Key Insights

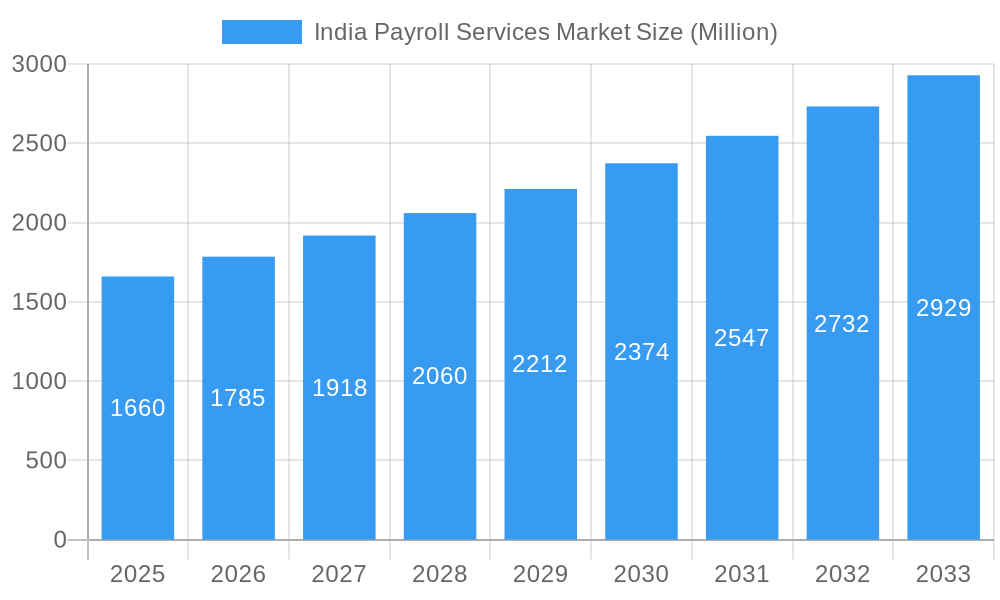

The India Payroll Services Market is experiencing robust growth, projected to reach \$1.66 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.49% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud-based payroll solutions offers businesses enhanced scalability, cost-effectiveness, and improved data security. Furthermore, the rising number of small and medium-sized enterprises (SMEs) in India, coupled with stringent government regulations regarding payroll compliance, fuels the demand for efficient and reliable payroll management services. Automation and the integration of artificial intelligence (AI) are streamlining payroll processes, leading to increased accuracy and reduced processing time. The market's growth is also influenced by the expanding gig economy, requiring sophisticated payroll solutions to manage diverse payment structures and compliance requirements for a non-traditional workforce. Finally, the growing focus on employee experience and enhancing overall HR efficiency further contributes to the market's positive trajectory.

India Payroll Services Market Market Size (In Billion)

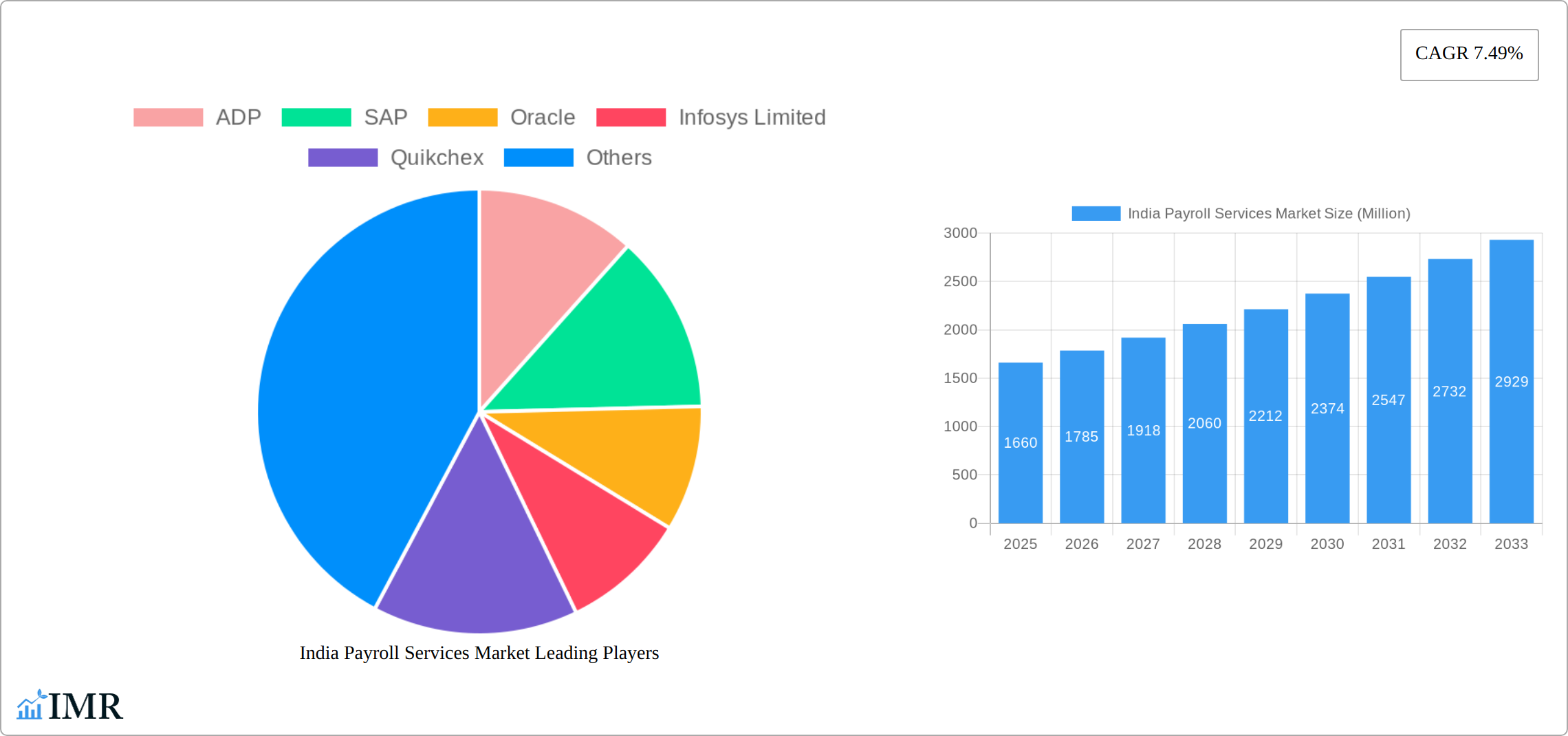

Major players like ADP, SAP, Oracle, Infosys, and several domestic players are actively shaping the market landscape through technological innovations and strategic partnerships. Competitive pressures are likely to intensify, driving further improvements in service quality and affordability. While challenges such as data security concerns and the need for continuous adaptation to evolving regulations remain, the overall outlook for the India Payroll Services Market is optimistic, indicating sustained growth and expansion in the coming years. The market is poised to benefit from continued digital transformation within Indian businesses, a growing focus on employee well-being, and ongoing improvements in technology which contribute to improved efficiency and reduced costs within the payroll processing sector.

India Payroll Services Market Company Market Share

India Payroll Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Payroll Services Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by [Insert Segment Details Here - e.g., by enterprise size (SME, Large Enterprises), by deployment type (Cloud, On-Premise), by industry vertical (IT, BFSI, Manufacturing, etc.)]. The total market size in 2025 is estimated at XX Million, and is projected to reach XX Million by 2033.

India Payroll Services Market Dynamics & Structure

The Indian payroll services market is characterized by a moderately concentrated structure, with key players like ADP, SAP, Oracle, Infosys Limited, Quikchex, Paysquare, ZingHR, Excelity Global, Hinduja Global Solutions, and Osourc holding significant market share. However, the market also exhibits considerable fragmentation, with numerous smaller players catering to niche segments.

Technological innovation is a primary driver, with cloud-based solutions and AI-powered automation gaining significant traction. The regulatory framework, including labor laws and tax regulations, significantly influences market dynamics. The increasing adoption of HR technology and the rising demand for efficient and compliant payroll management are fueling market growth.

- Market Concentration: The top 5 players hold approximately XX% of the market share in 2025.

- Technological Drivers: Cloud computing, AI, and machine learning are disrupting the traditional payroll landscape.

- Regulatory Framework: Compliance with labor laws and tax regulations presents both challenges and opportunities.

- Competitive Substitutes: In-house payroll solutions and spreadsheets represent a competitive substitute but lack scalability and advanced features.

- M&A Trends: The number of M&A deals in the sector has increased by XX% from 2020 to 2024, indicating consolidation efforts within the market. The average deal value is approximately XX Million.

India Payroll Services Market Growth Trends & Insights

The Indian payroll services market has witnessed robust growth over the past few years, driven by factors such as increasing digitization, rising adoption of cloud-based solutions, and the growing need for efficient and accurate payroll processing. The market size has expanded at a CAGR of XX% during the historical period (2019-2024) and is projected to maintain a strong CAGR of XX% during the forecast period (2025-2033). The market penetration rate for cloud-based payroll solutions is currently at approximately XX% and is expected to increase significantly in the coming years. This growth is fueled by the increasing adoption of cloud-based solutions by SMEs and large enterprises alike, driven by factors such as cost-effectiveness, scalability, and enhanced security. Shifting consumer behavior towards self-service payroll portals is also contributing to market expansion. Technological disruptions, particularly the integration of AI and machine learning, are reshaping payroll processes, leading to increased automation and improved accuracy.

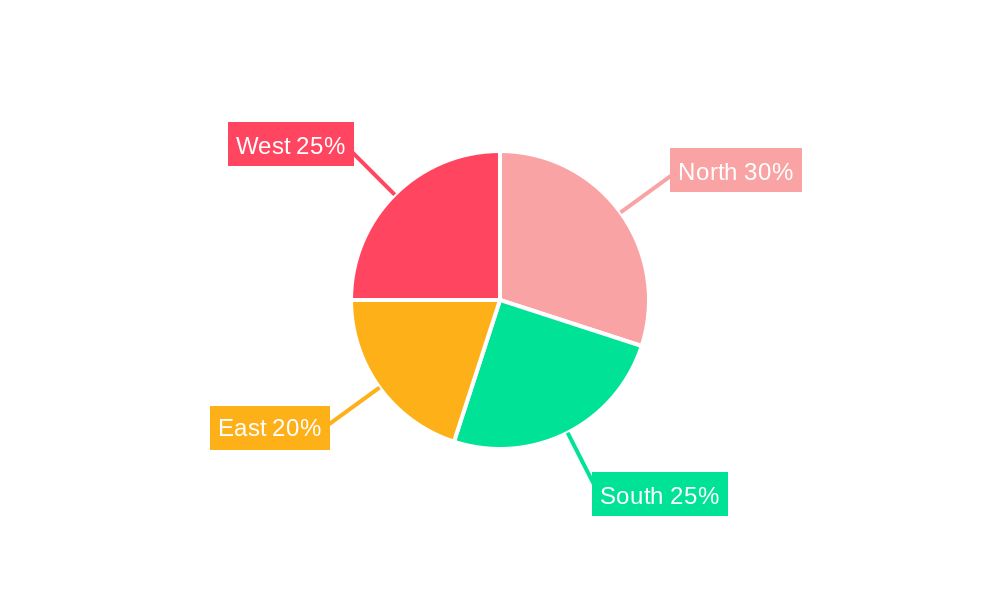

Dominant Regions, Countries, or Segments in India Payroll Services Market

The major metropolitan areas of India, including Mumbai, Delhi, Bengaluru, and Hyderabad, dominate the payroll services market due to their high concentration of businesses and a large workforce. These regions benefit from advanced infrastructure, a skilled workforce, and a favorable business environment. The IT and BFSI sectors are the leading consumers of payroll services, driven by their large employee bases and complex compensation structures.

- Key Drivers:

- Strong economic growth and increasing urbanization.

- Favorable government policies promoting digitalization.

- Growing adoption of cloud-based solutions.

- High concentration of businesses and skilled workforce in major cities.

- Dominance Factors:

- High market share and rapid growth potential in major metropolitan areas.

- Strong demand from IT and BFSI sectors.

- Advanced infrastructure and skilled IT workforce.

India Payroll Services Market Product Landscape

The India Payroll Services Market product landscape is dynamic and evolving, characterized by a robust offering of cloud-based payroll solutions, comprehensive on-premise payroll software, and flexible outsourced payroll services. Recent innovations are heavily influenced by advancements in artificial intelligence, leading to AI-powered features that significantly enhance accuracy, automate complex processes, and drive operational efficiency. Furthermore, there's a pronounced trend towards integrated HR and talent management solutions, enabling a holistic approach to workforce management. Key selling propositions that resonate with businesses include fortified data security measures, streamlined compliance with India's intricate regulatory framework, and a demonstrable reduction in operational costs. The industry is actively embracing the integration of advanced analytics and sophisticated reporting tools, empowering businesses with deeper, actionable insights derived from their payroll data.

Key Drivers, Barriers & Challenges in India Payroll Services Market

Key Drivers:

- The accelerating adoption of scalable and accessible cloud-based payroll solutions across businesses of all sizes.

- A surging demand for automation and efficiency in payroll processing to minimize manual errors and time expenditure.

- The indispensable need to adhere to increasingly stringent government regulations and compliance mandates pertaining to payroll.

- A continuous and rising requirement for highly accurate and exceptionally timely payroll processing to ensure employee satisfaction and operational continuity.

- The growing formalization of the Indian workforce and the expansion of the gig economy, necessitating structured payroll solutions.

Challenges and Restraints:

- Persistent data security and privacy concerns surrounding the handling of highly sensitive employee information, requiring robust protective measures.

- The substantial implementation and ongoing maintenance costs associated with sophisticated, feature-rich payroll systems, particularly for SMEs.

- A discernible lack of awareness and slower adoption rates of advanced payroll technologies in certain traditional sectors and micro-enterprises.

- The inherent complexity and frequent changes in labor laws and tax regulations across diverse states and union territories within India, posing a significant compliance hurdle.

- Resistance to change and a preference for manual processes among a segment of the workforce.

Emerging Opportunities in India Payroll Services Market

- Significant untapped market potential exists in tier-2 and tier-3 cities and smaller towns, where digital infrastructure and awareness are growing.

- A burgeoning demand for specialized and customized payroll solutions tailored to the unique needs of specific industries such as IT, manufacturing, healthcare, and retail.

- The accelerated adoption of mobile-based payroll applications, catering to a mobile-first demographic and providing on-the-go access to payroll information and management.

- Ample opportunities for strategic partnerships and seamless integrations with other HR technology platforms, CRM systems, and financial software to create a unified business ecosystem.

- The increasing focus on employee benefits management, including provident fund (PF), employee state insurance (ESI), and gratuity, presents opportunities for specialized payroll add-ons.

- The rise of remote work models is driving the need for payroll solutions that can effectively manage geographically dispersed workforces and comply with varied regional regulations.

Growth Accelerators in the India Payroll Services Market Industry

The long-term growth of the Indian payroll services market will be significantly influenced by technological advancements like AI-driven automation, the increasing adoption of cloud-based solutions, and strategic partnerships between payroll providers and HR technology companies. Expanding into underserved markets, such as rural areas and smaller businesses, also presents significant growth opportunities.

Key Players Shaping the India Payroll Services Market Market

- ADP

- SAP

- Oracle

- Infosys Limited

- Quikchex

- Paysquare

- ZingHR

- Excelity Global

- Hinduja Global Solutions

- Osourc

- Payrow

- FloatPays

- SuperWorks

- HR Mantra

- Payroll Cloud

Notable Milestones in India Payroll Services Market Sector

- February 2024: ADP enhanced its HR tools with generative AI for streamlined payroll validation.

- March 2024: Alight Inc. partnered with SAP to integrate its Worklife platform with SAP S/4HANA Cloud, creating a cutting-edge cloud-based payroll solution.

In-Depth India Payroll Services Market Market Outlook

The future trajectory of the Indian payroll services market is exceptionally promising, fueled by a confluence of factors including relentless technological advancements, a continuously growing demand for highly efficient and meticulously compliant payroll solutions, and the robust expansion of India's digital economy. Strategic alliances, astute mergers and acquisitions, and the unceasing development of intuitive, AI-powered payroll platforms are poised to unlock significant avenues for growth and market penetration. An unwavering focus on data security and adherence to regulatory frameworks will continue to be a dominant force in shaping market dynamics, creating substantial opportunities for providers of specialized solutions and value-added services. The market is expected to witness increased consolidation and a greater emphasis on end-to-end HR technology integration, positioning payroll services as a cornerstone of comprehensive human capital management.

India Payroll Services Market Segmentation

-

1. Type

- 1.1. Hybrid

- 1.2. Fully Outsourced

-

2. Organization Size

- 2.1. Small and Medium-Sized Enterprises

- 2.2. Large Enterprises

-

3. End-User

- 3.1. BFSI

- 3.2. Consumer and Industrial Products

- 3.3. IT and Telecommunication

- 3.4. Public Sector

- 3.5. Healthcare

- 3.6. Other End Users

India Payroll Services Market Segmentation By Geography

- 1. India

India Payroll Services Market Regional Market Share

Geographic Coverage of India Payroll Services Market

India Payroll Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 3.3. Market Restrains

- 3.3.1. The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Cloud Services Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Payroll Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hybrid

- 5.1.2. Fully Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium-Sized Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. BFSI

- 5.3.2. Consumer and Industrial Products

- 5.3.3. IT and Telecommunication

- 5.3.4. Public Sector

- 5.3.5. Healthcare

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SAP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oracle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infosys Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quikchex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paysquare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZingHR

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Excelity Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hinduja Global Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Osourc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP

List of Figures

- Figure 1: India Payroll Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Payroll Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Payroll Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: India Payroll Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: India Payroll Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: India Payroll Services Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 7: India Payroll Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Payroll Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: India Payroll Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: India Payroll Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: India Payroll Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: India Payroll Services Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 15: India Payroll Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Payroll Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Payroll Services Market?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the India Payroll Services Market?

Key companies in the market include ADP, SAP, Oracle, Infosys Limited, Quikchex, Paysquare, ZingHR, Excelity Global, Hinduja Global Solutions, Osourc.

3. What are the main segments of the India Payroll Services Market?

The market segments include Type, Organization Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.66 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape.

6. What are the notable trends driving market growth?

Technological Advancements and Cloud Services Driving the Market.

7. Are there any restraints impacting market growth?

The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape.

8. Can you provide examples of recent developments in the market?

March 2024: Alight Inc., a prominent provider of cloud-based human capital and technology services, enhanced its partnership with SAP. Through this collaboration, Alight's Worklife platform will harness the power of SAP S/4HANA Cloud, introducing a cutting-edge, cloud-based payroll solution. This innovative system not only boosts payroll efficiency and performance but also fortifies security measures for handling sensitive employee and organizational data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Payroll Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Payroll Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Payroll Services Market?

To stay informed about further developments, trends, and reports in the India Payroll Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence