Key Insights

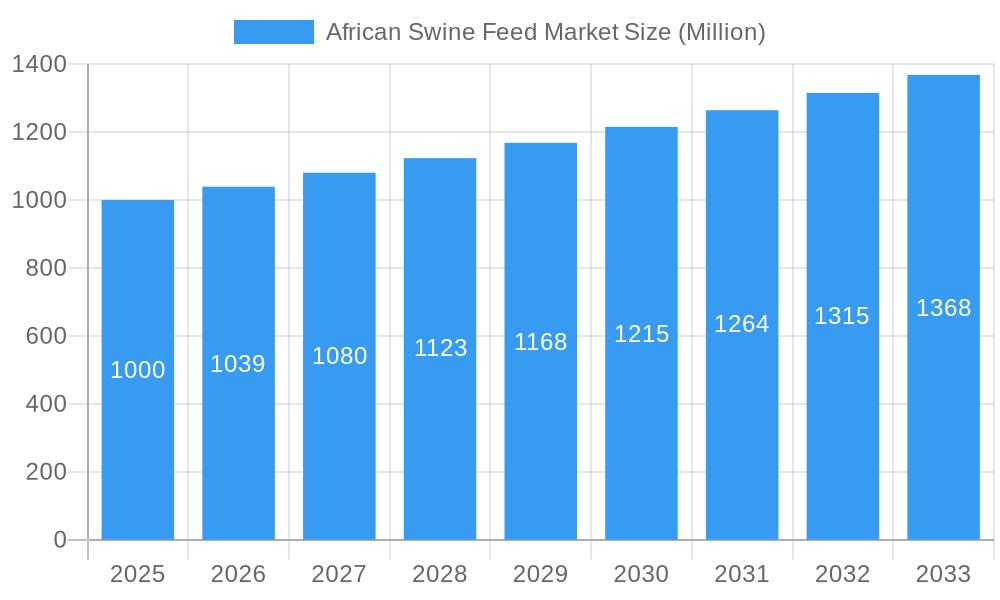

The African swine feed market, valued at approximately $4.32 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2025 to 2033. This growth is driven by rising pork demand from a growing African population and increasing disposable incomes. Furthermore, advancements in swine farming practices, including intensive methods and a focus on animal health, are increasing the demand for high-quality, specialized swine feeds. This includes feeds with premium ingredients like cereals, oilseed meals, and supplements such as vitamins and antioxidants to improve animal growth and reduce mortality. Challenges include fluctuating raw material prices for cereals and oilseed meals, and infrastructural limitations in certain regions that affect feed distribution and market access. The market is segmented by ingredient type (cereals, oilseed meals, oils, molasses) and supplement type (antibiotics, vitamins, antioxidants), presenting opportunities for specialized feed producers. Key players include Serfco Feeds, Cargill, Elanco, and others. Regional analysis of South Africa, Sudan, Uganda, Tanzania, and Kenya indicates varying market maturity and growth potential.

African Swine Feed Market Market Size (In Billion)

The forecast period of 2025-2033 offers significant expansion opportunities for the African swine feed market. East Africa is expected to see substantial growth due to increasing domestic pork consumption and government support for agricultural development. South Africa, a mature market, will likely experience continued but potentially slower growth. The adoption of advanced feed technologies, improved feed efficiency, and a better understanding of nutritional requirements in swine farming will shape a dynamic market where innovation and strategic partnerships are crucial for leadership. Market resilience will depend on overcoming challenges related to raw material price volatility and infrastructure constraints to fully capitalize on its growth potential.

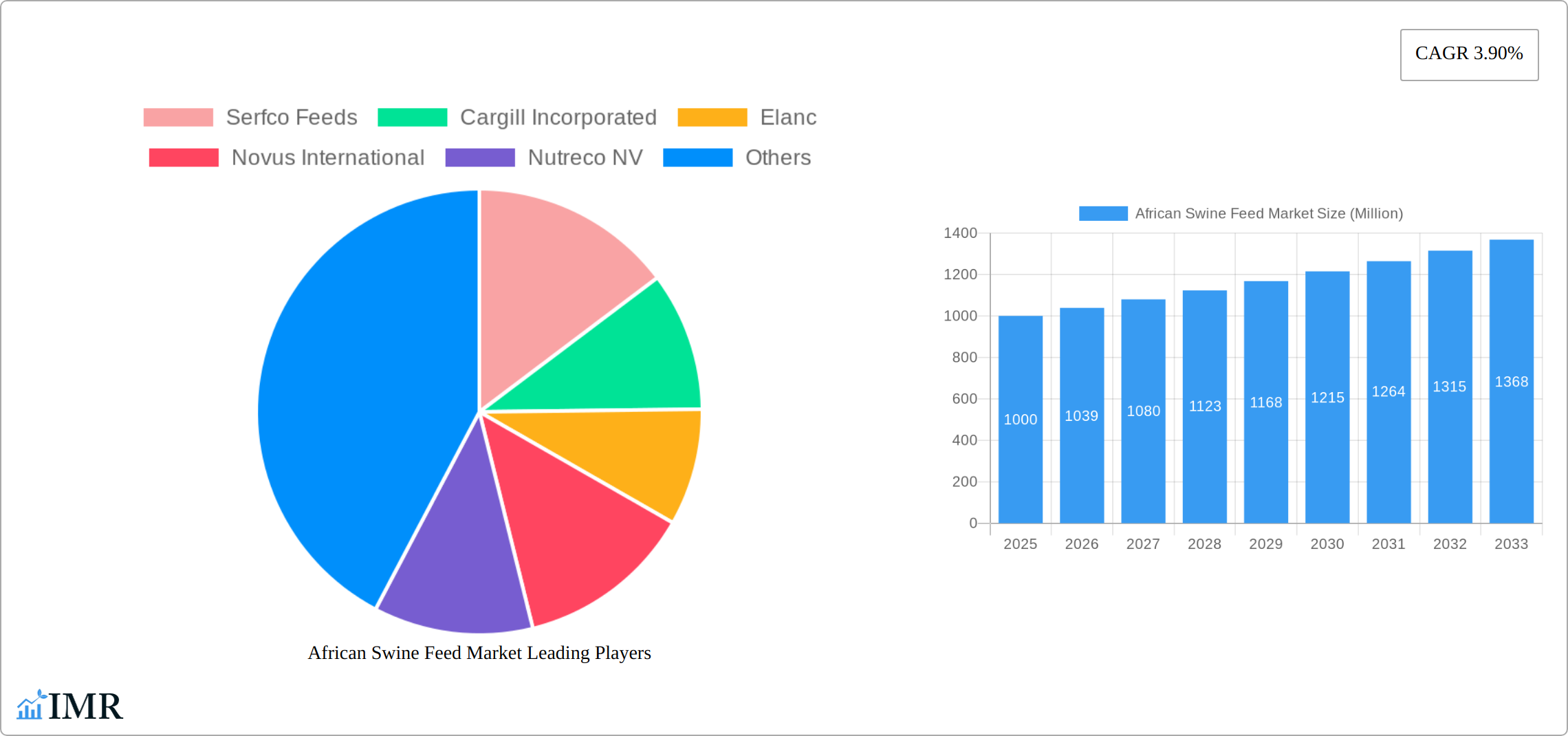

African Swine Feed Market Company Market Share

African Swine Feed Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the African swine feed market, offering invaluable insights for industry professionals, investors, and stakeholders. We delve into market dynamics, growth trends, dominant segments, and key players, projecting market evolution from 2019 to 2033. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and an estimated year of 2025, to forecast market trends until 2033. The total market value in 2025 is estimated at xx Million.

African Swine Feed Market Dynamics & Structure

The African swine feed market is characterized by a moderately fragmented structure, with key players like Cargill Incorporated, Cargill Incorporated, Nutreco NV, Nutreco NV, and Alltech Inc. Alltech Inc holding significant, but not dominant, market share. Market concentration is expected to increase slightly over the forecast period due to strategic acquisitions and expansions by larger players. Technological innovation, particularly in feed formulation and nutritional optimization, is a key driver, albeit hampered by limited access to advanced technologies and infrastructure in certain regions. Regulatory frameworks vary across African nations, impacting ingredient sourcing and feed quality standards. The market faces competition from traditional feed sources and is witnessing a growing adoption of sustainable and bio-secure feed solutions. M&A activity has been moderate, with a total of xx deals recorded between 2019 and 2024 (estimated).

- Market Concentration: Moderately Fragmented (2025: xx% market share held by top 5 players)

- Technological Innovation: Significant potential, hampered by infrastructure limitations.

- Regulatory Framework: Variable across African nations, impacting standardization.

- Competitive Substitutes: Traditional feed sources, increasing competition from sustainable alternatives.

- End-User Demographics: Predominantly small to medium-sized swine farms.

- M&A Trends: Moderate activity (xx deals from 2019-2024, estimated).

African Swine Feed Market Growth Trends & Insights

The African swine feed market exhibits substantial growth potential, driven by rising swine production, increasing consumer demand for pork, and improving agricultural practices. The market size has shown consistent expansion in recent years. The historical period (2019-2024) witnessed a CAGR of xx%, while the forecast period (2025-2033) is projected to see a CAGR of xx%. This growth is fueled by factors such as increasing per capita income, urbanization, and government initiatives promoting livestock farming. Technological advancements in feed formulation and disease management are further enhancing productivity and efficiency. However, challenges such as feed ingredient price volatility and infrastructural limitations can impact growth trajectory. Market penetration remains relatively low in certain regions, offering significant untapped potential. Consumer behavior shifts towards healthier and more sustainable pork products are influencing feed ingredient choices.

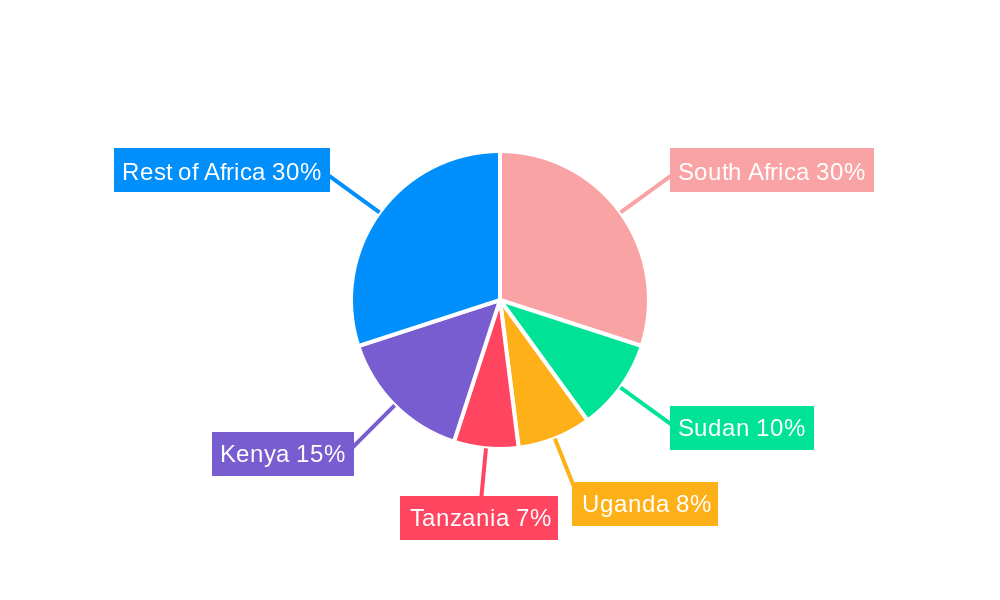

Dominant Regions, Countries, or Segments in African Swine Feed Market

The Southern African region currently commands a significant share of the African Swine Feed Market, primarily propelled by the well-established and robust swine production sector in key countries like South Africa. However, the landscape is dynamic, with substantial growth potential unfolding in East and West Africa. These regions are witnessing rapid economic expansion, increasing urbanization, and a burgeoning middle class, all contributing to a rising demand for pork. Within the critical ingredient categories, Cereals (estimated to reach xx Million in 2025) and their By-Products (estimated to reach xx Million in 2025) continue to be the cornerstones of swine feed formulation. Their dominance stems from their inherent cost-effectiveness, widespread availability across the continent, and their role as primary energy sources. In the realm of supplements, Vitamins (projected at xx Million in 2025) and Antibiotics (projected at xx Million in 2025) are pivotal. This prominence is directly linked to the overarching emphasis on maintaining optimal animal health, preventing disease outbreaks, and ultimately enhancing overall farm productivity and profitability.

- Key Drivers (Southern Africa): A mature and well-developed swine farming industry, supported by more established infrastructure, access to technology, and often, favorable government policies and subsidies.

- Growth Potential (East & West Africa): Characterized by robust economic development, a growing middle class with increasing disposable incomes, and a significant rise in consumer appetite for protein sources like pork, driven by changing dietary habits and cultural influences.

- Dominant Ingredient Segments: Cereals and their By-Products remain the backbone due to their economic viability, widespread agricultural production, and crucial role in providing essential nutrients, particularly carbohydrates and energy.

- Dominant Supplement Segments: Vitamins are crucial for numerous metabolic functions, immune support, and overall well-being. Antibiotics, while subject to increasing scrutiny and regulation, continue to play a role in disease prevention and treatment, contributing to herd health and reducing losses.

African Swine Feed Market Product Landscape

The African swine feed market is characterized by a sophisticated and evolving product landscape. Manufacturers are increasingly offering highly customized feed formulations, meticulously designed to cater to the specific nutritional requirements of swine at different life stages – from piglets to finishing pigs – and across diverse production systems, including intensive commercial farms and smaller-scale operations. The current innovation drive is squarely focused on developing feeds that deliver improved nutritional profiles, boasting enhanced digestibility to maximize nutrient absorption and minimize waste. Furthermore, there's a strong emphasis on developing products that contribute to disease prevention and bolster the animals' immune systems. Products enriched with higher protein content, the strategic inclusion of beneficial prebiotics and probiotics to promote gut health, and formulations designed for improved palatability are witnessing a significant uptick in market adoption. Technological advancements are also revolutionizing feed manufacturing processes. The integration of automated mixing and pelleting systems is not only boosting production efficiency but also ensuring greater consistency and quality control, leading to more reliable and effective feed products. The competitive edge in this market is increasingly being defined by compelling unique selling propositions (USPs) that highlight tangible benefits such as significantly improved animal health outcomes, demonstrably enhanced growth performance (e.g., faster weight gain), and a reduction in the critical feed conversion ratios (FCR), meaning less feed is required to produce a kilogram of pork.

Key Drivers, Barriers & Challenges in African Swine Feed Market

Key Drivers:

- Soaring Pork Consumption: A consistently growing demand for pork, fueled by rapid population expansion across the continent and a discernible rise in per capita disposable incomes, is a primary engine for market growth.

- Supportive Government Initiatives: Numerous governments are recognizing the strategic importance of the livestock sector and are implementing policies and programs aimed at bolstering agricultural productivity, including the swine industry, through subsidies, research funding, and infrastructure development.

- Technological Advancements: The continuous innovation in feed formulation science and more efficient feed production technologies, including better ingredient sourcing and processing, are improving the quality, efficacy, and affordability of swine feed.

Challenges:

- Price Volatility of Feed Ingredients: The market is highly susceptible to significant fluctuations in the prices of key feed ingredients, particularly staple commodities like corn and soybeans, which can dramatically impact production costs and profitability.

- Limited Access to Finance: A persistent challenge for many smallholder farmers and smaller feed producers is the restricted access to adequate and affordable financing, hindering their ability to invest in improved feed technologies, infrastructure, and raw materials.

- Inadequate Infrastructure: The lack of robust and widespread infrastructure, especially in storage facilities for raw materials and finished feed, as well as efficient transportation networks, presents a significant logistical hurdle in many regions, leading to increased spoilage and delivery costs.

- Regulatory Inconsistencies: The presence of diverse and sometimes conflicting regulatory frameworks across different African nations creates complexities for feed manufacturers and suppliers, potentially leading to an estimated xx% increase in production costs in certain regions due to compliance issues and market access barriers.

Emerging Opportunities in African Swine Feed Market

- Demand for Sustainable and Organic Feed: A growing consumer and producer awareness of environmental sustainability and animal welfare is creating a burgeoning demand for organic, natural, and sustainably sourced feed products.

- Precision Feeding Technologies: The adoption of precision feeding technologies, which utilize data analytics and sensor technology to deliver feed optimized for individual animal needs, presents a significant opportunity for efficiency gains and improved performance.

- Expansion into Untapped Rural Markets: While urban centers are key, there is substantial untapped potential in rural areas as smallholder farming practices evolve and demand for commercial feed solutions grows.

- Value-Added Feed Products: The development of specialized, value-added feed products targeting specific health challenges, nutritional deficiencies, or growth phases of swine offers lucrative niche market opportunities.

Growth Accelerators in the African Swine Feed Market Industry

Technological innovation, strategic partnerships between feed companies and livestock producers, and expansion into previously underserved markets are poised to accelerate growth in the African swine feed market. Investment in research and development focused on locally adapted feed formulations will be crucial. Public-private partnerships could play a significant role in improving infrastructure and access to finance.

Key Players Shaping the African Swine Feed Market Market

- Serfco Feeds

- Cargill Incorporated

- Elanc

- Novus International

- Nutreco NV

- Alltech Inc

- Novafeeds

- Kemin Industries Inc

Notable Milestones in African Swine Feed Market Sector

- 2021: Alltech Inc. launched a pioneering new feed formulation specifically engineered to enhance the gut health of swine, reflecting a growing industry focus on preventative animal care.

- 2022: Cargill Incorporated strategically expanded its market footprint through the acquisition of a prominent regional feed mill, signaling consolidation and increased investment in the African market.

- 2023: A significant step towards standardization and quality assurance was taken with the implementation of a new national feed quality standard in a major African country, aiming to improve product integrity and consumer confidence.

In-Depth African Swine Feed Market Market Outlook

The African swine feed market presents significant long-term growth potential, driven by various factors including a growing population, rising disposable incomes, and increasing demand for pork. Strategic investments in research and development, infrastructure development, and sustainable practices are essential to unlocking the full potential of this market. Companies leveraging technological innovations and strengthening partnerships within the value chain are expected to gain a competitive edge. The forecast period (2025-2033) promises exciting opportunities for both established players and new entrants.

African Swine Feed Market Segmentation

-

1. Ingredient

- 1.1. Cereals

- 1.2. Cereals By Product

- 1.3. Oilseed Meal

- 1.4. Molasses

- 1.5. Other Ingredients

-

2. Supplement

- 2.1. Antibiotics

- 2.2. Vitamins

- 2.3. Antioxidants

- 2.4. Enzymes

- 2.5. Acidifiers

- 2.6. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Rest of South Africa

African Swine Feed Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Rest of South Africa

African Swine Feed Market Regional Market Share

Geographic Coverage of African Swine Feed Market

African Swine Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Rising Swine Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 5.1.1. Cereals

- 5.1.2. Cereals By Product

- 5.1.3. Oilseed Meal

- 5.1.4. Molasses

- 5.1.5. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Supplement

- 5.2.1. Antibiotics

- 5.2.2. Vitamins

- 5.2.3. Antioxidants

- 5.2.4. Enzymes

- 5.2.5. Acidifiers

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Rest of South Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Rest of South Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 6. South Africa African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 6.1.1. Cereals

- 6.1.2. Cereals By Product

- 6.1.3. Oilseed Meal

- 6.1.4. Molasses

- 6.1.5. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Supplement

- 6.2.1. Antibiotics

- 6.2.2. Vitamins

- 6.2.3. Antioxidants

- 6.2.4. Enzymes

- 6.2.5. Acidifiers

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Rest of South Africa

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 7. Egypt African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 7.1.1. Cereals

- 7.1.2. Cereals By Product

- 7.1.3. Oilseed Meal

- 7.1.4. Molasses

- 7.1.5. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Supplement

- 7.2.1. Antibiotics

- 7.2.2. Vitamins

- 7.2.3. Antioxidants

- 7.2.4. Enzymes

- 7.2.5. Acidifiers

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Rest of South Africa

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 8. Rest of South Africa African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 8.1.1. Cereals

- 8.1.2. Cereals By Product

- 8.1.3. Oilseed Meal

- 8.1.4. Molasses

- 8.1.5. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Supplement

- 8.2.1. Antibiotics

- 8.2.2. Vitamins

- 8.2.3. Antioxidants

- 8.2.4. Enzymes

- 8.2.5. Acidifiers

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Rest of South Africa

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Serfco Feeds

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cargill Incorporated

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Elanc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Novus International

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Nutreco NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Alltech Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Novafeeds

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemin Industries Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Serfco Feeds

List of Figures

- Figure 1: African Swine Feed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: African Swine Feed Market Share (%) by Company 2025

List of Tables

- Table 1: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 2: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 3: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: African Swine Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 7: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 10: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 11: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 14: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 15: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Swine Feed Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the African Swine Feed Market?

Key companies in the market include Serfco Feeds, Cargill Incorporated, Elanc, Novus International, Nutreco NV, Alltech Inc, Novafeeds, Kemin Industries Inc.

3. What are the main segments of the African Swine Feed Market?

The market segments include Ingredient, Supplement, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Rising Swine Production Drives the Market.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Swine Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Swine Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Swine Feed Market?

To stay informed about further developments, trends, and reports in the African Swine Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence