Key Insights

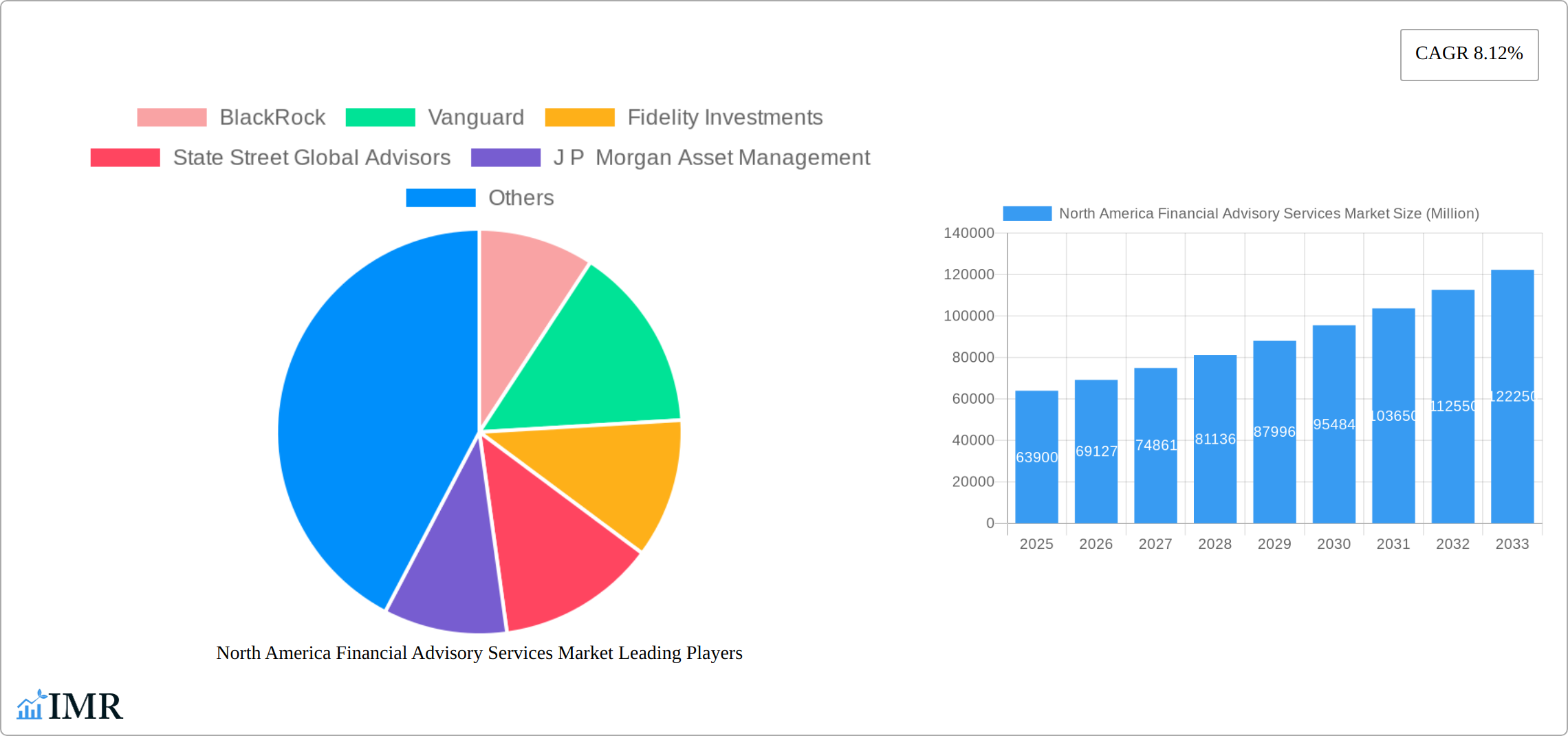

The North American financial advisory services market is a substantial and rapidly growing sector, projected to reach $63.90 billion in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.12% from 2025 to 2033. This growth is fueled by several key factors. Increasing affluence and a growing awareness of the need for sophisticated financial planning among individuals and businesses are driving demand. The rise of complex financial products and the increasing complexity of tax laws necessitate professional financial guidance. Furthermore, a shift towards fee-based advisory models, offering greater transparency and alignment of interests between advisors and clients, is contributing to market expansion. The market is also benefiting from technological advancements, including the use of robo-advisors and sophisticated data analytics, which enhance efficiency and improve the quality of advisory services. Leading players such as BlackRock, Vanguard, Fidelity Investments, and State Street Global Advisors, alongside prominent consulting firms like Boston Consulting Group and Deloitte, are shaping the competitive landscape through strategic partnerships, technological innovations, and expanding service offerings.

North America Financial Advisory Services Market Market Size (In Billion)

Despite the positive outlook, the market faces certain challenges. Regulatory scrutiny and compliance costs remain significant hurdles for financial advisory firms. The need for constant upskilling to adapt to evolving financial regulations and technological advancements also presents an ongoing challenge. Furthermore, competition is intense, with both established players and new fintech entrants vying for market share. Successfully navigating these challenges requires a strategic approach that balances innovation with regulatory compliance, focusing on client needs, and leveraging advanced technologies to enhance service delivery. The market's future trajectory points to continued growth, driven by ongoing demographic changes, expanding financial markets, and the persistent demand for professional financial expertise in a complex financial environment.

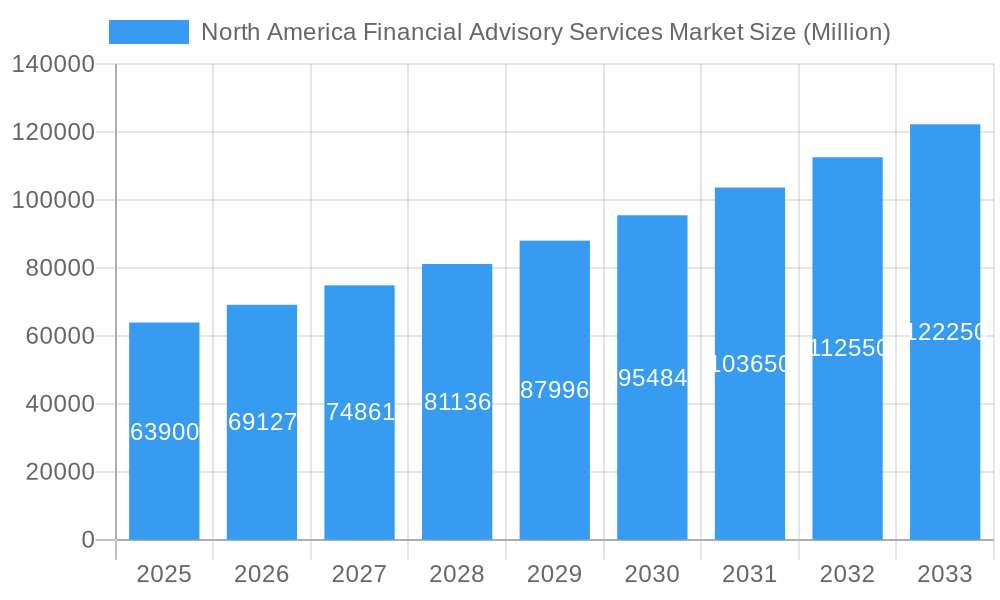

North America Financial Advisory Services Market Company Market Share

North America Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Financial Advisory Services Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market to provide a granular understanding of its various components, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market size in 2025 is estimated at xx Million.

North America Financial Advisory Services Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North American financial advisory services sector. The market is characterized by a high degree of concentration, with major players such as BlackRock, Vanguard, Fidelity Investments, and State Street Global Advisors holding significant market share. However, boutique firms and specialized advisors also contribute significantly to the market's overall dynamism.

- Market Concentration: The top 5 players account for an estimated xx% of the market in 2025.

- Technological Innovation: Fintech advancements, including AI-driven robo-advisors and digital platforms, are disrupting traditional advisory models. However, regulatory hurdles and data security concerns present significant barriers to widespread adoption.

- Regulatory Frameworks: Stringent regulations (e.g., Dodd-Frank Act, GDPR) influence advisory practices and compliance costs. These regulations also affect the competitive landscape and M&A activity.

- Competitive Product Substitutes: Self-directed investing platforms and online resources offer alternative options to traditional advisory services, impacting market share in specific segments.

- End-User Demographics: High-net-worth individuals, institutional investors, and retail investors represent key end-user segments, each with unique needs and preferences.

- M&A Trends: The market has witnessed a significant number of mergers and acquisitions (M&A) deals in recent years, driven by consolidation, expansion, and technological integration. An estimated xx M&A deals occurred between 2019 and 2024.

North America Financial Advisory Services Market Growth Trends & Insights

The North American financial advisory services market exhibits robust growth potential, driven by several factors. Increasing disposable incomes, rising wealth accumulation, and the growing demand for personalized financial planning fuel market expansion. Technological advancements, such as AI and big data analytics, further enhance the efficiency and scope of advisory services. Consumer behavior shifts towards digital platforms and personalized experiences also significantly influence market growth. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

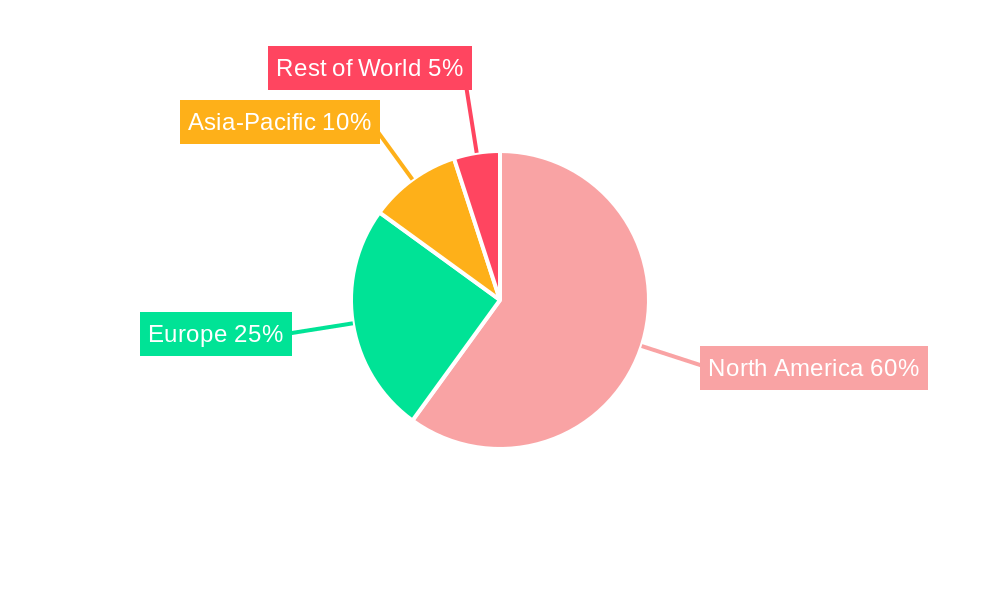

Dominant Regions, Countries, or Segments in North America Financial Advisory Services Market

The market exhibits variations in growth across different regions and segments. (Specific region/country details require further data to replace "xx".) The xx region dominates the market, driven by strong economic growth, favorable regulatory environments, and a high concentration of wealth.

- Key Drivers:

- Strong economic growth in the xx region.

- Favorable regulatory environment promoting financial innovation.

- High concentration of high-net-worth individuals and institutional investors.

- Robust infrastructure facilitating technological adoption.

- Dominance Factors:

- Higher per capita income levels in the dominant region contribute to increased demand for financial advisory services. (Specific quantitative data needed to replace "xx".)

- The established financial ecosystem in the dominant region attracts leading advisory firms and fosters competition. (Specific quantitative data needed to replace "xx".)

- The early adoption of fintech solutions has enabled faster growth in the dominant region. (Specific quantitative data needed to replace "xx".)

North America Financial Advisory Services Market Product Landscape

The North American financial advisory services market is a dynamic landscape offering a diverse array of products and services tailored to meet the evolving needs of individual and institutional clients. Core offerings encompass investment management, encompassing both traditional and alternative asset classes; comprehensive wealth planning, incorporating estate and tax strategies; retirement planning solutions, addressing diverse income streams and longevity risks; and tax advisory services, ensuring optimal tax efficiency. The market is experiencing a significant transformation driven by technological innovation, with a strong emphasis on personalized and data-driven solutions.

This technological evolution manifests in several key areas: the rise of robo-advisors offering automated, algorithm-driven investment management; AI-powered portfolio management tools providing sophisticated risk assessment and optimization; and the proliferation of digital platforms enabling seamless client interaction and access to financial information. These advancements are enhancing efficiency, improving client experience, and democratizing access to sophisticated financial advice. Key value propositions driving market growth include personalized investment strategies tailored to individual risk tolerance and financial goals, robust risk management solutions mitigating market volatility and unforeseen events, and comprehensive financial planning encompassing all facets of a client's financial life.

Key Drivers, Barriers & Challenges in North America Financial Advisory Services Market

Key Drivers: Rising disposable incomes, increasing awareness of financial planning, and the growth of the high-net-worth individual segment are key market drivers. Technological advancements, such as AI-powered robo-advisors, are also propelling market growth.

Key Challenges: Regulatory compliance costs, cybersecurity risks, and intense competition among established players and new entrants pose significant challenges. Supply chain disruptions impacting technology infrastructure can lead to service delays and increased costs. These issues can collectively impact market growth by an estimated xx% annually.

Emerging Opportunities in North America Financial Advisory Services Market

Untapped markets in underserved populations, the increasing adoption of sustainable and ESG (environmental, social, and governance) investing, and the rising demand for digital financial planning tools represent significant growth opportunities. The integration of blockchain technology and decentralized finance (DeFi) presents potential for innovative service offerings.

Growth Accelerators in the North America Financial Advisory Services Market Industry

Several key factors are propelling the growth of the North American financial advisory services market. Technological advancements are paramount, with the development of advanced analytical tools, AI-driven solutions, and machine learning algorithms enabling more accurate forecasting, personalized recommendations, and efficient portfolio management. Strategic partnerships between established financial institutions and innovative fintech companies are fostering a collaborative environment, leading to the development of hybrid models combining the expertise of traditional advisors with the scalability and efficiency of technology. This collaborative approach expands service offerings, enhances client experience, and drives market innovation.

Furthermore, expansion strategies targeting underserved market segments, such as millennials and Gen Z, and expanding into international markets are creating new avenues for growth. The increasing awareness of the importance of financial planning, coupled with the growing complexity of the financial landscape, is driving demand for professional financial advisory services. Regulatory changes and increasing demand for transparency and ethical practices are also shaping the market's evolution.

Key Players Shaping the North America Financial Advisory Services Market Market

Notable Milestones in North America Financial Advisory Services Market Sector

- February 2023: Deloitte significantly expanded its capabilities in supporting innovative firms within the financial technology space through the acquisition of 27 pilots, a German incubator, a venture capitalist, and a matchmaker. This strategic move strengthens Deloitte's position within the fintech ecosystem and broadens its access to cutting-edge technologies and talent.

- January 2023: Fidelity Investments' acquisition of Shoobx, a leading provider of automated equity management operations and financing software for private companies, underscores the growing importance of technology in private wealth management. This acquisition enhanced Fidelity's service offerings for private company clients and strengthens its technological capabilities.

- [Add another recent milestone here - include date, company, and brief description of the event and its significance to the market.]

In-Depth North America Financial Advisory Services Market Market Outlook

The North American financial advisory services market exhibits robust growth potential, driven by a confluence of factors. Technological advancements continue to reshape the industry, offering enhanced efficiency, personalization, and accessibility. Evolving consumer preferences, characterized by a greater demand for sophisticated financial planning and personalized solutions, are fueling market demand. The increasing complexity of financial markets and regulations necessitate the expertise of financial advisors, contributing to sustained growth. Strategic partnerships, expansion into new markets, and the ongoing development of innovative products and services will continue to shape the competitive landscape, presenting attractive opportunities for established players and new entrants alike. The market is projected to reach significant growth by [Insert Year], representing substantial investment and business opportunities. Specific figures and projections should be sourced from reputable market research reports for accuracy.

North America Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Others

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Others

North America Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Financial Advisory Services Market Regional Market Share

Geographic Coverage of North America Financial Advisory Services Market

North America Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Use of Robot Advisory Services is Growing in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vanguard

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fidelity Investments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Street Global Advisors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J P Morgan Asset Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bain & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PWC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deloitte**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: North America Financial Advisory Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: North America Financial Advisory Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Financial Advisory Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: North America Financial Advisory Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Financial Advisory Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Financial Advisory Services Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the North America Financial Advisory Services Market?

Key companies in the market include BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, J P Morgan Asset Management, Boston Consulting Group, Ernst & Young Global Limited, Bain & Company, PWC, Deloitte**List Not Exhaustive.

3. What are the main segments of the North America Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Use of Robot Advisory Services is Growing in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities by acquiring 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 pilots as part of its portfolio, Deloitte can better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the North America Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence