Key Insights

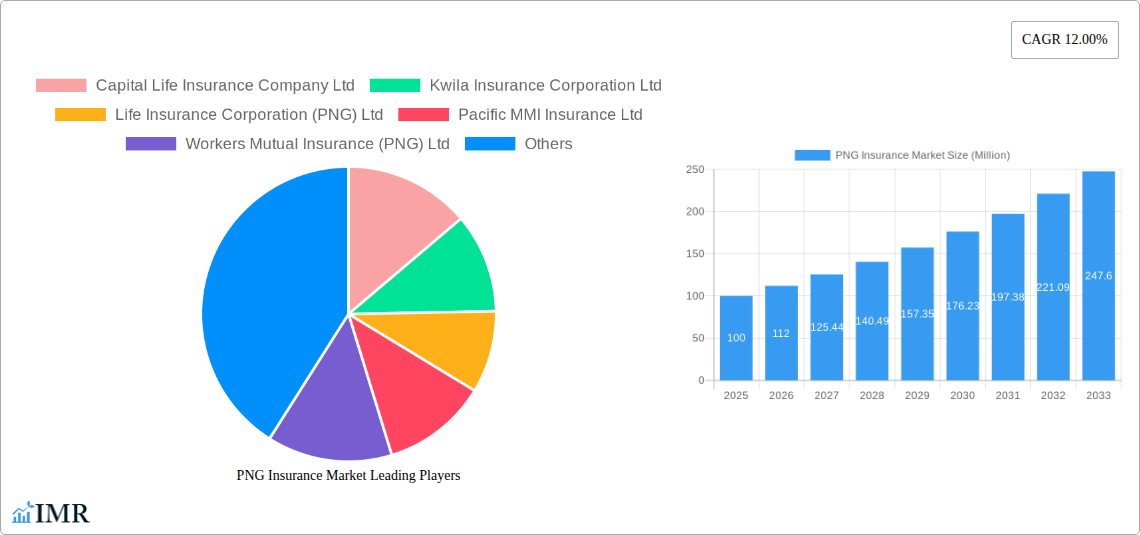

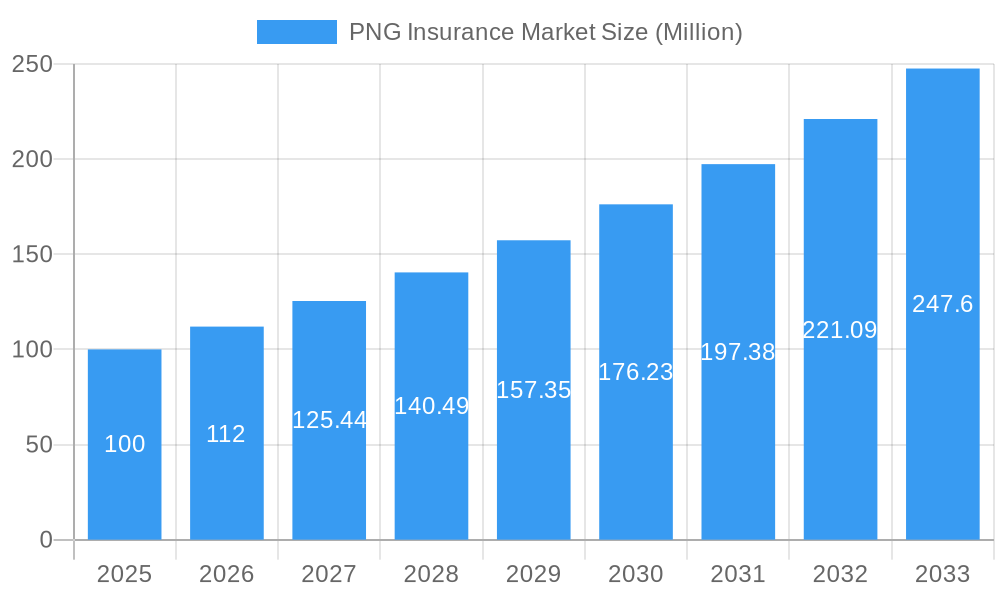

The Papua New Guinea (PNG) insurance market, exhibiting a Compound Annual Growth Rate (CAGR) of 12%, presents a robust growth trajectory from 2019 to 2033. This expansion is driven by several key factors. Rising disposable incomes, increased awareness of risk management strategies among businesses and individuals, and the government's focus on financial inclusion are all contributing to higher insurance penetration. The market is segmented by various insurance types (life, non-life, health, etc.), with life insurance potentially holding a significant share due to increasing life expectancy and a growing middle class. Furthermore, the presence of both domestic and international players, including Capital Life Insurance Company Ltd, Life Insurance Corporation (PNG) Ltd, and international brokers like AON and Marsh, indicates a competitive landscape fostering innovation and product diversification. However, challenges remain. These include infrastructure limitations hindering widespread access, particularly in rural areas, and a persistent lack of insurance awareness among certain segments of the population. The regulatory landscape, while evolving, could also play a role in shaping the market's growth trajectory. To fully realize its potential, the PNG insurance market requires ongoing efforts to improve financial literacy, enhance infrastructure, and build public trust in insurance products and services.

PNG Insurance Market Market Size (In Million)

The forecast period of 2025-2033 is expected to witness substantial growth, propelled by further economic development and improved regulatory frameworks. The market's value in 2025 is projected to be approximately $XX million (this requires a market size value from the original data which was not provided – a reasonable assumption based on 12% CAGR growth from a base year would be needed for accurate estimation. A reasonable estimation would require the initial market size to complete this statement). This growth will likely be uneven across segments, with some sectors experiencing faster growth than others based on evolving consumer needs and government policies. The competitive landscape will remain dynamic, with existing players consolidating their positions and new entrants potentially disrupting the market through innovative product offerings and distribution channels. Strategic partnerships and technological advancements will be critical for companies seeking sustainable growth and market leadership. Addressing infrastructural challenges and promoting financial inclusion will unlock the market's full potential and benefit the wider PNG economy.

PNG Insurance Market Company Market Share

PNG Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Papua New Guinea (PNG) insurance market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The report is structured for easy navigation and delivers actionable intelligence. The PNG insurance market, encompassing both life and non-life insurance, is segmented by product type and distribution channel, providing a granular view of market performance. The total market size in 2025 is estimated at xx Million, with projections extending to 2033.

PNG Insurance Market Dynamics & Structure

The PNG insurance market exhibits a moderately concentrated structure, with several dominant players and a growing number of smaller, niche operators. Market concentration is influenced by regulatory frameworks, technological adoption, and competitive intensity. Technological innovation, while present, faces barriers such as limited digital infrastructure and financial literacy among the population. The regulatory environment plays a significant role in shaping market behavior, impacting product offerings and pricing strategies. The market witnesses considerable competitive pressure, particularly in the life insurance segment where products are becoming increasingly sophisticated.

- Market Concentration: xx% market share held by top 5 players in 2025.

- Technological Innovation: Slow adoption due to infrastructure limitations, but increasing mobile penetration offers opportunities.

- Regulatory Framework: Stable but evolving, with ongoing efforts to improve consumer protection and market transparency.

- Competitive Substitutes: Traditional savings and informal risk-sharing mechanisms compete with formal insurance.

- End-User Demographics: Young and rapidly growing population with increasing disposable income, but low insurance penetration.

- M&A Trends: Low frequency but potential for consolidation amongst smaller firms, xx M&A deals observed during the historical period.

PNG Insurance Market Growth Trends & Insights

The PNG insurance market is experiencing steady growth, driven by increasing awareness of insurance benefits, rising disposable incomes, and government initiatives aimed at promoting financial inclusion. However, challenges such as low insurance penetration, limited financial literacy, and geographical constraints persist. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), fueled by penetration increases in segments with high-growth potential. Technological disruptions, including the use of mobile technology and digital platforms for insurance sales and distribution, are expected to significantly reshape the market landscape. Shifting consumer behavior towards digitalization, and the adoption of more tech-savvy distribution channels will be critical aspects to monitor.

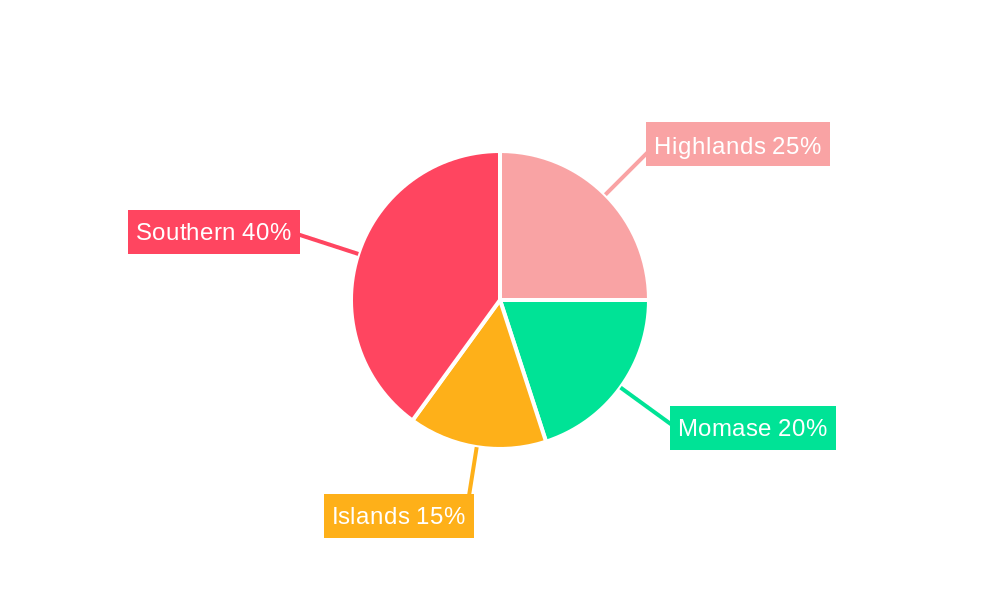

Dominant Regions, Countries, or Segments in PNG Insurance Market

The Port Moresby region, as the commercial and administrative center, currently dominates the PNG insurance market. This dominance is driven by high population density, greater economic activity, and concentration of businesses and financial institutions. The life insurance segment also holds a larger share compared to general insurance, reflecting greater focus on personal financial planning. Future growth is expected to be propelled by expansion into rural areas through improved infrastructure and targeted outreach programs.

- Key Drivers in Port Moresby: High concentration of businesses, disposable income and advanced infrastructure.

- Growth Potential in Rural Areas: Untapped market with increasing mobile phone penetration. Expansion hinges on improving infrastructure and financial literacy.

- Market Share: Port Moresby holds approximately xx% of the total market.

- Growth Projections: xx% CAGR for the Port Moresby region in the forecast period.

PNG Insurance Market Product Landscape

Product innovation in the PNG insurance market is driven by customer needs and technological advancements. Insurance companies are developing products targeting specific demographics, such as Wantok Delite by BSP Life, tailored for young professionals and small business owners. The use of mobile technology for product distribution and claims processing is gaining traction, simplifying the customer experience. Competitive differentiation relies on features like customized policy options and enhanced digital service capabilities.

Key Drivers, Barriers & Challenges in PNG Insurance Market

Key Drivers: Rising disposable incomes, increasing awareness of insurance benefits, government initiatives promoting financial inclusion, and technological advancements.

Key Challenges: Low insurance penetration (xx% in 2025), limited financial literacy, inadequate infrastructure in remote areas, fraudulent claims leading to insurer hesitancy and a complex regulatory environment.

Emerging Opportunities in PNG Insurance Market

Untapped market potential exists in underserved rural areas through mobile-based insurance offerings, catering to a broader demographic. Microinsurance, offering affordable products, remains a significant growth opportunity. Product innovation targeting specific sectors (such as agriculture) holds potential for significant market expansion. Furthermore, partnerships with mobile network operators (MNOs) offer increased reach and efficiency.

Growth Accelerators in the PNG Insurance Market Industry

Technological advancements, particularly in mobile technology and digital platforms, are key growth accelerators. Strategic partnerships between insurers, MNOs, and financial institutions to expand market reach and enhance distribution efficiency. Government policies promoting financial inclusion and insurance penetration will play a pivotal role in accelerating growth.

Key Players Shaping the PNG Insurance Market Market

- Capital Life Insurance Company Ltd

- Kwila Insurance Corporation Ltd

- Life Insurance Corporation (PNG) Ltd

- Pacific MMI Insurance Ltd

- Workers Mutual Insurance (PNG) Ltd

- Asia Pacific Insurance Brokers Ltd

- AON Risk Services Ltd

- Marsh (PNG) Ltd

- Niugini Islands Insurance Brokers

- Kanda International Insurance Brokers & Risk Consultants Ltd

List Not Exhaustive

Notable Milestones in PNG Insurance Market Sector

- June 2019: Exit of micro-insurance firm BIMA due to fraudulent claims, highlighting challenges in market integrity.

- January 2020: Launch of Wantok Delite by BSP Life, showcasing product innovation targeting a specific demographic.

In-Depth PNG Insurance Market Market Outlook

The PNG insurance market is poised for significant growth, driven by underlying economic expansion, improving infrastructure, and enhanced financial literacy initiatives. Strategic opportunities exist in leveraging technology to expand reach, introducing innovative products targeted at specific needs, and forging collaborative partnerships. Addressing challenges related to fraudulent claims and improving the regulatory environment will be critical for sustainable growth.

PNG Insurance Market Segmentation

-

1. Insurance type

- 1.1. Individual Insurance

- 1.2. Annuity Insurance

- 1.3. Endowment Insurance

- 1.4. Juvenile Insurance

- 1.5. Whole Life Insurance

- 1.6. Medical Insurance

- 1.7. Others

PNG Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PNG Insurance Market Regional Market Share

Geographic Coverage of PNG Insurance Market

PNG Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Favorable Regulatory Reforms is Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PNG Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Individual Insurance

- 5.1.2. Annuity Insurance

- 5.1.3. Endowment Insurance

- 5.1.4. Juvenile Insurance

- 5.1.5. Whole Life Insurance

- 5.1.6. Medical Insurance

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America PNG Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Individual Insurance

- 6.1.2. Annuity Insurance

- 6.1.3. Endowment Insurance

- 6.1.4. Juvenile Insurance

- 6.1.5. Whole Life Insurance

- 6.1.6. Medical Insurance

- 6.1.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America PNG Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Individual Insurance

- 7.1.2. Annuity Insurance

- 7.1.3. Endowment Insurance

- 7.1.4. Juvenile Insurance

- 7.1.5. Whole Life Insurance

- 7.1.6. Medical Insurance

- 7.1.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe PNG Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Individual Insurance

- 8.1.2. Annuity Insurance

- 8.1.3. Endowment Insurance

- 8.1.4. Juvenile Insurance

- 8.1.5. Whole Life Insurance

- 8.1.6. Medical Insurance

- 8.1.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa PNG Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Individual Insurance

- 9.1.2. Annuity Insurance

- 9.1.3. Endowment Insurance

- 9.1.4. Juvenile Insurance

- 9.1.5. Whole Life Insurance

- 9.1.6. Medical Insurance

- 9.1.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific PNG Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Individual Insurance

- 10.1.2. Annuity Insurance

- 10.1.3. Endowment Insurance

- 10.1.4. Juvenile Insurance

- 10.1.5. Whole Life Insurance

- 10.1.6. Medical Insurance

- 10.1.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Capital Life Insurance Company Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kwila Insurance Corporation Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Life Insurance Corporation (PNG) Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pacific MMI Insurance Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Workers Mutual Insurance (PNG) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Asia Pacific Insurance Brokers Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AON Risk Services Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marsh (PNG) Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Niugini Islands Insurance Brokers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kanda International Insurance Brokers & Risk Consultants Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Capital Life Insurance Company Ltd

List of Figures

- Figure 1: Global PNG Insurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America PNG Insurance Market Revenue (undefined), by Insurance type 2025 & 2033

- Figure 3: North America PNG Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 4: North America PNG Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America PNG Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America PNG Insurance Market Revenue (undefined), by Insurance type 2025 & 2033

- Figure 7: South America PNG Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 8: South America PNG Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America PNG Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe PNG Insurance Market Revenue (undefined), by Insurance type 2025 & 2033

- Figure 11: Europe PNG Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 12: Europe PNG Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe PNG Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa PNG Insurance Market Revenue (undefined), by Insurance type 2025 & 2033

- Figure 15: Middle East & Africa PNG Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 16: Middle East & Africa PNG Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa PNG Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific PNG Insurance Market Revenue (undefined), by Insurance type 2025 & 2033

- Figure 19: Asia Pacific PNG Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 20: Asia Pacific PNG Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific PNG Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PNG Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 2: Global PNG Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global PNG Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 4: Global PNG Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global PNG Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 9: Global PNG Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global PNG Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 14: Global PNG Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global PNG Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 25: Global PNG Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global PNG Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 33: Global PNG Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific PNG Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PNG Insurance Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the PNG Insurance Market?

Key companies in the market include Capital Life Insurance Company Ltd, Kwila Insurance Corporation Ltd, Life Insurance Corporation (PNG) Ltd, Pacific MMI Insurance Ltd, Workers Mutual Insurance (PNG) Ltd, Asia Pacific Insurance Brokers Ltd, AON Risk Services Ltd, Marsh (PNG) Ltd, Niugini Islands Insurance Brokers, Kanda International Insurance Brokers & Risk Consultants Ltd**List Not Exhaustive.

3. What are the main segments of the PNG Insurance Market?

The market segments include Insurance type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Favorable Regulatory Reforms is Boosting the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2020 - BSP Life PNG, part of Bank South Pacific Group, launched Wantok Delite, an endowment product with policy terms of 15, 18, 21 or 24 years. Premium will be invested in various assets with an annual bonus indexed to the policy based on asset performance. The policy is aimed at job starters and small business owners, who can add policy benefits such as term-life protection, accidental death cover and permanent disability insurance. Wantok Delite complements BSP Life's existing consumer credit and group term-life insurance products. The latter aims to encourage companies to offer employees life cover.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PNG Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PNG Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PNG Insurance Market?

To stay informed about further developments, trends, and reports in the PNG Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence