Key Insights

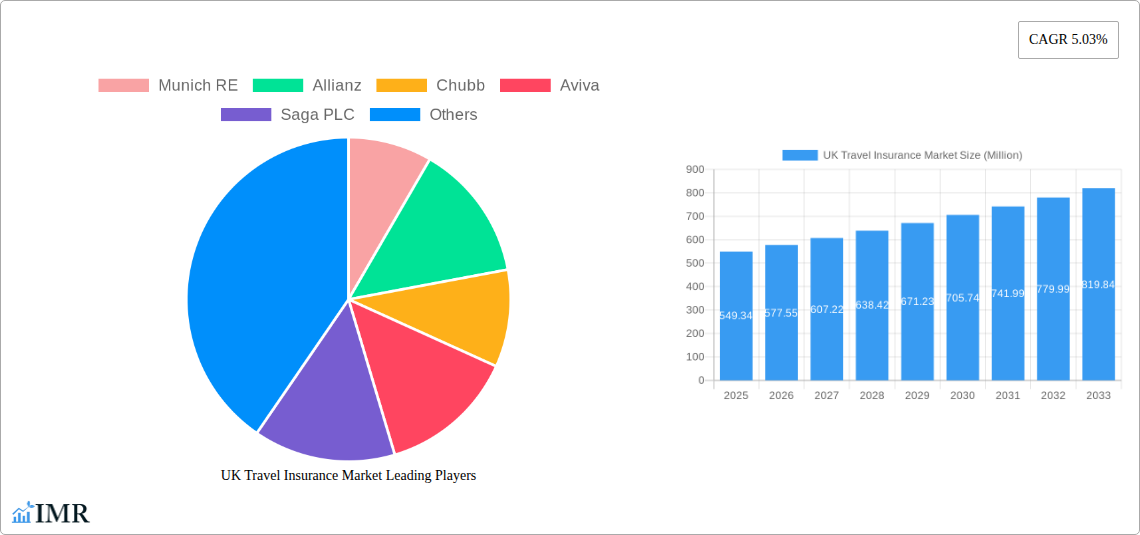

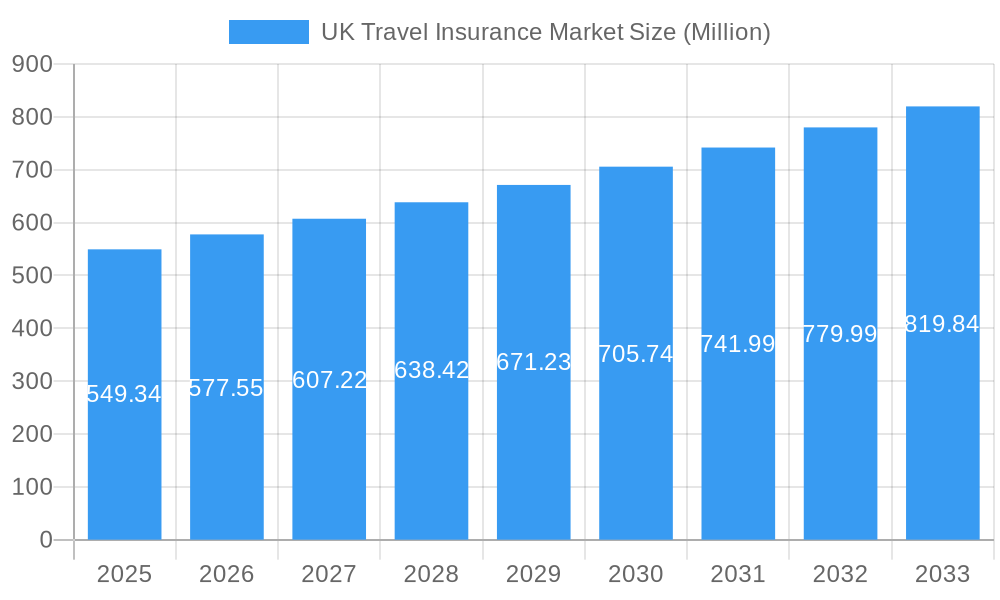

The UK travel insurance market, valued at £549.34 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.03% from 2025 to 2033. This expansion is driven by several factors. The rising popularity of international travel, fueled by increased disposable incomes and affordable airfares, significantly contributes to market growth. Furthermore, heightened awareness of potential travel disruptions, such as medical emergencies, flight cancellations, and lost luggage, is prompting more travelers to prioritize comprehensive travel insurance coverage. The increasing prevalence of adventure tourism and activities requiring specialized insurance also boosts demand. Key players such as Munich Re, Allianz, Chubb, and Aviva are leveraging technological advancements to enhance their offerings, including online platforms and personalized insurance packages, improving customer experience and market reach. Competition within the sector is fierce, driving innovation and competitive pricing strategies.

UK Travel Insurance Market Market Size (In Million)

However, certain restraints influence market growth. Economic downturns can reduce discretionary spending on travel, impacting insurance demand. The emergence of alternative risk management strategies, such as using credit cards with travel insurance benefits, also presents challenges to traditional travel insurance providers. Fluctuations in currency exchange rates can affect the cost of travel and insurance premiums. Regulation and compliance requirements within the insurance sector also create operational challenges. The industry is constantly adapting to these challenges and leveraging technological improvements to offset these restraints and remain competitive. The segment breakdown (while not provided) likely includes various coverage types such as single-trip, annual multi-trip, and specialized adventure insurance, reflecting the diverse needs of the UK travel population. The continued growth projections indicate a positive outlook for the UK travel insurance market, with opportunities for innovation and expansion in the coming years.

UK Travel Insurance Market Company Market Share

UK Travel Insurance Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK travel insurance market, examining its current dynamics, growth trends, and future potential. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It delves into key market segments, dominant players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market size is predicted to reach xx Million by 2033.

UK Travel Insurance Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the UK travel insurance sector. We explore market concentration, the impact of mergers and acquisitions (M&A), and the role of substitute products. The analysis incorporates both quantitative data (market share, M&A deal volume) and qualitative factors (innovation barriers).

- Market Concentration: The UK travel insurance market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top five players account for approximately xx% of the market.

- Technological Innovation: Digitalization, including online booking platforms and AI-powered risk assessment tools, is driving innovation. However, data security and regulatory compliance pose significant barriers to entry for new technologies.

- Regulatory Framework: The Financial Conduct Authority (FCA) regulations significantly shape the market, influencing product design, pricing, and customer protection. Changes in regulations can impact market dynamics significantly.

- Competitive Product Substitutes: Alternatives such as credit card travel insurance and bundled travel packages pose competitive challenges to standalone travel insurance products.

- End-User Demographics: The market caters to a diverse demographic, from individual travelers to families and corporate groups. Shifting travel patterns and preferences influence demand.

- M&A Trends: Consolidation within the market is evident, with several M&A deals observed during the historical period. The volume of deals averaged xx per year between 2019 and 2024.

UK Travel Insurance Market Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior within the UK travel insurance market. Data from various sources, including market research firms and industry publications, has been leveraged to deliver comprehensive insights. Specific metrics such as CAGR and market penetration rates are included to provide a clearer understanding of growth trajectory.

(600 words of detailed analysis will be provided here, incorporating quantitative data such as CAGR and market penetration rates and qualitative insights on consumer behaviour, technology adoption and market size evolution.)

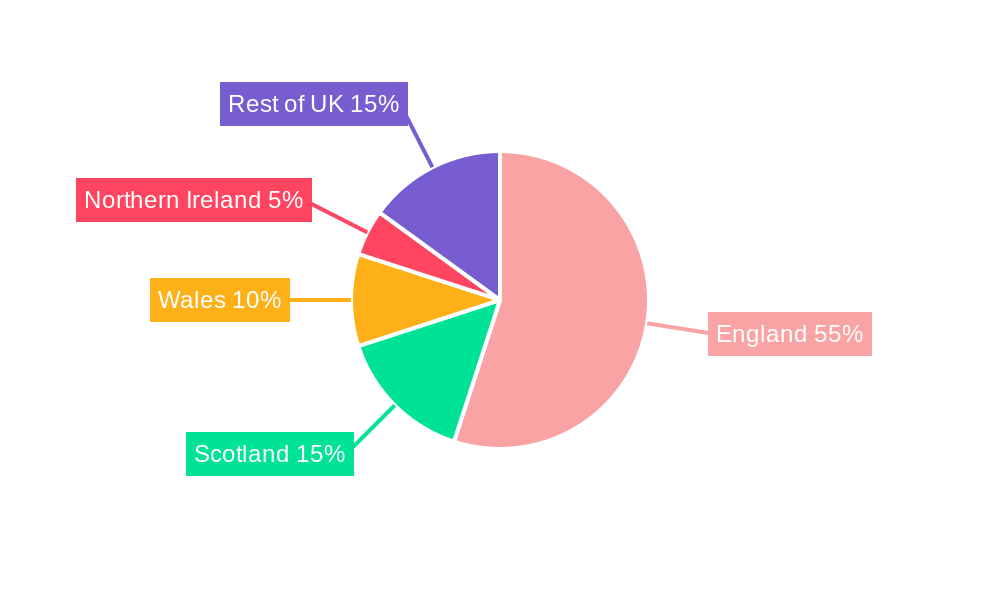

Dominant Regions, Countries, or Segments in UK Travel Insurance Market

This section identifies the leading regions, countries, or segments driving market growth within the UK travel insurance sector. The analysis is supported by both quantitative data, such as market share and growth rates, and qualitative factors such as economic policies and infrastructure development.

(600 words of detailed analysis including market share data, growth potential discussion and supporting bullet points will be provided here. The analysis will focus on the specific region, country, or segment driving UK travel insurance market growth.)

UK Travel Insurance Market Product Landscape

The UK travel insurance market offers a range of products catering to diverse needs, from basic coverage to comprehensive plans encompassing medical emergencies, trip cancellations, and baggage loss. Recent innovations focus on enhancing customer experience through digital platforms and personalized offerings. Technological advancements in risk assessment and fraud detection are also shaping product development. Key selling propositions often include flexible policy options, transparent pricing, and robust customer support.

Key Drivers, Barriers & Challenges in UK Travel Insurance Market

Key Drivers:

- Increasing international travel by UK citizens.

- Rising awareness of potential travel risks.

- Growing demand for comprehensive coverage.

- Technological advancements leading to enhanced product offerings.

Challenges & Restraints:

- Intense competition among insurers.

- Regulatory changes and compliance requirements.

- Economic fluctuations impacting consumer spending.

- Supply chain disruptions affecting the cost of claims handling. The impact of such disruptions in 2022 led to an estimated xx Million increase in claims processing costs.

Emerging Opportunities in UK Travel Insurance Market

The UK travel insurance market presents several emerging opportunities:

- Growth in niche travel insurance: Specialised policies catering to adventure travel, medical conditions, or senior travellers.

- Expansion of digital platforms: Developing user-friendly online portals for seamless policy purchase and claim management.

- Integration of wearable technology: Utilizing fitness trackers or other devices to monitor traveller well-being and potentially adjust premium rates.

- Sustainable travel insurance: Policies promoting eco-friendly travel practices.

Growth Accelerators in the UK Travel Insurance Market Industry

Long-term growth in the UK travel insurance market will be driven by technological innovation, strategic partnerships, and expansion into new market segments. The development of AI-powered risk assessment models, improved data analytics for more accurate pricing, and targeted marketing campaigns will be crucial in maximizing market penetration. Strategic partnerships, such as the recent collaboration between Munich Re and International SOS, will play a significant role in driving innovation and expanding product offerings.

Notable Milestones in UK Travel Insurance Market Sector

- October 2023: Munich Re partners with International SOS to offer integrated pandemic management solutions, enhancing policyholder support.

- December 2023: Chubb partners with NetSPI to strengthen cybersecurity and risk management, improving claims handling efficiency and reducing fraud.

In-Depth UK Travel Insurance Market Market Outlook

The future of the UK travel insurance market appears bright, driven by continued growth in international travel, increasing consumer awareness of travel risks, and ongoing technological advancements. Strategic partnerships, innovation in product offerings, and a focus on personalized customer experiences will be crucial for maintaining market leadership and capturing new opportunities. The market is predicted to experience a sustained period of growth, with a projected CAGR of xx% during the forecast period.

UK Travel Insurance Market Segmentation

-

1. Type

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Others

-

3. End User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

UK Travel Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Travel Insurance Market Regional Market Share

Geographic Coverage of UK Travel Insurance Market

UK Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media

- 3.3. Market Restrains

- 3.3.1. Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media

- 3.4. Market Trends

- 3.4.1. Expansion of Tourism Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-Trip Travel Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Insurance Companies

- 6.2.2. Insurance Intermediaries

- 6.2.3. Banks

- 6.2.4. Insurance Brokers

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Senior Citizens

- 6.3.2. Education Travelers

- 6.3.3. Family Travelers

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-Trip Travel Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Insurance Companies

- 7.2.2. Insurance Intermediaries

- 7.2.3. Banks

- 7.2.4. Insurance Brokers

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Senior Citizens

- 7.3.2. Education Travelers

- 7.3.3. Family Travelers

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-Trip Travel Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Insurance Companies

- 8.2.2. Insurance Intermediaries

- 8.2.3. Banks

- 8.2.4. Insurance Brokers

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Senior Citizens

- 8.3.2. Education Travelers

- 8.3.3. Family Travelers

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-Trip Travel Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Insurance Companies

- 9.2.2. Insurance Intermediaries

- 9.2.3. Banks

- 9.2.4. Insurance Brokers

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Senior Citizens

- 9.3.2. Education Travelers

- 9.3.3. Family Travelers

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Travel Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-Trip Travel Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Insurance Companies

- 10.2.2. Insurance Intermediaries

- 10.2.3. Banks

- 10.2.4. Insurance Brokers

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Senior Citizens

- 10.3.2. Education Travelers

- 10.3.3. Family Travelers

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Munich RE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allianz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chubb

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Saga PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prudential Guarantee

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KBC Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Europ Assistance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AllClear

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ABTA**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Munich RE

List of Figures

- Figure 1: Global UK Travel Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Travel Insurance Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 5: North America UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 13: North America UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 17: North America UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 20: South America UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 21: South America UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: South America UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 25: South America UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: South America UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: South America UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 29: South America UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 33: South America UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Europe UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 37: Europe UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Europe UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 41: Europe UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Europe UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Europe UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Europe UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 45: Europe UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Europe UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Europe UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 49: Europe UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East & Africa UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 53: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East & Africa UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 57: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East & Africa UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East & Africa UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 61: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East & Africa UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East & Africa UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 65: Middle East & Africa UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific UK Travel Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Asia Pacific UK Travel Insurance Market Volume (Million), by Type 2025 & 2033

- Figure 69: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific UK Travel Insurance Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific UK Travel Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Asia Pacific UK Travel Insurance Market Volume (Million), by Distribution Channel 2025 & 2033

- Figure 73: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Asia Pacific UK Travel Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Asia Pacific UK Travel Insurance Market Revenue (Million), by End User 2025 & 2033

- Figure 76: Asia Pacific UK Travel Insurance Market Volume (Million), by End User 2025 & 2033

- Figure 77: Asia Pacific UK Travel Insurance Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: Asia Pacific UK Travel Insurance Market Volume Share (%), by End User 2025 & 2033

- Figure 79: Asia Pacific UK Travel Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific UK Travel Insurance Market Volume (Million), by Country 2025 & 2033

- Figure 81: Asia Pacific UK Travel Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific UK Travel Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 7: Global UK Travel Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global UK Travel Insurance Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 15: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: United States UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 25: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 29: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 31: Brazil UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 39: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 43: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 45: United Kingdom UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Germany UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: France UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 51: Italy UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 53: Spain UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Russia UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Benelux UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Nordics UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 65: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 66: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 67: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 69: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 71: Turkey UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Israel UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: GCC UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: North Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: South Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 83: Global UK Travel Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 84: Global UK Travel Insurance Market Volume Million Forecast, by Type 2020 & 2033

- Table 85: Global UK Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 86: Global UK Travel Insurance Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 87: Global UK Travel Insurance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 88: Global UK Travel Insurance Market Volume Million Forecast, by End User 2020 & 2033

- Table 89: Global UK Travel Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global UK Travel Insurance Market Volume Million Forecast, by Country 2020 & 2033

- Table 91: China UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 93: India UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 95: Japan UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 97: South Korea UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 99: ASEAN UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 101: Oceania UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific UK Travel Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific UK Travel Insurance Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Travel Insurance Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the UK Travel Insurance Market?

Key companies in the market include Munich RE, Allianz, Chubb, Aviva, Saga PLC, Prudential Guarantee, KBC Group, Europ Assistance, AllClear, ABTA**List Not Exhaustive.

3. What are the main segments of the UK Travel Insurance Market?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 549.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media.

6. What are the notable trends driving market growth?

Expansion of Tourism Industry.

7. Are there any restraints impacting market growth?

Population Growth and the Emergence of Tourism are Driving the Market; The Positive Impact of Online Media.

8. Can you provide examples of recent developments in the market?

October 2023: Munich Re, a world-renowned reinsurance company, has joined forces with the world-renowned International SOS, an international leader in health and security, to create an integrated policy solution for the management of epidemics and pandemics. As a result of this new collaboration between the two companies, International SOS is now offering health advisory services for Munich Re's policyholders affected by the pandemic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Travel Insurance Market?

To stay informed about further developments, trends, and reports in the UK Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence