Key Insights

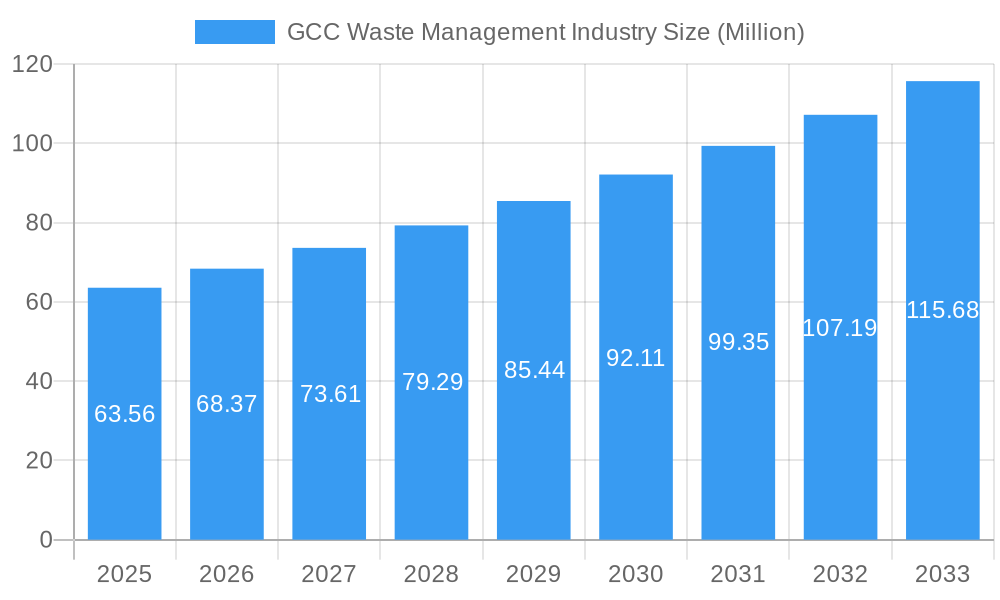

The GCC waste management market, valued at $63.56 million in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations promoting sustainable waste disposal practices. The 7.38% CAGR from 2025 to 2033 indicates a significant expansion, fueled by factors like the growing tourism sector generating substantial waste and the increasing adoption of advanced waste management technologies, including waste-to-energy solutions and improved recycling infrastructure. Key players like Averda, Suez Middle East Recycling LLC, and Bee'ah are strategically investing in infrastructure development and innovative technologies to capture market share. The market segmentation likely encompasses municipal solid waste, industrial waste, and hazardous waste management, each presenting unique opportunities and challenges. Growth is further influenced by government initiatives focused on promoting circular economy models and reducing landfill reliance. Challenges include the high cost of implementing advanced technologies and the need for improved public awareness and participation in waste segregation programs.

GCC Waste Management Industry Market Size (In Million)

The forecast period (2025-2033) anticipates substantial market expansion, particularly in sectors like e-waste management and medical waste disposal, which are experiencing accelerated growth due to technological advancements and increasing healthcare infrastructure. The regional breakdown, while not provided, would likely show variations based on population density, economic activity, and government policies across the GCC nations. Competitive pressures are expected to increase, with companies vying for larger market shares through acquisitions, technological innovation, and strategic partnerships. The market's trajectory suggests continued demand for efficient and sustainable waste management solutions, making it an attractive investment opportunity for both domestic and international players.

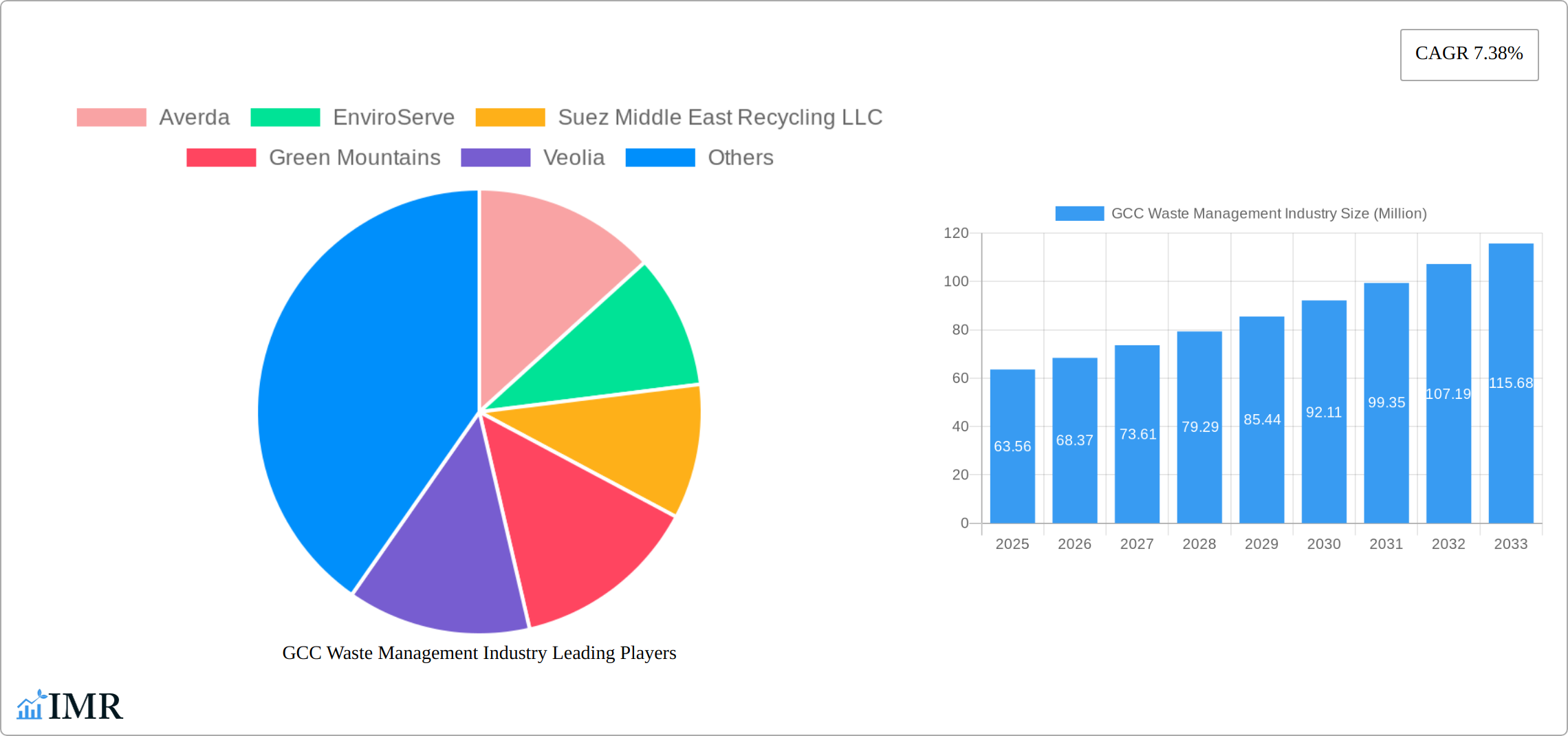

GCC Waste Management Industry Company Market Share

GCC Waste Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the GCC waste management industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report analyzes parent markets (waste management) and child markets (e.g., sewage treatment, recycling) to offer a granular view of this dynamic sector. The market size is projected at XX Million for 2025.

GCC Waste Management Industry Market Dynamics & Structure

The GCC waste management market is undergoing a dynamic transformation, characterized by a growing emphasis on sustainability and technological integration. While moderately concentrated, with a few key industry leaders and a broader spectrum of regional specialists, the market is experiencing increasing competition driven by innovative solutions. The market share is distributed, with leading entities capturing a significant portion, while a robust network of smaller, agile firms contributes to overall market breadth. Technological advancements are at the forefront, with a pronounced shift towards smart waste management systems. This includes the widespread adoption of IoT-enabled sensors for real-time monitoring and AI-driven algorithms for optimized collection routes, leading to enhanced operational efficiency and reduced environmental footprints. Concurrently, a robust and evolving regulatory landscape, driven by stringent environmental protection mandates and a collective commitment to sustainability across GCC nations, is actively shaping industry practices and encouraging responsible waste handling. The evaluation of competitive substitutes, such as advanced incineration with energy recovery versus traditional landfilling, is increasingly informed by a holistic assessment of cost-effectiveness, long-term environmental impact, and resource recovery potential. The primary end-user demographic encompasses a diverse range of stakeholders, prominently including municipal authorities responsible for public services, large-scale industrial facilities with significant waste streams, and a wide array of commercial establishments. Mergers and acquisitions (M&A) activity has been a notable aspect of market evolution, with a series of strategic consolidations and acquisitions contributing to market restructuring and the integration of specialized capabilities. Approximately XX such deals were recorded between 2019 and 2024, representing a cumulative investment of roughly XX Million.

- Market Concentration: Moderately concentrated, featuring a blend of established industry giants and a vibrant ecosystem of specialized regional operators.

- Technological Innovation: A pivotal growth catalyst, with substantial investment in smart waste management, artificial intelligence for operational optimization, and automation solutions.

- Regulatory Framework: Characterized by increasingly stringent environmental regulations and sustainability directives, actively promoting circular economy principles and responsible waste stewardship.

- Competitive Substitutes: A diversified range of alternatives to traditional landfilling, including advanced incineration with energy recovery, sophisticated composting techniques, and anaerobic digestion for biogas production, are being strategically evaluated.

- End-User Demographics: The primary client base includes municipal entities, major industrial complexes, and a broad spectrum of commercial enterprises.

- M&A Trends: Demonstrating moderate but strategic activity, with approximately XX significant transactions observed between 2019 and 2024, reflecting consolidation and capability enhancement within the sector.

GCC Waste Management Industry Growth Trends & Insights

The GCC waste management market has exhibited consistent growth over the historical period (2019-2024), with a CAGR of xx%. This growth is fueled by rising urbanization, increasing waste generation, and growing government initiatives promoting sustainable waste management practices. Technological disruptions, particularly the adoption of smart waste management systems and advanced recycling technologies, are accelerating market expansion. Consumer behavior is also shifting towards greater environmental awareness, leading to increased demand for eco-friendly waste disposal solutions. Market penetration of advanced technologies remains relatively low (xx%), indicating significant potential for future growth. The market is projected to reach XX Million by 2033, representing a CAGR of xx% during the forecast period.

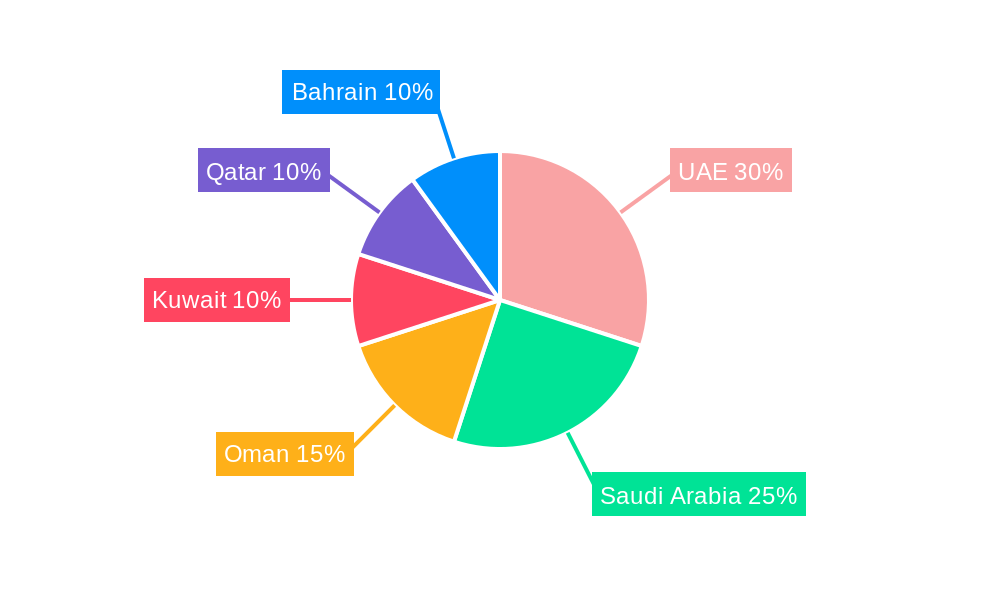

Dominant Regions, Countries, or Segments in GCC Waste Management Industry

The UAE and Saudi Arabia are the leading markets in the GCC region, accounting for approximately xx% of the total market size in 2025. This dominance is driven by higher waste generation rates, significant investments in infrastructure development, and proactive government policies supporting sustainable waste management practices. Further growth is expected in these countries due to ongoing infrastructure projects and rising population. The sewage treatment segment is also witnessing robust growth, driven by increasing urbanization and stricter environmental regulations.

- Key Drivers in UAE & Saudi Arabia: High waste generation, infrastructure investment, and supportive government policies.

- Growth Potential: Significant potential in other GCC countries with increasing urbanization and rising environmental awareness.

- Sewage Treatment Segment: Rapid growth driven by increased urbanization and strict environmental regulations.

GCC Waste Management Industry Product Landscape

The GCC waste management product landscape is undergoing a significant evolution, characterized by a clear pivot towards cutting-edge technologies and eco-conscious solutions. This transformation is marked by the proliferation of smart bins integrated with advanced sensor technology for intelligent waste level monitoring and reporting, sophisticated AI-powered route optimization software designed to streamline collection logistics and minimize fuel consumption, and state-of-the-art recycling facilities employing advanced sorting and processing techniques. These innovations are not merely incremental improvements; they represent a fundamental shift towards enhancing operational efficiency, substantially reducing operating expenditures, and significantly bolstering environmental sustainability across the entire waste management value chain. The overarching objective is to maximize resource recovery through effective recycling and reuse initiatives, while simultaneously minimizing the overall environmental impact of waste generation and disposal. This drive for innovation is spurring the development and implementation of groundbreaking solutions, including advanced waste-to-energy plants that convert waste into usable energy and cutting-edge recycling technologies that unlock new avenues for material recovery and valorization.

Key Drivers, Barriers & Challenges in GCC Waste Management Industry

Key Drivers:

- Rapid urbanization and sustained population growth are creating escalating demands for efficient waste management infrastructure.

- Heightened environmental awareness among the populace and increasingly stringent government regulations are compelling a shift towards sustainable practices.

- Proactive government initiatives and supportive policies designed to foster and accelerate the adoption of sustainable waste management solutions across the region.

- Continuous technological advancements and the integration of innovative solutions are enhancing the efficacy and sustainability of waste management operations.

Key Challenges & Restraints:

- The substantial initial capital investment required for the acquisition and implementation of advanced waste management technologies presents a significant hurdle.

- A persistent gap in public awareness and engagement concerning the critical importance and practical implementation of waste segregation at the source.

- A notable scarcity of a highly skilled and specialized workforce in certain niche areas of advanced waste management and processing.

- The inherent vulnerability of global and regional supply chains to geopolitical disruptions, which can impact the timely delivery of equipment and essential materials, leading to an estimated market impact of approximately XX Million in 2024.

Emerging Opportunities in GCC Waste Management Industry

The GCC waste management sector is ripe with emerging opportunities, particularly in the strategic expansion of smart waste management solutions into underserved areas, including smaller municipalities. The ongoing development and refinement of advanced recycling technologies, such as innovative plastic-to-fuel conversion processes and sophisticated chemical recycling methods, present substantial avenues for growth and value creation. Waste-to-energy projects are increasingly gaining traction as viable and sustainable solutions for both waste disposal and the generation of renewable energy resources. Furthermore, exploring and implementing novel financing models and fostering robust public-private partnerships are critical to unlocking new investment streams and significantly accelerating overall market expansion and the adoption of transformative technologies.

Growth Accelerators in the GCC Waste Management Industry

Sustained long-term growth within the GCC waste management industry will be significantly propelled by a commitment to continuous technological innovation, the formation of strategic alliances and partnerships between public and private sector entities, and the proactive expansion into currently untapped or underserviced markets across the GCC region. Crucial government support, manifested through forward-thinking policy initiatives and targeted funding programs, will be indispensable in driving the widespread adoption of sustainable waste management solutions. The increasing integration of digital technologies, coupled with the advanced utilization of data analytics, will be instrumental in optimizing operational efficiencies, enhancing resource allocation, and ultimately fostering a more sustainable and circular economy within the sector.

Key Players Shaping the GCC Waste Management Industry Market

- Averda

- EnviroServe

- Suez Middle East Recycling LLC

- Green Mountains

- Veolia

- Blue LLC

- Envac

- SEPCO Environment

- Wasco

- Saudi Investment Recycling Company

- Dulsco Waste Management Services

- Bee'ah

- Power Waste Management and Transport LLC

- Al Haya Enviro

- Bin-Ovation

- United Waste Management Company

- Kuwait Waste Collection and Recycling Company (List Not Exhaustive)

Notable Milestones in GCC Waste Management Industry Sector

- December 2023: Wardwizard Innovations and Mobility partnered with BEEAH Group to promote electric vehicles in the GCC and Africa, indirectly impacting waste management through sustainable transportation.

- October 2022: Marafiq commenced construction of a new sewage treatment plant at Jeddah Airport II (300,000 m3/d capacity).

- September 2022: A USD 1.48 billion public-private partnership contract was awarded for a 150,000 cubic meter per day sewage treatment facility in Qatar.

In-Depth GCC Waste Management Industry Market Outlook

The GCC waste management market is poised for substantial growth over the forecast period, driven by accelerating urbanization, rising environmental awareness, and the implementation of advanced technologies. Strategic partnerships and public-private initiatives will play a key role in unlocking the market's full potential, paving the way for innovative solutions and sustainable waste management practices across the region. The market presents significant opportunities for both established players and new entrants, creating a dynamic and promising landscape.

GCC Waste Management Industry Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. Hazardous Waste

- 1.4. E-Waste

- 1.5. Plastic Waste

- 1.6. Bio-Medical Waste

-

2. Disposal Method

- 2.1. Collection

- 2.2. Landfills

- 2.3. Incineration

- 2.4. Recycling

GCC Waste Management Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Waste Management Industry Regional Market Share

Geographic Coverage of GCC Waste Management Industry

GCC Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for mining waste co-disposable

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing demand for mining waste co-disposable

- 3.4. Market Trends

- 3.4.1. Increasing E-waste Generation in Gulf Cooperation Council Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-Waste

- 5.1.5. Plastic Waste

- 5.1.6. Bio-Medical Waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal Method

- 5.2.1. Collection

- 5.2.2. Landfills

- 5.2.3. Incineration

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. North America GCC Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste Type

- 6.1.1. Industrial Waste

- 6.1.2. Municipal Solid Waste

- 6.1.3. Hazardous Waste

- 6.1.4. E-Waste

- 6.1.5. Plastic Waste

- 6.1.6. Bio-Medical Waste

- 6.2. Market Analysis, Insights and Forecast - by Disposal Method

- 6.2.1. Collection

- 6.2.2. Landfills

- 6.2.3. Incineration

- 6.2.4. Recycling

- 6.1. Market Analysis, Insights and Forecast - by Waste Type

- 7. South America GCC Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste Type

- 7.1.1. Industrial Waste

- 7.1.2. Municipal Solid Waste

- 7.1.3. Hazardous Waste

- 7.1.4. E-Waste

- 7.1.5. Plastic Waste

- 7.1.6. Bio-Medical Waste

- 7.2. Market Analysis, Insights and Forecast - by Disposal Method

- 7.2.1. Collection

- 7.2.2. Landfills

- 7.2.3. Incineration

- 7.2.4. Recycling

- 7.1. Market Analysis, Insights and Forecast - by Waste Type

- 8. Europe GCC Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste Type

- 8.1.1. Industrial Waste

- 8.1.2. Municipal Solid Waste

- 8.1.3. Hazardous Waste

- 8.1.4. E-Waste

- 8.1.5. Plastic Waste

- 8.1.6. Bio-Medical Waste

- 8.2. Market Analysis, Insights and Forecast - by Disposal Method

- 8.2.1. Collection

- 8.2.2. Landfills

- 8.2.3. Incineration

- 8.2.4. Recycling

- 8.1. Market Analysis, Insights and Forecast - by Waste Type

- 9. Middle East & Africa GCC Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste Type

- 9.1.1. Industrial Waste

- 9.1.2. Municipal Solid Waste

- 9.1.3. Hazardous Waste

- 9.1.4. E-Waste

- 9.1.5. Plastic Waste

- 9.1.6. Bio-Medical Waste

- 9.2. Market Analysis, Insights and Forecast - by Disposal Method

- 9.2.1. Collection

- 9.2.2. Landfills

- 9.2.3. Incineration

- 9.2.4. Recycling

- 9.1. Market Analysis, Insights and Forecast - by Waste Type

- 10. Asia Pacific GCC Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste Type

- 10.1.1. Industrial Waste

- 10.1.2. Municipal Solid Waste

- 10.1.3. Hazardous Waste

- 10.1.4. E-Waste

- 10.1.5. Plastic Waste

- 10.1.6. Bio-Medical Waste

- 10.2. Market Analysis, Insights and Forecast - by Disposal Method

- 10.2.1. Collection

- 10.2.2. Landfills

- 10.2.3. Incineration

- 10.2.4. Recycling

- 10.1. Market Analysis, Insights and Forecast - by Waste Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Averda

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EnviroServe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Suez Middle East Recycling LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Green Mountains

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veolia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Blue LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Envac

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SEPCO Environment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wasco

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saudi Investment Recycling Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dulsco Waste Management Services

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bee'ah

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Power Waste Management and Transport LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Al Haya Enviro

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bin-Ovation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 United Waste Management Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Kuwait Waste Collection and Recycling Company**List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Averda

List of Figures

- Figure 1: Global GCC Waste Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global GCC Waste Management Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America GCC Waste Management Industry Revenue (Million), by Waste Type 2025 & 2033

- Figure 4: North America GCC Waste Management Industry Volume (Billion), by Waste Type 2025 & 2033

- Figure 5: North America GCC Waste Management Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America GCC Waste Management Industry Volume Share (%), by Waste Type 2025 & 2033

- Figure 7: North America GCC Waste Management Industry Revenue (Million), by Disposal Method 2025 & 2033

- Figure 8: North America GCC Waste Management Industry Volume (Billion), by Disposal Method 2025 & 2033

- Figure 9: North America GCC Waste Management Industry Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 10: North America GCC Waste Management Industry Volume Share (%), by Disposal Method 2025 & 2033

- Figure 11: North America GCC Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America GCC Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: North America GCC Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America GCC Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America GCC Waste Management Industry Revenue (Million), by Waste Type 2025 & 2033

- Figure 16: South America GCC Waste Management Industry Volume (Billion), by Waste Type 2025 & 2033

- Figure 17: South America GCC Waste Management Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 18: South America GCC Waste Management Industry Volume Share (%), by Waste Type 2025 & 2033

- Figure 19: South America GCC Waste Management Industry Revenue (Million), by Disposal Method 2025 & 2033

- Figure 20: South America GCC Waste Management Industry Volume (Billion), by Disposal Method 2025 & 2033

- Figure 21: South America GCC Waste Management Industry Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 22: South America GCC Waste Management Industry Volume Share (%), by Disposal Method 2025 & 2033

- Figure 23: South America GCC Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America GCC Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: South America GCC Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America GCC Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe GCC Waste Management Industry Revenue (Million), by Waste Type 2025 & 2033

- Figure 28: Europe GCC Waste Management Industry Volume (Billion), by Waste Type 2025 & 2033

- Figure 29: Europe GCC Waste Management Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 30: Europe GCC Waste Management Industry Volume Share (%), by Waste Type 2025 & 2033

- Figure 31: Europe GCC Waste Management Industry Revenue (Million), by Disposal Method 2025 & 2033

- Figure 32: Europe GCC Waste Management Industry Volume (Billion), by Disposal Method 2025 & 2033

- Figure 33: Europe GCC Waste Management Industry Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 34: Europe GCC Waste Management Industry Volume Share (%), by Disposal Method 2025 & 2033

- Figure 35: Europe GCC Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe GCC Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe GCC Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe GCC Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa GCC Waste Management Industry Revenue (Million), by Waste Type 2025 & 2033

- Figure 40: Middle East & Africa GCC Waste Management Industry Volume (Billion), by Waste Type 2025 & 2033

- Figure 41: Middle East & Africa GCC Waste Management Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 42: Middle East & Africa GCC Waste Management Industry Volume Share (%), by Waste Type 2025 & 2033

- Figure 43: Middle East & Africa GCC Waste Management Industry Revenue (Million), by Disposal Method 2025 & 2033

- Figure 44: Middle East & Africa GCC Waste Management Industry Volume (Billion), by Disposal Method 2025 & 2033

- Figure 45: Middle East & Africa GCC Waste Management Industry Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 46: Middle East & Africa GCC Waste Management Industry Volume Share (%), by Disposal Method 2025 & 2033

- Figure 47: Middle East & Africa GCC Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa GCC Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa GCC Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa GCC Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific GCC Waste Management Industry Revenue (Million), by Waste Type 2025 & 2033

- Figure 52: Asia Pacific GCC Waste Management Industry Volume (Billion), by Waste Type 2025 & 2033

- Figure 53: Asia Pacific GCC Waste Management Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 54: Asia Pacific GCC Waste Management Industry Volume Share (%), by Waste Type 2025 & 2033

- Figure 55: Asia Pacific GCC Waste Management Industry Revenue (Million), by Disposal Method 2025 & 2033

- Figure 56: Asia Pacific GCC Waste Management Industry Volume (Billion), by Disposal Method 2025 & 2033

- Figure 57: Asia Pacific GCC Waste Management Industry Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 58: Asia Pacific GCC Waste Management Industry Volume Share (%), by Disposal Method 2025 & 2033

- Figure 59: Asia Pacific GCC Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific GCC Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific GCC Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific GCC Waste Management Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Waste Management Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: Global GCC Waste Management Industry Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: Global GCC Waste Management Industry Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 4: Global GCC Waste Management Industry Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 5: Global GCC Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global GCC Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global GCC Waste Management Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 8: Global GCC Waste Management Industry Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 9: Global GCC Waste Management Industry Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 10: Global GCC Waste Management Industry Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 11: Global GCC Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global GCC Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Waste Management Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 20: Global GCC Waste Management Industry Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 21: Global GCC Waste Management Industry Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 22: Global GCC Waste Management Industry Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 23: Global GCC Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global GCC Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global GCC Waste Management Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 32: Global GCC Waste Management Industry Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 33: Global GCC Waste Management Industry Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 34: Global GCC Waste Management Industry Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 35: Global GCC Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global GCC Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global GCC Waste Management Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 56: Global GCC Waste Management Industry Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 57: Global GCC Waste Management Industry Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 58: Global GCC Waste Management Industry Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 59: Global GCC Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global GCC Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global GCC Waste Management Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 74: Global GCC Waste Management Industry Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 75: Global GCC Waste Management Industry Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 76: Global GCC Waste Management Industry Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 77: Global GCC Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global GCC Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific GCC Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific GCC Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Waste Management Industry?

The projected CAGR is approximately 7.38%.

2. Which companies are prominent players in the GCC Waste Management Industry?

Key companies in the market include Averda, EnviroServe, Suez Middle East Recycling LLC, Green Mountains, Veolia, Blue LLC, Envac, SEPCO Environment, Wasco, Saudi Investment Recycling Company, Dulsco Waste Management Services, Bee'ah, Power Waste Management and Transport LLC, Al Haya Enviro, Bin-Ovation, United Waste Management Company, Kuwait Waste Collection and Recycling Company**List Not Exhaustive.

3. What are the main segments of the GCC Waste Management Industry?

The market segments include Waste Type, Disposal Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.56 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for mining waste co-disposable.

6. What are the notable trends driving market growth?

Increasing E-waste Generation in Gulf Cooperation Council Region.

7. Are there any restraints impacting market growth?

4.; Increasing demand for mining waste co-disposable.

8. Can you provide examples of recent developments in the market?

December 2023: Electric mobility firm Wardwizard Innovations and Mobility entered into an agreement with the Sharjah Government co-owned sustainable waste management company BEEAH Group (BG) for the manufacturing of electric vehicles. Under this collaboration, Wardwizard Innovations and Mobility, along with BEEAH Group, will jointly promote electric vehicles in GCC nations and the African region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Waste Management Industry?

To stay informed about further developments, trends, and reports in the GCC Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence