Key Insights

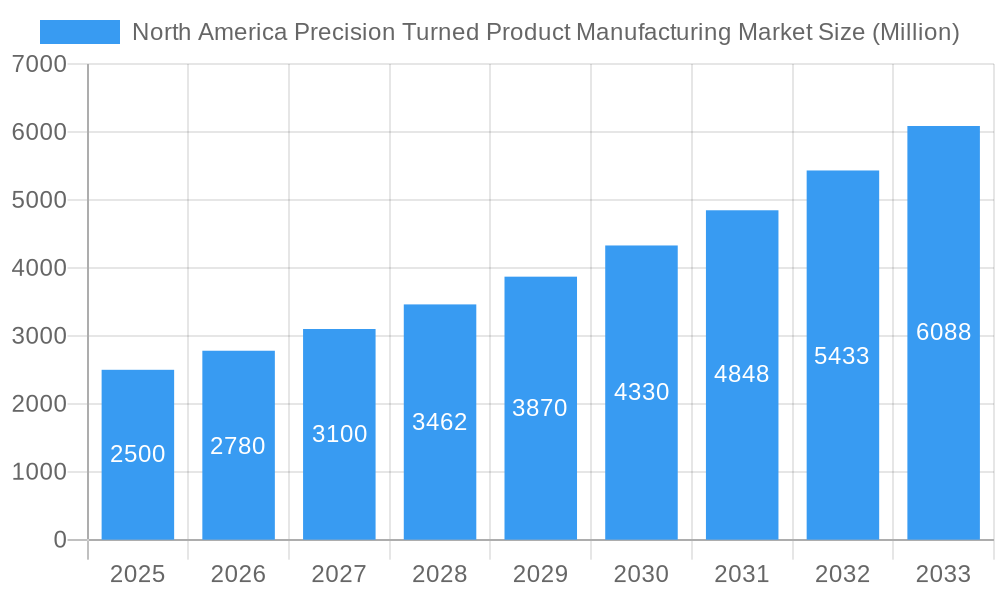

The North America Precision Turned Product Manufacturing market is poised for substantial expansion, propelled by escalating demand across key sectors including automotive, aerospace, medical devices, and electronics. The market's robust Compound Annual Growth Rate (CAGR) of 6.7% from 2025 to 2033 underscores this significant trajectory. Key growth catalysts encompass the increasing adoption of automation and advanced manufacturing technologies, a pronounced emphasis on product miniaturization and precision engineering, and the growing requirement for high-performance components across a spectrum of industries. The market is strategically segmented by product type (e.g., shafts, pins, bushings, screws), material (e.g., steel, aluminum, brass), and end-use industry, reflecting diverse application needs.

North America Precision Turned Product Manufacturing Market Market Size (In Billion)

The market size, projected to reach 110.33 billion by 2025, is anticipated to witness sustained growth. This upward trend is further reinforced by ongoing technological advancements and the increasing complexity of precision components. Potential challenges may arise from supply chain volatilities, material cost fluctuations, and the imperative for continuous investment in advanced machinery and skilled labor. Nevertheless, the long-term outlook remains highly favorable, offering considerable opportunities for enterprises prioritizing innovation, efficient production methodologies, and robust customer engagement. The competitive landscape features a dynamic interplay between established industry leaders and a considerable number of specialized manufacturers, indicating a market ripe for strategic growth and potential consolidation.

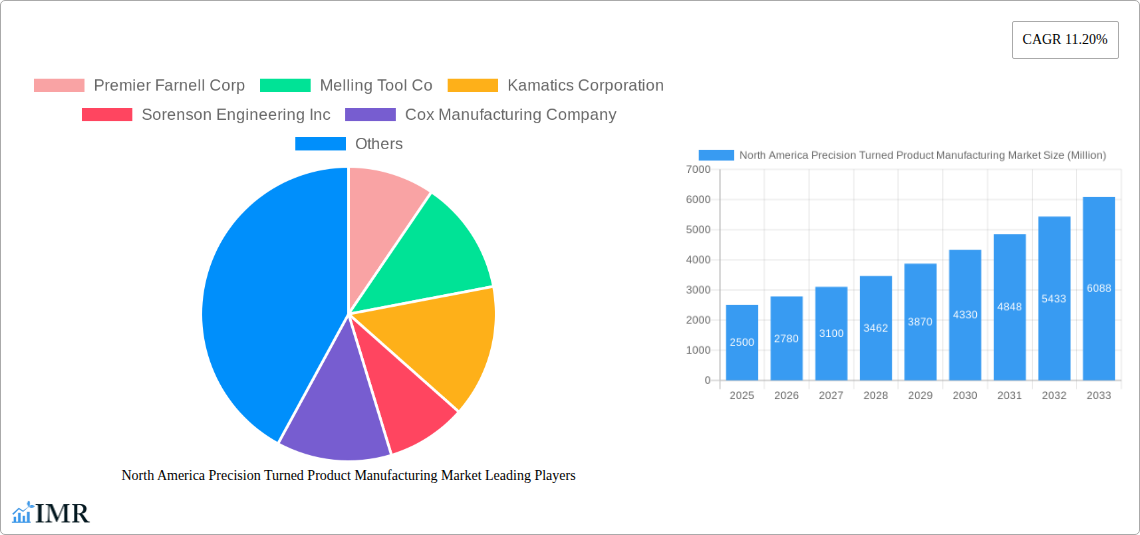

North America Precision Turned Product Manufacturing Market Company Market Share

North America Precision Turned Product Manufacturing Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America precision turned product manufacturing market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and a forecast period extending to 2033. The report segments the market to provide a granular view, enabling precise targeting of opportunities within this dynamic industry. The market is valued at xx Million Units in 2025 and is projected to reach xx Million Units by 2033, exhibiting a CAGR of xx%.

North America Precision Turned Product Manufacturing Market Dynamics & Structure

The North American precision turned product manufacturing market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the presence of numerous smaller, specialized manufacturers contributes to a competitive landscape. Technological innovation is a crucial driver, with advancements in CNC machining, automation, and materials science continually shaping production capabilities and product offerings. Regulatory frameworks, including those related to safety, environmental compliance, and labor standards, significantly influence operational costs and strategies. The market faces competition from alternative manufacturing processes, such as 3D printing and casting, particularly in niche applications. End-user demographics span diverse industries, including automotive, aerospace, medical devices, and electronics, each presenting unique demands and growth opportunities. The market has witnessed a moderate level of M&A activity, reflecting consolidation trends and strategic expansion efforts.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: CNC machining, automation, advanced materials (e.g., high-strength alloys, composites) are key drivers.

- Regulatory Landscape: Compliance with safety, environmental, and labor regulations impacts operational costs.

- Competitive Substitutes: 3D printing, casting, forging present competitive challenges in specific segments.

- End-User Demographics: Automotive, aerospace, medical devices, electronics are major end-use sectors.

- M&A Activity: Moderate level of mergers and acquisitions, driven by strategic expansion and market consolidation. Approximately xx M&A deals were recorded between 2019 and 2024.

North America Precision Turned Product Manufacturing Market Growth Trends & Insights

The North America precision turned product manufacturing market has experienced steady growth over the historical period (2019-2024), driven by increasing demand from key end-use sectors. The automotive industry, particularly the rise of electric vehicles and autonomous driving technologies, has fueled demand for precision-engineered components. The aerospace sector's focus on lightweighting and improved performance has also contributed to market growth. Technological advancements, such as the adoption of Industry 4.0 principles and advanced manufacturing technologies, have enhanced productivity and efficiency, further driving market expansion. Consumer behavior shifts, emphasizing product durability and reliability, benefit the market by increasing demand for high-quality precision-turned products.

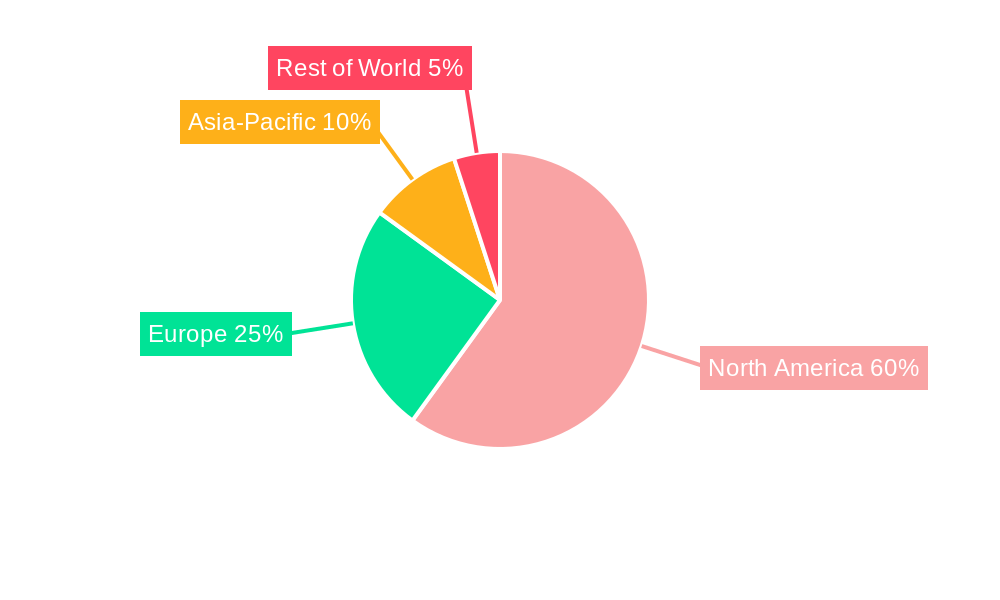

Dominant Regions, Countries, or Segments in North America Precision Turned Product Manufacturing Market

The Midwest and Southern regions of the United States are currently the dominant segments in the North American precision turned product manufacturing market. These regions benefit from established industrial bases, a skilled workforce, and proximity to major end-users. Mexico's growing manufacturing sector, particularly in the automotive industry, presents a significant growth opportunity for precision turned product manufacturers.

- Key Drivers in the Midwest & South (US): Established industrial infrastructure, skilled labor pool, proximity to key end-users, favorable economic policies.

- Growth Potential in Mexico: Expanding automotive manufacturing, lower labor costs, proximity to the US market.

- Market Share: The US Midwest holds approximately xx% of the market, while the South holds approximately xx%, with Mexico accounting for xx%. Growth potential is projected at xx% CAGR for Mexico over the forecast period.

North America Precision Turned Product Manufacturing Market Product Landscape

The market offers a diverse range of precision-turned products, varying in material, size, tolerance, and finish. Innovations focus on improved material properties, tighter tolerances, enhanced surface finishes, and miniaturization capabilities. These advancements cater to the demands of high-precision applications across various industries. Unique selling propositions often center on superior quality, faster turnaround times, and specialized customization capabilities. Technological advancements, such as the integration of advanced sensors and data analytics, are enhancing product performance and enabling predictive maintenance.

Key Drivers, Barriers & Challenges in North America Precision Turned Product Manufacturing Market

Key Drivers: Increasing demand from key end-use sectors (automotive, aerospace, medical devices), technological advancements in CNC machining and automation, government initiatives promoting domestic manufacturing.

Challenges: Supply chain disruptions, skilled labor shortages, rising material costs, intense competition from foreign manufacturers, fluctuating energy prices impacting operational costs. The combined impact of these factors could potentially reduce market growth by xx% annually by 2030 if not properly addressed.

Emerging Opportunities in North America Precision Turned Product Manufacturing Market

Emerging opportunities lie in the growing demand for precision components in renewable energy technologies, the expansion of the medical device industry, and the increasing adoption of additive manufacturing technologies for prototyping and low-volume production. Untapped markets exist in specialized applications within industries like robotics and advanced electronics. Evolving consumer preferences toward sustainable and ethically sourced materials offer further opportunities.

Growth Accelerators in the North America Precision Turned Product Manufacturing Market Industry

Long-term growth will be driven by technological breakthroughs in materials science, enabling the production of lighter, stronger, and more durable components. Strategic partnerships between precision turned product manufacturers and end-users to develop customized solutions will play a crucial role. Market expansion into emerging economies and strategic investments in automation and digitalization will further accelerate market growth.

Key Players Shaping the North America Precision Turned Product Manufacturing Market Market

- Premier Farnell Corp

- Melling Tool Co

- Kamatics Corporation

- Sorenson Engineering Inc

- Cox Manufacturing Company

- Nook Industries LLC

- Creed-Monarch Inc

- Camcraft Inc

- M & W Industries Inc

- Greystone of Lincoln Inc

- Swagelok Hy-Level Company

- Herker Industries Inc

- Supreme Screw Products Inc (List Not Exhaustive)

Notable Milestones in North America Precision Turned Product Manufacturing Market Sector

- November 2022: Momentum Manufacturing Group's acquisition of Evans Industries Inc. and Little Enterprises LLC expands its capabilities and market reach within mission-critical sectors.

- December 2021: Plansee Group's acquisition of Mi-Tech Tungsten Metals strengthens its North American market position in tungsten-based products.

In-Depth North America Precision Turned Product Manufacturing Market Outlook

The future of the North American precision turned product manufacturing market appears promising, driven by continued innovation, increasing demand from diverse end-use sectors, and strategic investments in advanced technologies. Strategic partnerships, focusing on collaborative product development and supply chain optimization, will be key to success. Companies that adapt to evolving technological landscapes and effectively manage supply chain challenges are poised for significant growth over the forecast period. The market's ability to capitalize on emerging opportunities in high-growth sectors like renewable energy and advanced medical devices will also significantly shape its future trajectory.

North America Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC)

- 2.4. Lathes or Turning Centers

-

3. Material Type

- 3.1. Plastic

- 3.2. Steel

- 3.3. Other Material Types

-

4. End Use

- 4.1. Automobile

- 4.2. Electronics

- 4.3. Defense

- 4.4. Healthcare

North America Precision Turned Product Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of North America Precision Turned Product Manufacturing Market

North America Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC)

- 5.2.4. Lathes or Turning Centers

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Plastic

- 5.3.2. Steel

- 5.3.3. Other Material Types

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Automobile

- 5.4.2. Electronics

- 5.4.3. Defense

- 5.4.4. Healthcare

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Premier Farnell Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Melling Tool Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kamatics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sorenson Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cox Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nook Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Creed-Monarch Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Camcraft Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greystone of Lincoln Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swagelok Hy-Level Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Herker Industries Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Supreme Screw Products Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Premier Farnell Corp

List of Figures

- Figure 1: North America Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 2: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 3: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 5: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 7: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 8: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America Precision Turned Product Manufacturing Market?

Key companies in the market include Premier Farnell Corp, Melling Tool Co, Kamatics Corporation, Sorenson Engineering Inc, Cox Manufacturing Company, Nook Industries LLC, Creed-Monarch Inc, Camcraft Inc, M & W Industries Inc, Greystone of Lincoln Inc, Swagelok Hy-Level Company, Herker Industries Inc, Supreme Screw Products Inc **List Not Exhaustive.

3. What are the main segments of the North America Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, Material Type, End Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 110.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT).

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence