Key Insights

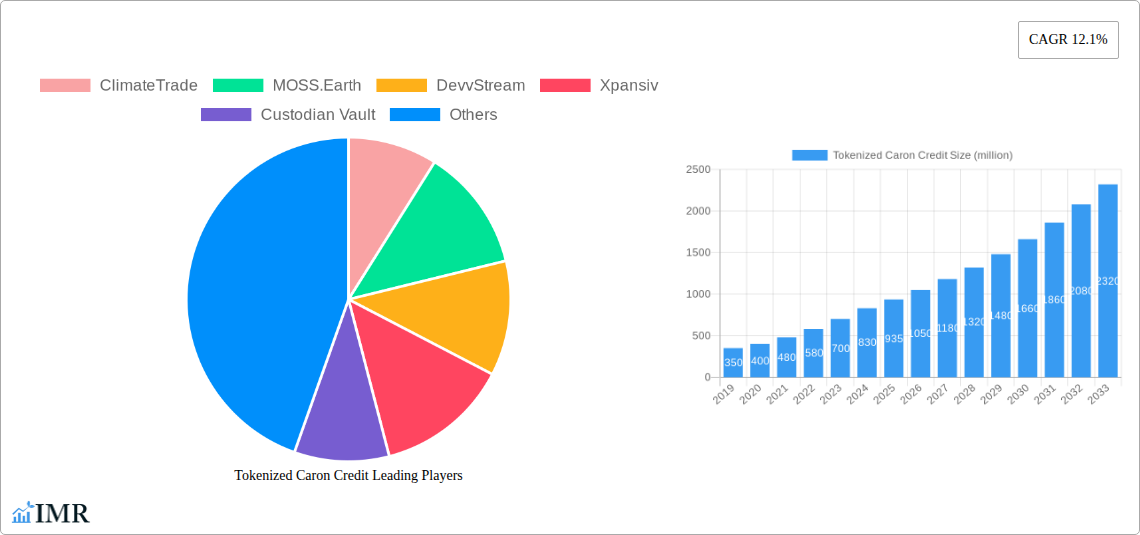

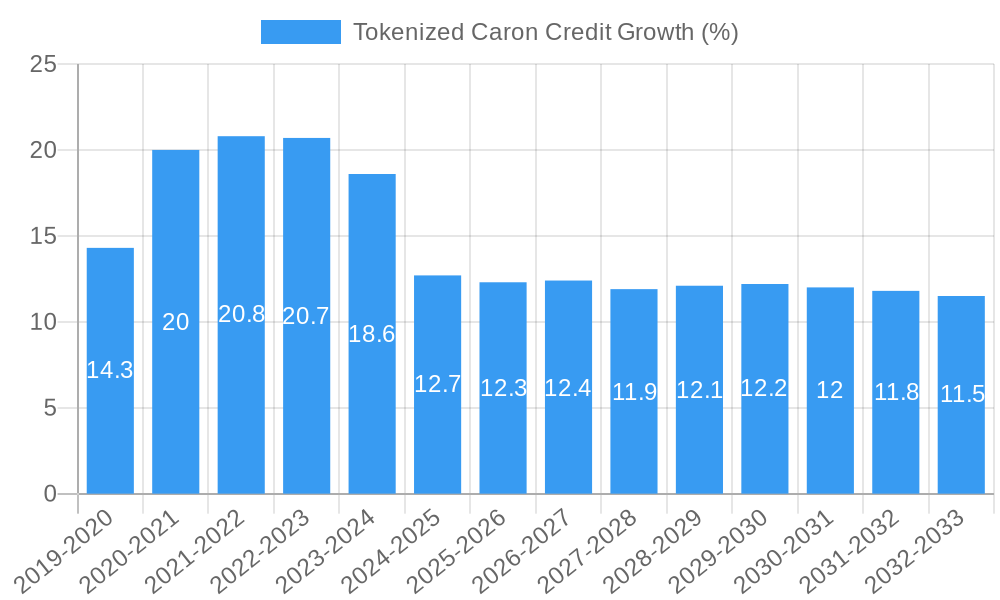

The global tokenized carbon credit market is poised for substantial growth, projected to reach an estimated \$935 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.1% expected throughout the forecast period of 2025-2033. This remarkable expansion is fundamentally driven by the increasing urgency for climate action and the growing adoption of innovative financial instruments to facilitate carbon offsetting. The emergence of blockchain technology has revolutionized the carbon credit landscape, enhancing transparency, traceability, and efficiency within both Voluntary Carbon Markets (VCM) and Compliance Carbon Markets. This technological integration allows for the fractionalization and easier trading of carbon assets, attracting a broader range of investors and participants. Furthermore, the escalating demand from environmental organizations and government agencies for verifiable and auditable carbon reduction strategies significantly fuels market expansion. The integration of tokenized carbon credits into digital platforms is streamlining the entire lifecycle, from credit issuance and verification to trading and retirement, making climate finance more accessible and impactful.

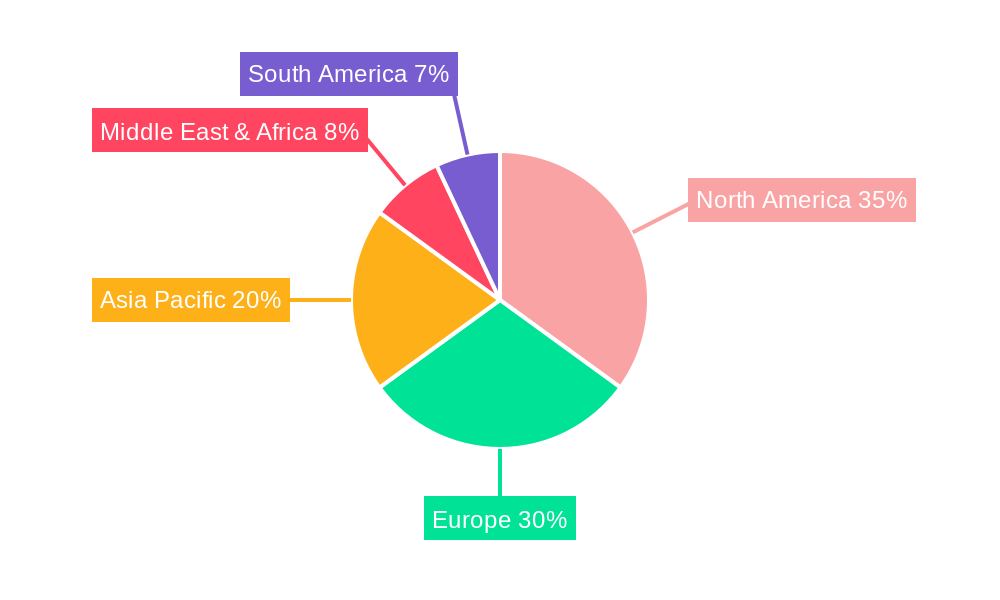

The market's trajectory is further shaped by key trends such as the increasing institutional investor interest in ESG (Environmental, Social, and Governance) assets and the development of sophisticated digital platforms that cater to both retail and institutional buyers. Initiatives focused on ensuring the integrity and credibility of tokenized credits, such as robust verification processes and clear regulatory frameworks, are crucial for sustained growth. While the market benefits from strong drivers, potential restraints include regulatory uncertainties, the need for standardization in tokenization processes, and the ongoing challenge of combating double-counting and ensuring the additionality of carbon credits. Geographically, North America, with its established carbon trading infrastructure and strong regulatory push, along with Europe, characterized by its ambitious climate targets and green finance initiatives, are anticipated to lead market adoption. The Asia Pacific region, particularly with the burgeoning economies of China and India, presents significant future growth opportunities as these nations increasingly prioritize carbon neutrality.

Here's a comprehensive, SEO-optimized report description for Tokenized Carbon Credit, ready for immediate use:

Tokenized Carbon Credit Market Dynamics & Structure

The global tokenized carbon credit market is experiencing a dynamic evolution, driven by increasing demand for transparent and efficient carbon offsetting solutions. Market concentration is gradually shifting as new blockchain-based platforms emerge, challenging established players and fostering innovation. Technological advancements, particularly in blockchain interoperability and tokenization standards, are key drivers of this transformation, enabling fractional ownership and easier transferability of carbon assets. Regulatory frameworks are still developing, creating both opportunities and challenges for market participants. While traditional carbon credit markets serve as competitive substitutes, tokenization offers enhanced liquidity and accessibility. End-user demographics are broadening, encompassing not only environmental organizations and government agencies but also a growing number of SMEs and large enterprises seeking to meet sustainability goals. Mergers and acquisitions (M&A) activity is anticipated to increase as key players consolidate their positions and acquire innovative technologies. For instance, approximately $50 million in M&A deals were observed in the historical period (2019-2024). The primary barrier to entry remains the complexity of integrating blockchain solutions with existing carbon accounting methodologies.

- Market Concentration: Fragmented, with a trend towards consolidation.

- Technological Innovation Drivers: Blockchain interoperability, tokenization standards, smart contracts.

- Regulatory Frameworks: Nascent and evolving, with potential for increased clarity driving adoption.

- Competitive Product Substitutes: Traditional carbon credits, direct emission reduction projects.

- End-User Demographics: Environmental Organizations, Government Agencies, SMEs, Large Enterprises.

- M&A Trends: Increasing as companies seek to enhance technological capabilities and market reach.

Tokenized Carbon Credit Growth Trends & Insights

The tokenized carbon credit market is poised for exponential growth, projected to reach approximately $2,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 22.5% from the base year of 2025. This significant expansion is underpinned by a substantial increase in adoption rates, particularly among environmentally conscious corporations and governments seeking verifiable and efficient decarbonization strategies. Technological disruptions, including the advent of digital carbon registries and the integration of IoT for real-time emissions monitoring, are fundamentally reshaping how carbon credits are created, traded, and retired. Consumer behavior is shifting towards greater demand for transparency and accountability in climate action, making tokenized assets, with their immutable ledger capabilities, highly attractive. Market penetration is expected to surge as regulatory clarity improves and more robust infrastructure for tokenized carbon is developed. During the forecast period (2025-2033), we anticipate a market size evolution from an estimated $800 million in 2025 to over $2,500 million, driven by increased participation from both the voluntary carbon market (VCM) platform and compliance carbon market platform segments. The historical period (2019-2024) saw foundational development, with the market size growing from approximately $100 million to an estimated $500 million, demonstrating early-stage but robust momentum. This growth trajectory is further supported by the increasing need for carbon neutrality by 2050.

Dominant Regions, Countries, or Segments in Tokenized Carbon Credit

North America currently dominates the tokenized carbon credit market, driven by robust government initiatives for climate action, a strong presence of leading technology providers, and high corporate adoption rates of sustainability practices. The United States, in particular, is a key market due to its advanced financial infrastructure and a growing number of enterprises actively participating in both voluntary and compliance carbon markets. For instance, North America is estimated to hold a 40% market share in the current landscape. The primary growth driver from the Application segment is Large Enterprises, which are increasingly setting ambitious net-zero targets and seeking efficient, auditable methods for carbon offsetting. These entities are leveraging tokenized carbon credits to meet their Scope 3 emissions obligations and demonstrate genuine climate commitment. The Voluntary Carbon Market (VCM) Platform type is also a significant contributor to market growth, offering flexibility and accessibility for a wider range of participants compared to more rigid compliance markets. Key drivers within this segment include the growing demand for high-quality, verified carbon removal projects and the desire for greater transparency in the credit lifecycle. Economic policies supportive of green finance and the development of digital infrastructure for carbon trading are further solidifying North America's leading position. Market share in this region is projected to reach 45% by 2033. Europe and Asia-Pacific are emerging as strong contenders, with increasing regulatory push and growing awareness of tokenized carbon solutions.

- Dominant Region: North America

- Leading Country: United States

- Dominant Application Segment: Large Enterprises

- Dominant Type Segment: Voluntary Carbon Market (VCM) Platform

- Key Drivers: Supportive government policies, advanced financial infrastructure, corporate sustainability targets, demand for transparency, technological adoption.

- Growth Potential: Significant, as more regions and enterprises adopt tokenization.

Tokenized Carbon Credit Product Landscape

The tokenized carbon credit product landscape is characterized by innovative applications and enhanced performance metrics. Products range from fractionalized carbon credits representing verified emission reductions from diverse projects, such as renewable energy or nature-based solutions, to sophisticated platforms enabling automated trading and retirement of these assets. Unique selling propositions include unparalleled transparency due to blockchain's immutable ledger, fractional ownership for increased accessibility, and improved liquidity compared to traditional markets. Technological advancements like the integration of the Verra registry data onto the blockchain ensure the integrity and traceability of each tokenized credit. MOSS.Earth and ClimateTrade are at the forefront, offering platforms that facilitate the creation and trading of these digital carbon assets, providing clear performance metrics such as verification standards and retirement rates.

Key Drivers, Barriers & Challenges in Tokenized Carbon Credit

Key Drivers:

- Increased Transparency & Trust: Blockchain technology provides an immutable ledger, enhancing the credibility of carbon offsets.

- Enhanced Liquidity & Accessibility: Tokenization enables fractional ownership and easier trading, opening the market to a broader investor base.

- Regulatory Push for ESG: Growing government mandates and corporate commitments to Environmental, Social, and Governance (ESG) goals are driving demand.

- Technological Advancements: Innovations in blockchain and smart contracts streamline the issuance, trading, and retirement of carbon credits.

- Demand for Carbon Neutrality: Businesses and governments globally are seeking effective tools to achieve net-zero targets.

Barriers & Challenges:

- Regulatory Uncertainty: Evolving regulatory frameworks can create ambiguity for market participants.

- Scalability of Blockchain Solutions: Ensuring blockchain platforms can handle high transaction volumes efficiently.

- Integration with Existing Systems: Challenges in harmonizing new tokenized systems with traditional carbon accounting and registry infrastructure.

- Market Education & Adoption: Raising awareness and fostering trust in tokenized carbon credits among potential users.

- Double Counting Concerns: Ensuring robust mechanisms to prevent the same carbon credit from being claimed multiple times.

Emerging Opportunities in Tokenized Carbon Credit

Emerging opportunities in the tokenized carbon credit sector lie in the development of more sophisticated DeFi (Decentralized Finance) applications built around carbon assets, such as carbon-backed stablecoins and carbon yield farming. Untapped markets include smaller businesses seeking affordable offsetting solutions and emerging economies looking to leverage their carbon sequestration potential. Innovative applications include integrating tokenized credits into supply chain financing to incentivize sustainable practices and creating personalized carbon portfolios for individuals. Evolving consumer preferences are leaning towards verifiable climate impact, making tokenized credits an attractive avenue for corporate social responsibility initiatives.

Growth Accelerators in the Tokenized Carbon Credit Industry

Growth accelerators for the tokenized carbon credit industry include strategic partnerships between leading technology providers like DevvStream and Custodian Vault with established carbon registries and financial institutions such as Northern Trust. Technological breakthroughs in interoperability standards will allow seamless exchange of tokenized credits across different blockchain networks, significantly expanding market reach. Market expansion strategies focusing on educating SMEs and developing user-friendly platforms will further drive adoption. The development of robust secondary markets for tokenized credits will enhance price discovery and liquidity, attracting greater institutional investment.

Key Players Shaping the Tokenized Carbon Credit Market

- ClimateTrade

- MOSS.Earth

- DevvStream

- Xpansiv

- Custodian Vault

- Verra

- Northern Trust

Notable Milestones in Tokenized Carbon Credit Sector

- 2019: Early exploration of blockchain for carbon credit tracking.

- 2020: Initial pilot programs for tokenizing carbon credits.

- 2021: Increased venture capital investment into blockchain-based carbon platforms.

- 2022: Growing collaboration between traditional carbon registries and tokenization companies.

- 2023: Launch of several VCM platforms offering tokenized carbon credits; increased regulatory discussions.

- 2024 (Estimated): Expansion of tokenized credit use cases beyond basic offsetting, integration with sustainability reporting frameworks.

In-Depth Tokenized Carbon Credit Market Outlook

The future market potential for tokenized carbon credits is immense, fueled by an accelerating global transition to net-zero economies. Growth accelerators, including technological innovation and increasing regulatory clarity, are paving the way for widespread adoption. Strategic opportunities include the development of standardized tokenization frameworks, the integration of tokenized credits into traditional financial markets, and the creation of robust carbon accounting infrastructure. As more enterprises and governments prioritize climate action, the demand for transparent, liquid, and accessible carbon offsetting solutions will continue to surge, positioning tokenized carbon credits as a critical component of global climate finance.

Tokenized Caron Credit Segmentation

-

1. Application

- 1.1. SME

- 1.2. Large Enterprises

- 1.3. Environmental Organizations

- 1.4. Government Agencies

-

2. Type

- 2.1. Voluntary Carbon Market (VCM) Platform

- 2.2. Compliance Carbon Market Platform

Tokenized Caron Credit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tokenized Caron Credit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tokenized Caron Credit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SME

- 5.1.2. Large Enterprises

- 5.1.3. Environmental Organizations

- 5.1.4. Government Agencies

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Voluntary Carbon Market (VCM) Platform

- 5.2.2. Compliance Carbon Market Platform

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tokenized Caron Credit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SME

- 6.1.2. Large Enterprises

- 6.1.3. Environmental Organizations

- 6.1.4. Government Agencies

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Voluntary Carbon Market (VCM) Platform

- 6.2.2. Compliance Carbon Market Platform

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tokenized Caron Credit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SME

- 7.1.2. Large Enterprises

- 7.1.3. Environmental Organizations

- 7.1.4. Government Agencies

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Voluntary Carbon Market (VCM) Platform

- 7.2.2. Compliance Carbon Market Platform

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tokenized Caron Credit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SME

- 8.1.2. Large Enterprises

- 8.1.3. Environmental Organizations

- 8.1.4. Government Agencies

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Voluntary Carbon Market (VCM) Platform

- 8.2.2. Compliance Carbon Market Platform

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tokenized Caron Credit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SME

- 9.1.2. Large Enterprises

- 9.1.3. Environmental Organizations

- 9.1.4. Government Agencies

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Voluntary Carbon Market (VCM) Platform

- 9.2.2. Compliance Carbon Market Platform

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tokenized Caron Credit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SME

- 10.1.2. Large Enterprises

- 10.1.3. Environmental Organizations

- 10.1.4. Government Agencies

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Voluntary Carbon Market (VCM) Platform

- 10.2.2. Compliance Carbon Market Platform

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ClimateTrade

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MOSS.Earth

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DevvStream

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xpansiv

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Custodian Vault

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Verra

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northern Trust

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ClimateTrade

List of Figures

- Figure 1: Global Tokenized Caron Credit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Tokenized Caron Credit Revenue (million), by Application 2024 & 2032

- Figure 3: North America Tokenized Caron Credit Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Tokenized Caron Credit Revenue (million), by Type 2024 & 2032

- Figure 5: North America Tokenized Caron Credit Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Tokenized Caron Credit Revenue (million), by Country 2024 & 2032

- Figure 7: North America Tokenized Caron Credit Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Tokenized Caron Credit Revenue (million), by Application 2024 & 2032

- Figure 9: South America Tokenized Caron Credit Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Tokenized Caron Credit Revenue (million), by Type 2024 & 2032

- Figure 11: South America Tokenized Caron Credit Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Tokenized Caron Credit Revenue (million), by Country 2024 & 2032

- Figure 13: South America Tokenized Caron Credit Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tokenized Caron Credit Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Tokenized Caron Credit Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Tokenized Caron Credit Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Tokenized Caron Credit Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Tokenized Caron Credit Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Tokenized Caron Credit Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Tokenized Caron Credit Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Tokenized Caron Credit Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Tokenized Caron Credit Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Tokenized Caron Credit Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Tokenized Caron Credit Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Tokenized Caron Credit Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tokenized Caron Credit Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Tokenized Caron Credit Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Tokenized Caron Credit Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Tokenized Caron Credit Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Tokenized Caron Credit Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Tokenized Caron Credit Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tokenized Caron Credit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tokenized Caron Credit Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Tokenized Caron Credit Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Tokenized Caron Credit Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Tokenized Caron Credit Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Tokenized Caron Credit Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Tokenized Caron Credit Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Tokenized Caron Credit Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Tokenized Caron Credit Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Tokenized Caron Credit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Tokenized Caron Credit Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Tokenized Caron Credit Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Tokenized Caron Credit Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Tokenized Caron Credit Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Tokenized Caron Credit Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Tokenized Caron Credit Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Tokenized Caron Credit Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Tokenized Caron Credit Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Tokenized Caron Credit Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tokenized Caron Credit Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tokenized Caron Credit?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Tokenized Caron Credit?

Key companies in the market include ClimateTrade, MOSS.Earth, DevvStream, Xpansiv, Custodian Vault, Verra, Northern Trust.

3. What are the main segments of the Tokenized Caron Credit?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 935 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tokenized Caron Credit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tokenized Caron Credit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tokenized Caron Credit?

To stay informed about further developments, trends, and reports in the Tokenized Caron Credit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence