Key Insights

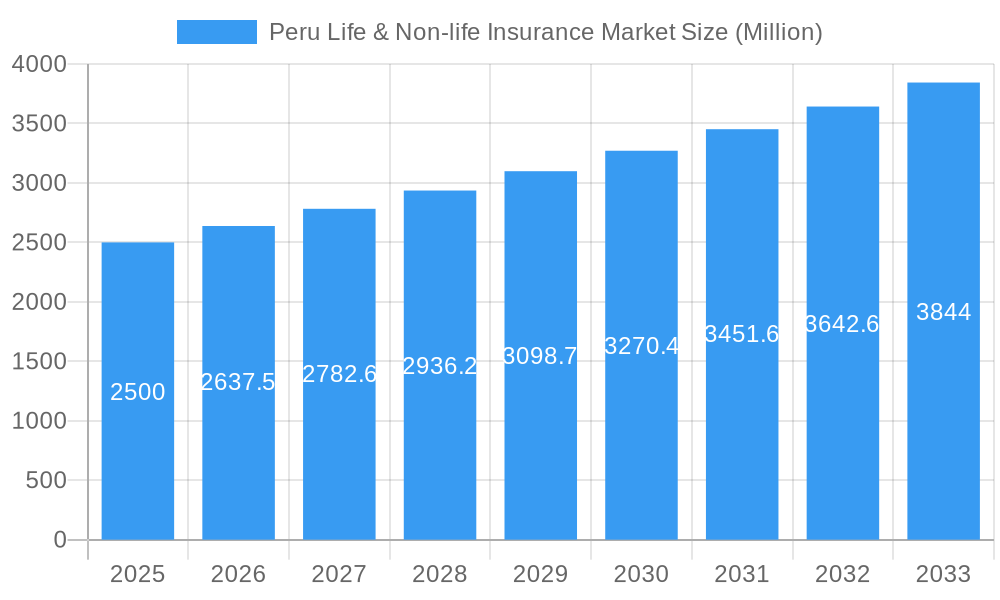

The Peruvian life and non-life insurance market is poised for significant expansion, driven by a growing middle class, elevated insurance product awareness, and supportive government initiatives fostering financial inclusion. Projected to achieve a Compound Annual Growth Rate (CAGR) of 8.11%, the market is expected to reach a valuation of 5.5 billion by 2024. Key growth catalysts include rising disposable incomes, increasing urbanization, and a heightened demand for health, life, and property insurance solutions. The market encompasses diverse product segments, including term life, whole life, health, motor, property, and other insurance categories. Major industry participants such as Rimac, Pacifico Seguros, and Mapfre Peru engage in intense competition, capitalizing on their established brand equity and expansive distribution channels. Nevertheless, challenges persist, including limited insurance penetration, particularly in rural areas, and a deficit in financial literacy among certain demographics. Addressing these constraints requires strategic focus on education and product innovation to unlock latent market potential. Future growth will be propelled by a broader array of products catering to varied needs, market penetration into underserved regions, and the integration of digital technologies to broaden customer reach and improve service delivery.

Peru Life & Non-life Insurance Market Market Size (In Billion)

Notwithstanding existing challenges, the long-term trajectory for the Peruvian insurance sector is decidedly positive. A robust economy and advancing infrastructure create an opportune environment for sustained expansion. Continued growth will be contingent upon government policies that bolster financial stability and consumer trust, alongside the insurance industry's adaptability to evolving consumer demands and technological innovations. The widespread adoption of digital platforms for sales and customer service, coupled with the introduction of bespoke insurance products for specific demographic and socioeconomic groups, will be instrumental in achieving sustained, high-growth outcomes. The competitive arena is anticipated to remain vibrant, with established firms and emerging players vying for market share, leading to enhanced product portfolios and more competitive consumer pricing.

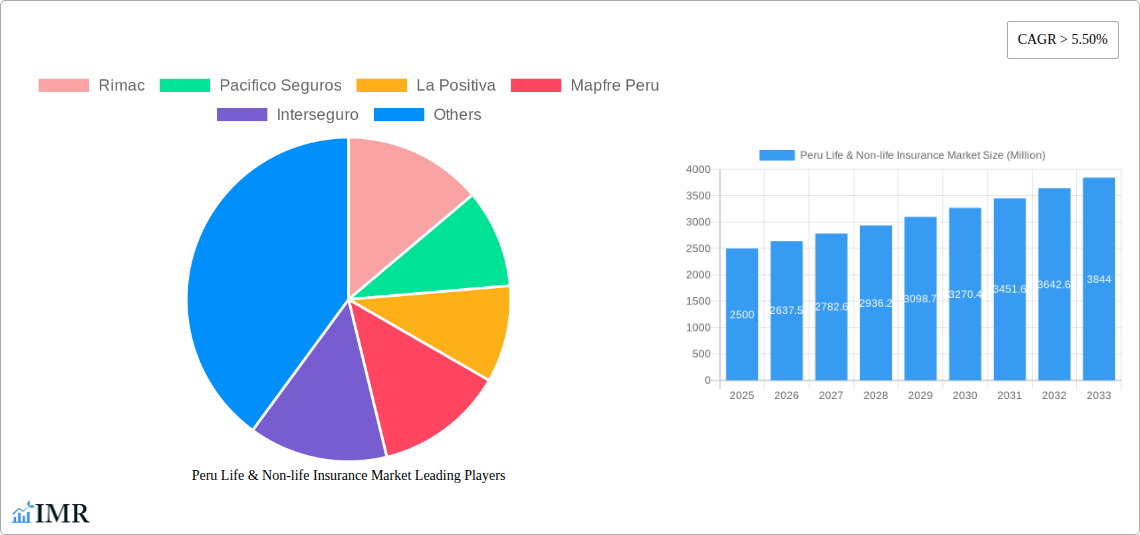

Peru Life & Non-life Insurance Market Company Market Share

Peru Life & Non-life Insurance Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Peruvian life and non-life insurance market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033. This report is essential for insurance professionals, investors, and anyone seeking to understand the evolving landscape of the Peruvian insurance sector. The report analyzes both the parent market (Peruvian Insurance Market) and child markets (Life Insurance and Non-Life Insurance).

Peru Life & Non-life Insurance Market Dynamics & Structure

This section analyzes the market concentration, technological advancements, regulatory landscape, competitive dynamics, and M&A activities within the Peruvian life and non-life insurance market. We delve into the interplay of these factors, examining their impact on market structure and future trajectory.

- Market Concentration: The Peruvian insurance market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Rimac, Pacifico Seguros, and La Positiva are among the leading companies, accounting for approximately xx% of the total market in 2024. Smaller players compete by specializing in niche segments or regions.

- Technological Innovation: The adoption of digital technologies is a significant driver of market transformation. Companies are investing in digital platforms to enhance customer experience, improve operational efficiency, and expand their reach. However, digital literacy and infrastructure limitations in certain regions remain barriers to widespread adoption.

- Regulatory Framework: The Superintendencia de Banca, Seguros y AFP (SBS) plays a crucial role in regulating the insurance sector in Peru. Regulatory changes and compliance requirements directly affect market dynamics and operational strategies of companies.

- Competitive Landscape: Intense competition exists among established players and new entrants, particularly in the non-life insurance segment. The strategies employed by these entities involve product innovation, expansion into new customer segments, and strategic partnerships to enhance market position.

- M&A Activity: The Peruvian insurance sector has witnessed significant M&A activity in recent years. For instance, the acquisition of a majority stake in La Positiva Seguros by FID Peru in 2019 exemplifies the consolidation trend in the market. Further consolidation is anticipated in the coming years.

Peru Life & Non-life Insurance Market Growth Trends & Insights

This section provides a comprehensive analysis of the Peruvian life and non-life insurance market's growth trajectory, incorporating data and insights into key market indicators such as market size, CAGR, penetration rates, and evolving consumer behavior. The analysis highlights the impact of technological advancements, economic shifts, and regulatory changes on overall market performance and projected growth. The market size is projected to reach xx million in 2025, with a CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors such as rising disposable incomes, increasing awareness of insurance products, and expansion of insurance penetration in underserved segments.

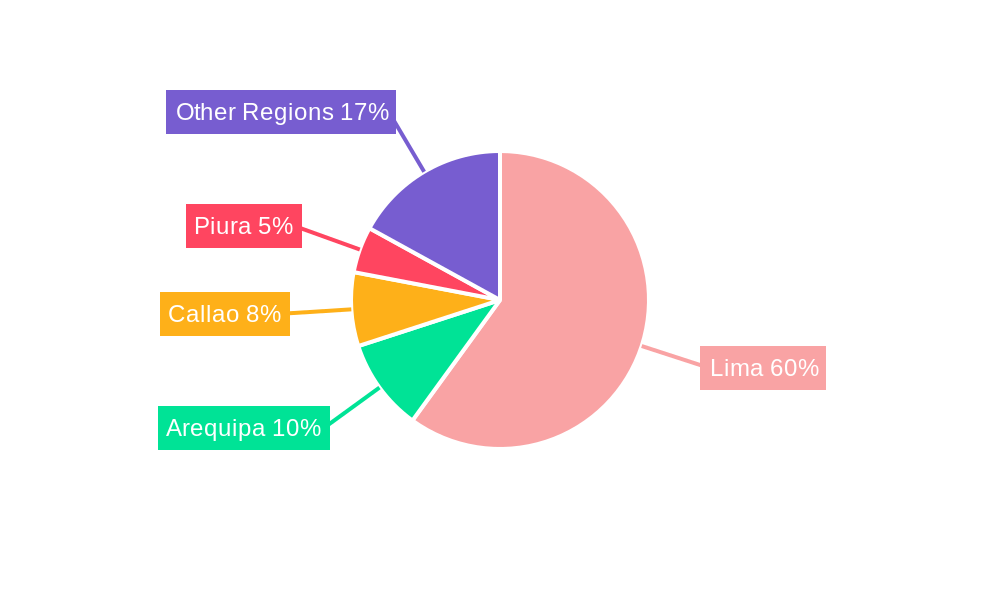

Dominant Regions, Countries, or Segments in Peru Life & Non-life Insurance Market

This section identifies the key regions and segments driving growth within the Peruvian life and non-life insurance market. Lima, being the largest metropolitan area, dominates the market, contributing the highest volume and growth. However, growth potential is present in other regions with increasing economic activity and improving infrastructure.

- Lima Metropolitan Area: This region represents the most significant contributor to the overall market size and growth, owing to its large population, higher disposable incomes, and greater awareness of insurance products.

- Other Regions: Significant growth potential exists in other regions of Peru with emerging economies and infrastructure development. This expansion requires focused strategies and localized product offerings catering to specific regional needs and risk profiles.

Peru Life & Non-life Insurance Market Product Landscape

The Peruvian insurance market offers a diverse range of products, including life insurance (term life, whole life, endowment), health insurance, motor insurance, property insurance, and liability insurance, among others. Recent innovations focus on enhancing customer experience through digital platforms and personalized product offerings. This includes the adoption of telematics in motor insurance and the development of innovative health insurance packages designed to meet specific consumer needs.

Key Drivers, Barriers & Challenges in Peru Life & Non-life Insurance Market

Key Drivers: The Peruvian life and non-life insurance market is driven by factors such as increasing disposable incomes, growing middle class, rising awareness about insurance, and government initiatives to promote financial inclusion. Technological advancements and digitalization are further enhancing market reach and efficiency.

Challenges: Challenges include low insurance penetration in rural areas, limited financial literacy, and stiff competition among established players. Regulatory hurdles and economic volatility are additional factors impacting market growth.

Emerging Opportunities in Peru Life & Non-life Insurance Market

Emerging opportunities lie in expanding insurance coverage in underserved rural areas through micro-insurance initiatives. Developing innovative products tailored to the specific needs of the burgeoning digital economy and adopting technological solutions such as AI and machine learning for risk assessment and claims processing can unlock significant growth potential.

Growth Accelerators in the Peru Life & Non-life Insurance Market Industry

Long-term growth is driven by continued economic growth, increasing urbanization, and enhanced financial literacy initiatives. Strategic partnerships between insurers and fintech companies, enabling digital distribution channels, will accelerate market expansion.

Key Players Shaping the Peru Life & Non-life Insurance Market Market

- Rimac

- Pacifico Seguros

- La Positiva

- Mapfre Peru

- Interseguro

- Protecta

- Cardif

- Ohio National Vida

- Chubb Seguros

- Crecer Seguros (List Not Exhaustive)

Notable Milestones in Peru Life & Non-life Insurance Market Sector

- January 2019: FID Peru SA completes acquisition of a majority stake in La Positiva Seguros y Reaseguros SA.

- March 2020: Rimac Seguros partners with Kyndryl for a 3-year digital transformation initiative using Microsoft Azure.

In-Depth Peru Life & Non-life Insurance Market Market Outlook

The Peruvian life and non-life insurance market is poised for robust growth over the next decade, fueled by expanding economic activity, rising middle class, and increasing penetration rates. Strategic investments in digital infrastructure, coupled with innovative product offerings, will be key to unlocking this potential. The market presents significant opportunities for both established players and new entrants with agile and customer-centric approaches.

Peru Life & Non-life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Fire

- 1.2.2. Motor

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Others

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Peru Life & Non-life Insurance Market Segmentation By Geography

- 1. Peru

Peru Life & Non-life Insurance Market Regional Market Share

Geographic Coverage of Peru Life & Non-life Insurance Market

Peru Life & Non-life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Introduction of Compulsory Life Insurance for Employees

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Life & Non-life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motor

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Others

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rimac

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pacifico Seguros

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 La Positiva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mapfre Peru

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interseguro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Protecta

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cardif

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ohio National Vida

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chubb Seguros

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Crecer Seguros**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rimac

List of Figures

- Figure 1: Peru Life & Non-life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Peru Life & Non-life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 2: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 5: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Life & Non-life Insurance Market?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Peru Life & Non-life Insurance Market?

Key companies in the market include Rimac, Pacifico Seguros, La Positiva, Mapfre Peru, Interseguro, Protecta, Cardif, Ohio National Vida, Chubb Seguros, Crecer Seguros**List Not Exhaustive.

3. What are the main segments of the Peru Life & Non-life Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Introduction of Compulsory Life Insurance for Employees.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On March 2020, RIMAC Seguros, a leading insurance company in Peru with 1.8 million customers along with Kyndryl, the world's largest IT infrastructure services provider announced a 3-year agreement to accelerate the company's digital transformation with the migration of its mission-critical IT systems and business applications to Microsoft Azure. This would increase the disgital presence of the company and boosting the coustmer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Life & Non-life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Life & Non-life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Life & Non-life Insurance Market?

To stay informed about further developments, trends, and reports in the Peru Life & Non-life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence