Key Insights

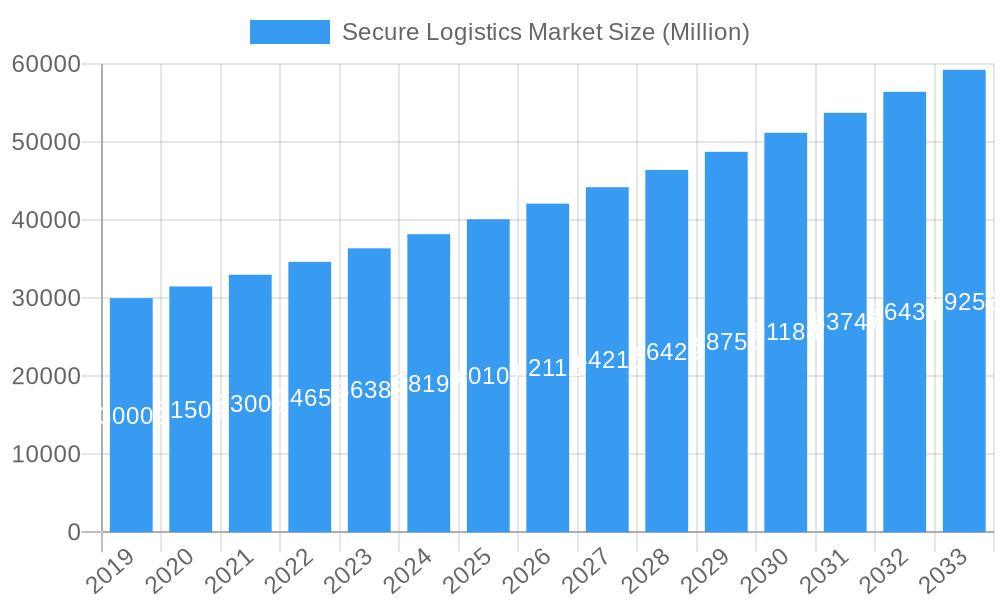

The global Secure Logistics Market is poised for robust expansion, projected to surpass \$50 billion in valuation by 2033, driven by a Compound Annual Growth Rate (CAGR) exceeding 7.00%. This significant growth is underpinned by escalating concerns surrounding the safety and integrity of high-value asset transportation, including cash, precious metals, diamonds, and manufactured goods. The increasing sophistication of organized crime and the sheer volume of global trade necessitate advanced security solutions, making secure logistics a critical component of various industries. Key drivers include the burgeoning e-commerce sector, which demands secure last-mile delivery, and the continuous innovation in tracking, monitoring, and armored transportation technologies. Furthermore, regulatory compliance and the growing emphasis on risk mitigation by financial institutions and jewelry businesses are fueling market adoption. The market's trajectory indicates a substantial increase in demand for both static and mobile security solutions, with a particular emphasis on integrated technologies that offer real-time visibility and threat detection.

Secure Logistics Market Market Size (In Billion)

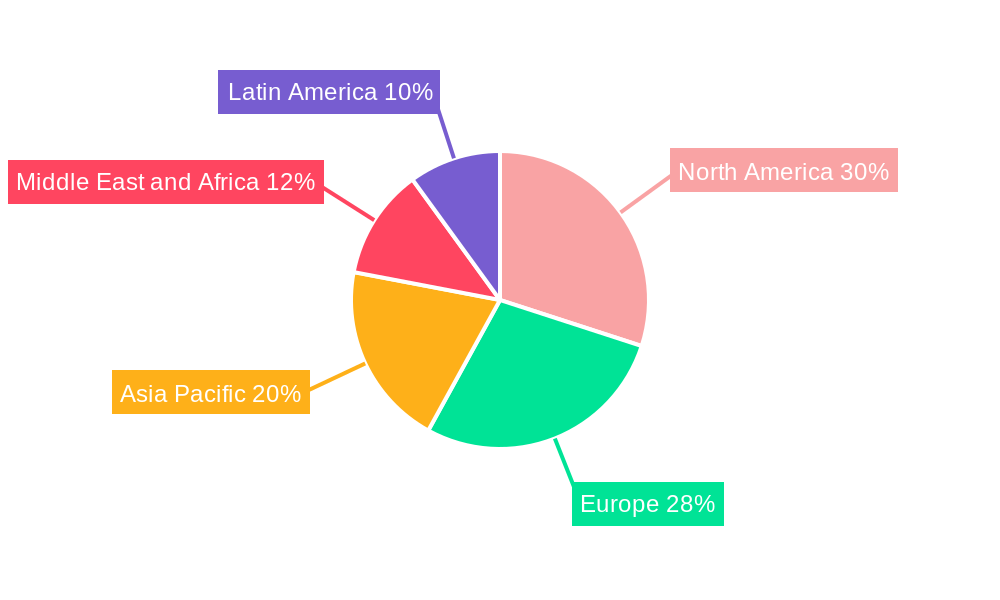

The market landscape is characterized by a strong demand for secure cash management, reflecting the ongoing need for ATM replenishment and cash-in-transit services, even in an increasingly digital world. The jewelry and precious metal segment also represents a substantial share, driven by the high value and inherent risk associated with these commodities. Manufacturing industries are increasingly leveraging secure logistics to protect sensitive components and finished products during transit. Geographically, North America and Europe currently dominate the market, owing to well-established infrastructure and stringent security regulations. However, the Asia Pacific region is anticipated to witness the fastest growth, fueled by rapid economic development, increasing urbanization, and a rising middle class with growing disposable income, all contributing to a surge in demand for secure transportation of goods. The competitive environment features established players like Prosegur and Brink's Incorporated, alongside emerging companies focusing on technological innovation and specialized services, indicating a dynamic and evolving market.

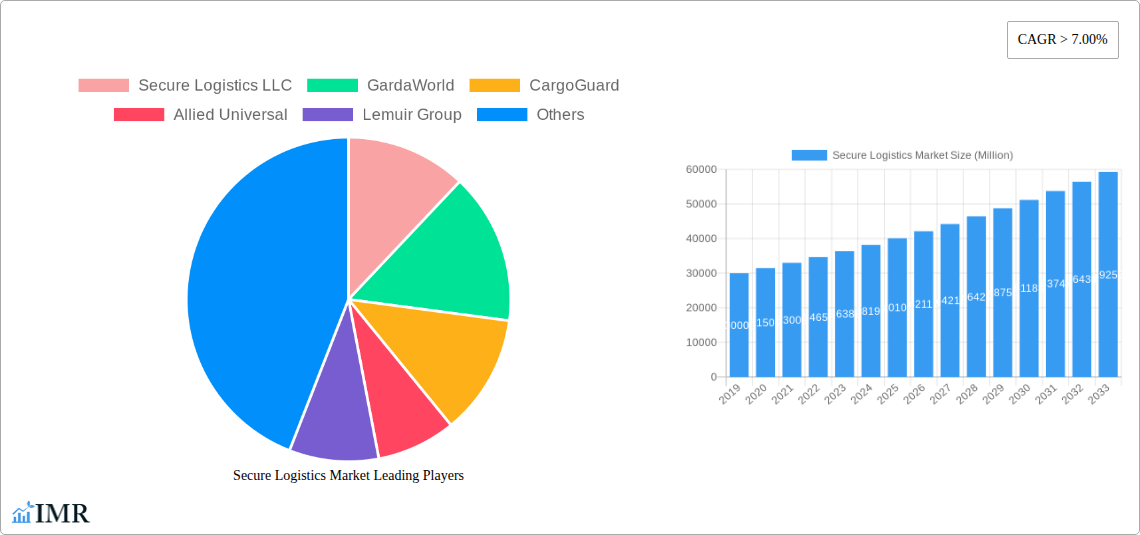

Secure Logistics Market Company Market Share

Secure Logistics Market Report: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a detailed analysis of the global Secure Logistics Market, exploring its current dynamics, growth trajectories, and future potential. We delve into crucial segments, including Cash Management Logistics, Diamonds and Precious Metals Transportation, and High-Value Manufacturing Security. The report covers Static and Mobile secure logistics solutions, and analyzes the impact of various Modes of Transport, including Roadways, Railways, and Airways. With a comprehensive Study Period from 2019 to 2033, including a Base Year of 2025 and a Forecast Period of 2025–2033, this report offers actionable insights for stakeholders seeking to navigate and capitalize on this evolving industry. The Historical Period (2019–2024) provides a robust foundation for understanding market evolution.

Secure Logistics Market Market Dynamics & Structure

The Secure Logistics Market is characterized by a moderate to high degree of market concentration, driven by the capital-intensive nature of operations and the stringent regulatory compliance required. Key players like GardaWorld, Prosegur, and Brink's Incorporated hold significant market shares, contributing to a consolidated landscape. Technological innovation is a pivotal driver, with advancements in GPS tracking, real-time monitoring systems, and AI-powered analytics enhancing efficiency and security. Regulatory frameworks, including those governing the transportation of hazardous materials and high-value goods, play a crucial role in shaping operational standards and market entry barriers. Competitive product substitutes are relatively limited, given the specialized nature of secure logistics, but advancements in digital payment solutions and reduced reliance on physical cash in some sectors represent indirect substitutes. End-user demographics are diverse, ranging from financial institutions and retail chains to manufacturing plants and high-net-worth individuals. Mergers and acquisitions (M&A) are prevalent, aimed at expanding service portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by a few key global players.

- Technological Innovation Drivers: Real-time tracking, AI analytics, IoT integration, advanced surveillance.

- Regulatory Frameworks: Compliance with international and national security and transportation laws is paramount.

- Competitive Product Substitutes: Limited direct substitutes, but shifts in payment methods and digitalization pose indirect challenges.

- End-User Demographics: Financial institutions, retail, manufacturing, mining, government, and private security sectors.

- M&A Trends: Consolidation for economies of scale, service diversification, and enhanced technology adoption.

Secure Logistics Market Growth Trends & Insights

The Secure Logistics Market is poised for robust growth, driven by an increasing global demand for the safe and efficient transportation of high-value assets and sensitive materials. The market size evolution is directly correlated with the expansion of global trade, the proliferation of e-commerce requiring secure last-mile delivery, and the heightened awareness of security risks. Adoption rates for advanced tracking and monitoring technologies are steadily increasing, as businesses recognize their importance in preventing loss and ensuring compliance. Technological disruptions, such as the integration of AI for predictive analytics and route optimization, are transforming operational efficiency. Consumer behavior shifts towards valuing enhanced security and reliability in logistics services are further fueling market demand. The CAGR of the secure logistics market is projected to be strong, reflecting these positive trends. Market penetration is deepening across various sectors, especially in emerging economies as their economic development necessitates more sophisticated security solutions. The increasing complexity of global supply chains also amplifies the need for specialized secure logistics providers.

Dominant Regions, Countries, or Segments in Secure Logistics Market

The Secure Logistics Market is experiencing dominant growth in North America and Europe, attributed to their well-established financial sectors, robust manufacturing industries, and stringent regulatory environments that mandate high security standards. Within these regions, the Cash Management application segment consistently drives significant market share, owing to the ongoing need for secure cash transportation and ATM servicing. Roadways remain the predominant mode of transport due to its flexibility and reach for last-mile deliveries, particularly in urban and suburban areas. The Mobile type of secure logistics solutions, encompassing armored vehicles and secure transport units, is crucial for the continuous movement of assets. Key drivers include strong economic policies supporting trade and finance, advanced infrastructure that facilitates efficient movement, and a high density of financial institutions and high-value retail operations. Emerging economies in Asia-Pacific are also witnessing rapid growth, fueled by increasing e-commerce penetration and a growing middle class demanding secure delivery of goods, including jewelry and precious metals.

- Leading Segment (Application): Cash Management, driven by financial sector needs.

- Dominant Mode of Transport: Roadways, offering extensive reach and flexibility.

- Key Type: Mobile solutions, essential for the continuous flow of assets.

- Dominant Regions: North America and Europe due to mature economies and strict regulations.

- Growth Potential in Emerging Markets: Asia-Pacific showing significant expansion due to e-commerce and economic development.

Secure Logistics Market Product Landscape

The Secure Logistics Market product landscape is characterized by innovative solutions focused on enhanced security, real-time visibility, and operational efficiency. Advanced armored vehicles equipped with GPS tracking, tamper-evident seals, and reinforced construction are standard. The integration of IoT devices for remote monitoring of temperature, humidity, and shock for sensitive cargo is gaining traction. Sophisticated software platforms offering end-to-end tracking, risk assessment, and predictive analytics are key differentiators. Performance metrics revolve around minimizing transit times, reducing the risk of theft and damage, and ensuring compliance with regulatory standards. Unique selling propositions often lie in specialized services like secure vault storage, escort services, and secure disposal of sensitive materials. Technological advancements are continuously improving the payload capacity and security features of transport units.

Key Drivers, Barriers & Challenges in Secure Logistics Market

The Secure Logistics Market is propelled by several key drivers, including the escalating global threat landscape, increasing value of goods in transit, and growing demand for specialized, high-security transportation solutions. Technological advancements in tracking and surveillance, coupled with strict regulatory mandates for safeguarding high-value assets, further accelerate market growth. The expansion of e-commerce and the need for secure last-mile delivery are also significant catalysts.

However, the market faces substantial barriers and challenges. High initial investment costs for specialized equipment and infrastructure, coupled with stringent regulatory compliance, can be deterrents. Global supply chain disruptions, geopolitical instability, and evolving cyber threats pose significant operational risks. Intense competition among service providers can lead to price pressures, impacting profitability. Labor shortages for skilled security personnel and drivers are also a growing concern.

Emerging Opportunities in Secure Logistics Market

Emerging opportunities in the Secure Logistics Market lie in the expansion of services for niche markets, such as pharmaceuticals, rare earth metals, and cybersecurity hardware. The growing demand for end-to-end secure supply chain solutions, encompassing warehousing, transportation, and disposal, presents a significant avenue for growth. The development of AI-powered predictive risk assessment tools and blockchain-based secure transaction records offers innovative applications. Furthermore, the increasing adoption of sustainable and eco-friendly secure logistics practices can attract environmentally conscious clients. Untapped markets in developing regions, as their economies mature and the volume of high-value goods increases, also represent considerable potential.

Growth Accelerators in the Secure Logistics Market Industry

Several catalysts are accelerating long-term growth in the Secure Logistics Market Industry. The continuous evolution of sophisticated security technologies, including advanced surveillance systems, biometric access controls, and real-time threat detection, will enhance service offerings. Strategic partnerships between technology providers and logistics firms are driving innovation and expanding service capabilities. The increasing trend towards outsourcing secure logistics operations by businesses seeking to focus on their core competencies is a significant growth accelerator. Furthermore, the expansion of global trade and the increasing complexity of supply chains necessitate more robust and secure transportation solutions, creating sustained demand.

Key Players Shaping the Secure Logistics Market Market

- Secure Logistics LLC

- GardaWorld

- CargoGuard

- Allied Universal

- Lemuir Group

- Prosegur

- Brink's Incorporated

- PlanITROI Inc

- CMS Info Systems

- Securitas AB

- 7 3 Other Companies

Notable Milestones in Secure Logistics Market Sector

- July 2023: Artificial Intelligence Technology Solutions Inc. and its wholly owned subsidiary, Robotic Assistance Devices Inc. (RAD), established a partnership to deliver RAD products to GardaWorld Security Systems customers in Canada. This collaboration aims to integrate advanced robotic security solutions into GardaWorld's existing service offerings, enhancing their technological capabilities.

- June 2023: Prosegur Cash and Linfox Armaguard, a financial logistics firm in Australia, planned a merger of Prosegur Australia. This strategic move is designed to create a more financially viable and consolidated provider of CIT services for Australian customers by pooling their cash management and ATM capabilities.

In-Depth Secure Logistics Market Market Outlook

The Secure Logistics Market is projected to witness sustained growth driven by a confluence of factors including increasing globalization of trade, a heightened focus on asset security, and continuous technological advancements. The adoption of AI and IoT in logistics will create more intelligent and responsive supply chains, minimizing risks and optimizing routes. Strategic partnerships and collaborations will continue to expand service portfolios and geographical reach. The growing demand for specialized logistics for high-value, sensitive goods across various industries will fuel market expansion. Furthermore, the development of more sustainable and efficient secure logistics solutions will cater to evolving client preferences and regulatory demands, positioning the market for significant future potential.

Secure Logistics Market Segmentation

-

1. Application

- 1.1. Cash Management

- 1.2. Diamonds

- 1.3. Jewelry and Precious Metal

- 1.4. Manufacturing

- 1.5. Others

-

2. Type

- 2.1. Static

- 2.2. Mobile

-

3. Mode of Transport

- 3.1. Roadways

- 3.2. Railways

- 3.3. Airways

- 3.4. Others

Secure Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Thailand

- 3.8. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Qatar

- 4.3. United Arab Emirates

- 4.4. Egypt

- 4.5. Rest of Middle East and Africa

-

5. Latin Maerica

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of Latin America

Secure Logistics Market Regional Market Share

Geographic Coverage of Secure Logistics Market

Secure Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1 During the Forecast Period

- 3.4.2 the Asia-Pacific Market is Expected to Grow at the Fastest Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Secure Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cash Management

- 5.1.2. Diamonds

- 5.1.3. Jewelry and Precious Metal

- 5.1.4. Manufacturing

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Static

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.3.1. Roadways

- 5.3.2. Railways

- 5.3.3. Airways

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Latin Maerica

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Secure Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cash Management

- 6.1.2. Diamonds

- 6.1.3. Jewelry and Precious Metal

- 6.1.4. Manufacturing

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Static

- 6.2.2. Mobile

- 6.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.3.1. Roadways

- 6.3.2. Railways

- 6.3.3. Airways

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Secure Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cash Management

- 7.1.2. Diamonds

- 7.1.3. Jewelry and Precious Metal

- 7.1.4. Manufacturing

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Static

- 7.2.2. Mobile

- 7.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.3.1. Roadways

- 7.3.2. Railways

- 7.3.3. Airways

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Secure Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cash Management

- 8.1.2. Diamonds

- 8.1.3. Jewelry and Precious Metal

- 8.1.4. Manufacturing

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Static

- 8.2.2. Mobile

- 8.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.3.1. Roadways

- 8.3.2. Railways

- 8.3.3. Airways

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Secure Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cash Management

- 9.1.2. Diamonds

- 9.1.3. Jewelry and Precious Metal

- 9.1.4. Manufacturing

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Static

- 9.2.2. Mobile

- 9.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.3.1. Roadways

- 9.3.2. Railways

- 9.3.3. Airways

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin Maerica Secure Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cash Management

- 10.1.2. Diamonds

- 10.1.3. Jewelry and Precious Metal

- 10.1.4. Manufacturing

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Static

- 10.2.2. Mobile

- 10.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.3.1. Roadways

- 10.3.2. Railways

- 10.3.3. Airways

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Secure Logistics LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GardaWorld

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CargoGuard

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allied Universal

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lemuir Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prosegur

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brink's incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PlanITROI Inc **List Not Exhaustive 7 3 Other Companie

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CMS Info Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Securitas AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Secure Logistics LLC

List of Figures

- Figure 1: Global Secure Logistics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Secure Logistics Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Secure Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Secure Logistics Market Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Secure Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Secure Logistics Market Revenue (undefined), by Mode of Transport 2025 & 2033

- Figure 7: North America Secure Logistics Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 8: North America Secure Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Secure Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Secure Logistics Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Secure Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Secure Logistics Market Revenue (undefined), by Type 2025 & 2033

- Figure 13: Europe Secure Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Secure Logistics Market Revenue (undefined), by Mode of Transport 2025 & 2033

- Figure 15: Europe Secure Logistics Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 16: Europe Secure Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Secure Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Secure Logistics Market Revenue (undefined), by Application 2025 & 2033

- Figure 19: Asia Pacific Secure Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Secure Logistics Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Asia Pacific Secure Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Secure Logistics Market Revenue (undefined), by Mode of Transport 2025 & 2033

- Figure 23: Asia Pacific Secure Logistics Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 24: Asia Pacific Secure Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Secure Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Secure Logistics Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Secure Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Secure Logistics Market Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East and Africa Secure Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Secure Logistics Market Revenue (undefined), by Mode of Transport 2025 & 2033

- Figure 31: Middle East and Africa Secure Logistics Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 32: Middle East and Africa Secure Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Secure Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin Maerica Secure Logistics Market Revenue (undefined), by Application 2025 & 2033

- Figure 35: Latin Maerica Secure Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Latin Maerica Secure Logistics Market Revenue (undefined), by Type 2025 & 2033

- Figure 37: Latin Maerica Secure Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin Maerica Secure Logistics Market Revenue (undefined), by Mode of Transport 2025 & 2033

- Figure 39: Latin Maerica Secure Logistics Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 40: Latin Maerica Secure Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Latin Maerica Secure Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Secure Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Secure Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Secure Logistics Market Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 4: Global Secure Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Secure Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Secure Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Secure Logistics Market Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 8: Global Secure Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Secure Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Secure Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Secure Logistics Market Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 15: Global Secure Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Italy Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Secure Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Secure Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 24: Global Secure Logistics Market Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 25: Global Secure Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: India Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Japan Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Singapore Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Thailand Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Secure Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Secure Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Secure Logistics Market Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 37: Global Secure Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Qatar Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: United Arab Emirates Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Egypt Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Global Secure Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Global Secure Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 45: Global Secure Logistics Market Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 46: Global Secure Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 47: Brazil Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Argentina Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Rest of Latin America Secure Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Secure Logistics Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Secure Logistics Market?

Key companies in the market include Secure Logistics LLC, GardaWorld, CargoGuard, Allied Universal, Lemuir Group, Prosegur, Brink's incorporated, PlanITROI Inc **List Not Exhaustive 7 3 Other Companie, CMS Info Systems, Securitas AB.

3. What are the main segments of the Secure Logistics Market?

The market segments include Application, Type, Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

During the Forecast Period. the Asia-Pacific Market is Expected to Grow at the Fastest Pace.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

July 2023: Artificial Intelligence Technology Solutions Inc. and its wholly owned subsidiary, Robotic Assistance Devices Inc. (RAD), established a partnership to deliver RAD products to GardaWorld Security Systems customers in Canada. GardaWorld Security Systems' commitment to providing cutting-edge technology is reflected in this new partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Secure Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Secure Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Secure Logistics Market?

To stay informed about further developments, trends, and reports in the Secure Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence