Key Insights

The UAE Industrial Waste Management Market is poised for significant expansion, projected to reach 66101.8 million by 2033. The Compound Annual Growth Rate (CAGR) of 7.77% from a base year of 2024 underscores robust market development, driven by stringent environmental regulations and the UAE's dynamic industrial growth. Increased awareness of sustainable practices and the economic advantages of effective waste management, including waste-to-energy solutions, are key market stimulants. Leading companies like Averda, Veolia, and Sembcorp Industries are instrumental in shaping the market through innovation and strategic collaborations. Challenges include the capital investment required for advanced technologies and infrastructure development to manage escalating waste volumes.

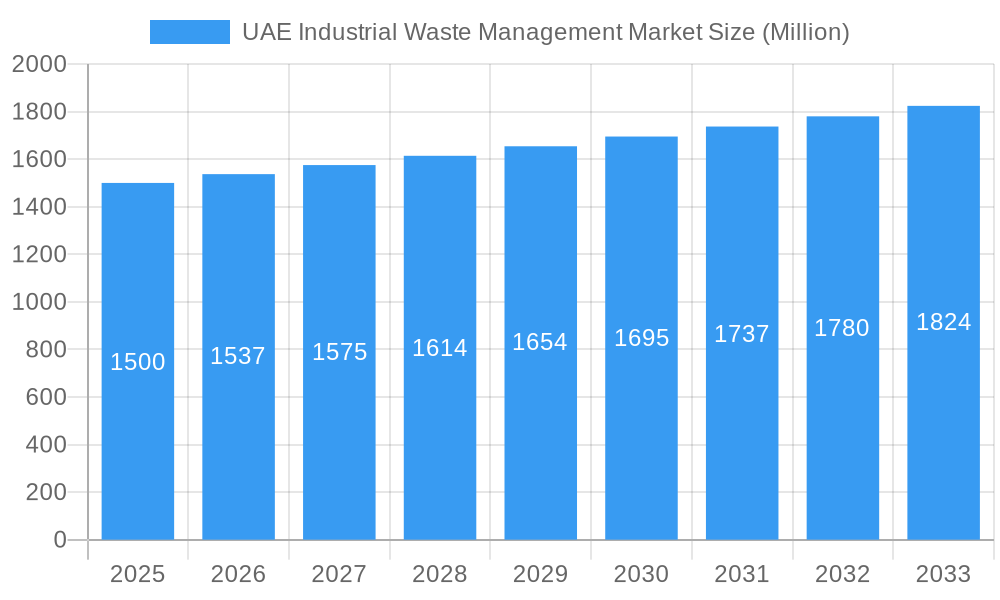

UAE Industrial Waste Management Market Market Size (In Billion)

The market segmentation covers waste types (hazardous and non-hazardous), treatment methods (recycling and incineration), and industrial sectors (manufacturing and construction). Future growth will be shaped by government initiatives promoting circular economy principles, advancements in waste processing technologies, and a broad adoption of sustainable industrial practices.

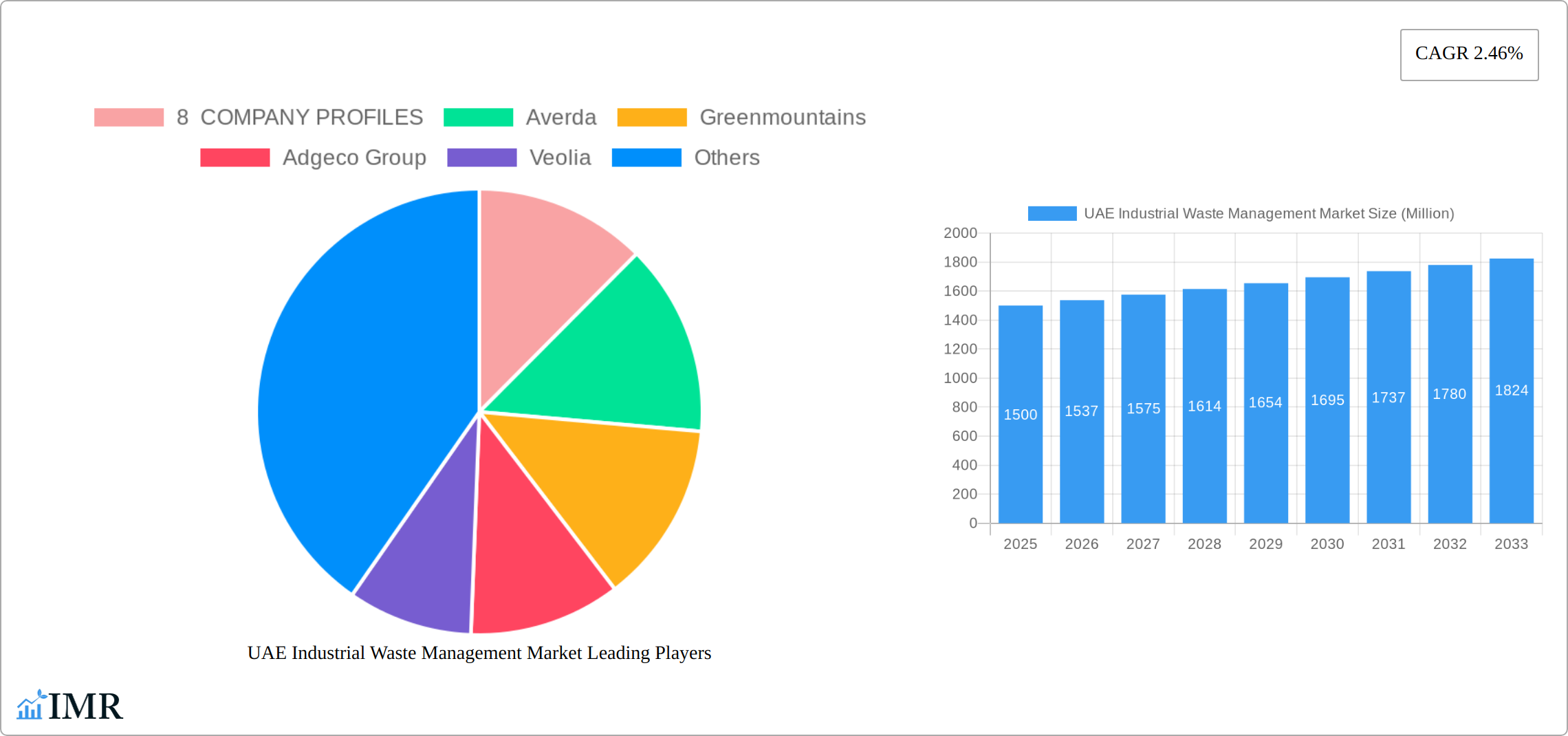

UAE Industrial Waste Management Market Company Market Share

The competitive arena features a blend of global and local enterprises. International firms contribute cutting-edge technologies and expertise, complemented by local players offering tailored solutions and market insights. The market anticipates increased consolidation and strategic alliances to enhance market presence and service portfolios. Future growth drivers include innovations in waste-to-energy, the implementation of smart waste management systems leveraging data analytics and IoT, and the pursuit of zero-waste objectives. Opportunities exist for specialized waste management solutions for sectors such as petrochemicals and construction. Over the forecast period, the market will increasingly favor sustainable and eco-friendly waste management practices, propelled by heightened consumer consciousness and stricter regulatory compliance.

UAE Industrial Waste Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the UAE Industrial Waste Management Market, offering invaluable insights for industry professionals, investors, and policymakers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by waste type (hazardous, non-hazardous), treatment method (recycling, incineration, landfill), and end-user industry (manufacturing, construction, oil & gas). The report values the market in million units.

Keywords: UAE Industrial Waste Management, Waste Management Market, Industrial Waste, Recycling, Incineration, Landfill, Hazardous Waste, Non-Hazardous Waste, Averda, Greenmountains, Adgeco Group, Veolia, Sembcorp Industries, Fivem Waste Management, ADSSC, Erragon-Gulf, Bee ah, Blue LL, UAE Recycling, UAE Waste Treatment, Market Size, Market Share, Market Growth, CAGR.

UAE Industrial Waste Management Market Dynamics & Structure

The UAE industrial waste management market is characterized by a moderately concentrated landscape, with a few large players dominating alongside numerous smaller, specialized firms. Technological innovation, driven by the need for sustainable solutions and stricter environmental regulations, is a significant growth driver. The market is highly regulated, with stringent rules on waste disposal and treatment impacting operational costs and investment decisions. The primary competitive substitute is the illegal dumping of waste, which the government is actively trying to curb. End-users are primarily large industrial conglomerates across various sectors, with a growing focus on sustainability initiatives. M&A activity has been moderate in recent years, with a focus on consolidating market share and acquiring specialized technologies (approximately xx M&A deals between 2019-2024, representing xx% market share consolidation).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on advanced recycling technologies, waste-to-energy solutions, and digital waste management platforms. Key barriers include high initial investment costs and lack of skilled workforce.

- Regulatory Framework: Stringent environmental regulations driving adoption of sustainable solutions, impacting operational costs.

- Competitive Substitutes: Illegal dumping remains a significant challenge, impacting market growth.

- End-User Demographics: Predominantly large industrial companies across various sectors (Oil & Gas, Construction, Manufacturing), increasingly demanding sustainable solutions.

- M&A Trends: Moderate activity focused on consolidation and acquisition of specialized technologies.

UAE Industrial Waste Management Market Growth Trends & Insights

The UAE industrial waste management market has experienced robust growth in recent years, driven by increased industrial activity and stricter environmental regulations. Market size reached xx million in 2024 and is projected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period. Adoption of sustainable waste management practices is increasing, with a notable rise in recycling rates. Technological disruptions, particularly in waste-to-energy and advanced recycling, are transforming the sector. Consumer behavior, specifically among industrial end-users, is shifting towards sustainable and environmentally friendly waste management solutions, creating new opportunities for innovative players.

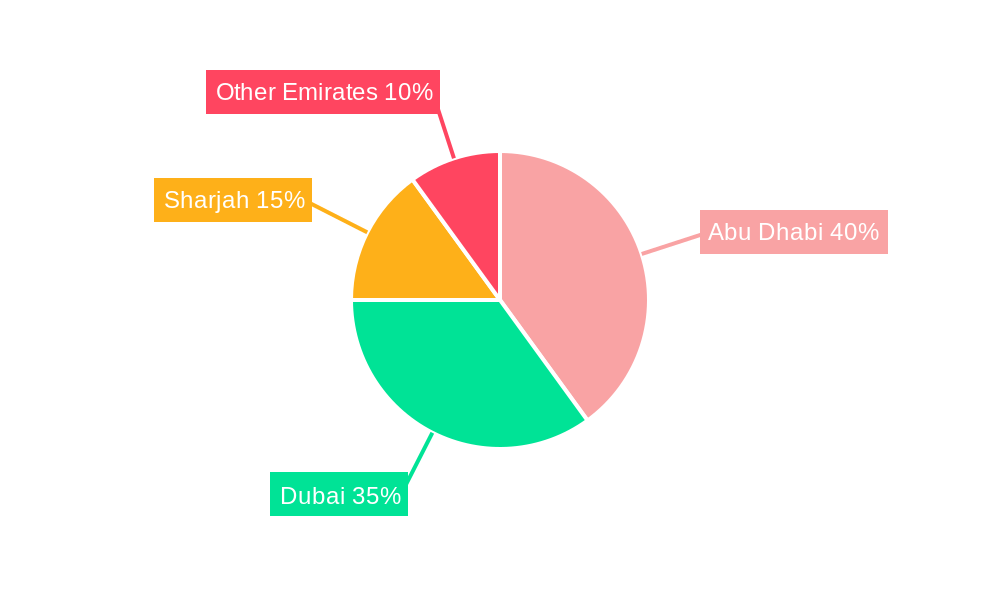

Dominant Regions, Countries, or Segments in UAE Industrial Waste Management Market

The emirates of Dubai and Abu Dhabi stand as the primary economic engines, spearheading the growth of the UAE Industrial Waste Management Market. This leadership is underpinned by their substantial concentration of diverse industrial activities, ranging from burgeoning manufacturing hubs to extensive infrastructure development projects. Complementing this industrial dynamism are the proactive and forward-thinking government policies actively promoting sustainable development and environmental stewardship. The robust economic expansion across the nation, coupled with significant investments in state-of-the-art infrastructure, has amplified the demand for sophisticated and efficient waste management solutions. These leading regions are further bolstered by a strong governmental commitment, manifested through a supportive regulatory framework, attractive financial incentives for sustainable practices, and substantial investments in critical waste management infrastructure.

- Key Drivers: Sustained economic growth, large-scale infrastructure development, progressively supportive government policies and initiatives, and a burgeoning environmental consciousness among industrial entities.

- Dominance Factors: The high density of industrial operations, a well-established and supportive regulatory environment, and significant governmental financial commitment to infrastructure development.

- Growth Potential: Substantial and ongoing growth potential driven by continued economic expansion, rapid urbanization, increasing industrial output, and a heightened societal and corporate focus on environmental preservation.

UAE Industrial Waste Management Market Product Landscape

The UAE Industrial Waste Management Market presents a comprehensive spectrum of services meticulously designed to address the complex needs of industrial clients. These offerings encompass the entire waste lifecycle, including specialized waste collection and transportation, advanced waste treatment methodologies, efficient recycling processes, and responsible disposal solutions. A significant thrust in innovation is directed towards the development and implementation of cutting-edge recycling technologies, sustainable waste-to-energy solutions that convert waste into valuable energy, and sophisticated digital platforms designed to optimize waste management operations through data analytics and automation. These advancements are pivotal in delivering enhanced operational efficiency, significantly reducing the environmental footprint of industrial activities, and achieving tangible cost savings for businesses. A key differentiator for market players often lies in their specialized treatment capabilities for hazardous waste, a testament to their commitment to safety and regulatory compliance, alongside an unwavering dedication to overarching sustainability principles.

Key Drivers, Barriers & Challenges in UAE Industrial Waste Management Market

Key Drivers:

- Stringent environmental regulations promoting sustainable waste management.

- Growing industrialization and urbanization leading to increased waste generation.

- Government initiatives and investments in waste management infrastructure.

Challenges and Restraints:

- High initial investment costs for advanced technologies.

- Shortage of skilled labor in waste management.

- Potential for illegal dumping and its impact on market growth (estimated impact xx million annually).

Emerging Opportunities in UAE Industrial Waste Management Market

The landscape of the UAE Industrial Waste Management Market is ripe with emerging opportunities, particularly in the development and scaling of advanced sustainable waste-to-energy solutions, which not only manage waste but also contribute to the nation's energy independence. There is a growing demand for expanding recycling capabilities to encompass a wider range of specialized waste streams, including industrial by-products and manufacturing residues. The adoption of advanced technologies such as AI-powered waste sorting and real-time monitoring systems offers significant potential for optimizing resource recovery and ensuring compliance. Furthermore, significant untapped markets exist in providing efficient and integrated solutions for e-waste management, a rapidly growing challenge, and in fostering the principles of the circular economy by developing systems that enable the reuse and remanufacturing of industrial materials.

Growth Accelerators in the UAE Industrial Waste Management Market Industry

The trajectory of the UAE Industrial Waste Management Market is being significantly accelerated by rapid technological advancements, most notably in the fields of artificial intelligence (AI) and automation. These innovations are leading to more sophisticated and efficient waste processing and management systems. Strategic partnerships and collaborations between leading waste management companies and key industrial end-users are proving instrumental in driving innovation, fostering the adoption of best-in-class sustainable practices, and tailoring solutions to specific industry needs. Additionally, market expansion strategies that strategically target underserved regions within the UAE and focus on developing specialized solutions for niche or challenging waste streams present considerable opportunities for robust and sustained growth.

Key Players Shaping the UAE Industrial Waste Management Market Market

- Averda

- Greenmountains

- Adgeco Group

- Veolia

- Sembcorp Industries

- Fivem Waste Management and Environmental Consultancy

- ADSSC

- Erragon-Gulf

- Bee ah - Sharjah

- Blue LL

Notable Milestones in UAE Industrial Waste Management Market Sector

- 2021: The Ministry of Climate Change and Environment launched the comprehensive National Waste Management Strategy, setting ambitious goals for waste reduction, recycling, and sustainable disposal across all sectors.

- 2022: The market witnessed several significant Mergers & Acquisitions (M&A) activities, indicating consolidation and strategic growth among key players aiming to enhance their service offerings and market reach.

- 2023: The introduction of stricter regulations specifically targeting the handling, treatment, and disposal of hazardous industrial waste, reflecting the government's commitment to environmental protection and public health.

In-Depth UAE Industrial Waste Management Market Market Outlook

The UAE industrial waste management market is poised for significant growth over the next decade, driven by continued economic expansion, supportive government policies, and technological advancements. Strategic opportunities exist for companies focusing on sustainable solutions, technological innovation, and partnerships with key industrial players. The market will continue to consolidate, with larger players acquiring smaller firms to expand their service offerings and geographic reach.

UAE Industrial Waste Management Market Segmentation

-

1. Type

-

1.1. Hazardous

- 1.1.1. Industrial Waste

- 1.1.2. Medical Waste

- 1.1.3. Oil and Gas Waste

- 1.1.4. Other Ha

-

1.2. Non-hazardous

- 1.2.1. Construction

- 1.2.2. Industrial and Commercial

- 1.2.3. Agricultural

- 1.2.4. Other Non-hazardous Types (Municipal Waste)

-

1.1. Hazardous

-

2. Service

- 2.1. Recycling

- 2.2. Collection

- 2.3. Landfill

- 2.4. Incineration

- 2.5. Other Services

UAE Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Industrial Waste Management Market Regional Market Share

Geographic Coverage of UAE Industrial Waste Management Market

UAE Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Development of Innovative Technologies and Advanced Waste Collection Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hazardous

- 5.1.1.1. Industrial Waste

- 5.1.1.2. Medical Waste

- 5.1.1.3. Oil and Gas Waste

- 5.1.1.4. Other Ha

- 5.1.2. Non-hazardous

- 5.1.2.1. Construction

- 5.1.2.2. Industrial and Commercial

- 5.1.2.3. Agricultural

- 5.1.2.4. Other Non-hazardous Types (Municipal Waste)

- 5.1.1. Hazardous

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Collection

- 5.2.3. Landfill

- 5.2.4. Incineration

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hazardous

- 6.1.1.1. Industrial Waste

- 6.1.1.2. Medical Waste

- 6.1.1.3. Oil and Gas Waste

- 6.1.1.4. Other Ha

- 6.1.2. Non-hazardous

- 6.1.2.1. Construction

- 6.1.2.2. Industrial and Commercial

- 6.1.2.3. Agricultural

- 6.1.2.4. Other Non-hazardous Types (Municipal Waste)

- 6.1.1. Hazardous

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Recycling

- 6.2.2. Collection

- 6.2.3. Landfill

- 6.2.4. Incineration

- 6.2.5. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hazardous

- 7.1.1.1. Industrial Waste

- 7.1.1.2. Medical Waste

- 7.1.1.3. Oil and Gas Waste

- 7.1.1.4. Other Ha

- 7.1.2. Non-hazardous

- 7.1.2.1. Construction

- 7.1.2.2. Industrial and Commercial

- 7.1.2.3. Agricultural

- 7.1.2.4. Other Non-hazardous Types (Municipal Waste)

- 7.1.1. Hazardous

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Recycling

- 7.2.2. Collection

- 7.2.3. Landfill

- 7.2.4. Incineration

- 7.2.5. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hazardous

- 8.1.1.1. Industrial Waste

- 8.1.1.2. Medical Waste

- 8.1.1.3. Oil and Gas Waste

- 8.1.1.4. Other Ha

- 8.1.2. Non-hazardous

- 8.1.2.1. Construction

- 8.1.2.2. Industrial and Commercial

- 8.1.2.3. Agricultural

- 8.1.2.4. Other Non-hazardous Types (Municipal Waste)

- 8.1.1. Hazardous

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Recycling

- 8.2.2. Collection

- 8.2.3. Landfill

- 8.2.4. Incineration

- 8.2.5. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hazardous

- 9.1.1.1. Industrial Waste

- 9.1.1.2. Medical Waste

- 9.1.1.3. Oil and Gas Waste

- 9.1.1.4. Other Ha

- 9.1.2. Non-hazardous

- 9.1.2.1. Construction

- 9.1.2.2. Industrial and Commercial

- 9.1.2.3. Agricultural

- 9.1.2.4. Other Non-hazardous Types (Municipal Waste)

- 9.1.1. Hazardous

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Recycling

- 9.2.2. Collection

- 9.2.3. Landfill

- 9.2.4. Incineration

- 9.2.5. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hazardous

- 10.1.1.1. Industrial Waste

- 10.1.1.2. Medical Waste

- 10.1.1.3. Oil and Gas Waste

- 10.1.1.4. Other Ha

- 10.1.2. Non-hazardous

- 10.1.2.1. Construction

- 10.1.2.2. Industrial and Commercial

- 10.1.2.3. Agricultural

- 10.1.2.4. Other Non-hazardous Types (Municipal Waste)

- 10.1.1. Hazardous

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Recycling

- 10.2.2. Collection

- 10.2.3. Landfill

- 10.2.4. Incineration

- 10.2.5. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 8 COMPANY PROFILES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Averda

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Greenmountains

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Adgeco Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veolia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sembcorp Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fivem Waste Management and Environmental Consultancy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ADSSC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Erragon-Gulf

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bee ah - Sharjah

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Blue LL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 8 COMPANY PROFILES

List of Figures

- Figure 1: Global UAE Industrial Waste Management Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UAE Industrial Waste Management Market Revenue (million), by Type 2025 & 2033

- Figure 3: North America UAE Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UAE Industrial Waste Management Market Revenue (million), by Service 2025 & 2033

- Figure 5: North America UAE Industrial Waste Management Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America UAE Industrial Waste Management Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America UAE Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Industrial Waste Management Market Revenue (million), by Type 2025 & 2033

- Figure 9: South America UAE Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UAE Industrial Waste Management Market Revenue (million), by Service 2025 & 2033

- Figure 11: South America UAE Industrial Waste Management Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: South America UAE Industrial Waste Management Market Revenue (million), by Country 2025 & 2033

- Figure 13: South America UAE Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Industrial Waste Management Market Revenue (million), by Type 2025 & 2033

- Figure 15: Europe UAE Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UAE Industrial Waste Management Market Revenue (million), by Service 2025 & 2033

- Figure 17: Europe UAE Industrial Waste Management Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe UAE Industrial Waste Management Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe UAE Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Industrial Waste Management Market Revenue (million), by Type 2025 & 2033

- Figure 21: Middle East & Africa UAE Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UAE Industrial Waste Management Market Revenue (million), by Service 2025 & 2033

- Figure 23: Middle East & Africa UAE Industrial Waste Management Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Middle East & Africa UAE Industrial Waste Management Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Industrial Waste Management Market Revenue (million), by Type 2025 & 2033

- Figure 27: Asia Pacific UAE Industrial Waste Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UAE Industrial Waste Management Market Revenue (million), by Service 2025 & 2033

- Figure 29: Asia Pacific UAE Industrial Waste Management Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific UAE Industrial Waste Management Market Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Industrial Waste Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Industrial Waste Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global UAE Industrial Waste Management Market Revenue million Forecast, by Service 2020 & 2033

- Table 3: Global UAE Industrial Waste Management Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global UAE Industrial Waste Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global UAE Industrial Waste Management Market Revenue million Forecast, by Service 2020 & 2033

- Table 6: Global UAE Industrial Waste Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Industrial Waste Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: Global UAE Industrial Waste Management Market Revenue million Forecast, by Service 2020 & 2033

- Table 12: Global UAE Industrial Waste Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Industrial Waste Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 17: Global UAE Industrial Waste Management Market Revenue million Forecast, by Service 2020 & 2033

- Table 18: Global UAE Industrial Waste Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Industrial Waste Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 29: Global UAE Industrial Waste Management Market Revenue million Forecast, by Service 2020 & 2033

- Table 30: Global UAE Industrial Waste Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Industrial Waste Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global UAE Industrial Waste Management Market Revenue million Forecast, by Service 2020 & 2033

- Table 39: Global UAE Industrial Waste Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: China UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Industrial Waste Management Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Industrial Waste Management Market?

The projected CAGR is approximately 7.77%.

2. Which companies are prominent players in the UAE Industrial Waste Management Market?

Key companies in the market include 8 COMPANY PROFILES, Averda, Greenmountains, Adgeco Group, Veolia, Sembcorp Industries, Fivem Waste Management and Environmental Consultancy, ADSSC, Erragon-Gulf, Bee ah - Sharjah, Blue LL.

3. What are the main segments of the UAE Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 66101.8 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Development of Innovative Technologies and Advanced Waste Collection Solutions.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the UAE Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence