Key Insights

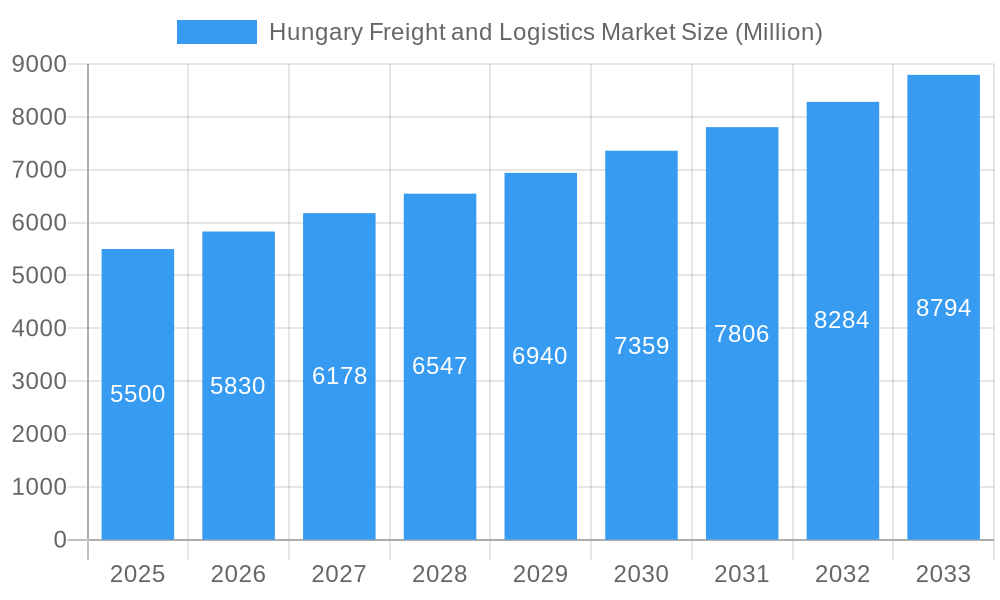

The Hungarian freight and logistics market is poised for robust expansion, driven by a dynamic economic landscape and increasing trade volumes. With an estimated market size of approximately USD 5,500 Million in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 6.00%, the sector is set to experience sustained value accretion. This growth is underpinned by significant investments in infrastructure, including road and rail networks, facilitating efficient movement of goods. Key drivers include the burgeoning manufacturing and automotive sectors, which rely heavily on sophisticated supply chains, and a growing construction industry demanding timely delivery of materials. Furthermore, the expansion of e-commerce continues to fuel demand for warehousing and value-added services, such as inventory management and last-mile delivery. Emerging trends like digitalization, automation in warehousing, and the adoption of sustainable logistics practices are shaping the market's future, enhancing efficiency and reducing environmental impact. The increasing integration of Hungary into European supply chains also presents substantial opportunities for freight forwarders and logistics providers.

Hungary Freight and Logistics Market Market Size (In Billion)

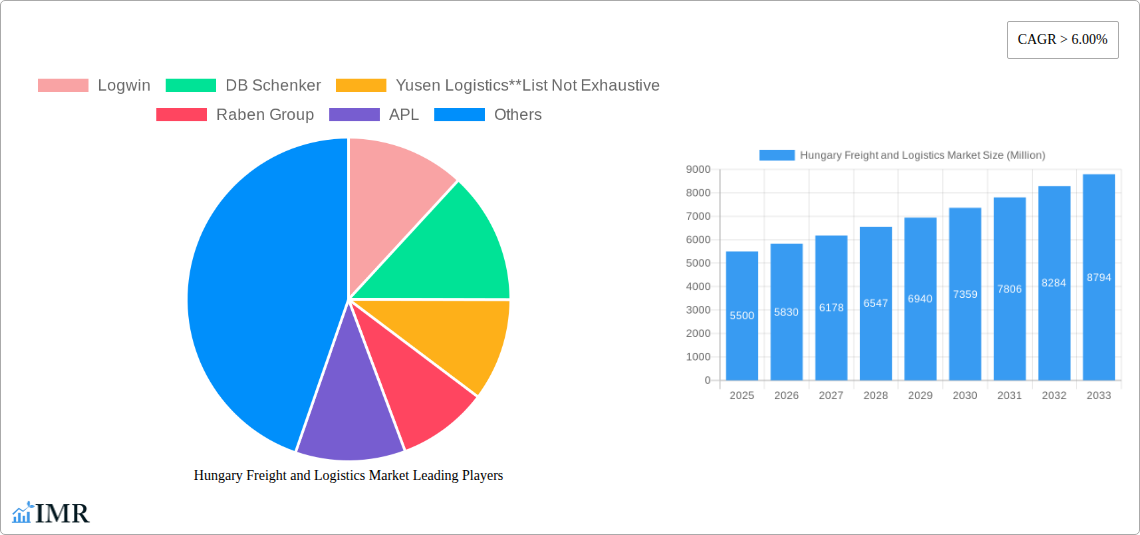

Despite the positive outlook, the market faces certain restraints. These include the escalating operational costs associated with fuel price volatility and labor shortages, which can impact profitability and service delivery. Stringent environmental regulations, while driving innovation, also necessitate significant capital investment for compliance. However, the inherent resilience of the Hungarian economy and its strategic geographical location within Central Europe are expected to mitigate these challenges. The diverse segmentation of the market, encompassing freight transport (road, shipping and inland water, air, rail), freight forwarding, warehousing, and value-added services, allows for specialized growth opportunities. Leading companies like DB Schenker, CEVA Logistics, and Raben Group are actively investing in and expanding their operations, indicating a competitive yet promising environment. The forecast period from 2025 to 2033 anticipates continued innovation and strategic partnerships to navigate complexities and capitalize on growth potential across all end-user industries.

Hungary Freight and Logistics Market Company Market Share

Hungary Freight and Logistics Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report offers a definitive analysis of the Hungary freight and logistics market, providing critical insights into its current state and projected trajectory through 2033. With a robust focus on road freight, freight forwarding, and warehousing solutions, this study is an indispensable resource for logistics providers, manufacturers, and investors seeking to capitalize on opportunities within this dynamic Central European hub. We dissect key market segments, including manufacturing and automotive logistics and retail distribution, and explore the impact of major industry players like DB Schenker and Raben Group.

Hungary Freight and Logistics Market Market Dynamics & Structure

The Hungary freight and logistics market is characterized by a moderately concentrated landscape, with leading global players vying for market share. Technological innovation is primarily driven by the adoption of digitalization, including warehouse automation, real-time tracking systems, and route optimization software, aiming to enhance efficiency and reduce operational costs. Regulatory frameworks, particularly those aligned with EU directives on transport, environmental standards, and labor, play a significant role in shaping market operations. Competitive product substitutes are emerging, especially in the warehousing segment, with the rise of shared warehousing and on-demand logistics platforms challenging traditional models. End-user demographics are increasingly sophisticated, demanding faster, more transparent, and sustainable logistics solutions, particularly within the burgeoning manufacturing and automotive sectors. Mergers and acquisitions (M&A) remain a significant trend, with companies strategically acquiring smaller entities to expand their service offerings and geographic reach. For instance, the acquisition by Dachser underscores consolidation efforts.

- Market Concentration: Dominated by a few key global players, but with significant room for niche providers.

- Technological Drivers: Digitalization, AI-powered route optimization, IoT for real-time tracking, and automation in warehousing.

- Regulatory Impact: EU compliance, sustainability mandates, and cross-border trade regulations.

- Competitive Substitutes: Rise of 3PL/4PL solutions, shared warehousing, and e-commerce focused fulfillment centers.

- End-User Demands: Increased emphasis on speed, visibility, sustainability, and customized solutions.

- M&A Activity: Strategic acquisitions to enhance service portfolios and market penetration. For example, Dachser's acquisition of its Hungarian joint ventures signals a trend of consolidation.

Hungary Freight and Logistics Market Growth Trends & Insights

The Hungary freight and logistics market is poised for robust growth, driven by its strategic geographical location as a gateway to both Western and Eastern Europe, coupled with a burgeoning industrial sector. The market size, estimated to reach approximately EUR 15,000 million by the end of the forecast period, will witness a steady Compound Annual Growth Rate (CAGR) of around 4.5% from 2025 to 2033. Adoption rates of advanced logistics technologies are on the rise, spurred by a need for greater efficiency and cost-effectiveness in supply chains. Technological disruptions, such as the integration of artificial intelligence in demand forecasting and autonomous vehicle trials, are expected to reshape operational paradigms. Consumer behavior shifts, particularly the exponential growth of e-commerce, are a significant catalyst, demanding more agile and efficient last-mile delivery solutions. The increasing complexity of global supply chains, exacerbated by geopolitical events and the push for nearshoring, further amplifies the demand for reliable and sophisticated logistics services in Hungary. The automotive industry, a cornerstone of the Hungarian economy, continues to be a major driver, necessitating specialized and time-sensitive freight transport and warehousing. Value-added services, including customized packaging, kitting, and reverse logistics, are gaining traction as companies seek to optimize their entire supply chain. The "Shipping and Inland Water" segment, while smaller, holds untapped potential with ongoing infrastructure improvements in the Danube region. The overall market penetration of integrated logistics solutions is increasing as businesses recognize the strategic advantage of outsourcing their supply chain management.

Dominant Regions, Countries, or Segments in Hungary Freight and Logistics Market

Within the Hungary freight and logistics market, Road Freight Transport stands out as the dominant segment, accounting for a significant portion of the market value, projected to be over EUR 8,000 million by 2033. This dominance is attributed to Hungary's extensive road network and its pivotal role as a transit country for goods moving across Europe. The Manufacturing and Automotive end-user segment is the primary driver of this growth, demanding efficient and timely transportation of raw materials, components, and finished vehicles. Its market share is estimated to reach over EUR 5,000 million by the forecast period's end. The strategic location of numerous automotive manufacturing plants and their associated supply chains across Hungary, particularly in regions like Western Hungary and around Budapest, further solidifies this segment's leadership.

- Dominant Segment: Road Freight Transport, propelled by its extensive reach and infrastructure.

- Key Drivers: High volume of cross-border transit, strong domestic manufacturing base, and increasing demand for just-in-time delivery.

- Market Share Projection: Expected to exceed 50% of the total freight transport market.

- Dominant End-User: Manufacturing and Automotive industry, a crucial pillar of the Hungarian economy.

- Key Drivers: Significant presence of global automotive manufacturers, complex supply chain requirements, and the need for specialized logistics solutions.

- Market Share Projection: Anticipated to contribute over 35% of the overall logistics market value.

- Regional Influence: Western Hungary and the Budapest Metropolitan Region are key logistics hubs due to the concentration of industrial facilities and transport infrastructure.

- Key Drivers: Proximity to borders, availability of skilled labor, and established logistics service providers.

- Emerging Strength: Warehousing and Distribution (Distribu) is experiencing significant growth due to the expansion of e-commerce and the need for efficient storage and fulfillment.

- Key Drivers: Growth in online retail, demand for cross-docking facilities, and the need for temperature-controlled storage solutions for food and pharmaceuticals.

- Growth Potential: Expected to witness a CAGR of over 5% during the forecast period.

Hungary Freight and Logistics Market Product Landscape

The product landscape of the Hungary freight and logistics market is increasingly sophisticated, moving beyond basic transport to offer integrated solutions. Innovations in freight forwarding include the development of digital platforms that provide real-time shipment tracking, automated customs clearance documentation, and dynamic pricing models. In warehousing, advancements are seen in the adoption of automated storage and retrieval systems (AS/RS), smart shelving, and temperature-controlled environments to cater to specialized goods like pharmaceuticals and perishables. Value-added services are expanding to include co-packing, labeling, returns management, and light assembly, offering end-to-end supply chain support. Performance metrics are increasingly focused on on-time delivery rates, shipment accuracy, inventory turnover, and carbon footprint reduction, reflecting a shift towards efficiency and sustainability.

Key Drivers, Barriers & Challenges in Hungary Freight and Logistics Market

Key Drivers: The Hungary freight and logistics market is propelled by several key drivers. The country's strategic geographical position in Central Europe facilitates significant transit trade, making it a crucial node in pan-European supply chains. Robust growth in the manufacturing sector, particularly automotive, pharmaceuticals, and electronics, directly translates to higher freight volumes. Furthermore, the expanding e-commerce landscape is creating a sustained demand for efficient warehousing and last-mile delivery services. Government initiatives aimed at improving infrastructure, such as road and rail network upgrades, also contribute to market expansion. Technological adoption, including digitalization and automation, is a significant driver for enhanced efficiency and cost reduction.

Barriers & Challenges: Despite strong growth prospects, the market faces several barriers and challenges. A persistent shortage of skilled labor, particularly truck drivers and warehouse personnel, remains a significant impediment to operational capacity. The increasing cost of fuel and energy presents a substantial operational challenge, impacting profitability. Regulatory compliance, particularly concerning emissions standards and working hours for drivers, adds complexity and cost to operations. Intense competition among a multitude of domestic and international players can lead to price pressures. Finally, occasional supply chain disruptions, whether due to geopolitical events or natural disasters, can impact the reliability and efficiency of logistics services. The market needs to address the xx million EUR in potential losses due to inefficient last-mile delivery.

Emerging Opportunities in Hungary Freight and Logistics Market

Emerging opportunities in the Hungary freight and logistics market are manifold. The burgeoning e-commerce sector presents a significant opportunity for specialized fulfillment centers and last-mile delivery solutions, especially in urban areas. The increasing demand for sustainable logistics offers chances for companies investing in green transportation technologies and carbon-neutral warehousing. Hungary’s growing role as a manufacturing hub for high-value goods, such as electronics and pharmaceuticals, creates a demand for specialized, temperature-controlled, and secure logistics services. Furthermore, the development of inland waterways and intermodal transport solutions presents untapped potential for diversifying freight movement and reducing road congestion. The integration of IoT and AI in logistics offers opportunities for developing predictive maintenance for fleets and optimizing inventory management for businesses.

Growth Accelerators in the Hungary Freight and Logistics Market Industry

Several growth accelerators are poised to significantly boost the Hungary freight and logistics market in the long term. The ongoing digitalization of the Hungarian economy, with increasing adoption of advanced technologies like AI, blockchain, and IoT across various industries, will fuel the demand for sophisticated logistics solutions that can support these digital transformations. Strategic partnerships between logistics providers and technology companies will accelerate the development and deployment of innovative services, such as automated last-mile delivery and predictive supply chain analytics. Furthermore, the Hungarian government's commitment to attracting foreign investment in manufacturing and R&D will continue to drive demand for efficient and reliable logistics infrastructure and services. The expansion of rail freight capacity and improved intermodal connectivity will also act as a major catalyst for sustainable and cost-effective goods movement. The increasing focus on circular economy principles will also lead to growth in reverse logistics and waste management logistics services.

Key Players Shaping the Hungary Freight and Logistics Market Market

- Logwin

- DB Schenker

- Yusen Logistics

- Raben Group

- APL

- CEVA Logistics

- Cargill

- NEC Logistics

- Rhenus Logistics

- Austromar

Notable Milestones in Hungary Freight and Logistics Market Sector

- December 2022: Dachser, a prominent German freight company, fully acquired its Hungarian joint ventures, "Liegl & DACHSER Szállítmányozási és Logisztikai Kft." and "Liegl & DACHSER ASL Hungary Kft." This strategic move consolidates Dachser's presence in Hungary across its European Logistics, Food Logistics, and Air & Sea Logistics business lines, enhancing its operational capabilities and market reach. The acquisition signifies a trend towards consolidation and increased investment by major European logistics players in the Hungarian market.

- May 2022: SPAR Hungary, a major retail company, announced substantial investments in its logistics network. The company invested over EUR 8.7 million (USD 9.4 million) in transportation and logistics developments during 2021 and an additional EUR 11.4 million (USD 12.3 million) in 2022. These investments highlight the growing importance of efficient and modern logistics for the retail sector, signaling increased demand for warehousing, distribution, and transportation services to support evolving consumer habits and supply chain demands.

In-Depth Hungary Freight and Logistics Market Market Outlook

The Hungary freight and logistics market is set for a period of sustained growth and transformation, driven by a confluence of factors including its strategic geographic positioning, a robust industrial base, and increasing digital adoption. The market outlook is characterized by an accelerated integration of advanced technologies, such as AI for route optimization and predictive analytics, and automation in warehousing, aimed at enhancing efficiency and reducing operational costs. The ongoing expansion of e-commerce will continue to be a significant demand driver, necessitating sophisticated fulfillment and last-mile delivery solutions. Furthermore, the growing emphasis on sustainability within the EU and globally presents a substantial opportunity for logistics providers who can offer eco-friendly transportation and warehousing options. Strategic partnerships and potential further consolidation among key players are expected to shape the competitive landscape, leading to a more integrated and technologically advanced logistics ecosystem in Hungary. The projected market growth of xx% signifies robust potential for stakeholders.

Hungary Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas

- 2.3. Mining and Quarrying

- 2.4. Agriculture, Fishing, and Forestry

- 2.5. Construction

- 2.6. Distribu

- 2.7. Other En

Hungary Freight and Logistics Market Segmentation By Geography

- 1. Hungary

Hungary Freight and Logistics Market Regional Market Share

Geographic Coverage of Hungary Freight and Logistics Market

Hungary Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. Rise in E-commerce Sector is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Freight and Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas

- 5.2.3. Mining and Quarrying

- 5.2.4. Agriculture, Fishing, and Forestry

- 5.2.5. Construction

- 5.2.6. Distribu

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logwin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Raben Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 APL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Austromar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logwin

List of Figures

- Figure 1: Hungary Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Freight and Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Freight and Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Hungary Freight and Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Hungary Freight and Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hungary Freight and Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Hungary Freight and Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Hungary Freight and Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Freight and Logistics Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Hungary Freight and Logistics Market?

Key companies in the market include Logwin, DB Schenker, Yusen Logistics**List Not Exhaustive, Raben Group, APL, CEVA Logistics, Cargill, NEC Logistics, Rhenus Logistics, Austromar.

3. What are the main segments of the Hungary Freight and Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

Rise in E-commerce Sector is Driving The Market.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

December 2022: Dachser (a German freight company) acquired the remaining 50 percent of the shares in its Hungarian joint ventures, "Liegl & DACHSER Szállítmányozási és Logisztikai Kft." (transport and storage of industrial goods and food products) and "Liegl & DACHSER ASL Hungary Kft." (air and sea freight). Dachser is active in Hungary with its European Logistics, Food Logistics, and Air & Sea Logistics business lines. The company employs 394 people at seven locations. The country organization's revenue amounted to about EUR 120 million (USD 130 million) in 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the Hungary Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence