Key Insights

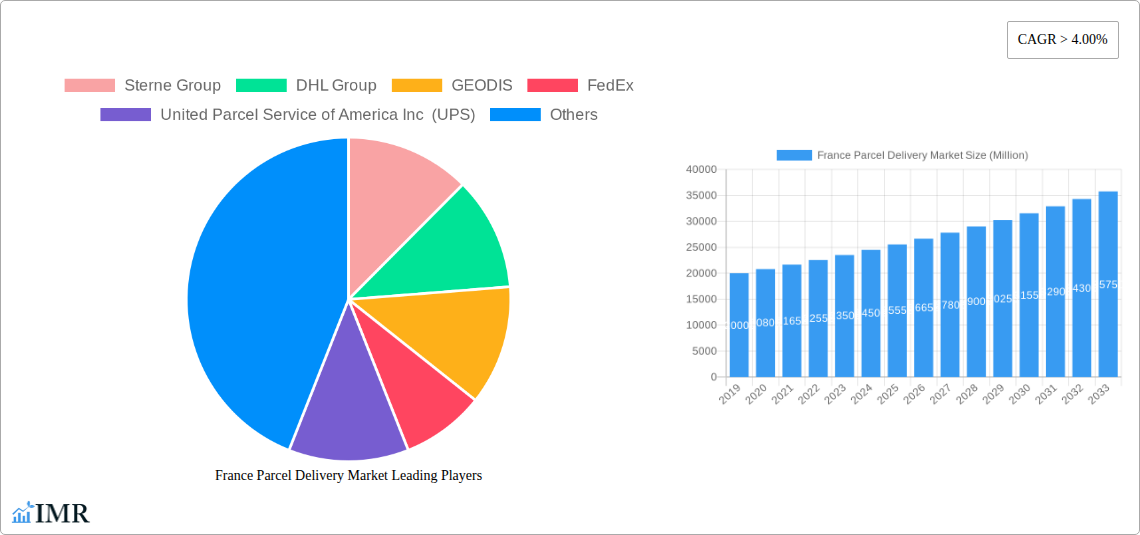

The France Parcel Delivery Market is projected to reach a size of $3.35 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033. This robust growth is primarily driven by the expanding e-commerce sector, which continues to fuel significant parcel volumes. The increasing adoption of online shopping, coupled with the demand for faster and more reliable delivery services, particularly express options, are key market enablers. Key market players include DHL Group, FedEx, UPS, La Poste Group, and GEODIS.

France Parcel Delivery Market Market Size (In Billion)

Market segmentation highlights the growing importance of international deliveries alongside domestic shipments. Express delivery services are experiencing accelerated demand. The market is segmented by Business-to-Business (B2B) and Business-to-Consumer (B2C), with B2C showing strong growth due to e-commerce. Road and air transport are the primary modes, with road dominant for domestic and air for international and expedited shipments. Key end-user industries include E-Commerce, Healthcare, Manufacturing, and Wholesale & Retail Trade (Offline).

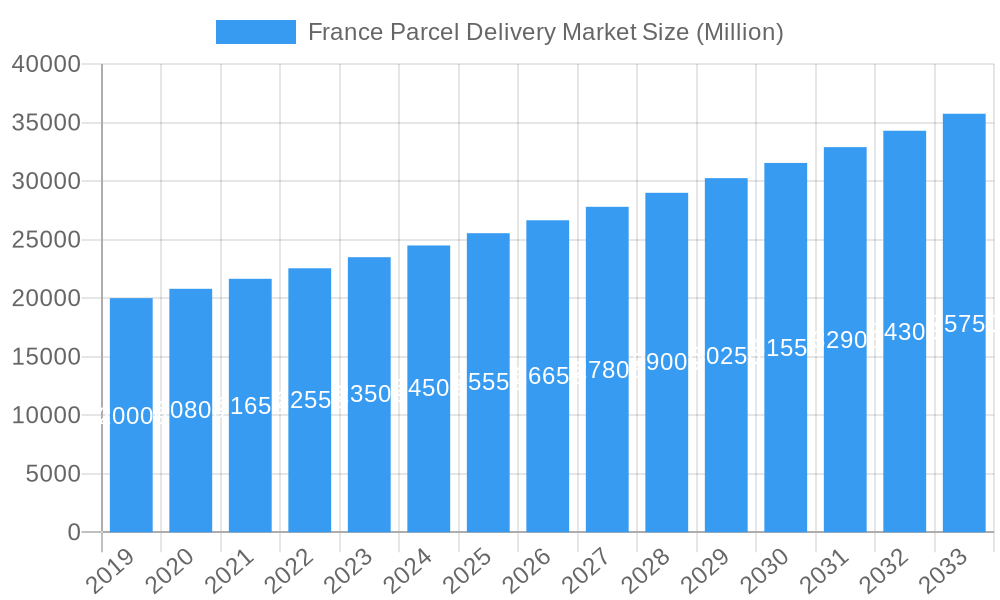

France Parcel Delivery Market Company Market Share

Gain comprehensive insights into the French parcel delivery market with our in-depth report, covering the historical period of 2019-2024 and a forecast from 2025-2033. This analysis provides strategic intelligence for industry leaders, logistics providers, e-commerce businesses, and investors, focusing on market structure, growth trends, dominant segments, and the competitive landscape, optimized with relevant SEO keywords.

France Parcel Delivery Market Market Dynamics & Structure

The France parcel delivery market is characterized by a highly fragmented yet competitive structure, with a blend of global logistics giants and established domestic players vying for market share. Technological innovation is a significant driver, pushing for faster delivery times, enhanced tracking capabilities, and sustainable logistics solutions. Regulatory frameworks, particularly concerning environmental impact and labor laws, play a crucial role in shaping operational strategies. The market faces intense competition from substitute services, including local courier networks and the evolving landscape of click-and-collect options. End-user demographics, heavily influenced by the booming e-commerce sector and shifting consumer expectations for convenience and speed, are dictating service offerings. Mergers and acquisitions (M&A) are a constant feature, as larger entities seek to consolidate their position, expand service portfolios, and achieve economies of scale. For instance, the market saw approximately 15 significant M&A activities in the past five years, with an average deal value of USD 50 million, indicating strategic consolidation. Barriers to innovation include the high capital expenditure required for technological upgrades and the complex urban logistics challenges in densely populated areas.

- Market Concentration: A moderate concentration with leading players holding significant but not dominant market shares.

- Technological Innovation Drivers: AI for route optimization, IoT for real-time tracking, automation in sorting facilities, and green logistics solutions.

- Regulatory Frameworks: EU e-commerce regulations, environmental protection policies, and postal service liberalization.

- Competitive Product Substitutes: Localized delivery services, locker networks, peer-to-peer delivery platforms.

- End-User Demographics: Growing demand from e-commerce consumers, an aging population requiring specialized delivery, and a focus on sustainable choices.

- M&A Trends: Consolidation for market expansion, acquisition of specialized tech companies, and integration of last-mile delivery networks.

France Parcel Delivery Market Growth Trends & Insights

The France parcel delivery market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. This expansion is significantly fueled by the escalating adoption rates of online shopping, with e-commerce penetration reaching an estimated 85% of the French population by 2025. Technological disruptions, such as the integration of AI for predictive logistics and the burgeoning use of autonomous delivery vehicles in pilot programs, are revolutionizing operational efficiency and customer experience. Consumer behavior shifts are prominently observed, with a strong demand for same-day delivery, personalized delivery windows, and eco-friendly shipping options. The market size, estimated at USD 25,000 million in the base year of 2025, is projected to reach USD 42,000 million by 2033. This growth trajectory is underpinned by increasing cross-border e-commerce activities and a sustained demand for B2C parcel services. The ongoing digital transformation across various industries, from healthcare to manufacturing, also contributes to a steady stream of parcel volumes, creating a multifaceted growth environment. The increasing preference for hyper-local delivery services, driven by urban density and environmental consciousness, presents a key area of market penetration. Moreover, the rise of the gig economy is influencing the logistics sector, offering flexible workforce solutions for last-mile delivery. The integration of blockchain technology for enhanced supply chain transparency and security is another emerging trend shaping market dynamics, offering greater trust and accountability for both businesses and consumers.

Dominant Regions, Countries, or Segments in France Parcel Delivery Market

Within the France parcel delivery market, the Domestic segment stands out as the dominant force, accounting for an estimated 70% of the total parcel volume. This is primarily driven by the mature e-commerce ecosystem within France and the widespread consumer reliance on local online retailers. The E-Commerce end-user industry is the most significant contributor, representing approximately 45% of all parcel deliveries. This dominance is fueled by a consistent increase in online purchases across all product categories, from fashion and electronics to groceries and pharmaceuticals.

The B2C (Business-to-Consumer) model accounts for the largest share, estimated at 65%, reflecting the direct impact of online retail on consumer purchasing habits. Light Weight Shipments, typically under 5 kg, form the bulk of parcel volumes due to their prevalence in e-commerce transactions. The Road mode of transport remains the backbone of parcel delivery, especially for domestic and intra-European routes, facilitating an estimated 88% of all deliveries. Non-Express speed of delivery options, while still substantial, are seeing increased competition from express services as consumer expectations for speed grow.

- Dominant Destination: Domestic, driven by robust internal e-commerce and consumer demand.

- Leading End-User Industry: E-Commerce, experiencing sustained double-digit growth.

- Primary Delivery Model: Business-to-Consumer (B2C), directly linked to online retail expansion.

- Prevalent Shipment Weight: Light Weight Shipments, characteristic of e-commerce goods.

- Key Mode of Transport: Road, offering flexibility and cost-effectiveness for extensive networks.

- Growing Segment: International parcel delivery, fueled by cross-border e-commerce growth and globalized supply chains.

- Emerging Trend: Increased demand for Express delivery options, pushing logistics providers to optimize their networks.

France Parcel Delivery Market Product Landscape

The product landscape in the France parcel delivery market is increasingly defined by innovative solutions focused on speed, transparency, and sustainability. Companies are investing in advanced tracking systems powered by IoT and AI, offering real-time visibility from origin to destination. Unique selling propositions include carbon-neutral delivery options, utilizing electric vehicles and optimized routing to minimize environmental impact. Performance metrics are being redefined by precise delivery windows, predictive arrival times, and enhanced parcel security. Technological advancements are leading to the development of specialized delivery services for temperature-sensitive goods, high-value items, and bulky products, catering to niche market demands and expanding the overall service offering.

Key Drivers, Barriers & Challenges in France Parcel Delivery Market

Key Drivers:

The France parcel delivery market is propelled by several key drivers. The relentless growth of e-commerce, with its expanding product categories and increasing consumer adoption, is the primary engine. Technological advancements, including AI-powered route optimization, IoT for real-time tracking, and automation in sorting facilities, enhance efficiency and customer satisfaction. Favorable economic policies supporting trade and business growth, coupled with a strong consumer propensity to spend online, further fuel demand. The increasing adoption of sustainable logistics solutions by both businesses and consumers is also becoming a significant differentiator.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces significant barriers and challenges. Intense competition leads to price wars and margin pressures, particularly for last-mile delivery. Rising operational costs, including fuel prices, labor expenses, and infrastructure investments, pose a continuous challenge. Regulatory hurdles, such as stringent environmental regulations and evolving labor laws, require constant adaptation and investment. Supply chain disruptions, exacerbated by global events and unforeseen circumstances, can impact delivery timelines and reliability. Furthermore, urban congestion and infrastructure limitations in densely populated areas present complex logistical challenges for efficient last-mile delivery.

Emerging Opportunities in France Parcel Delivery Market

Emerging opportunities in the France parcel delivery market lie in several key areas. The growing demand for sustainable and green logistics presents a significant avenue for differentiation, with companies investing in electric fleets and eco-friendly packaging. The expansion of cross-border e-commerce, particularly within the EU, offers substantial growth potential for international parcel services. Hyper-local delivery solutions, leveraging micro-fulfillment centers and drone technology in urban areas, cater to the increasing consumer preference for rapid delivery. The healthcare sector's digitalization, leading to an increase in pharmaceutical and medical equipment deliveries, opens up new specialized markets. Finally, the integration of advanced technologies like AI and blockchain for enhanced predictive analytics, route optimization, and supply chain transparency offers significant opportunities for service innovation and efficiency gains.

Growth Accelerators in the France Parcel Delivery Market Industry

Several growth accelerators are shaping the long-term trajectory of the France parcel delivery market. Technological breakthroughs, particularly in automation and AI, are enabling greater efficiency and cost reduction in operations, directly translating to improved service quality and competitive pricing. Strategic partnerships and collaborations between logistics providers, e-commerce platforms, and technology firms are crucial for expanding reach, optimizing networks, and co-developing innovative solutions. The increasing focus on market expansion strategies, including penetration into underserved regions and the development of specialized delivery services for niche industries, further fuels growth. The ongoing evolution of consumer expectations, demanding faster, more flexible, and sustainable delivery options, acts as a constant catalyst for innovation and service improvement across the entire industry.

Key Players Shaping the France Parcel Delivery Market Market

- Sterne Group

- DHL Group

- GEODIS

- FedEx

- United Parcel Service of America Inc (UPS)

- International Distributions Services (including GLS)

- La Poste Group

- Integer pl Capital Group

- Walden Group

- Logista

Notable Milestones in France Parcel Delivery Market Sector

- April 2023: GEODIS announced the expansion of its direct-to-customer cross-border delivery service offering, opening two new airport gateway facilities in the United States, Italy, and other European nations.

- April 2023: Transports DEVOLUY joined the GEODIS group, enhancing distribution and express services, particularly strengthening 12/24- and 24/48-hour distribution capacity in the Hautes-Alpes region.

- April 2023: STERNE Time Critical China opened a new office near SHA airport/railway station in China, aiming to provide NFO/Consol flight/OBC services to customers in China.

In-Depth France Parcel Delivery Market Market Outlook

The future outlook for the France parcel delivery market is exceptionally promising, driven by sustained growth accelerators. Continued investment in technological innovation, particularly in AI for predictive analytics and automation for operational efficiency, will be pivotal. Strategic alliances and market expansion into emerging sectors like healthcare and cross-border e-commerce will unlock significant potential. The increasing consumer demand for eco-friendly and rapid delivery options will continue to push the boundaries of service development. Overall, the market is set to experience dynamic evolution, offering substantial opportunities for stakeholders poised to adapt to these transformative trends and capitalize on the expanding digital economy.

France Parcel Delivery Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

France Parcel Delivery Market Segmentation By Geography

- 1. France

France Parcel Delivery Market Regional Market Share

Geographic Coverage of France Parcel Delivery Market

France Parcel Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Parcel Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. France

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sterne Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GEODIS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Parcel Service of America Inc (UPS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Distributions Services (including GLS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 La Poste Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Integer pl Capital Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Walden Grou

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logista

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sterne Group

List of Figures

- Figure 1: France Parcel Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Parcel Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: France Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: France Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: France Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: France Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: France Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: France Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: France Parcel Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: France Parcel Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: France Parcel Delivery Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: France Parcel Delivery Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: France Parcel Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: France Parcel Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: France Parcel Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: France Parcel Delivery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Parcel Delivery Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the France Parcel Delivery Market?

Key companies in the market include Sterne Group, DHL Group, GEODIS, FedEx, United Parcel Service of America Inc (UPS), International Distributions Services (including GLS), La Poste Group, Integer pl Capital Group, Walden Grou, Logista.

3. What are the main segments of the France Parcel Delivery Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

April 2023: GEODIS announced it expanded its direct-to-customer cross-border delivery service offering by opening two new airport gateway facilities in the United States, Italy, and other European nations.April 2023: Transports DEVOLUY joined the GEODIS group to provide distribution and express services. This new asset may strengthen its 12/24- and 24/48-hour distribution capacity in the Hautes-Alpes.April 2023: STERNE Time Critical China opened a new office in China near SHA airport/railway station to offer NFO/Consol flight/OBC service to customers in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Parcel Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Parcel Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Parcel Delivery Market?

To stay informed about further developments, trends, and reports in the France Parcel Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence