Key Insights

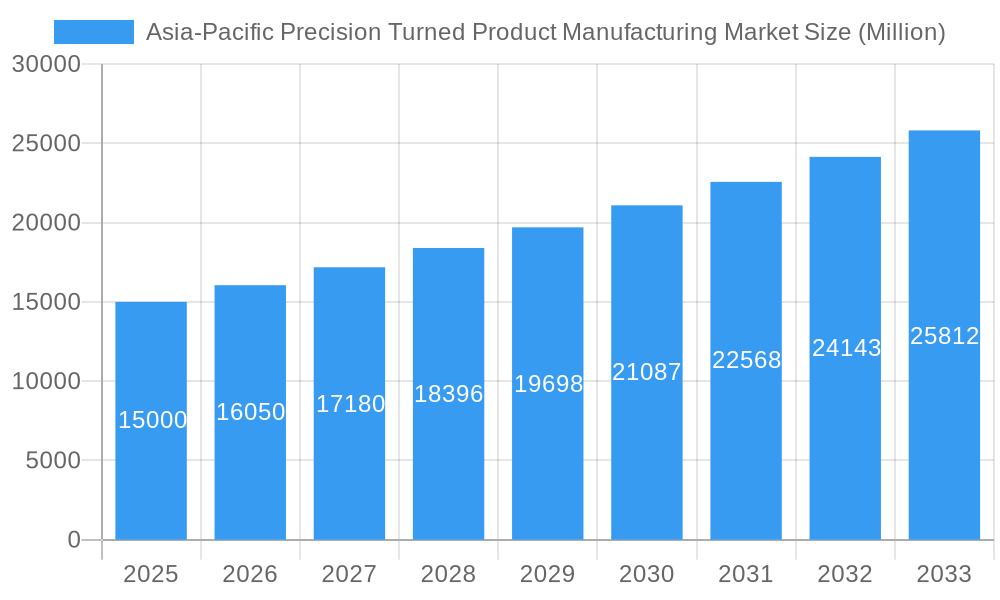

The Asia-Pacific precision turned product manufacturing market is poised for significant expansion, driven by robust demand in key sectors including automotive, aerospace, medical devices, and electronics. Projected to achieve a Compound Annual Growth Rate (CAGR) of 8.1%, the market is expected to reach an estimated size of $123.54 billion by 2025. This growth trajectory is propelled by advancements in CNC machining, manufacturing automation, and the widespread adoption of Industry 4.0 principles. The region's expanding manufacturing ecosystem, particularly in China, India, Japan, and South Korea, alongside strategic R&D investments by industry leaders, are fostering innovation and the development of high-precision, customized components.

Asia-Pacific Precision Turned Product Manufacturing Market Market Size (In Billion)

While the market demonstrates strong growth potential, certain factors warrant attention. Volatility in raw material prices, especially for metals, can influence profitability. Intense competition necessitates continuous enhancements in operational efficiency, product quality, and cost management to secure market share. Addressing skilled labor shortages and adhering to stringent product safety and environmental regulations are critical for sustainable expansion. The increasing integration of precision-turned parts in advanced technological products underscores a positive future outlook for the Asia-Pacific precision turned product manufacturing sector.

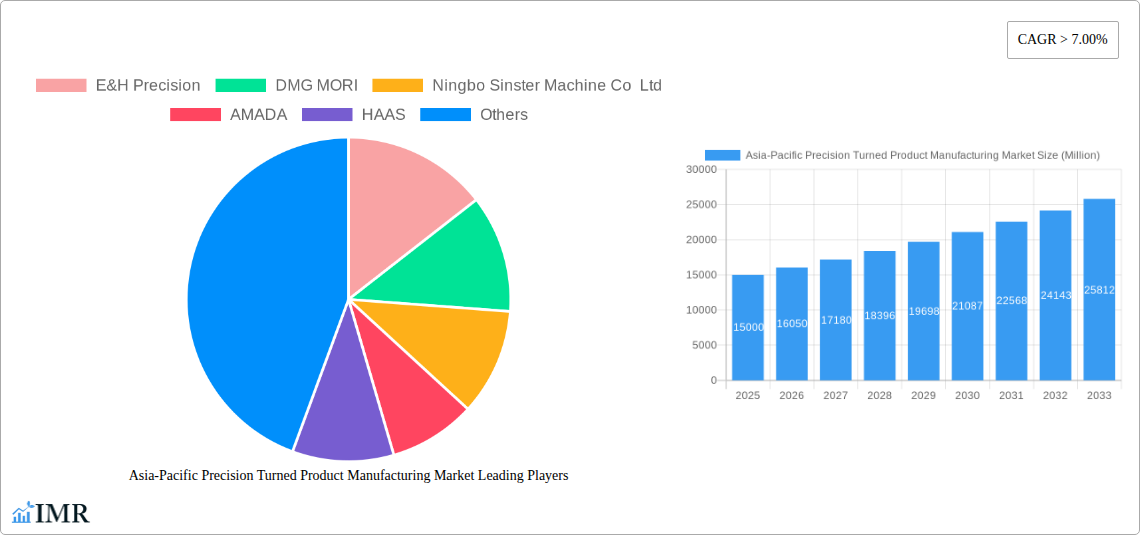

Asia-Pacific Precision Turned Product Manufacturing Market Company Market Share

Asia-Pacific Precision Turned Product Manufacturing Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific precision turned product manufacturing market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes a parent market approach encompassing the broader manufacturing sector and drills down to the child market of precision turned product manufacturing within the Asia-Pacific region. This granular approach provides a 360-degree view, invaluable for strategic decision-making. The market size is projected in Million units.

Asia-Pacific Precision Turned Product Manufacturing Market Dynamics & Structure

This section analyzes the market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends within the Asia-Pacific precision turned product manufacturing market. The market is characterized by a moderately concentrated structure, with a few major players holding significant market share, alongside numerous smaller, specialized manufacturers. Technological advancements, particularly in CNC machining and automation, are key growth drivers. Stringent quality and safety regulations in various sectors (e.g., automotive, medical) influence manufacturing practices. The market faces competition from alternative manufacturing processes (e.g., 3D printing) and is subject to fluctuations in raw material prices and global economic conditions. M&A activity in recent years has been moderate, with xx deals recorded between 2019 and 2024, resulting in a xx% increase in market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: CNC machining, automation, and advanced materials are key drivers.

- Regulatory Framework: Stringent quality and safety standards influence manufacturing processes.

- Competitive Substitutes: 3D printing and other manufacturing processes pose a competitive threat.

- End-User Demographics: Diverse end-users across automotive, medical, electronics, and aerospace sectors.

- M&A Trends: Moderate M&A activity, with xx deals recorded between 2019 and 2024.

Asia-Pacific Precision Turned Product Manufacturing Market Growth Trends & Insights

The Asia-Pacific precision turned product manufacturing market exhibits robust growth, driven by increasing demand from diverse end-use industries and technological advancements. The market size experienced a CAGR of xx% during the historical period (2019-2024), reaching xx Million units in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. The adoption of advanced technologies, such as automation and AI-powered solutions, is accelerating market penetration and improving efficiency. Consumer demand for high-precision components in various applications, coupled with favorable government policies and infrastructure development, further fuels market expansion. Shifting consumer preferences towards durable and high-quality products are also contributing factors.

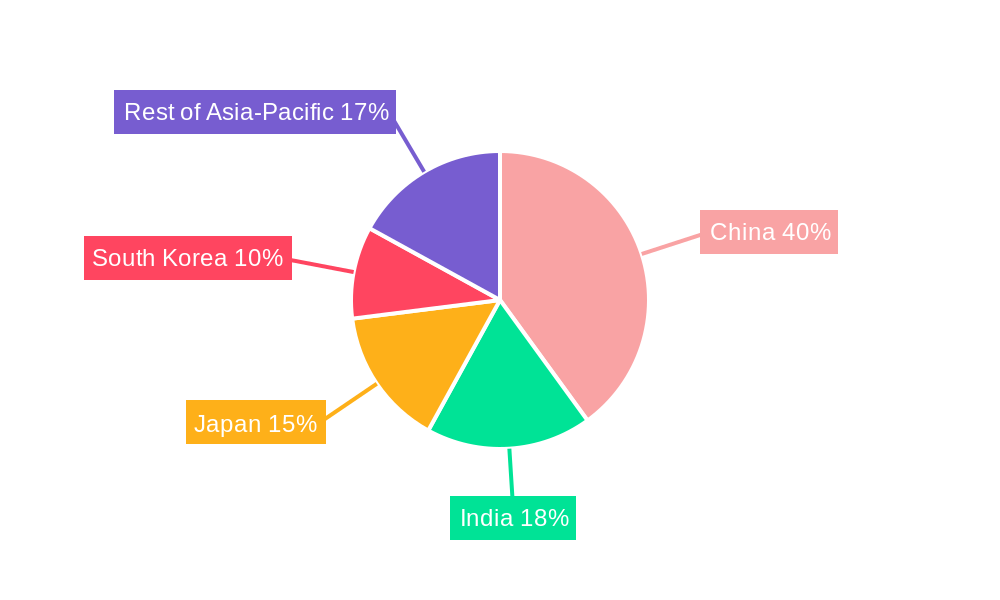

Dominant Regions, Countries, or Segments in Asia-Pacific Precision Turned Product Manufacturing Market

China and Japan are currently the leading countries in the Asia-Pacific precision turned product manufacturing market, driven by robust industrial growth, a large manufacturing base, and the presence of key players. These countries benefit from supportive government policies, well-established infrastructure, and a skilled workforce. Other countries like South Korea, India, and Singapore are experiencing significant growth, fueled by increasing investments in manufacturing capabilities and expanding industrial sectors. The automotive, electronics, and medical device sectors are among the primary growth drivers in these regions.

- China: Strong industrial base, supportive government policies, and a large domestic market.

- Japan: Advanced technological capabilities, skilled workforce, and presence of major manufacturers.

- South Korea: High-tech manufacturing capabilities and focus on advanced materials.

- India: Rapid industrial growth, increasing investments in manufacturing, and a young, growing workforce.

- Singapore: Strong infrastructure, strategic location, and focus on high-value-added manufacturing.

Asia-Pacific Precision Turned Product Manufacturing Market Product Landscape

The Asia-Pacific precision turned product manufacturing market encompasses a wide range of products, including shafts, pins, bushings, and complex components with intricate geometries. Continuous innovation is driving the development of advanced materials, such as high-strength alloys and ceramics, improving product performance and durability. Product differentiation is increasingly driven by superior precision, tighter tolerances, and enhanced surface finishes. Unique selling propositions often focus on specialized coatings, optimized manufacturing processes, and reduced lead times. Technological advancements like AI-driven quality control are enhancing accuracy and consistency.

Key Drivers, Barriers & Challenges in Asia-Pacific Precision Turned Product Manufacturing Market

Key Drivers:

- Rising demand from key end-use industries (automotive, medical, electronics).

- Technological advancements in CNC machining and automation.

- Favorable government policies promoting industrial development in several Asian countries.

- Increasing investments in infrastructure and manufacturing capabilities.

Challenges and Restraints:

- Fluctuations in raw material prices (e.g., metals) impacting manufacturing costs.

- Supply chain disruptions and geopolitical uncertainties.

- Intense competition from manufacturers in other regions.

- Skilled labor shortages in some areas.

- Stringent environmental regulations increasing operational costs.

Emerging Opportunities in Asia-Pacific Precision Turned Product Manufacturing Market

- Growing demand for lightweight and high-strength components in the automotive and aerospace sectors.

- Expansion into niche markets, such as medical devices and high-precision electronics.

- Adoption of additive manufacturing (3D printing) for prototyping and small-batch production.

- Development of sustainable and environmentally friendly manufacturing processes.

- Increased focus on digitalization and Industry 4.0 technologies.

Growth Accelerators in the Asia-Pacific Precision Turned Product Manufacturing Market Industry

Technological breakthroughs, particularly in automation and AI-driven quality control, are significantly accelerating market growth. Strategic partnerships between manufacturers and technology providers are also driving innovation. Expansion into new markets and diversification of product offerings are key growth strategies adopted by market players. Increased adoption of sustainable manufacturing practices and adherence to stringent environmental regulations are further driving growth.

Key Players Shaping the Asia-Pacific Precision Turned Product Manufacturing Market Market

- E&H Precision

- DMG MORI

- Ningbo Sinster Machine Co Ltd

- AMADA

- HAAS

- MAZAK

- Ningbo Sinster Machine Co Ltd

- Star Rapid

- 3E Rapid Prototyping (3ERP)

- Junying Metal Manufacturing Co Limited

Notable Milestones in Asia-Pacific Precision Turned Product Manufacturing Market Sector

- October 2022: Dover Precision Components opened a new innovation lab, enhancing its testing capabilities for fluid film bearings and compression products.

- June 2022: REHAU collaborated with TITUS, expanding its presence in the Indian hardware market for furniture components.

In-Depth Asia-Pacific Precision Turned Product Manufacturing Market Outlook

The Asia-Pacific precision turned product manufacturing market is poised for continued robust growth, driven by technological advancements, expanding end-use industries, and supportive government policies. Strategic opportunities lie in embracing automation, developing sustainable practices, and penetrating niche markets. Companies focusing on innovation, efficiency, and customer-centric solutions will be well-positioned to capitalize on the market's growth potential.

Asia-Pacific Precision Turned Product Manufacturing Market Segmentation

-

1. Type

- 1.1. Copper

- 1.2. Brass

- 1.3. Other Metals

- 1.4. Plastic

- 1.5. Other Types

-

2. Manufacturing Method

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC) Lathes

- 2.4. Turning Centres

- 2.5. Other Machines

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Precision Turned Product Manufacturing Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of Asia-Pacific Precision Turned Product Manufacturing Market

Asia-Pacific Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of Precision Manufacturing Sector and allied MSMEs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Copper

- 5.1.2. Brass

- 5.1.3. Other Metals

- 5.1.4. Plastic

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC) Lathes

- 5.2.4. Turning Centres

- 5.2.5. Other Machines

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Copper

- 6.1.2. Brass

- 6.1.3. Other Metals

- 6.1.4. Plastic

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 6.2.1. Automatic Screw Machines

- 6.2.2. Rotary Transfer Machines

- 6.2.3. Computer Numerically Controlled (CNC) Lathes

- 6.2.4. Turning Centres

- 6.2.5. Other Machines

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Copper

- 7.1.2. Brass

- 7.1.3. Other Metals

- 7.1.4. Plastic

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 7.2.1. Automatic Screw Machines

- 7.2.2. Rotary Transfer Machines

- 7.2.3. Computer Numerically Controlled (CNC) Lathes

- 7.2.4. Turning Centres

- 7.2.5. Other Machines

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Copper

- 8.1.2. Brass

- 8.1.3. Other Metals

- 8.1.4. Plastic

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 8.2.1. Automatic Screw Machines

- 8.2.2. Rotary Transfer Machines

- 8.2.3. Computer Numerically Controlled (CNC) Lathes

- 8.2.4. Turning Centres

- 8.2.5. Other Machines

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Copper

- 9.1.2. Brass

- 9.1.3. Other Metals

- 9.1.4. Plastic

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 9.2.1. Automatic Screw Machines

- 9.2.2. Rotary Transfer Machines

- 9.2.3. Computer Numerically Controlled (CNC) Lathes

- 9.2.4. Turning Centres

- 9.2.5. Other Machines

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Copper

- 10.1.2. Brass

- 10.1.3. Other Metals

- 10.1.4. Plastic

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 10.2.1. Automatic Screw Machines

- 10.2.2. Rotary Transfer Machines

- 10.2.3. Computer Numerically Controlled (CNC) Lathes

- 10.2.4. Turning Centres

- 10.2.5. Other Machines

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Copper

- 11.1.2. Brass

- 11.1.3. Other Metals

- 11.1.4. Plastic

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 11.2.1. Automatic Screw Machines

- 11.2.2. Rotary Transfer Machines

- 11.2.3. Computer Numerically Controlled (CNC) Lathes

- 11.2.4. Turning Centres

- 11.2.5. Other Machines

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 E&H Precision

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DMG MORI

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ningbo Sinster Machine Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AMADA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HAAS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MAZAK

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ningbo Sinster Machine Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Star Rapid

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 3E Rapid Prototyping (3ERP)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Junying Metal Manufacturing Co Limited**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 E&H Precision

List of Figures

- Figure 1: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 3: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 5: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 6: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 11: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 13: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 14: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 21: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 22: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 27: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 29: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 30: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 35: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 37: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 38: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 41: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 45: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 46: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 3: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 7: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 11: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 15: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 19: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 23: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 27: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Asia-Pacific Precision Turned Product Manufacturing Market?

Key companies in the market include E&H Precision, DMG MORI, Ningbo Sinster Machine Co Ltd, AMADA, HAAS, MAZAK, Ningbo Sinster Machine Co Ltd, Star Rapid, 3E Rapid Prototyping (3ERP), Junying Metal Manufacturing Co Limited**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Precision Turned Product Manufacturing Market?

The market segments include Type, Manufacturing Method, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.54 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of Precision Manufacturing Sector and allied MSMEs.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Dover Precision Components officially opened its innovation lab. The lab team focused on installing and commissioning key test rigs for its fluid film bearings and compression products since the nearly 12,000-square-foot building was completed. The lab has four independent test bays to allow for simultaneous work on multiple rigs and dedicated control rooms to monitor and collect test data and help ensure the equipment's safe operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence