Key Insights

The Canadian asset management market is poised for substantial growth, driven by a rising affluent population, increasing retirement savings needs, and a growing demand for sophisticated investment strategies. Key industry players are actively competing for market share through established brand reputation and diversified product offerings. The market encompasses various asset classes, investor types, and service models. While regulatory shifts and economic uncertainty present potential challenges, the long-term outlook remains positive, supported by consistent inflows from institutional and individual investors seeking professional wealth management.

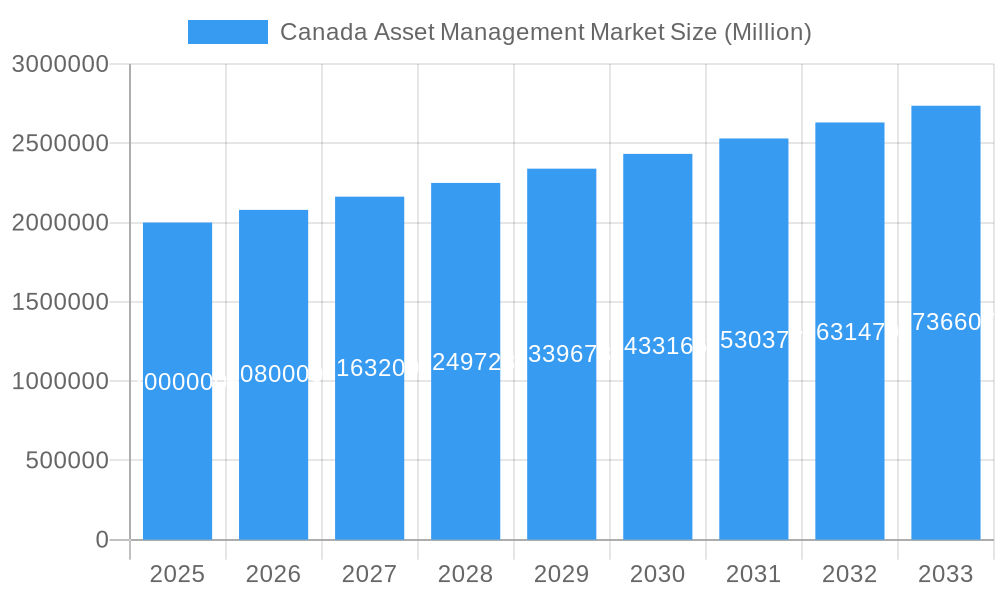

Canada Asset Management Market Market Size (In Billion)

The Canadian asset management market is projected to reach $489.4 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.6%. This projection is based on an analysis of the Canadian financial sector and growth trends in comparable markets, assuming sustained economic expansion and the current CAGR trajectory. Future growth will be shaped by technological advancements, evolving investor preferences such as ESG integration, and competitive dynamics including industry consolidation. This consolidation is expected to further concentrate market share among leading firms, influencing the competitive landscape.

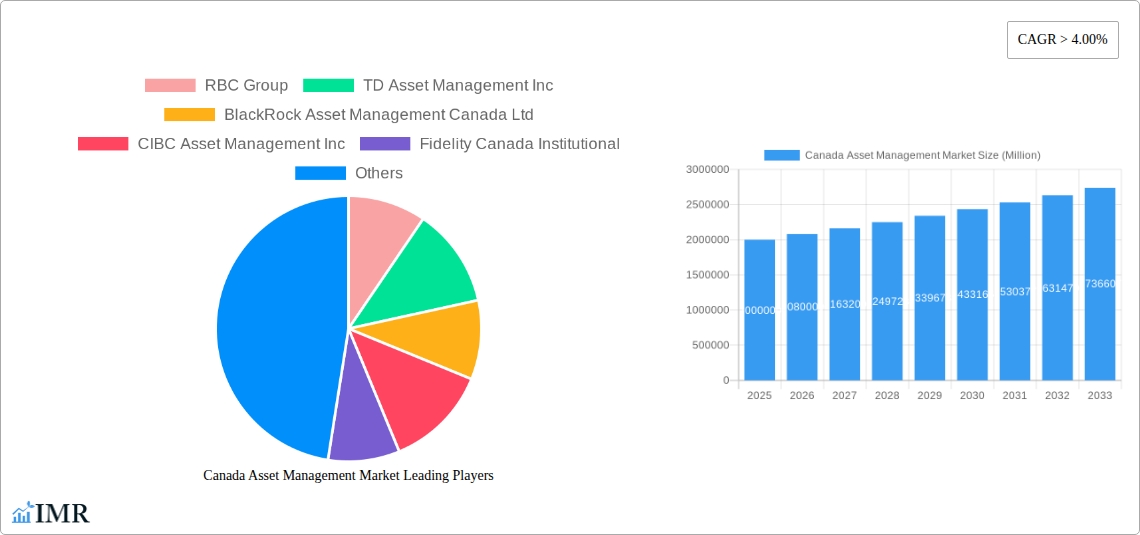

Canada Asset Management Market Company Market Share

Canada Asset Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Asset Management Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic planners seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented into various asset classes and investment strategies, providing granular insights into sub-segments.

Keywords: Canada Asset Management, Investment Management, Asset Under Management (AUM), Canadian Investments, Mutual Funds, ETFs, Pension Funds, RBC Group, TD Asset Management, BlackRock Canada, CIBC Asset Management, Fintech in Asset Management, Canada Financial Services, Market Share Canada, M&A in Asset Management

Canada Asset Management Market Market Dynamics & Structure

This section analyzes the structure and dynamics of the Canadian asset management market, examining factors influencing its evolution. The market, valued at xx Million in 2024, is characterized by a high degree of concentration among major players, with significant AUM controlled by a handful of large institutions. Technological advancements, particularly in fintech, are reshaping the industry, leading to increased automation, digitalization, and the rise of robo-advisors. Regulatory frameworks, such as those imposed by the OSC (Ontario Securities Commission) and other provincial regulators, play a vital role in shaping market practices and investor protection. The increasing adoption of ESG (Environmental, Social, and Governance) investing is influencing investment strategies and asset allocation decisions. Competitive pressures from both domestic and international players are intensifying. M&A activity remains a key factor, with several deals concluded in recent years to enhance scale, market reach, and technological capabilities.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: Fintech investments are driving automation and personalization in investment management services.

- Regulatory Framework: Stringent regulations ensure investor protection and market stability.

- Competitive Landscape: Intense competition amongst established players and new entrants.

- M&A Activity: Consolidation and expansion through mergers and acquisitions are expected to continue.

Canada Asset Management Market Growth Trends & Insights

The Canada Asset Management Market has witnessed consistent growth over the historical period (2019-2024). Driven by factors such as increasing household savings, favorable regulatory environment, and growing adoption of various investment products, including mutual funds, ETFs, and alternative investments. The market is projected to maintain a steady growth trajectory during the forecast period (2025-2033), with a CAGR of xx%. Technological advancements continue to accelerate market growth, enabling more efficient and accessible investment solutions. A shift towards passive investment strategies, driven by lower fees and simplicity, is impacting market dynamics. This shift, coupled with the increasing adoption of ESG considerations, shapes the future of investment preferences. Growth in specific segments, like alternative investments and specialized funds, contributes to the overall market expansion. The total market size is estimated to reach xx Million by 2033.

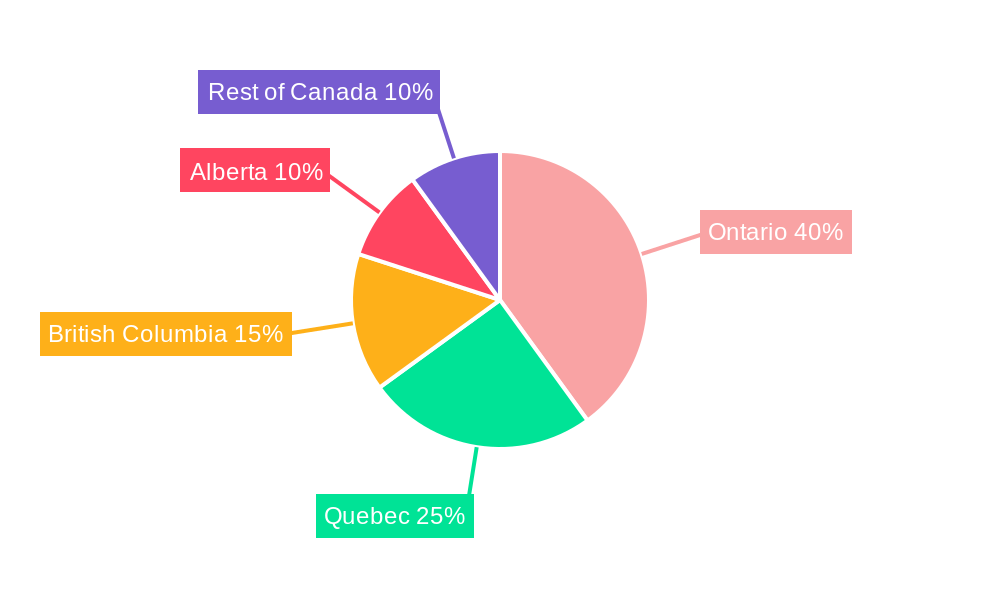

Dominant Regions, Countries, or Segments in Canada Asset Management Market

Ontario and British Columbia represent the most significant regions within the Canada Asset Management Market, driving substantial growth. These regions boast a high concentration of financial institutions, sophisticated investors, and robust economic activity. The strong presence of major asset management companies in these provinces contributes to their dominance. Supportive government policies, well-developed infrastructure, and a larger population base also drive market expansion in these areas. However, other provinces are showing promising growth potential due to increasing wealth and investor sophistication.

- Key Drivers (Ontario & British Columbia): High concentration of financial institutions, substantial AUM, favorable regulatory environment, strong economic activity, access to skilled talent.

- Growth Potential (Other Provinces): Increasing wealth, improved financial literacy, evolving investment strategies.

Canada Asset Management Market Product Landscape

The Canadian asset management market offers a diverse range of products catering to various investor needs and risk profiles. These include mutual funds, exchange-traded funds (ETFs), separately managed accounts (SMAs), alternative investments (hedge funds, private equity), and customized portfolio solutions. Product innovation focuses on enhancing transparency, personalization, and accessibility, with a surge in technology-driven investment solutions such as robo-advisors and algorithmic trading. Key features of many product offerings include ESG integration, lower fees, and tax efficiency.

Key Drivers, Barriers & Challenges in Canada Asset Management Market

Key Drivers:

- Increasing household wealth and savings

- Growing adoption of digital investment platforms

- Government initiatives to promote financial literacy

- Rise of ESG investing

Challenges and Restraints:

- Intense competition among asset management firms

- Regulatory complexity and compliance costs

- Geopolitical uncertainties and market volatility

- Cybersecurity threats and data protection concerns

Emerging Opportunities in Canada Asset Management Market

Emerging opportunities lie in the increasing demand for sustainable and responsible investing. The growth of alternative investments, such as infrastructure and real estate, presents significant potential. The expansion of fintech and the development of innovative investment technologies offer further opportunities for growth. There's an increased need for personalized and tailored investment advice to cater to diverse investor preferences, increasing the adoption of robo-advisors and digital wealth management platforms. The expansion into underserved markets, such as rural areas and underrepresented demographics, offers another avenue for growth.

Growth Accelerators in the Canada Asset Management Market Industry

Long-term growth will be fueled by technological advancements, including AI-driven investment strategies and blockchain technology for enhanced security and transparency. Strategic partnerships between asset managers and fintech companies will drive innovation and broaden market reach. Expansion into new geographic markets and the development of specialized products will also contribute to sustained growth. The integration of ESG factors into investment decisions will continue to accelerate market growth.

Key Players Shaping the Canada Asset Management Market Market

- RBC Group

- TD Asset Management Inc

- BlackRock Asset Management Canada Ltd

- CIBC Asset Management Inc

- Fidelity Canada Institutional

- CI Investments Inc (including CI Institutional Asset Management)

- Mackenzie Investments

- 1832 Asset Management LP (Scotiabank)

- Manulife Asset Management Ltd

- Brookfield Asset Management Inc

Notable Milestones in Canada Asset Management Market Sector

- June 2023: Ninepoint Partners LP expands its partnership with Monroe Capital LLC, signifying growth in the private credit sector.

- April 2023: CapIntel partners with SEI, enhancing sales and marketing processes within the asset management technology space.

In-Depth Canada Asset Management Market Market Outlook

The Canada Asset Management Market is poised for continued growth driven by the factors outlined above. Strategic partnerships, technological innovation, and a focus on ESG investing will shape the future landscape. The market presents lucrative opportunities for both established players and new entrants, particularly those focusing on providing innovative, customized, and technology-driven solutions. The market's long-term outlook is positive, with substantial potential for expansion across various segments.

Canada Asset Management Market Segmentation

-

1. Asset Class

- 1.1. Equity

- 1.2. Fixed Income

- 1.3. Alternative Investment

- 1.4. Hybrid

- 1.5. Cash Management

-

2. Source of Funds

- 2.1. Pension Funds and Insurance Companies

- 2.2. Individu

- 2.3. Corporate Investors

- 2.4. Other So

-

3. Type of Asset Management Firms

- 3.1. Large Financial Institutions/Bulge Brackets Banks

- 3.2. Mutual Funds and ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Hedge Funds

- 3.6. Other Types of Asset Management Firms

Canada Asset Management Market Segmentation By Geography

- 1. Canada

Canada Asset Management Market Regional Market Share

Geographic Coverage of Canada Asset Management Market

Canada Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Data-Driven Approaches

- 3.3. Market Restrains

- 3.3.1. Increasing Use of Data-Driven Approaches

- 3.4. Market Trends

- 3.4.1. Responsible Investment Funds are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Asset Class

- 5.1.1. Equity

- 5.1.2. Fixed Income

- 5.1.3. Alternative Investment

- 5.1.4. Hybrid

- 5.1.5. Cash Management

- 5.2. Market Analysis, Insights and Forecast - by Source of Funds

- 5.2.1. Pension Funds and Insurance Companies

- 5.2.2. Individu

- 5.2.3. Corporate Investors

- 5.2.4. Other So

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large Financial Institutions/Bulge Brackets Banks

- 5.3.2. Mutual Funds and ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Hedge Funds

- 5.3.6. Other Types of Asset Management Firms

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Asset Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 RBC Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TD Asset Management Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BlackRock Asset Management Canada Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CIBC Asset Management Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fidelity Canada Institutional

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CI Investments Inc (including CI Institutional Asset Management)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mackenzie Investments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1832 Asset Management LP (Scotiabank)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Manulife Asset Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brookfield Asset Management Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 RBC Group

List of Figures

- Figure 1: Canada Asset Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Asset Management Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Asset Management Market Revenue billion Forecast, by Asset Class 2020 & 2033

- Table 2: Canada Asset Management Market Revenue billion Forecast, by Source of Funds 2020 & 2033

- Table 3: Canada Asset Management Market Revenue billion Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: Canada Asset Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Asset Management Market Revenue billion Forecast, by Asset Class 2020 & 2033

- Table 6: Canada Asset Management Market Revenue billion Forecast, by Source of Funds 2020 & 2033

- Table 7: Canada Asset Management Market Revenue billion Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: Canada Asset Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Asset Management Market?

The projected CAGR is approximately 12.6%.

2. Which companies are prominent players in the Canada Asset Management Market?

Key companies in the market include RBC Group, TD Asset Management Inc, BlackRock Asset Management Canada Ltd, CIBC Asset Management Inc, Fidelity Canada Institutional, CI Investments Inc (including CI Institutional Asset Management), Mackenzie Investments, 1832 Asset Management LP (Scotiabank), Manulife Asset Management Ltd, Brookfield Asset Management Inc **List Not Exhaustive.

3. What are the main segments of the Canada Asset Management Market?

The market segments include Asset Class, Source of Funds, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD 489.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Data-Driven Approaches.

6. What are the notable trends driving market growth?

Responsible Investment Funds are Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Use of Data-Driven Approaches.

8. Can you provide examples of recent developments in the market?

June 2023: Ninepoint Partners LP, one of Canada’s investment management firms, has announced the expansion of its partnership with Chicago-based private credit asset management firm Monroe Capital LLC, a leader in middle-market private lending with approximately USD 16 billion in assets under management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Asset Management Market?

To stay informed about further developments, trends, and reports in the Canada Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence