Key Insights

The Polish Third-Party Logistics (3PL) market is poised for significant expansion, driven by the escalating need for optimized supply chain solutions across diverse sectors. With a projected CAGR of 5.63%, the market size is forecast to reach $35.71 billion by 2025. Key growth catalysts include the robust performance of manufacturing, automotive, pharmaceutical, healthcare, construction, and oil & gas industries. These sectors increasingly depend on advanced logistics services, encompassing domestic and international transportation, alongside sophisticated warehousing and distribution, to enhance operational efficiency and reduce costs. The growing complexity of global supply chains and the strategic outsourcing of logistics functions by Polish businesses further accelerate this market's development. Partnering with specialized 3PL providers offers businesses access to cutting-edge technology, expert knowledge, and economies of scale, ultimately boosting their competitive edge.

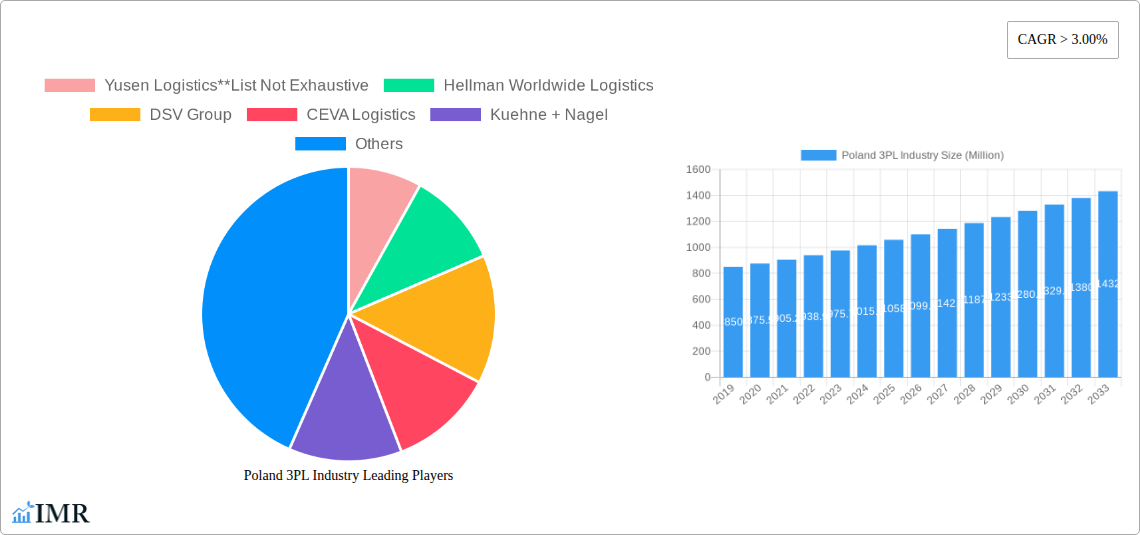

Poland 3PL Industry Market Size (In Billion)

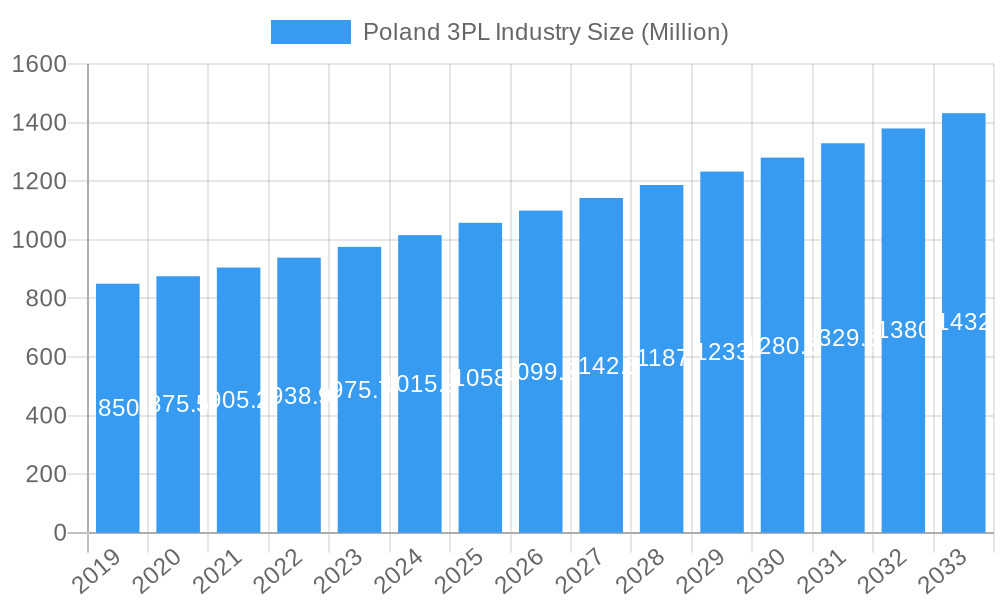

The Polish 3PL market is defined by a vigorous competitive landscape, featuring global leaders such as DHL Supply Chain, Kuehne + Nagel, and DSV Group, alongside significant regional players like Yusen Logistics and Hellman Worldwide Logistics. This competitive dynamic spurs innovation and service enhancements, benefiting end-users. Emerging technological advancements, including the integration of IoT, AI, and advanced analytics, are revolutionizing warehousing and transportation management, yielding enhanced visibility, efficiency, and predictive insights. The surge in e-commerce necessitates optimized last-mile delivery and effective returns management. Nevertheless, challenges such as rising operational expenditures, including labor and fuel costs, and evolving regulatory landscapes, may pose constraints. Despite these factors, the Polish 3PL market exhibits a strong positive outlook, with substantial opportunities for growth and development as businesses continue to prioritize streamlined and cost-effective supply chain strategies.

Poland 3PL Industry Company Market Share

Poland 3PL Industry Market Dynamics & Structure

The Polish Third-Party Logistics (3PL) market is characterized by a moderately concentrated structure, with a few key international players alongside a growing number of specialized domestic providers. The presence of global giants like DSV Group, CEVA Logistics, and Kuehne + Nagel signifies significant foreign direct investment and a competitive landscape. This concentration is further influenced by ongoing M&A trends, with strategic acquisitions aimed at expanding service portfolios, geographical reach, and technological capabilities. For instance, recent years have seen several notable transactions within the European logistics space that have directly impacted Poland's 3PL sector, though specific deal volumes for Poland are proprietary. Technological innovation is a primary driver, with increasing adoption of Warehouse Management Systems (WMS), Transportation Management Systems (TMS), and automation technologies like robotics and AI to enhance efficiency and reduce operational costs. Regulatory frameworks, particularly those related to transportation, customs, and environmental standards, play a crucial role in shaping market operations. For instance, EU directives on emissions and driver working hours directly influence international logistics operations. Competitive product substitutes are limited within the core 3PL offering, but advancements in in-house logistics capabilities by large manufacturers can present indirect competition. End-user demographics are shifting, with a growing demand from e-commerce fulfillment and a continued strong presence from the Manufacturing & Automotive and Pharma & Healthcare sectors.

- Market Concentration: Dominated by a mix of large international 3PL providers and agile domestic specialists.

- Technological Innovation Drivers: Automation, AI, WMS/TMS adoption, real-time tracking, and predictive analytics.

- Regulatory Frameworks: EU transportation laws, customs regulations, environmental standards, and labor laws.

- Competitive Product Substitutes: Primarily in-house logistics capabilities of large enterprises.

- End-User Demographics: Growing influence of e-commerce, strong demand from Manufacturing & Automotive, Pharma & Healthcare, and Oil & Gas and Chemicals.

- M&A Trends: Ongoing consolidation and strategic acquisitions to enhance capabilities and market share.

Poland 3PL Industry Growth Trends & Insights

The Polish Third-Party Logistics (3PL) market is poised for substantial growth, fueled by its strategic location within the European Union and a robust manufacturing base. The market size has experienced a steady upward trajectory throughout the historical period (2019–2024), driven by increasing outsourcing of logistics functions by businesses seeking to optimize supply chains and reduce operational costs. Our analysis, leveraging comprehensive market data, projects a significant expansion for the forecast period (2025–2033), with the base year (2025) serving as a pivotal point for future projections. The adoption rates for advanced 3PL services, including specialized warehousing and complex international transportation management, are escalating. This is largely attributed to the increasing complexity of global supply chains and the growing demand for efficient last-mile delivery solutions, especially from the burgeoning e-commerce sector.

Technological disruptions are acting as significant catalysts. Investments in digitalization, including the implementation of IoT devices for real-time tracking, blockchain for enhanced transparency, and AI-powered route optimization, are becoming standard. These advancements not only improve efficiency but also offer greater visibility and control over logistics operations, a key concern for end-users across various industries. Consumer behavior shifts, particularly the expectation of faster delivery times and personalized logistics options, are compelling 3PL providers to innovate and offer more agile and customer-centric solutions. The rise of e-commerce has fundamentally reshaped demand, necessitating flexible warehousing and distribution networks capable of handling higher volumes and more frequent order fulfillment.

Furthermore, the Polish 3PL market is benefiting from its role as a crucial hub for goods moving between Western and Eastern Europe. This geographical advantage, coupled with a skilled workforce and competitive operational costs compared to Western European counterparts, makes Poland an attractive location for logistics outsourcing. The average annual growth rate (CAGR) is expected to remain robust, underscoring the market's healthy expansion. Market penetration of advanced 3PL services continues to deepen as more companies recognize the strategic value of partnering with specialized logistics providers. The ongoing evolution of supply chain management, driven by global events and economic fluctuations, further emphasizes the need for resilient and adaptable logistics solutions, a niche that Polish 3PLs are increasingly adept at filling. The increasing complexity of inventory management and the need for just-in-time delivery models in sectors like Manufacturing & Automotive are also significant growth drivers.

Dominant Regions, Countries, or Segments in Poland 3PL Industry

The Polish 3PL industry's dominance is multifaceted, with specific segments and end-users exhibiting superior growth and market share. Among the Services, International Transportation Management stands out as a primary growth engine. Poland's strategic location at the crossroads of Europe, facilitating trade between the EU and countries to the east, makes it a vital transit and logistics hub. This is further amplified by robust infrastructure development, including significant investments in road and rail networks connecting major industrial and consumption centers. The continued expansion of intra-EU trade and the increasing demand for efficient cross-border logistics solutions directly benefit this segment.

In terms of End-Users, the Manufacturing & Automotive sector is unequivocally the largest and most influential driver of the Polish 3PL market. Poland has emerged as a significant manufacturing powerhouse, particularly in the automotive, electronics, and furniture industries. These sectors rely heavily on complex, time-sensitive supply chains for raw materials, components, and finished goods. 3PL providers are integral to managing these intricate logistics needs, offering specialized services like just-in-time deliveries, vendor-managed inventory, and reverse logistics. The sector's substantial contribution to Poland's GDP and export volume directly translates into a high demand for comprehensive 3PL solutions.

The Pharma & Healthcare sector is another significant and rapidly growing segment. The stringent requirements for temperature-controlled transportation, specialized handling, and regulatory compliance make this a high-value area for 3PL providers. The increasing healthcare spending in Poland and the growing demand for pharmaceuticals and medical devices, both domestically and for export, are fueling this growth. 3PLs equipped with cold chain logistics capabilities and adherence to Good Distribution Practices (GDP) are particularly well-positioned to capitalize on this trend.

The Oil & Gas and Chemicals sector, while perhaps more cyclical, also represents a substantial component of the 3PL market. Handling hazardous materials requires specialized expertise, safety protocols, and dedicated infrastructure, areas where experienced 3PL providers play a critical role. The strategic importance of these industries to the Polish economy ensures a consistent demand for sophisticated logistics services.

Value-added Warehousing and Distribution services are increasingly sought after across all these end-user segments. Businesses are outsourcing not just storage but also services like kitting, assembly, packaging, labeling, and returns management to 3PLs. This allows them to focus on core competencies while leveraging the 3PL's expertise and infrastructure for optimized inventory management and order fulfillment. The growth in e-commerce, as a cross-cutting theme impacting various end-user industries, further elevates the importance of efficient warehousing and distribution networks.

- Dominant Service Segment: International Transportation Management, driven by Poland's strategic European location and trade flows.

- Primary End-User Driver: Manufacturing & Automotive, due to Poland's strong industrial base and complex supply chain needs.

- High-Growth End-User Segment: Pharma & Healthcare, due to strict handling requirements and increasing demand.

- Key Growth Factor in Warehousing: Value-added services like kitting, assembly, and returns management, supporting e-commerce and manufacturing efficiency.

- Infrastructure Influence: Continuous investment in road and rail networks enhances the efficiency of transportation management.

- Market Share & Growth Potential: Manufacturing & Automotive leads in market share, while Pharma & Healthcare shows the highest growth potential due to specialized needs.

Poland 3PL Industry Product Landscape

The Polish 3PL industry's product landscape is defined by a suite of integrated services designed to optimize supply chain efficiency and reduce costs for businesses. Core offerings include comprehensive Domestic Transportation Management, encompassing last-mile delivery, LTL/FTL services, and dedicated fleet management, all enhanced by real-time tracking and route optimization technologies. International Transportation Management is another cornerstone, leveraging multimodal solutions (road, rail, air, sea) to facilitate seamless cross-border movements, supported by expertise in customs clearance and international trade regulations. Value-added Warehousing and Distribution represents a significant innovation area, moving beyond simple storage to include services like inventory management, order picking and packing, kitting, assembly, returns processing, and customized packaging solutions, all powered by advanced Warehouse Management Systems (WMS). Performance metrics such as on-time delivery rates (typically exceeding 98%), order accuracy (often above 99%), and cost per unit handled are key indicators of service excellence and technological integration. Unique selling propositions often lie in specialized capabilities, such as temperature-controlled logistics for the Pharma & Healthcare sector or specialized handling for oversized or hazardous materials in Oil & Gas and Chemicals. Technological advancements are evident in the increasing adoption of automation within warehouses, predictive analytics for demand forecasting, and digital platforms offering end-to-end supply chain visibility.

Key Drivers, Barriers & Challenges in Poland 3PL Industry

Key Drivers: The Polish 3PL industry is primarily propelled by Poland's strategic geographical location within the EU, serving as a crucial logistics gateway. Economic growth and increasing foreign investment, particularly in manufacturing and e-commerce, are significant demand drivers. The continuous outsourcing trend by businesses seeking operational efficiency and cost reduction is a core catalyst. Furthermore, advancements in logistics technology, such as automation, AI, and digitalization, are enabling providers to offer more sophisticated and efficient services, driving market expansion.

Barriers & Challenges: Despite robust growth, the industry faces several hurdles. A primary challenge is the shortage of skilled labor, particularly qualified drivers and warehouse personnel, exacerbated by emigration and a competitive labor market. Rising operational costs, including fuel prices and labor wages, can impact profitability. Intense competition, especially from international players with substantial resources, puts pressure on smaller domestic providers. Regulatory complexities, including evolving environmental standards and cross-border transportation regulations, also present ongoing challenges. Supply chain disruptions, as witnessed in recent global events, necessitate increased resilience and flexibility, which can be costly to implement.

Emerging Opportunities in Poland 3PL Industry

Emerging opportunities in the Poland 3PL industry are largely centered around the burgeoning e-commerce sector, which demands specialized fulfillment solutions, including same-day and next-day delivery, and efficient returns management. The growing focus on sustainability is creating a demand for green logistics solutions, such as optimized routing, electric vehicles, and eco-friendly packaging. Furthermore, the continued development of advanced manufacturing in Poland, especially in sectors like automotive and electronics, presents opportunities for 3PLs to offer highly specialized, integrated logistics services. The digitalization trend is also opening doors for data analytics and supply chain visibility platforms as a service.

Growth Accelerators in the Poland 3PL Industry Industry

Growth in the Poland 3PL industry is significantly accelerated by ongoing infrastructure development, particularly in road and rail networks, enhancing connectivity and transit times. Strategic partnerships between 3PL providers and technology companies are crucial for the adoption of cutting-edge solutions like AI-driven route optimization and advanced warehouse automation. The increasing sophistication of Polish manufacturing, coupled with its integration into global value chains, necessitates and rewards sophisticated 3PL capabilities. Furthermore, government initiatives supporting logistics infrastructure and digital transformation within the sector provide a conducive environment for accelerated growth.

Key Players Shaping the Poland 3PL Industry Market

- Yusen Logistics

- Hellman Worldwide Logistics

- DSV Group

- CEVA Logistics

- Kuehne + Nagel

- Kerry Logistics

- Ekol - Logistics 4 0

- Erontrans Logistics Services

- Raben

- Geis Global Logistics

- Geodis

- Dartom

- DHL Supply Chain

- Feige Logistics

- ID Logistics

Notable Milestones in Poland 3PL Industry Sector

- 2019: Increased investment in warehouse automation and WMS systems by major 3PL players to enhance efficiency.

- 2020: Significant surge in e-commerce fulfillment demand due to the global pandemic, leading to expansion of last-mile delivery networks.

- 2021: Focus on supply chain resilience and diversification as companies sought to mitigate global disruption risks.

- 2022: Continued growth in cross-border logistics, driven by strong EU trade, with investments in intermodal transportation solutions.

- 2023: Expansion of value-added services, including customization and assembly, to meet evolving client needs.

- 2024: Increased adoption of sustainable logistics practices and investments in green transportation solutions.

In-Depth Poland 3PL Industry Market Outlook

The future outlook for the Poland 3PL industry is exceptionally bright, driven by a convergence of favorable economic, geopolitical, and technological factors. Poland's established position as a key logistics hub within the European Union will continue to attract significant international trade and investment, fueling demand for comprehensive logistics solutions. The ongoing digitalization of supply chains, coupled with advancements in automation and AI, will enable 3PL providers to offer increasingly sophisticated and cost-effective services, enhancing operational efficiency and customer satisfaction. The sustained growth of e-commerce, alongside the robust performance of manufacturing sectors like automotive and pharmaceuticals, will provide consistent demand for specialized logistics capabilities. Strategic opportunities lie in further developing green logistics initiatives and leveraging data analytics to provide predictive insights and optimize complex supply networks.

Poland 3PL Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Poland 3PL Industry Segmentation By Geography

- 1. Poland

Poland 3PL Industry Regional Market Share

Geographic Coverage of Poland 3PL Industry

Poland 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade

- 3.3. Market Restrains

- 3.3.1. Nature of Supply Chain Business

- 3.4. Market Trends

- 3.4.1. Boom in the Warehousing Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yusen Logistics**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellman Worldwide Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSV Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEVA Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ekol - Logistics 4 0

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Erontrans Logistics Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Raben

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Geis Global Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Geodis

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dartom

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DHL Supply Chain

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Feige Logistics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ID Logistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Yusen Logistics**List Not Exhaustive

List of Figures

- Figure 1: Poland 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland 3PL Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Poland 3PL Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Poland 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Poland 3PL Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 5: Poland 3PL Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Poland 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland 3PL Industry?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Poland 3PL Industry?

Key companies in the market include Yusen Logistics**List Not Exhaustive, Hellman Worldwide Logistics, DSV Group, CEVA Logistics, Kuehne + Nagel, Kerry Logistics, Ekol - Logistics 4 0, Erontrans Logistics Services, Raben, Geis Global Logistics, Geodis, Dartom, DHL Supply Chain, Feige Logistics, ID Logistics.

3. What are the main segments of the Poland 3PL Industry?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade.

6. What are the notable trends driving market growth?

Boom in the Warehousing Sector.

7. Are there any restraints impacting market growth?

Nature of Supply Chain Business.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland 3PL Industry?

To stay informed about further developments, trends, and reports in the Poland 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence