1. Biotransformers

- 5.1.10. Phytogenics

- 5.1.10.1. Essential Oil

- 5.1.10.2. Herbs & Spices

- 5.1.10.3. Other Phytogenics

- 5.1.11. Pigments

- 5.1.11.1. Carotenoids

- 5.1.11.2. Curcumin & Spirulina

- 5.1.12. Prebiotics

- 5.1.12.1. Fructo Oligosaccharides

- 5.1.12.2. Galacto Oligosaccharides

- 5.1.12.3. Inulin

- 5.1.12.4. Lactulose

- 5.1.12.5. Mannan Oligosaccharides

- 5.1.12.6. Xylo Oligosaccharides

- 5.1.12.7. Other Prebiotics

- 5.1.13. Probiotics

- 5.1.13.1. Bifidobacteria

- 5.1.13.2. Enterococcus

- 5.1.13.3. Lactobacilli

- 5.1.13.4. Pediococcus

- 5.1.13.5. Streptococcus

- 5.1.13.6. Other Probiotics

- 5.1.14. Vitamins

- 5.1.14.1. Vitamin A

- 5.1.14.2. Vitamin B

- 5.1.14.3. Vitamin C

- 5.1.14.4. Vitamin E

- 5.1.14.5. Other Vitamins

- 5.1.15. Yeast

- 5.1.15.1. Live Yeast

- 5.1.15.2. Selenium Yeast

- 5.1.15.3. Spent Yeast

- 5.1.15.4. Torula Dried Yeast

- 5.1.15.5. Whey Yeast

- 5.1.15.6. Yeast Derivatives

- 5.1.1. Acidifiers

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solvay S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SHV (Nutreco NV)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSM Nutritional Products AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novus International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniel Midland Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lonza Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cargill Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phibro Animal Health Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Solvay S A

List of Figures

- Figure 1: Australia Feed Additive Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Feed Additive Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Feed Additive Market Revenue billion Forecast, by Additive 2020 & 2033

- Table 2: Australia Feed Additive Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 3: Australia Feed Additive Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Australia Feed Additive Market Revenue billion Forecast, by Additive 2020 & 2033

- Table 5: Australia Feed Additive Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 6: Australia Feed Additive Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Feed Additive Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Australia Feed Additive Market?

Key companies in the market include Solvay S A, SHV (Nutreco NV), DSM Nutritional Products AG, Novus International Inc, Archer Daniel Midland Co, BASF SE, Lonza Group Ltd, Cargill Inc, IFF(Danisco Animal Nutrition), Phibro Animal Health Corporation.

3. What are the main segments of the Australia Feed Additive Market?

The market segments include Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023: Novus International acquired the Biotech company Agrivida to develop new feed additives.June 2022: Delacon and Cargill collaborated to establish a global plant-based phytogenic feed additives business for enhanced animal nutrition. The partnership has helped in extensive feed additives expertise as well as an increase in the global presence.January 2022: Hiphorius is a new generation of phytase introduced by the DSM-Novozymes alliance. It is a comprehensive phytase solution created to assist poultry producers in achieving lucrative and sustainable protein output.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Feed Additive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Feed Additive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Feed Additive Market?

To stay informed about further developments, trends, and reports in the Australia Feed Additive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence