Key Insights

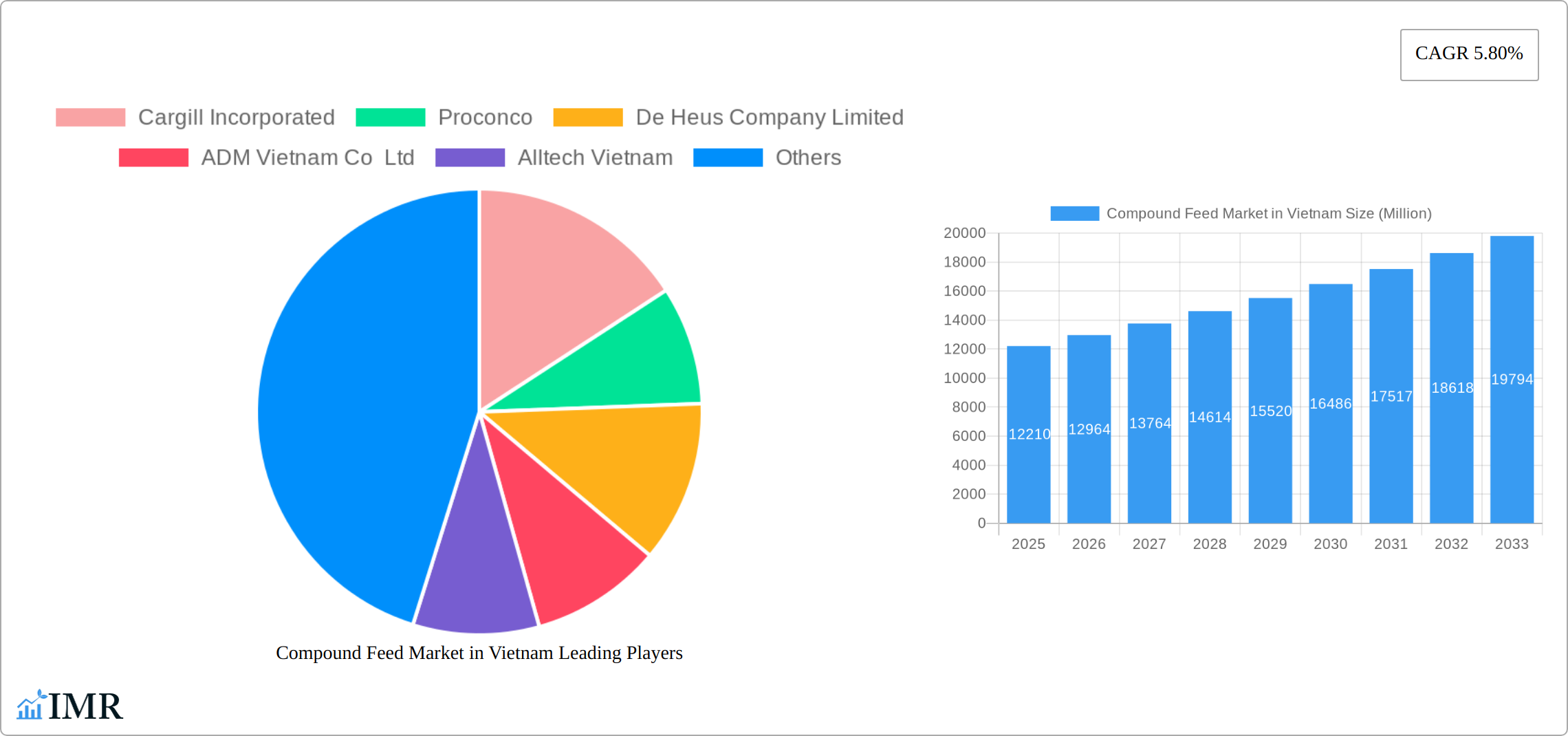

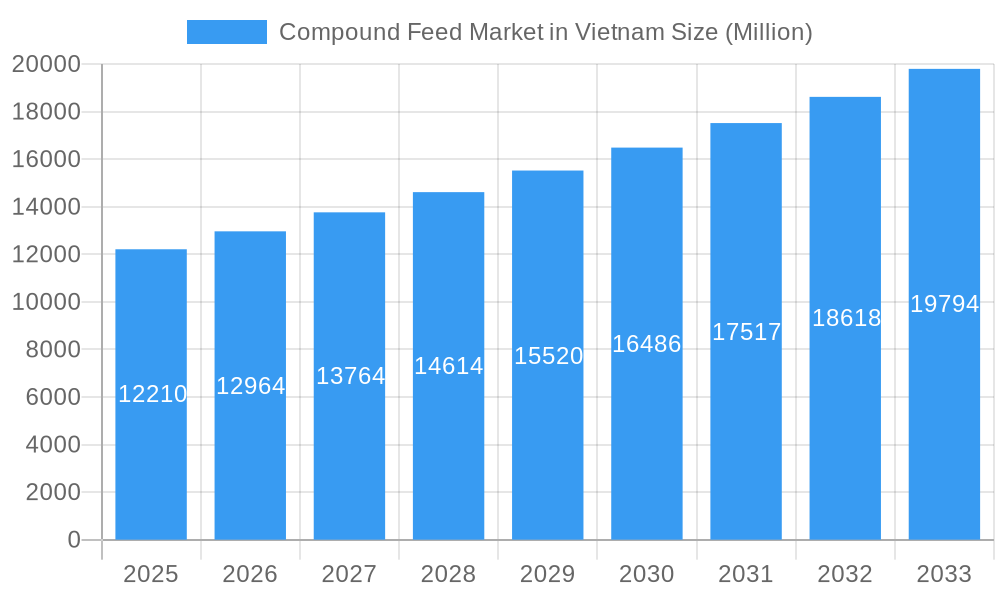

The Vietnamese compound feed market, valued at $12.21 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning aquaculture sector in Vietnam, driven by increasing global demand for seafood, significantly contributes to the market's growth. Simultaneously, the rising domestic consumption of poultry and swine products necessitates a higher production of compound feed to support these industries. Furthermore, advancements in feed formulation and technology, focusing on improved nutritional value and disease resistance, are enhancing feed efficiency and overall productivity, driving market expansion. Government initiatives promoting sustainable agricultural practices and supporting the growth of the livestock sector also play a crucial role. The market is segmented by ingredient type (grains and cereals, oilseeds and derivatives, fish meal and fish oil, supplements, and others) and animal type (ruminants, swine, poultry, aquaculture, and others), providing diverse opportunities for market players. Major players like Cargill, ADM, and CP Vietnam dominate the market, leveraging their established distribution networks and strong brand recognition. However, challenges like fluctuating raw material prices and potential environmental concerns related to feed production remain factors impacting the market’s trajectory. Competitive pressures are also expected to increase as smaller, regional players continue to emerge.

Compound Feed Market in Vietnam Market Size (In Billion)

The forecast period (2025-2033) suggests continued expansion, driven by consistent growth in Vietnam's livestock and aquaculture sectors. The increasing adoption of technologically advanced feed formulations, aimed at improving animal health and productivity, will also contribute significantly. However, it is crucial to monitor factors like the global economic climate, potential regulatory changes, and the overall availability and price of key feed ingredients to accurately predict long-term growth. Market segmentation analysis reveals that the poultry segment holds the largest market share, closely followed by the aquaculture sector. This suggests that investments and strategies tailored to these segments hold the greatest potential for return. Overall, the Vietnamese compound feed market presents a compelling investment opportunity for companies capable of adapting to evolving market dynamics and satisfying the growing demand for high-quality animal feed.

Compound Feed Market in Vietnam Company Market Share

Compound Feed Market in Vietnam: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Compound Feed Market in Vietnam, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market.

Compound Feed Market in Vietnam Market Dynamics & Structure

The Vietnamese compound feed market is characterized by a dynamic and evolving landscape, marked by a moderately concentrated structure where both established multinational corporations and agile domestic enterprises fiercely compete for market dominance. This competitive environment is further fueled by continuous technological advancements aimed at optimizing feed conversion ratios, enhancing animal health outcomes, and improving overall farm productivity. Concurrently, the market is shaped by the progressive evolution of regulatory frameworks that prioritize food safety, animal welfare, and the imperative of environmental sustainability. Emerging competitive pressures, particularly from the growing adoption of substitute products such as organic feed components and alternative protein sources, are also influencing market trajectories. The fundamental driver of market expansion remains the robust demand for animal protein, propelled by a burgeoning population, increasing urbanization, and a discernible shift in consumer preferences towards higher protein diets. Strategic mergers and acquisitions, while not a constant feature, continue to play a pivotal role in consolidating the market, fostering access to cutting-edge technologies, and expanding the operational footprints of key industry players.

- Market Concentration: Moderately concentrated, with the top 5 players estimated to hold approximately 60-70% of the market share (2024). This indicates a significant presence of leading entities while still allowing for competitive opportunities for smaller players.

- Technological Innovation: A strong emphasis is placed on precision feeding technologies, advanced feed formulations utilizing novel ingredients, and the development of sustainable sourcing practices. Key barriers to innovation include the significant investment required for research and development, as well as challenges in accessing and integrating advanced technological solutions across diverse farming operations.

- Regulatory Framework: The government is actively strengthening regulations focused on ensuring high standards of food safety, promoting responsible animal welfare practices, and encouraging environmentally sustainable production methods throughout the feed value chain.

- Competitive Substitutes: The market is experiencing a notable rise in the adoption of organic feed components and alternative protein sources, including insect-based proteins and single-cell proteins. These alternatives offer potential advantages in terms of sustainability and reduced environmental impact, posing a significant competitive challenge and an opportunity for innovation.

- End-User Demographics: A continuously growing population coupled with an increasing per capita consumption of animal protein products is a primary engine for sustained demand growth in the compound feed market. This trend is amplified by rising disposable incomes and changing dietary habits.

- M&A Trends: A moderate yet strategic level of M&A activity is observed, primarily driven by companies seeking to secure market expansion opportunities, acquire advanced technological capabilities, and strengthen their distribution networks. Approximately 5-7 major M&A deals have been recorded between 2019 and 2024, indicating a focused approach to strategic growth.

Compound Feed Market in Vietnam Growth Trends & Insights

The Vietnamese compound feed market has experienced consistent growth over the historical period (2019-2024), driven by factors such as rising livestock production, increasing consumer demand for animal protein, and government support for the agricultural sector. Adoption rates of improved feed formulations and technologies have steadily increased, leading to improved animal productivity and profitability for farmers. Technological disruptions, particularly in areas such as precision feeding and data analytics, are further enhancing market efficiency. Changes in consumer behavior, with growing awareness of animal welfare and food safety, influence the demand for high-quality compound feed. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), driven by continued economic growth, and increasing investment in the agricultural sector. Market penetration of improved feed technologies remains relatively high (xx%) but scope for further growth exists in less developed regions.

Dominant Regions, Countries, or Segments in Compound Feed Market in Vietnam

The poultry sector unequivocally commands the largest share within the Vietnamese compound feed market, accounting for an estimated 55-65% of the total market. This dominance is a direct consequence of the exceptionally high and consistent demand for poultry meat and eggs across the nation. In terms of ingredient composition, grains and cereals continue to be the most prominent segment, representing approximately 70-80% of the market. Their widespread availability and cost-effectiveness make them the cornerstone of most feed formulations. Geographically, Southern Vietnam emerges as the most dynamic and fastest-growing region for the compound feed market. This is attributed to a significantly higher concentration of commercial livestock farms, a well-developed agricultural infrastructure, and robust logistical networks that facilitate efficient distribution and access to feed.

- Leading Segment (Animal Type): Poultry (driven by widespread consumer preference for poultry products and relatively lower production costs compared to other livestock).

- Leading Segment (Ingredient Type): Grains and Cereals (due to their intrinsic cost-effectiveness, ready availability, and foundational role in animal nutrition).

- Dominant Region: Southern Vietnam (characterized by a high density of livestock operations, superior agricultural infrastructure, and established supply chain networks).

- Key Drivers: Robust economic growth, escalating disposable incomes leading to increased consumer spending on animal protein, proactive government support for the agricultural and livestock sectors, and the continuous expansion of overall livestock production capacity.

Compound Feed Market in Vietnam Product Landscape

The Vietnamese compound feed market offers a wide range of products tailored to specific animal types and nutritional requirements. Product innovations are focused on improving feed efficiency, enhancing animal health, and minimizing environmental impact. Key features include customized formulations, the incorporation of novel ingredients (e.g., insect-based proteins), and the use of advanced technologies for precise feed delivery. Unique selling propositions emphasize improved animal performance, enhanced feed conversion rates, and reduced disease incidence. Technological advancements such as precision feeding systems and data analytics contribute to the ongoing evolution of compound feed products.

Key Drivers, Barriers & Challenges in Compound Feed Market in Vietnam

Key Drivers:

- Growing demand for animal protein fueled by population growth and rising incomes.

- Government initiatives promoting agricultural development and livestock farming.

- Technological advancements improving feed efficiency and animal health.

Key Challenges:

- Fluctuations in raw material prices, impacting feed costs and profitability. (e.g., a xx% increase in corn prices in 2023 impacted margins by xx%).

- Stringent regulatory requirements for feed quality and safety, requiring significant compliance investment.

- Competition from both established multinational players and smaller domestic companies.

Emerging Opportunities in Compound Feed Market in Vietnam

- The growing demand for highly specialized and customized feed solutions designed to cater to the unique nutritional requirements of specific animal breeds, life stages, and health conditions presents a significant growth avenue.

- There is a discernible and increasing adoption of sustainable and environmentally conscious feed ingredients, with insect-based proteins and other novel, eco-friendly alternatives gaining traction as viable and potentially superior options.

- Significant opportunities exist for market expansion into underserved rural and remote areas that currently have limited access to high-quality, commercially produced compound feed, thereby improving local livestock productivity.

Growth Accelerators in the Compound Feed Market in Vietnam Industry

The compound feed market in Vietnam is experiencing substantial acceleration driven by continuous technological breakthroughs in areas such as sophisticated feed formulation techniques, the implementation of precision feeding systems, and the strategic application of data analytics to optimize feed usage and animal performance. Furthermore, the forging of strategic partnerships between leading feed manufacturers and innovative technology providers is significantly enhancing product development capabilities and broadening market reach. The proactive pursuit of expansion strategies, with a particular focus on penetrating underserved markets and introducing novel, value-added product lines, is also contributing immensely to the dynamic growth and increasing competitiveness within the industry.

Key Players Shaping the Compound Feed Market in Vietnam Market

- Cargill Incorporated

- Proconco

- De Heus Company Limited

- ADM Vietnam Co Ltd

- Alltech Vietnam

- Charoen Pokphand (CP) Vietnam

- Nutreco NV

- DeKalb Feeds

- Lai Thieu Feed Mill Co Ltd

- Archer Daniels Midland

- Austfee

- Kent Feeds

- GreenFeed (Vietnam) Co Ltd

- New Hope Group

- Land O'Lakes Purina

Notable Milestones in Compound Feed Market in Vietnam Sector

- November 2022: De Heus inaugurated its state-of-the-art premix factory in Vietnam, significantly bolstering its production capacity by an impressive 60,000 tons and substantially enhancing its supply chain efficiency and market responsiveness in Asia.

- June 2022: A landmark partnership was established between Innovafeed and Cargill, marking a pivotal moment in the industry's shift towards sustainability. This collaboration focused on the introduction of insect-based ingredients into compound feed formulations, signifying a progressive move towards more innovative and environmentally responsible feed solutions.

In-Depth Compound Feed Market in Vietnam Market Outlook

The Vietnamese compound feed market is poised for sustained growth, driven by ongoing economic development, rising consumption of animal protein, and technological advancements. Strategic opportunities exist in developing innovative feed solutions, expanding into new geographic markets, and leveraging data-driven approaches to improve feed efficiency and animal health. The market's future success hinges on adapting to evolving consumer preferences, addressing environmental concerns, and navigating the complexities of the regulatory landscape.

Compound Feed Market in Vietnam Segmentation

-

1. Ingredient Type

- 1.1. Grains and Cereals

- 1.2. Oilseeds and Derivatives

- 1.3. Fish Meal and Fish Oil

- 1.4. Supplements

- 1.5. Other Ingredient Types

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Swine

- 2.3. Poultry

- 2.4. Aquaculture

- 2.5. Other Animal Types

Compound Feed Market in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Compound Feed Market in Vietnam Regional Market Share

Geographic Coverage of Compound Feed Market in Vietnam

Compound Feed Market in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Meat and Meat-based Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compound Feed Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Grains and Cereals

- 5.1.2. Oilseeds and Derivatives

- 5.1.3. Fish Meal and Fish Oil

- 5.1.4. Supplements

- 5.1.5. Other Ingredient Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Swine

- 5.2.3. Poultry

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. North America Compound Feed Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Grains and Cereals

- 6.1.2. Oilseeds and Derivatives

- 6.1.3. Fish Meal and Fish Oil

- 6.1.4. Supplements

- 6.1.5. Other Ingredient Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Swine

- 6.2.3. Poultry

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. South America Compound Feed Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Grains and Cereals

- 7.1.2. Oilseeds and Derivatives

- 7.1.3. Fish Meal and Fish Oil

- 7.1.4. Supplements

- 7.1.5. Other Ingredient Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Swine

- 7.2.3. Poultry

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Europe Compound Feed Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Grains and Cereals

- 8.1.2. Oilseeds and Derivatives

- 8.1.3. Fish Meal and Fish Oil

- 8.1.4. Supplements

- 8.1.5. Other Ingredient Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Swine

- 8.2.3. Poultry

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Middle East & Africa Compound Feed Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Grains and Cereals

- 9.1.2. Oilseeds and Derivatives

- 9.1.3. Fish Meal and Fish Oil

- 9.1.4. Supplements

- 9.1.5. Other Ingredient Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Swine

- 9.2.3. Poultry

- 9.2.4. Aquaculture

- 9.2.5. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Asia Pacific Compound Feed Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10.1.1. Grains and Cereals

- 10.1.2. Oilseeds and Derivatives

- 10.1.3. Fish Meal and Fish Oil

- 10.1.4. Supplements

- 10.1.5. Other Ingredient Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminants

- 10.2.2. Swine

- 10.2.3. Poultry

- 10.2.4. Aquaculture

- 10.2.5. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Proconco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 De Heus Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ADM Vietnam Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alltech Vietnam

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Charoen Pokphand (CP) Vietnam

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nutreco NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DeKalb Feeds

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lai Thieu Feed Mill Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Archer Daniels Midland

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Austfee

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kent Feeds

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GreenFeed (Vietnam) Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 New Hope Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Land O'Lakes Purina

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Compound Feed Market in Vietnam Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Compound Feed Market in Vietnam Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 3: North America Compound Feed Market in Vietnam Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 4: North America Compound Feed Market in Vietnam Revenue (Million), by Animal Type 2025 & 2033

- Figure 5: North America Compound Feed Market in Vietnam Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Compound Feed Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Compound Feed Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Compound Feed Market in Vietnam Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 9: South America Compound Feed Market in Vietnam Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 10: South America Compound Feed Market in Vietnam Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: South America Compound Feed Market in Vietnam Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: South America Compound Feed Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Compound Feed Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Compound Feed Market in Vietnam Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 15: Europe Compound Feed Market in Vietnam Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 16: Europe Compound Feed Market in Vietnam Revenue (Million), by Animal Type 2025 & 2033

- Figure 17: Europe Compound Feed Market in Vietnam Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Europe Compound Feed Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Compound Feed Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Compound Feed Market in Vietnam Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 21: Middle East & Africa Compound Feed Market in Vietnam Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 22: Middle East & Africa Compound Feed Market in Vietnam Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Middle East & Africa Compound Feed Market in Vietnam Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East & Africa Compound Feed Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Compound Feed Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Compound Feed Market in Vietnam Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 27: Asia Pacific Compound Feed Market in Vietnam Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 28: Asia Pacific Compound Feed Market in Vietnam Revenue (Million), by Animal Type 2025 & 2033

- Figure 29: Asia Pacific Compound Feed Market in Vietnam Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Asia Pacific Compound Feed Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Compound Feed Market in Vietnam Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 2: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 5: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 11: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 17: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 29: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 38: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 39: Global Compound Feed Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Compound Feed Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compound Feed Market in Vietnam?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Compound Feed Market in Vietnam?

Key companies in the market include Cargill Incorporated, Proconco, De Heus Company Limited, ADM Vietnam Co Ltd, Alltech Vietnam, Charoen Pokphand (CP) Vietnam, Nutreco NV, DeKalb Feeds, Lai Thieu Feed Mill Co Ltd, Archer Daniels Midland, Austfee, Kent Feeds, GreenFeed (Vietnam) Co Ltd, New Hope Group, Land O'Lakes Purina.

3. What are the main segments of the Compound Feed Market in Vietnam?

The market segments include Ingredient Type, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for Meat and Meat-based Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: De Heus Inaugurated its first premix factory in Asia at May Industrial Park, Trang Bom district, Vietnam. It has a capacity of 60,000 tons. This will enable the company to ensure product quality and supply, reduce costs for the farmers and increase their production efficiency in Vietnam and the whole of Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compound Feed Market in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compound Feed Market in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compound Feed Market in Vietnam?

To stay informed about further developments, trends, and reports in the Compound Feed Market in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence