Key Insights

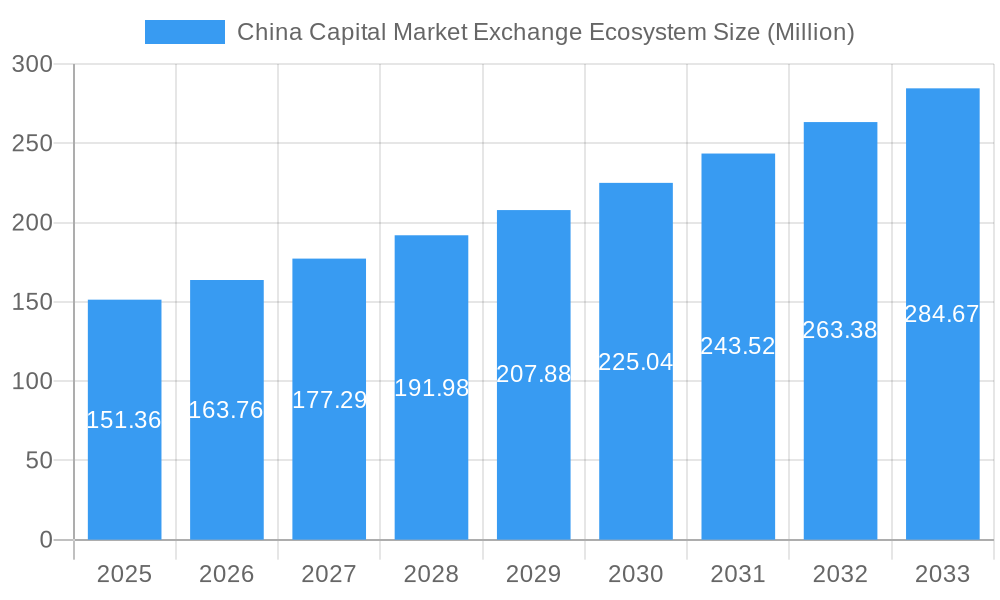

The China Capital Market Exchange Ecosystem, valued at $151.36 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.12% from 2025 to 2033. This expansion is driven by several key factors. Increasing digitalization and mobile penetration within China are fueling the adoption of online trading platforms, attracting both individual investors and institutional players. Government initiatives promoting financial inclusion and market development further contribute to this growth. The rising middle class with increased disposable income and a growing interest in wealth management are also significant contributors. However, regulatory uncertainties and potential volatility in the global financial markets pose challenges to sustained growth. Competition among established players like XM, HotForex, IQ Option, eToro, IC Markets, Alpari, FXTM, ExpertOption, OctaFX, and Olymp Trade (among others) is intense, demanding continuous innovation and adaptation to maintain market share. The segment breakdown likely reflects diverse product offerings (e.g., forex, CFDs, stocks) catering to varied investor profiles. Geographical distribution within China itself will also influence market share, with larger metropolitan areas potentially commanding greater participation. The historical period (2019-2024) likely showed significant market evolution, leading to the current 2025 valuation. Future growth will hinge on effective risk management, technological advancements, and the ability of these firms to adapt to evolving regulatory frameworks and investor preferences.

China Capital Market Exchange Ecosystem Market Size (In Million)

The forecast period (2025-2033) presents substantial opportunities for expansion, contingent upon navigating the aforementioned challenges. Growth is likely to be uneven across different segments and regions, with some experiencing faster growth than others. Proactive strategies focusing on customer acquisition, user experience enhancement, and compliance with increasingly stringent regulations will prove critical for maintaining a competitive edge. The overall outlook for the China Capital Market Exchange Ecosystem remains positive, driven by sustained economic growth, increased financial literacy, and a maturing investment landscape. Further research into specific segments and regional dynamics would offer a more granular understanding of market opportunities and potential risks.

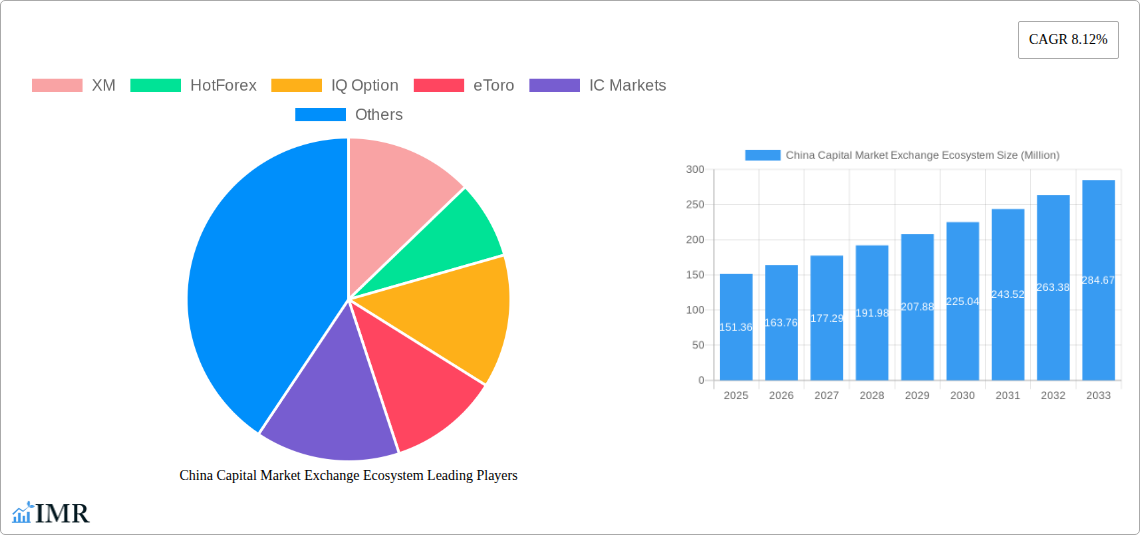

China Capital Market Exchange Ecosystem Company Market Share

China Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Capital Market Exchange Ecosystem, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, competitive landscapes, and future opportunities within this dynamic sector. The study includes detailed analysis of parent and child markets, providing a granular understanding of the ecosystem's intricate structure. Key players like XM, HotForex, IQ Option, eToro, IC Markets, Alpari, FXTM, ExpertOption, OctaFX, and Olymp Trade (list not exhaustive) are profiled, revealing their strategies and market positions.

China Capital Market Exchange Ecosystem Market Dynamics & Structure

This section analyzes the market concentration, technological advancements, regulatory landscape, competitive dynamics, and mergers & acquisitions (M&A) activity within the China Capital Market Exchange Ecosystem. The study period covers 2019-2024 (historical), 2025 (base & estimated year), and 2025-2033 (forecast). Market size in Million units will be presented throughout the report.

- Market Concentration: The market exhibits a [xx]% concentration ratio in 2025, with the top 5 players holding a combined [xx]% market share. This is expected to [increase/decrease] to [xx]% by 2033.

- Technological Innovation: Key drivers include [specific technologies, e.g., AI-driven trading platforms, blockchain technology for enhanced security]. Barriers to innovation include [regulatory hurdles, data privacy concerns, lack of skilled workforce].

- Regulatory Framework: The regulatory landscape is [describe the current regulatory environment, e.g., evolving, stringent, supportive]. [Mention specific regulations and their impact].

- Competitive Landscape: Competition is [intense/moderate/low] with key players focusing on [mention key competitive strategies, e.g., product differentiation, pricing strategies, technological advancement].

- M&A Activity: The historical period (2019-2024) witnessed [xx] M&A deals, totaling approximately [xx] Million units in value. The forecast period is expected to see [xx] deals, driven by [mention reasons, e.g., consolidation, expansion into new segments].

- End-User Demographics: The primary end-users are [mention user types, e.g., institutional investors, retail traders, high-net-worth individuals]. Their preferences and behaviors significantly influence market dynamics.

China Capital Market Exchange Ecosystem Growth Trends & Insights

This section leverages [mention data sources and methodologies used, e.g., primary research, secondary data, statistical modelling] to analyze market size evolution, adoption rates, technological disruptions, and consumer behavior shifts.

[Insert 600-word analysis here, incorporating data points such as CAGR, market penetration, and key trends driving market growth. Example: The market witnessed a CAGR of [xx]% during the historical period (2019-2024), driven primarily by [specific growth drivers]. This growth is projected to continue at a CAGR of [xx]% during the forecast period (2025-2033), fueled by [mention future drivers]. Market penetration is estimated at [xx]% in 2025 and is expected to reach [xx]% by 2033. Include detailed paragraphs discussing technological disruptions and consumer behavior shifts.]

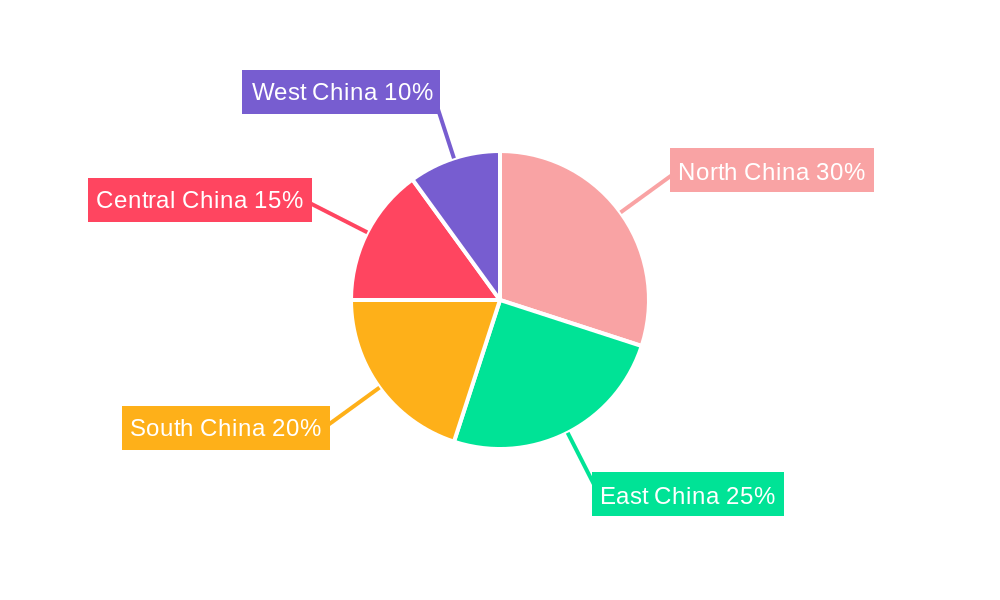

Dominant Regions, Countries, or Segments in China Capital Market Exchange Ecosystem

This section identifies the leading regions, countries, or segments driving market growth within the China Capital Market Exchange Ecosystem.

[Insert 600-word analysis here. Include bullet points highlighting key drivers and paragraphs analyzing dominance factors, including market share and growth potential. Example: The [region/segment] dominates the market, accounting for [xx]% of the total market share in 2025. Key growth drivers include [bullet points: favorable government policies, robust economic growth, well-developed infrastructure]. The region's dominance is primarily due to [explain in paragraphs]. The forecast suggests [region/segment] will continue to dominate, but [other regions/segments] are expected to show significant growth potential due to [mention reasons].]

China Capital Market Exchange Ecosystem Product Landscape

This section provides an overview of product innovations, applications, and performance metrics within the China Capital Market Exchange Ecosystem.

[Insert 100-150 word paragraph here detailing product innovations, applications, performance metrics, unique selling propositions, and technological advancements. Example: The market offers a wide range of products, including [list product types]. Recent innovations focus on [mention specific innovations], enhancing [mention benefits]. Key performance metrics include [mention metrics, e.g., trading speed, order execution, platform reliability].]

Key Drivers, Barriers & Challenges in China Capital Market Exchange Ecosystem

This section outlines the key factors driving market growth and the challenges faced by the industry.

Key Drivers:

[Insert 150-word paragraph or bullet points here, including technological, economic, and policy-driven factors with specific examples. Example: Increased adoption of online trading platforms, government initiatives to promote financial inclusion, and technological advancements are key growth drivers. Rising disposable incomes and increased financial literacy are also contributing factors.]

Key Challenges and Restraints:

[Insert 150-word paragraph or list here, addressing supply chain issues, regulatory hurdles, and competitive pressures with quantifiable impacts. Example: Regulatory uncertainties, cybersecurity risks, and intense competition pose significant challenges. Supply chain disruptions can impact platform availability and operational efficiency. The cost of compliance with regulatory requirements can also affect profitability.]

Emerging Opportunities in China Capital Market Exchange Ecosystem

This section highlights emerging trends and opportunities within the China Capital Market Exchange Ecosystem.

[Insert 150-word paragraph or list here, focusing on untapped markets, innovative applications, or evolving consumer preferences. Example: Growing adoption of mobile trading, expansion into underserved markets, and the development of innovative investment products present significant opportunities for growth. The integration of AI and blockchain technologies offers further potential.]

Growth Accelerators in the China Capital Market Exchange Ecosystem Industry

This section discusses catalysts driving long-term growth within the China Capital Market Exchange Ecosystem industry.

[Insert 150-word paragraph here, emphasizing technological breakthroughs, strategic partnerships, or market expansion strategies. Example: Strategic partnerships between technology providers and financial institutions, technological breakthroughs in AI and blockchain, and expansion into new geographical markets are key growth accelerators. Government support and favorable regulatory environments further enhance long-term growth potential.]

Key Players Shaping the China Capital Market Exchange Ecosystem Market

- XM

- HotForex

- IQ Option

- eToro

- IC Markets

- Alpari

- FXTM

- ExpertOption

- OctaFX

- Olymp Trade (List Not Exhaustive)

Notable Milestones in China Capital Market Exchange Ecosystem Sector

[Insert bullet points here, detailing developments with year/month and emphasizing their impact on market dynamics. Example:

- January 2022: Launch of a new regulatory framework for online trading platforms.

- March 2023: Acquisition of [Company A] by [Company B].

- June 2024: Introduction of a new mobile trading application by [Company C].]

In-Depth China Capital Market Exchange Ecosystem Market Outlook

[Insert 150-word paragraph here, summarizing growth accelerators and focusing on future market potential and strategic opportunities. Example: The China Capital Market Exchange Ecosystem is poised for significant growth in the coming years, driven by continued technological advancements, increasing market penetration, and favorable regulatory developments. Strategic opportunities lie in leveraging AI and blockchain technologies, expanding into new geographical markets, and developing innovative investment products tailored to the evolving needs of investors. The market presents significant potential for both established players and new entrants.]

China Capital Market Exchange Ecosystem Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Capital Market Exchange Ecosystem Segmentation By Geography

- 1. China

China Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of China Capital Market Exchange Ecosystem

China Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Impact of Increasing Foreign Direct Investment in China

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 XM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HotForex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IQ Option

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 eToro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IC Markets

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alpari

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FXTM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ExpertOption

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OctaFX

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olymp Trade**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 XM

List of Figures

- Figure 1: China Capital Market Exchange Ecosystem Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Production Analysis 2020 & 2033

- Table 3: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Consumption Analysis 2020 & 2033

- Table 5: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Region 2020 & 2033

- Table 12: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Region 2020 & 2033

- Table 13: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Production Analysis 2020 & 2033

- Table 15: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Consumption Analysis 2020 & 2033

- Table 17: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: China Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Capital Market Exchange Ecosystem Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Capital Market Exchange Ecosystem?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the China Capital Market Exchange Ecosystem?

Key companies in the market include XM, HotForex, IQ Option, eToro, IC Markets, Alpari, FXTM, ExpertOption, OctaFX, Olymp Trade**List Not Exhaustive.

3. What are the main segments of the China Capital Market Exchange Ecosystem?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.36 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Impact of Increasing Foreign Direct Investment in China.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the China Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence