Key Insights

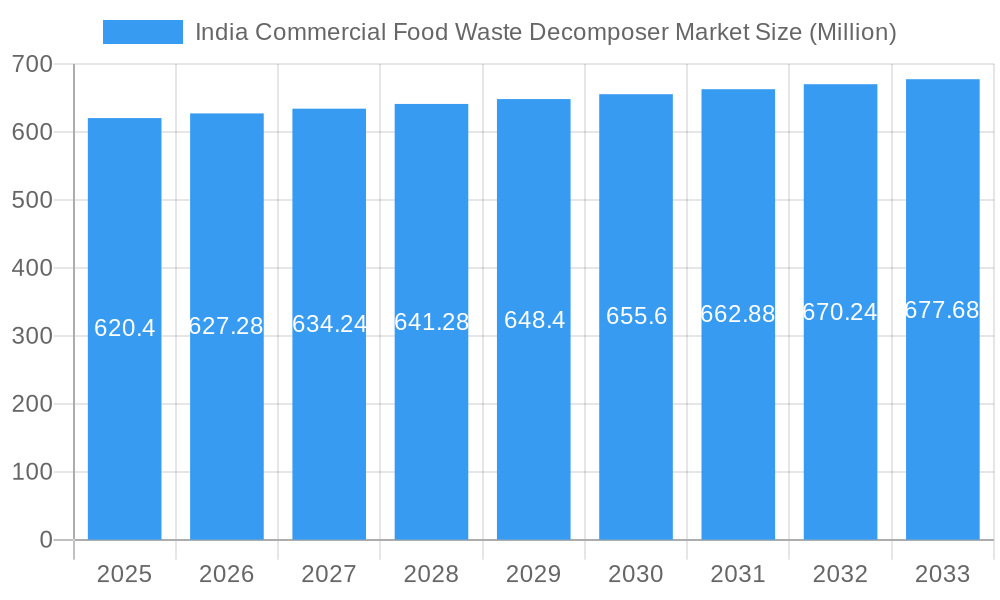

The India Commercial Food Waste Decomposer market, valued at $620.40 million in 2025, exhibits a modest Compound Annual Growth Rate (CAGR) of 1.15% from 2025 to 2033. This relatively low CAGR suggests a market currently characterized by steady, rather than explosive, growth. Several factors contribute to this. Increasing awareness of sustainable waste management practices among commercial establishments, coupled with stricter government regulations on food waste disposal, are key drivers. The rising popularity of eco-friendly solutions and the potential cost savings associated with reduced landfill fees further fuel market expansion. However, high initial investment costs for decomposer systems and a lack of widespread awareness in certain regions may act as restraints. The market is likely segmented by technology type (e.g., anaerobic digestion, composting), capacity, and end-user (e.g., hotels, restaurants, hospitals). Key players like Zigma Machinery & Equipment Solutions, Kings Industries, and others are competing primarily on factors such as technology efficiency, cost-effectiveness, and after-sales service. The market's future trajectory hinges on effective government incentives promoting adoption and technological advancements leading to more efficient and affordable decomposer systems.

India Commercial Food Waste Decomposer Market Market Size (In Million)

Looking ahead, the market is expected to witness gradual growth, primarily driven by the ongoing expansion of the hospitality and food service sectors, alongside heightened environmental consciousness. Furthermore, technological innovation, such as the development of more compact and automated systems suitable for smaller commercial spaces, could unlock new market segments and accelerate growth. Addressing the restraints through targeted awareness campaigns, financial support programs, and potentially standardized regulations could significantly impact market expansion in the coming years. The presence of established players alongside emerging companies suggests a competitive landscape ripe for innovation and market share consolidation. The long-term outlook suggests steady, albeit modest, growth, with the potential for faster expansion subject to successful mitigation of current market restraints and the successful integration of innovative technologies.

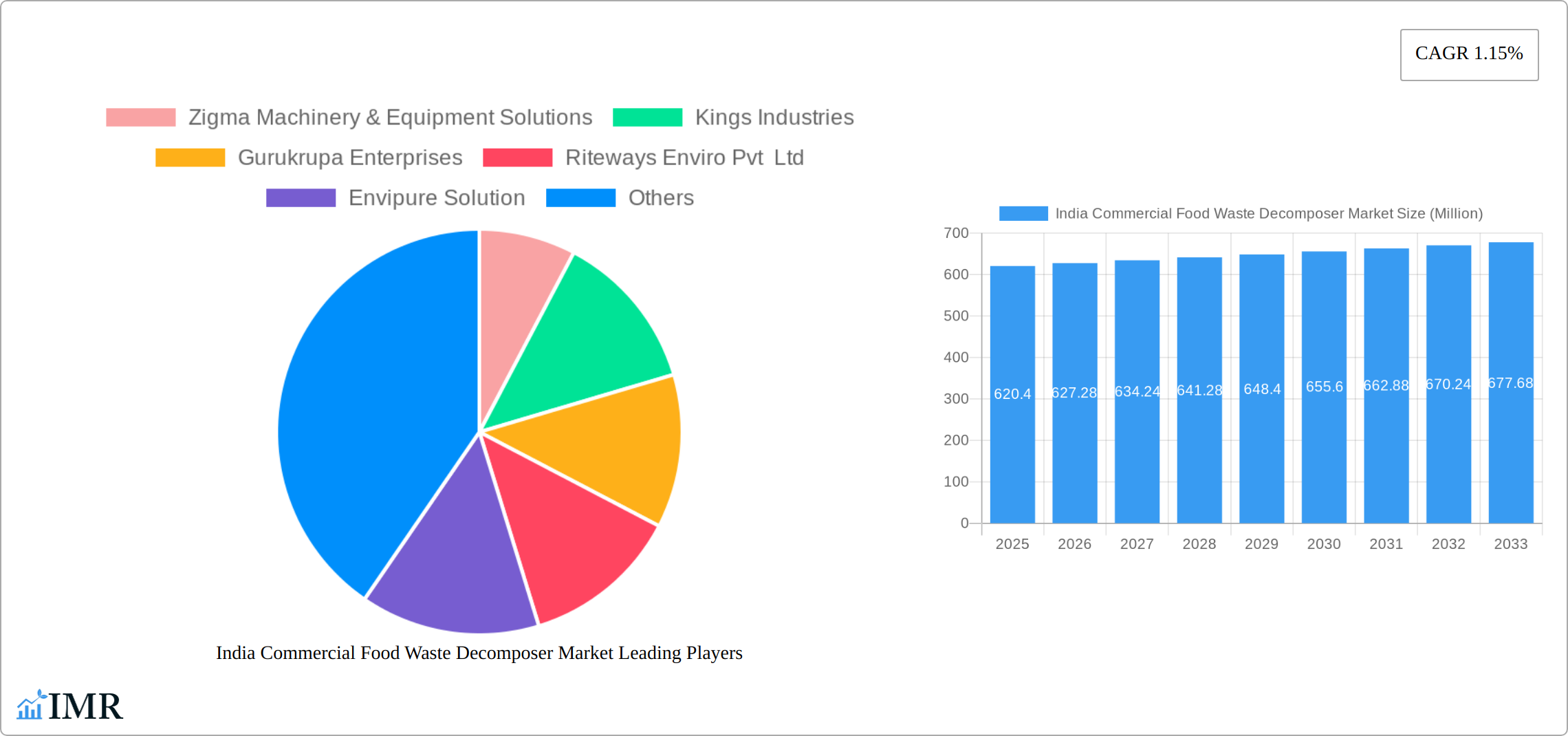

India Commercial Food Waste Decomposer Market Company Market Share

India Commercial Food Waste Decomposer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Commercial Food Waste Decomposer Market, encompassing market dynamics, growth trends, regional insights, and key player analysis. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable data for businesses and investors seeking to navigate this burgeoning sector. The parent market is the broader waste management industry in India, while the child market focuses specifically on commercial food waste decomposers. The market size is projected to reach xx Million units by 2033.

India Commercial Food Waste Decomposer Market Dynamics & Structure

The Indian commercial food waste decomposer market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, driven by the need for efficient and sustainable waste management solutions, is a significant driver. Stringent regulatory frameworks promoting waste reduction and environmental protection are further shaping market growth. Competitive substitutes, such as landfills and incineration, continue to exist, although concerns over environmental impact and cost-effectiveness are pushing adoption towards decomposers. The end-user demographics consist primarily of restaurants, hotels, food processing facilities, and commercial kitchens. M&A activity, as exemplified by Whirlpool's acquisition of InSinkErator in April 2022, indicates industry consolidation and a focus on expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Focus on automation, improved efficiency, and reduced environmental footprint.

- Regulatory Framework: Increasingly stringent regulations promoting sustainable waste management.

- Competitive Substitutes: Landfills, incineration, but facing challenges regarding sustainability and cost.

- End-User Demographics: Restaurants, hotels, food processing units, commercial kitchens.

- M&A Trends: Consolidation through acquisitions, aiming for broader market penetration (e.g., Whirlpool's acquisition of InSinkErator). XX M&A deals were recorded between 2019 and 2024.

India Commercial Food Waste Decomposer Market Growth Trends & Insights

The Indian commercial food waste decomposer market is experiencing robust expansion, fueled by a confluence of escalating environmental consciousness, increasingly stringent waste management mandates, and a growing imperative for sanitary food handling across diverse commercial establishments. The market size witnessed a significant Compound Annual Growth Rate (CAGR) of [Insert Actual CAGR for 2019-2024]% during the 2019-2024 period. Projections indicate sustained momentum, with an anticipated CAGR of [Insert Projected CAGR for 2025-2033]% from 2025 to 2033, aiming for an impressive market valuation of [Insert Projected Market Value in Million Units by 2033] Million units by the end of 2033. Continuous innovation, particularly in developing highly efficient, user-friendly, and cost-effective decomposer solutions, is a pivotal factor driving market adoption. Evolving consumer and corporate preferences leaning towards eco-friendly operational practices are also playing a crucial role in stimulating demand. With an estimated market penetration of [Insert Estimated Market Penetration % in 2025]% in 2025, the market presents substantial untapped potential for widespread adoption across various commercial sectors.

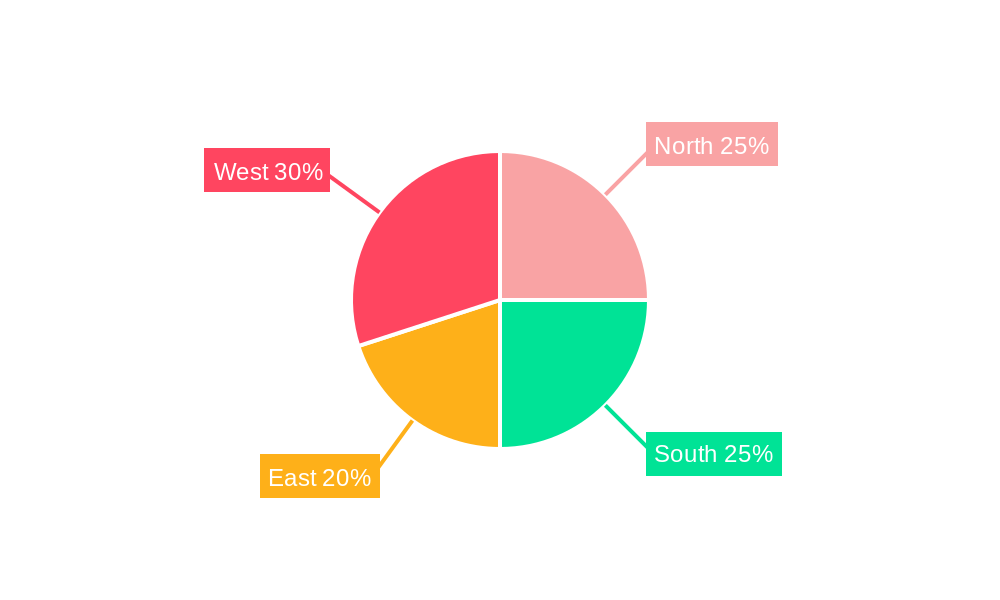

Dominant Regions, Countries, or Segments in India Commercial Food Waste Decomposer Market

The market's growth is largely driven by metropolitan cities in India like Mumbai, Delhi, Bengaluru, and Chennai which are experiencing rapid urbanization and high density of commercial establishments. These regions exhibit higher awareness of sustainable practices and stricter waste management regulations. Key drivers in these regions include robust infrastructure, supportive government policies, and high concentration of target end-users. However, Tier-2 and Tier-3 cities also represent significant untapped potential.

- Key Drivers:

- Stringent waste management regulations in major cities.

- Increasing awareness of environmental sustainability amongst businesses.

- Growing demand for hygienic food handling in commercial settings.

- Government initiatives promoting sustainable waste management practices.

- Dominance Factors:

- High concentration of commercial establishments.

- Improved infrastructure and waste disposal systems.

- Higher consumer awareness and adoption rates.

India Commercial Food Waste Decomposer Market Product Landscape

The Indian market for commercial food waste decomposers is characterized by a dynamic and diversified product portfolio, catering to a spectrum of waste treatment needs. Key technologies available include advanced anaerobic digestion systems, efficient aerobic composting units, and sophisticated enzymatic breakdown solutions. Product development is keenly focused on optimizing decomposition rates, minimizing energy footprints, and enhancing overall environmental sustainability. Leading manufacturers are emphasizing features such as automated operational cycles, space-saving modular designs ideal for compact commercial kitchens, and intuitive digital interfaces for simplified operation. Prioritizing ease of maintenance and minimal operational disruptions is paramount for these solutions. Prominent unique selling propositions often highlight accelerated waste processing capabilities, significant reduction in odor generation, and the versatility to handle a broad spectrum of food waste compositions, from vegetable scraps to meat residues.

Key Drivers, Barriers & Challenges in India Commercial Food Waste Decomposer Market

Key Drivers:

- Heightened environmental responsibility and corporate sustainability goals among businesses.

- Increasingly stringent government regulations and enforcement of waste segregation and disposal norms.

- Growing emphasis on maintaining high standards of hygiene and sanitation in commercial food service environments.

- Continuous technological advancements leading to enhanced decomposition efficiency, reduced operating costs, and improved user experience.

- Rising awareness of the circular economy principles and the benefits of waste valorization.

Challenges & Restraints:

- Significant initial capital investment required for purchasing and installing advanced decomposer systems.

- Gaps in understanding and awareness regarding the operational benefits and long-term cost savings of these technologies among potential clients.

- Scarcity of adequately trained and skilled personnel for the effective operation and maintenance of sophisticated decomposer units.

- Potential disruptions in the supply chain for critical components, impacting manufacturing and timely delivery.

- Perceived complexity of some technologies and resistance to adopting new operational procedures.

Emerging Opportunities in India Commercial Food Waste Decomposer Market

- Significant potential for market penetration in Tier-2 and Tier-3 cities, driven by rapid urbanization and burgeoning commercial activities.

- Development of highly customized and scalable decomposer solutions tailored to the unique waste generation patterns and operational requirements of specific commercial segments, such as fine-dining restaurants, catering services, and food processing units.

- Integration of advanced IoT and AI-powered smart technologies for real-time performance monitoring, predictive maintenance, remote diagnostics, and optimized operational efficiency.

- Exploring and capitalizing on the valuable byproduct generation potential from food waste decomposition, including the production of renewable energy (biogas) and high-quality organic compost for agricultural applications.

- Collaborations with urban local bodies and municipal corporations to establish decentralized waste management solutions for commercial districts.

Growth Accelerators in the India Commercial Food Waste Decomposer Market Industry

Government-backed initiatives, including financial incentives, subsidies, and tax benefits for adopting sustainable waste management technologies, are poised to act as significant catalysts for market expansion. Strategic alliances and partnerships between leading decomposer technology manufacturers, waste management service providers, and key industry stakeholders are expected to streamline market access, foster innovation, and accelerate widespread adoption. Geographic expansion into underserved regions and a focused approach to engaging with smaller and medium-sized commercial establishments will unlock substantial growth avenues. Furthermore, ongoing technological breakthroughs, concentrating on enhancing decomposition speeds, lowering energy consumption, reducing operational expenses, and improving the overall efficacy of waste processing, will undoubtedly propel long-term market growth and solidify India's position in this crucial sector.

Key Players Shaping the India Commercial Food Waste Decomposer Market Market

- Zigma Machinery & Equipment Solutions

- Kings Industries

- Gurukrupa Enterprises

- Riteways Enviro Pvt Ltd

- Envipure Solution

- Vakratund Invention India Private Limited

- Reva Engineering Enterprises

- Ecopollutech Engineers

- Greenrich Grow India Private Limited

- Greenshield Enviro (List Not Exhaustive)

Notable Milestones in India Commercial Food Waste Decomposer Market Sector

- April 2022: Whirlpool Corporation acquired InSinkErator, expanding its food waste disposal product line and market reach.

- September 2023: InSinkErator launched new garbage disposals designed for faster and more environmentally friendly food waste management.

In-Depth India Commercial Food Waste Decomposer Market Market Outlook

The India commercial food waste decomposer market is poised for significant expansion over the forecast period, driven by a confluence of factors including increasing environmental awareness, stringent government regulations, and technological advancements. Strategic partnerships, technological innovations, and market expansion into underpenetrated regions will create lucrative opportunities for businesses operating within this sector. The market's future potential is substantial, offering significant returns for early entrants and those capable of adapting to evolving market demands.

India Commercial Food Waste Decomposer Market Segmentation

-

1. Machine Type

- 1.1. Continuous Composters

- 1.2. Batch Composters

-

2. Application

- 2.1. Agricultural

- 2.2. Restaurants & Hotels

- 2.3. Food Processing Industries

-

3. Sales Channel

- 3.1. Direct Sales

- 3.2. Distributor

-

4. Capacity

- 4.1. Small-Scale

- 4.2. Medium-Scale

- 4.3. Large-Scale

India Commercial Food Waste Decomposer Market Segmentation By Geography

- 1. India

India Commercial Food Waste Decomposer Market Regional Market Share

Geographic Coverage of India Commercial Food Waste Decomposer Market

India Commercial Food Waste Decomposer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.3. Market Restrains

- 3.3.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.4. Market Trends

- 3.4.1. Growing Food Service Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Food Waste Decomposer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Continuous Composters

- 5.1.2. Batch Composters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agricultural

- 5.2.2. Restaurants & Hotels

- 5.2.3. Food Processing Industries

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. Small-Scale

- 5.4.2. Medium-Scale

- 5.4.3. Large-Scale

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zigma Machinery & Equipment Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kings Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gurukrupa Enterprises

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riteways Enviro Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Envipure Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vakratund Invention India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reva Engineering Enterprises

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ecopollutech Engineers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Greenrich Grow India Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greenshield Enviro**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zigma Machinery & Equipment Solutions

List of Figures

- Figure 1: India Commercial Food Waste Decomposer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Commercial Food Waste Decomposer Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 3: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 8: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 9: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 12: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 13: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 15: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 16: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 17: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 18: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 19: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Food Waste Decomposer Market?

The projected CAGR is approximately 1.15%.

2. Which companies are prominent players in the India Commercial Food Waste Decomposer Market?

Key companies in the market include Zigma Machinery & Equipment Solutions, Kings Industries, Gurukrupa Enterprises, Riteways Enviro Pvt Ltd, Envipure Solution, Vakratund Invention India Private Limited, Reva Engineering Enterprises, Ecopollutech Engineers, Greenrich Grow India Private Limited, Greenshield Enviro**List Not Exhaustive.

3. What are the main segments of the India Commercial Food Waste Decomposer Market?

The market segments include Machine Type, Application, Sales Channel, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 620.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

6. What are the notable trends driving market growth?

Growing Food Service Industry Drives the Market.

7. Are there any restraints impacting market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

8. Can you provide examples of recent developments in the market?

September 2023: InSinkErator introduced new garbage disposals in the market. The new garbage disposal aims to grind a variety of wastes quickly and provide environmentally friendly solutions for managing food waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Food Waste Decomposer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Food Waste Decomposer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Food Waste Decomposer Market?

To stay informed about further developments, trends, and reports in the India Commercial Food Waste Decomposer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence