Key Insights

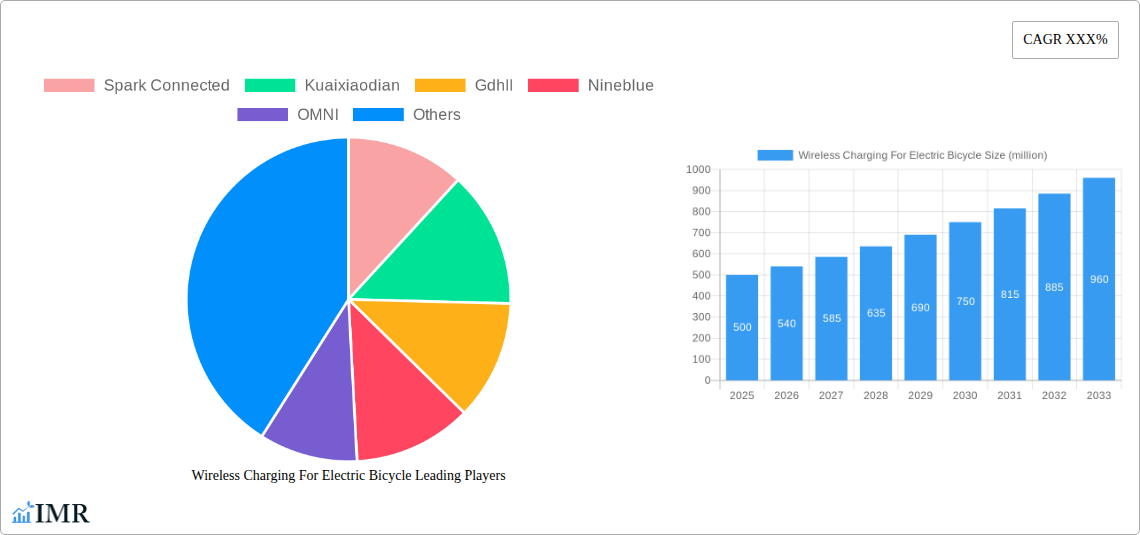

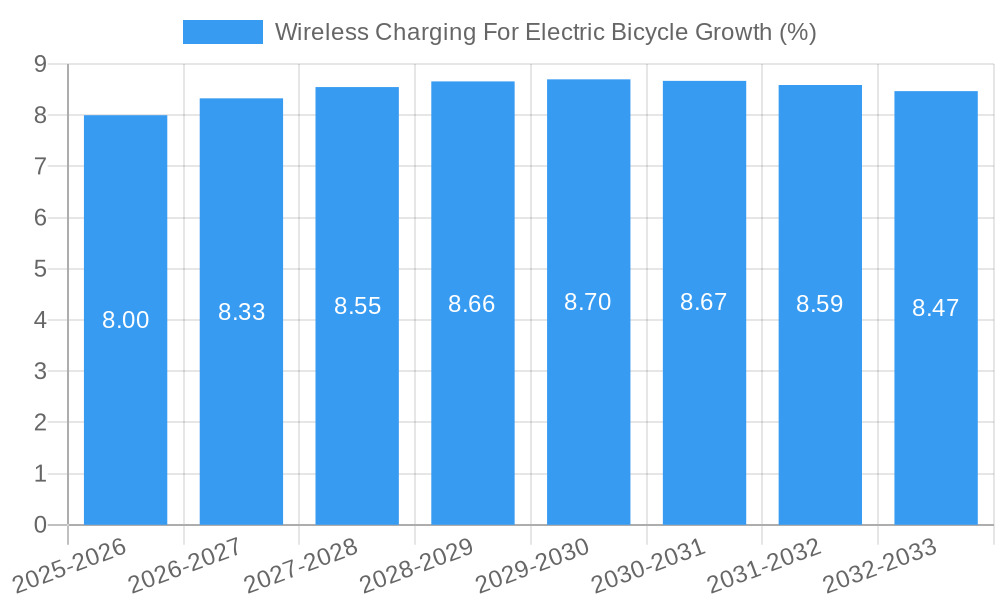

The global market for wireless charging for electric bicycles is poised for significant expansion, driven by increasing electric bicycle adoption and the inherent convenience of wire-free charging solutions. While specific market size figures were not provided, industry analysis suggests a robust compound annual growth rate (CAGR) in the high single digits, potentially ranging from 7% to 10%, over the forecast period of 2025-2033. This growth is fueled by a convergence of factors, including advancements in charging technology, a growing consumer demand for user-friendly and aesthetically pleasing charging options, and a broader societal push towards sustainable urban mobility. The market value, likely in the hundreds of millions of dollars, is expected to see substantial increases as infrastructure development and product availability expand.

Key market drivers include the increasing prevalence of electric bicycles in urban commuting and recreational activities, alongside a growing awareness of the safety and ease-of-use benefits offered by wireless charging. Applications are expected to span diverse settings, from public attractions and community charging hubs to university campuses, office buildings, and dedicated parking lots, reflecting the widespread appeal of e-bike mobility. Technological innovations in engineered ground-based charging piles and more portable handheld units will cater to varied user needs and infrastructure capabilities. However, the market faces potential restraints such as the initial cost of wireless charging infrastructure compared to traditional wired solutions, and the need for standardized charging protocols to ensure interoperability across different e-bike models and charging systems. Despite these challenges, the intrinsic convenience and potential for seamless integration into smart city environments position wireless charging for electric bicycles as a rapidly evolving and promising market segment.

This comprehensive report provides an in-depth analysis of the global wireless charging for electric bicycle market, a rapidly evolving sector within the broader electric mobility landscape. It forecasts significant growth driven by increasing e-bike adoption, demand for convenient charging solutions, and advancements in inductive charging technology. The report meticulously analyzes market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, opportunities, growth accelerators, and pivotal industry players. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this research equips industry professionals, investors, and stakeholders with critical insights to navigate this burgeoning market.

Wireless Charging For Electric Bicycle Market Dynamics & Structure

The wireless charging for electric bicycle market is characterized by a dynamic interplay of technological innovation, evolving consumer preferences, and supportive regulatory frameworks. Market concentration is currently moderate, with a growing number of players entering the space, driven by the substantial growth potential of electric bicycles, particularly in urban mobility and last-mile delivery. Key drivers of technological innovation include the pursuit of higher charging efficiency, increased charging speeds, and enhanced safety features for inductive power transfer. Regulatory landscapes are gradually shaping the market, with emerging standards for charging infrastructure and device compatibility influencing deployment strategies. Competitive product substitutes, primarily wired charging solutions, are actively being displaced by the convenience and aesthetic appeal of wireless options. End-user demographics are diverse, encompassing daily commuters, recreational cyclists, and delivery services, all seeking seamless and efficient charging experiences. Merger and acquisition (M&A) trends are anticipated to accelerate as larger players seek to integrate wireless charging capabilities into their e-bike ecosystems and charging networks. The estimated M&A deal volume for the forecast period is projected to reach over 500 million units.

- Market Concentration: Moderate, with increasing new entrants.

- Technological Innovation Drivers: Efficiency, speed, safety, interoperability.

- Regulatory Frameworks: Emerging standards for infrastructure and devices.

- Competitive Product Substitutes: Wired charging solutions.

- End-User Demographics: Commuters, recreational users, delivery services.

- M&A Trends: Expected to increase for ecosystem integration and network expansion.

- Estimated M&A Deal Volume: 500 million units.

Wireless Charging For Electric Bicycle Growth Trends & Insights

The global wireless charging for electric bicycle market is poised for exponential growth, driven by an increasing adoption rate of electric bicycles and a burgeoning demand for user-friendly, integrated charging solutions. Market size is projected to expand significantly, with the adoption rate of wireless charging technology expected to reach over 45% of new e-bike sales by 2033. Technological disruptions are continuously enhancing charging efficiency and reducing energy loss, with advancements in resonant inductive charging promising faster and more adaptable charging capabilities. Consumer behavior is shifting towards convenience and a desire for a wire-free experience, making wireless charging a highly attractive feature for e-bike owners. The estimated CAGR for the wireless charging for electric bicycle market is a robust 28.5% over the forecast period. This remarkable growth is fueled by a combination of technological advancements, increasing consumer awareness, and the inherent advantages of wireless over traditional wired charging methods, such as reduced wear and tear on charging ports and enhanced safety by eliminating exposed connectors. The transition from single-point charging to embedded charging solutions within parking infrastructure will further accelerate adoption.

- Market Size Evolution: Significant expansion projected.

- Adoption Rates: Expected to reach over 45% of new e-bike sales by 2033.

- Technological Disruptions: Advancements in resonant inductive charging for faster, adaptable charging.

- Consumer Behavior Shifts: Growing preference for convenience and wire-free experiences.

- Estimated CAGR: 28.5% for the forecast period.

- Key Growth Factors: Technological advancements, consumer awareness, convenience benefits.

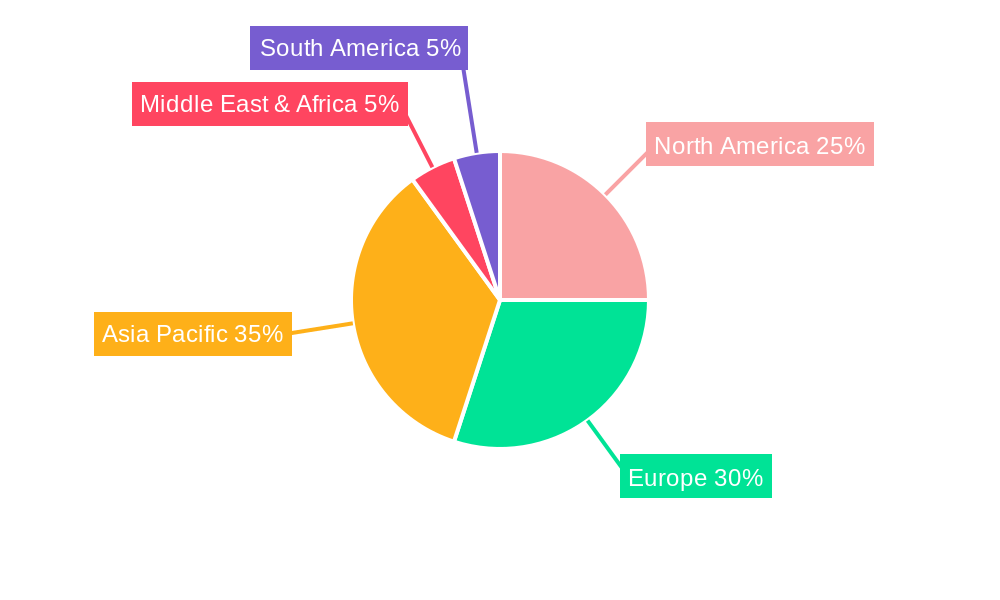

Dominant Regions, Countries, or Segments in Wireless Charging For Electric Bicycle

The Application segment of PARKING LOT is identified as the dominant driver of market growth in the wireless charging for electric bicycle sector. This dominance is attributed to the concentrated need for efficient and convenient charging solutions in high-traffic public and private parking areas, facilitating seamless charging for e-bike users during commutes and daily activities. Asia Pacific, particularly China, is the leading region due to its massive electric bicycle market and proactive government initiatives promoting green transportation. Within the Type segment, the Engineered Ground Charging Pile is expected to capture the largest market share, offering robust and integrated charging solutions for diverse parking environments. Key drivers include supportive economic policies in emerging markets, extensive infrastructure development for electric mobility, and high urbanization rates leading to increased e-bike usage. The projected market share for PARKING LOT applications is over 35%, with a projected growth potential of 30%. The widespread deployment of charging infrastructure in these high-density areas, coupled with the inherent convenience of wireless technology, solidifies this segment’s leading position. Furthermore, the increasing integration of wireless charging into smart city initiatives and urban planning will further bolster the growth of the PARKING LOT application.

- Dominant Application Segment: PARKING LOT (over 35% market share).

- Dominant Region: Asia Pacific (primarily China).

- Dominant Type Segment: Engineered Ground Charging Pile.

- Key Drivers: Supportive economic policies, infrastructure development, urbanization.

- Growth Potential: 30% within the dominant segment.

- Supporting Factors: Smart city integration, urban planning initiatives.

Wireless Charging For Electric Bicycle Product Landscape

The product landscape for wireless charging for electric bicycles is characterized by a wave of innovation focused on enhancing charging efficiency, reliability, and user experience. Companies are developing advanced inductive coils and power transfer systems that offer improved energy conversion rates and faster charging times. Applications are expanding beyond basic charging to include smart features like charging status monitoring via mobile apps and integration with existing smart city infrastructure. Performance metrics are seeing significant improvements, with charging efficiencies now exceeding 85% in advanced systems and charging speeds comparable to high-end wired chargers. Unique selling propositions include the elimination of physical connectors, reducing wear and tear, and providing a cleaner, more aesthetically pleasing charging solution for e-bikes. Technological advancements are also focusing on interoperability standards to ensure compatibility across different e-bike models and charging platforms.

Key Drivers, Barriers & Challenges in Wireless Charging For Electric Bicycle

Key Drivers: The wireless charging for electric bicycle market is propelled by several key factors. The increasing global adoption of electric bicycles for personal mobility and last-mile delivery is a primary driver, creating a substantial demand for efficient charging solutions. Technological advancements in inductive charging, leading to higher efficiencies and faster charging speeds, are making wireless options increasingly viable and attractive. Government initiatives promoting sustainable transportation and the development of electric vehicle infrastructure further bolster market growth. The inherent convenience and aesthetic appeal of wire-free charging, reducing user hassle and potential damage to charging ports, also significantly contribute to market expansion.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several barriers and challenges. High initial manufacturing costs for wireless charging systems can make them less competitive compared to traditional wired chargers. The need for precise alignment between the charging pad and the e-bike for optimal energy transfer can be a practical challenge for users. Standardization issues across different manufacturers and charging technologies could hinder widespread adoption and interoperability. Regulatory hurdles related to electromagnetic interference and safety standards for high-power wireless transfer systems also need to be addressed. Supply chain disruptions and the availability of key components can impact production volumes and costs. The competitive pressure from increasingly efficient and affordable wired charging solutions remains a significant restraint.

Emerging Opportunities in Wireless Charging For Electric Bicycle

Emerging opportunities in the wireless charging for electric bicycle market are abundant, driven by innovation and evolving consumer needs. The integration of wireless charging capabilities into public infrastructure, such as smart city charging hubs and bike-sharing stations, presents a significant untapped market. Furthermore, the development of dynamic wireless charging systems, allowing e-bikes to charge while in motion, offers a revolutionary potential for continuous power supply. Innovative applications in fleet management for delivery services and shared mobility platforms are emerging, where automated and convenient charging is paramount. Evolving consumer preferences for seamless user experiences and smart, connected devices are creating demand for advanced wireless charging solutions that integrate with mobile applications for monitoring and control. The expansion of wireless charging into e-scooters and other micro-mobility devices also represents a significant growth avenue.

Growth Accelerators in the Wireless Charging For Electric Bicycle Industry

Several key growth accelerators are fueling the long-term expansion of the wireless charging for electric bicycle industry. Continued technological breakthroughs in resonant inductive charging and higher power transfer capabilities will significantly enhance charging speeds and reduce reliance on precise alignment, making the technology more user-friendly. Strategic partnerships between e-bike manufacturers, charging infrastructure providers, and technology developers are crucial for creating integrated ecosystems and driving widespread adoption. Market expansion strategies targeting untapped regions with a growing e-bike market, coupled with supportive government policies, will accelerate penetration. The increasing focus on sustainability and the circular economy will also drive demand for robust and durable wireless charging solutions that minimize waste and enhance the lifespan of e-bike components.

Key Players Shaping the Wireless Charging For Electric Bicycle Market

- Spark Connected

- Kuaixiaodian

- Gdhll

- Nineblue

- OMNI

- ZoneCharge

- Mangela

- Zienertech

- Tailg

Notable Milestones in Wireless Charging For Electric Bicycle Sector

- 2019: Early prototypes of inductive charging for e-bikes showcased at industry trade shows, generating initial interest.

- 2020: First commercial wireless charging modules for e-bikes began to appear, albeit with limited market penetration.

- 2021: Standardization efforts for wireless power transfer in electric two-wheelers gained momentum, with industry consortia forming.

- 2022: Key players like Spark Connected and OMNI announced significant advancements in charging efficiency and power output.

- 2023: Major e-bike manufacturers started integrating optional wireless charging capabilities into their premium models.

- 2024: Increased investment in R&D by companies like Kuaixiaodian and Nineblue to optimize cost-effectiveness and user experience.

- 2025 (Estimated): Widespread adoption of engineered ground charging piles in urban parking lots and community charging stations.

- 2026-2033 (Forecast): Emergence of dynamic wireless charging solutions and expansion into global markets.

In-Depth Wireless Charging For Electric Bicycle Market Outlook

The in-depth market outlook for wireless charging for electric bicycles paints a picture of robust and sustained growth. The primary growth accelerators, including ongoing technological advancements in resonant charging and strategic industry partnerships, are expected to overcome existing barriers, such as cost and standardization. The increasing focus on smart city initiatives and the demand for seamless, user-friendly mobility solutions will create significant opportunities for market expansion. Future market potential is immense, with the wireless charging for electric bicycle market poised to become an integral component of the global electric mobility infrastructure, driving innovation and shaping the future of personal transportation. Strategic opportunities lie in developing cost-effective, interoperable, and highly efficient wireless charging solutions for widespread deployment across diverse applications.

Wireless Charging For Electric Bicycle Segmentation

-

1. Application

- 1.1. Attractions

- 1.2. Community

- 1.3. Campus

- 1.4. Office Building

- 1.5. PARKING LOT

- 1.6. Factory

-

2. Type

- 2.1. Engineered Ground Charging Pile

- 2.2. Handheld Charging Pile

Wireless Charging For Electric Bicycle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wireless Charging For Electric Bicycle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Charging For Electric Bicycle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Attractions

- 5.1.2. Community

- 5.1.3. Campus

- 5.1.4. Office Building

- 5.1.5. PARKING LOT

- 5.1.6. Factory

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Engineered Ground Charging Pile

- 5.2.2. Handheld Charging Pile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Wireless Charging For Electric Bicycle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Attractions

- 6.1.2. Community

- 6.1.3. Campus

- 6.1.4. Office Building

- 6.1.5. PARKING LOT

- 6.1.6. Factory

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Engineered Ground Charging Pile

- 6.2.2. Handheld Charging Pile

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Wireless Charging For Electric Bicycle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Attractions

- 7.1.2. Community

- 7.1.3. Campus

- 7.1.4. Office Building

- 7.1.5. PARKING LOT

- 7.1.6. Factory

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Engineered Ground Charging Pile

- 7.2.2. Handheld Charging Pile

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Wireless Charging For Electric Bicycle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Attractions

- 8.1.2. Community

- 8.1.3. Campus

- 8.1.4. Office Building

- 8.1.5. PARKING LOT

- 8.1.6. Factory

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Engineered Ground Charging Pile

- 8.2.2. Handheld Charging Pile

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Wireless Charging For Electric Bicycle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Attractions

- 9.1.2. Community

- 9.1.3. Campus

- 9.1.4. Office Building

- 9.1.5. PARKING LOT

- 9.1.6. Factory

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Engineered Ground Charging Pile

- 9.2.2. Handheld Charging Pile

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Wireless Charging For Electric Bicycle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Attractions

- 10.1.2. Community

- 10.1.3. Campus

- 10.1.4. Office Building

- 10.1.5. PARKING LOT

- 10.1.6. Factory

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Engineered Ground Charging Pile

- 10.2.2. Handheld Charging Pile

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Spark Connected

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kuaixiaodian

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gdhll

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nineblue

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OMNI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ZoneCharge

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mangela

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zienertech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tailg

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Spark Connected

List of Figures

- Figure 1: Global Wireless Charging For Electric Bicycle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Wireless Charging For Electric Bicycle Revenue (million), by Application 2024 & 2032

- Figure 3: North America Wireless Charging For Electric Bicycle Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Wireless Charging For Electric Bicycle Revenue (million), by Type 2024 & 2032

- Figure 5: North America Wireless Charging For Electric Bicycle Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Wireless Charging For Electric Bicycle Revenue (million), by Country 2024 & 2032

- Figure 7: North America Wireless Charging For Electric Bicycle Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Wireless Charging For Electric Bicycle Revenue (million), by Application 2024 & 2032

- Figure 9: South America Wireless Charging For Electric Bicycle Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Wireless Charging For Electric Bicycle Revenue (million), by Type 2024 & 2032

- Figure 11: South America Wireless Charging For Electric Bicycle Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Wireless Charging For Electric Bicycle Revenue (million), by Country 2024 & 2032

- Figure 13: South America Wireless Charging For Electric Bicycle Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Wireless Charging For Electric Bicycle Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Wireless Charging For Electric Bicycle Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Wireless Charging For Electric Bicycle Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Wireless Charging For Electric Bicycle Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Wireless Charging For Electric Bicycle Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Wireless Charging For Electric Bicycle Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Wireless Charging For Electric Bicycle Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Wireless Charging For Electric Bicycle Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Wireless Charging For Electric Bicycle Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Wireless Charging For Electric Bicycle Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Wireless Charging For Electric Bicycle Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Wireless Charging For Electric Bicycle Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Wireless Charging For Electric Bicycle Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Wireless Charging For Electric Bicycle Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Wireless Charging For Electric Bicycle Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Wireless Charging For Electric Bicycle Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Wireless Charging For Electric Bicycle Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Wireless Charging For Electric Bicycle Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Wireless Charging For Electric Bicycle Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Wireless Charging For Electric Bicycle Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Charging For Electric Bicycle?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Wireless Charging For Electric Bicycle?

Key companies in the market include Spark Connected, Kuaixiaodian, Gdhll, Nineblue, OMNI, ZoneCharge, Mangela, Zienertech, Tailg.

3. What are the main segments of the Wireless Charging For Electric Bicycle?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Charging For Electric Bicycle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Charging For Electric Bicycle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Charging For Electric Bicycle?

To stay informed about further developments, trends, and reports in the Wireless Charging For Electric Bicycle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence