Key Insights

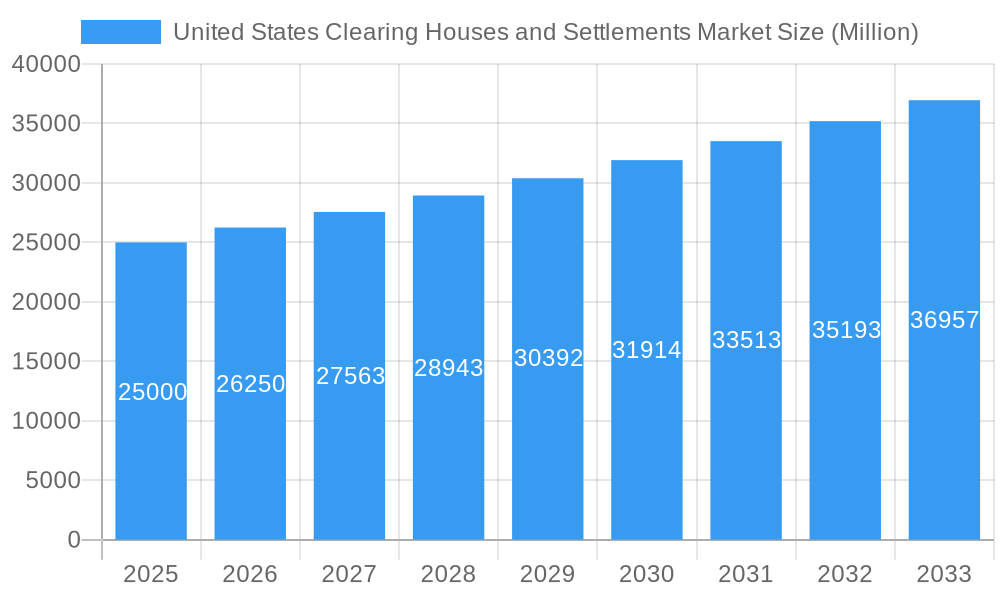

The United States clearing and settlement market is experiencing significant expansion, driven by escalating trading volumes, stringent regulatory requirements for risk mitigation, and the pervasive adoption of advanced technologies such as blockchain and AI. With a projected Compound Annual Growth Rate (CAGR) of 5%, the market is poised for continued growth through 2033. This upward trajectory is underpinned by the increasing complexity of financial instruments and the critical need for efficient and secure post-trade processing. Key market participants, including major stock exchanges, are actively investing in infrastructure enhancements and technological innovations to bolster their clearing and settlement capabilities, fostering a competitive and dynamic market environment. The market is segmented by asset class, encompassing equities, derivatives, and fixed-income clearing and settlement services, each influenced by distinct market trends and regulatory shifts. The estimated market size for the base year 2024 is $6.75 billion, reflecting the immense volume of daily transactions within the US financial ecosystem. While geographically concentrated within the United States, cross-border transactions contribute minor international involvement. Potential growth constraints include cybersecurity threats, regulatory compliance expenditures, and the risk of market volatility.

United States Clearing Houses and Settlements Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, potentially moderating slightly due to the inherent cyclicality of financial markets. Automation and digitalization will be pivotal in shaping the market's future, leading to enhanced efficiency, reduced operational costs, and the development of novel risk management and transaction processing solutions. The integration of fintech innovations and the emergence of new clearing and settlement paradigms will further influence market evolution. Continuous adaptation and innovation are imperative for market participants navigating evolving regulatory landscapes and competitive pressures.

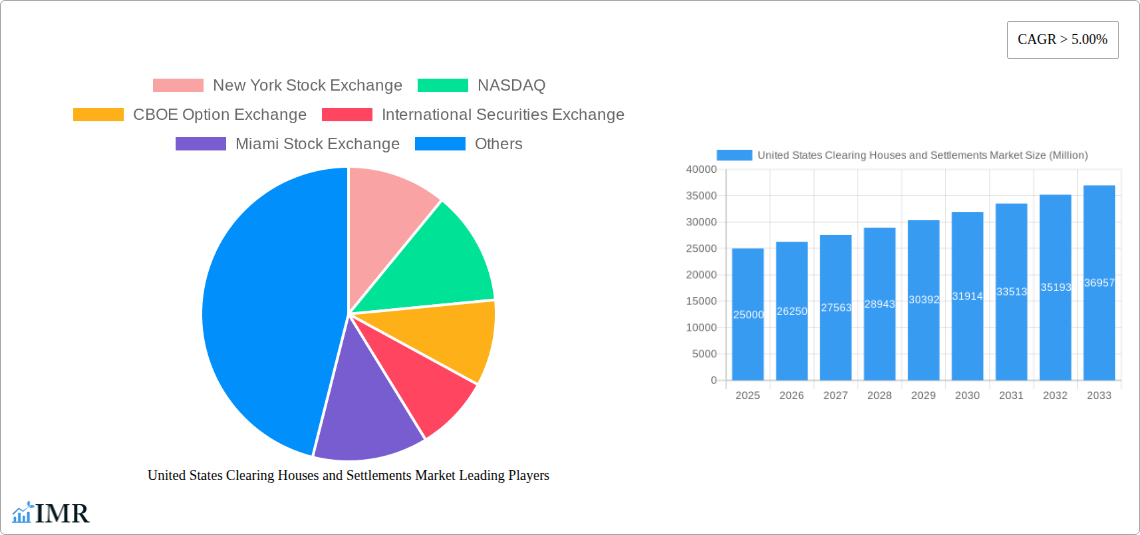

United States Clearing Houses and Settlements Market Company Market Share

United States Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Clearing Houses and Settlements Market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of Financial Services and the child market of Securities Clearing and Settlement, this report is essential for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in millions of US dollars.

United States Clearing Houses and Settlements Market Dynamics & Structure

The US clearing houses and settlements market is characterized by high concentration among major players, significant technological innovation, and a complex regulatory framework. The market witnesses continuous mergers and acquisitions (M&A) activity, shaping the competitive landscape. The increasing adoption of technology, particularly in areas like blockchain and AI, is driving efficiency and innovation. However, high regulatory compliance costs and potential cybersecurity risks pose significant challenges.

- Market Concentration: The market is dominated by a few large players, with the top 5 holding approximately xx% market share in 2024 (estimated).

- Technological Innovation: The sector is experiencing rapid advancements in automation, high-frequency trading systems, and distributed ledger technologies. However, integrating these innovations requires significant investment and expertise.

- Regulatory Framework: Stringent regulations, aimed at reducing systemic risk and ensuring market integrity, significantly impact operational costs and market entry barriers. Recent regulatory changes, like those enacted in December 2023, further solidify this trend.

- Competitive Landscape: Competition is intense, driven by technological innovation, pricing strategies, and client acquisition. M&A activity is frequent, with xx major deals recorded between 2019 and 2024 (estimated).

- End-User Demographics: The market caters to a diverse range of financial institutions, including banks, broker-dealers, hedge funds, and institutional investors.

United States Clearing Houses and Settlements Market Growth Trends & Insights

The US clearing houses and settlements market has exhibited robust growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily driven by increasing trading volumes, stricter regulatory compliance requirements, and the growing adoption of advanced technologies. The market size reached approximately $xx million in 2024 (estimated) and is projected to reach $xx million by 2033, showcasing a CAGR of xx% during the forecast period (2025-2033). Market penetration is increasing across different segments as institutional investors embrace efficient clearing and settlement practices. This growth is influenced by technological disruptions, including the development of more robust and faster clearing systems. Changes in consumer behavior, particularly the rise of algorithmic trading, also play a key role in shaping market trends.

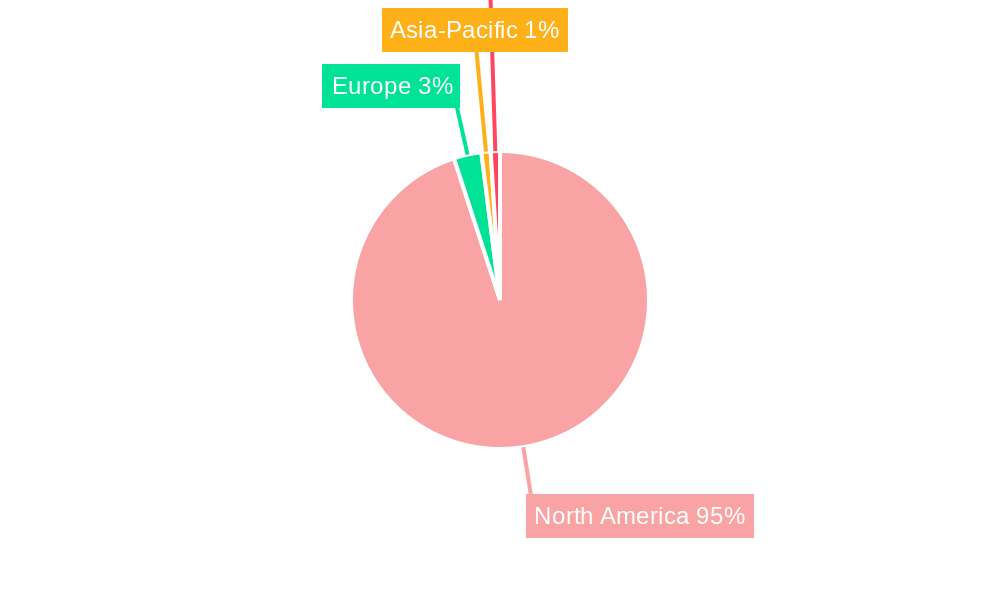

Dominant Regions, Countries, or Segments in United States Clearing Houses and Settlements Market

New York, as the global financial hub, is the dominant region, accounting for approximately xx% of the market share in 2024 (estimated). This dominance is primarily attributed to its well-established financial infrastructure, high concentration of financial institutions, and regulatory framework conducive to market growth. Other major regions contributing substantially to the market are major metropolitan areas in California and Illinois.

- Key Drivers in New York:

- Concentrated presence of major financial institutions and exchanges.

- Highly developed technological infrastructure and robust cybersecurity measures.

- Strong regulatory oversight and enforcement.

- Growth Potential in Other Regions: While New York dominates, significant growth potential exists in other regions through expansion of existing infrastructure and attracting fintech firms to these areas.

United States Clearing Houses and Settlements Market Product Landscape

The market offers a range of products and services, including clearing and settlement services for equities, derivatives, and fixed income securities. Innovation focuses on enhancing speed, efficiency, and security through advanced technologies like blockchain and AI. These improvements in processing speed and security are key selling points for service providers, driving competition and improving overall market functionality. Real-time risk management systems and enhanced data analytics capabilities are also key features driving product development and differentiation.

Key Drivers, Barriers & Challenges in United States Clearing Houses and Settlements Market

Key Drivers:

- Increased Trading Volumes: The rising volume of financial transactions fuels the demand for efficient clearing and settlement solutions.

- Regulatory Compliance: Stricter regulations require robust and reliable clearing systems, driving market growth.

- Technological Advancements: Innovations in blockchain, AI, and automation enhance efficiency and reduce costs.

Key Challenges:

- Cybersecurity Threats: The digital nature of clearing and settlement systems makes them vulnerable to cyberattacks, potentially leading to significant financial losses.

- Regulatory Complexity: Navigating the complex regulatory landscape requires substantial investment and expertise.

- Competition: Intense competition among established players and emerging fintech companies creates pressure on pricing and profitability. Market share struggles will lead to consolidation.

Emerging Opportunities in United States Clearing Houses and Settlements Market

- Expansion into Fintech: Integrating fintech solutions like blockchain into traditional clearing systems can significantly enhance speed, transparency, and security.

- Cross-Border Clearing: Expanding into cross-border clearing and settlement operations can unlock new revenue streams and provide services to a larger international client base.

- Data Analytics and Risk Management: Offering advanced data analytics and risk management tools to clients adds value and strengthens competitive advantage.

Growth Accelerators in the United States Clearing Houses and Settlements Market Industry

The market's long-term growth will be fueled by ongoing technological innovation, strategic partnerships between established players and fintech startups, and expansion into new market segments, such as decentralized finance (DeFi). The increasing adoption of advanced analytics tools will play a critical role, increasing operational efficiency and risk management capabilities. Furthermore, government support for financial technology may spur additional growth.

Key Players Shaping the United States Clearing Houses and Settlements Market Market

- New York Stock Exchange

- NASDAQ

- CBOE Option Exchange

- International Securities Exchange

- Miami Stock Exchange

- National Stock Exchange

- Philadelphia Stock Exchange

Notable Milestones in United States Clearing Houses and Settlements Market Sector

- December 2023: Miami International Holdings, Inc. launched MIAX Sapphire, a new physical trading floor and electronic exchange in Miami, expanding options trading capacity.

- December 2023: New regulations mandated by Wall Street regulators force increased usage of clearing houses for U.S. Treasury market transactions, reducing systemic risk in the $26 trillion market.

In-Depth United States Clearing Houses and Settlements Market Market Outlook

The future of the US clearing houses and settlements market is bright, with significant growth potential driven by technological advancements, increasing trading volumes, and stricter regulatory requirements. Strategic partnerships, expansion into new markets, and the development of innovative products and services will be key factors determining success in this dynamic and competitive landscape. The market is poised for continued consolidation as smaller players seek mergers or acquisitions to compete with larger organizations.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence