Key Insights

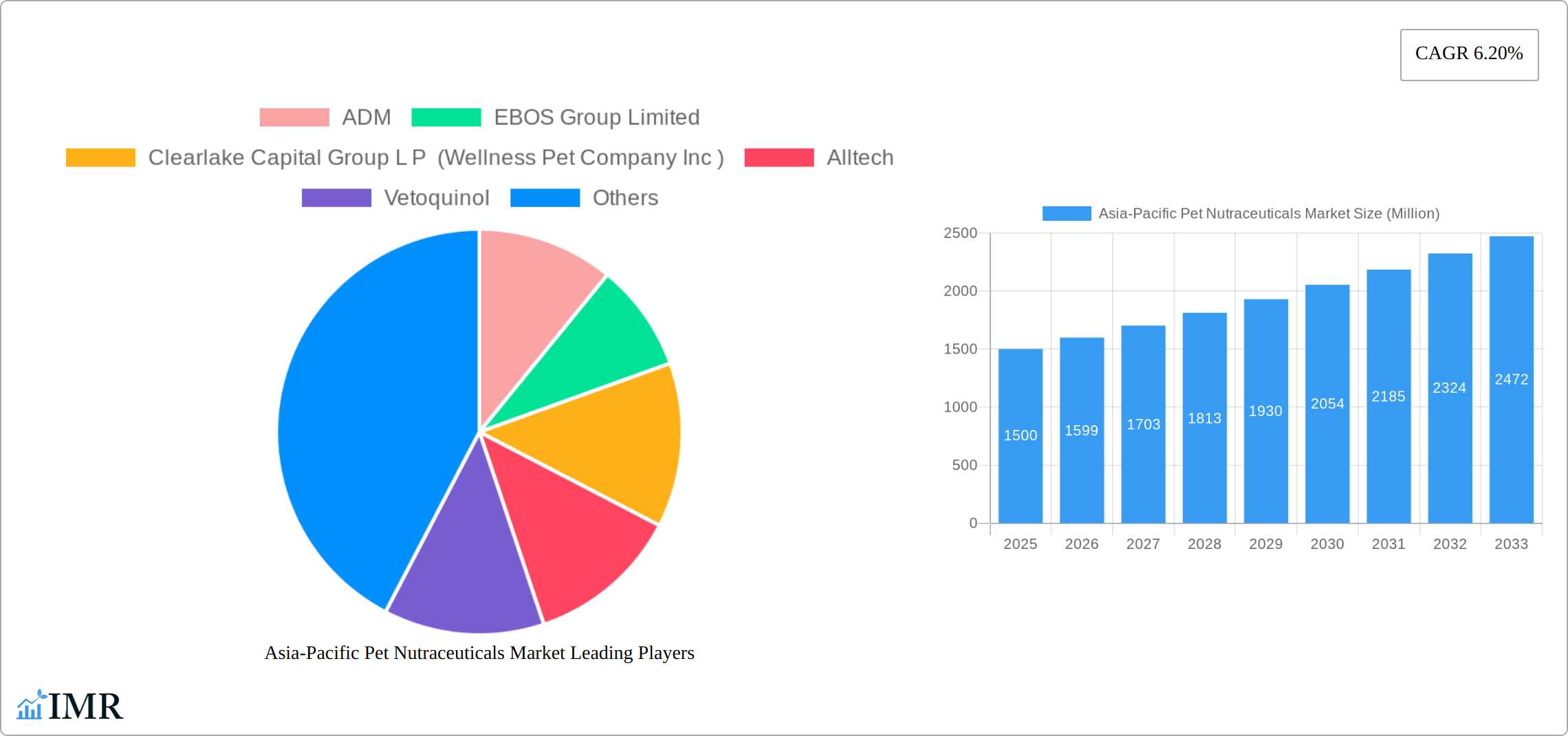

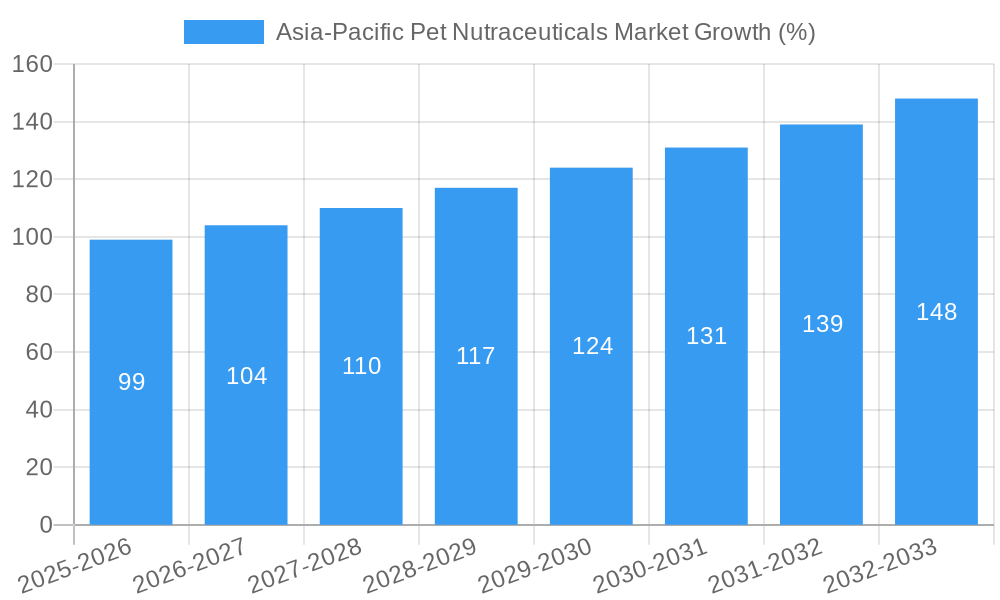

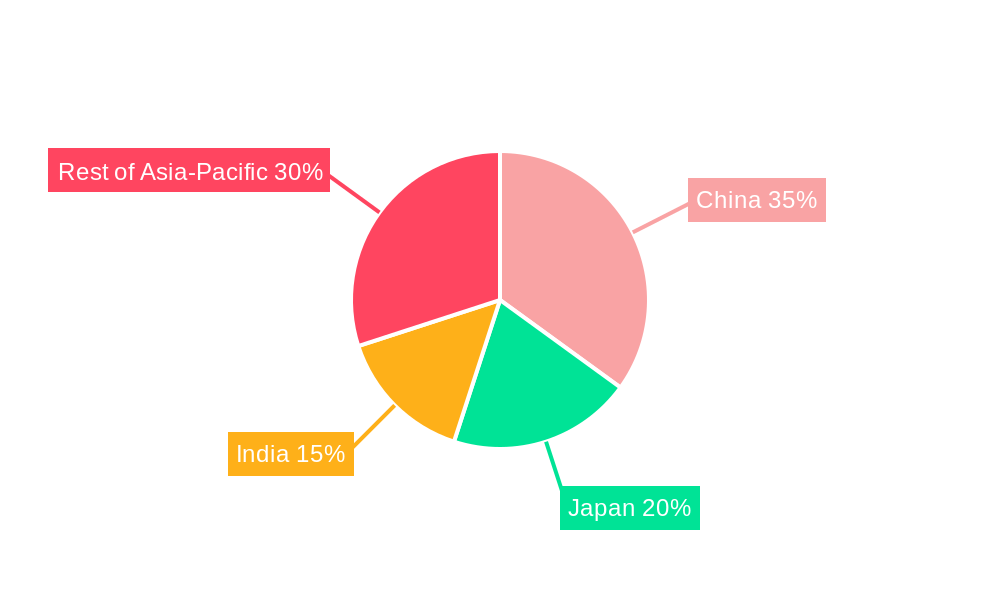

The Asia-Pacific pet nutraceuticals market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing pet ownership, rising pet humanization trends, and growing awareness of pet health and wellness. The market's Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033 signifies a significant expansion opportunity. Key drivers include the increasing disposable incomes in several Asia-Pacific countries, leading to higher spending on premium pet products, including nutraceuticals. Furthermore, the rising prevalence of chronic diseases in pets is fueling demand for specialized nutraceuticals addressing specific health concerns like joint health, immunity, and digestive issues. The market is segmented by product type (Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, Other Nutraceuticals), pet type (Cats, Dogs, Other Pets), and distribution channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). China, Japan, and India are expected to be the leading markets within the region, reflecting their large and growing pet populations. However, regulatory hurdles and inconsistent product quality in some emerging markets could pose challenges to market expansion.

The market's growth is also influenced by evolving consumer preferences. Online channels are witnessing substantial growth due to increasing internet penetration and convenience, offering a broader reach to consumers. The emergence of specialized pet stores and veterinary clinics is further enhancing product accessibility and promoting consumer awareness. Major players, including ADM, EBOS Group Limited, and Mars Incorporated, are strategically investing in research and development to introduce innovative and high-quality pet nutraceuticals. Competition is expected to intensify in the coming years, with a focus on product differentiation, brand building, and strategic partnerships to gain market share. The forecast period of 2025-2033 promises significant opportunities for existing and new players alike. The continued expansion of the pet owner base and increased demand for preventive healthcare solutions will be pivotal factors determining the future trajectory of the Asia-Pacific pet nutraceuticals market.

Asia-Pacific Pet Nutraceuticals Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific pet nutraceuticals market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with 2025 as the base year and forecasts extending to 2033. The market is segmented by sub-product (Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, Other Nutraceuticals), pet type (Cats, Dogs, Other Pets), distribution channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels), and country (Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand, Vietnam, Rest of Asia-Pacific). The report’s insights are invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market.

Asia-Pacific Pet Nutraceuticals Market Dynamics & Structure

The Asia-Pacific pet nutraceuticals market is characterized by moderate concentration, with several major players and numerous smaller niche companies competing. Technological innovation, particularly in areas like targeted delivery systems and personalized nutrition, is a key driver. Regulatory frameworks vary across countries, influencing product development and market access. The market faces competition from traditional pet food and veterinary treatments, though nutraceuticals are increasingly viewed as complementary health solutions. The rising pet ownership rate, particularly in developing economies, is a crucial factor. Furthermore, the market witnesses significant M&A activity, with larger companies seeking to consolidate their market share and expand their product portfolios. The estimated value of M&A deals in the Asia-Pacific pet nutraceuticals market between 2019 and 2024 reached approximately xx Million.

- Market Concentration: Moderately concentrated, with a few dominant players and many smaller firms.

- Technological Innovation: Strong emphasis on targeted delivery systems and personalized nutrition.

- Regulatory Landscape: Varies across countries, impacting market entry and product development.

- Competitive Substitutes: Traditional pet food and veterinary treatments.

- End-User Demographics: Growing pet ownership rates across the region, especially in developing nations.

- M&A Activity: Significant consolidation through mergers and acquisitions.

Asia-Pacific Pet Nutraceuticals Market Growth Trends & Insights

The Asia-Pacific pet nutraceuticals market exhibited strong growth between 2019 and 2024, driven by increasing pet ownership, rising disposable incomes, and growing awareness of pet health and wellness. The market size reached xx Million in 2024, registering a CAGR of xx% during this period. Technological advancements, like the development of more effective and palatable nutraceutical formulations, have further fueled adoption rates. Consumer behavior is shifting towards premium and specialized pet products, with a greater emphasis on preventative healthcare. This trend is particularly pronounced in urban areas and among younger demographics. The market penetration rate is projected to reach xx% by 2033, indicating significant future growth potential. The forecast period (2025-2033) projects continued expansion, with a projected CAGR of xx%, driven by factors such as increasing pet humanization, growing demand for functional pet foods, and expanding distribution channels.

Dominant Regions, Countries, or Segments in Asia-Pacific Pet Nutraceuticals Market

China and Japan are currently the dominant markets within the Asia-Pacific region, driven by high pet ownership rates and robust economies. However, countries like India and Indonesia exhibit significant growth potential due to increasing pet adoption and expanding middle-class populations. Within the product segments, Probiotics, Omega-3 Fatty Acids, and Vitamins and Minerals are experiencing the highest growth, reflecting a strong consumer focus on immune support and overall pet health. The online channel is showing robust growth, driven by rising internet penetration and e-commerce adoption.

- Leading Regions: China and Japan.

- High-Growth Potential: India and Indonesia.

- Dominant Sub-Products: Probiotics, Omega-3 Fatty Acids, and Vitamins and Minerals.

- Fastest-Growing Distribution Channel: Online Channel.

- Key Drivers: Rising pet ownership, increasing disposable incomes, and greater awareness of pet health and wellness.

Asia-Pacific Pet Nutraceuticals Market Product Landscape

The Asia-Pacific pet nutraceutical market showcases a diverse range of products, from functional chews and powders to liquid supplements. Innovations include novel delivery systems (e.g., targeted release capsules) and personalized formulations based on pet breed and health needs. Companies are emphasizing natural ingredients, transparency in labeling, and scientific validation of product efficacy. These developments underscore the focus on improving product quality, palatability, and overall value proposition.

Key Drivers, Barriers & Challenges in Asia-Pacific Pet Nutraceuticals Market

Key Drivers: Rising pet humanization, increasing disposable incomes, expansion of the pet owner base, and growing awareness of pet health and wellness. Government initiatives promoting animal welfare also contribute positively.

Challenges: Stricter regulatory requirements in some markets, varying consumer preferences across different countries, intense competition from established pet food brands, and potential supply chain disruptions. Price sensitivity among consumers presents another significant challenge.

Emerging Opportunities in Asia-Pacific Pet Nutraceuticals Market

Opportunities lie in expanding into untapped markets within the region, focusing on niche pet health needs (e.g., senior pet care, specific breed-related health issues), and developing innovative product formats (e.g., functional treats, subscription services). Tailoring product offerings to specific regional preferences and leveraging digital marketing strategies can further drive market penetration.

Growth Accelerators in the Asia-Pacific Pet Nutraceuticals Market Industry

Strategic partnerships, particularly between nutraceutical manufacturers and pet food companies, will be crucial. Technological advancements, including personalized nutrition solutions and improved manufacturing processes, will drive efficiency and product innovation. Expanding into emerging economies and leveraging e-commerce platforms will further accelerate market growth.

Key Players Shaping the Asia-Pacific Pet Nutraceuticals Market Market

- ADM

- EBOS Group Limited

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- Alltech

- Vetoquinol

- Mars Incorporated

- Nestle (Purina)

- Vafo Praha s r o

- Nutramax Laboratories Inc

- Virba

Notable Milestones in Asia-Pacific Pet Nutraceuticals Market Sector

- April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific, boosting product innovation.

- March 2023: Virbac launched its hyper-premium physiology range in India, expanding product availability.

- February 2023: ADM opened a new probiotics and postbiotics production facility in Spain, enhancing supply to Asia-Pacific.

In-Depth Asia-Pacific Pet Nutraceuticals Market Market Outlook

The Asia-Pacific pet nutraceuticals market is poised for substantial growth over the forecast period. Continued investment in research and development, coupled with strategic expansions into new markets and a focus on innovative product offerings, will drive market expansion. Companies that effectively leverage digital marketing strategies and cater to evolving consumer preferences will be best positioned to capitalize on this growth potential. The focus on personalized nutrition and preventative health solutions will be key for long-term success.

Asia-Pacific Pet Nutraceuticals Market Segmentation

-

1. Sub Product

- 1.1. Milk Bioactives

- 1.2. Omega-3 Fatty Acids

- 1.3. Probiotics

- 1.4. Proteins and Peptides

- 1.5. Vitamins and Minerals

- 1.6. Other Nutraceuticals

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Asia-Pacific Pet Nutraceuticals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Pet Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Milk Bioactives

- 5.1.2. Omega-3 Fatty Acids

- 5.1.3. Probiotics

- 5.1.4. Proteins and Peptides

- 5.1.5. Vitamins and Minerals

- 5.1.6. Other Nutraceuticals

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. China Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Pet Nutraceuticals Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ADM

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 EBOS Group Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Alltech

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Vetoquinol

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mars Incorporated

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nestle (Purina)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vafo Praha s r o

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nutramax Laboratories Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Virba

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ADM

List of Figures

- Figure 1: Asia-Pacific Pet Nutraceuticals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Pet Nutraceuticals Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 3: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Pets 2019 & 2032

- Table 4: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 15: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Pets 2019 & 2032

- Table 16: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Asia-Pacific Pet Nutraceuticals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia-Pacific Pet Nutraceuticals Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Pet Nutraceuticals Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Asia-Pacific Pet Nutraceuticals Market?

Key companies in the market include ADM, EBOS Group Limited, Clearlake Capital Group L P (Wellness Pet Company Inc ), Alltech, Vetoquinol, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Nutramax Laboratories Inc, Virba.

3. What are the main segments of the Asia-Pacific Pet Nutraceuticals Market?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific. This new facility, called the APAC pet center, will support the company's product development.March 2023: Virbac launched its hyper-premium physiology range in India. It is available in leading veterinary clinics and key pet shops across eight cities in India.February 2023: ADM opened its new probiotics and postbiotics production facility in Spain. The facility will supply these supplements to North America, EMEA, and Asia-Pacific.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Pet Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Pet Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Pet Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Pet Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence