Key Insights

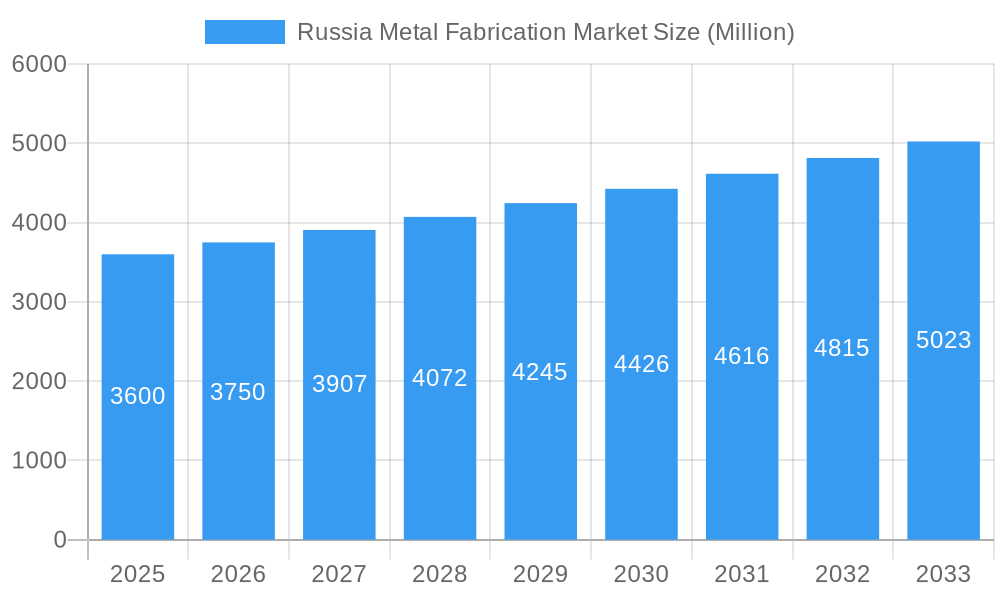

The Russia metal fabrication market, valued at $3.60 billion in 2025, is projected to experience steady growth, driven by robust infrastructure development, particularly in sectors like construction and energy. A Compound Annual Growth Rate (CAGR) of 4.31% from 2025 to 2033 indicates a considerable expansion, with the market expected to surpass $5 billion by 2033. This growth is fueled by increasing government investment in modernization projects and a rising demand for fabricated metal products across various end-use industries. While sanctions and geopolitical uncertainties present challenges, the domestic demand and ongoing initiatives to boost the country's manufacturing sector are likely to offset these headwinds. Key players like Severstal-metiz, NLMK, and MMK are strategically positioned to benefit from this market expansion, focusing on product diversification and technological advancements to maintain competitiveness. The market segments, while not explicitly detailed, can be reasonably assumed to include structural steel fabrication, sheet metal fabrication, and specialized metal fabrication for machinery and equipment. The ongoing emphasis on import substitution further supports market growth, fostering opportunities for domestic metal fabricators.

Russia Metal Fabrication Market Market Size (In Billion)

The sustained growth in the Russian metal fabrication market is contingent on several factors. The resilience of the domestic construction industry, despite external pressures, provides a strong foundation for demand. Furthermore, the ongoing modernization of energy infrastructure and the expansion of manufacturing capabilities are contributing significantly to the market's dynamism. However, potential fluctuations in raw material prices and the global economic climate could impact growth trajectories. Continuous technological advancements, focusing on automation and efficiency, are vital for maintaining competitiveness and ensuring sustained growth. The strategic partnerships between Russian metal fabricators and international players will also play a critical role in shaping the market's future. Companies are likely adapting to the evolving geopolitical landscape by focusing on strengthening domestic supply chains and exploring new export opportunities.

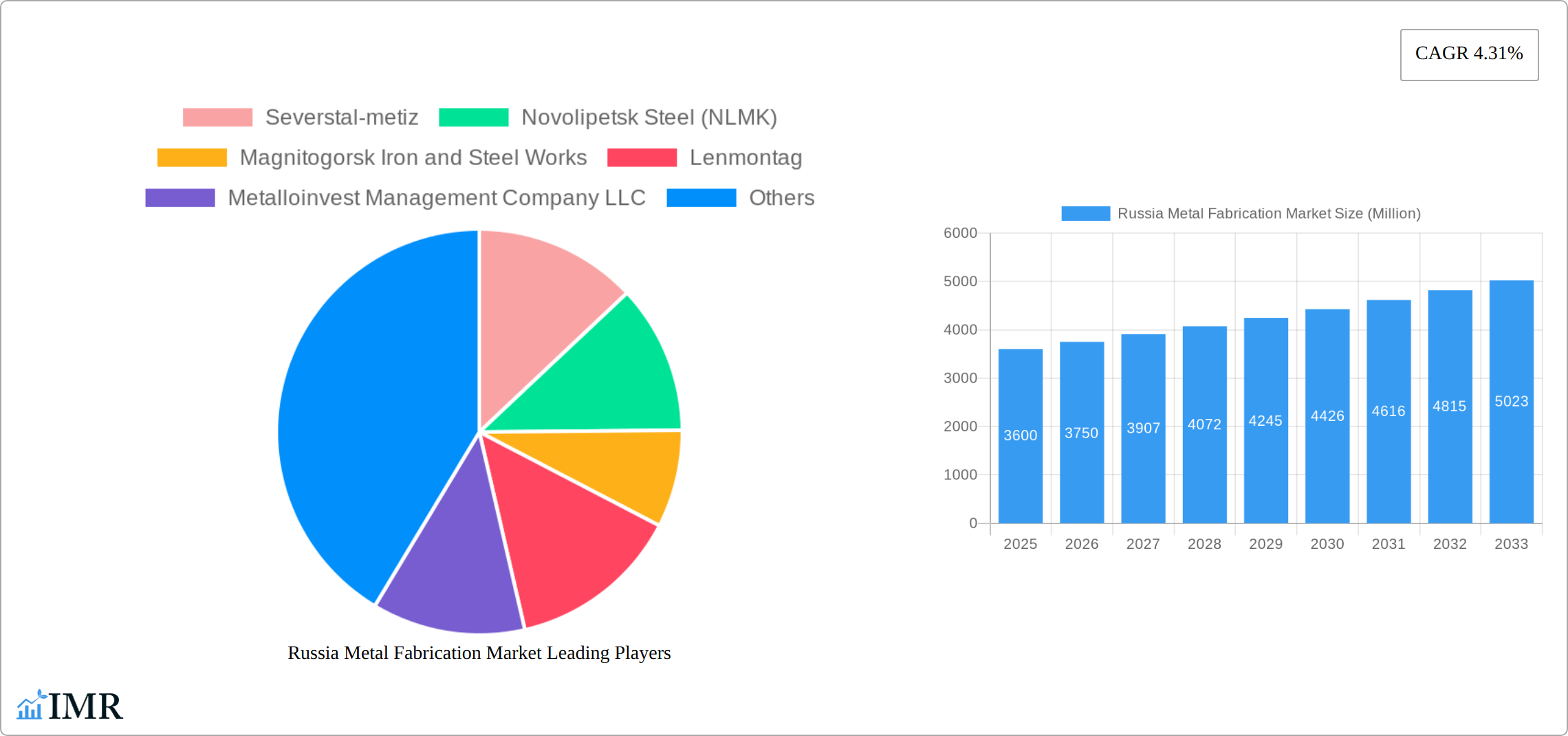

Russia Metal Fabrication Market Company Market Share

Russia Metal Fabrication Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia Metal Fabrication Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The market is segmented by various factors (detailed within the report) and includes analysis of both parent and child markets to provide a holistic view. Market values are presented in Million units.

Russia Metal Fabrication Market Dynamics & Structure

The Russia Metal Fabrication Market exhibits a moderately concentrated structure, with several large players holding significant market share. However, a fragmented landscape also exists, particularly among smaller, specialized fabricators. Technological innovation, driven by increasing automation and advanced materials, is a key driver, alongside government regulations focused on safety and environmental sustainability. The market faces competition from substitute materials like plastics and composites, although steel maintains its dominance in many applications. End-user demographics are diverse, spanning construction, automotive, machinery, and energy sectors. M&A activity in the sector has been moderate in recent years, with a total of xx deals valued at xx million recorded between 2019 and 2024, indicating a trend of consolidation among larger players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Strong emphasis on automation, robotics, and advanced materials (e.g., high-strength steel).

- Regulatory Framework: Stringent safety and environmental regulations influence production processes and material choices.

- Competitive Substitutes: Plastics and composites present competition in specific niche applications.

- End-User Demographics: Construction, automotive, machinery, and energy sectors are primary end-users.

- M&A Trends: Moderate consolidation observed in recent years, with xx deals completed in 2019-2024.

Russia Metal Fabrication Market Growth Trends & Insights

The Russia Metal Fabrication Market is poised for dynamic expansion, exhibiting a strong historical growth rate of [XX]% Compound Annual Growth Rate (CAGR) during the period of 2019-2024, culminating in an estimated market size of [XX] million in 2024. This upward trajectory is underpinned by significant investments in infrastructure development across crucial sectors such as construction and energy, complemented by a concerted push towards industrialization and supportive government policies championing domestic manufacturing capabilities. The market is further invigorated by technological advancements, with the increasing integration of additive manufacturing (3D printing) and sophisticated welding techniques playing a pivotal role in driving market evolution. Furthermore, evolving consumer demands for sustainable and high-performance materials are acting as a significant catalyst for growth. Looking ahead to the forecast period of 2025-2033, the market is anticipated to sustain a healthy, albeit moderated, growth trend, projecting a CAGR of approximately [XX]%. Key drivers and emerging trends fueling this continued expansion are elaborated in the subsequent sections. Notably, the adoption rate for cutting-edge fabrication technologies remains relatively nascent, signaling substantial untapped potential for innovation and market penetration.

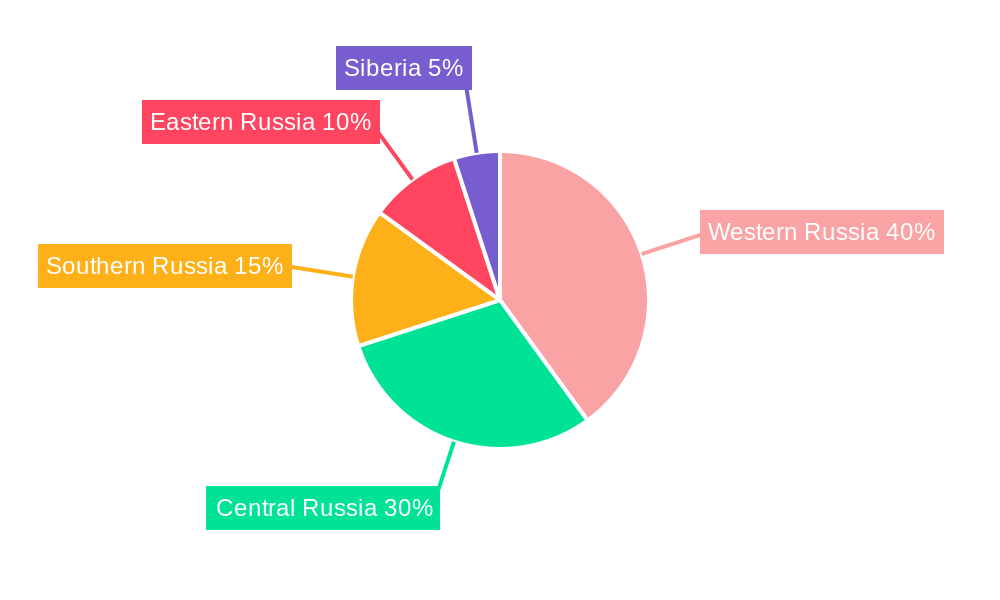

Dominant Regions, Countries, or Segments in Russia Metal Fabrication Market

The Central Federal District of Russia currently dominates the metal fabrication market, accounting for approximately xx% of total market value in 2024. This dominance stems from its high concentration of industrial activity, robust infrastructure, and proximity to major raw material sources. However, other regions, such as the Ural Federal District and Southern Federal District, exhibit significant growth potential due to planned infrastructure developments and expanding industrial sectors. Specific growth drivers vary regionally but include government investments in infrastructure projects, burgeoning automotive and construction sectors, and supportive economic policies promoting industrial diversification.

- Central Federal District: Highest market share (xx%), driven by concentrated industrial activity and infrastructure.

- Ural Federal District: Significant growth potential due to expanding industrial sectors and resource availability.

- Southern Federal District: Emerging growth driven by infrastructure projects and regional economic development.

Russia Metal Fabrication Market Product Landscape

The landscape of the Russia Metal Fabrication Market is characterized by a diverse and expanding array of products, encompassing everything from robust structural steel components essential for large-scale construction projects to highly precise engineered parts for specialized industrial applications, and bespoke customized fabrications designed to meet unique client specifications. The emphasis on product innovation is sharply focused on augmenting critical performance characteristics, including an improved strength-to-weight ratio, enhanced corrosion resistance for greater longevity, and superior overall durability. Key differentiating factors and unique selling propositions within the market frequently revolve around the provision of meticulously tailored solutions that address specific application requirements and the integration of advanced surface treatment techniques to elevate product quality and functionality. The transformative influence of technological advancements, such as the precision of laser cutting, the efficiency of robotic welding, and the versatility of 3D printing, is actively reshaping manufacturing processes, paving the way for unprecedented levels of precision, amplified operational efficiency, and a notable reduction in overall production expenditures.

Key Drivers, Barriers & Challenges in Russia Metal Fabrication Market

Key Drivers:

- Government initiatives supporting domestic manufacturing and infrastructure development.

- Growth of key end-use sectors like construction, automotive, and energy.

- Technological advancements leading to enhanced product performance and efficiency.

Challenges and Restraints:

- Fluctuations in raw material prices (e.g., steel) impacting production costs and profitability.

- Geopolitical uncertainties and sanctions impacting trade and investment.

- Competition from imported products and substitute materials. This has led to a xx% decrease in market share for domestic producers in certain segments between 2022 and 2024.

Emerging Opportunities in Russia Metal Fabrication Market

The Russia Metal Fabrication Market is brimming with emergent opportunities, prominently featuring the strategic adoption of transformative technologies like additive manufacturing and advanced automation. Concurrently, a growing imperative for sustainable and lightweight materials across a spectrum of industries is creating substantial demand. Significant untapped potential lies within specialized and high-growth sectors such as aerospace and the rapidly expanding renewable energy industry, where the requirement for high-performance, intricately fabricated metal components is paramount and on the rise. Furthermore, shifting consumer preferences are increasingly steering the market towards customized and aesthetically appealing metal products, thereby opening up valuable avenues for niche fabricators capable of delivering specialized and design-forward solutions.

Growth Accelerators in the Russia Metal Fabrication Market Industry

Long-term growth will be accelerated by strategic partnerships between fabricators and technology providers, facilitating the adoption of innovative manufacturing processes. Expanding into new, high-growth market segments, such as renewable energy infrastructure and advanced transportation systems, represents a key growth catalyst. Continuous technological innovation, particularly in areas like material science and automation, will further propel market expansion.

Key Players Shaping the Russia Metal Fabrication Market Market

- Severstal-metiz

- Novolipetsk Steel (NLMK)

- Magnitogorsk Iron and Steel Works

- Lenmontag

- Metalloinvest Management Company LLC

- Mechel

- Ruspolimet

- Pic Metall

- Evraz Group

- TMK

List Not Exhaustive

Notable Milestones in Russia Metal Fabrication Market Sector

- November 2022: Novolipetsk Steel (NLMK) successfully implemented a significant upgrade to the dedusting system of its Blast Furnace No. 3, achieving an exceptional dust capture rate of 99.9%, underscoring advancements in environmental control and operational efficiency.

- December 2022: Metalloinvest undertook a substantial modernization initiative for Kiln No. 4 at its Lebedinsky GOK pellet plant. This upgrade resulted in a remarkable 10% increase in capacity, boosting its annual output to 2.5 million metric tons and highlighting advancements in raw material processing capabilities.

In-Depth Russia Metal Fabrication Market Outlook

The Russia Metal Fabrication Market is poised for sustained growth, driven by ongoing infrastructure development, technological advancements, and a growing focus on sustainable manufacturing practices. Strategic investments in automation and innovative materials will be crucial for companies to maintain competitiveness. The long-term outlook is positive, with opportunities for both established players and new entrants to capitalize on the market's expanding potential. However, successful navigation requires addressing challenges related to raw material price volatility, geopolitical uncertainty, and technological disruption.

Russia Metal Fabrication Market Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Utilities

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

- 2.3. Other Material Types

-

3. Service Type

- 3.1. Casting

- 3.2. Forging

- 3.3. Machining

- 3.4. Welding & Tubing

- 3.5. Other Service Types

Russia Metal Fabrication Market Segmentation By Geography

- 1. Russia

Russia Metal Fabrication Market Regional Market Share

Geographic Coverage of Russia Metal Fabrication Market

Russia Metal Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Number of Manufacturing Plants in Russia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Metal Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Utilities

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Casting

- 5.3.2. Forging

- 5.3.3. Machining

- 5.3.4. Welding & Tubing

- 5.3.5. Other Service Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Severstal-metiz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novolipetsk Steel (NLMK)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Magnitogorsk Iron and Steel Works

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lenmontag

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metalloinvest Management Company LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mechel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ruspolimet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pic Metall

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evraz Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TMK**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Severstal-metiz

List of Figures

- Figure 1: Russia Metal Fabrication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Metal Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Metal Fabrication Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Russia Metal Fabrication Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Russia Metal Fabrication Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: Russia Metal Fabrication Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: Russia Metal Fabrication Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Russia Metal Fabrication Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 7: Russia Metal Fabrication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Russia Metal Fabrication Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Russia Metal Fabrication Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Russia Metal Fabrication Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Russia Metal Fabrication Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Russia Metal Fabrication Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: Russia Metal Fabrication Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Russia Metal Fabrication Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 15: Russia Metal Fabrication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Russia Metal Fabrication Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Metal Fabrication Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Russia Metal Fabrication Market?

Key companies in the market include Severstal-metiz, Novolipetsk Steel (NLMK), Magnitogorsk Iron and Steel Works, Lenmontag, Metalloinvest Management Company LLC, Mechel, Ruspolimet, Pic Metall, Evraz Group, TMK**List Not Exhaustive.

3. What are the main segments of the Russia Metal Fabrication Market?

The market segments include End-user Industry, Material Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Number of Manufacturing Plants in Russia.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Novolipetsk Steel (NLMK) Lipetsk, one of the main production sites of NLMK Group, Russia's biggest producer of steel and high-valued steel products and steel makers, has upgraded its Blast Furnace No. 3 dedusting system, achieving a 99.9% dust capture rate. As a result of NLMK's ongoing environmental improvements, all of its blast furnaces now have advanced dedusting systems that are on par with the best global technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Metal Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Metal Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Metal Fabrication Market?

To stay informed about further developments, trends, and reports in the Russia Metal Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence