Key Insights

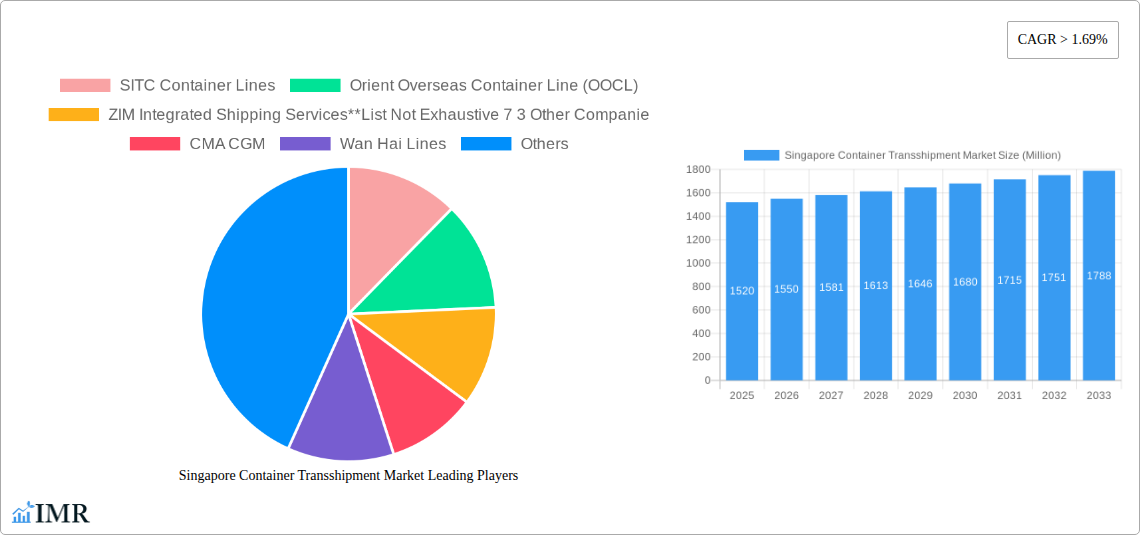

The Singapore container transshipment market, valued at $1.52 billion in 2025, is projected to experience robust growth, driven by the nation's strategic geographical location, well-developed port infrastructure, and its role as a crucial hub connecting major shipping lanes in Asia and beyond. A Compound Annual Growth Rate (CAGR) exceeding 1.69% forecasts a significant market expansion through 2033. This growth is fueled by the increasing global trade volume, particularly within the Asia-Pacific region, the rise of e-commerce and its associated demand for efficient logistics, and ongoing investments in port modernization and technological advancements such as automation and digitalization to enhance operational efficiency and reduce transit times. The market is segmented by container type (general and refrigerated) and end-user industries, including automotive, mining & minerals, agriculture, chemicals & petrochemicals, pharmaceuticals, food & beverages, and retail. Refrigerated containers, crucial for the transportation of perishable goods, are expected to witness particularly strong growth due to the increasing demand for fresh produce and temperature-sensitive pharmaceuticals globally. The competitive landscape comprises major global players like Maersk Line, Mediterranean Shipping Company (MSC), CMA CGM, and regional operators, fostering a dynamic market environment characterized by ongoing competition and strategic alliances. Potential constraints include geopolitical uncertainties, fluctuating fuel prices, and the ongoing challenges of maintaining port capacity to meet rising demand.

Singapore Container Transshipment Market Market Size (In Billion)

The dominance of established players highlights the need for smaller companies to differentiate themselves through specialized services, technological innovation, and strategic partnerships. The increasing adoption of sustainable practices within the shipping industry, driven by growing environmental concerns, presents both a challenge and an opportunity for market participants. Investing in green technologies and eco-friendly operations can offer a competitive advantage while aligning with global sustainability initiatives. Government policies aimed at promoting efficient logistics and sustainable port operations will continue to play a significant role in shaping the market's trajectory in the coming years. The Singapore container transshipment market's future outlook remains optimistic, promising substantial growth driven by sustained global trade and ongoing improvements in infrastructure and technology.

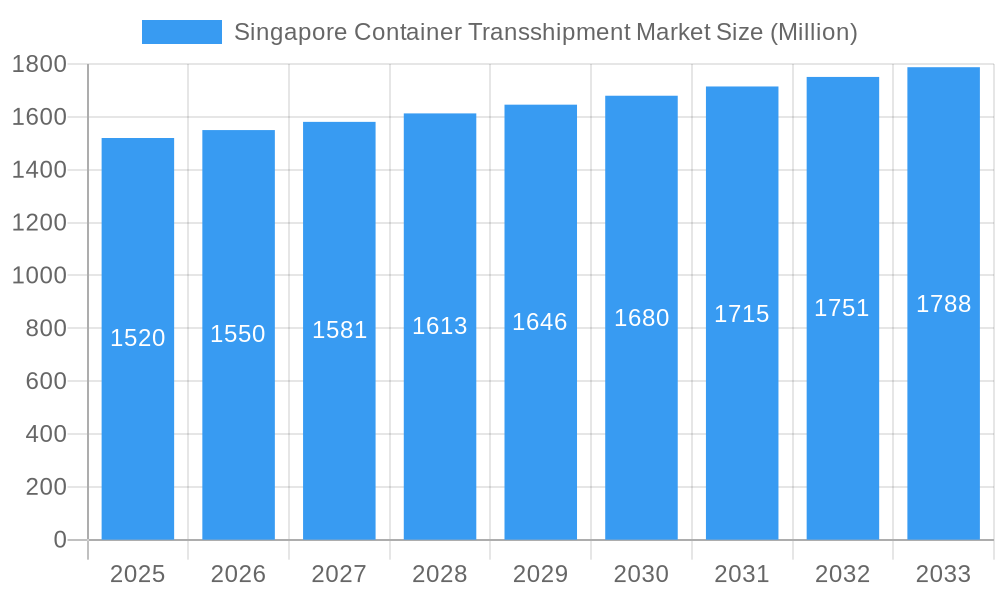

Singapore Container Transshipment Market Company Market Share

Singapore Container Transshipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Singapore container transshipment market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of global shipping and the child market of Singapore's transshipment hub, this report is essential for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes data from 2019-2024 (historical period) to forecast market trends from 2025-2033.

Singapore Container Transshipment Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Singapore container transshipment sector. The market is characterized by a high level of concentration, with major players like Maersk, MSC, and CMA CGM holding significant market share. The total market size in 2025 is estimated at XX Million units.

- Market Concentration: The top 10 players account for approximately 70% of the market share in 2025. This high concentration indicates a relatively oligopolistic market structure.

- Technological Innovation: Automation, digitalization (e.g., blockchain technology for improved tracking and transparency), and the Internet of Things (IoT) are key drivers of innovation, enhancing efficiency and reducing operational costs. However, high implementation costs present a barrier to entry for smaller companies.

- Regulatory Framework: The Maritime and Port Authority of Singapore (MPA) plays a crucial role in shaping the regulatory landscape, influencing operational standards and environmental regulations.

- Competitive Product Substitutes: While direct substitutes are limited, alternative transportation modes (e.g., air freight) present indirect competition, especially for time-sensitive goods.

- End-User Demographics: The market is driven by diverse end-users, including automotive, mining & minerals, agriculture, chemicals & petrochemicals, pharmaceuticals, food & beverages, retail, and other industries. The automotive and retail sectors are expected to show robust growth in the coming years.

- M&A Trends: The past five years have witnessed XX M&A deals in the Singapore container transshipment market, reflecting industry consolidation and expansion strategies. These deals primarily focused on enhancing logistical capabilities and expanding geographic reach.

Singapore Container Transshipment Market Growth Trends & Insights

The Singapore container transshipment market exhibits robust growth, driven by increasing global trade, the strategic location of the Port of Singapore, and continuous infrastructure improvements. The market size is projected to reach XX Million units by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). This growth is supported by rising e-commerce activities and the expanding Asian economies. Technological advancements and automation are expected to further boost efficiency and capacity, driving higher volumes. The adoption rate of new technologies, such as AI-powered predictive analytics for optimized vessel scheduling, is increasing steadily. Consumer behavior shifts towards faster delivery and greater transparency are impacting the demand for efficient transshipment services.

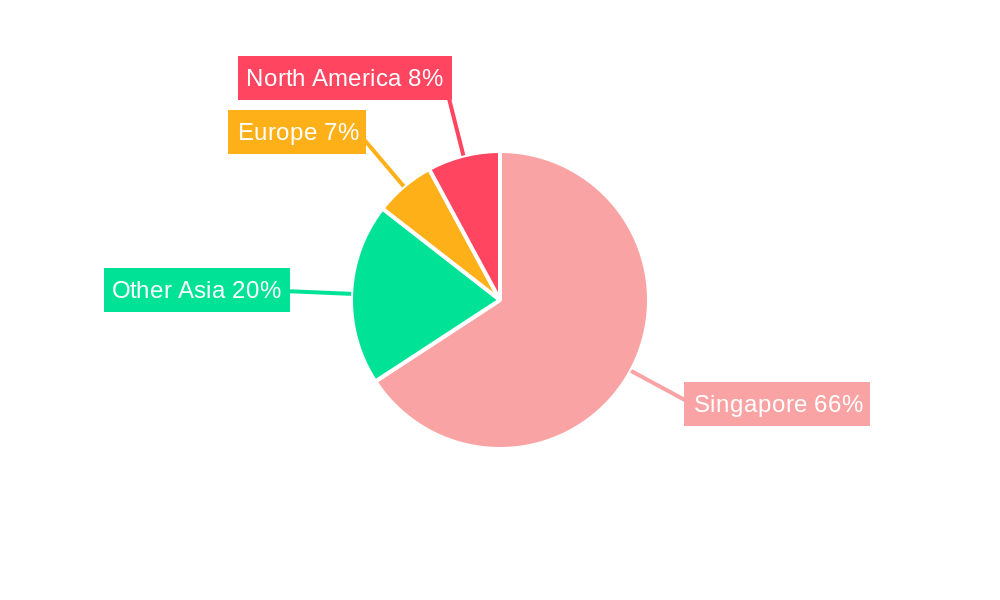

Dominant Regions, Countries, or Segments in Singapore Container Transshipment Market

The Port of Singapore dominates the market as the world's second busiest port in terms of container volume. Its strategic location, advanced infrastructure, and efficient operations contribute to its dominance. The general container segment holds the largest market share (XX%) followed by refrigerated containers (XX%). Within the end-user segments, automotive and retail are projected to demonstrate the highest growth rates.

- Key Drivers:

- Singapore's strategic geopolitical position.

- Government investment in port infrastructure and technology.

- Strong connectivity to global shipping routes.

- Efficient port operations and streamlined customs procedures.

- Dominance Factors:

- High throughput capacity of the Port of Singapore.

- Extensive network of shipping lines and global connectivity.

- Reliable and efficient logistics infrastructure.

- Pro-business environment and supportive government policies.

Singapore Container Transshipment Market Product Landscape

The market features various container types, including general-purpose containers, refrigerated containers (reefers), and specialized containers for specific goods. Innovations focus on enhancing container durability, security features (e.g., GPS tracking, tamper-proof seals), and improved handling efficiency. Technological advancements incorporate smart containers with real-time monitoring capabilities, optimizing inventory management and reducing losses from damage or theft. The development of reusable and sustainable containers is an emerging trend.

Key Drivers, Barriers & Challenges in Singapore Container Transshipment Market

Key Drivers:

- Increasing global trade volumes, particularly within Asia.

- Technological advancements, leading to higher efficiency and capacity.

- Government investment in port infrastructure and digitalization initiatives.

Challenges and Restraints:

- Geopolitical uncertainty and trade tensions can negatively impact container volumes.

- Rising labor costs and competition for skilled workforce.

- Environmental concerns and pressure for sustainable practices (emissions regulations).

Emerging Opportunities in Singapore Container Transshipment Market

- Growth of e-commerce: The surge in online shopping fuels demand for fast and efficient delivery solutions.

- Expansion into new markets: Singapore's strategic location enables expansion into Southeast Asian countries.

- Development of specialized logistics solutions: Meeting the specific needs of diverse industries like pharmaceuticals and perishables.

Growth Accelerators in the Singapore Container Transshipment Market Industry

The continuous modernization and expansion of the Port of Singapore, along with technological advancements and strategic partnerships with global players, will accelerate long-term market growth. Furthermore, initiatives focused on sustainability and environmental responsibility will attract environmentally conscious customers and investors.

Key Players Shaping the Singapore Container Transshipment Market Market

- SITC Container Lines

- Orient Overseas Container Line (OOCL)

- ZIM Integrated Shipping Services

- CMA CGM

- Wan Hai Lines

- NYK Line

- Hapag-Lloyd

- Pacific International Lines (PIL)

- Mediterranean Shipping Company (MSC)

- Maersk Line

- Evergreen Marine Corporation

Notable Milestones in Singapore Container Transshipment Market Sector

- February 2024: Maersk announced a USD 500 million investment to expand its Southeast Asian supply chain infrastructure, adding nearly 480,000 sqm of capacity by 2026. This significantly boosts its capacity and reinforces Singapore's role as a regional hub.

- February 2024: HERE Technologies partnered with PSA Singapore to revolutionize container truck operations, improving efficiency at the world's largest transshipment hub. This exemplifies the adoption of technology to enhance logistics within the sector.

In-Depth Singapore Container Transshipment Market Outlook

The Singapore container transshipment market is poised for continued growth, driven by its strategic location, robust infrastructure, and technological advancements. Strategic partnerships, further investments in automation and digitalization, and a focus on sustainability will unlock significant future market potential. The expansion of e-commerce and the increasing demand for efficient and reliable supply chains in Southeast Asia present substantial opportunities for growth and innovation.

Singapore Container Transshipment Market Segmentation

-

1. Container Type

- 1.1. General

- 1.2. Refrigerator

-

2. End-User

- 2.1. Automotive

- 2.2. Mining & Minerals

- 2.3. Agriculture

- 2.4. Chemicals & Petrochemicals

- 2.5. Pharmaceuticals

- 2.6. Food & Beverages

- 2.7. Retail

- 2.8. Other End Users

Singapore Container Transshipment Market Segmentation By Geography

- 1. Singapore

Singapore Container Transshipment Market Regional Market Share

Geographic Coverage of Singapore Container Transshipment Market

Singapore Container Transshipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce is Booming the Market; Increasing Intra-Regional Trade

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Competition From the Global Players

- 3.4. Market Trends

- 3.4.1. Increasing Trade Activities are Boosting the Market Growth in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Container Transshipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 5.1.1. General

- 5.1.2. Refrigerator

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Mining & Minerals

- 5.2.3. Agriculture

- 5.2.4. Chemicals & Petrochemicals

- 5.2.5. Pharmaceuticals

- 5.2.6. Food & Beverages

- 5.2.7. Retail

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SITC Container Lines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orient Overseas Container Line (OOCL)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wan Hai Lines

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NYK Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hapag-Lloyd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific International Lines (PIL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediterranean Shipping Company (MSC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Maersk Line

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Evergreen Marine Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SITC Container Lines

List of Figures

- Figure 1: Singapore Container Transshipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Container Transshipment Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2020 & 2033

- Table 2: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2020 & 2033

- Table 5: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Container Transshipment Market?

The projected CAGR is approximately > 1.69%.

2. Which companies are prominent players in the Singapore Container Transshipment Market?

Key companies in the market include SITC Container Lines, Orient Overseas Container Line (OOCL), ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie, CMA CGM, Wan Hai Lines, NYK Line, Hapag-Lloyd, Pacific International Lines (PIL), Mediterranean Shipping Company (MSC), Maersk Line, Evergreen Marine Corporation.

3. What are the main segments of the Singapore Container Transshipment Market?

The market segments include Container Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce is Booming the Market; Increasing Intra-Regional Trade.

6. What are the notable trends driving market growth?

Increasing Trade Activities are Boosting the Market Growth in the Country.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Competition From the Global Players.

8. Can you provide examples of recent developments in the market?

February 2024: A.P. Moller-Maersk (Maersk) announced more than USD 500 million in investment to expand its supply chain infrastructure to support Southeast Asia's emergence as a global production hub and a consumption powerhouse. Maersk’s planned three-year investment will target its Logistics & Services arm. Still, at the same time, a substantial amount of investment will also be channeled into its Ocean and Terminals infrastructure. By 2026, Maersk expects to add nearly 480,000 sqm capacity spread across Malaysia, Indonesia, Singapore, and the Philippines. With these investments, Maersk will be able to better serve customers with mega distribution centers that are strategically located, sustainable, and equipped with advanced automation to drive increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Container Transshipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Container Transshipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Container Transshipment Market?

To stay informed about further developments, trends, and reports in the Singapore Container Transshipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence