Key Insights

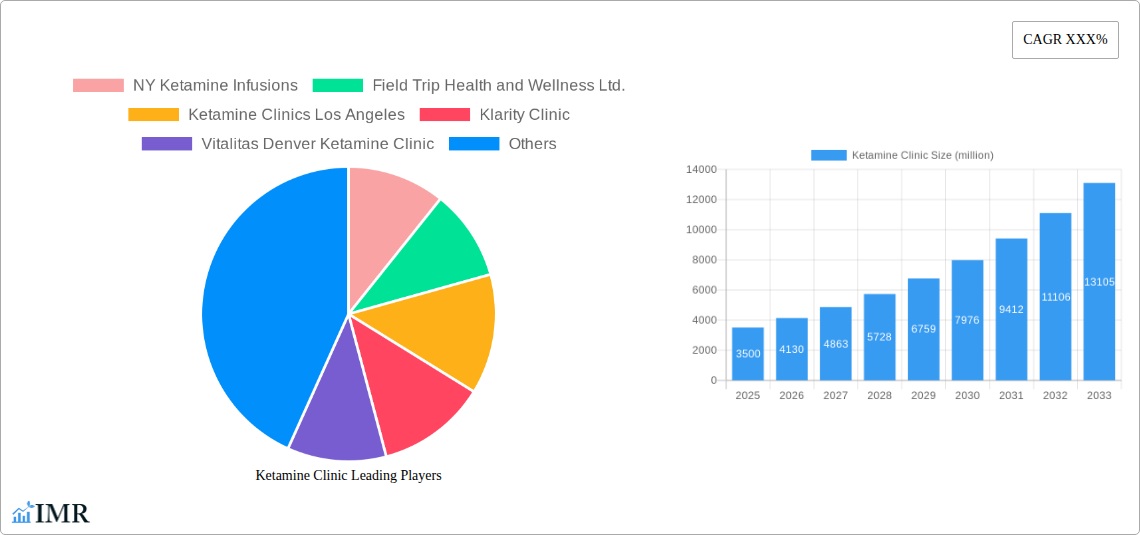

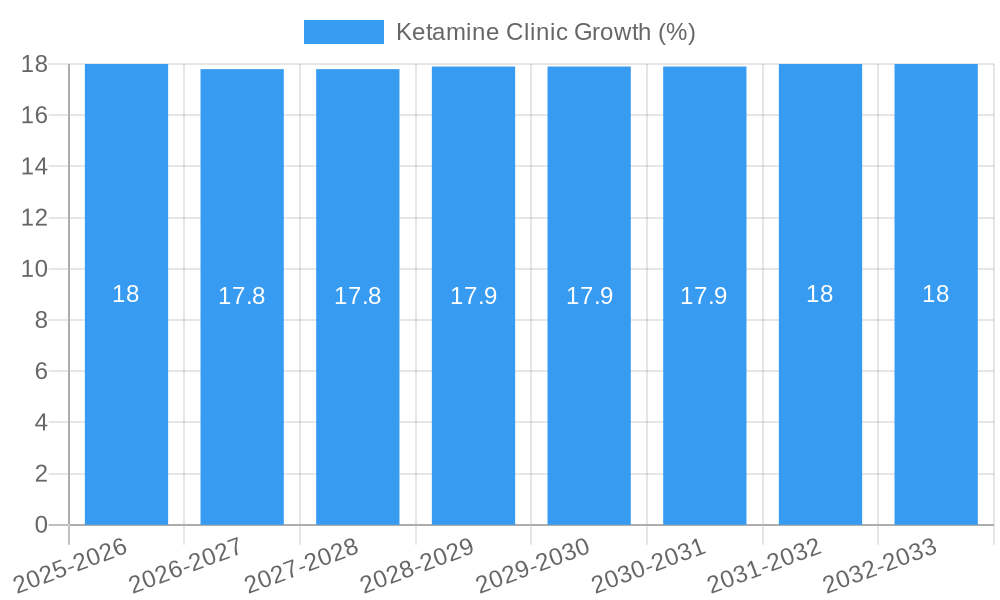

The global Ketamine Clinic market is experiencing robust growth, projected to reach an estimated market size of $3,500 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033. This rapid expansion is significantly fueled by the increasing prevalence of mental health conditions such as depression, anxiety, and PTSD, which are driving demand for innovative and effective treatment modalities. Ketamine therapy has emerged as a groundbreaking solution, offering rapid relief for treatment-resistant conditions where traditional therapies have proven insufficient. The convenience and accessibility offered by both on-site and online therapy segments are further propelling market adoption. Leading companies like NY Ketamine Infusions, Field Trip Health and Wellness Ltd., and Mindbloom, Inc. are investing heavily in expanding their service offerings and geographic reach, indicating a dynamic and competitive landscape.

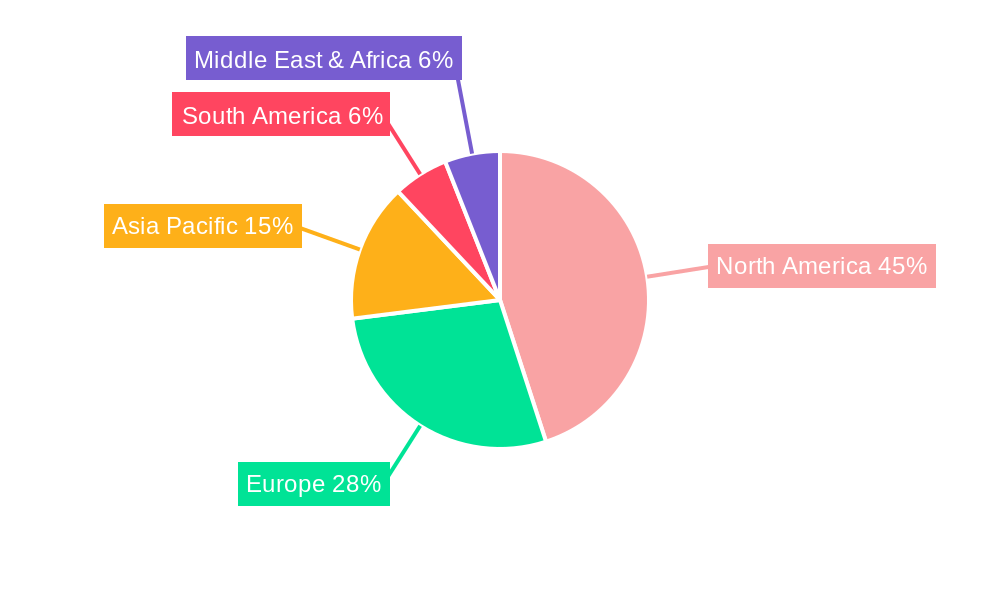

The market's trajectory is also influenced by evolving regulatory landscapes, increased awareness and acceptance of ketamine as a legitimate therapeutic option, and a growing body of clinical evidence supporting its efficacy. While the market enjoys strong growth drivers, it also faces certain restraints, such as the high cost of treatment and the need for skilled medical professionals. However, the expanding reimbursement policies and the growing preference for personalized mental health solutions are expected to mitigate these challenges. North America is anticipated to dominate the market share due to early adoption and established infrastructure, followed by Europe. The Asia Pacific region presents a significant growth opportunity with its large population and increasing focus on mental well-being. The ongoing research into new applications and delivery methods for ketamine therapy will continue to shape the market's future.

Comprehensive Ketamine Clinic Market Report: Insights, Trends, and Future Outlook (2019-2033)

This in-depth market research report provides a panoramic view of the global Ketamine Clinic market, meticulously analyzing its dynamics, growth trajectories, and future potential. Delving into the burgeoning ketamine therapy market, this study offers actionable insights for stakeholders across mental health treatment, neurology, and pharmacology. The report is designed to empower industry professionals, investors, and policymakers with the data and analysis needed to navigate this rapidly evolving sector. Covering a comprehensive study period of 2019–2033, with 2025 as the base and estimated year, and a forecast period from 2025–2033, this report is an indispensable resource for understanding the current landscape and anticipating future developments in ketamine-assisted therapy.

Key Segments Covered:

- Applications: Depression, Anxiety, PTSD

- Therapy Types: On-site Therapy, Online Therapy

- Companies: NY Ketamine Infusions, Field Trip Health and Wellness Ltd., Ketamine Clinics Los Angeles, Klarity Clinic, Vitalitas Denver Ketamine Clinic, Mindbloom, Inc, Nue Life Health, PBC., Better U, LLC, Innerwell, Klarisana.

Ketamine Clinic Market Dynamics & Structure

The Ketamine Clinic market is characterized by a moderate level of concentration, with a mix of established players and emerging startups vying for market share. Technological innovation, particularly in drug formulation and delivery systems, acts as a primary driver, alongside evolving regulatory frameworks that are gradually becoming more conducive to ketamine-based treatments for mental health conditions. Competitive product substitutes, primarily other psychotherapeutic modalities and pharmacological interventions, exert pressure but are increasingly differentiated by ketamine's rapid efficacy for treatment-resistant conditions. End-user demographics are expanding beyond traditional patient pools to include individuals seeking novel and effective solutions for persistent mental health challenges. Mergers and acquisitions (M&A) are becoming more prevalent as larger healthcare entities recognize the significant growth potential of this sector.

- Market Concentration: Moderate, with key players investing heavily in infrastructure and research.

- Technological Innovation: Focus on improved bioavailability, patient monitoring, and integration with digital health platforms.

- Regulatory Frameworks: Evolving FDA approvals and state-level variations influencing market access and reimbursement.

- Competitive Substitutes: Traditional antidepressants, psychotherapy, electroconvulsive therapy (ECT), transcranial magnetic stimulation (TMS).

- End-User Demographics: Individuals with treatment-resistant depression, anxiety, and PTSD, as well as those seeking mental wellness enhancements.

- M&A Trends: Increasing consolidation driven by strategic expansion and economies of scale, with an estimated xx billion units in deal value during the historical period.

Ketamine Clinic Growth Trends & Insights

The Ketamine Clinic market has experienced a substantial growth trajectory, projected to continue its upward momentum through the forecast period. This expansion is fueled by a confluence of factors including increasing mental health awareness, the limitations of conventional treatments for certain debilitating conditions, and a growing body of scientific evidence supporting ketamine's therapeutic benefits. The global ketamine market size is estimated to have reached approximately $3,500 million in 2024, with a robust CAGR projected to reach over 15% from 2025 to 2033. Adoption rates for ketamine-assisted therapy have surged as more clinics open and insurance providers begin to offer coverage. Technological disruptions, such as the development of esketamine nasal sprays and the refinement of intravenous infusion protocols, are enhancing treatment accessibility and efficacy. Consumer behavior is shifting towards seeking faster-acting and more comprehensive mental health solutions, with ketamine therapy emerging as a prominent option for individuals experiencing treatment-resistant depression, anxiety disorders, and post-traumatic stress disorder (PTSD). The parent market for psychiatric drugs and treatments is valued at over $70,000 million, with ketamine clinics carving out a significant and rapidly growing niche within this broader landscape. The child market, specifically focusing on advanced ketamine formulations and delivery systems, is also showing exceptional promise.

- Market Size Evolution: From an estimated $2,200 million in 2019 to a projected $3,500 million in 2025, with significant growth expected.

- Adoption Rates: Steadily increasing, driven by clinical efficacy and expanded access.

- Technological Disruptions: Innovations in formulations (e.g., esketamine) and delivery methods are enhancing treatment outcomes and patient experience.

- Consumer Behavior Shifts: Growing demand for rapid relief from mental health conditions and preference for evidence-based, advanced therapeutic options.

- CAGR (2025-2033): Estimated to exceed 15%.

- Market Penetration: Increasing, especially in regions with supportive regulatory environments and higher prevalence of mental health disorders.

Dominant Regions, Countries, or Segments in Ketamine Clinic

The Depression segment within the Ketamine Clinic market is currently the most dominant, driven by the high global prevalence of depressive disorders and the significant unmet need for effective treatments, particularly for treatment-resistant depression. North America, led by the United States, stands out as the leading region and country in the ketamine clinic market. This dominance is attributed to several key factors: robust healthcare infrastructure, significant investment in mental health research and treatment modalities, a well-established network of specialized clinics, and a growing acceptance and awareness of ketamine therapy among both healthcare providers and patients. The On-site Therapy model remains the primary mode of delivery, offering controlled environments and direct medical supervision, which is crucial for patient safety and therapeutic effectiveness. However, Online Therapy models are rapidly gaining traction, particularly for follow-up care and for individuals with geographical limitations, representing a significant growth area.

- Dominant Segment (Application): Depression, accounting for an estimated 60% of the total ketamine clinic market share in 2025, followed by Anxiety (25%) and PTSD (15%).

- Leading Region: North America, with an estimated 55% market share.

- Leading Country: United States, holding approximately 50% of the North American market.

- Dominant Therapy Type: On-site Therapy, representing 70% of the market.

- Growth Potential (Online Therapy): Projected to experience a CAGR of over 20% from 2025-2033 due to increased accessibility and technological advancements.

- Key Drivers in North America:

- High prevalence of mental health conditions.

- Advanced healthcare systems and research funding.

- Supportive regulatory pathways for novel therapies.

- Increasing patient and physician acceptance of ketamine treatments.

- Market Share (On-site vs. Online): While on-site dominates, online therapy is projected to capture a larger share of the market by 2033, driven by convenience and cost-effectiveness.

Ketamine Clinic Product Landscape

The Ketamine Clinic product landscape is defined by innovation in drug formulations, delivery methods, and integrated therapeutic protocols. While IV ketamine infusions remain a cornerstone, advancements in intranasal esketamine and potentially other oral or sublingual formulations are expanding treatment options. Performance metrics focus on speed of onset, duration of effect, remission rates, and minimization of side effects. Unique selling propositions often revolve around rapid relief for severe mental health symptoms and effectiveness in cases where other treatments have failed. Technological advancements are also enabling more personalized treatment plans, real-time patient monitoring, and the integration of ketamine therapy with psychotherapy for enhanced long-term outcomes. The market is witnessing the introduction of proprietary blends and delivery devices designed to optimize patient experience and therapeutic efficacy, with an estimated $1,800 million invested in R&D for ketamine-based therapeutics globally in the historical period.

Key Drivers, Barriers & Challenges in Ketamine Clinic

Key Drivers:

- Rising Mental Health Burden: Increasing global prevalence of depression, anxiety, and PTSD, creating a vast patient pool.

- Limited Efficacy of Conventional Treatments: Growing demand for alternative solutions for treatment-resistant conditions.

- Rapid Onset of Action: Ketamine offers faster symptom relief compared to traditional antidepressants.

- Growing Scientific Evidence: Robust clinical research validating ketamine's therapeutic benefits.

- Technological Advancements: Innovations in formulations and delivery methods improving accessibility and efficacy.

- Evolving Regulatory Landscape: Gradual acceptance and approval of ketamine-based treatments.

Barriers & Challenges:

- Regulatory Hurdles: Complex and varied approval processes and reimbursement policies across different regions.

- Stigma and Misconceptions: Lingering societal stigma associated with ketamine's historical use, impacting patient and provider perception.

- Cost and Accessibility: High treatment costs and limited insurance coverage in many areas, restricting access for a significant portion of the population.

- Potential for Abuse and Diversion: Concerns regarding the misuse of ketamine necessitating stringent controls.

- Need for Specialized Training: Requirement for trained medical professionals to administer and monitor ketamine therapy safely.

- Supply Chain Volatility: Potential disruptions in the supply of pharmaceutical-grade ketamine, impacting clinic operations. The global supply chain for ketamine is estimated to be worth approximately $500 million.

Emerging Opportunities in Ketamine Clinic

Emerging opportunities in the Ketamine Clinic market lie in expanding therapeutic applications beyond the primary mental health indications, such as chronic pain management and neurological disorders like stroke rehabilitation. The development of novel, more orally bioavailable ketamine derivatives or adjunctive therapies that enhance ketamine's effects while minimizing side effects presents a significant avenue for growth. Furthermore, the integration of digital health platforms for remote patient monitoring, personalized treatment adjustments, and virtual reality-assisted psychotherapy alongside ketamine infusions offers a unique value proposition. Untapped geographical markets in developing economies with growing mental health needs also represent a substantial opportunity, provided regulatory pathways can be navigated. The focus on preventative mental healthcare and wellness programs incorporating ketamine therapy for resilience building is another promising frontier.

Growth Accelerators in the Ketamine Clinic Industry

The ketamine clinic industry's growth is being accelerated by several key factors. Ongoing clinical research and real-world evidence continue to solidify ketamine's efficacy and safety profile, leading to broader acceptance by medical professionals and regulatory bodies. Strategic partnerships between ketamine clinics, pharmaceutical companies, and mental health technology providers are fostering innovation and market expansion. The increasing inclusion of ketamine therapy in insurance plans, albeit gradually, is significantly boosting patient access and demand. Furthermore, the development of decentralized clinical trial networks focused on ketamine research allows for faster data acquisition and quicker translation of findings into clinical practice. Technological breakthroughs in non-invasive delivery systems and AI-driven personalized treatment algorithms are also poised to drive substantial long-term growth.

Key Players Shaping the Ketamine Clinic Market

- NY Ketamine Infusions

- Field Trip Health and Wellness Ltd.

- Ketamine Clinics Los Angeles

- Klarity Clinic

- Vitalitas Denver Ketamine Clinic

- Mindbloom, Inc

- Nue Life Health, PBC.

- Better U, LLC

- Innerwell

- Klarisana

Notable Milestones in Ketamine Clinic Sector

- 2019: FDA approval of esketamine nasal spray (Spravato) for treatment-resistant depression, a significant regulatory milestone.

- 2020: Increased adoption of telehealth and online therapy models to maintain patient access during the COVID-19 pandemic.

- 2021: Growing number of ketamine clinics opening across major metropolitan areas, expanding geographic reach.

- 2022: Significant investment rounds for leading ketamine therapy providers, signaling strong investor confidence.

- 2023: Expansion of research into ketamine's efficacy for other mental health and neurological conditions beyond depression.

- 2024 (estimated): Further integration of ketamine therapy with digital mental health platforms and personalized treatment approaches.

In-Depth Ketamine Clinic Market Outlook

The outlook for the Ketamine Clinic market remains exceptionally positive, fueled by a strong demand for effective mental health solutions and ongoing innovation. Growth accelerators such as increasing clinical validation, supportive regulatory shifts, and technological advancements in drug delivery and patient monitoring will continue to propel the market forward. Strategic partnerships and market expansion into underserved regions offer significant opportunities for revenue growth. The convergence of ketamine therapy with digital health and personalized medicine approaches is expected to redefine patient care, creating a more accessible, effective, and patient-centric mental healthcare landscape. The market's potential to address significant unmet medical needs positions it for sustained, robust expansion throughout the forecast period, with estimated market value to exceed $10,000 million by 2033.

Ketamine Clinic Segmentation

-

1. Application

- 1.1. Depression

- 1.2. Anxiety

- 1.3. PTSD

-

2. Type

- 2.1. On-site Therapy

- 2.2. Online Therapy

Ketamine Clinic Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ketamine Clinic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ketamine Clinic Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Depression

- 5.1.2. Anxiety

- 5.1.3. PTSD

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. On-site Therapy

- 5.2.2. Online Therapy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ketamine Clinic Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Depression

- 6.1.2. Anxiety

- 6.1.3. PTSD

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. On-site Therapy

- 6.2.2. Online Therapy

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ketamine Clinic Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Depression

- 7.1.2. Anxiety

- 7.1.3. PTSD

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. On-site Therapy

- 7.2.2. Online Therapy

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ketamine Clinic Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Depression

- 8.1.2. Anxiety

- 8.1.3. PTSD

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. On-site Therapy

- 8.2.2. Online Therapy

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ketamine Clinic Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Depression

- 9.1.2. Anxiety

- 9.1.3. PTSD

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. On-site Therapy

- 9.2.2. Online Therapy

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ketamine Clinic Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Depression

- 10.1.2. Anxiety

- 10.1.3. PTSD

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. On-site Therapy

- 10.2.2. Online Therapy

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NY Ketamine Infusions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Field Trip Health and Wellness Ltd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ketamine Clinics Los Angeles

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Klarity Clinic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vitalitas Denver Ketamine Clinic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mindbloom Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nue Life Health PBC.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Better U LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Innerwell

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Klarisana

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NY Ketamine Infusions

List of Figures

- Figure 1: Global Ketamine Clinic Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ketamine Clinic Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ketamine Clinic Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ketamine Clinic Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ketamine Clinic Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ketamine Clinic Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ketamine Clinic Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ketamine Clinic Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ketamine Clinic Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ketamine Clinic Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ketamine Clinic Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ketamine Clinic Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ketamine Clinic Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ketamine Clinic Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ketamine Clinic Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ketamine Clinic Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ketamine Clinic Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ketamine Clinic Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ketamine Clinic Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ketamine Clinic Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ketamine Clinic Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ketamine Clinic Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ketamine Clinic Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ketamine Clinic Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ketamine Clinic Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ketamine Clinic Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ketamine Clinic Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ketamine Clinic Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ketamine Clinic Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ketamine Clinic Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ketamine Clinic Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ketamine Clinic Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ketamine Clinic Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ketamine Clinic Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ketamine Clinic Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ketamine Clinic Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ketamine Clinic Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ketamine Clinic Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ketamine Clinic Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ketamine Clinic Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ketamine Clinic Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ketamine Clinic Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ketamine Clinic Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ketamine Clinic Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ketamine Clinic Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ketamine Clinic Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ketamine Clinic Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ketamine Clinic Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ketamine Clinic Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ketamine Clinic Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ketamine Clinic Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ketamine Clinic?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Ketamine Clinic?

Key companies in the market include NY Ketamine Infusions, Field Trip Health and Wellness Ltd., Ketamine Clinics Los Angeles, Klarity Clinic, Vitalitas Denver Ketamine Clinic, Mindbloom, Inc, Nue Life Health, PBC., Better U, LLC, Innerwell, Klarisana.

3. What are the main segments of the Ketamine Clinic?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ketamine Clinic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ketamine Clinic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ketamine Clinic?

To stay informed about further developments, trends, and reports in the Ketamine Clinic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence