Key Insights

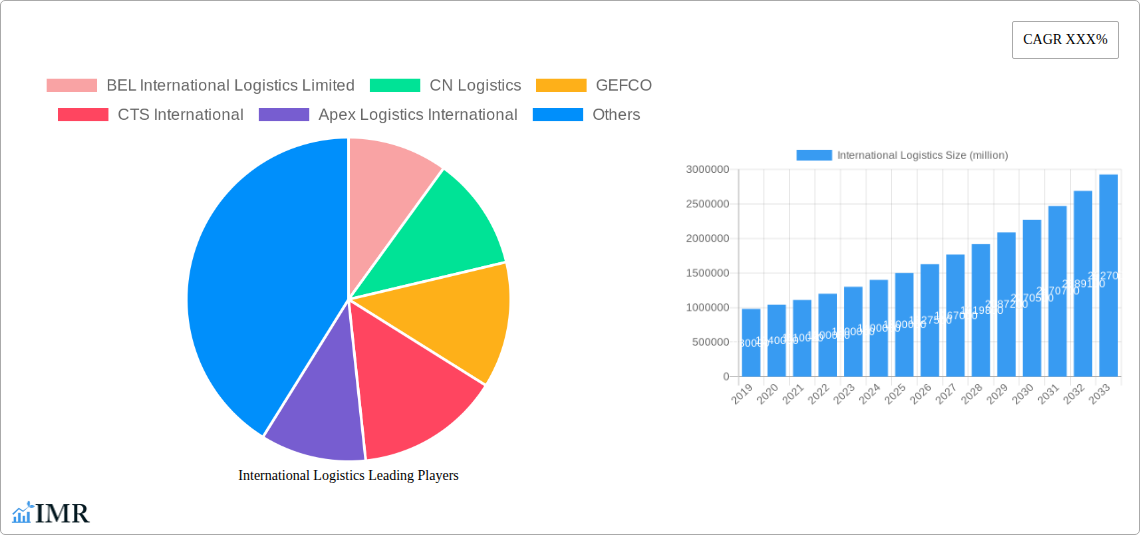

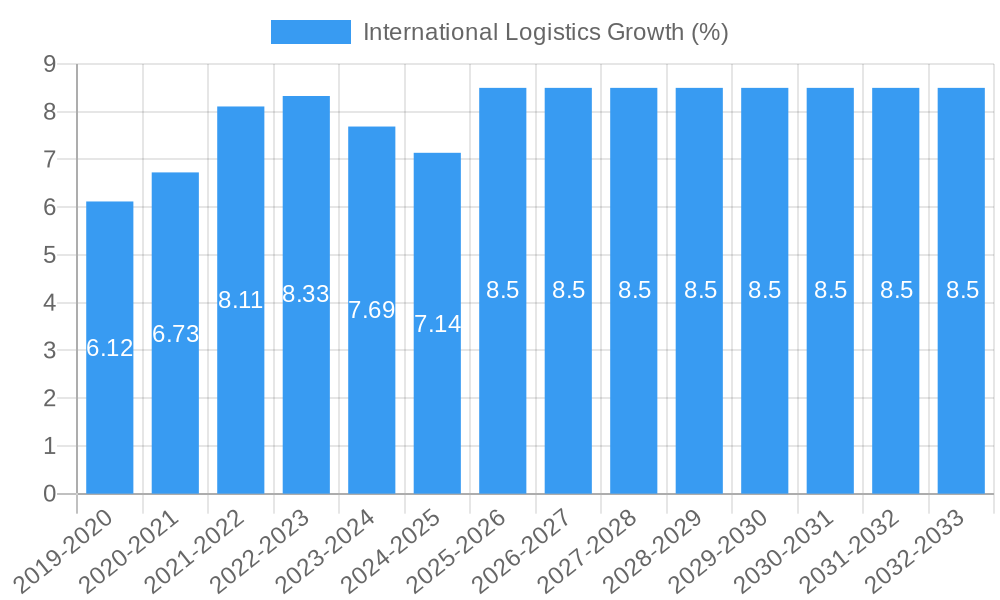

The global international logistics market is poised for substantial growth, driven by escalating cross-border trade and the increasing complexity of global supply chains. With a projected market size reaching an estimated $1,500,000 million by 2025, this sector is experiencing a robust Compound Annual Growth Rate (CAGR) of approximately 8.5%. This expansion is primarily fueled by the insatiable demand from key industries such as Manufacturing and Automotive, Oil and Gas, and Mining and Quarrying, which rely heavily on efficient and reliable international transportation and warehousing solutions. Furthermore, the burgeoning e-commerce sector and the growing adoption of advanced technologies like automation and AI in logistics operations are acting as significant catalysts, enhancing operational efficiency and service delivery. The increasing emphasis on value-added services, including customs brokerage, freight forwarding, and supply chain optimization, further contributes to the market's upward trajectory.

Despite the optimistic outlook, the international logistics market faces certain restraints. Geopolitical instability, trade protectionism, and fluctuating fuel prices can introduce volatility and increase operational costs. Additionally, stringent regulatory frameworks in different regions and the persistent challenge of infrastructure limitations in developing economies can pose hurdles to seamless international trade. However, the market's resilience is evident in the continuous innovation and strategic partnerships being forged among leading players like A.P. Moller-Maersk, DHL, and FedEx. These collaborations aim to address these challenges by optimizing routes, enhancing visibility, and developing more sustainable logistics solutions. The market is segmenting further, with transportation services forming the largest share, followed by warehousing and value-added services, indicating a shift towards integrated logistics offerings that cater to diverse client needs across various applications and geographies.

International Logistics Market: Comprehensive Report 2019-2033

This report provides an in-depth analysis of the global International Logistics market, encompassing its dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and future outlook. Covering the historical period from 2019-2024, the base year of 2025, and a forecast period from 2025-2033, this study offers actionable insights for industry stakeholders. We delve into parent and child market segments, utilizing high-traffic keywords to maximize search engine visibility and engage industry professionals. All values are presented in million units.

International Logistics Market Dynamics & Structure

The international logistics market is characterized by a highly concentrated structure, with a few dominant players holding significant market share. Technological innovation serves as a primary driver, with advancements in AI-powered route optimization, IoT for real-time tracking, and blockchain for enhanced transparency revolutionizing operational efficiency. Regulatory frameworks, particularly concerning trade agreements, customs procedures, and environmental standards, significantly influence market entry and operational costs. While direct product substitutes are limited within core logistics functions, alternative supply chain models and in-house logistics solutions present competitive pressures. End-user demographics are increasingly sophisticated, demanding faster delivery times, greater visibility, and sustainable logistics practices. Mergers and acquisitions (M&A) are prevalent, consolidating market share and expanding service portfolios.

- Market Concentration: Top 5 players estimated to hold over 60% of the global market share by value in 2025.

- Technological Innovation Drivers:

- Adoption of AI in demand forecasting and route planning.

- Increased use of IoT devices for cargo monitoring and condition assessment.

- Emergence of blockchain for secure and traceable supply chains.

- Regulatory Frameworks: Trade policies and customs regulations impacting cross-border movements.

- Competitive Product Substitutes: Shift towards digitalization and automation reducing reliance on traditional manual processes.

- End-User Demographics: Growing demand for e-commerce fulfillment and last-mile delivery solutions.

- M&A Trends: Estimated M&A deal volume of $25,000 million in the historical period (2019-2024), driven by consolidation and service expansion.

International Logistics Growth Trends & Insights

The global international logistics market is poised for robust growth, driven by escalating global trade volumes, the ever-expanding e-commerce sector, and the increasing complexity of global supply chains. The market size is projected to grow from an estimated $850,000 million in 2025 to over $1,100,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5%. Adoption rates of advanced technologies such as automation in warehousing, predictive analytics for inventory management, and sustainable logistics solutions are accelerating. Technological disruptions, including the integration of autonomous vehicles and drones for last-mile delivery, are reshaping operational models. Consumer behavior shifts, particularly the demand for faster, more flexible, and environmentally conscious delivery options, are further fueling market expansion. The interplay of these factors is creating a dynamic and evolving landscape for international logistics providers.

- Market Size Evolution: Projected growth from $850,000 million in 2025 to $1,100,000 million by 2033.

- CAGR: Estimated 4.5% during the forecast period (2025-2033).

- Adoption Rates: Increasing uptake of automation and digital solutions across the supply chain.

- Technological Disruptions: Emergence of autonomous systems and advanced data analytics.

- Consumer Behavior Shifts: Demand for speed, flexibility, and eco-friendly delivery options.

- Market Penetration: Significant growth in specialized logistics services catering to niche industries.

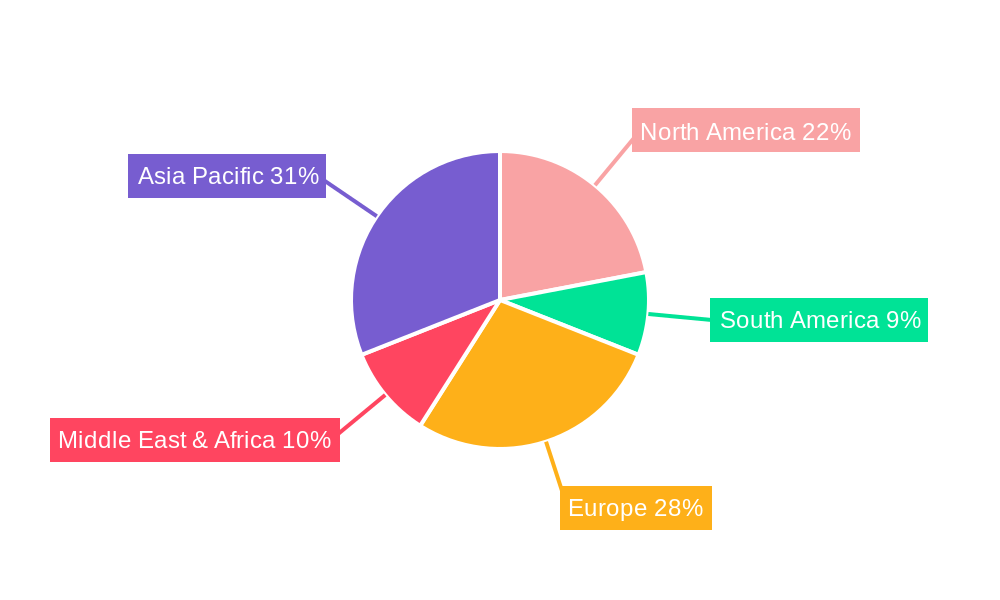

Dominant Regions, Countries, or Segments in International Logistics

The Manufacturing and Automotive segment, within the Transportation type, is anticipated to be a dominant force driving international logistics growth. This is attributed to the extensive global networks required for sourcing raw materials, component distribution, and finished vehicle delivery. North America and Europe are leading regions due to established industrial bases and sophisticated trade infrastructure, while Asia-Pacific is demonstrating rapid growth, largely fueled by China's manufacturing prowess and expanding e-commerce market. The Oil and Gas sector also contributes significantly, requiring specialized transportation and handling for heavy machinery and raw materials, albeit with cyclical fluctuations.

- Dominant Application Segment: Manufacturing and Automotive, estimated to contribute over 30% to the market value in 2025.

- Key Drivers: Globalized production networks, just-in-time inventory management, and the demand for efficient supply chains for complex manufacturing processes.

- Market Share: Significant share of global freight movement for components and finished goods.

- Growth Potential: Sustained by new product launches and increasing demand for electric vehicles.

- Dominant Type Segment: Transportation, accounting for an estimated 70% of the market value in 2025.

- Key Drivers: Air freight for time-sensitive goods, ocean freight for bulk commodities, and road/rail for intermodal connectivity.

- Market Share: Dominance due to its essential role in moving goods across borders.

- Growth Potential: Driven by advancements in multimodal transportation and infrastructure development.

- Leading Regions: North America and Europe, with Asia-Pacific exhibiting the highest growth rate.

- Economic Policies: Favorable trade agreements and industrial policies.

- Infrastructure: Well-developed ports, airports, and transportation networks.

International Logistics Product Landscape

The international logistics product landscape is defined by a suite of advanced solutions designed to optimize global supply chain operations. Innovations are centered around real-time visibility platforms, offering end-to-end tracking of shipments from origin to destination. Warehouse automation technologies, including robotic sorting systems and automated storage and retrieval systems (AS/RS), are enhancing efficiency and reducing operational costs. Value-added services, such as kitting, labeling, and final mile customization, are increasingly integrated to meet specific customer requirements. Performance metrics are continuously improving, with reductions in transit times and enhanced cargo security being key selling propositions.

Key Drivers, Barriers & Challenges in International Logistics

Key Drivers:

- Globalization and International Trade: Increasing cross-border commerce necessitates robust logistics solutions.

- E-commerce Boom: Exponential growth in online retail drives demand for efficient global fulfillment.

- Technological Advancements: AI, IoT, and automation enhance efficiency, visibility, and cost-effectiveness.

- Emerging Markets: Growing economies creating new trade routes and logistics demands.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events, natural disasters, and pandemics pose significant risks.

- Regulatory Complexity: Navigating diverse customs regulations and trade policies can be challenging.

- Infrastructure Deficiencies: Limited or outdated infrastructure in certain regions can impede efficient movement.

- Rising Fuel Costs and Sustainability Pressures: Balancing cost-effectiveness with environmental responsibility.

- Talent Shortage: A lack of skilled professionals in logistics and supply chain management.

Emerging Opportunities in International Logistics

Emerging opportunities in international logistics lie in the digitalization of trade finance to streamline cross-border transactions and the expansion of cold chain logistics to support the growing pharmaceutical and perishable goods markets. The increasing adoption of green logistics solutions, focusing on reducing carbon emissions through optimized routes and alternative fuels, presents a significant growth avenue. Furthermore, the development of smart containers equipped with advanced sensors for real-time monitoring of temperature, humidity, and shock is creating new possibilities for high-value cargo protection.

Growth Accelerators in the International Logistics Industry

Key growth accelerators in the international logistics industry include the relentless pursuit of supply chain resilience through diversification and risk mitigation strategies. Strategic partnerships between logistics providers and technology firms are fostering innovation and the deployment of cutting-edge solutions. Furthermore, government initiatives aimed at improving trade facilitation and investing in logistics infrastructure development are creating a more conducive environment for growth. The ongoing digital transformation across all sectors of the economy also fuels demand for integrated and efficient international logistics services.

Key Players Shaping the International Logistics Market

- BEL International Logistics Limited

- CN Logistics

- GEFCO

- CTS International

- Apex Logistics International

- DHL

- SENATOR INTERNATIONAL

- Crown Logistics

- UPS

- FedEx

- A.P. Moller-Maersk

- NYK Group

- MOL

- Sinotrans

- CMA CGM

- China COSCO Holdings

Notable Milestones in International Logistics Sector

- 2019: Increased adoption of AI-powered predictive analytics for demand forecasting.

- 2020: Surge in demand for e-commerce logistics due to global pandemic, highlighting the need for resilient supply chains.

- 2021: Significant investment in warehouse automation and robotics to address labor shortages and improve efficiency.

- 2022: Growing emphasis on sustainable logistics practices and carbon footprint reduction.

- 2023: Advancements in blockchain technology for enhanced supply chain transparency and security.

- 2024: Expansion of autonomous delivery trials for last-mile logistics.

In-Depth International Logistics Market Outlook

The future of international logistics is characterized by a strong emphasis on end-to-end visibility, enhanced supply chain resilience, and sustainable operations. Growth accelerators will continue to be driven by technological breakthroughs, strategic alliances, and the expansion of logistics services into emerging markets. Companies that invest in digitalization, automation, and green logistics solutions are best positioned to capitalize on future market potential. The integration of advanced data analytics and AI will be crucial for optimizing operations and providing predictive insights, thereby enabling businesses to navigate the complexities of global trade more effectively and strategically.

International Logistics Segmentation

-

1. Application

- 1.1. Manufacturing and Automotive

- 1.2. Oil and Gas, Mining, and Quarrying

- 1.3. Agriculture, Fishing and Forestry

- 1.4. Construction

- 1.5. Others

-

2. Type

- 2.1. Transportation

- 2.2. Warehousing

- 2.3. Value-added Services

International Logistics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

International Logistics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global International Logistics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Manufacturing and Automotive

- 5.1.2. Oil and Gas, Mining, and Quarrying

- 5.1.3. Agriculture, Fishing and Forestry

- 5.1.4. Construction

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Transportation

- 5.2.2. Warehousing

- 5.2.3. Value-added Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America International Logistics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Manufacturing and Automotive

- 6.1.2. Oil and Gas, Mining, and Quarrying

- 6.1.3. Agriculture, Fishing and Forestry

- 6.1.4. Construction

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Transportation

- 6.2.2. Warehousing

- 6.2.3. Value-added Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America International Logistics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Manufacturing and Automotive

- 7.1.2. Oil and Gas, Mining, and Quarrying

- 7.1.3. Agriculture, Fishing and Forestry

- 7.1.4. Construction

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Transportation

- 7.2.2. Warehousing

- 7.2.3. Value-added Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe International Logistics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Manufacturing and Automotive

- 8.1.2. Oil and Gas, Mining, and Quarrying

- 8.1.3. Agriculture, Fishing and Forestry

- 8.1.4. Construction

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Transportation

- 8.2.2. Warehousing

- 8.2.3. Value-added Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa International Logistics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Manufacturing and Automotive

- 9.1.2. Oil and Gas, Mining, and Quarrying

- 9.1.3. Agriculture, Fishing and Forestry

- 9.1.4. Construction

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Transportation

- 9.2.2. Warehousing

- 9.2.3. Value-added Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific International Logistics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Manufacturing and Automotive

- 10.1.2. Oil and Gas, Mining, and Quarrying

- 10.1.3. Agriculture, Fishing and Forestry

- 10.1.4. Construction

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Transportation

- 10.2.2. Warehousing

- 10.2.3. Value-added Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BEL International Logistics Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CN Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GEFCO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CTS International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apex Logistics International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DHL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SENATOR INTERNATIONAL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crown Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 UPS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FedEx

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 A.P. Moller-Maersk

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NYK Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MOL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sinotrans

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CMA CGM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 China COSCO Holdings

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 BEL International Logistics Limited

List of Figures

- Figure 1: Global International Logistics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America International Logistics Revenue (million), by Application 2024 & 2032

- Figure 3: North America International Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America International Logistics Revenue (million), by Type 2024 & 2032

- Figure 5: North America International Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America International Logistics Revenue (million), by Country 2024 & 2032

- Figure 7: North America International Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America International Logistics Revenue (million), by Application 2024 & 2032

- Figure 9: South America International Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America International Logistics Revenue (million), by Type 2024 & 2032

- Figure 11: South America International Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America International Logistics Revenue (million), by Country 2024 & 2032

- Figure 13: South America International Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe International Logistics Revenue (million), by Application 2024 & 2032

- Figure 15: Europe International Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe International Logistics Revenue (million), by Type 2024 & 2032

- Figure 17: Europe International Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe International Logistics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe International Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa International Logistics Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa International Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa International Logistics Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa International Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa International Logistics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa International Logistics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific International Logistics Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific International Logistics Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific International Logistics Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific International Logistics Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific International Logistics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific International Logistics Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global International Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global International Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global International Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global International Logistics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global International Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global International Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global International Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global International Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global International Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global International Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global International Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global International Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global International Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global International Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global International Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global International Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global International Logistics Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global International Logistics Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global International Logistics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania International Logistics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific International Logistics Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the International Logistics?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the International Logistics?

Key companies in the market include BEL International Logistics Limited, CN Logistics, GEFCO, CTS International, Apex Logistics International, DHL, SENATOR INTERNATIONAL, Crown Logistics, UPS, FedEx, A.P. Moller-Maersk, NYK Group, MOL, Sinotrans, CMA CGM, China COSCO Holdings.

3. What are the main segments of the International Logistics?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "International Logistics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the International Logistics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the International Logistics?

To stay informed about further developments, trends, and reports in the International Logistics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence