Key Insights

The Qatar Private K-12 Education Market, valued at $102.63 billion in 2024, is projected for substantial expansion, forecasting a Compound Annual Growth Rate (CAGR) of 12% from 2024 to 2033. This robust growth is primarily attributed to Qatar's thriving economy and diversification initiatives, which are attracting a growing expatriate population seeking high-quality international education. Increasing disposable incomes among local families and a pronounced preference for international curricula further fuel market demand. Key contributing factors also include heightened awareness of early childhood education's importance and significant investments in educational technology. The market offers diverse options, segmented by school type (e.g., British, American, International), grade level, and geographic location, catering to a wide spectrum of student needs and preferences. Intense competition among established providers such as GEMS Education and SABIS Education Services necessitates continuous innovation in teaching methodologies, extracurricular programs, and facility upgrades.

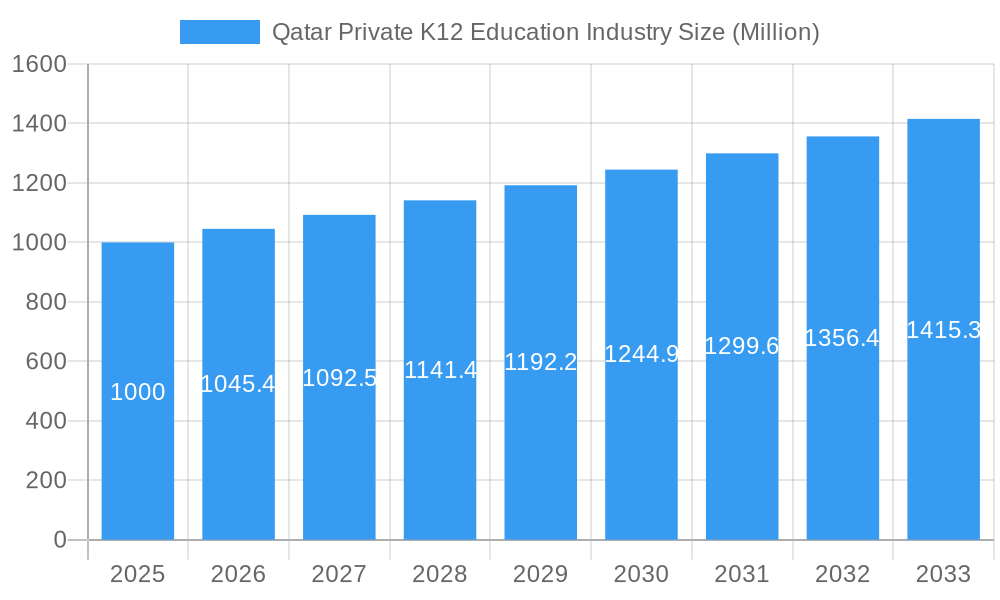

Qatar Private K12 Education Industry Market Size (In Billion)

Despite positive momentum, the market navigates challenges including stringent government regulations and licensing procedures for new entrants. Tuition fees represent a significant cost for families, influencing purchasing decisions. Maintaining superior educational standards and attracting and retaining top-tier educators in a global talent market remain critical priorities for private institutions. Future economic volatility necessitates careful monitoring of its impact on parental expenditure for private education. Nonetheless, the long-term outlook is optimistic, supported by sustained government investment in education and infrastructure, which will underpin the continued growth of the private K-12 sector in Qatar.

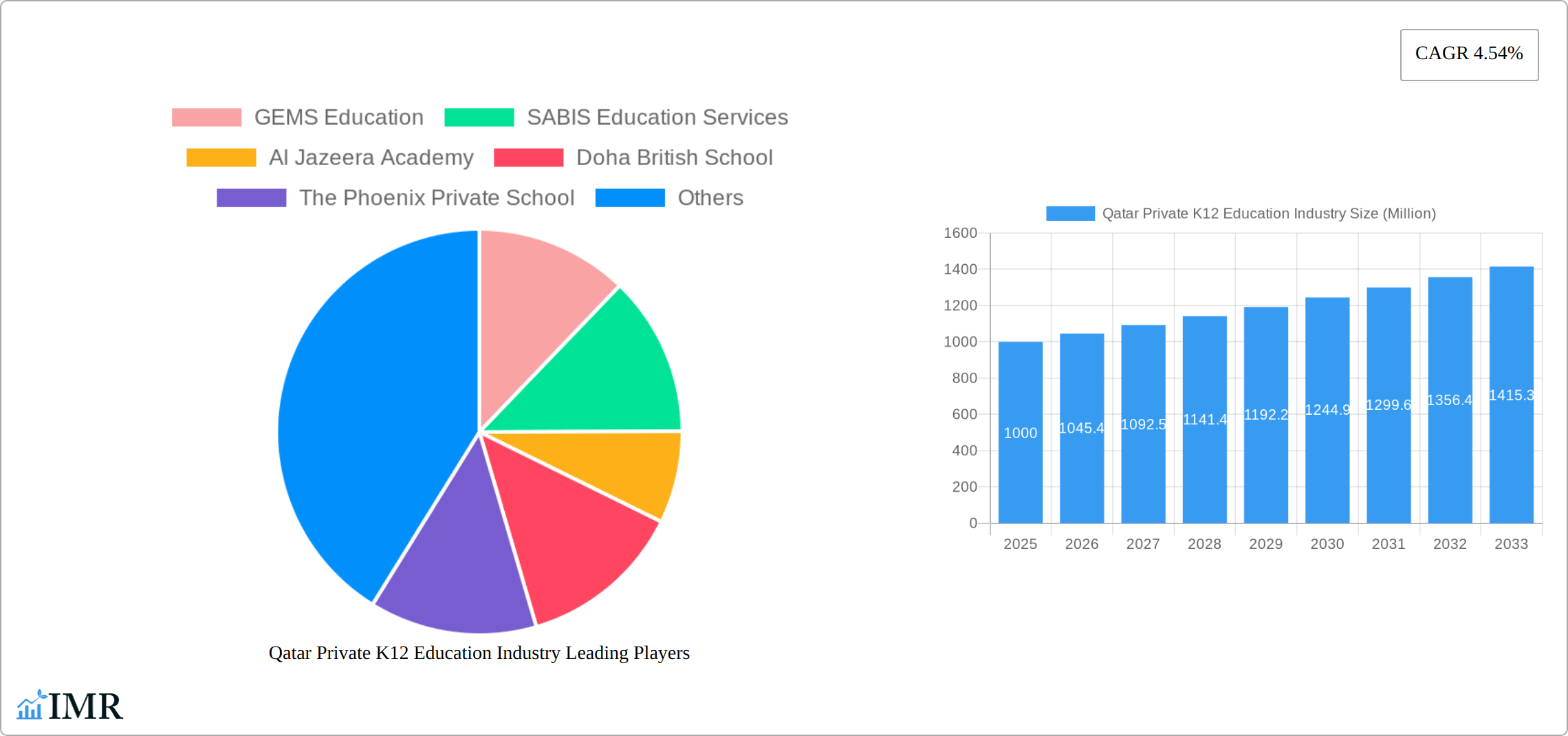

Qatar Private K12 Education Industry Company Market Share

Qatar Private K12 Education Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Qatar private K12 education market, covering the period 2019-2033. It offers invaluable insights for investors, educators, policymakers, and industry professionals seeking to understand the dynamics, growth trends, and future opportunities within this rapidly evolving sector. The report leverages extensive data analysis to provide a robust forecast, with a base year of 2025 and a forecast period extending to 2033. Key segments analyzed include international schools, national private schools, and specialized learning centers. The parent market is the overall education sector in Qatar, while the child market focuses specifically on the private K12 segment.

Qatar Private K12 Education Industry Market Dynamics & Structure

This section provides a comprehensive analysis of the Qatar private K12 education sector, delving into market concentration, the pace of technological innovation, the influential regulatory environment, the competitive landscape, and merger and acquisition (M&A) activities. The sector is characterized by a dynamic interplay between established international educational brands and agile, locally owned institutions, each contributing to the market's vibrant ecosystem.

- Market Concentration: The market exhibits a moderate level of concentration. While a few prominent international and national players command a significant market share, a substantial number of smaller, independent schools also play a vital role in serving diverse educational needs. In 2025, the top five market players are estimated to account for approximately 45-55% of the total market revenue, showcasing a balanced distribution of influence.

- Technological Innovation: The adoption of educational technology (EdTech) is experiencing a notable acceleration. This surge is fueled by supportive government initiatives and a burgeoning demand for personalized and adaptive learning experiences. However, the widespread integration of EdTech still encounters certain obstacles, including the initial investment costs, the necessity for robust teacher professional development, and ongoing infrastructure enhancements.

- Regulatory Framework: The Qatari government plays an instrumental role in fostering the growth and quality of private education. Through the implementation of progressive policies and regulations, the government actively aims to elevate educational standards and expand access. These strategic governmental interventions significantly shape and propel the market's overall growth trajectory.

- Competitive Product Substitutes: While traditional face-to-face classroom instruction remains the predominant mode of learning, the emergence of sophisticated online learning platforms and the growing interest in homeschooling are introducing compelling alternative educational pathways for parents. These evolving options are actively influencing the competitive dynamics within the market.

- End-User Demographics: The student populace is remarkably diverse, a direct reflection of Qatar's multicultural and cosmopolitan society. Demand is predominantly driven by a steadily increasing expatriate community seeking world-class education, alongside a growing Qatari middle class with rising disposable incomes and a strong aspiration for high-quality private schooling.

- M&A Trends: The private K12 education sector has observed a consistent pattern of M&A activity in recent years. Larger, established institutions are strategically acquiring smaller schools to consolidate their market positions, expand their geographical reach, and diversify their offerings. Between 2019 and 2024, an estimated 15-20 M&A deals were recorded, with an estimated aggregate value of QAR 250-350 Million, indicating strategic consolidation and growth.

Qatar Private K12 Education Industry Growth Trends & Insights

This section meticulously examines the evolutionary trajectory of the Qatar private K12 education market. Through a comprehensive analysis of market size, adoption rates of new educational methodologies, the impact of technological disruptions, and evolving consumer preferences, this section offers valuable insights. Leveraging extensive data analytics, we project robust growth for the sector, primarily propelled by a burgeoning student population, increasing household disposable incomes, and sustained governmental investment in education. The market size is projected to reach approximately QAR 7.5 - 8.5 Billion in 2025, demonstrating a healthy Compound Annual Growth Rate (CAGR) of 8-10% during the forecast period (2025-2033). This growth is further amplified by the escalating demand for internationally recognized curricula and specialized, niche educational programs. The market penetration of private K12 education is anticipated to reach 55-65% by 2033. While technological advancements such as online learning platforms and personalized learning software are gradually capturing a larger market share, their adoption is proceeding at a moderate pace due to prevailing infrastructural limitations and specific cultural considerations.

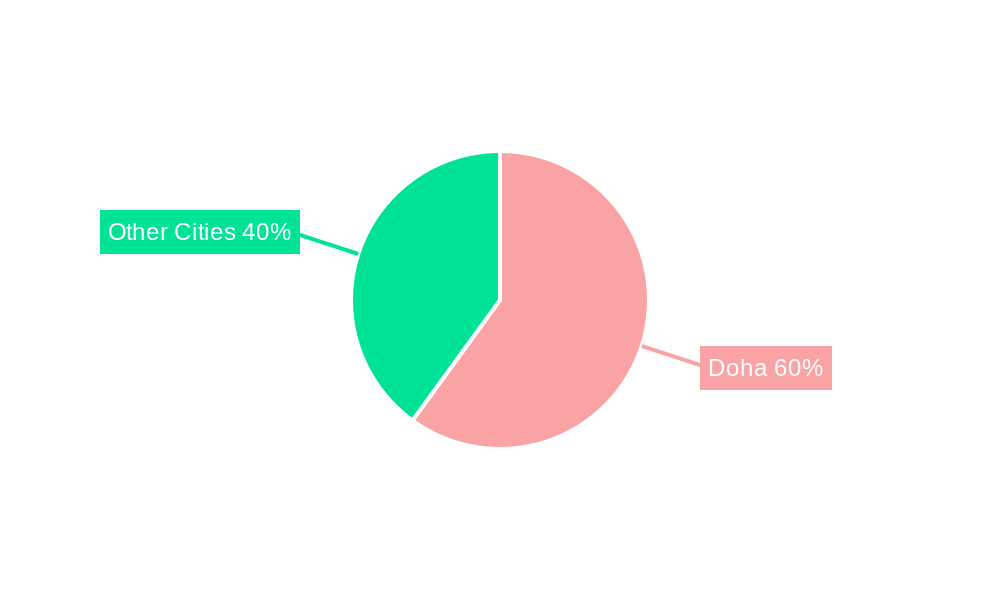

Dominant Regions, Countries, or Segments in Qatar Private K12 Education Industry

The Doha metropolitan area stands out as the preeminent and most dominant region within Qatar's private K12 education market, commanding the largest share. This geographical dominance is primarily attributed to a significantly higher concentration of expatriate families, a well-developed and modern infrastructure that facilitates accessibility, and a more extensive availability of high-caliber educational institutions offering diverse curricula.

-

Key Drivers:

- A high influx and sustained presence of expatriate communities and multinational corporations, leading to a consistent demand for international-standard education.

- Highly developed urban infrastructure, including transportation networks and digital connectivity, enhancing accessibility and operational efficiency for schools.

- Strong and consistent government support, evidenced by strategic investments and favorable policies aimed at elevating the education sector.

- A robust and growing middle and upper-middle class with substantial disposable incomes, enabling greater parental investment in private education.

-

Dominance Factors:

- The Doha region's market share is estimated to exceed 70-80% of the national private K12 education market.

- A high concentration of premium international schools offering a wide array of curricula (e.g., British, American, IB, French).

- Perennial strong demand for English-medium instruction catering to a diverse international student body.

- Significant government and private sector investment in developing world-class educational infrastructure within the Doha area.

Qatar Private K12 Education Industry Product Landscape

The product landscape within Qatar's private K12 education sector is remarkably diverse and continually evolving. It encompasses traditional, instructor-led classroom learning environments that are increasingly augmented by sophisticated and integrated educational technology (EdTech) solutions. Schools offer a broad spectrum of curricula designed to meet varied academic and developmental needs, including highly sought-after programs such as the British curriculum, American curriculum, International Baccalaureate (IB) program, and other internationally recognized frameworks. Furthermore, innovative pedagogical approaches centered on personalized learning, powered by advanced technology and data analytics, are gaining significant traction. However, the widespread adoption of these cutting-edge methods is still navigating challenges related to comprehensive teacher training and the associated financial investments. Key differentiating factors and unique selling propositions offered by private schools include specialized academic or extracurricular programs, a favorable teacher-to-student ratio ensuring individualized attention, and access to state-of-the-art facilities and learning resources. Technological advancements are prominently featured, including the integration of interactive whiteboards, robust online learning platforms, and intelligent personalized learning software designed to adapt to individual student learning paces and styles.

Key Drivers, Barriers & Challenges in Qatar Private K12 Education Industry

Key Drivers:

- Government initiatives supporting private education.

- Increasing demand from a growing expatriate and local population.

- Rising disposable incomes, leading to increased spending on education.

- Demand for international curricula and specialized programs.

Challenges:

- High operational costs, including teacher salaries and infrastructure maintenance.

- Intense competition among schools, leading to price pressures.

- Regulatory compliance and licensing requirements.

- Dependence on expatriate teachers, potentially leading to staff shortages. This challenge impacts approximately xx% of private K12 schools, resulting in an estimated xx Million in revenue loss annually.

Emerging Opportunities in Qatar Private K12 Education Industry

Emerging opportunities include:

- Expansion into underserved areas outside Doha.

- Increased demand for specialized education, such as STEM and vocational training.

- Growth of online and blended learning platforms.

- Partnerships between private schools and universities.

Growth Accelerators in the Qatar Private K12 Education Industry

Long-term growth will be driven by continued government investment in education, increasing adoption of technology, and a focus on improving educational outcomes. Strategic partnerships between private schools and international educational institutions could further accelerate growth. Expansion into niche areas like STEM education and vocational training will also contribute to market expansion.

Key Players Shaping the Qatar Private K12 Education Market

- GEMS Education

- SABIS Education Services

- Al Jazeera Academy

- Doha British School

- The Phoenix Private School

- Park House English School

- American School of Doha

- Kings College Doha

- Newton International School

- List Not Exhaustive

Notable Milestones in Qatar Private K12 Education Industry Sector

- 2020: In response to the unprecedented global challenges posed by the COVID-19 pandemic, numerous private schools swiftly launched and expanded their online learning platforms and virtual classrooms, ensuring continuity of education.

- 2021: The Qatari government announced and initiated significant new investments aimed at enhancing and modernizing educational infrastructure across the nation, benefiting both public and private institutions.

- 2022: The sector witnessed a notable wave of mergers and acquisitions (M&A) activity, as larger school groups strategically consolidated their presence and expanded their portfolios through the acquisition of smaller, independent schools.

- 2023: The Ministry of Education and Higher Education introduced a series of new, enhanced regulations and quality assurance frameworks designed to further elevate educational standards and improve student outcomes across all private K12 institutions.

- 2024: Several leading private schools made substantial strategic investments in developing and expanding their Science, Technology, Engineering, and Mathematics (STEM) education programs and facilities, recognizing the growing importance of these fields.

In-Depth Qatar Private K12 Education Industry Market Outlook

The Qatar private K12 education market is poised for continued robust growth over the forecast period (2025-2033). Strategic investments in technology, diversification of educational offerings, and increased focus on quality and innovation will be key success factors for players in this dynamic market. Expanding into niche areas and forging strategic partnerships will be crucial for capturing significant market share. The potential for growth is substantial, especially within the expanding technology-driven learning sector.

Qatar Private K12 Education Industry Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic

- 2.4. CBSE

- 2.5. Others

Qatar Private K12 Education Industry Segmentation By Geography

- 1. North Region

- 2. West region

- 3. South Region

- 4. East Region

Qatar Private K12 Education Industry Regional Market Share

Geographic Coverage of Qatar Private K12 Education Industry

Qatar Private K12 Education Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Favorable Government Initiatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Qatar Private K12 Education Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic

- 5.2.4. CBSE

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region Qatar Private K12 Education Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic

- 6.2.4. CBSE

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West region Qatar Private K12 Education Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic

- 7.2.4. CBSE

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region Qatar Private K12 Education Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic

- 8.2.4. CBSE

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region Qatar Private K12 Education Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic

- 9.2.4. CBSE

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GEMS Education

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SABIS Education Services

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Al Jazeera Academy

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Doha British School

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Phoenix Private School

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Park House English School

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 American School of Doha

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kings College Doha

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Newton International School**List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 GEMS Education

List of Figures

- Figure 1: Global Qatar Private K12 Education Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North Region Qatar Private K12 Education Industry Revenue (billion), by Source of Revenue 2025 & 2033

- Figure 3: North Region Qatar Private K12 Education Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 4: North Region Qatar Private K12 Education Industry Revenue (billion), by Curriculum 2025 & 2033

- Figure 5: North Region Qatar Private K12 Education Industry Revenue Share (%), by Curriculum 2025 & 2033

- Figure 6: North Region Qatar Private K12 Education Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North Region Qatar Private K12 Education Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: West region Qatar Private K12 Education Industry Revenue (billion), by Source of Revenue 2025 & 2033

- Figure 9: West region Qatar Private K12 Education Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 10: West region Qatar Private K12 Education Industry Revenue (billion), by Curriculum 2025 & 2033

- Figure 11: West region Qatar Private K12 Education Industry Revenue Share (%), by Curriculum 2025 & 2033

- Figure 12: West region Qatar Private K12 Education Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: West region Qatar Private K12 Education Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South Region Qatar Private K12 Education Industry Revenue (billion), by Source of Revenue 2025 & 2033

- Figure 15: South Region Qatar Private K12 Education Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 16: South Region Qatar Private K12 Education Industry Revenue (billion), by Curriculum 2025 & 2033

- Figure 17: South Region Qatar Private K12 Education Industry Revenue Share (%), by Curriculum 2025 & 2033

- Figure 18: South Region Qatar Private K12 Education Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: South Region Qatar Private K12 Education Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: East Region Qatar Private K12 Education Industry Revenue (billion), by Source of Revenue 2025 & 2033

- Figure 21: East Region Qatar Private K12 Education Industry Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 22: East Region Qatar Private K12 Education Industry Revenue (billion), by Curriculum 2025 & 2033

- Figure 23: East Region Qatar Private K12 Education Industry Revenue Share (%), by Curriculum 2025 & 2033

- Figure 24: East Region Qatar Private K12 Education Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: East Region Qatar Private K12 Education Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Curriculum 2020 & 2033

- Table 3: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Source of Revenue 2020 & 2033

- Table 5: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Curriculum 2020 & 2033

- Table 6: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Curriculum 2020 & 2033

- Table 9: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Source of Revenue 2020 & 2033

- Table 11: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Curriculum 2020 & 2033

- Table 12: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Curriculum 2020 & 2033

- Table 15: Global Qatar Private K12 Education Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Private K12 Education Industry?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Qatar Private K12 Education Industry?

Key companies in the market include GEMS Education, SABIS Education Services, Al Jazeera Academy, Doha British School, The Phoenix Private School, Park House English School, American School of Doha, Kings College Doha, Newton International School**List Not Exhaustive.

3. What are the main segments of the Qatar Private K12 Education Industry?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD 102.63 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Favorable Government Initiatives: Qatar National Vision 2030.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Private K12 Education Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Private K12 Education Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Private K12 Education Industry?

To stay informed about further developments, trends, and reports in the Qatar Private K12 Education Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence