Key Insights

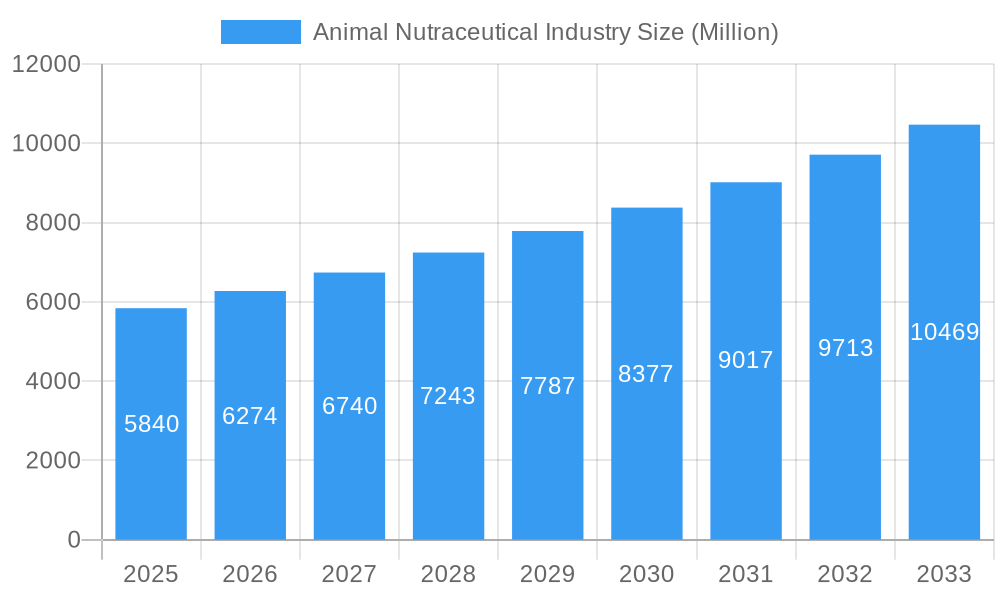

The global Animal Nutraceutical Industry is poised for substantial expansion, projected to reach a market size of USD 5.84 billion in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.6%, indicating a consistent upward trajectory for the industry over the forecast period extending to 2033. This expansion is largely driven by increasing pet humanization trends, where owners are prioritizing their pets' health and well-being with the same diligence they apply to their own. Consequently, there's a surging demand for scientifically formulated supplements and functional foods designed to enhance animal vitality, manage specific health conditions, and promote longevity. Key product segments contributing to this growth include Omega-3 Fatty Acids, vital for cognitive function and joint health, and Probiotics, crucial for digestive health and immunity. Proteins and Peptides are also gaining traction for muscle development and recovery. The industry is witnessing a dynamic interplay of innovation and consumer awareness, pushing the boundaries of animal nutrition beyond basic dietary needs.

Animal Nutraceutical Industry Market Size (In Billion)

The market's growth is further fueled by advancements in scientific research, leading to the development of more targeted and effective nutraceutical solutions. The "Other Nutraceuticals" segment, encompassing a wide array of specialized ingredients, is expected to witness significant innovation and adoption. While the market is primarily concentrated on Dogs and Cats, a growing interest in "Other Pets" indicates a broadening consumer base. Distribution channels are evolving, with the Online Channel experiencing remarkable growth, offering convenience and accessibility to a wider audience. Specialty Stores are also emerging as key players, providing expert advice and curated product selections. However, the industry must navigate potential restraints such as rising ingredient costs and the need for stringent regulatory compliance to ensure product safety and efficacy. Nonetheless, the overarching positive market sentiment, driven by a commitment to animal health, positions the Animal Nutraceutical Industry for sustained and vigorous expansion.

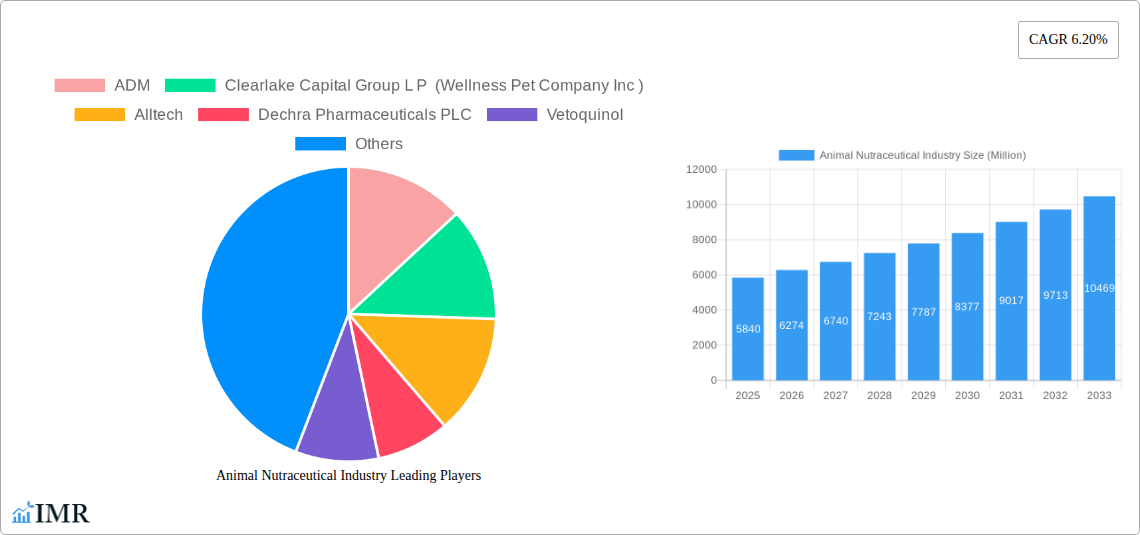

Animal Nutraceutical Industry Company Market Share

Animal Nutraceutical Industry Report: Market Insights, Growth Projections, and Key Players (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Animal Nutraceutical Industry, encompassing a detailed market outlook, growth trends, regional dominance, product landscape, and key strategic drivers. Covering the historical period from 2019-2024 and a robust forecast period from 2025-2033, with 2025 as the base and estimated year, this study provides actionable insights for industry professionals, investors, and stakeholders. Explore the evolving landscape of animal health and wellness, driven by increasing pet humanization, a growing demand for preventative care, and advancements in scientific research. The market is segmented by sub-product categories including Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, and Other Nutraceuticals. We also examine the impact across key pet segments: Cats, Dogs, and Other Pets, and analyze the influence of various distribution channels such as Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels. The projected market size for the Animal Nutraceutical Industry is estimated to reach $XX billion by 2033, with a CAGR of XX% during the forecast period.

Animal Nutraceutical Industry Market Dynamics & Structure

The Animal Nutraceutical Industry is characterized by a dynamic interplay of market concentration, technological innovation, stringent regulatory frameworks, and evolving end-user demographics. While key players like ADM, Clearlake Capital Group L P (Wellness Pet Company Inc), Alltech, Dechra Pharmaceuticals PLC, Vetoquinol, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Nutramax Laboratories Inc, and Virbac hold significant market share, the industry also fosters innovation through a blend of established giants and agile emerging companies. Technological advancements in ingredient sourcing, formulation, and delivery systems are pivotal drivers, enabling the development of more effective and targeted nutraceutical solutions. For instance, advancements in probiotics research have led to highly specific strains for gut health in both companion animals and livestock, contributing to the estimated $XX billion market for probiotics within the animal nutraceuticals sector.

- Market Concentration: The market exhibits moderate concentration, with a few dominant global players and numerous regional and specialized manufacturers. The increasing focus on premium and science-backed products is consolidating market share among companies with strong R&D capabilities.

- Technological Innovation Drivers: Innovations in biotechnology, fermentation processes for probiotics, and the extraction of novel milk bioactives are transforming product efficacy. Research into the synergistic effects of nutrient combinations, such as omega-3 fatty acids and vitamins and minerals, is a key area of development.

- Regulatory Frameworks: Stringent regulations governing ingredient safety, efficacy claims, and manufacturing practices in major markets like North America and Europe influence product development and market entry strategies. Compliance with bodies such as the FDA and EMA is paramount.

- Competitive Product Substitutes: While not direct substitutes, high-quality veterinary diets and pharmaceuticals offer alternative approaches to managing animal health, pushing nutraceutical companies to demonstrate superior preventative and supportive benefits.

- End-User Demographics: The increasing humanization of pets, particularly among millennials and Gen Z, drives demand for premium, natural, and health-focused products, mirroring human wellness trends. This demographic shift significantly impacts the Cats and Dogs segments, which are projected to account for over XX% of the total market value.

- M&A Trends: Mergers and acquisitions are a significant feature, driven by the pursuit of expanded product portfolios, market reach, and technological acquisition. For example, the recent acquisition by Virbac highlights a trend of consolidation and strategic expansion to bolster market presence. The estimated deal volume in M&A activities within the animal health sector has been around $XX billion in recent years.

Animal Nutraceutical Industry Growth Trends & Insights

The Animal Nutraceutical Industry is poised for substantial growth, fueled by a convergence of scientific advancements, evolving consumer preferences, and a deepening understanding of animal physiology. The market size is projected to witness a remarkable expansion from an estimated $XX billion in 2024 to $XX billion by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of XX%. This upward trajectory is underpinned by several critical trends. The increasing adoption of preventative healthcare for pets, mirroring human wellness trends, is a primary catalyst. Pet owners are becoming more proactive in managing their animals' health through diet and supplementation, moving beyond reactive treatment of illness. This shift is evident in the surging demand for probiotics and omega-3 fatty acids, known for their benefits in digestive health, immune support, and joint function. The market penetration of specialized nutraceuticals for age-related conditions and chronic diseases in pets is also on the rise, indicating a growing sophistication in pet care.

Technological disruptions are continually reshaping the industry. Innovations in bioavailability and targeted delivery systems are enhancing the efficacy of existing ingredients and paving the way for novel formulations. For instance, advancements in encapsulation technologies for probiotics ensure better survival rates in the gastrointestinal tract, maximizing their impact. Similarly, research into the specific applications of proteins and peptides for muscle development and recovery in performance animals is opening new market avenues. Consumer behavior is also a significant influence. The "pet humanization" trend continues unabated, with owners increasingly viewing their pets as family members and investing in their well-being with the same dedication they would apply to human health. This translates into a demand for high-quality, natural, and transparently sourced ingredients, driving market growth for premium nutraceuticals. The online channel, offering convenience and a wide selection of products, has emerged as a dominant distribution platform, facilitating wider market access and consumer engagement. Furthermore, the growing awareness among farmers about the economic benefits of improved animal health and productivity through nutraceutical supplementation is driving the demand in the livestock segment, even as the companion animal sector remains the dominant market force. The overall market adoption rate for scientifically validated animal nutraceuticals is expected to climb steadily, driven by increasing veterinarian recommendations and positive consumer testimonials.

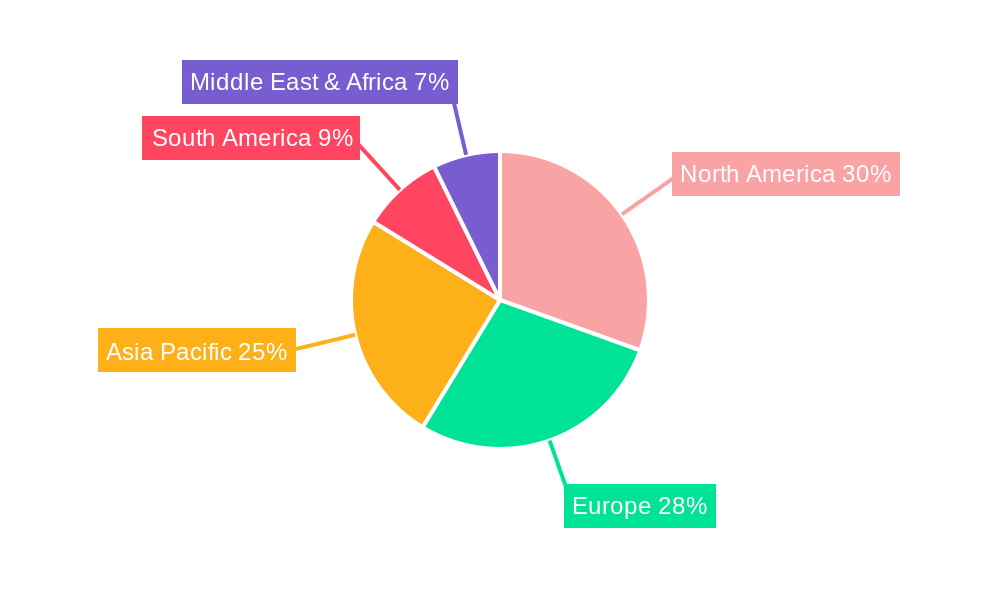

Dominant Regions, Countries, or Segments in Animal Nutraceutical Industry

The Animal Nutraceutical Industry's growth is a multifaceted phenomenon, with significant regional variations and segment-specific dynamics. North America currently stands as the dominant region, driven by a highly developed pet care market, strong consumer spending power, and a proactive approach to animal health and wellness. The United States, in particular, represents a substantial market share, fueled by high pet ownership rates and a growing acceptance of nutraceuticals as a crucial component of preventative pet healthcare. The Dogs segment within North America is a primary growth engine, accounting for an estimated XX% of the regional market value, followed closely by the Cats segment. The increasing trend of pet humanization and the willingness of owners to invest in premium products for their canine and feline companions directly contribute to this dominance.

Within the sub-product categories, Probiotics and Omega-3 Fatty Acids are experiencing exceptional growth across all major regions. The perceived benefits for digestive health, immune support, and anti-inflammatory properties have cemented their positions as high-demand ingredients. The Omega-3 Fatty Acids market alone is projected to reach $XX billion by 2033, with a significant portion of this driven by demand for EPA and DHA in both companion animals and aquaculture. The online channel has emerged as a significant growth accelerator in distribution, offering unparalleled reach and convenience, and is projected to capture over XX% of the market share by 2033. This channel is particularly strong in developed economies where internet penetration is high and consumers are comfortable with e-commerce for pet supplies.

Dominant Region: North America

- Key Drivers: High pet ownership, significant disposable income, strong veterinary recommendation, and consumer awareness of preventative health.

- Market Share: Estimated to hold over XX% of the global Animal Nutraceutical Industry market.

- Growth Potential: Continued expansion driven by innovation and increasing demand for specialized products.

Dominant Pet Segment: Dogs

- Key Drivers: High popularity as pets, diverse needs across breeds and ages, and owners' willingness to invest in their health.

- Market Share: Accounts for an estimated XX% of the total pet nutraceutical market.

- Growth Potential: Robust growth fueled by specialized joint support, immune-boosting, and anxiety-reducing supplements.

Dominant Sub-Product Segment: Probiotics

- Key Drivers: Increasing awareness of gut health benefits, scientific validation, and use in managing digestive issues.

- Market Share: Expected to reach $XX billion by 2033.

- Growth Potential: Significant expansion with new strain discoveries and applications for immune modulation.

Dominant Distribution Channel: Online Channel

- Key Drivers: Convenience, accessibility, competitive pricing, and wide product availability.

- Market Share: Projected to command over XX% of the market by 2033.

- Growth Potential: Continued dominance with advancements in e-commerce logistics and direct-to-consumer models.

In Europe, the market is also robust, driven by similar trends but with a stronger emphasis on natural and organic ingredients. Asia-Pacific, particularly China and India, presents significant emerging market opportunities, with rapidly growing pet ownership and increasing disposable incomes. The implementation of favorable economic policies and the development of robust distribution infrastructure in these regions are key factors supporting this growth.

Animal Nutraceutical Industry Product Landscape

The Animal Nutraceutical Industry's product landscape is characterized by continuous innovation, focusing on enhancing animal health and well-being through scientifically formulated ingredients. Sub-products like Milk Bioactives, known for their immune-modulating and growth-promoting properties, are gaining traction, particularly in the livestock sector. Omega-3 Fatty Acids, derived from fish oil and algae, are vital for supporting cardiovascular health, reducing inflammation, and improving cognitive function in pets. The market for Probiotics is booming, with diverse strains tailored to specific digestive needs and immune support for various animal species. Proteins and Peptides are increasingly formulated into specialized diets and supplements for muscle development, recovery, and overall vitality. Vitamins and Minerals remain foundational, with an emphasis on bioavailable forms and synergistic combinations to address specific deficiencies and support metabolic functions. Other novel nutraceuticals, including antioxidants, prebiotics, and specialized plant extracts, are emerging to address a wider range of health concerns. The unique selling propositions often lie in ingredient purity, scientifically validated efficacy, palatability, and the ability to address specific life stages or health conditions in animals. Technological advancements in ingredient processing and formulation are leading to more stable, potent, and easy-to-administer products, such as chewable tablets, palatable powders, and liquid supplements.

Key Drivers, Barriers & Challenges in Animal Nutraceutical Industry

The Animal Nutraceutical Industry is propelled by several key drivers that are shaping its growth trajectory. The increasing humanization of pets, leading owners to invest in premium health and wellness products, is a paramount driver. Scientific advancements in understanding animal nutrition and the benefits of specific bioactive compounds continue to fuel innovation and product development. The growing awareness among pet owners and farmers about the preventative and therapeutic benefits of nutraceuticals, supported by veterinary recommendations, is also a significant catalyst.

- Key Drivers:

- Pet Humanization: Owners treating pets as family members and investing in their health.

- Scientific Advancements: Deeper understanding of animal physiology and the role of nutrients.

- Preventative Healthcare Trend: Shift from reactive treatment to proactive health management.

- Veterinary Endorsement: Increased recommendations from veterinary professionals.

- Growing Demand for Natural/Organic Products: Consumer preference for clean-label ingredients.

However, the industry faces considerable barriers and challenges that can impede its full potential. Stringent and evolving regulatory landscapes across different geographies can create complexities in product approval and market entry. The high cost of raw materials and advanced research and development can lead to premium pricing, potentially limiting accessibility for some consumer segments. The prevalence of misinformation and the lack of standardized efficacy testing for certain nutraceuticals can create consumer confusion and distrust.

- Key Barriers & Challenges:

- Regulatory Hurdles: Complex and varying approval processes in different countries.

- High R&D Costs: Significant investment required for product development and validation.

- Price Sensitivity: Premium pricing can limit market penetration for certain segments.

- Lack of Standardization: Inconsistent efficacy testing and product quality claims.

- Supply Chain Vulnerabilities: Dependence on specific raw material sources.

- Competitive Pressures: Intense competition from both established and new players.

Emerging Opportunities in Animal Nutraceutical Industry

Emerging opportunities in the Animal Nutraceutical Industry are abundant, driven by evolving consumer demands and scientific breakthroughs. The growing interest in functional foods for pets, mirroring human trends, presents a significant avenue for innovation, particularly in products that support cognitive function, immune health, and gut microbiome balance. The expansion of the Other Pets segment, encompassing exotic animals and smaller companion animals, offers untapped market potential for specialized nutraceutical solutions. Furthermore, the development of personalized nutrition plans based on an individual animal's genetic makeup, lifestyle, and specific health needs is a burgeoning area. The integration of wearable technology and AI-driven diagnostics could enable more precise and targeted nutraceutical interventions, creating a significant growth opportunity in the personalized pet wellness market. The demand for sustainable and ethically sourced ingredients, such as plant-based omega-3 alternatives and upcycled by-products, is also creating new product development avenues.

Growth Accelerators in the Animal Nutraceutical Industry Industry

Several powerful growth accelerators are propelling the Animal Nutraceutical Industry forward. Technological breakthroughs in ingredient extraction, fermentation, and delivery systems are enhancing the efficacy and bioavailability of nutraceuticals, leading to improved animal health outcomes. Strategic partnerships between ingredient manufacturers, product formulators, and veterinary clinics are crucial for validating product claims and expanding market reach. For instance, collaborations focusing on research into the synergistic effects of vitamins and minerals with proteins and peptides can unlock new product categories. Market expansion strategies targeting emerging economies with rapidly growing pet populations and increasing disposable incomes represent a significant growth opportunity. The development of novel applications for existing ingredients, such as the use of specific milk bioactives in neonatal animal care, further drives market penetration. The increasing adoption of a holistic approach to animal wellness, integrating nutrition, exercise, and preventative care, positions nutraceuticals as an integral component of this strategy.

Key Players Shaping the Animal Nutraceutical Industry Market

- ADM

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- Alltech

- Dechra Pharmaceuticals PLC

- Vetoquinol

- Mars Incorporated

- Nestle (Purina)

- Vafo Praha s r o

- Nutramax Laboratories Inc

- Virbac

Notable Milestones in Animal Nutraceutical Industry Sector

- May 2023: Virbac acquired its distributor (GS Partners) in the Czech Republic and Slovakia, expanding its subsidiary network to 35 and strengthening its presence in these markets.

- April 2023: Mars Incorporated launched its first pet food research and development center in Asia-Pacific, the APAC pet center, to accelerate product innovation.

- April 2023: Vafo Praha, s.r.o. secured a majority stake in Swedish pet food wholesaler Lupus Foder AB, enhancing its position in Scandinavia.

In-Depth Animal Nutraceutical Industry Market Outlook

The future outlook for the Animal Nutraceutical Industry is exceptionally promising, driven by sustained growth accelerators and emerging opportunities. The increasing emphasis on preventative health, coupled with ongoing scientific research into the efficacy of various bioactive compounds, will continue to fuel product innovation and market expansion. The industry is expected to witness a significant surge in personalized nutrition solutions, leveraging advancements in diagnostics and data analytics to tailor supplements to individual animal needs. Strategic collaborations and mergers and acquisitions will remain pivotal for consolidating market share and expanding geographical reach. The growing demand for natural, organic, and sustainably sourced ingredients will also shape product development and consumer preferences, presenting opportunities for companies that prioritize these attributes. As pet humanization continues to influence consumer spending, the market for premium, science-backed animal nutraceuticals is set to thrive, making it an attractive sector for investment and development. The projected market size of $XX billion by 2033 underscores the substantial long-term potential.

Animal Nutraceutical Industry Segmentation

-

1. Sub Product

- 1.1. Milk Bioactives

- 1.2. Omega-3 Fatty Acids

- 1.3. Probiotics

- 1.4. Proteins and Peptides

- 1.5. Vitamins and Minerals

- 1.6. Other Nutraceuticals

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Animal Nutraceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Animal Nutraceutical Industry Regional Market Share

Geographic Coverage of Animal Nutraceutical Industry

Animal Nutraceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Milk Bioactives

- 5.1.2. Omega-3 Fatty Acids

- 5.1.3. Probiotics

- 5.1.4. Proteins and Peptides

- 5.1.5. Vitamins and Minerals

- 5.1.6. Other Nutraceuticals

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. North America Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 6.1.1. Milk Bioactives

- 6.1.2. Omega-3 Fatty Acids

- 6.1.3. Probiotics

- 6.1.4. Proteins and Peptides

- 6.1.5. Vitamins and Minerals

- 6.1.6. Other Nutraceuticals

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 7. South America Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 7.1.1. Milk Bioactives

- 7.1.2. Omega-3 Fatty Acids

- 7.1.3. Probiotics

- 7.1.4. Proteins and Peptides

- 7.1.5. Vitamins and Minerals

- 7.1.6. Other Nutraceuticals

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 8. Europe Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 8.1.1. Milk Bioactives

- 8.1.2. Omega-3 Fatty Acids

- 8.1.3. Probiotics

- 8.1.4. Proteins and Peptides

- 8.1.5. Vitamins and Minerals

- 8.1.6. Other Nutraceuticals

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 9. Middle East & Africa Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 9.1.1. Milk Bioactives

- 9.1.2. Omega-3 Fatty Acids

- 9.1.3. Probiotics

- 9.1.4. Proteins and Peptides

- 9.1.5. Vitamins and Minerals

- 9.1.6. Other Nutraceuticals

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 10. Asia Pacific Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 10.1.1. Milk Bioactives

- 10.1.2. Omega-3 Fatty Acids

- 10.1.3. Probiotics

- 10.1.4. Proteins and Peptides

- 10.1.5. Vitamins and Minerals

- 10.1.6. Other Nutraceuticals

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alltech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dechra Pharmaceuticals PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetoquinol

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nestle (Purina)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vafo Praha s r o

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nutramax Laboratories Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virba

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Animal Nutraceutical Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 3: North America Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 4: North America Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 5: North America Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 11: South America Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 12: South America Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 13: South America Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 19: Europe Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 20: Europe Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 21: Europe Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Europe Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 27: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 28: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 29: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 35: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 36: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 37: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 2: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 3: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 6: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 7: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 13: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 14: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 20: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 21: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 33: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 34: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 43: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 44: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Nutraceutical Industry?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the Animal Nutraceutical Industry?

Key companies in the market include ADM, Clearlake Capital Group L P (Wellness Pet Company Inc ), Alltech, Dechra Pharmaceuticals PLC, Vetoquinol, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Nutramax Laboratories Inc, Virba.

3. What are the main segments of the Animal Nutraceutical Industry?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Virbac acquired its distributor (GS Partners) in the Czech Republic and Slovakia, which became Virbac's 35th subsidiary. This new subsidiary allows Virbac to expand its presence more in these countries.April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific. This new facility, called the APAC pet center, will support the company's product development.April 2023: Vafo Praha, s.r.o. partnered with the Swedish wholesaler of pet food products, Lupus Foder AB. Under this partnership, VAFO got the majority stake in Lupus Foder, thus expanding its position in Scandinavia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Nutraceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Nutraceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Nutraceutical Industry?

To stay informed about further developments, trends, and reports in the Animal Nutraceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence