Key Insights

The global waste management market is poised for significant expansion, fueled by increasing urbanization, stringent environmental regulations, and growing consumer demand for sustainable disposal practices. The market, valued at $10.58 billion in the base year 2025, is projected to experience a compound annual growth rate (CAGR) of 6.63%, reaching substantial market value by 2033. Key growth drivers include the expanding industrial sector, the proliferation of waste-to-energy technologies, and proactive government initiatives promoting recycling and resource recovery. Emerging trends focus on smart waste management solutions leveraging IoT for optimized collection and processing, alongside a surge in demand for sustainable and biodegradable packaging to minimize waste at its origin. While challenges persist, including fluctuating raw material costs and high infrastructure investment, the competitive landscape features major global players actively pursuing consolidation and strategic alliances to enhance market share and service portfolios.

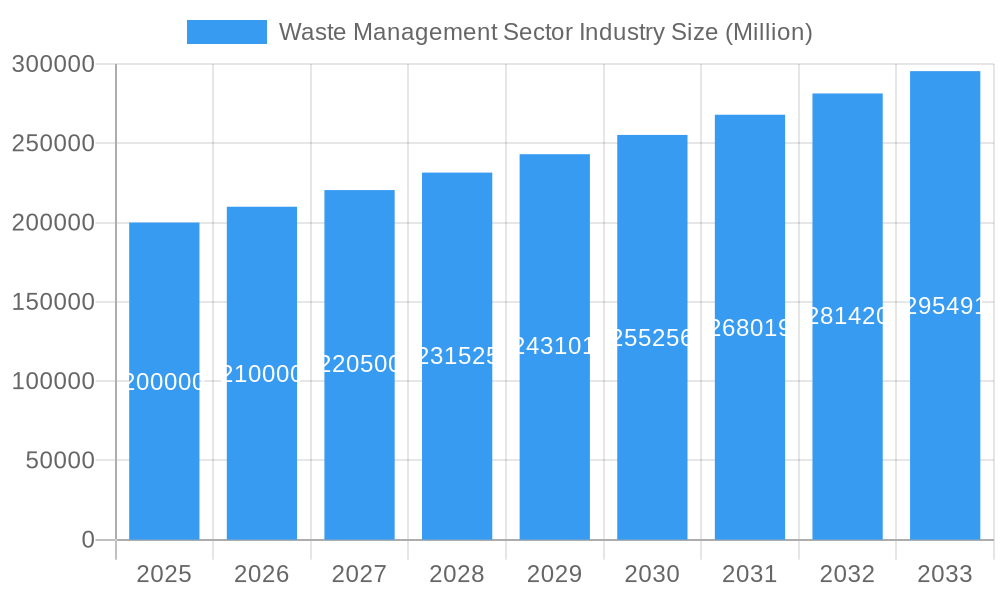

Waste Management Sector Industry Market Size (In Billion)

Market segmentation spans diverse waste streams such as municipal solid waste, industrial waste, and hazardous waste, alongside various collection methods and advanced treatment technologies including recycling and anaerobic digestion. Developed regions like North America and Europe currently lead in per capita waste generation and infrastructure sophistication. The forecast period anticipates substantial investment in cutting-edge waste management technologies, a broader embrace of circular economy principles, and a heightened focus on reducing the environmental impact of waste disposal, presenting significant opportunities for innovative and sustainable solution providers. Ongoing regulatory advancements and public awareness campaigns will continue to shape the industry, driving efficiency and environmental accountability across the waste management value chain.

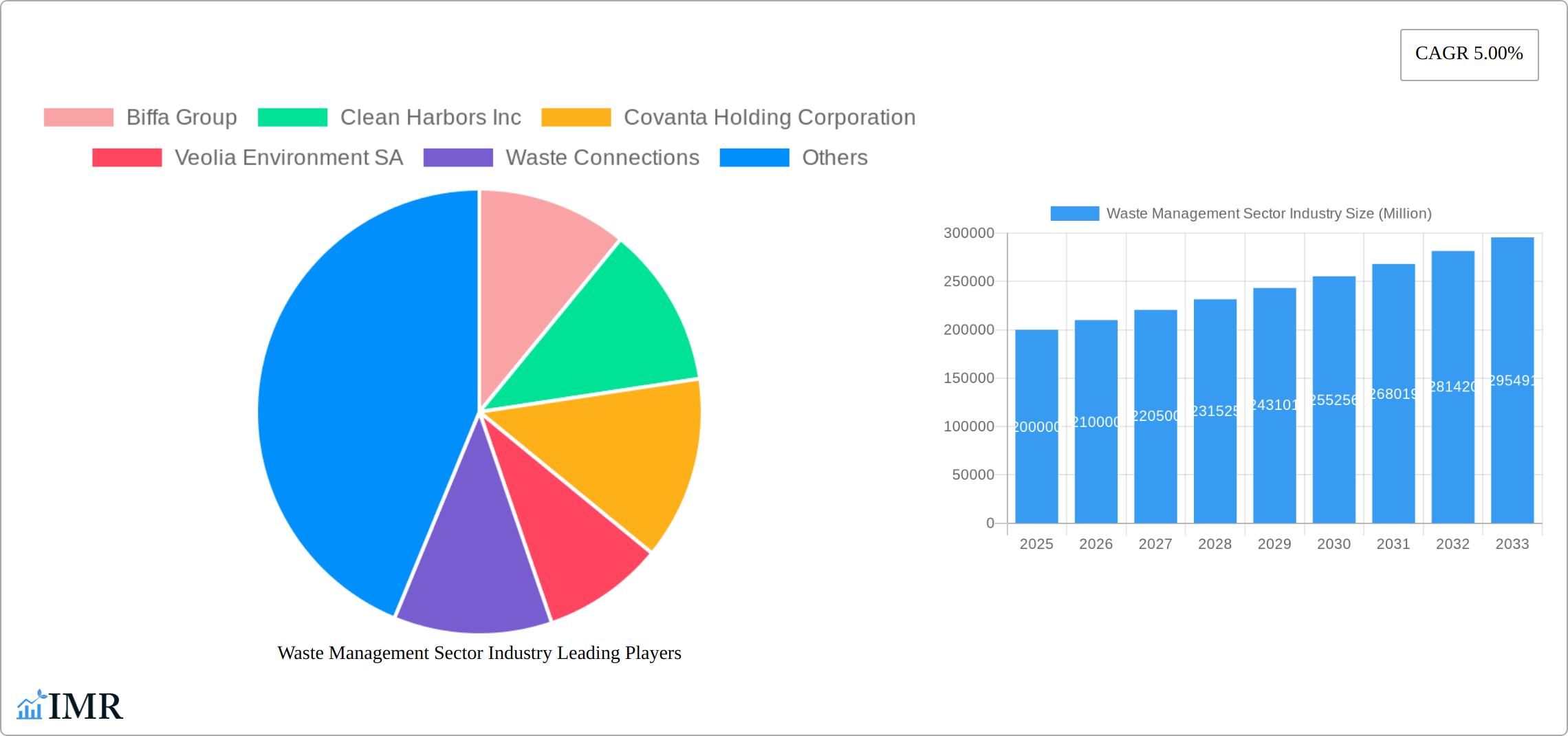

Waste Management Sector Industry Company Market Share

Global Waste Management Market Analysis: Trends, Size, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the global waste management sector, detailing market dynamics, growth trajectories, regional insights, product landscapes, and key industry participants. The analysis covers the period from 2025 to 2033, with 2025 designated as the base year. This research is essential for industry professionals, investors, and strategic decision-makers navigating this dynamic market. The market is segmented across key areas including Municipal Solid Waste, Industrial Waste, Hazardous Waste, and Recycling, with granular analysis of driving factors and emerging opportunities. The market is projected to reach $10.58 billion in 2025, with a projected CAGR of 6.63%.

Waste Management Sector Industry Market Dynamics & Structure

The global waste management sector is a dynamic and evolving landscape characterized by a moderately concentrated market structure. Leading global entities such as Waste Management Inc., Republic Services, Veolia Environment SA, and Waste Connections command significant market share. However, the sector is also enlivened by a robust ecosystem of regional and specialized players, fostering a competitive environment. Innovation remains a paramount driver, with continuous advancements in high-efficiency recycling technologies, sophisticated waste-to-energy solutions, and the integration of smart waste management systems shaping the future. A pivotal influence on market dynamics stems from increasingly stringent environmental regulations, which vary considerably across different geographical regions. The rising prominence of biodegradable and compostable alternatives presents a competitive challenge to conventional waste management methodologies. Furthermore, evolving end-user demographics, particularly the accelerating pace of urbanization and the burgeoning waste generation in developing economies, are significant catalysts for market expansion.

Mergers and acquisitions (M&A) continue to be a strategic tool for industry consolidation and expansion. Notable recent transactions, such as Biffa Group's acquisition of Company Shop Group and Waste Management's substantial USD 4.6 billion acquisition of Advanced Disposal, underscore this trend.

- Market Concentration: While developed regions exhibit higher market concentration, developing nations present a more fragmented picture. The top 5 players collectively hold an estimated xx% market share as of 2024.

- Technological Innovation: The focus is intensifying on automation, AI-powered waste sorting for enhanced efficiency, and advanced anaerobic digestion processes for energy recovery.

- Regulatory Frameworks: Robust environmental regulations in North America and Europe are a significant impetus for substantial investments in sustainable waste management solutions.

- Competitive Substitutes: The increasing adoption of biodegradable plastics and compostable packaging poses a discernible challenge to established traditional waste management practices.

- M&A Trends: The industry is witnessing a trend towards consolidation through strategic acquisitions and mergers, aimed at broadening geographical reach and expanding service portfolios. The total M&A deal volume for 2024 is projected to reach approximately xx Million.

Waste Management Sector Industry Growth Trends & Insights

The global waste management market exhibits robust growth, driven by several factors. [Insert XXX – e.g., statistical data, market research reports, industry publications]. The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing urbanization, rising industrial activities, and growing environmental awareness. Technological disruptions, such as the adoption of smart bins and advanced recycling technologies, are significantly impacting adoption rates. Consumer behavior shifts, including increasing demand for sustainable waste management solutions and recycling initiatives, further contribute to market expansion. Market penetration of advanced technologies remains relatively low, indicating substantial future growth potential.

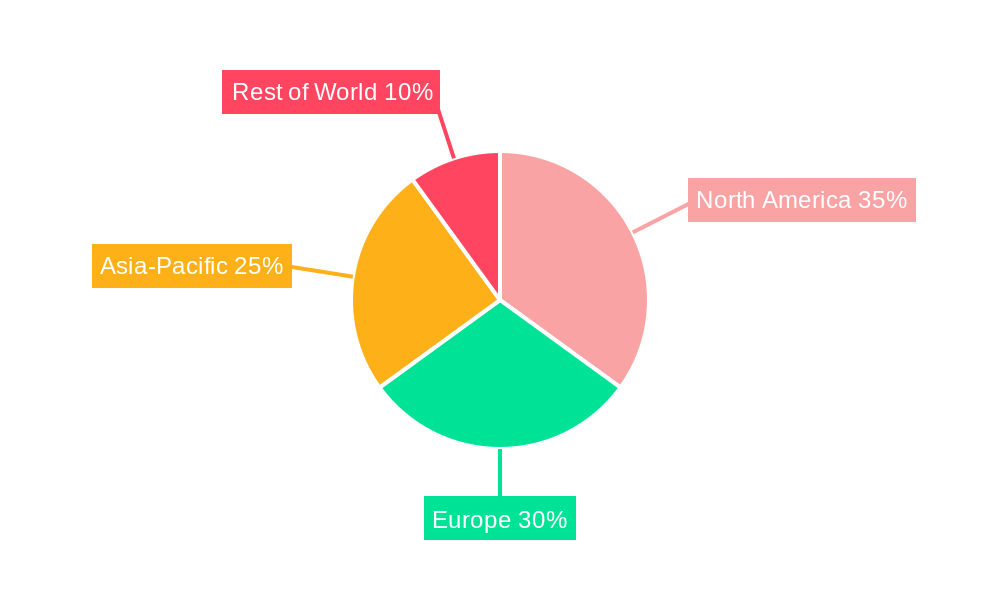

Dominant Regions, Countries, or Segments in Waste Management Sector Industry

Currently, North America and Europe stand as the dominant forces in the global waste management market. This leadership is attributed to their well-established infrastructure, the presence of rigorous environmental regulations, and a high level of public awareness regarding sustainable waste management practices. However, the Asia-Pacific region is rapidly emerging as a high-growth area, propelled by swift urbanization, extensive industrialization, and escalating government investments dedicated to enhancing waste management infrastructure.

- Key Drivers: Stringent environmental regulations are primary drivers in Europe and North America, while rapid urbanization, industrialization, rising disposable incomes, and increased government infrastructure spending are key in Asia-Pacific.

- Dominance Factors: North America and Europe benefit from established infrastructure, cutting-edge technological advancements, and robust regulatory frameworks. The Asia-Pacific region offers substantial growth potential due to escalating waste generation and proactive government initiatives.

- Market Share: As of 2024, market share distribution is estimated as: North America (xx%), Europe (xx%), Asia-Pacific (xx%), and the Rest of the World (xx%).

- Growth Potential: The highest growth potential is anticipated in developing economies within the Asia-Pacific and Latin American regions.

Waste Management Sector Industry Product Landscape

The waste management sector offers a diverse range of products and services, including waste collection, transportation, processing, recycling, and disposal solutions. Recent innovations focus on advanced sorting technologies, waste-to-energy plants, and smart waste management systems using IoT and AI. These innovations improve efficiency, reduce landfill burden, and enhance resource recovery. The unique selling propositions include cost-effectiveness, environmental sustainability, and technological advancements. Performance metrics like recycling rates, landfill diversion rates, and greenhouse gas emission reduction are crucial indicators of success.

Key Drivers, Barriers & Challenges in Waste Management Sector Industry

Key Drivers:

- Increasing environmental regulations and stringent emission norms.

- Growing urbanization and industrialization leading to increased waste generation.

- Rising consumer awareness about sustainability and environmental protection.

- Technological advancements enabling efficient waste management solutions.

Key Challenges:

- High initial investment costs for advanced technologies.

- Lack of infrastructure in developing countries.

- Complex regulatory landscape and permitting processes.

- Competition from informal waste management sectors impacting profitability. Estimated revenue loss due to informal competition in 2024: xx Million.

Emerging Opportunities in Waste Management Sector Industry

- Strategic expansion into developing economies that currently lack adequate waste management infrastructure.

- Intensified development of pioneering technologies focused on efficient waste-to-energy conversion and advanced resource recovery processes.

- Capitalizing on the escalating demand for environmentally responsible and sustainable waste management solutions.

- Leveraging advanced digital technologies to optimize waste collection routes and enhance overall management efficiency.

Growth Accelerators in the Waste Management Sector Industry

Technological breakthroughs in waste sorting, recycling methodologies, and waste-to-energy technologies are identified as key accelerators propelling market growth. Strategic alliances and partnerships forged between waste management companies and innovative technology providers are instrumental in fostering innovation and facilitating market expansion. Government initiatives that champion sustainable waste management practices, including the provision of financial incentives and supportive policies, further invigorate long-term growth trajectories. The strategic expansion of service offerings into nascent and emerging markets, coupled with the active development and implementation of circular economy models, presents significant and valuable opportunities for the sector.

Key Players Shaping the Waste Management Sector Industry Market

- Biffa Group

- Clean Harbors Inc

- Covanta Holding Corporation

- Veolia Environment SA

- Waste Connections

- Remondis AG & Co Kg

- Suez Environment S A

- Daiseki Co Ltd

- Waste Management Inc

- Republic Services

- Averda

- List Not Exhaustive

Notable Milestones in Waste Management Sector Industry Sector

- October 2020: Waste Management completed its acquisition of Advanced Disposal for USD 4.6 billion.

- February 2021: Biffa Group acquired Company Shop Group, expanding its reach in waste redistribution.

In-Depth Waste Management Sector Industry Market Outlook

The future of the waste management sector is bright, driven by increasing environmental awareness, technological advancements, and supportive government policies. The market is poised for significant growth, particularly in developing economies. Companies that embrace innovation, strategic partnerships, and sustainable practices are best positioned to capitalize on emerging opportunities and shape the future of waste management. The continued shift towards circular economy models and increasing focus on resource recovery will further accelerate market expansion.

Waste Management Sector Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Biomedical and Other Waste Types

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Recycling

Waste Management Sector Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East

- 5. Latin America

Waste Management Sector Industry Regional Market Share

Geographic Coverage of Waste Management Sector Industry

Waste Management Sector Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Spotlight on the Construction and Demolition waste management systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Biomedical and Other Waste Types

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. North America Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 6.1.1. Industrial waste

- 6.1.2. Municipal solid waste

- 6.1.3. E-waste

- 6.1.4. Plastic waste

- 6.1.5. Biomedical and Other Waste Types

- 6.2. Market Analysis, Insights and Forecast - by Disposal methods

- 6.2.1. Landfill

- 6.2.2. Incineration

- 6.2.3. Recycling

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 7. Europe Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 7.1.1. Industrial waste

- 7.1.2. Municipal solid waste

- 7.1.3. E-waste

- 7.1.4. Plastic waste

- 7.1.5. Biomedical and Other Waste Types

- 7.2. Market Analysis, Insights and Forecast - by Disposal methods

- 7.2.1. Landfill

- 7.2.2. Incineration

- 7.2.3. Recycling

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 8. Asia Pacific Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 8.1.1. Industrial waste

- 8.1.2. Municipal solid waste

- 8.1.3. E-waste

- 8.1.4. Plastic waste

- 8.1.5. Biomedical and Other Waste Types

- 8.2. Market Analysis, Insights and Forecast - by Disposal methods

- 8.2.1. Landfill

- 8.2.2. Incineration

- 8.2.3. Recycling

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 9. Middle East Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 9.1.1. Industrial waste

- 9.1.2. Municipal solid waste

- 9.1.3. E-waste

- 9.1.4. Plastic waste

- 9.1.5. Biomedical and Other Waste Types

- 9.2. Market Analysis, Insights and Forecast - by Disposal methods

- 9.2.1. Landfill

- 9.2.2. Incineration

- 9.2.3. Recycling

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 10. Latin America Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 10.1.1. Industrial waste

- 10.1.2. Municipal solid waste

- 10.1.3. E-waste

- 10.1.4. Plastic waste

- 10.1.5. Biomedical and Other Waste Types

- 10.2. Market Analysis, Insights and Forecast - by Disposal methods

- 10.2.1. Landfill

- 10.2.2. Incineration

- 10.2.3. Recycling

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Biffa Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clean Harbors Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Covanta Holding Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veolia Environment SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Connections

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Remondis AG & Co Kg

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suez Environment S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daiseki Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Waste Management Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Republic Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Averda**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Biffa Group

List of Figures

- Figure 1: Global Waste Management Sector Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 3: North America Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 4: North America Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 5: North America Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 6: North America Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 9: Europe Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 10: Europe Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 11: Europe Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 12: Europe Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 15: Asia Pacific Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 16: Asia Pacific Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 17: Asia Pacific Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 18: Asia Pacific Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 21: Middle East Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 22: Middle East Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 23: Middle East Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 24: Middle East Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 27: Latin America Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 28: Latin America Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 29: Latin America Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 30: Latin America Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin America Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 2: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 3: Global Waste Management Sector Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 5: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 6: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 10: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 18: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 19: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 26: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 27: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 29: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 30: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste Management Sector Industry?

The projected CAGR is approximately 6.63%.

2. Which companies are prominent players in the Waste Management Sector Industry?

Key companies in the market include Biffa Group, Clean Harbors Inc, Covanta Holding Corporation, Veolia Environment SA, Waste Connections, Remondis AG & Co Kg, Suez Environment S A, Daiseki Co Ltd, Waste Management Inc, Republic Services, Averda**List Not Exhaustive.

3. What are the main segments of the Waste Management Sector Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.58 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Spotlight on the Construction and Demolition waste management systems.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2021: Biffa group announced the acquisition of Company Shop Group ('CSG'), the UK's leading and largest redistributor of surplus food and household products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste Management Sector Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste Management Sector Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste Management Sector Industry?

To stay informed about further developments, trends, and reports in the Waste Management Sector Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence