Key Insights

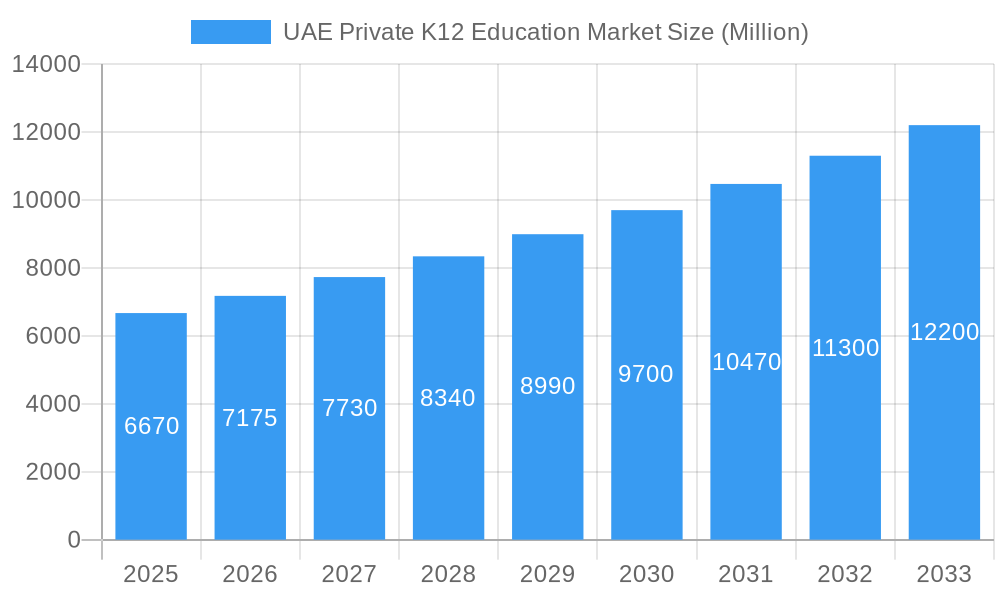

The UAE private K12 education market is a dynamic and rapidly expanding sector, projected to reach a substantial size. With a Compound Annual Growth Rate (CAGR) of 7.50% from 2019 to 2033, the market's value is estimated to significantly exceed $6.67 million (the 2025 value) within the forecast period. This robust growth is fueled by several key factors. A rising expatriate population, increasing disposable incomes among UAE residents, and a growing emphasis on high-quality international education are driving demand for private schooling. Furthermore, the UAE's strategic focus on education as a key pillar of economic diversification fuels investment in infrastructure and innovative pedagogical approaches within the private sector. Parents are increasingly seeking international curricula, bilingual education programs, and advanced facilities, contributing to the market's expansion. Competitive pressures among established players like GEMS Education, Nord Anglia Education, and Dubai American Academy, alongside the emergence of new players, further stimulates market dynamism.

UAE Private K12 Education Market Market Size (In Billion)

However, the market faces certain challenges. Government regulations concerning licensing, curriculum standards, and fee structures could influence growth trajectories. The increasing cost of education, potential economic fluctuations impacting parental spending power, and the ongoing competition for student enrollment present ongoing hurdles. Nevertheless, the long-term outlook for the UAE's private K12 education market remains positive, underpinned by sustained economic growth and a commitment to providing world-class educational opportunities. The market's segmentation likely includes various curriculum offerings (e.g., British, American, IB), school types (e.g., day schools, boarding schools), and different price points, catering to a broad spectrum of consumer needs and preferences. This segmentation allows for both niche players and large-scale operators to thrive in this increasingly competitive landscape.

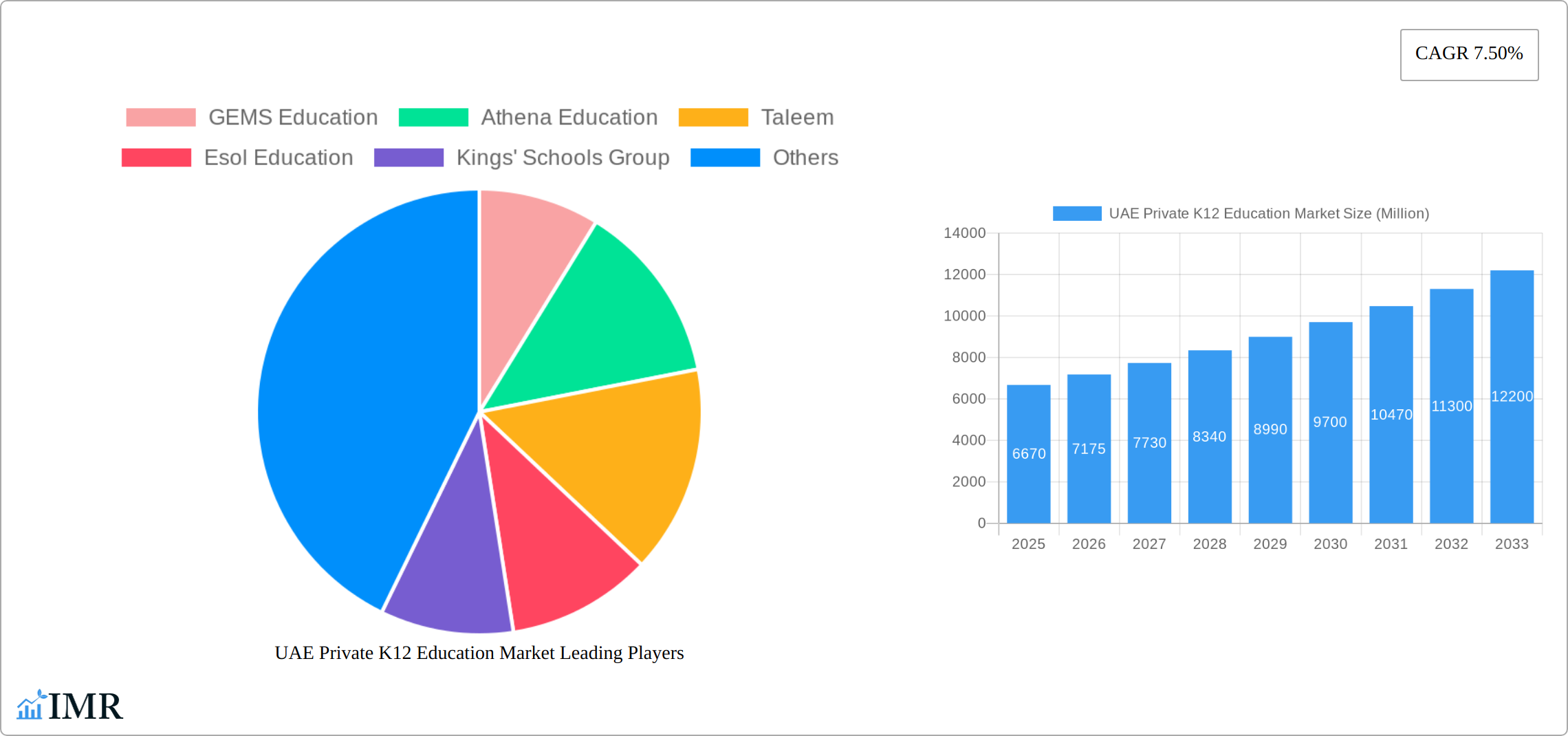

UAE Private K12 Education Market Company Market Share

UAE Private K12 Education Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Private K12 Education Market, encompassing market dynamics, growth trends, key players, and future opportunities. With a focus on the parent market (Private Education) and the child market (K12), this report offers invaluable insights for investors, educators, and industry professionals seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in Million units.

UAE Private K12 Education Market Market Dynamics & Structure

The UAE's private K12 education market is characterized by a moderately concentrated landscape with a few large players like GEMS Education and smaller independent schools competing for market share. Technological innovation, driven by the increasing adoption of EdTech solutions and digital learning platforms, is reshaping the sector. A robust regulatory framework, established by the Ministry of Education, ensures quality standards and curriculum alignment. The market also faces competition from alternative education models, such as homeschooling and online learning platforms. The demographic shift towards a younger population fuels demand, while M&A activity remains significant, with a projected xx M&A deals in 2025, consolidating market presence and driving expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Rapid adoption of EdTech, personalized learning platforms, and digital assessments.

- Regulatory Framework: Stringent quality standards and curriculum regulations ensuring high educational quality.

- Competitive Substitutes: Homeschooling, online learning platforms, and international curricula present alternative options.

- End-User Demographics: Growing expatriate population and rising affluence drive demand for private education.

- M&A Trends: Consolidation continues, with an estimated xx M&A deals in 2025, focusing on expansion and enhanced service offerings. Innovation barriers include high initial investment costs in technology and adapting to the regulatory framework.

UAE Private K12 Education Market Growth Trends & Insights

The UAE private K12 education market is experiencing a period of dynamic expansion, propelled by a confluence of factors including rising disposable incomes, a continuously growing expatriate population, and the UAE government's unwavering commitment to elevating educational standards through strategic initiatives. The market size is projected to reach a significant value in 2025, with continued robust expansion anticipated at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. A key driver of this evolution is the accelerating adoption of EdTech solutions, with penetration rates expected to reach xx% by 2033. Consumer behavior is increasingly characterized by a demand for personalized learning journeys, a strong preference for internationally recognized curricula, and a keen interest in institutions offering a comprehensive range of enriching extracurricular activities. Disruptions stemming from rapid technological advancements and the ever-evolving expectations of parents are fundamentally reshaping the competitive landscape and the very nature of educational delivery.

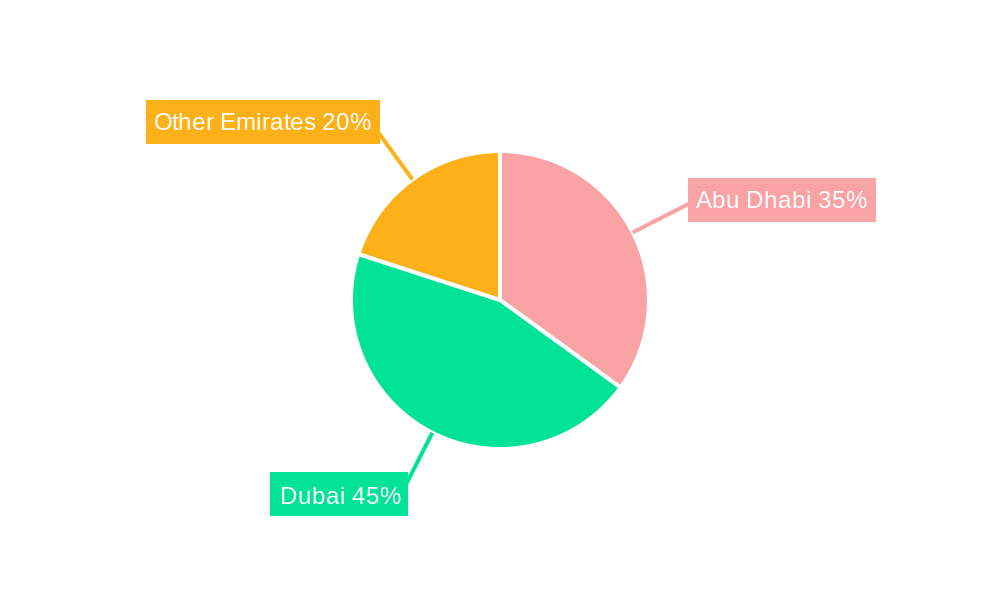

Dominant Regions, Countries, or Segments in UAE Private K12 Education Market

Dubai and Abu Dhabi dominate the UAE private K12 education market, driven by their higher concentration of expatriates, robust economies, and established infrastructure. These emirates account for xx% of the market in 2025.

- Key Drivers:

- Strong economic growth and high disposable incomes in Dubai and Abu Dhabi.

- Large expatriate population seeking international education standards.

- Government initiatives promoting quality education and attracting foreign investment.

- Well-developed infrastructure supporting the expansion of private schools.

The dominance of Dubai and Abu Dhabi stems from their established reputation as educational hubs, attracting both domestic and international students. The market exhibits significant growth potential in other emirates as infrastructure develops and demand for quality private education expands.

UAE Private K12 Education Market Product Landscape

The UAE private K12 education market offers an expansive and multifaceted array of educational products and services designed to cater to diverse student needs and parental aspirations. This spectrum encompasses traditional, instructor-led classroom environments, alongside highly specialized academic and enrichment programs focusing on areas such as Science, Technology, Engineering, and Mathematics (STEM), the Arts, and a variety of engaging extracurricular pursuits. The integration of cutting-edge technological advancements is a defining characteristic, leading to the widespread adoption of sophisticated digital learning platforms, AI-powered personalized learning tools, and immersive virtual reality applications that enhance engagement and comprehension. Key differentiators that shape the competitive landscape include the diversity and quality of curriculum offerings, such as renowned British, American, and International Baccalaureate (IB) programs, the creation of distinct and specialized learning environments, and, crucially, the caliber and pedagogical expertise of the teaching faculty.

Key Drivers, Barriers & Challenges in UAE Private K12 Education Market

Key Drivers:

- The sustained growth in disposable incomes and a continually expanding expatriate population are powerful catalysts driving increased demand for high-quality private education options.

- Proactive government support for the development of educational infrastructure and the implementation of policies aimed at raising and maintaining educational quality standards.

- The transformative impact of technological advancements in creating more engaging learning experiences and optimizing operational efficiencies for educational institutions.

Key Challenges:

- Elevated operational expenditures, encompassing substantial costs associated with faculty remuneration, infrastructure development and maintenance, and significant investments in educational technology, which can impact overall profitability.

- A highly competitive market environment characterized by the presence of well-established institutions and the continuous emergence of new and innovative entrants.

- Navigating complex regulatory frameworks and consistently upholding stringent educational quality standards can present significant operational hurdles for private K12 institutions. The cumulative impact of these challenges is estimated to exert a moderating influence on market growth, potentially reducing it by approximately xx% annually.

Emerging Opportunities in UAE Private K12 Education Market

Emerging opportunities lie in specialized education programs (STEM, arts, vocational training), personalized learning solutions tailored to individual student needs, and the expansion of online and blended learning models. Untapped potential exists in smaller emirates beyond Dubai and Abu Dhabi, as well as catering to specific niche demands, such as bilingual education or specialized learning disabilities support.

Growth Accelerators in the UAE Private K12 Education Market Industry

Long-term growth is fueled by increasing government investment in education infrastructure, partnerships between private schools and technology providers, and the expansion of international collaborations to attract renowned educational institutions. Technological advancements, such as AI-powered personalized learning platforms and virtual reality applications, will further accelerate market growth and enhance the learning experience.

Key Players Shaping the UAE Private K12 Education Market Market

- GEMS Education

- Athena Education

- Taleem

- Esol Education

- Kings’ Schools Group

- SABIS Education Services

- British International School

- Al-Mizhar American Academy

- Nord Anglia Education

- Dubai American Academy

- Glendale International School

- Deira International School

- List Not Exhaustive

Notable Milestones in UAE Private K12 Education Market Sector

- May 2023: The inauguration of Glendale International School in Dubai, with a capacity to accommodate 3000 students, underscores the substantial investment being channeled into the expansion of private K12 educational infrastructure across the Emirates.

- March 2023: Kings’ Education's strategic partnership with Leap signifies a commitment to enhancing student support services and expanding its appeal to a broader international student demographic, illustrating the trend of strategic collaborations shaping market dynamics.

In-Depth UAE Private K12 Education Market Market Outlook

The outlook for the UAE private K12 education market remains exceptionally positive, indicating a trajectory of sustained and significant growth. This optimism is underpinned by the nation's continued economic prosperity, a burgeoning population, and the relentless pace of technological innovation. The future market landscape will undoubtedly be shaped by strategic alliances, substantial investments in state-of-the-art infrastructure, and a deepening focus on delivering personalized, adaptive, and forward-thinking learning experiences. For both established market leaders and ambitious new entrants, the UAE private K12 education sector presents compelling and lucrative opportunities to capitalize on the ever-increasing demand for world-class private educational offerings.

UAE Private K12 Education Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic/UAE

- 2.4. Indian

- 2.5. Other Curricula

UAE Private K12 Education Market Segmentation By Geography

- 1. North Region

- 2. West Region

- 3. South Region

- 4. East Region

UAE Private K12 Education Market Regional Market Share

Geographic Coverage of UAE Private K12 Education Market

UAE Private K12 Education Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.4. Market Trends

- 3.4.1 Increased Rate of Population Growth

- 3.4.2 including Expatriates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic/UAE

- 5.2.4. Indian

- 5.2.5. Other Curricula

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West Region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic/UAE

- 6.2.4. Indian

- 6.2.5. Other Curricula

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic/UAE

- 7.2.4. Indian

- 7.2.5. Other Curricula

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic/UAE

- 8.2.4. Indian

- 8.2.5. Other Curricula

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic/UAE

- 9.2.4. Indian

- 9.2.5. Other Curricula

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GEMS Education

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Athena Education

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taleem

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Esol Education

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kings' Schools Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SABIS Education Services

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 British International School

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al-Mizhar American Academy

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nord Anglia Education

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dubai American Academy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Glendale International School

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Deira International School**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 GEMS Education

List of Figures

- Figure 1: Global UAE Private K12 Education Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Private K12 Education Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 4: North Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 5: North Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 7: North Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 8: North Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 9: North Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 10: North Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 11: North Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 15: West Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 16: West Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 17: West Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 18: West Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 19: West Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 20: West Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 21: West Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 22: West Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 23: West Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 24: West Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 25: West Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: West Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 28: South Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 29: South Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: South Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 31: South Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 32: South Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 33: South Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 34: South Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 35: South Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 36: South Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 37: South Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 39: East Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 40: East Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 41: East Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 42: East Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 43: East Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 44: East Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 45: East Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 46: East Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 47: East Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 48: East Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 49: East Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: East Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 4: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 5: Global UAE Private K12 Education Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Private K12 Education Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 9: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 10: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 11: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 15: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 16: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 17: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 20: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 21: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 22: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 23: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 26: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 27: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 28: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 29: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Private K12 Education Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the UAE Private K12 Education Market?

Key companies in the market include GEMS Education, Athena Education, Taleem, Esol Education, Kings' Schools Group, SABIS Education Services, British International School, Al-Mizhar American Academy, Nord Anglia Education, Dubai American Academy, Glendale International School, Deira International School**List Not Exhaustive.

3. What are the main segments of the UAE Private K12 Education Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

6. What are the notable trends driving market growth?

Increased Rate of Population Growth. including Expatriates.

7. Are there any restraints impacting market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Glendale International School opened its doors to students aged 3 to 11 in Dubai. Singapore-based Global Schools Foundation announced the launch. Sprawling over 20,000 square meters, the new premises can accommodate 3000 students.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Private K12 Education Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Private K12 Education Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Private K12 Education Market?

To stay informed about further developments, trends, and reports in the UAE Private K12 Education Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence