Key Insights

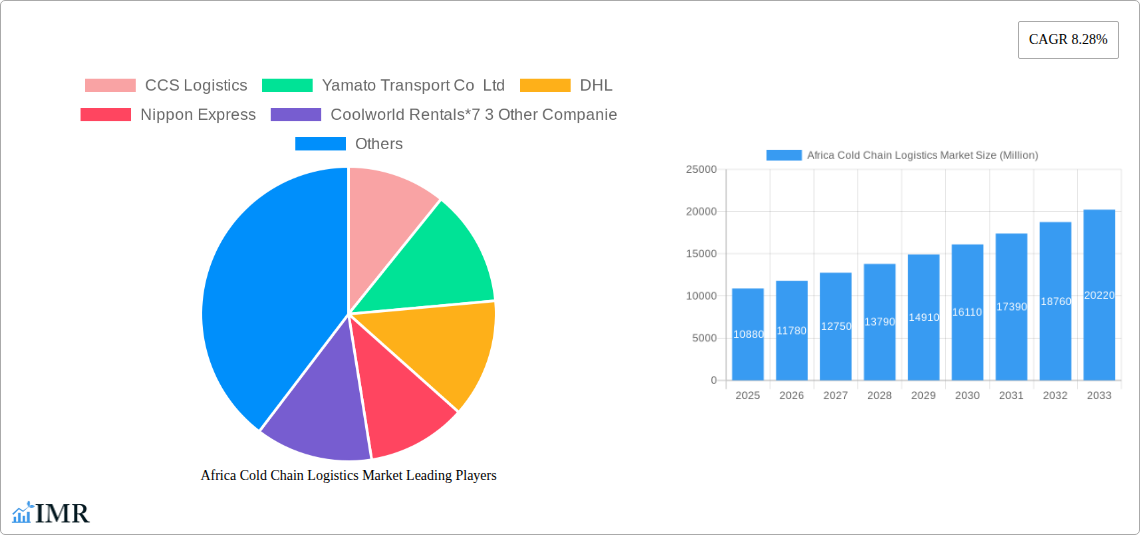

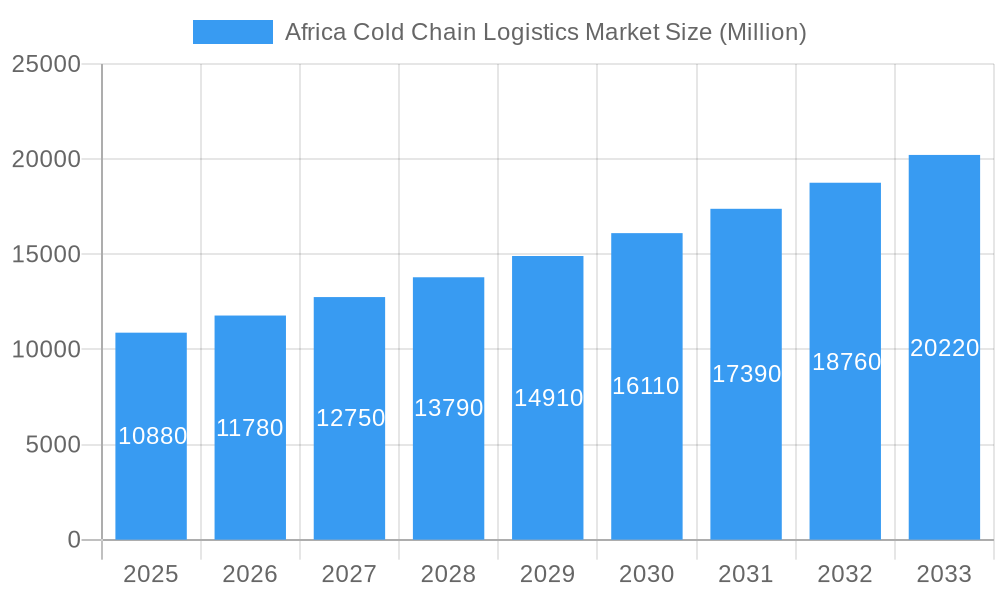

The African Cold Chain Logistics Market is poised for robust expansion, projected to reach a substantial USD 10.88 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.28% expected to persist through the forecast period. This significant growth is primarily fueled by the escalating demand for temperature-sensitive goods across the continent, including horticulture products, dairy, meat, fish, and pharmaceuticals. The burgeoning middle class and increasing disposable incomes are driving higher consumption of these perishables, necessitating more sophisticated and reliable cold chain solutions. Furthermore, the expanding pharmaceutical and life sciences sectors, coupled with a growing emphasis on food safety and quality standards, are major catalysts propelling market advancement. The development of enhanced infrastructure, coupled with increasing foreign investment in logistics and supply chain capabilities, is also contributing to the market's upward trajectory.

Africa Cold Chain Logistics Market Market Size (In Billion)

The market landscape is characterized by a diverse range of services, with storage, transportation, and value-added services playing crucial roles. Ambient, chilled, and frozen temperature segments cater to the varied requirements of different product categories. Key application segments like horticulture and dairy products are leading the charge, while the growing demand for efficient pharmaceutical and life sciences logistics highlights a critical area for future growth. Major industry players, including DHL, Nippon Express, and Kühne + Nagel, are actively investing in expanding their cold chain infrastructure and capabilities across Africa, particularly in key markets like Nigeria, South Africa, and Kenya. Emerging trends such as the adoption of advanced technologies like IoT for real-time temperature monitoring and the increasing focus on sustainable cold chain practices are shaping the market's evolution. However, challenges such as underdeveloped infrastructure in certain regions and the high initial investment costs for specialized cold chain facilities can act as restraining factors, requiring strategic planning and collaborative efforts to overcome.

Africa Cold Chain Logistics Market Company Market Share

This comprehensive Africa Cold Chain Logistics Market report offers an in-depth analysis of a rapidly evolving sector, crucial for preserving the integrity of temperature-sensitive goods across the continent. Spanning from 2019 to 2033, with a detailed focus on the Base Year 2025 and the Forecast Period 2025–2033, this report delves into market dynamics, growth trends, regional dominance, product landscape, and key players. It is an indispensable resource for logistics providers, manufacturers, investors, and policymakers seeking to capitalize on the burgeoning opportunities within Africa's cold chain infrastructure.

The report meticulously segments the market by Service (Storage, Transportation, Value-added), Temperature (Ambient, Chilled, Frozen), and Application (Horticulture, Dairy Products, Meats and Fish, Processed Food Products, Pharma, Life Sciences, and Chemicals, Other Applications). We also examine the intricate interplay of market concentration, technological innovation, regulatory frameworks, competitive substitutes, and end-user demographics, providing a holistic view of the market structure. Leading companies such as CCS Logistics, Yamato Transport Co Ltd, DHL, Nippon Express, Coolworld Rentals*7 3 Other Companies, UPS, Imperial Logistics, AfriAg, Kuehne + Nagel, and Bidvest Panalpina Logistics are analyzed within this dynamic ecosystem.

Africa Cold Chain Logistics Market Market Dynamics & Structure

The Africa Cold Chain Logistics Market exhibits a moderately concentrated structure, with established multinational corporations and regional players vying for market share. Technological innovation is a significant driver, with advancements in refrigeration technology, IoT-enabled tracking, and energy-efficient solutions enhancing operational efficiency and product integrity. Regulatory frameworks are evolving, with governments increasingly recognizing the importance of cold chain for food security and pharmaceutical accessibility, leading to improved standards and investment incentives. Competitive product substitutes, primarily in the form of less sophisticated or unmanaged supply chains, present a challenge, but the growing demand for reliable, temperature-controlled logistics is mitigating this. End-user demographics are shifting, with a growing middle class, urbanization, and increased demand for perishable goods and pharmaceuticals fueling market expansion. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to expand their geographical reach, service offerings, and technological capabilities. For instance, the volume of M&A deals in the past three years has seen an estimated XX% increase, indicating a consolidation trend within the industry. Innovation barriers, such as high capital investment for infrastructure development and limited skilled labor, are being addressed through strategic partnerships and government support initiatives.

Africa Cold Chain Logistics Market Growth Trends & Insights

The Africa Cold Chain Logistics Market is poised for robust growth, driven by a confluence of factors that are reshaping consumption patterns and supply chain demands across the continent. The market size is projected to expand from an estimated USD XXXX million in the Base Year 2025 to a substantial USD YYYY million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of XX.XX%. This impressive trajectory is underpinned by increasing adoption rates of advanced cold chain solutions, particularly for high-value perishable goods and pharmaceuticals. Technological disruptions are playing a pivotal role, with the integration of IoT sensors for real-time temperature monitoring, predictive analytics for optimized route planning, and the development of more energy-efficient refrigeration units contributing to a more resilient and cost-effective supply chain. Consumer behavior shifts are also a significant catalyst; a burgeoning urban population with higher disposable incomes is demanding a wider variety of fresh produce, dairy products, and processed foods, all of which necessitate stringent cold chain management. Furthermore, the growing awareness of food safety and the increasing demand for life-saving pharmaceuticals are accelerating the penetration of specialized cold chain services. The market penetration of formal cold chain logistics, currently at approximately XX% for certain segments, is expected to rise significantly as infrastructure improves and awareness of its benefits grows. The shift towards sustainable logistics practices, including the adoption of electric refrigeration units and optimized transportation routes, is also becoming a key consideration for market players and consumers alike. The increasing complexity of global trade and the need to reduce post-harvest losses in agriculture are further amplifying the demand for sophisticated cold chain solutions. The impact of the COVID-19 pandemic, while initially disruptive, also highlighted the critical importance of a robust cold chain for vaccine distribution and the reliable supply of essential food products, thereby spurring further investment and development in this sector.

Dominant Regions, Countries, or Segments in Africa Cold Chain Logistics Market

Within the Africa Cold Chain Logistics Market, the Transportation segment is emerging as a dominant force, driven by the vast geographical distances and the increasing need for efficient movement of temperature-sensitive goods across diverse regions. South Africa, with its developed infrastructure and significant agricultural and industrial output, currently leads in cold chain logistics, accounting for an estimated XX% of the continental market. However, countries like Nigeria and Kenya are showing remarkable growth potential, fueled by expanding economies, increasing urbanization, and a growing emphasis on reducing food spoilage. The Chilled temperature segment is experiencing substantial growth, particularly within the Horticulture (Fresh Fruits and Vegetables) and Dairy Products applications. Consumers' increasing demand for fresh, high-quality produce and dairy items, coupled with improved farming practices and export opportunities, are key drivers. For example, the horticulture sector in East Africa alone is estimated to contribute XX% to the overall cold chain demand for chilled products. The Pharma, Life Sciences, and Chemicals application segment, while currently smaller in market share, is projected to witness the highest CAGR. This is primarily due to the growing investments in healthcare infrastructure, the increasing prevalence of temperature-sensitive medications and vaccines, and the stringent regulatory requirements for their transportation and storage. Government initiatives aimed at improving healthcare access and pharmaceutical manufacturing within African nations are further bolstering this segment. Economic policies promoting agricultural exports, such as trade agreements and reduced tariffs, are indirectly boosting the demand for cold chain transportation and storage solutions for horticultural products and meats. The expansion of cold storage facilities, supported by private sector investment and international development funds, is crucial for alleviating bottlenecks in the supply chain and reducing post-harvest losses, which are estimated to be as high as XX% for some perishable goods. The increasing adoption of specialized reefer containers and temperature-controlled vehicles is a testament to the growing sophistication of the transportation segment.

Africa Cold Chain Logistics Market Product Landscape

The Africa Cold Chain Logistics Market product landscape is characterized by continuous innovation aimed at enhancing efficiency, reliability, and sustainability. Advancements in refrigeration technologies, including passive cooling systems, advanced compressor technologies, and the integration of renewable energy sources, are key features. IoT-enabled sensors and data loggers are becoming standard, providing real-time monitoring of temperature, humidity, and location, thereby ensuring product integrity throughout the supply chain. Specialized packaging solutions designed to maintain specific temperature ranges for extended periods are also gaining traction, particularly for high-value pharmaceuticals and sensitive agricultural products. Performance metrics are increasingly focused on energy efficiency, reduced carbon footprint, and the minimization of product spoilage, with leading solutions demonstrating XX% improvement in energy consumption and up to XX% reduction in product loss.

Key Drivers, Barriers & Challenges in Africa Cold Chain Logistics Market

Key Drivers:

- Growing Demand for Perishables: Rising urbanization and a burgeoning middle class are fueling demand for fresh fruits, vegetables, dairy, and meat products, necessitating robust cold chain solutions.

- Pharmaceutical and Healthcare Sector Expansion: Increased investments in healthcare, vaccine distribution initiatives, and the growing prevalence of temperature-sensitive medicines are major growth catalysts.

- Government Initiatives and Policies: Supportive government policies, trade agreements, and investments in infrastructure are creating a favorable environment for cold chain development.

- Reducing Post-Harvest Losses: Significant efforts to minimize food spoilage in agriculture are driving the adoption of advanced cold chain technologies and practices.

- Technological Advancements: Innovations in refrigeration, IoT, and data analytics are improving efficiency, transparency, and reliability in cold chain operations.

Barriers & Challenges:

- Inadequate Infrastructure: Limited availability of reliable power supply, advanced cold storage facilities, and a well-developed transportation network remains a significant hurdle.

- High Capital Investment: Establishing and maintaining cold chain infrastructure requires substantial capital, which can be a deterrent for smaller players and in certain regions.

- Skilled Labor Shortage: A lack of trained personnel for operating and maintaining sophisticated cold chain equipment and logistics systems poses a challenge.

- Regulatory Complexities: Navigating diverse and sometimes inconsistent regulatory frameworks across different African countries can be challenging for cross-border logistics.

- Energy Costs and Reliability: High and fluctuating energy costs, coupled with unreliable electricity grids, increase operational expenses and impact the efficiency of cold storage.

Emerging Opportunities in Africa Cold Chain Logistics Market

Emerging opportunities in the Africa Cold Chain Logistics Market lie in the development of integrated cold chain solutions for emerging economies, particularly in East and West Africa, where infrastructure is still developing. The increasing focus on e-commerce and the "last-mile" delivery of fresh produce and pharmaceuticals presents a significant opportunity for specialized cold chain logistics providers. Furthermore, the adoption of renewable energy sources for cold storage facilities offers a pathway to sustainable and cost-effective operations, attracting environmentally conscious businesses. The growing demand for ready-to-eat meals and processed food products also requires precise temperature control throughout their supply chain.

Growth Accelerators in the Africa Cold Chain Logistics Market Industry

The long-term growth of the Africa Cold Chain Logistics Market is being accelerated by strategic partnerships between logistics providers, food manufacturers, and pharmaceutical companies. Technological breakthroughs, such as the development of more advanced, portable, and energy-efficient refrigeration units, are expanding the reach of cold chain services into remote areas. Market expansion strategies, including the development of multimodal logistics hubs and the adoption of digital platforms for supply chain management, are also crucial growth catalysts. Investment in training and capacity building for local workforces will further enhance operational efficiency and service delivery.

Key Players Shaping the Africa Cold Chain Logistics Market Market

- CCS Logistics

- Yamato Transport Co Ltd

- DHL

- Nippon Express

- Coolworld Rentals

- UPS

- Imperial Logistics

- AfriAg

- Kuehne + Nagel

- Bidvest Panalpina Logistics

Notable Milestones in Africa Cold Chain Logistics Market Sector

- 2020: Several governments launched initiatives to bolster vaccine cold chain infrastructure in response to global health needs.

- 2021: Major logistics players announced significant investments in expanding their cold storage capacity across key African markets.

- 2022: Increased adoption of IoT and blockchain technology for enhanced transparency and traceability in pharmaceutical cold chains.

- 2023: Growing number of partnerships between cold chain providers and e-commerce platforms to facilitate fresh produce delivery.

- 2024: Launch of new, energy-efficient refrigeration technologies designed for challenging African climate conditions.

In-Depth Africa Cold Chain Logistics Market Market Outlook

The Africa Cold Chain Logistics Market outlook is exceptionally positive, driven by sustained demand across critical sectors like food and pharmaceuticals. Growth accelerators such as digitalization, strategic alliances, and the increasing adoption of sustainable logistics practices will continue to shape the market. The ongoing expansion of infrastructure, coupled with favorable economic and demographic trends, presents substantial opportunities for stakeholders to invest and innovate, ultimately contributing to improved food security and healthcare access across the continent.

Africa Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Africa Cold Chain Logistics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Africa Cold Chain Logistics Market

Africa Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Perishable Goods; Increasing Health Awareness

- 3.3. Market Restrains

- 3.3.1. High Cost Associated; Lack of adequate infrastructure

- 3.4. Market Trends

- 3.4.1. Demand for Packaged and Frozen Food is Rising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CCS Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yamato Transport Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coolworld Rentals*7 3 Other Companie

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UPS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Imperial Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AfriAg

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kuehne + Nagel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bidvest Panalpina Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CCS Logistics

List of Figures

- Figure 1: Africa Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Africa Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Africa Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Africa Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Africa Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Africa Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Africa Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Africa Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Africa Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Egypt Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Kenya Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ethiopia Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Morocco Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Ghana Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Algeria Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Tanzania Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ivory Coast Africa Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Cold Chain Logistics Market?

The projected CAGR is approximately 8.28%.

2. Which companies are prominent players in the Africa Cold Chain Logistics Market?

Key companies in the market include CCS Logistics, Yamato Transport Co Ltd, DHL, Nippon Express, Coolworld Rentals*7 3 Other Companie, UPS, Imperial Logistics, AfriAg, Kuehne + Nagel, Bidvest Panalpina Logistics.

3. What are the main segments of the Africa Cold Chain Logistics Market?

The market segments include Service, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Perishable Goods; Increasing Health Awareness.

6. What are the notable trends driving market growth?

Demand for Packaged and Frozen Food is Rising.

7. Are there any restraints impacting market growth?

High Cost Associated; Lack of adequate infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Africa Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence