Key Insights

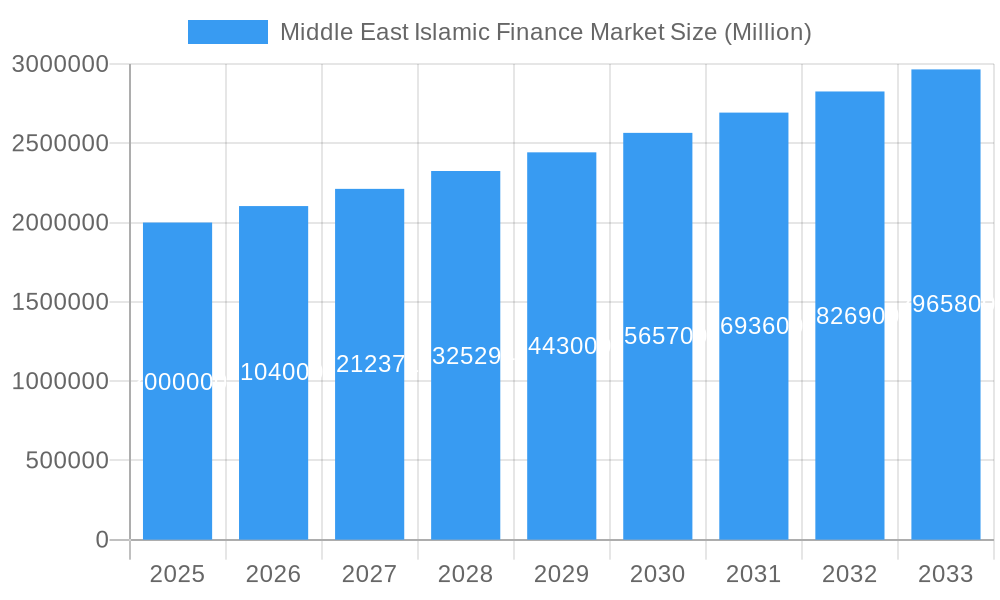

The Middle East Islamic finance market, currently valued at approximately $2 trillion in 2025 (estimated based on a 5.12% CAGR from a likely larger base year value than indicated, considering the market's size and growth trajectory), is experiencing robust growth. Driven by a rising Muslim population, increasing awareness of Islamic financial products, and supportive government initiatives promoting Sharia-compliant investments, the market is projected to maintain a healthy expansion throughout the forecast period (2025-2033). Key drivers include the region's substantial sovereign wealth funds actively investing in Islamic finance, the increasing demand for ethical and socially responsible investments, and the development of innovative Islamic financial instruments catering to diverse investment needs. Furthermore, technological advancements, such as fintech solutions enabling more accessible and efficient transactions, are fueling market growth. While challenges such as regulatory complexities and the need for greater standardization of Islamic financial products remain, the overall outlook is positive, with significant growth potential across various segments including banking, insurance, and investment.

Middle East Islamic Finance Market Market Size (In Million)

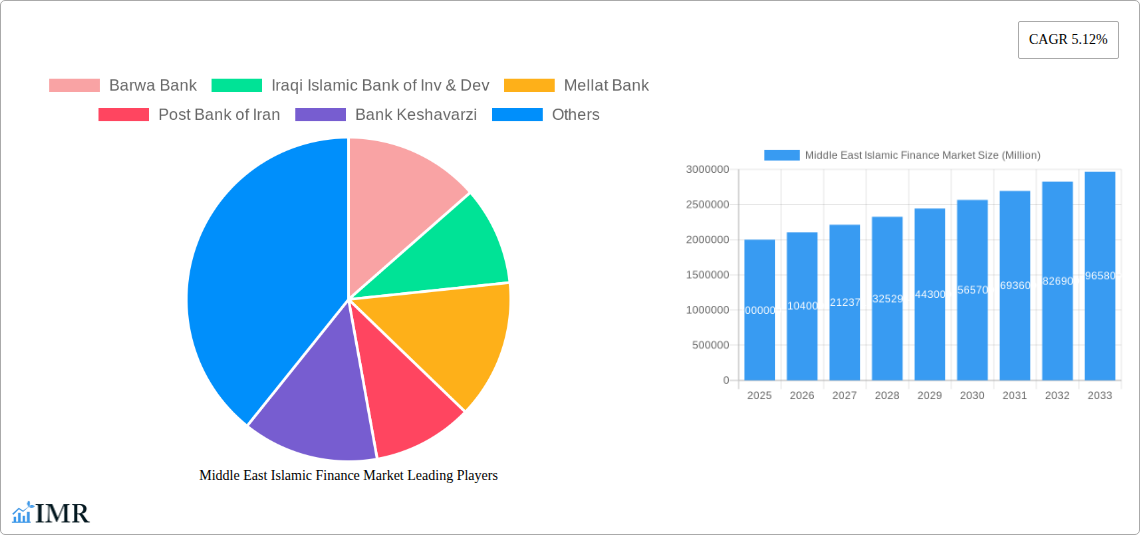

The leading players – including Barwa Bank, Iraqi Islamic Bank of Investment & Development, Mellat Bank, Post Bank of Iran, Bank Keshavarzi, Abu Dhabi Commercial Bank, Saudi British Bank, and Riyad Bank – are actively expanding their offerings and geographical reach to capitalize on the market's growth. Competition is expected to intensify, pushing innovation and potentially leading to mergers and acquisitions. The market's segmentation is likely to evolve with the introduction of new products and services tailored to specific customer needs. Continued focus on strengthening regulatory frameworks, investor education, and technological integration will be crucial to unlocking the full potential of this dynamic market. Growth will likely be strongest in sectors aligned with regional development priorities like infrastructure and renewable energy, attracting both domestic and international investment.

Middle East Islamic Finance Market Company Market Share

Middle East Islamic Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Islamic Finance Market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The report analyzes both parent markets (Islamic Finance) and child markets (specific Islamic financial products and services) to provide a granular understanding of market segmentation. The market size is projected to reach xx Million by 2033.

Middle East Islamic Finance Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements shaping the Middle East Islamic Finance Market. The market exhibits a moderately concentrated structure with key players holding significant market share. However, the emergence of fintech companies and innovative financial products is driving increased competition.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: The adoption of FinTech solutions, including Islamic mobile banking and digital payment platforms, is accelerating. However, challenges remain in terms of cybersecurity and data privacy.

- Regulatory Framework: Regulatory bodies across the Middle East are actively working to enhance the regulatory framework for Islamic finance, promoting transparency and stability. However, inconsistencies across different jurisdictions can pose challenges.

- Competitive Product Substitutes: Conventional banking products continue to compete with Islamic finance offerings; however, the increasing demand for Shariah-compliant products is driving market growth.

- End-User Demographics: The increasing young and tech-savvy population across the Middle East are driving adoption rates of digital Islamic financial services.

- M&A Trends: The number of M&A deals in the Islamic finance sector has increased in recent years, driven by consolidation and expansion strategies. xx M&A deals were recorded in 2024.

Middle East Islamic Finance Market Growth Trends & Insights

The Middle East Islamic Finance Market is experiencing robust growth, driven by factors including rising religious observance, increasing demand for ethical investments, and supportive government policies. The market size is estimated to be xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing financial inclusion, technological disruptions, and evolving consumer preferences towards ethical and sustainable financial products. The market penetration rate for Islamic financial services is projected to reach xx% by 2033, highlighting significant growth potential.

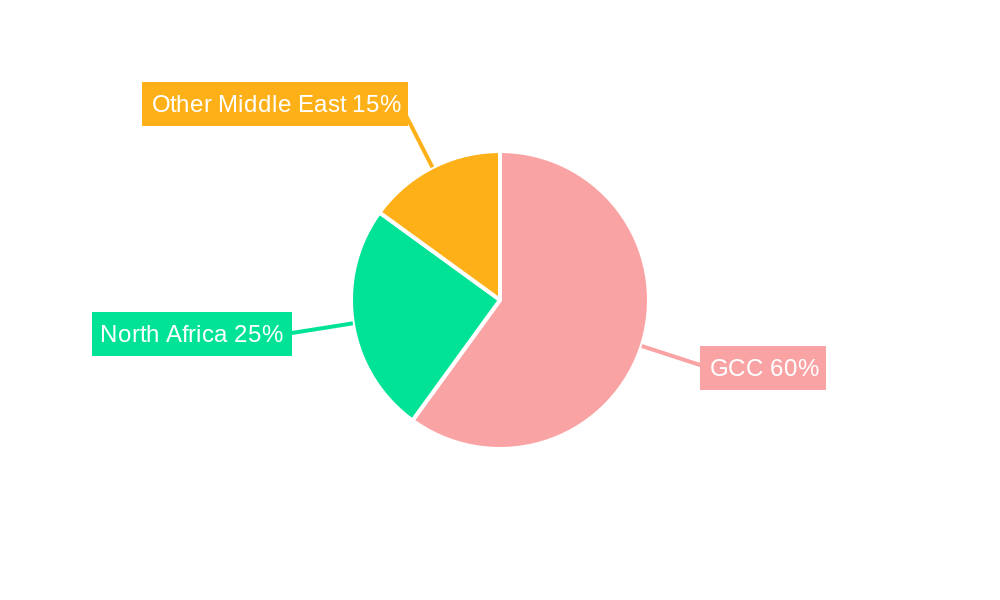

Dominant Regions, Countries, or Segments in Middle East Islamic Finance Market

The United Arab Emirates (UAE), Saudi Arabia, and Bahrain are currently the leading countries in the Middle East Islamic Finance Market, driven by strong regulatory support, robust financial infrastructure, and the presence of major Islamic financial institutions.

- UAE: Strong government support, a sophisticated financial infrastructure, and a diverse economy contribute to the UAE's dominant position.

- Saudi Arabia: The Kingdom's Vision 2030 initiative is actively promoting the growth of the Islamic finance sector, driving substantial investment and innovation.

- Bahrain: Bahrain's established Islamic banking sector and its role as a regional financial hub contribute to its significant market share.

- Growth Drivers: Favorable demographics, increasing disposable income, and government incentives are key drivers across these countries.

Middle East Islamic Finance Market Product Landscape

The market offers a diverse range of Shariah-compliant financial products, including Islamic banking, takaful (Islamic insurance), sukuk (Islamic bonds), and other investment instruments. Recent product innovations focus on digital platforms, enhanced customer experience, and tailored financial solutions for specific segments. Technological advancements like blockchain are being explored to enhance transparency and efficiency in Islamic finance transactions. Unique selling propositions often center around ethical and socially responsible investing practices aligned with Islamic principles.

Key Drivers, Barriers & Challenges in Middle East Islamic Finance Market

Key Drivers:

- Increasing religious observance and demand for Shariah-compliant financial products.

- Supportive government policies and regulatory frameworks promoting Islamic finance.

- Technological advancements enhancing efficiency and accessibility of Islamic financial services.

Challenges:

- Standardization of Islamic finance products and services across different jurisdictions.

- Competition from conventional banking products, especially in retail banking segments.

- Talent shortages in specialized areas within the Islamic finance sector.

Emerging Opportunities in Middle East Islamic Finance Market

Untapped markets within the Middle East and North Africa (MENA) region present significant opportunities for expansion. Growing demand for green finance and sustainable investments is driving the development of Shariah-compliant green finance products. Moreover, the increasing adoption of fintech solutions is creating opportunities for innovative Islamic financial services.

Growth Accelerators in the Middle East Islamic Finance Market Industry

Strategic partnerships between Islamic financial institutions and fintech companies are accelerating innovation and market penetration. Government initiatives aimed at promoting financial inclusion and digital transformation are also significant growth catalysts. Expansion into new product areas, such as Islamic wealth management and microfinance, are creating new revenue streams.

Key Players Shaping the Middle East Islamic Finance Market Market

- Barwa Bank

- Iraqi Islamic Bank of Inv & Dev

- Mellat Bank

- Post Bank of Iran

- Bank Keshavarzi

- Abu Dhabi Commercial Bank

- Saudi British Bank

- Riyad Bank

- List Not Exhaustive

Notable Milestones in Middle East Islamic Finance Market Sector

- September 2023: Abu Dhabi Securities Exchange (ADX) collaborated with Sharjah Islamic Bank (SIB) to enhance and streamline access to Initial Public Offering (IPO) subscriptions for investors. This improves investor accessibility and participation in capital markets.

- March 2023: Aafaq Islamic Finance partnered with Rasmala to develop new Shariah-compliant products and advisory services, broadening product offerings and enhancing client services.

In-Depth Middle East Islamic Finance Market Market Outlook

The Middle East Islamic finance market is poised for continued robust growth, driven by supportive regulatory environments, rising demand for Shariah-compliant financial solutions, and technological advancements. Strategic partnerships, product innovation, and expansion into untapped markets will play a crucial role in shaping the future of the industry. The long-term outlook is extremely positive, with significant opportunities for both established players and new entrants.

Middle East Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance 'Takaful'

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Fi

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Iraq

- 2.4. Iran

- 2.5. United Arab Emirates

- 2.6. Rest of Middle East

Middle East Islamic Finance Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Iraq

- 4. Iran

- 5. United Arab Emirates

- 6. Rest of Middle East

Middle East Islamic Finance Market Regional Market Share

Geographic Coverage of Middle East Islamic Finance Market

Middle East Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Muslim Population is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Muslim Population is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growing Fintech Digital Sukuk

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance 'Takaful'

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Iraq

- 5.2.4. Iran

- 5.2.5. United Arab Emirates

- 5.2.6. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Iraq

- 5.3.4. Iran

- 5.3.5. United Arab Emirates

- 5.3.6. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. Saudi Arabia Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance 'Takaful'

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Fi

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Iraq

- 6.2.4. Iran

- 6.2.5. United Arab Emirates

- 6.2.6. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. Qatar Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance 'Takaful'

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Fi

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Iraq

- 7.2.4. Iran

- 7.2.5. United Arab Emirates

- 7.2.6. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Iraq Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance 'Takaful'

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Fi

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Iraq

- 8.2.4. Iran

- 8.2.5. United Arab Emirates

- 8.2.6. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Iran Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance 'Takaful'

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Fi

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Iraq

- 9.2.4. Iran

- 9.2.5. United Arab Emirates

- 9.2.6. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. United Arab Emirates Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance 'Takaful'

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Fi

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Iraq

- 10.2.4. Iran

- 10.2.5. United Arab Emirates

- 10.2.6. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of Middle East Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance 'Takaful'

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Fi

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. Qatar

- 11.2.3. Iraq

- 11.2.4. Iran

- 11.2.5. United Arab Emirates

- 11.2.6. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Barwa Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Iraqi Islamic Bank of Inv & Dev

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mellat Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Post Bank of Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bank Keshavarzi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abu Dhabi Commercial Bank

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Saudi British Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Riyad Bank**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Barwa Bank

List of Figures

- Figure 1: Global Middle East Islamic Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Middle East Islamic Finance Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 4: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 5: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 6: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 7: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 9: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Qatar Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 16: Qatar Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 17: Qatar Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 18: Qatar Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 19: Qatar Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 20: Qatar Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 21: Qatar Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Qatar Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: Qatar Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Qatar Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Qatar Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Qatar Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Iraq Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 28: Iraq Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 29: Iraq Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 30: Iraq Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 31: Iraq Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 32: Iraq Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 33: Iraq Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 34: Iraq Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 35: Iraq Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Iraq Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Iraq Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Iraq Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Iran Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 40: Iran Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 41: Iran Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 42: Iran Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 43: Iran Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Iran Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 45: Iran Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Iran Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Iran Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Iran Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Iran Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Iran Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 52: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 53: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 54: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 55: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 56: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 57: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 64: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 65: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 66: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 67: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 68: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 69: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 71: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 73: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 2: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 3: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 5: Global Middle East Islamic Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 8: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 9: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 11: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 14: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 15: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 17: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 20: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 21: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 23: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 26: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 27: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 29: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 32: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 33: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 35: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 38: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 39: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 41: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Islamic Finance Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Middle East Islamic Finance Market?

Key companies in the market include Barwa Bank, Iraqi Islamic Bank of Inv & Dev, Mellat Bank, Post Bank of Iran, Bank Keshavarzi, Abu Dhabi Commercial Bank, Saudi British Bank, Riyad Bank**List Not Exhaustive.

3. What are the main segments of the Middle East Islamic Finance Market?

The market segments include Financial Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Muslim Population is Driving the Market.

6. What are the notable trends driving market growth?

Growing Fintech Digital Sukuk.

7. Are there any restraints impacting market growth?

Growing Muslim Population is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Abu Dhabi Securities Exchange (ADX) collaborated with Sharjah Islamic Bank (SIB) to enhance and streamline access to Initial Public Offering (IPO) subscriptions for investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Middle East Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence