Key Insights

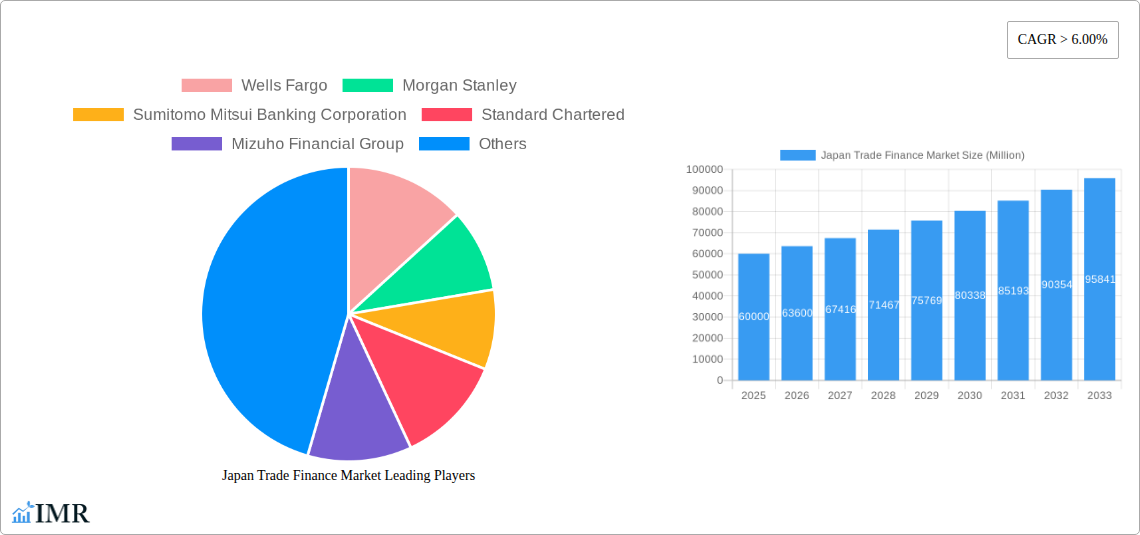

The Japan Trade Finance Market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This growth is driven by Japan's pivotal role in global commerce, particularly within the Asian region, generating robust demand for trade finance solutions. The increasing sophistication of international transactions, alongside the imperative for risk mitigation and efficient financing, further propels market advancement. Supportive government policies promoting exports and cross-border trade also contribute to this positive trajectory. Leading institutions such as Wells Fargo, Morgan Stanley, and Sumitomo Mitsui Banking Corporation are actively engaged, leveraging their extensive networks and expertise. The estimated market size for 2025 is 52.39 billion, reflecting Japan's economic prominence and substantial international trade volume.

Japan Trade Finance Market Market Size (In Billion)

Market segmentation encompasses diverse financial instruments, including letters of credit, guarantees, and factoring, serving key sectors such as manufacturing, technology, and agriculture. Growth will be influenced by global economic trends, evolving trade policies, and advancements in financial technology. Potential challenges may include regulatory shifts, cybersecurity threats, and competition from innovative fintech solutions. The 2025-2033 forecast period presents considerable opportunities for both established financial institutions and emerging players, necessitating strategic adaptation and innovation within this dynamic market.

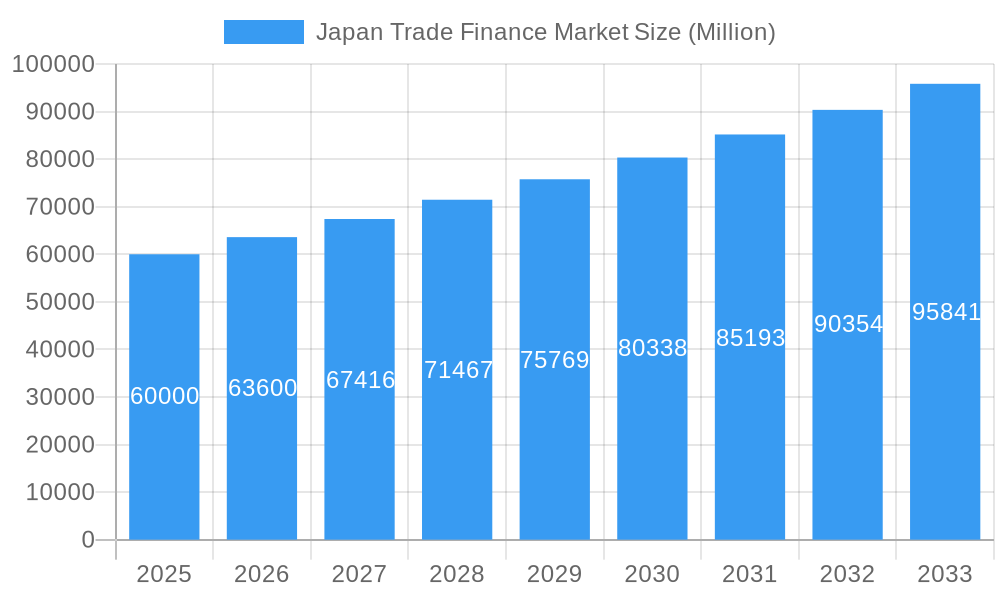

Japan Trade Finance Market Company Market Share

Japan Trade Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan Trade Finance Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for investors, industry professionals, and anyone seeking to understand this dynamic market. Market values are presented in Million units.

Japan Trade Finance Market Market Dynamics & Structure

The Japan Trade Finance market, a key sub-segment of the broader Asian Trade Finance market, is characterized by a moderate level of concentration, with several major players holding significant market share. The market structure is influenced by stringent regulatory frameworks, technological advancements driving innovation, and the presence of competitive product substitutes. End-user demographics, predominantly large corporations and SMEs involved in international trade, are crucial factors shaping demand. Mergers and acquisitions (M&A) activity has been moderate in recent years, indicating a relatively stable, but evolving, competitive landscape.

Quantitative Insights:

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- M&A Deal Volume (2019-2024): xx deals, averaging xx million USD in value per deal.

Qualitative Factors:

- Technological Innovation Drivers: Blockchain technology, AI-driven risk assessment, and digital trade platforms are driving efficiency and transparency.

- Regulatory Frameworks: Stringent compliance requirements impact operational costs and necessitate substantial investments in technology and expertise.

- Competitive Product Substitutes: Alternative financing options, such as factoring and supply chain finance, pose competitive pressure.

- Innovation Barriers: High initial investment costs and integration complexities hinder the adoption of advanced technologies by smaller players.

Japan Trade Finance Market Growth Trends & Insights

The Japan Trade Finance market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx Million in 2024. This growth is attributed to the increasing volume of international trade, expanding e-commerce activities, and the ongoing digital transformation within the financial sector. The market is projected to maintain a steady growth trajectory, with a forecasted CAGR of xx% during the forecast period (2025-2033), driven by further digitalization initiatives, supportive government policies, and rising demand for efficient and secure trade finance solutions. Market penetration is expected to increase from xx% in 2024 to xx% by 2033. Technological disruptions, such as the adoption of blockchain and AI, are significantly influencing consumer behavior, leading to a preference for faster, more transparent, and cost-effective trade finance solutions.

Dominant Regions, Countries, or Segments in Japan Trade Finance Market

The Kanto region dominates the Japan Trade Finance market, accounting for xx% of the total market size in 2025, driven by its high concentration of major corporations and financial institutions. Other regions, including Kansai and Chubu, also contribute significantly to market growth, albeit at a smaller scale.

Key Drivers:

- Robust Economic Activity: Japan's strong economic foundation and its role in global supply chains fuel demand for trade finance services.

- Government Support: Government initiatives promoting trade and investment create a favorable environment for market growth.

- Developed Infrastructure: Well-developed infrastructure and logistics networks facilitate efficient trade flows.

Dominance Factors:

- High Concentration of Businesses: The Kanto region’s high concentration of large corporations and SMEs heavily involved in international trade drives demand.

- Presence of Major Financial Institutions: The region's presence of major banks and financial institutions ensures adequate supply of trade finance services.

- Established Trade Networks: Extensive existing trade relationships within and beyond the region further solidify its dominance.

Japan Trade Finance Market Product Landscape

The Japan Trade Finance market offers a diverse range of products, including letters of credit, guarantees, documentary collections, and supply chain finance solutions. Recent product innovations include the integration of blockchain technology to enhance security and transparency, and the development of AI-driven risk assessment tools to improve efficiency. These advancements cater to evolving client needs for faster processing times, reduced costs, and enhanced security. Unique selling propositions often emphasize customized solutions, technological superiority, and a deep understanding of the specific needs of Japanese businesses engaged in international trade.

Key Drivers, Barriers & Challenges in Japan Trade Finance Market

Key Drivers:

- Growing Global Trade: Increased international trade volumes necessitate robust trade finance solutions.

- Technological Advancements: Blockchain, AI, and digital platforms are revolutionizing the industry.

- Government Initiatives: Supportive policies and regulations stimulate market expansion.

Key Challenges and Restraints:

- Supply Chain Disruptions: Global supply chain vulnerabilities continue to impact trade flows and increase risk. This has resulted in a xx% increase in delays for trade finance transactions in 2024.

- Regulatory Complexity: Compliance requirements pose significant challenges for smaller players.

- Competitive Pressure: Intense competition among established players and fintech firms limits profitability.

Emerging Opportunities in Japan Trade Finance Market

Emerging opportunities lie in the expansion of supply chain finance solutions, tailored services for SMEs, and the integration of innovative technologies like AI and machine learning to enhance risk management and operational efficiency. Untapped market segments include micro, small and medium enterprises (MSMEs) participating in cross-border e-commerce, offering significant growth potential. Furthermore, the increasing demand for sustainable and ethical finance solutions creates new opportunities for environmentally and socially responsible trade finance offerings.

Growth Accelerators in the Japan Trade Finance Market Industry

The long-term growth of the Japan Trade Finance market will be significantly fueled by the continued adoption of innovative technologies, such as blockchain and AI. Strategic partnerships between financial institutions and technology providers will accelerate digital transformation and improve operational efficiency. Expansion into new markets and the development of tailored solutions for specific industry segments will contribute to sustained market expansion. Government support for trade and investment will further strengthen the growth trajectory.

Key Players Shaping the Japan Trade Finance Market Market

Notable Milestones in Japan Trade Finance Market Sector

- October 2022: Morgan Stanley Investment Management's partnership with Opportunity Finance Network highlights a growing focus on inclusive finance within the trade finance sector.

- August 2022: The MOU between Sumitomo Mitsui Banking Corporation and Banque Misr signifies advancements in trade digitization and cross-border collaboration.

In-Depth Japan Trade Finance Market Market Outlook

The future of the Japan Trade Finance market appears bright, driven by sustained growth in global trade, increasing adoption of digital technologies, and supportive government policies. Strategic opportunities exist for players focusing on innovative solutions, efficient risk management, and expansion into niche market segments. The market is poised for continued expansion, with significant potential for growth in the coming years.

Japan Trade Finance Market Segmentation

-

1. Service Provider

- 1.1. Banks

- 1.2. Trade Finance Companies

- 1.3. Insurance Companies

- 1.4. Other Service Providers

-

2. Application

- 2.1. Domestic

- 2.2. International

Japan Trade Finance Market Segmentation By Geography

- 1. Japan

Japan Trade Finance Market Regional Market Share

Geographic Coverage of Japan Trade Finance Market

Japan Trade Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitization is Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Trade Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 5.1.1. Banks

- 5.1.2. Trade Finance Companies

- 5.1.3. Insurance Companies

- 5.1.4. Other Service Providers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wells Fargo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morgan Stanley

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Banking Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Standard Chartered

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mizuho Financial Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Bank Of Scotland Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank Of America

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi UFJ Financial Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Development Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Wells Fargo

List of Figures

- Figure 1: Japan Trade Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Trade Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Trade Finance Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 2: Japan Trade Finance Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Japan Trade Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Trade Finance Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 5: Japan Trade Finance Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Japan Trade Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Trade Finance Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Japan Trade Finance Market?

Key companies in the market include Wells Fargo, Morgan Stanley, Sumitomo Mitsui Banking Corporation, Standard Chartered, Mizuho Financial Group, Royal Bank Of Scotland Plc, Bank Of America, Mitsubishi UFJ Financial Group Inc, BNP Paribas, Asian Development Bank**List Not Exhaustive.

3. What are the main segments of the Japan Trade Finance Market?

The market segments include Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitization is Boosting the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Morgan Stanley Investment Management (MSIM) chose Opportunity Finance Network (OFN) as its diversity and inclusion partner for MSIM's charity donation connected to the recently introduced Impact Class, the firm said today. The OFN is a top national network comprising 370 Community Development Finance Institutions (CDFIs). Its goal is to help underserved areas get cheap, honest financial services and products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Trade Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Trade Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Trade Finance Market?

To stay informed about further developments, trends, and reports in the Japan Trade Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence